Reports

Reports

Bionics is the study of biological functions and the development artificial organs and body parts that are used as a replacement of the original part or organs. The bionic organs are designed in such a way so that they can imitate the functions of the organs in order to operate properly. The market is expected to grow during the forecast period due to the increasing demand for artificial organs in the healthcare sector. In addition, the aging population is resulting into multiple organ failure. This in return is creating a need for organ transplant. However, the chance for getting a suitable donor for a transplant requires lot of time and thus reduces the chance of survival. The use of bionics part does not require time and these parts are designed to adjust with the body requirements. Furthermore, the bionics are also being applied in the defense sector in the form of exoskeleton suits which enables a soldier to carry heavy loads without reducing his or her speed in the battlefield.

The global bionics market can be segmented by types into bionic brain, bionic heart, bionic limbs, vision bionics, exoskeleton and others. In terms of application the market has been divided in healthcare and defense. Furthermore, the bionics market has also been segregated by types of technology into mechanical bionics and electrical bionics. Globally, bionic limbs occupy the largest market share by types of bionics, followed by bionic heart. The bionic limbs are extensively being used globally as an alternative solution after amputations and increase in heart failure is resulting in the development bionic heart replacement organs.

The global bionics market has been valued at USD 7.96 billion in 2014, growing at a CAGR of 13.2% from 2015 to 2021. The bionics is majorly used in the healthcare sector in the form of artificial organs to replace the malfunctioning organs in the human body. In addition, the bionics is also being applied in the defense sector to create exoskeleton suits for soldiers to give them added advantage in the battle field.

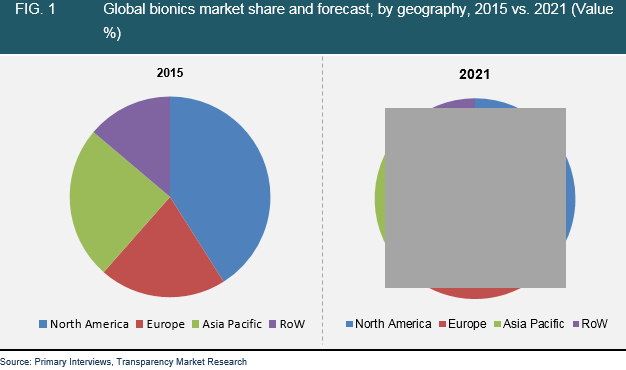

By geography, the global bionics market has been segmented into North America, Europe, Asia Pacific (APAC) and Rest of the world (RoW). The bionics market is facing demand due to the increasing cases of accidents which is leading to paralysis or amputation of limbs. In addition, the aging population is resulting into organ failures, which is fuelling the growth for this market.

In 2015, North America is leading the global bionics market and is expected to dominate the market during the forecast period. The increasing application of bionics as a replacement for organ transplant is acting as a driver for the market. North America is followed by Asia Pacific accounting for than 20% of the global market. Asia Pacific is also the fastest growing region due to the presence of major economies such as China, Japan and India. However rest of the world is expected to maintain steady growth due of the developing regions as the use of bionic organs is very expensive.

The global bionics market by types is categorized into bionic brain, bionic heart, bionic limbs, bionic vision, exoskeleton and other bionic organs. The bionic limb has the highest market share in 2015 and is expected to dominate the market during the forecast period. The growth of bionic limbs is due to increasing number of accidents which is leading to amputation or paralysis of limbs.

In terms of application, the bionics market can be segmented into: healthcare and defense. The bionics is majorly used in the healthcare sector and account for nearly 75% of the global bionics market. However, the defense sector is the fastest growing segment during the forecast period.

Advancements in 3D Printing to Escalate the Growth Opportunities across the Bionics Market

The change in the lifestyle of a large number of individuals is leading to a rise in the incidence of disabilities and organ failures. The increasing rate of such disabilities among a large chunk of the global populace is leading to the development of artificial organs. All these aspects invite promising growth for the bionics market during the assessment period of 2015-2021.

Chapter 1 Preface

1.1 Research description

1.2 Research scope

1.3 Research methodology

Chapter 2 Executive Summary

Chapter 3 Market overview

3.1 Introduction

3.2 Key trend analysis

3.3 Market Drivers

3.3.1 Supply Side

3.3.1.1 Technological advancements in healthcare sector

3.3.2 Demand Side

3.3.2.1 Aging population leading to increase in organ failure

3.3.2.2 Increasing accidents leading to amputations

3.3.2.3 Increase in application of exoskeletons in defense

3.3.3 Impact Analysis of Drivers

3.4 Market Restraints

3.4.1 High cost of bionic devices

3.5 Market Opportunities

3.5.1 Increase in disposable income and rising awareness for health in emerging economies

3.5.2 Bionics as a substitute of robotics

3.6 Market attractiveness, by types, 2020

3.7 Market share of key players

Chapter 4 Global Bionics Market Analysis, by Types 2014-2021 (USD Billion)

4.1 Overview

4.2 Bionic brain

4.2.1 Bionic brains market size and forecast, 2014 – 2021 (USD billion)

4.3 Bionic heart

4.3.1 Bionic heart market size and forecast, 2014 – 2021 (USD billion)

4.4 Bionic limbs

4.4.1 Bionic limbs market size and forecast, 2014 – 2020 (USD billion)

4.5 Bionic vision

4.5.1 Bionic vision market size and forecast, 2014 – 2020 (USD billion)

4.6 Exoskeleton

4.6.1 Exoskeleton market size and forecast, 2014 – 2021 (USD billion)

4.7 Others

4.7.1 Others market size and forecast, 2014 – 2020 (USD billion)

Chapter 5 Global Bionics Market Analysis, by Application 2014-2021 (USD Billion)

5.1 Overview

5.2 Healthcare

5.2.1 Healthcare market size and forecast, 2014 – 2021 (USD billion)

5.3 Defense

5.3.1 Defence market size and forecast, 2014 – 2021 (USD billion)

Chapter 6 Global Bionics Market Analysis, by Technology 2014-2021 (USD Billion)

6.1 Overview

6.2 Mechanical Bionics

6.2.1 Mechanical bionics market size and forecast, 2014 – 2021 (USD billion)

6.3 Electronic Bionics

6.3.1 Electronic bionics market size and forecast, 2014 – 2021 (USD billion)

Chapter 7 Global Bionics Market Analysis by Geography 2014-2021 (USD Billion)

7.1 Overview

7.2 North America bionics market

7.2.1 North America bionics market size and forecast, 2014 – 2021 (USD billion)

7.3 Europe bionics market

7.3.1 Bionics market size and forecast in Europe, 2014 – 2021 (USD billion)

7.4 Asia Pacific bionics market

7.4.1 Bionics market size and forecast in Asia Pacific, 2014 – 2021 (USD billion)

7.5 RoW bionics market

7.5.1 RoW Bionics Market Size and Forecast, 2014 – 2021 (USD billion)

Chapter 8 Company Profiles

8.1 Abiomed, Inc.

8.2 Asahi Kasei Medical Co. Ltd.

8.3 Baxter International, Inc.

8.4 Sonova Holding AG

8.5 Medtronic Plc

8.6 Nikkiso Co. Ltd.

8.7 SynCardia Systems, Inc.

8.8 HeartWare, Inc.

8.9 EKSO Bionics

8.10 Ottobock Healthcare

List of Tables

TABLE 1 Global Bionics Market Snapshot

TABLE 2 Bionics market size and forecast, by Types, 2014 – 2021 (USD billion)

TABLE 3 Drivers for global bionics: Impact analysis

TABLE 4 North America bionics market size and forecast by Types, 2014 – 2021 (USD billion)

TABLE 5 North America bionics market and forecast by Application, 2014 – 2021 (USD billion)

TABLE 6 North America bionics market and forecast by Technology, 2014 – 2021 (USD billion)

TABLE 7 Europe bionics market size and forecast by Types 2014 – 2021 (USD billion)

TABLE 8 Europe bionics market and forecast by Application, 2014 – 2021 (USD billion)

TABLE 9 Europe bionics market and forecast by Technology, 2014 – 2021 (USD billion)

TABLE 10 Asia Pacific bionics market size and forecast by Types, 2014 – 2021 (USD billion)

TABLE 11 Asia Pacific bionics market and forecast by Application, 2014 – 2021 (USD billion)

TABLE 12 Asia Pacific bionics market and forecast by Technology, 2014 – 2021 (USD billion)

TABLE 13 Rest of the world bionics market size and forecast by Types, 2014 – 2021 (USD billion)

TABLE 14 Rest of the world bionics market and forecast by Application, 2014 – 2021 (USD billion)

TABLE 15 Rest of the world bionics market and forecast by Technology, 2014 – 2021 (USD billion)

List of Figures

FIG. 1 Market segmentation: Global Bionics Market

FIG. 2 Global bionics market attractiveness, by types

FIG. 3 Global bionics market share and forecast by Types, 2014 vs. 2021 (Value %)

FIG. 4 Bionic brains market size and forecast, 2014 – 2021 (USD billion)

FIG. 5 Bionic heart market size and forecast, 2014 – 2021 (USD billion)

FIG. 6 Bionic limbs market size and forecast, 2014 – 2021 (USD billion)

FIG. 7 Bionic vision market size and forecast, 2014 – 2021 (USD billion)

FIG. 8 Exoskeleton size and forecast, 2014 – 2021 (USD billion)

FIG. 9 Others market size and forecast, 2014 – 2021 (USD billion)

FIG. 10 Global bionics market share and forecast by Applications, 2014 vs. 2021 (Value %)

FIG. 11 Healthcare market size and forecast, 2014 – 2021 (USD billion)

FIG. 12 Defence market size and forecast, 2014 – 2021 (USD billion)

FIG. 13 Global bionics market share and forecast by services, 2014 vs. 2021 (Value %)

FIG. 14 Mechanical bionics market size and forecast, 2014 – 2021 (USD billion)

FIG. 15 Electronic bionics market size and forecast, 2014 – 2021 (USD billion)

FIG. 16 Global bionics market trend by geography, 2014 - 2021 (USD billion)

FIG. 17 North America bionics market size and forecast, 2014 – 2021 (USD billion)

FIG. 18 Bionics market size and forecast in Europe, 2014 – 2021 (USD billion)

FIG. 19 Bionics market size and forecast in Asia Pacific, 2014 – 2021 (USD billion)

FIG. 20 RoW bionics Market Size and Forecast, 2014 – 2021 (USD billion)