Reports

Reports

Due to the fall in cases of coronavirus, companies in the Asia Pacific ionomer resins market for construction industry are witnessing an increase in business activities. Manufacturers are focusing on mission-critical applications such as lamination, wood plastic composites (WPC), and glass interlayers to keep their economies running despite poor demand sentiments.

Companies in the Asia Pacific ionomer resins market for construction industry are collaborating to increase research and create value added products. They are becoming price competitive and taking advantage of government stimulus programs to stay financially afloat. Manufacturers are tapping into revenue opportunities in positive or limited negative impact industries to ensure business continuity. They are bolstering local production capabilities to reduce dependence on other countries for raw materials and other products.

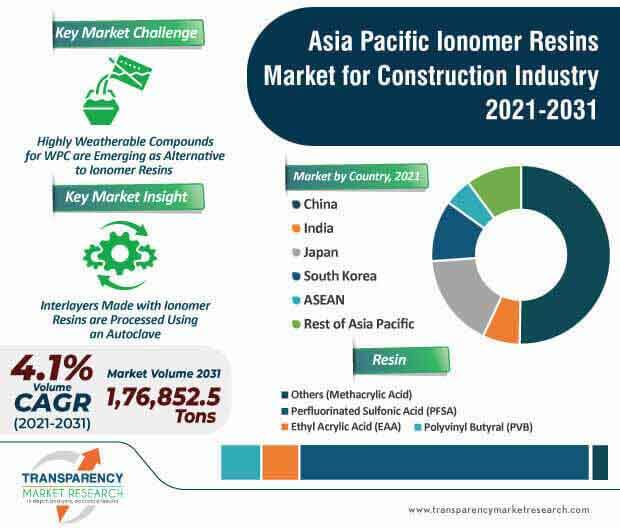

The Asia Pacific ionomer resins market for construction industry is expected to clock a CAGR of 5.5% during the forecast period. This is evident since alternative and less expensive highly weatherable compounds for the cap layers of WPC are emerging as an alternative to expensive ionomer resins. Nevertheless, conventional ionomer resins are not entirely replaceable with the newly developed weatherable compounds, as ionomer resins offer exceptional resistance to scratches, stains, and impact, among other situations.

WPCs have the potential to serve as an option for traditional lumber, owing to the former’s low lifecycle cost. Minimal maintenance and lightweight attributes of WPC are being preferred by end users.

Ionomer resin is being publicized as a stiffer and tougher interlayer as compared to polyvinyl butyral (PVB). Manufacturers in the Asia Pacific ionomer resins market for construction industry are boosting their production capabilities since ionomer resins bons well with some metals and can be used to design bespoke glass structures. This explains why the Asia Pacific ionomer resins market for construction industry is predicted to surpass US$ 11,528.9 Th by 2031. Structural glass applications such as large unsupported sections of feature glass, glass stairs, and glass floors are fueling the demand for ionomer resins. Interlayers made with ionomer resins are processed using an autoclave.

Ionomer resins are becoming an important part of anion-exchange membrane fuel cells (AEMFCs). Companies in the Asia Pacific ionomer resins market for construction industry are increasing their research in a series of hydroxide-ion-conducting ionomers for the catalyst binder for the membrane electrode assembly in AEMFCs.

Electrode ionomer significantly influences catalyst layer morphology and fuel cell performance. Companies in the Asia Pacific ionomer resins market for construction industry are leveraging revenue opportunities with electrode ionomers to develop eco-friendly proton-exchange membrane fuel cells (PEMFCs). PEMFCs are being commercialized in transportation systems. Microbial fuel cells using proton exchange membranes have attracted attention for their improved performance, owing to the development of anode materials.

Analysts’ Viewpoint

Companies in the Asia Pacific ionomer resins market for construction industry are analyzing their high-risk clients, partners and customers where recovery of debt may be an issue during the ongoing coronavirus pandemic. New developments in less expensive and highly weatherable compounds for the cap layers of WPCs are emerging as an alternative to expensive ionomer resins. Hence, manufacturers should diversify their applications in lamination, building-integrated photovoltaics (BIPV), and PEMFCs to compensate for new developments in materials for WPCs. As such, WPCs made with ionomer resins are being known for their sustainability, low lifecycle costs, and processability. Increased moisture resistance and stiffness are being preferred in WPCs.

|

Attribute |

Details |

|

Market Size Value in 2020 |

US$ 6,457.8 Th |

|

Market Forecast Value in 2031 |

US$ 11,528.9 Th |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at Asia Pacific as well as at country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Asia Pacific Ionomer Resins Market For Construction Industry is expected to reach US$ 11,528.9 Th By 2031

Asia Pacific Ionomer Resins Market For Construction Industry is estimated to rise at a CAGR of 5.5% during forecast period

Increase in application of ionomer resins in lamination and WPC, led by the rise in consumption of ionomer resins in the building & construction industry, and projected to augment the ionomer resins market for construction industry in Asia Pacific in the near future

Prominent players operating in the Ionomer Resins Market for Construction Industry in Asia Pacific include DuPont de Nemours Inc., SK Geo Centric, Honeywell International Inc., Exxon Mobil Corporation, Solvay SA, LyondellBasell Industries Holdings B.V., 3M Company, and Brenntag SE.

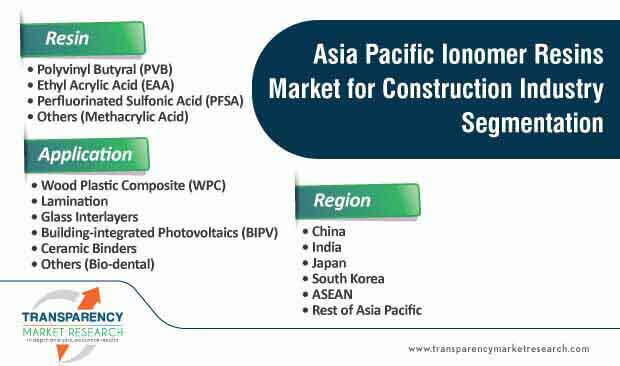

Wood Plastic Composite (WPC), Lamination, Glass Interlayers, Building-integrated Photovoltaics (BIPV), Ceramic Binders are the application segments in the Asia Pacific Ionomer Resins Market For Construction Industry

1. Executive Summary

1.1. Ionomer Resins Market for Construction Industry Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Key Manufacturers

2.6.2. List of Existing & Potential Customers, by Country

2.6.3. List of Key Distributors

3. COVID-19 Impact Analysis

4. Pricing Analysis Trends and Forecast, 2020-2031

4.1. Price Comparison Analysis, by Resin

5. Asia Pacific Ionomer Resins Market for Construction Industry Analysis and Forecast, by Resin, 2020–2031

5.1. Introduction and Definitions

5.2. Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

5.2.1. Polyvinyl Butyral (PVB)

5.2.2. Ethyl Acrylic Acid (EAA)

5.2.3. Perfluorinated Sulfonic Acid (PFSA)

5.2.4. Others

5.3. Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

6. Asia Pacific Ionomer Resins Market for Construction Industry Analysis and Forecast, by Application, 2020–2031

6.1. Introduction and Definitions

6.2. Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.2.1. Wood Plastic Composite (WPC)

6.2.2. Lamination

6.2.3. Glass Interlayers

6.2.4. Building-integrated Photovoltaics (BIPV)

6.2.5. Ceramic Binders

6.2.6. Others

6.3. Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

7. Asia Pacific Ionomer Resins Market for Construction Industry Analysis and Forecast, by Country, 2020–2031

7.1. Key Findings

7.2. Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

7.2.1. China

7.2.2. India

7.2.3. Japan

7.2.4. South Korea

7.2.5. ASEAN

7.2.6. Rest of Asia Pacific

7.3. Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Country

8. China Ionomer Resins Market for Construction Industry Analysis and Forecast, by Resin, 2020–2031

8.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

8.1.1. Polyvinyl Butyral (PVB)

8.1.2. Ethyl Acrylic Acid (EAA)

8.1.3. Perfluorinated Sulfonic Acid (PFSA)

8.1.4. Others

8.2. China Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

9. China Ionomer Resins Market for Construction Industry Analysis and Forecast, by Application, 2020–2031

9.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

9.1.1. Wood Plastic Composite (WPC)

9.1.2. Lamination

9.1.3. Glass Interlayers

9.1.4. Building-integrated Photovoltaics (BIPV)

9.1.5. Ceramic Binders

9.1.6. Others

9.2. China Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

10. India Ionomer Resins Market for Construction Industry Analysis and Forecast, by Resin, 2020–2031

10.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

10.1.1. Polyvinyl Butyral (PVB)

10.1.2. Ethyl Acrylic Acid (EAA)

10.1.3. Perfluorinated Sulfonic Acid (PFSA)

10.1.4. Others

10.2. India Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

11. India Ionomer Resins Market for Construction Industry Analysis and Forecast, by Application, 2020–2031

11.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

11.1.1. Wood Plastic Composite (WPC)

11.1.2. Lamination

11.1.3. Glass Interlayers

11.1.4. Building-integrated Photovoltaics (BIPV)

11.1.5. Ceramic Binders

11.1.6. Others

11.2. India Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

12. Japan Ionomer Resins Market for Construction Industry Analysis and Forecast, by Resin, 2020–2031

12.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

12.1.1. Polyvinyl Butyral (PVB)

12.1.2. Ethyl Acrylic Acid (EAA)

12.1.3. Perfluorinated Sulfonic Acid (PFSA)

12.1.4. Others

12.2. Japan Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

13. Japan Ionomer Resins Market for Construction Industry Analysis and Forecast, by Application, 2020–2031

13.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

13.1.1. Wood Plastic Composite (WPC)

13.1.2. Lamination

13.1.3. Glass Interlayers

13.1.4. Building-integrated Photovoltaics (BIPV)

13.1.5. Ceramic Binders

13.1.6. Others

13.2. Japan Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

14. South Korea Ionomer Resins Market for Construction Industry Analysis and Forecast, by Resin, 2020–2031

14.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

14.1.1. Polyvinyl Butyral (PVB)

14.1.2. Ethyl Acrylic Acid (EAA)

14.1.3. Perfluorinated Sulfonic Acid (PFSA)

14.1.4. Others

14.2. South Korea Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

15. South Korea Ionomer Resins Market for Construction Industry Analysis and Forecast, by Application, 2020–2031

15.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

15.1.1. Wood Plastic Composite (WPC)

15.1.2. Lamination

15.1.3. Glass Interlayers

15.1.4. Building-integrated Photovoltaics (BIPV)

15.1.5. Ceramic Binders

15.1.6. Others

15.2. South Korea Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

16. ASEAN Ionomer Resins Market for Construction Industry Analysis and Forecast, by Resin, 2020–2031

16.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

16.1.1. Polyvinyl Butyral (PVB)

16.1.2. Ethyl Acrylic Acid (EAA)

16.1.3. Perfluorinated Sulfonic Acid (PFSA)

16.1.4. Others

16.2. ASEAN Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

17. ASEAN Ionomer Resins Market for Construction Industry Analysis and Forecast, by Application, 2020–2031

17.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

17.1.1. Wood Plastic Composite (WPC)

17.1.2. Lamination

17.1.3. Glass Interlayers

17.1.4. Building-integrated Photovoltaics (BIPV)

17.1.5. Ceramic Binders

17.1.6. Others

17.2. ASEAN Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

18. Rest of Asia Pacific Ionomer Resins Market for Construction Industry Analysis and Forecast, by Resin, 2020–2031

18.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

18.1.1. Polyvinyl Butyral (PVB)

18.1.2. Ethyl Acrylic Acid (EAA)

18.1.3. Perfluorinated Sulfonic Acid (PFSA)

18.1.4. Others

18.2. Rest of Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

19. Rest of Asia Pacific Ionomer Resins Market for Construction Industry Analysis and Forecast, by Application, 2020–2031

19.1. Market Size (Tons) (US$ Mn) Forecast, by Resin, 2020-2031

19.1.1. Wood Plastic Composite (WPC)

19.1.2. Lamination

19.1.3. Glass Interlayers

19.1.4. Building-integrated Photovoltaics (BIPV)

19.1.5. Ceramic Binders

19.1.6. Others

19.2. Rest of Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

20. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

20.1.1. DuPont de Nemours Inc.

20.1.1.1. Company Description

20.1.1.2. Business Overview

20.1.1.3. Financial Overview

20.1.1.4. Strategic Overview

20.1.2. SK Geo Centric.

20.1.2.1. Company Description

20.1.2.2. Business Overview

20.1.2.3. Financial Overview

20.1.2.4. Strategic Overview

20.1.3. Honeywell International Inc.

20.1.3.1. Company Description

20.1.3.2. Business Overview

20.1.3.3. Financial Overview

20.1.3.4. Strategic Overview

20.1.4. Exxon Mobil Corporation

20.1.4.1. Company Description

20.1.4.2. Business Overview

20.1.4.3. Financial Overview

20.1.4.4. Strategic Overview

20.1.5. Solvay SA

20.1.5.1. Company Description

20.1.5.2. Business Overview

20.1.5.3. Financial Overview

20.1.5.4. Strategic Overview

20.1.6. LyondellBasell Industries Holdings B.V.

20.1.6.1. Company Description

20.1.6.2. Business Overview

20.1.6.3. Financial Overview

20.1.6.4. Strategic Overview

20.1.7. 3M Company

20.1.7.1. Company Description

20.1.7.2. Business Overview

20.1.7.3. Financial Overview

20.1.7.4. Strategic Overview

20.1.8. Brenntag SE

20.1.8.1. Company Description

20.1.8.2. Business Overview

20.1.8.3. Financial Overview

20.1.8.4. Strategic Overview

21. Primary Research: Key Insights

22. Appendix

List of Tables

Table 1: Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Resin, 2020–2031

Table 2: Asia Pacific Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 3: Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Application, 2020–2031

Table 4: Asia Pacific Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Country, 2020–2031

Table 6: Asia Pacific Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Country, 2020–2031

Table 7: China Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Resin, 2020–2031

Table 8: China Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 9: China Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Application, 2020–2031

Table 10: China Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: India Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Resin, 2020–2031

Table 12: India Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 13: India Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Application, 2020–2031

Table 14: India Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: Japan Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Resin, 2020–2031

Table 16: Japan Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 17: Japan Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Application, 2020–2031

Table 18: Japan Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: South Korea Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Resin, 2020–2031

Table 20: South Korea Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 21: South Korea Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Application, 2020–2031

Table 22: South Korea Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: ASEAN Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Resin, 2020–2031

Table 24: ASEAN Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 25: ASEAN Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Application, 2020–2031

Table 26: ASEAN Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Rest of Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Resin, 2020–2031

Table 28: Rest of Asia Pacific Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 29: Rest of Asia Pacific Ionomer Resins Market for Construction Industry Volume (Tons) Forecast, by Application, 2020–2031

Table 30: Rest of Asia Pacific Ionomer Resins Market for Construction Industry Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Asia Pacific Ionomer Resins Price Trend, by Resin, 2020–2031 (US$/Ton)

Figure 2: Asia Pacific Ionomer Resins Market for Construction Industry Volume Share Analysis, by Resin, 2020, 2025, and 2031

Figure 3: Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Resin

Figure 4: Asia Pacific Ionomer Resins Market for Construction Industry Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 5: Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Application

Figure 6: Asia Pacific Ionomer Resins Market for Construction Industry Volume Share Analysis, by Country, 2020, 2025, and 2031

Figure 7: Asia Pacific Ionomer Resins Market for Construction Industry Attractiveness Analysis, by Country

Figure 8: Asia Pacific Ionomer Resins Market for Construction Industry Share Analysis, by Company, 2020