Reports

Reports

Analysts’ Viewpoint

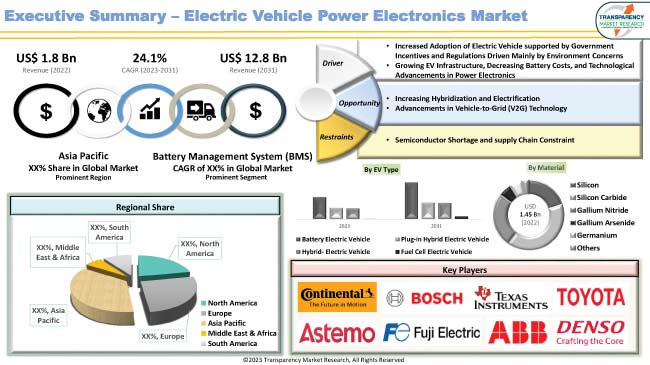

Rise in environmental consciousness is prompting consumers and businesses to choose electric vehicles, which in turn is boosting the demand for power electronics that are essential for the functionality of electric vehicles (EVs). Furthermore, collaborations and partnerships between automotive manufacturers, power electronics companies, and battery manufacturers have become crucial for the successful integration of EV powertrains. Moreover, EV adoption is influenced significantly by government policies, regulations, and incentives. Businesses should closely monitor policy changes in different regions to understand electric vehicle power electronics market trends and plan their strategies accordingly.

Companies in the electric vehicle power electronics business should track and assess the expansion of charging networks, as it directly impacts EV sales and power electronics demand. Additionally, growing demand for power electronics solutions in commercial electric vehicles, buses, trucks, and two-wheelers has prompted companies to diversify their product offerings to cater to different vehicle segments and capitalize on additional electric vehicle power electronic market opportunities.

The electric vehicle power electronics industry engages in the design, development, manufacturing, and distribution of power electronics components and systems specifically tailored for EVs. Power electronics play a crucial role in electric vehicles, as they manage the flow of electrical energy between the battery, electric motor, and other vehicle systems. These components are responsible for converting and controlling the electrical power to ensure efficient and optimal operation of the EV.

Increase in adoption of electric vehicles worldwide has been fueling the EV power electronics market growth for the last few years. Demand for efficient and reliable power electronics in electric vehicles is expected to continue to rise, as governments and consumers embrace the shift toward cleaner transportation options in order to reduce greenhouse gas emissions and combat climate change.

Several governments around the world are actively promoting the adoption of electric vehicles as part of their efforts to reduce greenhouse gas emissions and combat climate change. Additionally, governments implement regulations that require automakers to increase their share of electric vehicles in their fleet. This is fueling the demand for electric mobility power electronics and consequently driving the electric vehicle power electronics industry growth.

EVs are considered more environmentally friendly than internal combustion engine vehicles since they produce zero tailpipe emissions when powered by electricity. The convergence of these drivers is fostering innovation in power electronics technology for electric vehicles and driving the electric vehicle power electronics market demand. Power electronics is likely to remain a critical component as the EV market continues to expand and mature, which in turn is projected to boost the widespread adoption of electric vehicles worldwide.

Expansion of charging infrastructure, including public charging stations and private charging points, addresses one of the significant concerns of potential EV buyers, which is range anxiety. Growth in charging infrastructure and increase in accessibility are likely to prompt consumers to invest in electric vehicles. This is anticipated to lead to a higher demand for power electronic systems and boost the electric vehicle power electronics market development in the next few years.

Advancements in power electronics technology have led to the development of more efficient, compact, and reliable electronic components for electric vehicles. One of the primary drivers of the cost of electric vehicles is the battery. However, the cost of lithium-ion batteries, which are commonly used in EVs, has been steadily declining for the last few years. This cost reduction makes electric vehicles more affordable and increases the demand for power electronics that are integral to battery management and electric propulsion systems.

According to the electric vehicle power electronics market analysis, in terms of material, the silicon carbide (SiC) segment is estimated to dominate the global market demand during the forecast period. Silicon Carbide (SiC) is a wide-bandgap semiconductor material that is gaining popularity in power electronics for EVs due to its higher breakdown voltage, faster switching speed, and lower conduction losses as compared to silicon. SiC-based devices enable higher efficiency and power density in EV power electronics.

The Gallium Nitride (GaN) segment is also expected to hold a notable electric vehicle power electronics market share during the forecast period. GaN is another wide-bandgap semiconductor material that offers high electron mobility and fast switching characteristics. GaN-based power devices are well-suited for high-frequency and high-power applications in electric vehicles, contributing to improved efficiency and reduced size and weight of power electronics systems.

Battery management application is a critical aspect that ensures the safe, efficient, and reliable operation of electric vehicle (EV) batteries. Battery management systems (BMS) are an integral part of power electronics in EVs, and they serve several key functions related to the vehicle's battery pack. The BMS monitors the battery's state of charge, which indicates the remaining capacity of the battery. It estimates the state of charge (SOC) by measuring the voltage, current, and temperature of individual battery cells or modules, enabling the EV motor controller and driver to know the available energy and range.

Asia Pacific accounted for the largest share of the global market in 2022. China has emerged as the largest market for electric vehicles globally. Aggressive policies and incentives by the Government of China have driven significant EV adoption, making it a dominant force in the regional and global EV power electronics industry.

Japan and South Korea have also been significant markets due to their technological prowess and automotive industry expertise. Other countries in Asia Pacific, such as India and those in Southeast Asia, have been gradually increasing their focus on electric mobility, thereby contributing to the growth of the electric vehicle power electronics market value in the region.

Adoption of electric vehicles has been increasing at a rapid pace in Europe, with countries such as Euro 5, Norway, the Netherlands, and Sweden leading the way in EV market share. The European Union has enacted stringent emissions regulations and targets for reducing greenhouse gas emissions, providing a strong impetus for the transition to electric mobility. Europe has a well-established charging infrastructure network, which further supports the growth of the demand for EV power conversion solutions.

The U.S. and Canada have implemented supportive policies and financial incentives to encourage EV adoption, including tax credits, rebates, and subsidies for EV purchases. Several prominent EV manufacturers and power electronics companies are based in North America, contributing to the growth of the regional market.

The adoption of electric vehicles in South America and Middle East & Africa, has been relatively sluggish as compared to the regions mentioned above. However, some countries in these regions have started implementing policies and initiatives to promote EV adoption and are gradually developing charging infrastructure.

Leading players in the electric vehicle power electronics market are using new technology in electric mobility. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by prominent players. Some of the prominent players in the global market include ABB, BYD Auto, Continental AG, Delphi Technologies PLC., Denso Corporation, EVS Auto Group, FUJITSU, Fuji Electric Co., Ltd., Hitachi Automotive Systems, Mitsubishi Electric, Metric Mind, Robert Bosch GmbH, Siemens AG, Texas Instruments, NXP Semiconductors, Electrodrive Powertrain Solutions Pvt Ltd., HYUNDAI KEFICO Corporation, Toyota Industries Corporation, and AEM Electronics.

Key players in the electric vehicle power electronics market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2021 |

US$ 1.8 Bn |

|

Market Forecast Value in 2031 |

US$ 12.8 Bn |

|

Growth Rate (CAGR) |

24.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at Global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.8 Bn in 2022

It is expected to expand at a CAGR of 24.1% by 2031

The global business is likely to be valued at US$ 12.8 Bn in 2031

Increased adoption of electric vehicles supported by government incentives and regulations driven mainly by environment concerns, growing EV infrastructure, decreasing battery costs, and technological advancements in power electronics

Based on electric vehicle type, the BEV segment accounted for prominent share in 2022

Asia pacific was a highly lucrative region

ABB, BYD Auto, Continental AG, Delphi Technologies PLC., Denso Corporation, EVS Auto Group, FUJITSU, Fuji Electric Co., Ltd., Hitachi Automotive Systems, Mitsubishi Electric, Metric Mind, Robert Bosch GmbH, Siemens AG, Texas Instruments, NXP Semiconductors, Electrodrive Powertrain Solutions Pvt Ltd., HYUNDAI KEFICO Corporation, Toyota Industries Corporation, AEM Electronics

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Million Units, Value US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Definition / Scope / Limitations

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

4. Emergence of CASE (Connected, Autonomous, Shared and Electric) Mobility and its impact on EV Power Electronics Market in Global Market

5. Global Electric Vehicle Power Electronics Market, by Power Control Unit

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Power Control Unit

5.2.1. Motor Control Unit

5.2.2. LDC (Low Voltage DC-DC Converter)

5.2.3. HDC (High Voltage DC-DC Converter)

5.2.4. Inverter (DC-AC & AC-DC Converter)

5.2.5. VCU (Vehicle Control Unit)

5.2.6. Cooling Units

5.2.7. Others

6. Global Electric Vehicle Power Electronics Market, by Material

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Material

6.2.1. Silicon

6.2.2. Silicon Carbide

6.2.3. Gallium Nitride

6.2.4. Gallium Arsenide

6.2.5. Germanium

6.2.6. Others

6.2.6.1. Gallium Oxide

6.2.6.2. Diamond

7. Global Electric Vehicle Power Electronics Market, by Device Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Device Type

7.2.1. Power IC

7.2.1.1. Power Management ICs

7.2.1.2. Application Specific ICs

7.2.2. Discrete Component

7.2.2.1. Diode

7.2.2.2. Transistor

7.2.2.3. Thermistor

7.2.2.4. Thyristor

7.2.3. Module

7.2.3.1. Intelligent Power module (IPM)

7.2.3.2. Power Integrated Module (PIM)

8. Global Electric Vehicle Power Electronics Market, by Component

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Component

8.2.1. Sensors

8.2.2. Microcontrollers

9. Global Electric Vehicle Power Electronics Market, by Application

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Application

9.2.1. ADAS & Safety

9.2.1.1. ADAS

9.2.1.2. Electric Power Steering (EPS)

9.2.1.3. Anti-lock Braking System (ABS)

9.2.2. Body Control & Comfort

9.2.2.1. Tire Pressure Monitoring System (TPMS)

9.2.2.2. Lighting

9.2.2.2.1. Exterior Lighting

9.2.2.2.2. Interior Lighting

9.2.2.3. Seat Control

9.2.2.3.1. Heated Seats

9.2.2.3.2. Seat Adjustment

9.2.2.4. HVAC

9.2.2.5. Start-Stop Module

9.2.3. Infotainment

9.2.3.1. Instrument Cluster

9.2.3.2. Audio System

9.2.4. Telematics

9.2.4.1. Vehicle Management

9.2.4.2. V2X

9.2.5. Engine Management & Powertrain

9.2.5.1. Engine Control

9.2.5.2. Transmission Control

9.2.6. Battery Management

10. Global Electric Vehicle Power Electronics Market, by Vehicle Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Vehicle Type

10.2.1. Two Wheelers

10.2.2. Passenger Cars

10.2.2.1. Hatchback

10.2.2.2. Sedan

10.2.2.3. Utility Vehicles (SUVs & MPVs)

10.2.3. Light Commercial Vehicles

10.2.4. Heavy Duty Trucks

10.2.5. Buses and Coaches

10.2.6. Others

11. Global Electric Vehicle Power Electronics Market, by Electric Vehicle Type

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Electric Vehicle Type

11.2.1. Battery Electric Vehicle (BEVs)

11.2.2. Plug-in Hybrid Electric Vehicle (PHEVs)

11.2.3. Hybrid Electric Vehicle (HEVs)

11.2.4. Fuel Cell Electric Vehicle (FCEVs)

12. Global Electric Vehicle Power Electronics Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Electric Vehicle Power Electronics Market

13.1. Market Snapshot

13.2. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Power Control Unit

13.2.1. Motor Control Unit

13.2.2. LDC (Low Voltage DC-DC Converter)

13.2.3. HDC (High Voltage DC-DC Converter)

13.2.4. Inverter (DC-AC & AC-DC Converter)

13.2.5. VCU (Vehicle Control Unit)

13.2.6. Cooling Units

13.2.7. Others

13.3. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Material

13.3.1. Silicon

13.3.2. Silicon Carbide

13.3.3. Gallium Nitride

13.3.4. Gallium Arsenide

13.3.5. Germanium

13.3.6. Others

13.3.6.1. Gallium Oxide

13.3.6.2. Diamond

13.4. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Device Type

13.4.1. Power IC

13.4.1.1. Power Management ICs

13.4.1.2. Application Specific ICs

13.4.2. Discrete Component

13.4.2.1. Diode

13.4.2.2. Transistor

13.4.2.3. Thermistor

13.4.2.4. Thyristor

13.4.3. Module

13.4.3.1. Intelligent Power module (IPM)

13.4.3.2. Power Integrated Module (PIM)

13.5. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Component

13.5.1. Sensors

13.5.2. Microcontrollers

13.6. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Application

13.6.1. ADAS & Safety

13.6.1.1. ADAS

13.6.1.2. Electric Power Steering (EPS)

13.6.1.3. Anti-lock Braking System (ABS)

13.6.2. Body Control & Comfort

13.6.2.1. Tire Pressure Monitoring System (TPMS)

13.6.2.2. Lighting

13.6.2.2.1. Exterior Lighting

13.6.2.2.2. Interior Lighting

13.6.2.3. Seat Control

13.6.2.3.1. Heated Seats

13.6.2.3.2. Seat Adjustment

13.6.2.4. HVAC

13.6.2.5. Start-Stop Module

13.6.3. Infotainment

13.6.3.1. Instrument Cluster

13.6.3.2. Audio System

13.6.4. Telematics

13.6.4.1. Vehicle Management

13.6.4.2. V2X

13.6.5. Engine Management & Powertrain

13.6.5.1. Engine Control

13.6.5.2. Transmission Control

13.6.6. Battery Management

13.7. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Vehicle Type

13.7.1. Two Wheelers

13.7.2. Passenger Cars

13.7.2.1. Hatchback

13.7.2.2. Sedan

13.7.2.3. Utility Vehicles (SUVs & MPVs)

13.7.3. Light Commercial Vehicles

13.7.4. Heavy Duty Trucks

13.7.5. Buses and Coaches

13.7.6. Others

13.8. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Electric Vehicle Type

13.8.1. Battery Electric Vehicle (BEVs)

13.8.2. Plug-in Hybrid Electric Vehicle (PHEVs)

13.8.3. Hybrid Electric Vehicle (HEVs)

13.8.4. Fuel Cell Electric Vehicle (FCEVs)

13.9. Key Country Analysis - North America Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031

13.9.1. U. S.

13.9.2. Canada

13.9.3. Mexico

14. Europe Electric Vehicle Power Electronics Market

14.1. Market Snapshot

14.2. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Power Control Unit

14.2.1. Motor Control Unit

14.2.2. LDC (Low Voltage DC-DC Converter)

14.2.3. HDC (High Voltage DC-DC Converter)

14.2.4. Inverter (DC-AC & AC-DC Converter)

14.2.5. VCU (Vehicle Control Unit)

14.2.6. Cooling Units

14.2.7. Others

14.3. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Material

14.3.1. Silicon

14.3.2. Silicon Carbide

14.3.3. Gallium Nitride

14.3.4. Gallium Arsenide

14.3.5. Germanium

14.3.6. Others

14.3.6.1. Gallium Oxide

14.3.6.2. Diamond

14.4. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Device Type

14.4.1. Power IC

14.4.1.1. Power Management ICs

14.4.1.2. Application Specific ICs

14.4.2. Discrete Component

14.4.2.1. Diode

14.4.2.2. Transistor

14.4.2.3. Thermistor

14.4.2.4. Thyristor

14.4.3. Module

14.4.3.1. Intelligent Power module (IPM)

14.4.3.2. Power Integrated Module (PIM)

14.5. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Component

14.5.1. Sensors

14.5.2. Microcontrollers

14.6. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Application

14.6.1. ADAS & Safety

14.6.1.1. ADAS

14.6.1.2. Electric Power Steering (EPS)

14.6.1.3. Anti-lock Braking System (ABS)

14.6.2. Body Control & Comfort

14.6.2.1. Tire Pressure Monitoring System (TPMS)

14.6.2.2. Lighting

14.6.2.2.1. Exterior Lighting

14.6.2.2.2. Interior Lighting

14.6.2.3. Seat Control

14.6.2.3.1. Heated Seats

14.6.2.3.2. Seat Adjustment

14.6.2.4. HVAC

14.6.2.5. Start-Stop Module

14.6.3. Infotainment

14.6.3.1. Instrument Cluster

14.6.3.2. Audio System

14.6.4. Telematics

14.6.4.1. Vehicle Management

14.6.4.2. V2X

14.6.5. Engine Management & Powertrain

14.6.5.1. Engine Control

14.6.5.2. Transmission Control

14.6.6. Battery Management

14.7. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Vehicle Type

14.7.1. Two Wheelers

14.7.2. Passenger Cars

14.7.2.1. Hatchback

14.7.2.2. Sedan

14.7.2.3. Utility Vehicles (SUVs & MPVs)

14.7.3. Light Commercial Vehicles

14.7.4. Heavy Duty Trucks

14.7.5. Buses and Coaches

14.7.6. Others

14.8. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Electric Vehicle Type

14.8.1. Battery Electric Vehicle (BEVs)

14.8.2. Plug-in Hybrid Electric Vehicle (PHEVs)

14.8.3. Hybrid Electric Vehicle (HEVs)

14.8.4. Fuel Cell Electric Vehicle (FCEVs)

14.9. Key Country Analysis - Europe Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031

14.9.1. Germany

14.9.2. U. K.

14.9.3. France

14.9.4. Italy

14.9.5. Spain

14.9.6. Nordic Countries

14.9.7. Russia & CIS

14.9.8. Rest of Europe

15. Asia Pacific Electric Vehicle Power Electronics Market

15.1. Market Snapshot

15.2. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Power Control Unit

15.2.1. Motor Control Unit

15.2.2. LDC (Low Voltage DC-DC Converter)

15.2.3. HDC (High Voltage DC-DC Converter)

15.2.4. Inverter (DC-AC & AC-DC Converter)

15.2.5. VCU (Vehicle Control Unit)

15.2.6. Cooling Units

15.2.7. Others

15.3. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Material

15.3.1. Silicon

15.3.2. Silicon Carbide

15.3.3. Gallium Nitride

15.3.4. Gallium Arsenide

15.3.5. Germanium

15.3.6. Others

15.3.6.1. Gallium Oxide

15.3.6.2. Diamond

15.4. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Device Type

15.4.1. Power IC

15.4.1.1. Power Management ICs

15.4.1.2. Application Specific ICs

15.4.2. Discrete Component

15.4.2.1. Diode

15.4.2.2. Transistor

15.4.2.3. Thermistor

15.4.2.4. Thyristor

15.4.3. Module

15.4.3.1. Intelligent Power module (IPM)

15.4.3.2. Power Integrated Module (PIM)

15.5. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Component

15.5.1. Sensors

15.5.2. Microcontrollers

15.6. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Application

15.6.1. ADAS & Safety

15.6.1.1. ADAS

15.6.1.2. Electric Power Steering (EPS)

15.6.1.3. Anti-lock Braking System (ABS)

15.6.2. Body Control & Comfort

15.6.2.1. Tire Pressure Monitoring System (TPMS)

15.6.2.2. Lighting

15.6.2.2.1. Exterior Lighting

15.6.2.2.2. Interior Lighting

15.6.2.3. Seat Control

15.6.2.3.1. Heated Seats

15.6.2.3.2. Seat Adjustment

15.6.2.4. HVAC

15.6.2.5. Start-Stop Module

15.6.3. Infotainment

15.6.3.1. Instrument Cluster

15.6.3.2. Audio System

15.6.4. Telematics

15.6.4.1. Vehicle Management

15.6.4.2. V2X

15.6.5. Engine Management & Powertrain

15.6.5.1. Engine Control

15.6.5.2. Transmission Control

15.6.6. Battery Management

15.7. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Vehicle Type

15.7.1. Two Wheelers

15.7.2. Passenger Cars

15.7.2.1. Hatchback

15.7.2.2. Sedan

15.7.2.3. Utility Vehicles (SUVs & MPVs)

15.7.3. Light Commercial Vehicles

15.7.4. Heavy Duty Trucks

15.7.5. Buses and Coaches

15.7.6. Others

15.8. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Electric Vehicle Type

15.8.1. Battery Electric Vehicle (BEVs)

15.8.2. Plug-in Hybrid Electric Vehicle (PHEVs)

15.8.3. Hybrid Electric Vehicle (HEVs)

15.8.4. Fuel Cell Electric Vehicle (FCEVs)

15.9. Key Country Analysis - Asia Pacific Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031

15.9.1. China

15.9.2. India

15.9.3. Japan

15.9.4. ASEAN Countries

15.9.5. South Korea

15.9.6. ANZ

15.9.7. Rest of Asia Pacific

16. Middle East & Africa Electric Vehicle Power Electronics Market

16.1. Market Snapshot

16.2. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Power Control Unit

16.2.1. Motor Control Unit

16.2.2. LDC (Low Voltage DC-DC Converter)

16.2.3. HDC (High Voltage DC-DC Converter)

16.2.4. Inverter (DC-AC & AC-DC Converter)

16.2.5. VCU (Vehicle Control Unit)

16.2.6. Cooling Units

16.2.7. Others

16.3. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Material

16.3.1. Silicon

16.3.2. Silicon Carbide

16.3.3. Gallium Nitride

16.3.4. Gallium Arsenide

16.3.5. Germanium

16.3.6. Others

16.3.6.1. Gallium Oxide

16.3.6.2. Diamond

16.4. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Device Type

16.4.1. Power IC

16.4.1.1. Power Management ICs

16.4.1.2. Application Specific ICs

16.4.2. Discrete Component

16.4.2.1. Diode

16.4.2.2. Transistor

16.4.2.3. Thermistor

16.4.2.4. Thyristor

16.4.3. Module

16.4.3.1. Intelligent Power module (IPM)

16.4.3.2. Power Integrated Module (PIM)

16.5. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Component

16.5.1. Sensors

16.5.2. Microcontrollers

16.6. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Application

16.6.1. ADAS & Safety

16.6.1.1. ADAS

16.6.1.2. Electric Power Steering (EPS)

16.6.1.3. Anti-lock Braking System (ABS)

16.6.2. Body Control & Comfort

16.6.2.1. Tire Pressure Monitoring System (TPMS)

16.6.2.2. Lighting

16.6.2.2.1. Exterior Lighting

16.6.2.2.2. Interior Lighting

16.6.2.3. Seat Control

16.6.2.3.1. Heated Seats

16.6.2.3.2. Seat Adjustment

16.6.2.4. HVAC

16.6.2.5. Start-Stop Module

16.6.3. Infotainment

16.6.3.1. Instrument Cluster

16.6.3.2. Audio System

16.6.4. Telematics

16.6.4.1. Vehicle Management

16.6.4.2. V2X

16.6.5. Engine Management & Powertrain

16.6.5.1. Engine Control

16.6.5.2. Transmission Control

16.6.6. Battery Management

16.7. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Vehicle Type

16.7.1. Two Wheelers

16.7.2. Passenger Cars

16.7.2.1. Hatchback

16.7.2.2. Sedan

16.7.2.3. Utility Vehicles (SUVs & MPVs)

16.7.3. Light Commercial Vehicles

16.7.4. Heavy Duty Trucks

16.7.5. Buses and Coaches

16.7.6. Others

16.8. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Electric Vehicle Type

16.8.1. Battery Electric Vehicle (BEVs)

16.8.2. Plug-in Hybrid Electric Vehicle (PHEVs)

16.8.3. Hybrid Electric Vehicle (HEVs)

16.8.4. Fuel Cell Electric Vehicle (FCEVs)

16.9. Key Country Analysis - Middle East & Africa Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031

16.9.1. GCC

16.9.2. South Africa

16.9.3. Turkey

16.9.4. Rest of Middle East & Africa

17. South America Electric Vehicle Power Electronics Market

17.1. Market Snapshot

17.2. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Power Control Unit

17.2.1. Motor Control Unit

17.2.2. LDC (Low Voltage DC-DC Converter)

17.2.3. HDC (High Voltage DC-DC Converter)

17.2.4. Inverter (DC-AC & AC-DC Converter)

17.2.5. VCU (Vehicle Control Unit)

17.2.6. Cooling Units

17.2.7. Others

17.3. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Material

17.3.1. Silicon

17.3.2. Silicon Carbide

17.3.3. Gallium Nitride

17.3.4. Gallium Arsenide

17.3.5. Germanium

17.3.6. Others

17.3.6.1. Gallium Oxide

17.3.6.2. Diamond

17.4. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Device Type

17.4.1. Power IC

17.4.1.1. Power Management ICs

17.4.1.2. Application Specific ICs

17.4.2. Discrete Component

17.4.2.1. Diode

17.4.2.2. Transistor

17.4.2.3. Thermistor

17.4.2.4. Thyristor

17.4.3. Module

17.4.3.1. Intelligent Power module (IPM)

17.4.3.2. Power Integrated Module (PIM)

17.5. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Component

17.5.1. Sensors

17.5.2. Microcontrollers

17.6. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Application

17.6.1. ADAS & Safety

17.6.1.1. ADAS

17.6.1.2. Electric Power Steering (EPS)

17.6.1.3. Anti-lock Braking System (ABS)

17.6.2. Body Control & Comfort

17.6.2.1. Tire Pressure Monitoring System (TPMS)

17.6.2.2. Lighting

17.6.2.2.1. Exterior Lighting

17.6.2.2.2. Interior Lighting

17.6.2.3. Seat Control

17.6.2.3.1. Heated Seats

17.6.2.3.2. Seat Adjustment

17.6.2.4. HVAC

17.6.2.5. Start-Stop Module

17.6.3. Infotainment

17.6.3.1. Instrument Cluster

17.6.3.2. Audio System

17.6.4. Telematics

17.6.4.1. Vehicle Management

17.6.4.2. V2X

17.6.5. Engine Management & Powertrain

17.6.5.1. Engine Control

17.6.5.2. Transmission Control

17.6.6. Battery Management

17.7. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Vehicle Type

17.7.1. Two Wheelers

17.7.2. Passenger Cars

17.7.2.1. Hatchback

17.7.2.2. Sedan

17.7.2.3. Utility Vehicles (SUVs & MPVs)

17.7.3. Light Commercial Vehicles

17.7.4. Heavy Duty Trucks

17.7.5. Buses and Coaches

17.7.6. Others

17.8. Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031, by Electric Vehicle Type

17.8.1. Battery Electric Vehicle (BEVs)

17.8.2. Plug-in Hybrid Electric Vehicle (PHEVs)

17.8.3. Hybrid Electric Vehicle (HEVs)

17.8.4. Fuel Cell Electric Vehicle (FCEVs)

17.9. Key Country Analysis - South America Electric Vehicle Power Electronics Market Size & Forecast, 2017-2031

17.9.1. Brazil

17.9.2. Argentina

17.9.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2022

18.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

19. Company Profile/ Key Players

19.1. ABB

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.2. BYD Auto

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.3. Continental AG

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.4. Delphi Technologies PLC.

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.5. Denso Corporation

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.6. EVS Auto Group

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.7. FUJITSU

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.8. Fuji Electric Co., Ltd.

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.9. Hitachi Automotive Systems

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.10. Mitsubishi Electric

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.11. Metric Mind

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.12. Robert Bosch GmbH

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.13. Siemens AG

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.14. Texas Instruments

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.15. NXP Semiconductors

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.16. Electrodrive Powertrain Solutions Pvt Ltd

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.17. HYUNDAI KEFICO Corporation

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.18. Toyota Industries Corporation

19.18.1. Company Overview

19.18.2. Company Footprints

19.18.3. Production Locations

19.18.4. Product Portfolio

19.18.5. Competitors & Customers

19.18.6. Subsidiaries & Parent Organization

19.18.7. Recent Developments

19.18.8. Financial Analysis

19.18.9. Profitability

19.18.10. Revenue Share

19.19. AEM Electronics

19.19.1. Company Overview

19.19.2. Company Footprints

19.19.3. Production Locations

19.19.4. Product Portfolio

19.19.5. Competitors & Customers

19.19.6. Subsidiaries & Parent Organization

19.19.7. Recent Developments

19.19.8. Financial Analysis

19.19.9. Profitability

19.19.10. Revenue Share

19.20. Other Key Players

19.20.1. Company Overview

19.20.2. Company Footprints

19.20.3. Production Locations

19.20.4. Product Portfolio

19.20.5. Competitors & Customers

19.20.6. Subsidiaries & Parent Organization

19.20.7. Recent Developments

19.20.8. Financial Analysis

19.20.9. Profitability

19.20.10. Revenue Share

List of Tables

Table 1: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Table 2: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Table 3: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 4: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 5: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Table 6: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Table 7: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 8: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 9: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 10: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 11: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 12: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 13: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 14: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 15: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 16: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 17: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Table 18: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Table 19: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 20: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 21: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Table 22: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Table 23: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 24: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 25: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 26: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 27: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 28: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 29: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 30: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 31: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 33: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Table 34: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Table 35: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 36: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 37: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Table 38: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Table 39: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 40: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 41: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 42: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 43: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 45: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 46: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 47: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 49: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Table 50: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Table 51: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 52: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 53: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Table 54: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Table 55: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 56: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 57: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 58: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 59: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 60: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 61: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 62: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 63: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 64: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 65: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Table 66: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Table 67: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 68: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 69: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Table 70: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Table 71: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 72: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 73: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 74: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 75: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 76: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 77: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 78: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 79: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 80: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 81: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Table 82: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Table 83: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 84: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Table 85: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Table 86: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Table 87: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Table 88: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 89: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 90: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 91: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 92: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 93: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 94: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 95: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 96: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Figure 2: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Figure 3: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Power Control Unit, Value (US$ Mn), 2023-2031

Figure 4: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 5: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 6: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 7: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Figure 8: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Figure 9: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Device Type, Value (US$ Mn), 2023-2031

Figure 10: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 11: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 12: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 13: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 14: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 15: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 16: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 17: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 18: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 19: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 20: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 21: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 22: Global Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 23: Global Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 24: Global Electric Vehicle Power Electronics Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 25: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Figure 26: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Figure 27: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Power Control Unit, Value (US$ Mn), 2023-2031

Figure 28: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 29: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 30: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 31: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Figure 32: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Figure 33: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Device Type, Value (US$ Mn), 2023-2031

Figure 34: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 35: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 36: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 37: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 38: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 39: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 40: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 41: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 42: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 43: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 44: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 45: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 46: North America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: North America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 48: North America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 49: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Figure 50: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Figure 51: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Power Control Unit, Value (US$ Mn), 2023-2031

Figure 52: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 53: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 54: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 55: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Figure 56: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Figure 57: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Device Type, Value (US$ Mn), 2023-2031

Figure 58: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 59: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 60: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 61: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 62: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 63: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 64: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 67: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 68: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 69: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 70: Europe Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Europe Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 72: Europe Electric Vehicle Power Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 73: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Figure 74: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Figure 75: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Power Control Unit, Value (US$ Mn), 2023-2031

Figure 76: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 77: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 78: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 79: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Figure 80: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Figure 81: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Device Type, Value (US$ Mn), 2023-2031

Figure 82: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 83: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 84: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 85: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 86: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 87: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 88: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 89: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 90: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 91: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 92: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 93: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 94: Asia Pacific Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 95: Asia Pacific Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 96: Asia Pacific Electric Vehicle Power Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 97: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Figure 98: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Figure 99: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Power Control Unit, Value (US$ Mn), 2023-2031

Figure 100: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 101: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 102: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 103: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Figure 104: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Figure 105: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Device Type, Value (US$ Mn), 2023-2031

Figure 106: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 107: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 108: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 109: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 110: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 111: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 112: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 113: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 114: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 115: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 116: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 117: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 118: Middle East & Africa Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 119: Middle East & Africa Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 120: Middle East & Africa Electric Vehicle Power Electronics Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 121: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Power Control Unit, 2017-2031

Figure 122: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Power Control Unit, 2017-2031

Figure 123: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Power Control Unit, Value (US$ Mn), 2023-2031

Figure 124: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 125: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 126: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 127: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Device Type, 2017-2031

Figure 128: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Device Type, 2017-2031

Figure 129: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Device Type, Value (US$ Mn), 2023-2031

Figure 130: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Component, 2017-2031

Figure 131: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 132: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 133: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 134: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 135: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 136: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 137: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 138: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 139: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 140: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 141: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 142: South America Electric Vehicle Power Electronics Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 143: South America Electric Vehicle Power Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 144: South America Electric Vehicle Power Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031