Reports

Reports

Analysts’ Viewpoint on Market Scenario

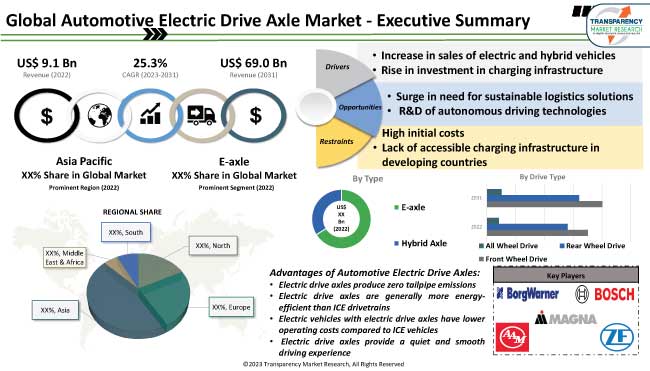

Increase in adoption of electric vehicles is expected to propel the automotive electric drive axle market size during the forecast period. Countries across the globe are setting ambitious targets for transitioning to electric mobility and automakers are investing heavily in electric vehicle production. These factors are positively impacting the global automotive electric drive axle industry growth.

Rise in environmental awareness and concerns about air pollution and climate change are pushing consumers and governments toward cleaner modes of transportation. This, in turn, is projected to offer lucrative opportunities to automotive electric drive axle manufacturers. Supply chain expansion and localization of electric drive axle production are likely to influence the automotive electric drive axle market growth in the near future.

Automotive electric drive axle refers to the system that provides propulsion to the wheels of an electric vehicle. It is an essential component in Electric Vehicles (EVs) responsible for transmitting power from the electric motor(s) to the wheels, allowing the vehicle to move.

An electric drive axle typically consists of key components such as electric motors, power electronics, reduction gear, differential, axle shafts, electric drive units, and heat management devices. Electric drive axles are available in various configurations, including Front Wheel Drive (FWD), Rear Wheel Drive (RWD), and All Wheel Drive (AWD). The choice of drive configuration depends on the vehicle's design, performance goals, and intended application.

Advancements in electric drive axle technology, such as improved power electronics, motor efficiency, and regenerative braking systems, have resulted in better performance and efficiency of electric vehicles. These technological improvements have driven the adoption of electric drive axles in the automotive industry.

Many countries and regions worldwide are implementing stringent emission regulations and offering incentives to promote the adoption of electric and hybrid vehicles. These policies aim to reduce greenhouse gas emissions and combat air pollution, thereby driving consumers and automakers toward cleaner alternatives. This, in turn, is fueling the automotive electric drive axle market value.

The cost of battery production for electric vehicles has been decreasing steadily over the years. As battery costs become more competitive with traditional internal combustion engines, electric vehicles become more economically viable, making them attractive to a broader range of consumers. Thus, demand for high-performance automotive electric drive axles is projected to grow as more consumers are opting for electric vehicles.

Growth in awareness regarding environmental issues and the resultant surge in need for cleaner and more sustainable transportation options are fueling consumer interest in electric and hybrid vehicles. Demand for efficient electric drive axles for EVs is expected to rise in the near future as consumers are becoming more informed about the benefits of electric vehicles.

Drive range is a primary concern of EV buyers. Increase in the availability of charging stations, especially fast-charging networks, can help address this issue. Governments across the globe are expanding charging infrastructure in urban areas, highways, workplaces, and residential buildings, thereby making charging more accessible and convenient for EV owners. This ease of charging is encouraging more people to switch to electric vehicles, which is propelling the automotive electric drive axle market expansion.

Expansion of charging infrastructure signals a commitment to electric mobility and attracts more investment in electric vehicle technology and related components, including lightweight automotive electric drive axles. This investment supports research, development, and innovation in the electric vehicle industry, further driving market revenue.

According to the latest automotive electric drive axle market trends, the e-axle type segment is expected to hold largest share from 2023 to 2031. The segment accounted for 66.1% share in 2022. E-axles integrate essential components, such as the electric motor, power electronics, and reduction gear, into a single compact unit. This integration simplifies the vehicle's design, reduces complexity, and saves space, making it an attractive option for electric vehicle manufacturers.

E-axles can lead to cost and weight savings in electric vehicles compared to traditional drivetrain setups. By combining multiple components into one unit, manufacturers can reduce manufacturing and assembly costs, making electric vehicles more competitive in the market.

According to the latest automotive electric drive axle market analysis, front wheel drive was the largest drive type segment with 43.2% share in 2022. FWD layouts allow for a more space-efficient vehicle design. Placing the electric motor and drivetrain components at the front of the vehicle leaves more room in the rear for passengers and cargo. This is particularly beneficial for compact and midsize electric cars, which are popular choices for urban commuting.

FWD provides good traction and stability, especially in slippery or challenging road conditions, making it suitable for a wide range of driving scenarios. This is essential for electric vehicles as it enhances safety and overall drivability. Electric vehicles are popular choices for urban commuting, where the majority of driving occurs on well-maintained roads with good traction. FWD is well suited for this type of driving, making it an attractive option for urban dwellers and city drivers.

According to the latest automotive electric drive axle market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Implementation of stringent energy regulations and government incentives promoting the adoption of electric vehicles are fueling the market dynamics of the region. These policies often include financial incentives, tax breaks, and subsidies for EV buyers, as well as stringent emission standards for traditional internal combustion engine vehicles. Such initiatives are creating a favorable environment for electric vehicle adoption, thereby boosting demand for automotive electric drive axles.

Rise in investment in EV charging infrastructure, including public charging stations and fast-charging networks, is propelling market statistics in Asia Pacific. Expansion of charging infrastructure helps address the range anxiety concern for EV owners and boosts confidence in using electric vehicles, thereby leading to higher demand for automotive electric drive axles.

The global industry is fragmented, with the presence of several automotive electric drive axle vendors. Most companies are expanding their supply chain networks to increase their automotive electric drive axle market share. They are also adopting collaboration, partnership, and merger & acquisition strategies to broaden their customer base.

American Axle & Manufacturing, Inc., Benevelli Srl, Bonfiglioli S.p.A, BorgWarner Inc., Continental AG, Dana Limited, FPW Axles Limited, GKN Automotive Limited, LOHR, Magna International Inc., PRM Newage, Protean, Robert Bosch GmbH, Schaeffler AG, Toyoda Gosei Co., Ltd., Univance Corporation, Danfoss, ZF Friedrichshafen AG, and ZIEHL –ABEGG SE are key entities operating in this industry.

Each of these players has been profiled in the automotive electric drive axle market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 9.1 Bn |

|

Market Forecast Value in 2031 |

US$ 69.0 Bn |

|

Growth Rate (CAGR) |

25.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s five forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 9.1 Bn in 2022

It is projected to advance at a CAGR of 25.3% from 2023 to 2031

It is estimated to reach US$ 69.0 Bn by the end of 2031

Increase in sales of electric and hybrid vehicles and rise in investment in charging infrastructure

The e-axle type segment accounted for major share of 66.1% in 2022

Asia Pacific is projected to record the highest demand during the forecast period

American Axle & Manufacturing, Inc., Benevelli Srl, Bonfiglioli S.p.A, BorgWarner Inc., Continental AG, Dana Limited, FPW Axles Limited, GKN Automotive Limited, LOHR, Magna International Inc., PRM Newage, Protean, Robert Bosch GmbH, Schaeffler AG, Toyoda Gosei Co., Ltd., Univance Corporation, Danfoss, ZF Friedrichshafen AG, and ZIEHL –ABEGG SE

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value, Units, US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Value Chain Analysis

2.10. Gross Margin Analysis

3. Global Automotive Electric Drive Axle Market: Transition of Auto Industry - ICE to EVs

3.1. Comparison of ICV and EVs

3.2. Government Regulations and Subsidies on EVs

3.3. Government Announcement on EVs

3.4. Global Electric Vehicle Charging Stations

4. Global Automotive Electric Drive Axle Market - Impact of EVs

5. Global Automotive Electric Drive Axle Market - Technological Overview

6. Global Automotive Electric Drive Axle Market - Business Case Study

7. Global Automotive Electric Drive Axle Market, By Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Type

7.2.1. E-axle

7.2.2. Hybrid Axle

8. Global Automotive Electric Drive Axle Market, By Drive Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Drive Type

8.2.1. Front Wheel Drive

8.2.2. Rear Wheel Drive

8.2.3. All Wheel Drive

9. Global Automotive Electric Drive Axle Market, By Vehicle Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.2.1. Passenger Cars

9.2.1.1. Hatchbacks

9.2.1.2. Sedans

9.2.1.3. SUVs

9.2.2. Light Commercial Vehicles

9.2.3. Heavy Duty Trucks

9.2.4. Buses and Coaches

10. Global Automotive Electric Drive Axle Market, By Electric Vehicle Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

10.2.1. Battery Electric Vehicles (BEVs)

10.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

10.2.3. Hybrid Electric Vehicles (HEVs)

11. Global Automotive Electric Drive Axle Market, By Sales Channel

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.2.1. OEMs

11.2.2. Aftermarket

12. Global Automotive Electric Drive Axle Market, By Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Automotive Electric Drive Axle Market

13.1. Market Snapshot

13.2. North America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Type

13.2.1. E-axle

13.2.2. Hybrid Axle

13.3. North America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Drive Type

13.3.1. Front Wheel Drive

13.3.2. Rear Wheel Drive

13.3.3. All Wheel Drive

13.4. North America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.4.1. Passenger Cars

13.4.1.1. Hatchbacks

13.4.1.2. Sedans

13.4.1.3. SUVs

13.4.2. Light Commercial Vehicles

13.4.3. Heavy Duty Trucks

13.4.4. Buses and Coaches

13.5. North America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

13.5.1. Battery Electric Vehicles (BEVs)

13.5.2. Plug-in Hybrid Electric Vehicles (PHEVs)

13.5.3. Hybrid Electric Vehicles (HEVs)

13.6. North America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.6.1. OEMs

13.6.2. Aftermarket

13.7. Key Country Analysis - North America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031

13.7.1. U.S.

13.7.2. Canada

13.7.3. Mexico

14. Europe Automotive Electric Drive Axle Market

14.1. Market Snapshot

14.2. Europe Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Type

14.2.1. E-axle

14.2.2. Hybrid Axle

14.3. Europe Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Drive Type

14.3.1. Front Wheel Drive

14.3.2. Rear Wheel Drive

14.3.3. All Wheel Drive

14.4. Europe Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.4.1. Passenger Cars

14.4.1.1. Hatchbacks

14.4.1.2. Sedans

14.4.1.3. SUVs

14.4.2. Light Commercial Vehicles

14.4.3. Heavy Duty Trucks

14.4.4. Buses and Coaches

14.5. Europe Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

14.5.1. Battery Electric Vehicles (BEVs)

14.5.2. Plug-in Hybrid Electric Vehicles (PHEVs)

14.5.3. Hybrid Electric Vehicles (HEVs)

14.6. Europe Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Sales Channel

14.6.1. OEMs

14.6.2. Aftermarket

14.7. Key Country Analysis - Europe Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031

14.7.1. Germany

14.7.2. U.K.

14.7.3. France

14.7.4. Italy

14.7.5. Spain

14.7.6. Nordic Countries

14.7.7. Russia & CIS

14.7.8. Rest of Europe

15. Asia Pacific Automotive Electric Drive Axle Market

15.1. Market Snapshot

15.2. Asia Pacific Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Type

15.2.1. E-axle

15.2.2. Hybrid Axle

15.3. Asia Pacific Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Drive Type

15.3.1. Front Wheel Drive

15.3.2. Rear Wheel Drive

15.3.3. All Wheel Drive

15.4. Asia Pacific Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

15.4.1. Passenger Cars

15.4.1.1. Hatchbacks

15.4.1.2. Sedans

15.4.1.3. SUVs

15.4.2. Light Commercial Vehicles

15.4.3. Heavy Duty Trucks

15.4.4. Buses and Coaches

15.5. Asia Pacific Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

15.5.1. Battery Electric Vehicles (BEVs)

15.5.2. Plug-in Hybrid Electric Vehicles (PHEVs)

15.5.3. Hybrid Electric Vehicles (HEVs)

15.6. Asia Pacific Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Sales Channel

15.6.1. OEMs

15.6.2. Aftermarket

15.7. Key Country Analysis - Asia Pacific Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031

15.7.1. China

15.7.2. India

15.7.3. Japan

15.7.4. ASEAN Countries

15.7.5. South Korea

15.7.6. ANZ

15.7.7. Rest of Asia Pacific

16. Middle East & Africa Automotive Electric Drive Axle Market

16.1. Market Snapshot

16.2. Middle East & Africa Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Type

16.2.1. E-axle

16.2.2. Hybrid Axle

16.3. Middle East & Africa Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Drive Type

16.3.1. Front Wheel Drive

16.3.2. Rear Wheel Drive

16.3.3. All Wheel Drive

16.4. Middle East & Africa Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

16.4.1. Passenger Cars

16.4.1.1. Hatchbacks

16.4.1.2. Sedans

16.4.1.3. SUVs

16.4.2. Light Commercial Vehicles

16.4.3. Heavy Duty Trucks

16.4.4. Buses and Coaches

16.5. Middle East & Africa Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

16.5.1. Battery Electric Vehicles (BEVs)

16.5.2. Plug-in Hybrid Electric Vehicles (PHEVs)

16.5.3. Hybrid Electric Vehicles (HEVs)

16.6. Middle East & Africa Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Sales Channel

16.6.1. OEMs

16.6.2. Aftermarket

16.7. Key Country Analysis - Middle East & Africa Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031

16.7.1. GCC

16.7.2. South Africa

16.7.3. Turkey

16.7.4. Rest of Middle East & Africa

17. South America Automotive Electric Drive Axle Market

17.1. Market Snapshot

17.2. South America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Type

17.2.1. E-axle

17.2.2. Hybrid Axle

17.3. South America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Drive Type

17.3.1. Front Wheel Drive

17.3.2. Rear Wheel Drive

17.3.3. All Wheel Drive

17.4. South America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

17.4.1. Passenger Cars

17.4.1.1. Hatchbacks

17.4.1.2. Sedans

17.4.1.3. SUVs

17.4.2. Light Commercial Vehicles

17.4.3. Heavy Duty Trucks

17.4.4. Buses and Coaches

17.5. South America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

17.5.1. Battery Electric Vehicles (BEVs)

17.5.2. Plug-in Hybrid Electric Vehicles (PHEVs)

17.5.3. Hybrid Electric Vehicles (HEVs)

17.6. South America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031, By Sales Channel

17.6.1. OEMs

17.6.2. Aftermarket

17.7. Key Country Analysis - South America Automotive Electric Drive Axle Market Size Analysis & Forecast, 2017-2031

17.7.1. Brazil

17.7.2. Argentina

17.7.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2022

18.2. Pricing Comparison Among Key Players

18.3. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

19. Company Profiles/ Key Players

19.1. American Axle & Manufacturing, Inc.

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.2. Benevelli Srl

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.3. Bonfiglioli S.p.A

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.4. BorgWarner Inc.

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.5. Continental AG

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.6. Dana Limited

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.7. FPW Axles Limited

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.8. GKN Automotive Limited

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.9. LOHR

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.10. Magna International Inc.

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.11. PRM Newage

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.12. Protean

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.13. Robert Bosch GmbH

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.14. Schaeffler AG

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.15. Toyoda Gosei Co., Ltd.

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.16. Univance Corporation

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.17. Danfoss

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.18. ZF Friedrichshafen AG

19.18.1. Company Overview

19.18.2. Company Footprints

19.18.3. Production Locations

19.18.4. Product Portfolio

19.18.5. Competitors & Customers

19.18.6. Subsidiaries & Parent Organization

19.18.7. Recent Developments

19.18.8. Financial Analysis

19.18.9. Profitability

19.18.10. Revenue Share

19.19. ZIEHL -ABEGG SE

19.19.1. Company Overview

19.19.2. Company Footprints

19.19.3. Production Locations

19.19.4. Product Portfolio

19.19.5. Competitors & Customers

19.19.6. Subsidiaries & Parent Organization

19.19.7. Recent Developments

19.19.8. Financial Analysis

19.19.9. Profitability

19.19.10. Revenue Share

19.20. Other Key Players

19.20.1. Company Overview

19.20.2. Company Footprints

19.20.3. Production Locations

19.20.4. Product Portfolio

19.20.5. Competitors & Customers

19.20.6. Subsidiaries & Parent Organization

19.20.7. Recent Developments

19.20.8. Financial Analysis

19.20.9. Profitability

19.20.10. Revenue Share

List of Tables

Table 1: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 3: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Table 4: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 5: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 7: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 8: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 9: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 11: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Table 14: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 15: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Table 16: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 17: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 20: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 21: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 23: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Table 26: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 27: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Table 28: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 29: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 30: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 31: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 32: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 33: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 35: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Table 38: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 39: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Table 40: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 41: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 42: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 43: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 44: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 45: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 47: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Table 50: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 51: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Table 52: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 53: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 54: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 55: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 57: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Table 62: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 63: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Table 64: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 65: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 66: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 67: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 68: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 69: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 71: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Figure 2: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 3: Global Automotive Electric Drive Axle Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Figure 5: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 6: Global Automotive Electric Drive Axle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Electric Drive Axle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 11: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 12: Global Automotive Electric Drive Axle Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Automotive Electric Drive Axle Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 16: Global Automotive Electric Drive Axle Market Volume (Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Electric Drive Axle Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Figure 20: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 21: North America Automotive Electric Drive Axle Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Figure 23: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 24: North America Automotive Electric Drive Axle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Automotive Electric Drive Axle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 29: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 30: North America Automotive Electric Drive Axle Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Automotive Electric Drive Axle Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 34: North America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Electric Drive Axle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Figure 38: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 39: Europe Automotive Electric Drive Axle Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Figure 41: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 42: Europe Automotive Electric Drive Axle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 44: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 45: Europe Automotive Electric Drive Axle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 46: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 47: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 48: Europe Automotive Electric Drive Axle Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 49: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Automotive Electric Drive Axle Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 52: Europe Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Electric Drive Axle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Figure 56: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 57: Asia Pacific Automotive Electric Drive Axle Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Figure 59: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 60: Asia Pacific Automotive Electric Drive Axle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 62: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 63: Asia Pacific Automotive Electric Drive Axle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 65: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Electric Drive Axle Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Automotive Electric Drive Axle Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Electric Drive Axle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Figure 74: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 75: Middle East & Africa Automotive Electric Drive Axle Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Figure 77: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 78: Middle East & Africa Automotive Electric Drive Axle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 80: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 81: Middle East & Africa Automotive Electric Drive Axle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Electric Drive Axle Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Electric Drive Axle Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Electric Drive Axle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 91: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Type, 2017-2031

Figure 92: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 93: South America Automotive Electric Drive Axle Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 94: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Drive Type, 2017-2031

Figure 95: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 96: South America Automotive Electric Drive Axle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 97: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 98: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 99: South America Automotive Electric Drive Axle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 100: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 101: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 102: South America Automotive Electric Drive Axle Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 103: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Automotive Electric Drive Axle Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 106: South America Automotive Electric Drive Axle Market Volume (Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Electric Drive Axle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Electric Drive Axle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031