Reports

Reports

Potassium Hydroxide De-icers Increasingly Used for Safe Air Travel

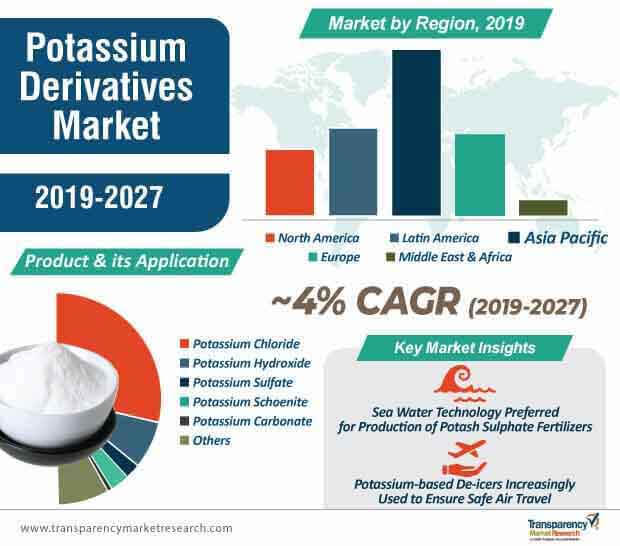

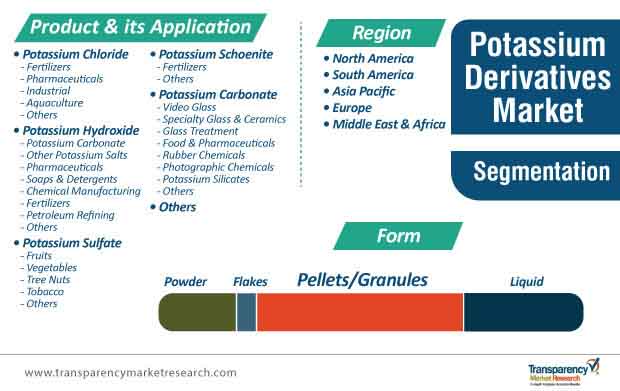

Manufacturers in the potassium derivatives market are tapping into new incremental opportunities, one of them being increasing the availability of potassium-based de-icers that are used to ensure safe air travel. Potassium chloride is anticipated to dominate the market in terms of both, value and volume, during the forecast period, and de-icing serves as one of the important sources of revenue for manufacturers in the potassium derivatives market.

Stakeholders in the air travel landscape are increasingly using potassium-based de-icers to minimize the risk aircraft sliding off the taxiway. Thus, the de-icing technique is crucial to ensure passenger and crew safety in regions that have extreme cold temperatures. However, de-icers contain chemicals that may be harmful for the environment. Hence, manufacturers are developing de-icers made from potassium hydroxide that are as effective as conventional potassium de-icers, and help reduce the environmental impact. This is evident, as potassium hydroxide is projected to account for the second-highest revenue amongst all potassium compounds in the potassium derivatives market, with an estimated value of ~US$ 2.8 billion by 2027.

Potassium Sulfate Fertilizers Support Global Demand for Premium Food Products

Manufacturers in the potassium derivatives market hold an important position in the eyes of stakeholders in the agricultural value chain. The global agricultural output of grains accounted for a production yield of ~2,600 million metric tons in 2017. Hence, there is growing demand for effective fertilizers that comply with food safety norms in the agricultural space. Manufacturers in the potassium derivatives market are innovating new potash sulfate fertilizers with the help of the sea water technology. They are increasing their capabilities in the mass-scale production of fertilizers, using this technology. Fertilizers developed from the sea water technology are complementing the abundant cultivation of crops rich in carbohydrates.

Since developing fertilizers from muriate of potash (MOP) is comparatively less expensive than sulfate of potash (SOP), manufacturers in the potassium derivatives market are capitalizing on this trend. As such, they are utilizing SOP, since it contains premium potash and does not contain chloride. Thus, SOP-based fertilizers are being increasingly used for the cultivation of fruits, vegetables, tobacco, tree crops, and nuts.

Although potassium sulfate is projected to account for the fifth-largest revenue share in the potassium derivatives market by the end of 2027, its advantages are well-received by stakeholders in the agricultural value chain. For instance, SOP-based fertilizers are ideal for use in arid regions and salty or sandy soils. They add value for farmers, since these fertilizers help improve the shelf-life of food products, and this supports the worldwide demand for premium-quality products.

Food Manufacturers Teaming Up with Stakeholders in Potassium Derivatives Market

Regulations pertaining to salt and sodium content in food are surfacing in some parts of the world. Though food manufacturers are taking conscious efforts to replace sodium in salt, they are facing certain challenges in the food manufacturing landscape.

After several research attempts, it has been found that, potassium chloride serves as an effective alternative to sodium in salt. Hence, manufacturers in the potassium derivatives market are increasing their focus on meeting the demands of food manufacturers. The increasing application of potassium chloride in various end uses has triggered market growth. Potassium chloride is projected to continue to gain prominence in the potassium derivatives market throughout the forecast period, with an estimated production output of ~40,000 kilo tons by the end of 2027.

Food manufacturers are increasingly using potassium chloride to replace sodium in salts after the introduction of updates in previous food regulations. Even the FDA is encouraging food manufacturers to use mineral salts containing potassium chloride to reduce sodium intake and lower the risk of blood pressure amongst consumers. However, if not utilized judiciously, potassium chloride can lead to severely impaired kidney functioning as well as decreased blood pressure, independent of sodium intake. Hence, food manufacturers are maintaining the right ratio of sodium and potassium during the manufacturing process of food products. They are focusing more on complying with the regulations and less on enhancing the taste of the food products.

Analysts’ Viewpoint

Apart from de-icers, potassium hydroxide and potassium carbonate are being increasingly used for the development of electrolytes in batteries. As such, potassium-based graphite dual-ion batteries are posing a threat to lithium-ion batteries.

Manufacturers in the potassium derivatives market should focus on untapped opportunities in Latin America and Europe. However, the global market is highly consolidated. Also, the market is challenged by other limitations such as health complications resulting from high concentration of potassium chloride through intravenous injections. Hence, manufacturers should increase the availability of pre-diluted formulations, and encourage health commissions to implement standardized prescription norms for dosage purposes. They should focus on developing improved fertilizers, since agriculture is one of the key end use industries for manufacturers in the potassium derivatives landscape.

Potassium Derivatives Market: Description

Key Growth Driver of Potassium Derivatives Market

Major Challenge for Potassium Derivatives Market

Lucrative Opportunity for Global Potassium Derivatives Market

Asia Pacific to Dominate Potassium Derivatives Market

Potassium Chloride to Account for Prominent Share of Potassium Derivatives Market

Popularity of Pellets/Granules Form

Leading Players Actively Engage in Joint Ventures and R&D Activities in Potassium Derivatives Market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Potassium Derivatives Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators/Definitions

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Potassium Derivatives Market Analysis and Forecast, 2019–2027

4.4.1. Global Potassium Derivatives Market Volume (Kilo Tons)

4.4.2. Global Potassium Derivatives Market Value (US$ Mn)

4.5. Porters Five Forces Analysis

4.6. Value Chain Analysis

4.6.1. List of Potential Customers

4.7. Regulatory Landscape

5. Production Outlook, 2018

5.1. Production Outlook, by Region

6. Global Import-Export Analysis, by Region, 2015-2018

7. Global Potash Market Analysis

7.1. Introduction & Key Findings

7.2. Global Potash Market Price Trend

7.3. Global Potash Market Volume (Kilo Tons)

7.4. Global Potash Market Value (US$ Mn)

7.5. Global Potash Market Share Analysis

8. Pricing Analysis, 2018 (Benchmarking)

8.1. Price Comparison Analysis, by Product

8.2. Price Comparison Analysis, by Region

9. Global Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Product and its Application

9.1. Key Findings and Introduction

9.2. Global Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

9.2.1. Potassium Chloride

9.2.1.1. Fertilizers

9.2.1.2. Pharmaceuticals

9.2.1.3. Industrial

9.2.1.4. Aquaculture

9.2.1.5. Others (De-icing)

9.2.2. Potassium Hydroxide

9.2.2.1. Potassium Carbonate

9.2.2.2. Other Potassium Salts

9.2.2.3. Pharmaceuticals

9.2.2.4. Soaps & Detergents

9.2.2.5. Chemical Manufacturing

9.2.2.6. Fertilizers

9.2.2.7. Petroleum Refining

9.2.2.8. Others (pH Balancing Agent and Electrolytes in Batteries)

9.2.3. Potassium Sulfate

9.2.3.1. Fruits

9.2.3.2. Vegetables

9.2.3.3. Tree Nuts

9.2.3.4. Tobacco

9.2.3.5. Others (Glass Manufacturing, Tea, Horticultural Plants, Dry Soils, and Salty Soils)

9.2.4. Potassium Schoenite

9.2.4.1. Fertilizer

9.2.4.2. Others (Aquaculture)

9.2.5. Potassium Carbonate

9.2.5.1. Video Glass

9.2.5.2. Specialty Glass & Ceramics

9.2.5.3. Glass Treatment

9.2.5.4. Food & Pharmaceuticals

9.2.5.5. Rubber Chemicals

9.2.5.6. Photographic Chemicals

9.2.5.7. Potassium Silicates

9.2.5.8. Others (pH Balancing Agents, Fire suppressants, Welding, Animal Feed, and Potassium Bicarbonate)

9.2.6. Others (Potassium Nitrate, Potassium Bicarbonate, and Potassium Permanganate)

9.3. Global Potassium Derivatives Market Attractiveness Analysis, by Product and its Application

10. Global Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Form

10.1. Key Findings and Introduction

10.2. Global Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

10.2.1. Powder

10.2.2. Flakes

10.2.3. Pellets/Granules

10.2.4. Liquid

10.3. Global Potassium Derivatives Market Attractiveness Analysis, by Form

11. Global Potassium Derivatives Market Analysis, by Region

11.1. Global Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Latin America

11.1.5. Middle East & Africa

11.2. Global Potassium Derivatives Market Attractiveness Analysis, by Region

12. North America Potassium Derivatives Market Overview

12.1. North America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

12.2. North America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

12.3. North America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country

12.3.1. U.S. Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

12.3.2. U.S. Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

12.3.3. Canada Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

12.3.4. Canada Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

12.4. North America Potassium Derivatives Market Attractiveness Analysis, by Product and its Application

12.5. North America Potassium Derivatives Market Attractiveness Analysis, by Form

13. Europe Potassium Derivatives Market Overview

13.1. Europe Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.2. Europe Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.3. Europe Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

13.3.1. Germany Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.3.2. Germany Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.3.3. France Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.3.4. France Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.3.5. U.K. Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.3.6. U.K. Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.3.7. Italy Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.3.8. Italy Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.3.9. Spain Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.3.10. Spain Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.3.11. Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.3.12. Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.3.13. Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

13.3.14. Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

13.4. Europe Potassium Derivatives Market Attractiveness Analysis, by Product and its Application

13.5. Europe Potassium Derivatives Market Attractiveness Analysis, by Form

14. Asia Pacific Potassium Derivatives Market Overview

14.1. Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

14.2. Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

14.3. Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

14.3.1. China Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

14.3.2. China Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

14.3.3. India Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

14.3.4. India Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

14.3.5. Japan Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

14.3.6. Japan Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

14.3.7. ASEAN Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

14.3.8. ASEAN Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

14.3.9. Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

14.3.10. Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

14.4. Asia Pacific Potassium Derivatives Market Attractiveness Analysis, by Product and its Application

14.5. Asia Pacific Potassium Derivatives Market Attractiveness Analysis, by Form

15. Latin America Potassium Derivatives Market Overview

15.1. Latin America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

15.2. Latin America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

15.3. Latin America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

15.3.1. Brazil Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

15.3.2. Brazil Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

15.3.3. Mexico Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

15.3.4. Mexico Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

15.3.5. Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

15.3.6. Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

15.4. Latin America Potassium Derivatives Market Attractiveness Analysis, by Product and its Application

15.5. Latin America Potassium Derivatives Market Attractiveness Analysis, by Form

16. Middle East & Africa Potassium Derivatives Market Overview

16.1. Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

16.2. Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

16.3. Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

16.3.1. GCC Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

16.3.2. GCC Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

16.3.3. South Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

16.3.4. South Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

16.3.5. Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product and its Application, 2018–2027

16.3.6. Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2018–2027

16.4. Middle East & Africa Potassium Derivatives Market Attractiveness Analysis, by Product and its Application

16.5. Middle East & Africa Potassium Derivatives Market Attractiveness Analysis, by Form

17. Competition Landscape

17.1. Global Potassium Hydroxide Market Share Analysis, by Company, 2018

17.2. Global Potassium Sulfate Market Share Analysis, by Company, 2018 (By Production Capacity)

17.3. Global Potassium Chloride Market Share Analysis, by Company, 2018

17.4. Competition Matrix (Potassium Hydroxide)

17.5. Competition Matrix (Potassium Sulfate)

17.6. Competition Matrix (Potassium Chloride)

17.7. Company Profiles

17.7.1. Evonik Industries AG

17.7.1.1. Company Description

17.7.1.2. Business Overview

17.7.1.3. Financial Details

17.7.1.4. Key Developments

17.7.2. Vynova Group

17.7.2.1. Company Description

17.7.2.2. Business Overview

17.7.3. TOAGOSEI CO., LTD.

17.7.3.1. Company Description

17.7.3.2. Business Overview

17.7.3.3. Financial Details

17.7.3.4. Key Developments

17.7.4. The Olin Corporation

17.7.4.1. Company Description

17.7.4.2. Business Overview

17.7.4.3. Financial Details

17.7.4.4. Key Developments

17.7.5. ERCO Worldwide

17.7.5.1. Company Description

17.7.5.2. Business Overview

17.7.6. Pan-Americana S.A Indústrias Químicas

17.7.6.1. Company Description

17.7.6.2. Business Overview

17.7.7. Unid Co Ltd.

17.7.7.1. Company Description

17.7.7.2. Business Overview

17.7.7.3. Financial Details

17.7.7.4. Key Developments

17.7.8. Altair Chimica SpA

17.7.8.1. Company Description

17.7.8.2. Business Overview

17.7.9. Agrocel Industries Pvt. Ltd.

17.7.9.1. Company Description

17.7.9.2. Business Overview

17.7.10. SPOLCHEMIE

17.7.10.1. Company Description

17.7.10.2. Business Overview

List of Tables

Table 1: Global Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 2: Global Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 3: Global Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 4: Global Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 5: Global Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 6: Global Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 7: Global Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 8: Global Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 9: Global Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 10: Global Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 11: Global Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 12: Global Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 13: Global Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Region, 2019–2027

Table 14: Global Potassium Derivatives Market Value (US$ Mn) Forecast, by Region, 2019–2027

Table 15: North America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 16: North America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 17: North America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 18: North America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 19: North America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 20: North America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 21: North America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 22: North America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 23: North America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 24: North America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 25: North America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 26: North America Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 27: U.S. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 28: U.S. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 29: U.S. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 30: U.S. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 31: U.S. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 32: U.S. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 33: U.S. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 34: U.S. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 35: U.S. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 36: U.S. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 37: U.S. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 38: U.S. Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 39: Canada Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 40: Canada Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 41: Canada Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 42: Canada Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 43: Canada Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 44: Canada Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 45: Canada Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 46: Canada Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 47: Canada Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 48: Canada Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 49: Canada Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 50: Canada Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 51: Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 52: Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 53: Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 54: Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 55: Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 56: Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 57: Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 58: Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 59: Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 60: Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 61: Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 62: Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 63: Germany Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 64: Germany Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 65: Germany Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 66: Germany Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 67: Germany Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 68: Germany Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 69: Germany Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 70: Germany Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 71: Germany Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 72: Germany Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 73: Germany Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 74: Germany Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 75: U.K. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 76: U.K. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 77: U.K. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 78: U.K. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 79: U.K. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 80: U.K. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 81: U.K. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 82: U.K. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 83: U.K. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 84: U.K. Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 85: U.K. Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 86: U.K. Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 87: France Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 88: France Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 89: France Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 90: France Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 91: France Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 92: France Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 93: France Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 94: France Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 95: France Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 96: France Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 97: France Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 98: France Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 99: Spain Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 100: Spain Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 101: Spain Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 102: Spain Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 103: Spain Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 104: Spain Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 105: Spain Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 106: Spain Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 107: Spain Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 108: Spain Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 109: Spain Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 110: Spain Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 111: Italy Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 112: Italy Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 113: Italy Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 114: Italy Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 115: Italy Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 116: Italy Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 117: Italy Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 118: Italy Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 119: Italy Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 120: Italy Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 121: Italy Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 122: Italy Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 123: Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 124: Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 125: Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 126: Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 127: Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 128: Russia & CIS Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 129: Russia & CIS Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 130: Russia & CIS Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 131: Russia & CIS Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 132: Russia & CIS Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 133: Russia & CIS Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 134: Russia & CIS Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 135: Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 136: Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 137: Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 138: Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 139: Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 140: Rest of Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 141: Rest of Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 142: Rest of Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 143: Rest of Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 144: Rest of Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 145: Rest of Europe Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 146: Rest of Europe Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 147: Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 148: Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 149: Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 150: Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 151: Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 152: Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 153: Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 154: Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 155: Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 156: Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 157: Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 158: Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 159: China Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 160: China Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 161: China Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 162: China Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 163: China Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 164: China Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 165: China Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 166: China Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 167: China Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 168: China Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 169: China Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 170: China Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 171: Japan Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 172: Japan Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 173: Japan Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 174: Japan Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 175: Japan Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 176: Japan Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 177: Japan Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 178: Japan Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 179: Japan Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 180: Japan Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 181: Japan Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 182: Japan Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 183: India Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 184: India Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 185: India Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 186: India Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 187: India Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 188: India Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 189: India Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 190: India Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 191: India Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 192: India Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 193: India Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 194: India Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 195: Australia Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 196: Australia Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 197: Australia Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 198: Australia Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 199: Australia Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 200: Australia Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 201: Australia Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 202: Australia Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 203: Australia Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 204: Australia Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 205: Australia Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 206: Australia Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 207: Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 208: Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 209: Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 210: Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 211: Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 212: Rest of Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 213: Rest of Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 214: Rest of Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 215: Rest of Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 216: Rest of Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 217: Rest of Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 218: Rest of Asia Pacific Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 219: Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 220: Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 221: Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 222: Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 223: Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 224: Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 225: Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 226: Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 227: Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 228: Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 229: Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 230: Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 231: Brazil Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 232: Brazil Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 234: Brazil Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 235: Brazil Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 236: Brazil Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 237: Brazil Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 238: Brazil Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 239: Brazil Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 240: Brazil Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 241: Brazil Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 242: Brazil Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 243: Brazil Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 244: Mexico Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 245: Mexico Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 246: Mexico Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 247: Mexico Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 248: Mexico Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 249: Mexico Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 250: Mexico Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 251: Mexico Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 252: Mexico Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 253: Mexico Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 254: Mexico Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 255: Mexico Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 256: Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 257: Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 258: Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 259: Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 260: Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 261: Rest of Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 262: Rest of Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 263: Rest of Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 264: Rest of Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 265: Rest of Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 266: Rest of Latin America Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 267: Rest of Latin America Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 268: Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 269: Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 270: Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 271: Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 272: Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 273: Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 274: Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 275: Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 276: Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 277: Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 278: Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 279: Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 280: GCC Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 281: GCC Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 282: GCC Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 283: GCC Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 284: GCC Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 285: GCC Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 286: GCC Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 287: GCC Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 288: GCC Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 289: GCC Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 290: GCC Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 291: GCC Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 292: South Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 293: South Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 294: South Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 295: South Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 296: South Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 297: South Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 298: South Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 299: South Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 300: South Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 301: South Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 302: South Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 303: South Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

Table 304: Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 305: Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 306: Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 307: Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 308: Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Product and its Application, 2019–2027

Table 309: Rest of Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 310: Rest of Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 311: Rest of Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 312: Rest of Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 313: Rest of Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Product and its Application, 2019–2027

Table 314: Rest of Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) Forecast, by Form, 2019–2027

Table 315: Rest of Middle East & Africa Potassium Derivatives Market Value (US$ Mn) Forecast, by Form, 2019–2027

List of Figures

Figure 1: Global Potassium Derivatives Market Volume Share, by Region, 2018 and 2027

Figure 2: Global Potassium Derivatives Market Attractiveness, by Region

Figure 3: North America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 4: North America Potassium Derivatives Market Attractiveness, by Country

Figure 5: North America Potassium Derivatives Market Volume Share, by Country, 2018 and 2027

Figure 6: Europe Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 7: Europe Potassium Derivatives Market Attractiveness, by Country and Sub-region

Figure 8: Europe Potassium Derivatives Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 9: Asia Pacific Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 10: Asia Pacific Potassium Derivatives Market Attractiveness, by Country and Sub-region

Figure 11: Asia Pacific Potassium Derivatives Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 12: Latin America Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 13: Latin America Potassium Derivatives Market Attractiveness, by Country and Sub-region

Figure 14: Latin America Potassium Derivatives Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 15: Middle East & Africa Potassium Derivatives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 16: Middle East & Africa Potassium Derivatives Market Attractiveness, by Country and Sub-region

Figure 17: Middle East & Africa Potassium Derivatives Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 18: Global Potassium Hydroxide Market Share Analysis, by Company, 2018

Figure 19: Global Potassium Sulfate Market Share Analysis, by Company, 2018 (By Production Capacity)

Figure 20: Global Potassium Chloride Market Share Analysis, by Company, 2018