Reports

Reports

Companies in the Europe low density polyethylene (LDPE) foams market are tapping into revenue opportunities in positive or limited negative impact industries during the ongoing coronavirus crisis. Pharmaceuticals, telecommunications, and software industries are thriving whereas travel, automotive, and construction industries are witnessing a slump in business activities. Nevertheless, manufacturers are striving to increase sales efficiencies and marching toward digital sales with the help of eCommerce.

Manufacturers in the Europe low density polyethylene (LDPE) foams market are focusing on key revenue generating industries such as packaging to revive market growth. In order to support customers, clients, and partners, market stakeholders are increasing their efforts to shorten sales cycles. Clear prioritization rules help to accelerate time-consuming testing and sampling activities.

Since plastics have always been associated with growing environmental footprint, companies in the Europe low density polyethylene (LDPE) foams market are adopting sustainable ways of producing LDPE products. Borealis AG - an Austrian chemical company specializing in polyethylene and polypropylene, is building its portfolio in LDPE foams using the extrusion process without crosslinking and requires the use of a branched polymer.

Manufacturers are producing branched polyethylene materials by tubular and autoclave processes. Superior foamability and homogenous foam cell structures are preferred in LDPE foams. Such foams are in high demand for packaging, sports, transport, and construction applications. Manufacturers are increasing the availability of foams that lead to the lowest carbon footprint.

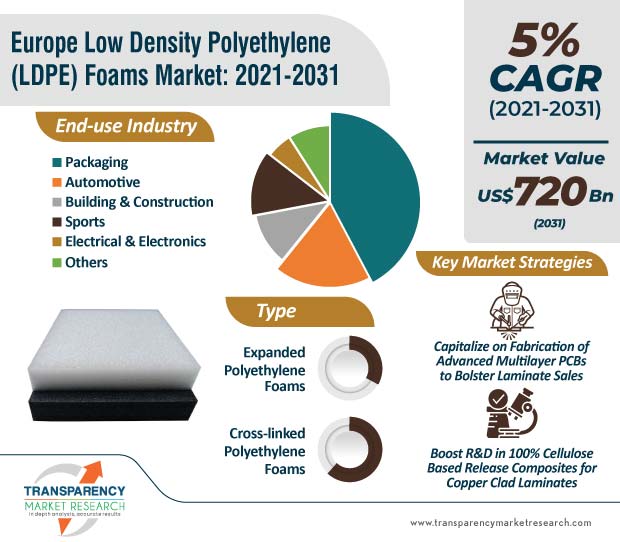

The Europe low density polyethylene (LDPE) foams market is expected to reach the revenue of US$ 720 Mn by 2031. LDPE foams offer protection to high value goods during transport and provide cushioning to protective sports equipment and toys. Next-gen LDPE foams offer special benefits for the physical foam extrusion process. This helps to increase the availability of lightweight LDPE foams.

Companies in the Europe low density polyethylene (LDPE) foams market are increasing their R&D efforts to develop foams that are less sensitive to web breaks or foam collapse. This leads to higher material yield during processing. Manufacturers are developing LDPE foams that have a high compression strength and better resilience.

Manufacturers in the Europe low density polyethylene (LDPE) foams market are boosting production of extruded and cross-linked LDPE foams. Excellent water resistance, chemical resistance, and energy absorbance are preferred in LDPE foams. The high quality LDPE foams are gaining prominence in electric materials, since these foams perform well for dielectric strength and constancy.

The Europe low density polyethylene (LDPE) foams market is projected to surpass an output of 149.60 kilo tons by 2031. Many applications that must perform in the presence of water also depend on polyethylene foam for its high water resistance and buoyancy.

The packaging industry is creating stable revenue streams for manufacturers in the Europe low density polyethylene (LDPE) foams market. This is evident since LDPE foams help to protect products by absorbing energy and achieving different levels of cushioning protection, depending on the exact density of the foam.

The Europe low density polyethylene (LDPE) foams market is slated to register a value CAGR of 5% during the forecast period. Ethylene foam’s chemical resistance properties help to resist common causes of degradation. However, prolonged ultraviolet (UV) sunlight exposure over long periods of time can cause some basic degradation.

Crosslinkable foam extrusion processes help to create LDPE foams that showcase unique controlled reactivity combined with outstanding quality consistency. Such LDPE foams have an improved properties to weight ratio, which holds promising potentials for their use in higher added value applications.

-foams-market-segmentation.jpg)

Analysts’ Viewpoint

Mission-critical applications in packaging, construction, and electronics sectors are helping to create income sources during the ongoing COVID-19 crisis. Even though extruded and cross-linked LDPE foams bear a high resemblance to one another, cross-linked foam tends to be softer than extruded foam and uniform. On the other hand, uniformity in chemically cross-linked foam is not consistent across the batch whereas in extruded cross-linked batches, the uniformity is better. Manufacturers in the Europe low density polyethylene (LDPE) foams market should unlock growth opportunities in coatings for paper milk cartons and disposable beverage cups. Shrink wraps and stretch films are contributing to increased sales of LDPE foams.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 422.38 Mn |

|

Market Forecast Value in 2031 |

US$ 720 Mn |

|

Growth Rate (CAGR) |

5% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Dynamics

2.4. Drivers and Restraints Snapshot Analysis

2.4.1.1. Drivers

2.4.1.2. Restraints

2.4.1.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.5.1. Threat of Substitutes

2.5.2. Bargaining Power of Buyers

2.5.3. Bargaining Power of Suppliers

2.5.4. Threat of New Entrants

2.5.5. Degree of Competition

2.6. Regulatory Scenario

2.7. Value Chain Analysis

3. Production Output Analysis

4. Price Trend Analysis

5. Europe Low Density Polyethylene (LDPE) Foams Overview

5.1. Key Findings

5.2. Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.3. Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4. Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

5.4.1. Germany Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.2. Germany Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4.3. U.K. Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.4. U.K. Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4.5. France Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.6. France Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4.7. Italy Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.8. Italy Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4.9. Spain Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.10. Spain Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4.11. Romania Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.12. Romania Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4.13. Russia & CIS Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.14. Russia & CIS Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.4.15. Rest of Europe Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

5.4.16. Rest of Europe Low Density Polyethylene (LDPE) Foams Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

5.5. Europe Low Density Polyethylene (LDPE) Foams Market Attractive Analysis, by Type

5.6. Europe Low Density Polyethylene (LDPE) Foams Market Attractive Analysis, by End-use Industry

5.7. Europe Low Density Polyethylene (LDPE) Foams Market Attractive Analysis, by Country and Sub-region

6. Primary Research – Key Insights

7. Appendix

7.1. Research Methodology and Assumptions

List of Tables

Table 01: Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 02: Europe Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 03: Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 04: Europe Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 05: Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 06: Europe Low Density Polyethylene (LDPE) Foams Market Forecast (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 07: Germany Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 08: Germany Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 09: Germany Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 10: U.K. Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 11: U.K. Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 12: U.K. Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 13: France Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 14: France Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 15: France Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 16: Italy Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 17: Italy Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 18: Italy Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 19: Spain Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 20: Spain Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 21: Spain Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 22: Romania Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 23: Romania Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 24: Romania Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 25: Russia & CIS Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 26: Russia & CIS Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 27: Russia & CIS Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

Table 28: Rest of Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 29: Rest of Europe Low Density Polyethylene (LDPE) Foams Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 30: Rest of Europe Low Density Polyethylene (LDPE) Foams Market Volume (Kilo Tons) Forecast, by End-use Industry, 2020–2031

List of Figures

Figure 01: Europe Low Density Polyethylene (LDPE) Foams Pricing Analysis (US$/Ton), by Type, 2020-2031

Figure 02: Europe Low Density Polyethylene (LDPE) Foams Market Volume Share Analysis, by Type, 2020, 2026 and 2031

Figure 03: Europe Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 04: Europe Low Density Polyethylene (LDPE) Foams Market Volume Share Analysis, by End-use Industry, 2020, 2026, and 2031

Figure 05: Europe Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 06: Europe Low Density Polyethylene (LDPE) Foams Market Volume Share Analysis, by Country and Sub-region

Figure 07: Europe Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Country and Sub-region

Figure 08: Germany Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 09: Germany Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 10: U.K. Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 11: U.K. Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 12: France Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 13: France Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 14: Italy Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 15: Italy Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 16: Spain Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 17: Spain Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 18: Romania Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 19: Romania Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 20: Russia & CIS Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 21: Russia & CIS Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry

Figure 22: Rest of Europe Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by Type

Figure 23: Rest of Europe Low Density Polyethylene (LDPE) Foams Market Attractiveness Analysis, by End-use Industry