Reports

Reports

Analysts’ Viewpoint on ESD Protection Devices Market Scenario

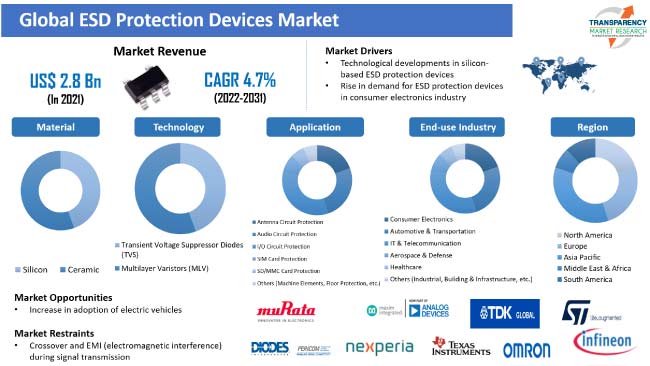

ESD protection devices offer flexibility, reliability, outstanding low capacitance, better signal integrity, and antenna compatibility. Therefore, ESD protection devices are used in various end-use industries such as consumer electronics, automotive & transportation, IT & telecommunication, aerospace & defense, and healthcare. Rise in penetration of technologies such as industry 4.0, artificial intelligence, cloud computing, big data analytics, IoT, 5G, and cyber security is contributing to the growth of the global ESD protection devices market. Applications of ESD protection devices in communication equipment such as base stations, routers, switches, and g-pon (gigabit passive optical network) are expanding at a considerable pace. This is expected to propel the demand for ESD protection devices in the near future. Rise in demand for BMS (battery management system) and ADAS (advanced driver assistance system) is also likely to fuel the global market during the forecast period.

Usage of silicon-based transient voltage suppressor diodes has been increasing in several applications, ranging from USB 2.0, super-speed USB at 10 Gbps, HDMI 2.0, and BaseT, for the last five years. Silicon-based transient voltage suppressor diodes are also utilized in automotive A/V monitors displays and cameras owing to signal integrity and system protection. Moreover, extensive use of in-vehicle networks (IVN) associated with infotainment and vehicle communications is expected to create lucrative opportunities for silicon-based transient voltage suppressor diodes (TVS) as an ESD protection device.

Rise in penetration of ESD devices in consumer electronics such as laptops tablets, and computers is a key factor that is projected to boost the electrostatic discharge (ESD) protection devices market share during the forecast period. Increase in applications of ESD protection devices in LCD displays, audio lines, keypads, touchpads, tablets, and smartphones is also contributing to the market growth.

According to the Semiconductor Industry Association (SIA), in 2021, annual growth for computer devices was 21.2% with a total value of US$ 142.2 Billion. Furthermore, ESD tools, polymeric ESD suppressors, ESD bags & pouch packaging, and ESD cardboard are being adopted in the industrial sector to protect against ESD surges while walking on the floor. The global ESD protection devices market size is expected to increase during the forecast period, owing to the rise in applications of ceramic ESD protection devices and silicon ESD protection devices in various end-use industries.

ESD protection devices are widely used in consumer electronic products such as smartphones, laptops & notebooks, household appliances, digital cameras, communication equipment, electronic instruments, etc. ESD protection devices are used to clamp over voltages and dissipate high transient power surges. ESD protection diode and ESD Suppressor break down and create a low impedance path that limits the peak voltage and current by diverting the current flow to the ground, thereby protecting the IC.

The antenna of several electronic devices can act as a low-impedance path for ESD strikes to enter the system and damage downstream circuitry such as the filtering network, amplifier, or transceiver in wireless applications such as Global Positioning Systems (GPS), Wireless Local Area Network (WLAN), and Wireless-Fidelity (Wi-Fi). As higher-frequency communication devices such as smartphones, and laptops, are developed to transmit more information in less time, it becomes increasingly challenging to identify solutions that would not compromise stringent signal integrity requirements at higher data rates. ESD suppressors are used with low internal capacitance to avoid such instances, and curtail the distortion in the data communication signals.

In terms of directionality, the global ESD protection devices market has been bifurcated into uni-directional and bi-directional. Unidirectional ESD protection devices are best-suited for the protection of circuit nodes with unidirectional signals, which are always above or below the reference voltage. A large number of IC manufacturers are using innovative and highly advanced CMOS technologies to enhance performance of their systems. The uni-directional segment of the global ESD protection devices market is expected to hold major market share during the forecast period, as a majority of circuit designs are based on CMOS technology. Furthermore, chip designers are using unidirectional ESD protection devices, as the use of bi-directional devices may result in overload. For instance, In December 2021, Taiwan Semiconductor introduced an ultra-low capacitance ESD protection diode that includes two unidirectional ESD-rated clamping devices to protect high-speed data interfaces. This device would protect sensitive electronic components connected to data and -or transmission lines from over-stress caused by ESD (Electrostatic Discharge).

Silicon ESD protection devices with low capacitance are extensively used in various end-use industries such as consumer electronics, automotive & transportation, aerospace & defense, healthcare to protect electrical or electronic parts, assemblies, and equipment against ESD damage. These devices offer numerous features such as bi-directional and symmetric I/V characteristics for optimized design & assembly, very low reverse current, and small form factor.

These devices offer ESD protection to super high speed I/O - USB 3.0/3.1, firewire, DVI, HDMI, SATA (Serial Advanced Technology Attachment), DisplayPort, and Thunderbolt. Manufacturers of silicon-based ESD protection devices are focusing on the development of cost-effective products with a wide range of features. For instance, in February 2020, Nexperia launched silicon-based, OPEN Alliance-compliant ESD protection for 100BASE-T1 and 1000BASE-T1 automotive Ethernet systems. Increase in demand for silicon-based ESD protection for consumer electronic devices across the globe is anticipated to offer significant opportunities for ESD protection devices market players during the forecast period.

Asia Pacific is expected to hold major share of the global ESD protection devices market during the forecast period. This can be ascribed to the increased demand for ESD protection devices from tablets, desktop computers and their peripherals, test & measurement equipment, microphone, headset, automotive systems such as battery management systems, ADAS, telematics control unit, and among the others. For instance, in September 2021, the Government of India issued a notification regarding a PLI scheme for automobile and auto components worth Rs. 25,938 crores (US$ 3.49 billion). Rapid urbanization, digitization, increase in penetration of internet of things (IoT), rise in investment in 4G & 5G communication are some of the factors boosting the ESD protection devices market growth in Asia Pacific.

The ESD protection devices market in North America and Europe is expected to grow at a significant pace during the forecast period due to rise in adoption of online education, remote working, and e-commerce platforms. Demand for consumer electronics such as smartphones, laptops, notebooks, and smart wearables, etc., is high in these regions. This is augmenting the sale of ESD protection devices in North America and Europe. Moreover, growth of the market is anticipated to be driven by leading countries such as the Germany, Spain, Italy, France, Hungary, U.K., Russia, U.S, and Canada during the forecast period. The ESD protection devices market in Middle East & Africa and South America is projected to grow at a steady pace during the forecast period.

The global ESD protection devices market is fragmented, with a small number of large-scale vendors that control majority of the share. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by leading manufacturers operating in the global market.

Key players operating in the global ESD protection devices market are Bourns, Inc. Diodes Incorporated, Infineon Technologies AG, Kyocera AVX, Littelfuse, Inc., Analog Devices (Maxim Integrated), Microchip Technology Inc., Murata Manufacturing Co., Ltd., Nexperia, Omron Corporation, Onesemi, ROHM SEMICONDUCTOR, Semtech Corporation, STMicroelectronics N.V., TDK Corporation, Texas Instruments Incorporated, and TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION.

Key players have been profiled in the ESD protection devices market report based on parameters such as company overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.8 Bn |

|

Market Forecast Value in 2031 |

US$ 4.4 Bn |

|

Growth Rate (CAGR) |

4.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global ESD protection devices market stood at US$ 2.8 Bn in 2021

The global ESD protection devices market is expected to grow at a CAGR of 4.7% from 2022 to 2031

The global ESD protection devices market is likely to reach US$ 4.4 Bn in 2031

Technological developments in silicon-based ESD protection devices and rise in demand from consumer electronics industry

Asia Pacific is more lucrative region of the global ESD protection devices market

Analog Devices (Maxim Integrated), Microchip Technology Inc., Murata Manufacturing Co., Ltd., Nexperia, Omron Corporation, Onsemi, Infineon Technologies AG, STMicroelectronics N.V., TDK Corporation, Texas Instruments Incorporated, and TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global ESD Protection Devices Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Voltage Protection Devices Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global ESD Protection Devices Market Analysis, by Material

5.1. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

5.1.1. Silicon

5.1.2. Ceramic

5.2. Market Attractiveness Analysis, by Material

6. Global ESD Protection Devices Market Analysis, by Technology

6.1. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

6.1.1. Transient Voltage Suppressor Diodes (TVS)

6.1.2. Multilayer Varistors (MLV)

6.2. Market Attractiveness Analysis, by Technology

7. Global ESD Protection Devices Market Analysis, by Directionality

7.1. ESD Protection Devices Market Size (US$ Mn Analysis & Forecast, by Directionality, 2017–2031

7.1.1. Uni-directional

7.1.2. Bi-directional

7.2. Market Attractiveness Analysis, by Directionality

8. Global ESD Protection Devices Market Analysis, by Protection

8.1. ESD Protection Devices Market Size (US$ Mn Analysis & Forecast, by Protection, 2017–2031

8.1.1. Data-line

8.1.2. Power-line

8.2. Market Attractiveness Analysis, by Protection

9. Global ESD Protection Devices Market Analysis, by Application

9.1. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

9.1.1. Antenna Circuit Protection

9.1.2. Audio Circuit Protection

9.1.3. I/O Circuit Protection

9.1.4. SIM Card Protection

9.1.5. SD/MMC Card Protection

9.1.6. Others

9.2. Market Attractiveness Analysis, by Application

10. Global ESD Protection Devices Market Analysis, by End-use

10.1. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

10.1.1. Electronic Devices

10.1.1.1. Smartphones & Tablets

10.1.1.2. Laptops & Notebooks

10.1.1.3. Smart Wearables

10.1.1.4. Digital Cameras

10.1.2. Medical Devices

10.1.3. Communications Equipment

10.1.4. Data Centers & High-performance Computing Devices

10.1.5. Electric Vehicles

10.1.6. Others

10.2. Market Attractiveness Analysis, by End-use

11. Global ESD Protection Devices Market Analysis, by End-use Industry

11.1. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.1.1. Consumer Electronics

11.1.2. Automotive & Transportation

11.1.3. IT & Telecommunication

11.1.4. Aerospace & Defense

11.1.5. Healthcare

11.1.6. Others

11.2. Market Attractiveness Analysis, by End-use Industry

12. Global ESD Protection Devices Market Analysis and Forecast, by Region

12.1. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Market Attractiveness Analysis, by Region

13. North America ESD Protection Devices Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

13.3.1. Silicon

13.3.2. Ceramic

13.4. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

13.4.1. Transient Voltage Suppressor Diodes (TVS)

13.4.2. Multilayer Varistors (MLV)

13.5. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Directionality, 2017–2031

13.5.1. Uni-directional

13.5.2. Bi-directional

13.6. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Protection, 2017–2031

13.6.1. Data-line

13.6.2. Power-line

13.7. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.7.1. Antenna Circuit Protection

13.7.2. Audio Circuit Protection

13.7.3. I/O Circuit Protection

13.7.4. SIM Card Protection

13.7.5. SD/MMC Card Protection

13.7.6. Others

13.8. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

13.8.1. Electronic Devices

13.8.1.1. Smartphones & Tablets

13.8.1.2. Laptops & Notebooks

13.8.1.3. Smart Wearables

13.8.1.4. Digital Cameras

13.8.2. Medical Devices

13.8.3. Communications Equipment

13.8.4. Data Centers & High-performance Computing Devices

13.8.5. Electric Vehicles

13.8.6. Others

13.9. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.9.1. Consumer Electronics

13.9.2. Automotive & Transportation

13.9.3. IT & Telecommunication

13.9.4. Aerospace & Defense

13.9.5. Healthcare

13.9.6. Others

13.10. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.10.1. The U.S.

13.10.2. Canada

13.10.3. Rest of North America

13.11. Market Attractiveness Analysis

13.11.1. By Material

13.11.2. By Technology

13.11.3. By Directionality

13.11.4. By Protection

13.11.5. By Application

13.11.6. By End-use

13.11.7. By End-use Industry

13.11.8. By Country/Sub-region

14. Europe ESD Protection Devices Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

14.3.1. Silicon

14.3.2. Ceramic

14.4. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

14.4.1. Transient Voltage Suppressor Diodes (TVS)

14.4.2. Multilayer Varistors (MLV)

14.5. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Directionality, 2017–2031

14.5.1. Uni-directional

14.5.2. Bi-directional

14.6. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Protection, 2017–2031

14.6.1. Data-line

14.6.2. Power-line

14.7. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

14.7.1. Antenna Circuit Protection

14.7.2. Audio Circuit Protection

14.7.3. I/O Circuit Protection

14.7.4. SIM Card Protection

14.7.5. SD/MMC Card Protection

14.7.6. Others

14.8. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

14.8.1. Electronic Devices

14.8.1.1. Smartphones & Tablets

14.8.1.2. Laptops & Notebooks

14.8.1.3. Smart Wearables

14.8.1.4. Digital Cameras

14.8.2. Medical Devices

14.8.3. Communications Equipment

14.8.4. Data Centers & High-performance Computing Devices

14.8.5. Electric Vehicles

14.8.6. Others

14.9. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

14.9.1. Consumer Electronics

14.9.2. Automotive & Transportation

14.9.3. IT & Telecommunication

14.9.4. Aerospace & Defense

14.9.5. Healthcare

14.9.6. Others

14.10. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.10.1. The U.K.

14.10.2. Germany

14.10.3. France

14.10.4. Rest of Europe

14.11. Market Attractiveness Analysis

14.11.1. By Material

14.11.2. By Technology

14.11.3. By Directionality

14.11.4. By Protection

14.11.5. By Application

14.11.6. By End-use

14.11.7. By End-use Industry

14.11.8. By Country/Sub-region

15. Asia Pacific ESD Protection Devices Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

15.3.1. Silicon

15.3.2. Ceramic

15.4. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

15.4.1. Transient Voltage Suppressor Diodes (TVS)

15.4.2. Multilayer Varistors (MLV)

15.5. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Directionality, 2017–2031

15.5.1. Uni-directional

15.5.2. Bi-directional

15.6. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Protection, 2017–2031

15.6.1. Data-line

15.6.2. Power-line

15.7. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

15.7.1. Antenna Circuit Protection

15.7.2. Audio Circuit Protection

15.7.3. I/O Circuit Protection

15.7.4. SIM Card Protection

15.7.5. SD/MMC Card Protection

15.7.6. Others

15.8. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

15.8.1. Electronic Devices

15.8.1.1. Smartphones & Tablets

15.8.1.2. Laptops & Notebooks

15.8.1.3. Smart Wearables

15.8.1.4. Digital Cameras

15.8.2. Medical Devices

15.8.3. Communications Equipment

15.8.4. Data Centers & High-performance Computing Devices

15.8.5. Electric Vehicles

15.8.6. Others

15.9. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

15.9.1. Consumer Electronics

15.9.2. Automotive & Transportation

15.9.3. IT & Telecommunication

15.9.4. Aerospace & Defense

15.9.5. Healthcare

15.9.6. Others

15.10. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

15.10.1. China

15.10.2. Japan

15.10.3. India

15.10.4. South Korea

15.10.5. ASEAN

15.10.6. Rest of Asia Pacific

15.11. Market Attractiveness Analysis

15.11.1. By Material

15.11.2. By Technology

15.11.3. By Directionality

15.11.4. By Protection

15.11.5. By Application

15.11.6. By End-use

15.11.7. By End-use Industry

15.11.8. By Country/Sub-region

16. Middle East & Africa ESD Protection Devices Market Analysis and Forecast

16.1. Market Snapshot

16.2. Drivers and Restraints: Impact Analysis

16.3. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

16.3.1. Silicon

16.3.2. Ceramic

16.4. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

16.4.1. Transient Voltage Suppressor Diodes (TVS)

16.4.2. Multilayer Varistors (MLV)

16.5. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Directionality, 2017–2031

16.5.1. Uni-directional

16.5.2. Bi-directional

16.6. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Protection, 2017–2031

16.6.1. Data-line

16.6.2. Power-line

16.7. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

16.7.1. Antenna Circuit Protection

16.7.2. Audio Circuit Protection

16.7.3. I/O Circuit Protection

16.7.4. SIM Card Protection

16.7.5. SD/MMC Card Protection

16.7.6. Others

16.8. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

16.8.1. Electronic Devices

16.8.1.1. Smartphones & Tablets

16.8.1.2. Laptops & Notebooks

16.8.1.3. Smart Wearables

16.8.1.4. Digital Cameras

16.8.2. Medical Devices

16.8.3. Communications Equipment

16.8.4. Data Centers & High-performance Computing Devices

16.8.5. Electric Vehicles

16.8.6. Others

16.9. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

16.9.1. Consumer Electronics

16.9.2. Automotive & Transportation

16.9.3. IT & Telecommunication

16.9.4. Aerospace & Defense

16.9.5. Healthcare

16.9.6. Others

16.10. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

16.10.1. GCC

16.10.2. South Africa

16.10.3. Rest of Middle East & Africa

16.11. Market Attractiveness Analysis

16.11.1. By Material

16.11.2. By Technology

16.11.3. By Directionality

16.11.4. By Protection

16.11.5. By Application

16.11.6. By End-use

16.11.7. By End-use Industry

16.11.8. By Country/Sub-region

17. South America ESD Protection Devices Market Analysis and Forecast

17.1. Market Snapshot

17.2. Drivers and Restraints: Impact Analysis

17.3. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

17.3.1. Silicon

17.3.2. Ceramic

17.4. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

17.4.1. Transient Voltage Suppressor Diodes (TVS)

17.4.2. Multilayer Varistors (MLV)

17.5. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Directionality, 2017–2031

17.5.1. Uni-directional

17.5.2. Bi-directional

17.6. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Protection, 2017–2031

17.6.1. Data-line

17.6.2. Power-line

17.7. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

17.7.1. Antenna Circuit Protection

17.7.2. Audio Circuit Protection

17.7.3. I/O Circuit Protection

17.7.4. SIM Card Protection

17.7.5. SD/MMC Card Protection

17.7.6. Others

17.8. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

17.8.1. Electronic Devices

17.8.1.1. Smartphones & Tablets

17.8.1.2. Laptops & Notebooks

17.8.1.3. Smart Wearables

17.8.1.4. Digital Cameras

17.8.2. Medical Devices

17.8.3. Communications Equipment

17.8.4. Data Centers & High-performance Computing Devices

17.8.5. Electric Vehicles

17.8.6. Others

17.9. ESD Protection Devices Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

17.9.1. Consumer Electronics

17.9.2. Automotive & Transportation

17.9.3. IT & Telecommunication

17.9.4. Aerospace & Defense

17.9.5. Healthcare

17.9.6. Others

17.10. ESD Protection Devices Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

17.10.1. Brazil

17.10.2. Rest of South America

17.11. Market Attractiveness Analysis

17.11.1. By Material

17.11.2. By Technology

17.11.3. By Directionality

17.11.4. By Protection

17.11.5. By Application

17.11.6. By End-use

17.11.7. By End-use Industry

17.11.8. By Country/Sub-region

18. Competition Assessment

18.1. Global ESD Protection Devices Market Competition Matrix - a Dashboard View

18.1.1. Global ESD Protection Devices Market Company Share Analysis, by Value (2021)

18.1.2. Technological Differentiator

19. Company Profiles (Global Manufacturers/Suppliers)

19.1. Bourns, Inc.

19.1.1. Overview

19.1.2. Product Portfolio

19.1.3. Sales Footprint

19.1.4. Key Subsidiaries or Distributors

19.1.5. Strategy and Recent Developments

19.1.6. Key Financials

19.2. Diodes Incorporated

19.2.1. Overview

19.2.2. Product Portfolio

19.2.3. Sales Footprint

19.2.4. Key Subsidiaries or Distributors

19.2.5. Strategy and Recent Developments

19.2.6. Key Financials

19.3. Infineon Technologies AG

19.3.1. Overview

19.3.2. Product Portfolio

19.3.3. Sales Footprint

19.3.4. Key Subsidiaries or Distributors

19.3.5. Strategy and Recent Developments

19.3.6. Key Financials

19.4. Kyocera AVX

19.4.1. Overview

19.4.2. Product Portfolio

19.4.3. Sales Footprint

19.4.4. Key Subsidiaries or Distributors

19.4.5. Strategy and Recent Developments

19.4.6. Key Financials

19.5. Littelfuse, Inc.

19.5.1. Overview

19.5.2. Product Portfolio

19.5.3. Sales Footprint

19.5.4. Key Subsidiaries or Distributors

19.5.5. Strategy and Recent Developments

19.5.6. Key Financials

19.6. Analog Devices (Maxim Integrated)

19.6.1. Overview

19.6.2. Product Portfolio

19.6.3. Sales Footprint

19.6.4. Key Subsidiaries or Distributors

19.6.5. Strategy and Recent Developments

19.6.6. Key Financials

19.7. Microchip Technology Inc.

19.7.1. Overview

19.7.2. Product Portfolio

19.7.3. Sales Footprint

19.7.4. Key Subsidiaries or Distributors

19.7.5. Strategy and Recent Developments

19.7.6. Key Financials

19.8. Murata Manufacturing Co., Ltd.

19.8.1. Overview

19.8.2. Product Portfolio

19.8.3. Sales Footprint

19.8.4. Key Subsidiaries or Distributors

19.8.5. Strategy and Recent Developments

19.8.6. Key Financials

19.9. Nexperia

19.9.1. Overview

19.9.2. Product Portfolio

19.9.3. Sales Footprint

19.9.4. Key Subsidiaries or Distributors

19.9.5. Strategy and Recent Developments

19.9.6. Key Financials

19.10. Omron Corporation

19.10.1. Overview

19.10.2. Product Portfolio

19.10.3. Sales Footprint

19.10.4. Key Subsidiaries or Distributors

19.10.5. Strategy and Recent Developments

19.10.6. Key Financials

19.11. Onsemi

19.11.1. Overview

19.11.2. Product Portfolio

19.11.3. Sales Footprint

19.11.4. Key Subsidiaries or Distributors

19.11.5. Strategy and Recent Developments

19.11.6. Key Financials

19.12. ROHM SEMICONDUCTOR

19.12.1. Overview

19.12.2. Product Portfolio

19.12.3. Sales Footprint

19.12.4. Key Subsidiaries or Distributors

19.12.5. Strategy and Recent Developments

19.12.6. Key Financials

19.13. Semtech Corporation

19.13.1. Overview

19.13.2. Product Portfolio

19.13.3. Sales Footprint

19.13.4. Key Subsidiaries or Distributors

19.13.5. Strategy and Recent Developments

19.13.6. Key Financials

19.14. STMicroelectronics N.V.

19.14.1. Overview

19.14.2. Product Portfolio

19.14.3. Sales Footprint

19.14.4. Key Subsidiaries or Distributors

19.14.5. Strategy and Recent Developments

19.14.6. Key Financials

19.15. TDK Corporation

19.15.1. Overview

19.15.2. Product Portfolio

19.15.3. Sales Footprint

19.15.4. Key Subsidiaries or Distributors

19.15.5. Strategy and Recent Developments

19.15.6. Key Financials

19.16. Texas Instruments Incorporated

19.16.1. Overview

19.16.2. Product Portfolio

19.16.3. Sales Footprint

19.16.4. Key Subsidiaries or Distributors

19.16.5. Strategy and Recent Developments

19.16.6. Key Financials

19.17. TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

19.17.1. Overview

19.17.2. Product Portfolio

19.17.3. Sales Footprint

19.17.4. Key Subsidiaries or Distributors

19.17.5. Strategy and Recent Developments

19.17.6. Key Financials

20. Recommendation

20.1. Opportunity Assessment

20.1.1. By Material

20.1.2. By Technology

20.1.3. By Directionality

20.1.4. By Protection

20.1.5. By Application

20.1.6. By End-use

20.1.7. By End-use Industry

20.1.8. By Country/Sub-region

List of Tables

Table 01: Global ESD Protection Devices Market Size & Forecast, by Material, Value (US$ Mn), 2017–2031

Table 02: Global ESD Protection Devices Market Size & Forecast, by Material, Volume (Million Units), 2017–2031

Table 03: Global ESD Protection Devices Market Size & Forecast, by Technology (US$ Mn), 2017–2031

Table 04: Global ESD Protection Devices Market Size & Forecast, by Technology, Volume (Million Units), 2017–2031

Table 05: Global ESD Protection Devices Market Size & Forecast, by Directionality (US$ Mn), 2017–2031

Table 06: Global ESD Protection Devices Market Size & Forecast, by Protection (US$ Mn), 2017–2031

Table 07: Global ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 08: Global ESD Protection Devices Market Size & Forecast, by End-use (US$ Mn), 2017–2031

Table 09: Global ESD Protection Devices Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 10: Global ESD Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 11: North America ESD Protection Devices Market Size & Forecast, by Material, Value (US$ Mn), 2017–2031

Table 12: North America ESD Protection Devices Market Size & Forecast, by Material, Volume (Million Units), 2017–2031

Table 13: North America ESD Protection Devices Market Size & Forecast, by Technology (US$ Mn), 2017–2031

Table 14: North America ESD Protection Devices Market Size & Forecast, by Technology, Volume (Million Units), 2017–2031

Table 15: North America ESD Protection Devices Market Size & Forecast, by Directionality (US$ Mn), 2017–2031

Table 16: North America ESD Protection Devices Market Size & Forecast, by Protection (US$ Mn), 2017–2031

Table 17: North America ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 18: North America ESD Protection Devices Market Size & Forecast, by End-use (US$ Mn), 2017–2031

Table 19: North America ESD Protection Devices Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 20: North America ESD Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 21: Europe ESD Protection Devices Market Size & Forecast, by Material, Value (US$ Mn), 2017–2031

Table 22: Europe ESD Protection Devices Market Size & Forecast, by Material, Volume (Million Units), 2017–2031

Table 23: Europe ESD Protection Devices Market Size & Forecast, by Technology (US$ Mn), 2017–2031

Table 24: Europe ESD Protection Devices Market Size & Forecast, by Technology, Volume (Million Units), 2017–2031

Table 25: Europe ESD Protection Devices Market Size & Forecast, by Directionality (US$ Mn), 2017–2031

Table 26: Europe ESD Protection Devices Market Size & Forecast, by Protection (US$ Mn), 2017–2031

Table 27: Europe ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 28: Europe ESD Protection Devices Market Size & Forecast, by End-use (US$ Mn), 2017–2031

Table 29: Europe ESD Protection Devices Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 30: Europe ESD Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 31: Asia Pacific ESD Protection Devices Market Size & Forecast, by Material, Value (US$ Mn), 2017–2031

Table 32: Asia Pacific ESD Protection Devices Market Size & Forecast, by Material, Volume (Million Units), 2017–2031

Table 33: Asia Pacific ESD Protection Devices Market Size & Forecast, by Technology (US$ Mn), 2017–2031

Table 34: Asia Pacific ESD Protection Devices Market Size & Forecast, by Technology, Volume (Million Units), 2017–2031

Table 35: Asia Pacific ESD Protection Devices Market Size & Forecast, by Directionality (US$ Mn), 2017–2031

Table 36: Asia Pacific ESD Protection Devices Market Size & Forecast, by Protection (US$ Mn), 2017–2031

Table 37: Asia Pacific ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 38: Asia Pacific ESD Protection Devices Market Size & Forecast, by End-use (US$ Mn), 2017–2031

Table 39: Asia Pacific ESD Protection Devices Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 40: Asia Pacific ESD Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 41: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Material, Value (US$ Mn), 2017–2031

Table 42: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Material, Volume (Million Units), 2017–2031

Table 43: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Technology (US$ Mn), 2017–2031

Table 44: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Technology, Volume (Million Units), 2017–2031

Table 45: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Directionality (US$ Mn), 2017–2031

Table 46: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Protection (US$ Mn), 2017–2031

Table 47: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 48: Middle East & Africa ESD Protection Devices Market Size & Forecast, by End-use (US$ Mn), 2017–2031

Table 49: Middle East & Africa ESD Protection Devices Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 50: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 51: South America ESD Protection Devices Market Size & Forecast, by Material, Value (US$ Mn), 2017–2031

Table 52: South America ESD Protection Devices Market Size & Forecast, by Material, Volume (Million Units), 2017–2031

Table 53: South America ESD Protection Devices Market Size & Forecast, by Technology (US$ Mn), 2017–2031

Table 54: South America ESD Protection Devices Market Size & Forecast, by Technology, Volume (Million Units), 2017–2031

Table 55: South America ESD Protection Devices Market Size & Forecast, by Directionality (US$ Mn), 2017–2031

Table 56: South America ESD Protection Devices Market Size & Forecast, by Protection (US$ Mn), 2017–2031

Table 57: South America ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 58: South America ESD Protection Devices Market Size & Forecast, by End-use (US$ Mn), 2017–2031

Table 59: South America ESD Protection Devices Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 60: South America ESD Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

List of Figures

Figure 01: Global ESD Protection Devices Price Trend Analysis (Average Price, US$) (Million Units)

Figure 02: Global ESD Protection Devices Market, Y-O-Y Growth 2017–2031

Figure 03: Global ESD Protection Devices Market, Value (US$ Mn), 2017–2031

Figure 04: Global ESD Protection Devices Market, Volume (Million Units), 2017–2031

Figure 05: Global ESD Protection Devices Market Projections, by Material, Value (US$ Mn), 2017–2031

Figure 06: Global ESD Protection Devices Market, Incremental Opportunity, by Material, Value (US$ Mn), 2022 – 2031

Figure 07: Global ESD Protection Devices Market Share, by Material, Value (US$ Mn), 2022 – 2031

Figure 08: Global ESD Protection Devices Market Projections, by Technology, Value (US$ Mn), 2017–2031

Figure 09: Global ESD Protection Devices Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022 – 2031

Figure 10: Global ESD Protection Devices Market Share, by Technology, Value (US$ Mn), 2022 – 2031

Figure 11: Global ESD Protection Devices Market Projections, by Directionality, Value (US$ Mn), 2017–2031

Figure 12: Global ESD Protection Devices Market, Incremental Opportunity, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 13: Global ESD Protection Devices Market Share, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 14: Global ESD Protection Devices Market Projections, by Protection, Value (US$ Mn), 2017–2031

Figure 15: Global ESD Protection Devices Market, Incremental Opportunity, by Protection, Value (US$ Mn), 2022 – 2031

Figure 16: Global ESD Protection Devices Market Share, by Protection, Value (US$ Mn), 2022 – 2031

Figure 17: Global ESD Protection Devices Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 18: Global ESD Protection Devices Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 19: Global ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 20: Global ESD Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017–2031

Figure 21: Global ESD Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022 – 2031

Figure 22: Global ESD Protection Devices Market Share Analysis, by End-use, 2021 and 2031

Figure 23: Global ESD Protection Devices Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 24: Global ESD Protection Devices Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 25: Global ESD Protection Devices Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 26: Global ESD Protection Devices Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 27: Global ESD Protection Devices Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 28: Global ESD Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2022 – 2031

Figure 29: North America ESD Protection Devices Market, Y-O-Y Growth 2017–2031

Figure 30: North America ESD Protection Devices Market, Value (US$ Mn), 2017–2031

Figure 31: North America ESD Protection Devices Market, Volume (Million Units), 2017–2031

Figure 32: North America ESD Protection Devices Market Projections, by Material, Value (US$ Mn), 2017–2031

Figure 33: North America ESD Protection Devices Market, Incremental Opportunity, by Material, Value (US$ Mn), 2022 – 2031

Figure 34: North America ESD Protection Devices Market Share, by Material, Value (US$ Mn), 2022 – 2031

Figure 35: North America ESD Protection Devices Market Projections, by Technology, Value (US$ Mn), 2017–2031

Figure 36: North America ESD Protection Devices Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022 – 2031

Figure 37: North America ESD Protection Devices Market Share, by Technology, Value (US$ Mn), 2022 – 2031

Figure 38: North America ESD Protection Devices Market Projections, by Directionality, Value (US$ Mn), 2017–2031

Figure 39: North America ESD Protection Devices Market, Incremental Opportunity, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 40: North America ESD Protection Devices Market Share, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 41: North America ESD Protection Devices Market Projections, by Protection, Value (US$ Mn), 2017–2031

Figure 42: North America ESD Protection Devices Market, Incremental Opportunity, by Protection, Value (US$ Mn), 2022 – 2031

Figure 43: North America ESD Protection Devices Market Share, by Protection, Value (US$ Mn), 2022 – 2031

Figure 44: North America ESD Protection Devices Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 45: North America ESD Protection Devices Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 46: North America ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 47: North America ESD Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017–2031

Figure 48: North America ESD Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022 – 2031

Figure 49: North America ESD Protection Devices Market Share Analysis, by End-use, 2021 and 2031

Figure 50: North America ESD Protection Devices Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 51: North America ESD Protection Devices Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 52: North America ESD Protection Devices Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 53: North America ESD Protection Devices Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 54: North America ESD Protection Devices Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 55: Europe ESD Protection Devices Market, Y-O-Y Growth 2017–2031

Figure 56: Europe ESD Protection Devices Market, Value (US$ Mn), 2017–2031

Figure 57: Europe ESD Protection Devices Market, Volume (Million Units), 2017–2031

Figure 58: Europe ESD Protection Devices Market Projections, by Material, Value (US$ Mn), 2017–2031

Figure 59: Europe ESD Protection Devices Market, Incremental Opportunity, by Material, Value (US$ Mn), 2022 – 2031

Figure 60: Europe ESD Protection Devices Market Share, by Material, Value (US$ Mn), 2022 – 2031

Figure 61: Europe ESD Protection Devices Market Projections, by Technology, Value (US$ Mn), 2017–2031

Figure 62: Europe ESD Protection Devices Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022 – 2031

Figure 63: Europe ESD Protection Devices Market Share, by Technology, Value (US$ Mn), 2022 – 2031

Figure 64: Europe ESD Protection Devices Market Projections, by Directionality, Value (US$ Mn), 2017–2031

Figure 65: Europe ESD Protection Devices Market, Incremental Opportunity, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 66: Europe ESD Protection Devices Market Share, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 67: Europe ESD Protection Devices Market Projections, by Protection, Value (US$ Mn), 2017–2031

Figure 68: Europe ESD Protection Devices Market, Incremental Opportunity, by Protection, Value (US$ Mn), 2022 – 2031

Figure 69: Europe ESD Protection Devices Market Share, by Protection, Value (US$ Mn), 2022 – 2031

Figure 70: Europe ESD Protection Devices Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 71: Europe ESD Protection Devices Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 72: Europe ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 73: Europe ESD Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017–2031

Figure 74: Europe ESD Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022 – 2031

Figure 75: Europe ESD Protection Devices Market Share Analysis, by End-use, 2021 and 2031

Figure 76: Europe ESD Protection Devices Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 77: Europe ESD Protection Devices Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 78: Europe ESD Protection Devices Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 79: Europe ESD Protection Devices Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 80: Europe ESD Protection Devices Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 81: Asia Pacific ESD Protection Devices Market, Y-O-Y Growth 2017–2031

Figure 82: Asia Pacific ESD Protection Devices Market, Value (US$ Mn), 2017–2031

Figure 83: Asia Pacific ESD Protection Devices Market, Volume (Million Units), 2017–2031

Figure 84: Asia Pacific ESD Protection Devices Market Projections, by Material, Value (US$ Mn), 2017–2031

Figure 85: Asia Pacific ESD Protection Devices Market, Incremental Opportunity, by Material, Value (US$ Mn), 2022 – 2031

Figure 86: Asia Pacific ESD Protection Devices Market Share, by Material, Value (US$ Mn), 2022 – 2031

Figure 87: Asia Pacific ESD Protection Devices Market Projections, by Technology, Value (US$ Mn), 2017–2031

Figure 88: Asia Pacific ESD Protection Devices Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022 – 2031

Figure 89: Asia Pacific ESD Protection Devices Market Share, by Technology, Value (US$ Mn), 2022 – 2031

Figure 90: Asia Pacific ESD Protection Devices Market Projections, by Directionality, Value (US$ Mn), 2017–2031

Figure 91: Asia Pacific ESD Protection Devices Market, Incremental Opportunity, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 92: Asia Pacific ESD Protection Devices Market Share, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 93: Asia Pacific ESD Protection Devices Market Projections, by Protection, Value (US$ Mn), 2017–2031

Figure 94: Asia Pacific ESD Protection Devices Market, Incremental Opportunity, by Protection, Value (US$ Mn), 2022 – 2031

Figure 95: Asia Pacific ESD Protection Devices Market Share, by Protection, Value (US$ Mn), 2022 – 2031

Figure 96: Asia Pacific ESD Protection Devices Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 97: Asia Pacific ESD Protection Devices Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 98: Asia Pacific ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 99: Asia Pacific ESD Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017–2031

Figure 100: Asia Pacific ESD Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022 – 2031

Figure 101: Asia Pacific ESD Protection Devices Market Share Analysis, by End-use, 2021 and 2031

Figure 102: Asia Pacific ESD Protection Devices Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 103: Asia Pacific ESD Protection Devices Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 104: Asia Pacific ESD Protection Devices Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 105: Asia Pacific ESD Protection Devices Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 106: Asia Pacific ESD Protection Devices Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 107: Middle East & Africa ESD Protection Devices Market, Y-O-Y Growth 2017–2031

Figure 108: Middle East & Africa ESD Protection Devices Market, Value (US$ Mn), 2017–2031

Figure 109: Middle East & Africa ESD Protection Devices Market, Volume (Million Units), 2017–2031

Figure 110: Middle East & Africa ESD Protection Devices Market Projections, by Material, Value (US$ Mn), 2017–2031

Figure 111: Middle East & Africa ESD Protection Devices Market, Incremental Opportunity, by Material, Value (US$ Mn), 2022 – 2031

Figure 112: Middle East & Africa ESD Protection Devices Market Share, by Material, Value (US$ Mn), 2022 – 2031

Figure 113: Middle East & Africa ESD Protection Devices Market Projections, by Technology, Value (US$ Mn), 2017–2031

Figure 114: Middle East & Africa ESD Protection Devices Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022 – 2031

Figure 115: Middle East & Africa ESD Protection Devices Market Share, by Technology, Value (US$ Mn), 2022 – 2031

Figure 116: Middle East & Africa ESD Protection Devices Market Projections, by Directionality, Value (US$ Mn), 2017–2031

Figure 117: Middle East & Africa ESD Protection Devices Market, Incremental Opportunity, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 118: Middle East & Africa ESD Protection Devices Market Share, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 119: Middle East & Africa ESD Protection Devices Market Projections, by Protection, Value (US$ Mn), 2017–2031

Figure 120: Middle East & Africa ESD Protection Devices Market, Incremental Opportunity, by Protection, Value (US$ Mn), 2022 – 2031

Figure 121: Middle East & Africa ESD Protection Devices Market Share, by Protection, Value (US$ Mn), 2022 – 2031

Figure 122: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 123: Middle East & Africa ESD Protection Devices Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 124: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 125: Middle East & Africa ESD Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017–2031

Figure 126: Middle East & Africa ESD Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022 – 2031

Figure 127: Middle East & Africa ESD Protection Devices Market Share Analysis, by End-use, 2021 and 2031

Figure 128: Middle East & Africa ESD Protection Devices Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 129: Middle East & Africa ESD Protection Devices Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 130: Middle East & Africa ESD Protection Devices Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 131: Middle East & Africa ESD Protection Devices Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 132: Middle East & Africa ESD Protection Devices Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 133: South America ESD Protection Devices Market, Y-O-Y Growth 2017–2031

Figure 134: South America ESD Protection Devices Market, Value (US$ Mn), 2017–2031

Figure 135: South America ESD Protection Devices Market, Volume (Million Units), 2017–2031

Figure 136: South America ESD Protection Devices Market Projections, by Material, Value (US$ Mn), 2017–2031

Figure 137: South America ESD Protection Devices Market, Incremental Opportunity, by Material, Value (US$ Mn), 2022 – 2031

Figure 138: South America ESD Protection Devices Market Share, by Material, Value (US$ Mn), 2022 – 2031

Figure 139: South America ESD Protection Devices Market Projections, by Technology, Value (US$ Mn), 2017–2031

Figure 140: South America ESD Protection Devices Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2022 – 2031

Figure 141: South America ESD Protection Devices Market Share, by Technology, Value (US$ Mn), 2022 – 2031

Figure 142: South America ESD Protection Devices Market Projections, by Directionality, Value (US$ Mn), 2017–2031

Figure 143: South America ESD Protection Devices Market, Incremental Opportunity, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 144: South America ESD Protection Devices Market Share, by Directionality, Value (US$ Mn), 2022 – 2031

Figure 145: South America ESD Protection Devices Market Projections, by Protection, Value (US$ Mn), 2017–2031

Figure 146: South America ESD Protection Devices Market, Incremental Opportunity, by Protection, Value (US$ Mn), 2022 – 2031

Figure 147: South America ESD Protection Devices Market Share, by Protection, Value (US$ Mn), 2022 – 2031

Figure 148: South America ESD Protection Devices Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 149: South America ESD Protection Devices Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 150: South America ESD Protection Devices Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 151: South America ESD Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017–2031

Figure 152: South America ESD Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022 – 2031

Figure 153: South America ESD Protection Devices Market Share Analysis, by End-use, 2021 and 2031

Figure 154: South America ESD Protection Devices Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 155: South America ESD Protection Devices Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 156: South America ESD Protection Devices Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 157: South America ESD Protection Devices Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 158: South America ESD Protection Devices Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031