Reports

Reports

Analyst Viewpoint

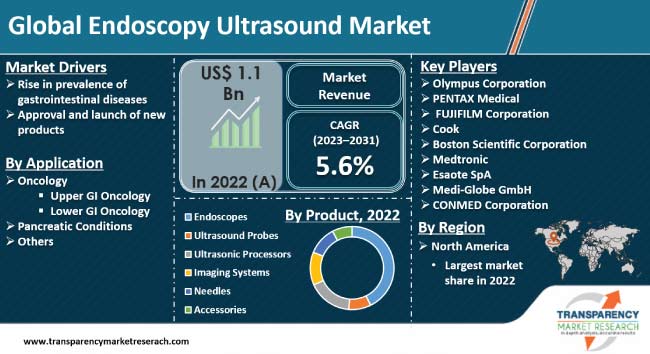

Rise in prevalence of gastrointestinal diseases and approval and launch of new products are propelling the endoscopy ultrasound market size. Endoscopy ultrasound is widely employed for the diagnosis of pancreatic cancer, inflammatory bowel disease, and other gastrointestinal diseases. Adaptable and high-performance ultrasound platforms are gaining traction in clinics and hospitals for high-quality patient care.

Growth in need for minimally invasive procedures is likely to offer lucrative opportunities for players in the sector. Key players are introducing new products and enhancing the features of their current portfolio to expand their customer base and increase their endoscopy ultrasound market share.

Endoscopic ultrasound (EUS) is a minimally invasive procedure used to diagnose gastrointestinal and lung conditions. EUS uses a specialized endoscopic ultrasound scope to transmit high-frequency sound waves, which produce incredibly detailed images of the walls and lining of the digestive tract.

The purpose of EUS is to collect a range of medical observations, including the origin of symptoms such as abdomen or chest pain. Additionally, it is possible to obtain pictures of organs, including the liver, pancreas, and lymph nodes with the help of endoscopic ultrasound scope.

Endobronchial ultrasound is used to perform ultrasonography. In the process, an endoscopic probe is inserted inside the bronchi. The ultrasound equipment produces sound waves that show images of the pancreas and surrounding tissues. Healthcare professionals perform an endoscopic ultrasound-guided biopsy, which involves removing tissue and fluid from the chest or belly for in-depth examination.

Gastrointestinal cancer is the second-leading cause of death worldwide and the top cause of death in the U.S. About 27,500 instances of stomach cancer were detected in the U.S. in 2019, according to the American Cancer Society. Consequently, there is a great unmet need for early detection of gastrointestinal disorders, which is propelling the endoscopy ultrasound market development.

The global endoscopic ultrasound industry is witnessing an emergence of cutting-edge products with the potential to enhance clinical results. Endoscopic ultrasound-guided fine needle aspiration is a widely employed minimally invasive method for early detection of pancreatic cancer. It offers high accuracy in diagnosis.

In September 2023, the Food and Drug Administration (FDA) granted 510(k) clearance for Limaca Medical’s Precision GITM Endoscopic Ultrasound (EUS) Biopsy Device, which may facilitate improved quality and quantity of biopsy tissue. Precision GI features a unique motorized, automated rotational cutting needle for successful, safe, and high-quality tissue acquisition. Thus, approval and launch of new products is augmenting the endoscopy ultrasound market landscape. Similarly, MyLab V8 by ESAOTE offers adaptable and high-performance ultrasound platforms to support clinics and hospitals in providing high-quality patient care.

According to the latest endoscopy ultrasound market trends, North America held largest share in 2022. High prevalence of gastrointestinal illnesses and growth in adoption of minimally invasive diagnostic procedures Are propelling the market dynamics of the region. According to the American Cancer Society, pancreatic cancer is the fourth most common cause of cancer-related deaths in the US, with an expected 60,430 new cases in 2021.Rise in R&D expenditures is also boosting the endoscopy ultrasound industry statistics in North America.

According to the latest endoscopy ultrasound industry forecast, Asia Pacific is expected to grow at a steady pace from 2023 to 2031. Increase in incidence of gastrointestinal diseases and growth in geriatric population are driving the market trajectory in the region. According to the United Nations, the number of elderly people in Asia Pacific is expected to reach approximately 1.3 billion by 2050. Surge in demand for minimally invasive diagnostic procedures and rise in focus on early diagnosis are also fueling the endoscopy ultrasound market revenue in the region.

Key players are investing in the R&D of new products to expand their product portfolio and increase their endoscopy ultrasound market share. Olympus Corporation, PENTAX Medical, FUJIFILM Corporation, Cook, Boston Scientific Corporation, Medtronic, Esaote SpA, Medi-Globe GmbH, and CONMED Corporation are key players operating in this market.

Each of these companies has been profiled in the endoscopy ultrasound market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 1.1 Bn |

| Market Forecast (Value) in 2031 | US$ 1.8 Bn |

| Growth Rate (CAGR) | 6.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.1 Bn in 2022

It is anticipated to grow at a CAGR of 5.6% from 2023 to 2031

Rise in prevalence of gastrointestinal diseases and approval and launch of new products

The endoscopes segment held the largest share in 2022

North American region provided higher business opportunities in 2022

Olympus Corporation, PENTAX Medical, FUJIFILM Corporation, Cook, Boston Scientific Corporation, Medtronic, Esaote SpA, Medi-Globe GmbH, and CONMED Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Endoscopy Ultrasound Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Endoscopy Ultrasound Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Endoscopy Ultrasound Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Endoscopes

6.3.2. Ultrasound Probes

6.3.3. Ultrasonic Processors

6.3.4. Imaging Systems

6.3.5. Needles

6.3.6. Accessories

6.4. Market Attractiveness, by Product

7. Global Endoscopy Ultrasound Market Analysis and Forecast, by Application

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Oncology

7.3.1.1. Upper GI Oncology

7.3.1.2. Lower GI Oncology

7.3.2. Pancreatic Conditions

7.3.3. Others

7.4. 7.4 Market Attractiveness, by Application

8. Global Endoscopy Ultrasound Market Analysis and Forecast, by Technology

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Technology, 2017–2031

8.3.1. Radical Scanning

8.3.2. Linear Scanning

8.4. Market Attractiveness, by Technology

9. Global Endoscopy Ultrasound Market Analysis and Forecast, By Procedure

9.1. Introduction and Definitions

9.2. Key Findings/Developments

9.3. Market Value Forecast, By Procedure, 2017–2031

9.3.1. Upper EUS

9.3.2. Lower EUS

9.3.3. EUS Guided Fine-needle Aspiration

9.3.4. Others

9.4. Market Attractiveness, By Procedure

10. Global Endoscopy Ultrasound Market Analysis and Forecast, by End-user

10.1. Introduction and Definitions

10.2. Key Findings/Developments

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Specialty Clinic

10.3.3. Ambulatory Surgery Centers

10.3.4. Diagnostic Centers

10.4. Market Attractiveness, by End-user

11. Global Endoscopy Ultrasound Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region, 2017–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness, by Region

12. North America Endoscopy Ultrasound Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Endoscopes

12.2.2. Ultrasound Probes

12.2.3. Ultrasonic Processors

12.2.4. Imaging Systems

12.2.5. Needles

12.2.6. Accessories

12.3. Market Attractiveness, by Product

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Oncology

12.4.1.1. Upper GI Oncology

12.4.1.2. Lower GI Oncology

12.4.2. Pancreatic Conditions

12.4.3. Others

12.5. Market Attractiveness, by Application

12.6. Market Value Forecast, by Technology, 2017–2031

12.6.1. Radical Scanning

12.6.2. Linear Scanning

12.7. Market Attractiveness, by Technology

12.8. Market Value Forecast, By Procedure, 2017–2031

12.8.1. Upper EUS

12.8.2. Lower EUS

12.8.3. EUS Guided Fine-needle Aspiration

12.8.4. Others

12.9. Market Attractiveness, By Procedure

12.10. Market Value Forecast, by End-user, 2017–2031

12.10.1. Hospitals

12.10.2. Specialty Clinic

12.10.3. Ambulatory Surgery Centers

12.10.4. Diagnostic Centers

12.11. Market Attractiveness, by End-user

12.12. Market Value Forecast, by Country/Sub-region, 2017–2031

12.12.1. U.S.

12.12.2. Canada

12.13. Market Attractiveness Analysis

12.13.1. By Product

12.13.2. By Application

12.13.3. By Technology

12.13.4. By Procedure

12.13.5. By End-user

12.13.6. By Country

13. Europe Endoscopy Ultrasound Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Endoscopes

13.2.2. Ultrasound Probes

13.2.3. Ultrasonic Processors

13.2.4. Imaging Systems

13.2.5. Needles

13.2.6. Accessories

13.3. Market Attractiveness, by Product

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Oncology

13.4.1.1. Upper GI Oncology

13.4.1.2. Lower GI Oncology

13.4.2. Pancreatic Conditions

13.4.3. Others

13.5. Market Attractiveness, by Application

13.6. Market Value Forecast, by Technology, 2017–2031

13.6.1. Radical Scanning

13.6.2. Linear Scanning

13.7. Market Attractiveness, by Technology

13.8. Market Value Forecast, By Procedure, 2017–2031

13.8.1. Upper EUS

13.8.2. Lower EUS

13.8.3. EUS Guided Fine-needle Aspiration

13.8.4. Others

13.9. Market Attractiveness, By Procedure

13.10. Market Value Forecast, by End-user, 2017–2031

13.10.1. Hospitals

13.10.2. Specialty Clinic

13.10.3. Ambulatory Surgery Centers

13.10.4. Diagnostic Centers

13.11. Market Attractiveness, by End-user

13.12. Market Value Forecast, by Country/Sub-region, 2017–2031

13.12.1. Germany

13.12.2. U.K.

13.12.3. France

13.12.4. Italy

13.12.5. Spain

13.12.6. Rest of Europe

13.13. Market Attractiveness Analysis

13.13.1. By Product

13.13.2. By Application

13.13.3. By Technology

13.13.4. By Procedure

13.13.5. By End-user

13.13.6. By Country/Sub-region

14. Asia Pacific Endoscopy Ultrasound Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Endoscopes

14.2.2. Ultrasound Probes

14.2.3. Ultrasonic Processors

14.2.4. Imaging Systems

14.2.5. Needles

14.2.6. Accessories

14.3. Market Attractiveness, by Product

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Oncology

14.4.1.1. Upper GI Oncology

14.4.1.2. Lower GI Oncology

14.4.2. Pancreatic Conditions

14.4.3. Others

14.5. Market Attractiveness, by Application

14.6. Market Value Forecast, by Technology, 2017–2031

14.6.1. Radical Scanning

14.6.2. Linear Scanning

14.7. Market Attractiveness, by Technology

14.8. Market Value Forecast, By Procedure, 2017–2031

14.8.1. Upper EUS

14.8.2. Lower EUS

14.8.3. EUS Guided Fine-needle Aspiration

14.8.4. Others

14.9. Market Attractiveness, By Procedure

14.10. Market Value Forecast, by End-user, 2017–2031

14.10.1. Hospitals

14.10.2. Specialty Clinic

14.10.3. Ambulatory Surgery Centers

14.10.4. Diagnostic Centers

14.11. Market Attractiveness, by End-user

14.12. Market Value Forecast, by Country/Sub-region, 2017–2031

14.12.1. China

14.12.2. Japan

14.12.3. India

14.12.4. Australia & New Zealand

14.12.5. Rest of Asia Pacific

14.13. Market Attractiveness Analysis

14.13.1. By Product

14.13.2. By Application

14.13.3. By Technology

14.13.4. By Procedure

14.13.5. By End-user

14.13.6. By Country/Sub-region

15. Latin America Endoscopy Ultrasound Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Endoscopes

15.2.2. Ultrasound Probes

15.2.3. Ultrasonic Processors

15.2.4. Imaging Systems

15.2.5. Needles

15.2.6. Accessories

15.3. Market Attractiveness, by Product

15.4. Market Value Forecast, by Application, 2017–2031

15.4.1. Oncology

15.4.1.1. Upper GI Oncology

15.4.1.2. Lower GI Oncology

15.4.2. Pancreatic Conditions

15.4.3. Others

15.5. Market Attractiveness, by Application

15.6. Market Value Forecast, by Technology, 2017–2031

15.6.1. Radical Scanning

15.6.2. Linear Scanning

15.7. Market Attractiveness, by Technology

15.8. Market Value Forecast, By Procedure, 2017–2031

15.8.1. Upper EUS

15.8.2. Lower EUS

15.8.3. EUS Guided Fine-needle Aspiration

15.8.4. Others

15.9. Market Attractiveness, By Procedure

15.10. Market Value Forecast, by End-user, 2017–2031

15.10.1. Hospitals

15.10.2. Specialty Clinic

15.10.3. Ambulatory Surgery Centers

15.10.4. Diagnostic Centers

15.11. Market Attractiveness, by End-user

15.12. Market Value Forecast, by Country/Sub-region, 2017–2031

15.12.1. Brazil

15.12.2. Mexico

15.12.3. Rest of Latin America

15.13. Market Attractiveness Analysis

15.13.1. By Product

15.13.2. By Application

15.13.3. By Technology

15.13.4. By Procedure

15.13.5. By End-user

15.13.6. By Country/Sub-region

16. Middle East & Africa Endoscopy Ultrasound Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Product, 2017–2031

16.2.1. Endoscopes

16.2.2. Ultrasound Probes

16.2.3. Ultrasonic Processors

16.2.4. Imaging Systems

16.2.5. Needles

16.2.6. Accessories

16.3. Market Attractiveness, by Product

16.4. Market Value Forecast, by Application, 2017–2031

16.4.1. Oncology

16.4.1.1. Upper GI Oncology

16.4.1.2. Lower GI Oncology

16.4.2. Pancreatic Conditions

16.4.3. Others

16.5. Market Attractiveness, by Application

16.6. Market Value Forecast, by Technology, 2017–2031

16.6.1.1. Radical Scanning

16.6.1.2. Linear Scanning

16.7. Market Attractiveness, by Technology

16.8. Market Value Forecast, By Procedure, 2017–2031

16.8.1. Upper EUS

16.8.2. Lower EUS

16.8.3. EUS Guided Fine-needle Aspiration

16.8.4. Others

16.9. Market Attractiveness, By Procedure

16.10. Market Value Forecast, by End-user, 2017–2031

16.10.1. Hospitals

16.10.2. Specialty Clinic

16.10.3. Ambulatory Surgery Centers

16.10.4. Diagnostic Centers

16.11. Market Attractiveness, by End-user

16.12. Market Value Forecast, by Country/Sub-region, 2017–2031

16.12.1. GCC Countries

16.12.2. South Africa

16.12.3. Rest of Middle East & Africa

16.13. Market Attractiveness Analysis

16.13.1. By Product

16.13.2. By Application

16.13.3. By Technology

16.13.4. By Procedure

16.13.5. By End-user

16.13.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of Companies)

17.2. Market Share Analysis, by Company (2022)

17.3. Company Profiles

17.3.1. Olympus Corporation

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Product Portfolio

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. PENTAX Medical

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Product Portfolio

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. FUJIFILM Corporation

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Product Portfolio

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Cook

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Product Portfolio

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. Boston Scientific Corporation

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Product Portfolio

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. Medtronic

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Product Portfolio

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Esaote SpA

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Product Portfolio

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. Medi-Globe GmbH

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Product Portfolio

17.3.8.3. Financial Overview

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. CONMED Corporation

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Product Portfolio

17.3.9.3. Financial Overview

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

List of Tables

Table 01: Global Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Endoscopy Ultrasound Market Size (US$ Mn) Forecast, By Procedure, 2017–2031

Table 04: Global Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 05: Global Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 09: North America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 11: North America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, By Procedure, 2017–2031

Table 12: North America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Europe Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Europe Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 17: Europe Endoscopy Ultrasound Market Size (US$ Mn) Forecast, By Procedure, 2017–2031

Table 18: Europe Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 21: Asia Pacific Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 22: Asia Pacific Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 23: Asia Pacific Endoscopy Ultrasound Market Size (US$ Mn) Forecast, By Procedure, 2017–2031

Table 24: Asia Pacific Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 27: Latin America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 28: Latin America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 29: Latin America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, By Procedure, 2017–2031

Table 30: Latin America Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 33: Middle East & Africa Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 34: Middle East & Africa Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 35: Middle East & Africa Endoscopy Ultrasound Market Size (US$ Mn) Forecast, By Procedure, 2017–2031

Table 36: Middle East & Africa Endoscopy Ultrasound Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Endoscopy Ultrasound Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Endoscopy Ultrasound Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Endoscopy Ultrasound Market Value Share, by Product, 2022

Figure 04: Global Endoscopy Ultrasound Market Revenue (US$ Mn), by Application, 2022

Figure 05: Global Endoscopy Ultrasound Market Value Share, by Application, 2022

Figure 06: Global Endoscopy Ultrasound Market Revenue (US$ Mn), by Technology, 2022

Figure 07: Global Endoscopy Ultrasound Market Value Share, by Technology, 2022

Figure 08: Global Endoscopy Ultrasound Market Revenue (US$ Mn), By Procedure, 2022

Figure 09: Global Endoscopy Ultrasound Market Value Share, By Procedure, 2022

Figure 10: Global Endoscopy Ultrasound Market Revenue (US$ Mn), by End-user, 2022

Figure 11: Global Endoscopy Ultrasound Market Value Share, by End-user, 2022

Figure 12: Global Endoscopy Ultrasound Market Value Share, by Region, 2022

Figure 13: Global Endoscopy Ultrasound Market Value (US$ Mn) Forecast, 2017–2031

Figure 14: Global Endoscopy Ultrasound Market Value Share Analysis, by Product, 2022 and 2031

Figure 15: Global Endoscopy Ultrasound Market Attractiveness Analysis, by Product, 2023-2031

Figure 16: Global Endoscopy Ultrasound Market Value Share Analysis, by Application, 2022 and 2031

Figure 17: Global Endoscopy Ultrasound Market Attractiveness Analysis, by Application, 2023-2031

Figure 18: Global Endoscopy Ultrasound Market Value Share Analysis, by Technology, 2022 and 2031

Figure 19: Global Endoscopy Ultrasound Market Attractiveness Analysis, by Technology, 2023-2031

Figure 20: Global Endoscopy Ultrasound Market Revenue (US$ Mn), By Procedure, 2022

Figure 21: Global Endoscopy Ultrasound Market Value Share, By Procedure, 2022

Figure 22: Global Endoscopy Ultrasound Market Revenue (US$ Mn), by End-user, 2022

Figure 23: Global Endoscopy Ultrasound Market Value Share, by End-user, 2022

Figure 24: Global Endoscopy Ultrasound Market Value Share Analysis, by Region, 2022 and 2031

Figure 25: Global Endoscopy Ultrasound Market Attractiveness Analysis, by Region, 2023-2031

Figure 26: North America Endoscopy Ultrasound Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 27: North America Endoscopy Ultrasound Market Attractiveness Analysis, by Country, 2023–2031

Figure 28: North America Endoscopy Ultrasound Market Value Share Analysis, by Country, 2022 and 2031

Figure 29: North America Endoscopy Ultrasound Market Value Share Analysis, by Product, 2022 and 2031

Figure 30: North America Endoscopy Ultrasound Market Value Share Analysis, by Application, 2022 and 2031

Figure 31: North America Endoscopy Ultrasound Market Value Share Analysis, by Technology, 2022 and 2031

Figure 32: North America Endoscopy Ultrasound Market Value Share Analysis, By Procedure, 2022 and 2031

Figure 33: North America Endoscopy Ultrasound Market Value Share Analysis, by End-user, 2022 and 2031

Figure 34: North America Endoscopy Ultrasound Market Attractiveness Analysis, by Product, 2023–2031

Figure 35: North America Endoscopy Ultrasound Market Attractiveness Analysis, by Application, 2023–2031

Figure 36: North America Endoscopy Ultrasound Market Attractiveness Analysis, by Technology, 2023–2031

Figure 37: North America Endoscopy Ultrasound Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 38: North America Endoscopy Ultrasound Market Attractiveness Analysis, by End-user, 2023–2031

Figure 39: Europe Endoscopy Ultrasound Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 40: Europe Endoscopy Ultrasound Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 41: Europe Endoscopy Ultrasound Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Europe Endoscopy Ultrasound Market Value Share Analysis, by Product, 2022 and 2031

Figure 43: Europe Endoscopy Ultrasound Market Value Share Analysis, by Application, 2022 and 2031

Figure 44: Europe Endoscopy Ultrasound Market Value Share Analysis, by Technology, 2022 and 2031

Figure 45: Europe Endoscopy Ultrasound Market Value Share Analysis, By Procedure, 2022 and 2031

Figure 46: Europe Endoscopy Ultrasound Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Europe Endoscopy Ultrasound Market Attractiveness Analysis, by Product, 2023–2031

Figure 48: Europe Endoscopy Ultrasound Market Attractiveness Analysis, by Application, 2023–2031

Figure 49: Europe Endoscopy Ultrasound Market Attractiveness Analysis, by Technology, 2023–2031

Figure 50: Europe Endoscopy Ultrasound Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 51: Europe Endoscopy Ultrasound Market Attractiveness Analysis, by End-user, 2023–2031

Figure 52: Asia Pacific Endoscopy Ultrasound Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 53: Asia Pacific Endoscopy Ultrasound Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 54: Asia Pacific Endoscopy Ultrasound Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55: Asia Pacific Endoscopy Ultrasound Market Value Share Analysis, by Product, 2022 and 2031

Figure 56: Asia Pacific Endoscopy Ultrasound Market Value Share Analysis, by Application, 2022 and 2031

Figure 57: Asia Pacific Endoscopy Ultrasound Market Value Share Analysis, by Technology, 2022 and 2031

Figure 58: Asia Pacific Endoscopy Ultrasound Market Value Share Analysis, By Procedure, 2022 and 2031

Figure 59: Asia Pacific Endoscopy Ultrasound Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Asia Pacific Endoscopy Ultrasound Market Attractiveness Analysis, by Product, 2023–2031

Figure 61: Asia Pacific Endoscopy Ultrasound Market Attractiveness Analysis, by Application, 2023–2031

Figure 62: Asia Pacific Endoscopy Ultrasound Market Attractiveness Analysis, by Technology, 2023–2031

Figure 63: Asia Pacific Endoscopy Ultrasound Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 64: Asia Pacific Endoscopy Ultrasound Market Attractiveness Analysis, by End-user, 2023–2031

Figure 65: Latin America Endoscopy Ultrasound Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 66: Latin America Endoscopy Ultrasound Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 67: Latin America Endoscopy Ultrasound Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 68: Latin America Endoscopy Ultrasound Market Value Share Analysis, by Product, 2022 and 2031

Figure 69: Latin America Endoscopy Ultrasound Market Value Share Analysis, by Application, 2022 and 2031

Figure 70: Latin America Endoscopy Ultrasound Market Value Share Analysis, by Technology, 2022 and 2031

Figure 71: Latin America Endoscopy Ultrasound Market Value Share Analysis, By Procedure, 2022 and 2031

Figure 72: Latin America Endoscopy Ultrasound Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Latin America Endoscopy Ultrasound Market Attractiveness Analysis, by Product, 2023–2031

Figure 74: Latin America Endoscopy Ultrasound Market Attractiveness Analysis, by Application, 2023–2031

Figure 75: Latin America Endoscopy Ultrasound Market Attractiveness Analysis, by Technology, 2023–2031

Figure 76: Latin America Endoscopy Ultrasound Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 77: Latin America Endoscopy Ultrasound Market Attractiveness Analysis, by End-user, 2023–2031

Figure 78: Middle East & Africa Endoscopy Ultrasound Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 79: Middle East & Africa Endoscopy Ultrasound Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 80: Middle East & Africa Endoscopy Ultrasound Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 81: Middle East & Africa Endoscopy Ultrasound Market Value Share Analysis, by Product, 2022 and 2031

Figure 82: Middle East & Africa Endoscopy Ultrasound Market Value Share Analysis, by Application, 2022 and 2031

Figure 83: Middle East & Africa Endoscopy Ultrasound Market Value Share Analysis, by Technology, 2022 and 2031

Figure 84: Middle East & Africa Endoscopy Ultrasound Market Value Share Analysis, By Procedure, 2022 and 2031

Figure 85: Middle East & Africa Endoscopy Ultrasound Market Value Share Analysis, by End-user, 2022 and 2031

Figure 86: Middle East & Africa Endoscopy Ultrasound Market Attractiveness Analysis, by Product, 2023–2031

Figure 87: Middle East & Africa Endoscopy Ultrasound Market Attractiveness Analysis, by Application, 2023–2031

Figure 88: Middle East & Africa Endoscopy Ultrasound Market Attractiveness Analysis, by Technology, 2023–2031

Figure 89: Middle East & Africa Endoscopy Ultrasound Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 90: Middle East & Africa Endoscopy Ultrasound Market Attractiveness Analysis, by End-user, 2023–2031