Reports

Reports

Polymer Dispersion Market to Evolve with Advent of Nano-dispersion Technology

Though the global polymer dispersion market has reached a mature and stable stage, it is undergoing major transitions with the emergence of technological innovations, which are triggered by the growing need for environment-friendly polymer applications.

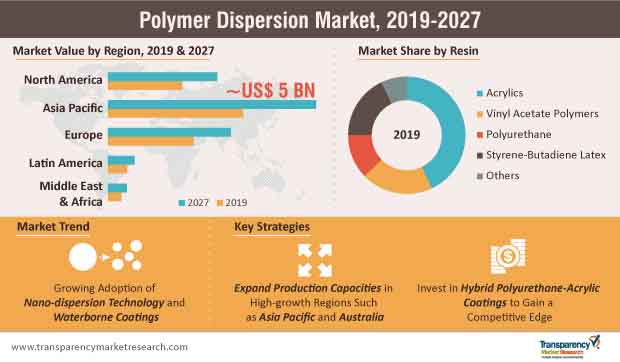

The global polymer dispersion market is currently valued at ~US$ 7.6 billion, and is anticipated to experience double digit growth by 2027, to reach a value of ~US$ 11.8 billion. Ongoing developments in the polymer dispersion landscape are giving rise to newer applications for sealers and primers with the help of nano-dispersion technology. Likewise, stakeholders are using this technology to its full potential to provide their clients and end users with high-efficiency sealants and adhesion improved penetration primers devised with nano emulsions.

Owing to the rising demand for high-performance adhesives and sealants in various industrial applications, nano-emulsions offer several advantages as compared to conventional emulsions. However, the issue of durability and shelf-life of surfaces and structures may slow down the demand for nano-emulsions. Although nano-emulsions might have a few drawbacks, various studies and experiments show that, the water repellency attribute of nano-emulsions, prevention of ruptures, and moisture migration are creating demand for suitable applications on other substrates such as wood, concrete, tiles, and plaster to leverage product performance when used with additives.

Business Scope for Hybrid Polyurethane-Acrylic Coatings to Rise

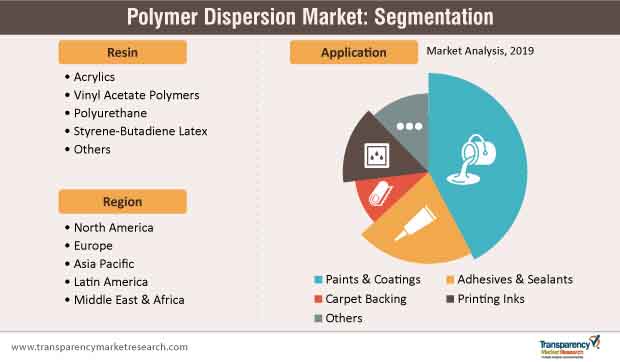

The demand for polymers began from the mid-20th century with the introduction of plastics in the polymer dispersion market, and has evolved as a profitable industry with numerous applications in resin-based acrylics, paints, coatings and printing inks. With new opportunities coming to the fore in the polyurethane industry, stakeholders in the polymer dispersion market are likely to focus on adopting novel techniques such as crosslinking polyurethane dispersions for highly-efficacious wood coatings.

Polyurethane dispersions (PUDs) create a unique film formation, which provides customers with a distinguished appearance for wooden structures and high-resistance properties. However, though polyurethane coatings have several advantages, the usage of PUDs is sometimes limited due to their high costs as compared to acrylic emulsions. Eventually, this challenge could hamper the demand for polyurethane coatings in the polymer dispersion landscape.

Since acrylics account for ~43% revenue share of the polymer dispersion market, manufacturers are opting to crosslink PUDs with acrylic through a chemical reaction or physical blend, which results in a PUD-acrylic hybrid, in order to equalize the high costs of polyurethane coatings. This PUD-acrylic hybrid acts as a highly-efficient wood coating that improves the crosslink density of the film coating, thus adding up to the consumer value for wooden furniture.

Bio-based Polymers Serve as Eco-friendly Alternatives for Interior Paints & Plasters

As governments are encouraging the manufacturing of environmentally-friendly materials, stakeholders in the polymer dispersion market are increasing research & development capacities to meet stringent government regulations. These research experiments are being used to produce materials based on renewable raw materials.

Influenced by the exponential revenue growth of bio-based paints and coatings in the polymer dispersion landscape in the U.S and Europe, manufacturers are now turning towards the production of bio-based interior paints and plasters. For instance, in February 2019, Wacker Chemie AG ? one of the leading chemicals company in the landscape of polymer dispersions, announced the launch of hybrid polymeric binders that are produced using vinyl acetate-ethylene polymers and starch for industrial applications. As vinyl acetate polymers account for ~one-third of the polymer dispersion market share, Wacker Chemie AG became one of the first companies in the world to manufacture bio-based hybrid polymeric binders used as additive in paints and plasters for lasting adhesion and an eco-friendly alternative for polymers made with fossil resources such as petroleum and natural gas.

Stakeholders Climb Success Steps with Increased Offerings in Paints & Coatings and Printing Inks

Apart from paints, coatings, adhesives and sealants, stakeholders in the polymer dispersion market are also expanding their product offerings for a wide spectrum of oilfield applications. Manufacturers are increasing efforts in research & development to produce bio-polymer additives. Likewise, AkzoNobel ? one of the largest global paints and coatings companies in the polymer dispersion landscape, announced the launch of several product offerings for the oilfield industry, through its business unit Surface Chemistry. These products include a range of natural and synthetic materials that are used to produce iron-linked pseudo-polymer complexes that serve as effective crude oil extractors.

Besides increased research and developments, stakeholders are advancing on transforming business operations to provide consumers and end users with efficacious printing inks for various industrial purposes, since printing inks account for ~two-thirds of the polymer dispersion market. Recently, a study was conducted on the effect of different surfactant monomers on water-soluble emulsion polymers as a binder for water-based printing inks. Results concluded that, synthesized di maleate surfomer ? a type of surfactant monomer, enhances the color strength of the printing ink, but slightly affects its viscosity.

Waterborne Coatings and Strategic Expansions Combat Market Restraints

The global polymer dispersion market is prone to stringent environment regulations, and governments across countries are appealing for greener and sustainable materials and polymers. This appeal from governments has given rise to various innovations, and waterborne coatings is one such innovation, with the help of which, stakeholders are maximizing their businesses. The high-water content in waterborne coatings makes them environment-friendly, and easy to apply on various structures and surfaces. Also, their attribute for several applications in furniture, automobiles, plastics and printing inks makes them a highly-appreciated choice for consumers and end users.

Owing to the major market share of acrylics in the polymer dispersion landscape, manufacturers are expanding production capacities in some high-growth potential regions such as Asia Pacific. Manufacturers are devising business strategies by increasing investments that would double the production capacities and facilitate the demand from major end-user industries such as construction, adhesives, and coatings. For instance, in October 2018, BASF SE ? a German leader and one of the largest chemical producers in the polymer dispersion market, announced the expansion of its production capacity for acrylic dispersions in Malaysia. Through this expansion, the company plans to offer a reliable supply of high-efficacy dispersions solutions to clients and end users in fast-growing ASEAN (Association of Southeast Nations) countries, New Zealand, and Australia.

Analysts’ Viewpoint

Analysts of the polymer dispersion market offer a 3600 overview of the strategic opportunities and challenges that stakeholders might face during the projection period of 2019-2027. The polymer dispersion landscape provides a favorable go-ahead for stakeholders that are planning to invest in some of the most fastest-growing markets, such as Asia Pacific, Europe, and North America.

The polymer dispersion market has a wide scope for technological innovations and incremental opportunities. However, stringent environmental regulations from governments for greener and sustainable polymer dispersions are creating pressure on stakeholders to increase research & development activities. With the help of eco-friendly product offerings, such as waterborne coatings and bio-based polymers, stakeholders could be empowered to provide added product value to consumers and other end users.

Global Polymer Dispersion Market: Description

Key Growth Drivers of Global Polymer Dispersion Market

Major Challenges for Global Polymer Dispersion Market

Lucrative Opportunities for Global Polymer Dispersion Market

Asia Pacific a Prominent Polymer Dispersion Market

North America Offers Growth Opportunities

Paints & Coatings Application to Account for a Prominent Share

Leading Players Actively Engage in Capacity Expansions and R&D Activities

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Acronyms Used

3. Executive Summary: Global Polymer Dispersion Market

4. Market Overview

4.1. Introduction

4.2. Key Market Developments

4.3. Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunities

4.5. Global Polymer Dispersion Market Analysis and Forecast, 2018–2027

4.5.1. Global Polymer Dispersion Market Volume (Kilo Tons)

4.5.2. Global Polymer Dispersion Market Value (US$ Mn)

4.6. Porters Five Forces Analysis

4.7. Value Chain Analysis

4.8. Pricing Analysis (Benchmarking), by Region, 2018–2027

5. Global Polymer Dispersion Market Analysis and Forecast, by Resin

5.1. Introduction

5.2. Key Findings

5.3. Global Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2019–2027

5.3.1. Acrylics

5.3.2. Vinyl Acetate Polymer

5.3.3. Polyurethane

5.3.4. Styrene-Butadiene Latex

5.3.5. Others

5.4. Global Polymer Dispersion Market Attractiveness, by Resin

6. Global Polymer Dispersion Market Analysis and Forecast, by Application

6.1. Introduction

6.2. Key Findings

6.3. Global Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

6.3.1. Paints & Coatings

6.3.2. Adhesives

6.3.3. Carpet Backing

6.3.4. Printing Inks

6.3.5. Others

6.4. Global Polymer Dispersion Market Attractiveness, by Application

7. Global Polymer Dispersion Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Global Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Global Polymer Dispersion Market Attractiveness, by Region

8. North America Polymer Dispersion Market Analysis and Forecast

8.1. Key Findings

8.2. North America Polymer Dispersion Forecast, by Resin, 2018–2027

8.3. North America Polymer Dispersion Forecast, by Application, 2018–2027

8.4. North America Polymer Dispersion Market Forecast, by Country, 2018–2027

8.4.1. U.S. Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

8.4.2. U.S. Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.4.3. Canada Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

8.4.4. Canada Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.5. North America Polymer Dispersion Market Attractiveness Analysis

9. Europe Polymer Dispersion Market Analysis and Forecast

9.1. Key Findings

9.2. Europe Polymer Dispersion Forecast, by Resin, 2018–2027

9.3. Europe Polymer Dispersion Forecast, by Application, 2018–2027

9.4. Europe Polymer Dispersion Market Forecast, by Country and Sub-region, 2018–2027

9.4.1. Germany Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

9.4.2. Germany Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.3. France Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

9.4.4. France Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.5. U.K. Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

9.4.6. U.K. Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.7. Italy Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

9.4.8. Italy Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.9. Spain Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

9.4.10. Spain Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.11. Russia & CIS Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

9.4.12. Russia & CIS Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.13. Rest of Europe Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

9.4.14. Rest of Europe Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.5. Europe Polymer Dispersion Market Attractiveness Analysis

10. Asia Pacific Polymer Dispersion Market Analysis and Forecast

10.1. Key Findings

10.2. Asia Pacific Polymer Dispersion Forecast, by Resin, 2018–2027

10.3. Asia Pacific Polymer Dispersion Forecast, by Application, 2018–2027

10.4. Asia Pacific Polymer Dispersion Market Forecast, by Country and Sub-region, 2018–2027

10.4.1. China Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

10.4.2. China Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.3. Japan Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

10.4.4. Japan Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.5. India Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

10.4.6. India Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.7. ASEAN Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

10.4.8. ASEAN Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.4.9. Rest of Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

10.4.10. Rest of Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

10.5. Asia Pacific Polymer Dispersion Market Attractiveness Analysis

11. Latin America Polymer Dispersion Market Analysis and Forecast

11.1. Key Findings

11.2. Latin America Polymer Dispersion Forecast, by Resin, 2018–2027

11.3. Latin America Polymer Dispersion Forecast, by Application, 2018–2027

11.4. Latin America Polymer Dispersion Market Forecast, by Country and Sub-region, 2018–2027

11.4.1. Brazil Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

11.4.2. Brazil Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.4.3. Mexico Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

11.4.4. Mexico Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.4.5. Rest of Latin America Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

11.4.6. Rest of Latin America Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

11.5. Latin America Polymer Dispersion Market Attractiveness Analysis

12. Middle East & Africa Polymer Dispersion Market Analysis and Forecast

12.1. Key Findings

12.2. Middle East & Africa Polymer Dispersion Forecast, by Resin, 2018–2027

12.3. Middle East & Africa Polymer Dispersion Forecast, by Application, 2018–2027

12.4. Middle East & Africa Polymer Dispersion Market Forecast, by Country and Sub-region, 2018–2027

12.4.1. GCC Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

12.4.2. GCC Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.4.3. South Africa Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

12.4.4. South Africa Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.4.5. Rest of Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2018–2027

12.4.6. Rest of Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

12.5. Middle East & Africa Polymer Dispersion Market Attractiveness Analysis

13. Competition Landscape

13.1. Global Polymer Dispersion Market Share Analysis, by Company, 2018

13.2. Market Players-Competition Matrix

13.2.1. Wacker Chemie AG

13.2.2. BASF SE

13.2.3. AkzoNobel N.V.

13.2.4. Clariant AG

13.3. Competitive Business Strategies

13.4. Company Profiles

13.4.1. Wacker Chemie AG

13.4.1.1. Company Description

13.4.1.2. Business Overview

13.4.1.3. Financial Details

13.4.1.4. Strategic Overview

13.4.2. AkzoNobel N.V.

13.4.2.1. Company Description

13.4.2.2. Business Overview

13.4.2.3. Financial Details

13.4.2.4. Strategic Overview

13.4.2.5. Product/Technology Feature

13.4.2.6. Recent Development

13.4.3. BASF SE

13.4.3.1. Company Description

13.4.3.2. Business Overview

13.4.3.3. Financial Details

13.4.3.4. Strategic Overview

13.4.4. Clariant AG

13.4.4.1. Company Description

13.4.4.2. Business Overview

13.4.4.3. Financial Details

13.4.4.4. Strategic Overview

13.4.5. Celanese Corporation

13.4.5.1. Company Description

13.4.5.2. Business Overview

13.4.6. Huntsman International LLC.

13.4.6.1. Company Description

13.4.6.2. Business Overview

13.4.6.3. Financial Details

13.4.6.4. Strategic Overview

13.4.7. The Dow Chemical Company

13.4.7.1. Company Description

13.4.7.2. Business Overview

13.4.7.3. Strategic Overview

13.4.8. Lanxess

13.4.8.1. Company Description

13.4.8.2. Business Overview

13.4.8.3. Financial Details

13.4.8.4. Strategic Overview

13.4.9. Mitsui Chemicals, Inc.

13.4.9.1. Company Description

13.4.9.2. Business Overview

13.4.9.3. Financial Details

13.4.9.4. Strategic Overview

13.4.10. Solvay SA

13.4.10.1. Company Description

13.4.10.2. Business Overview

13.4.10.3. Financial Details

13.4.10.4. Strategic Overview

13.4.11. DIC Corporation

13.4.11.1. Company Description

13.4.11.2. Business Overview

13.4.11.3. Financial Details

13.4.11.4. Strategic Overview

13.4.12. Arkema

13.4.12.1. Company Description

13.4.12.2. Business Overview

13.4.12.3. Financial Details

13.4.12.4. Strategic Overview

List of Tables

Table 01 Global Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 02 Global Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 03 Global Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 04 Global Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 05 Global Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Region, 2018–2027

Table 06 Global Polymer Dispersion Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 07 North America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 08 North America Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 09 North America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 10 North America Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 11 North America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Country, 2018–2027

Table 12 North America Polymer Dispersion Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 13 U.S. Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 14 U.S. Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 15 U.S. Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 16 U.S. Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 17 Canada Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 18 Canada Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 19 Canada Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 20 Canada Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 21 Europe Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 22 Europe Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 23 Europe Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 24 Europe Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 25 Europe Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 26 Europe Polymer Dispersion Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 27 Germany Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 28 Germany Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 29 Germany Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 30 Germany Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 31 France Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 32 France Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 33 France Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 34 France Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 35 U.K. Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 36 U.K. Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 37 U.K. Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 38 U.K. Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 39 Italy Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 40 Italy Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 41 Italy Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 42 Italy Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 43 Spain Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 44 Spain Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 45 Spain Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 46 Spain Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 47 Russia & CIS Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 48 Russia & CIS Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 49 Russia & CIS Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 50 Russia & CIS Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 51 Rest of Europe Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 52 Rest of Europe Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 53 Rest of Europe Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 54 Rest of Europe Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 55 Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 56 Asia Pacific Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 57 Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 58 Asia Pacific Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 59 Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 60 Asia Pacific Polymer Dispersion Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 61 China Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 62 China Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 63 China Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 64 China Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 65 Japan Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 66 Japan Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 67 Japan Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 68 Japan Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 69 India Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 70 India Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 71 India Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 72 India Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 73 ASEAN Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 74 ASEAN Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 75 ASEAN Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 76 ASEAN Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 77 Rest of Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 78 Rest of Asia Pacific Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 79 Rest of Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 80 Rest of Asia Pacific Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 81 Latin America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 82 Latin America Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 83 Latin America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 84 Latin America Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 85 Latin America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 86 Latin America Polymer Dispersion Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 87 Brazil Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 88 Brazil Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 89 Brazil Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 90 Brazil Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 91 Mexico Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 92 Mexico Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 93 Mexico Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 94 Mexico Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 95 Rest of Latin America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 96 Rest of Latin America Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 97 Rest of Latin America Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 98 Rest of Latin America Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 99 Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 100 Middle East & Africa Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 101 Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 102 Middle East & Africa Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 103 Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 104 Middle East & Africa Polymer Dispersion Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 105 GCC Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 106 GCC Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 107 GCC Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 108 GCC Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 109 South Africa Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 110 South Africa Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 111 South Africa Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 112 South Africa Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 113 Rest of Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Resin, 2018–2027

Table 114 Rest of Middle East & Africa Polymer Dispersion Market Value (US$ Mn) Forecast, by Resin, 2018–2027

Table 115 Rest of Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 116 Rest of Middle East & Africa Polymer Dispersion Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 01 Global Polymer Dispersion Price Trend (US$/Ton), 2018–2027

Figure 02 Global Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 03 Global Polymer Dispersion Market Value Share, by Resin, 2018 and 2027

Figure 04 Global Polymer Dispersion Market Attractiveness, by Resin

Figure 05 Global Polymer Dispersion Market Value Share, by Application, 2018 and 2027

Figure 06 Global Polymer Dispersion Market Attractiveness, by Application

Figure 07 Global Polymer Dispersion Market Value Share, by Region, 2018 and 2027

Figure 08 Global Polymer Dispersion Market Attractiveness, by Region

Figure 09 North America Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 10 North America Polymer Dispersion Market Attractiveness, by Country

Figure 11 North America Polymer Dispersion Market Value Share, by Resin, 2018 and 2027

Figure 12 North America Polymer Dispersion Market Value Share, by Application, 2018 and 2027

Figure 13 North America Polymer Dispersion Market Value Share, by Country, 2018 and 2027

Figure 14 North America Polymer Dispersion Market Attractiveness, by Resin

Figure 15 North America Polymer Dispersion Market Attractiveness, by Application

Figure 16 Europe Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 17 Europe Polymer Dispersion Market Attractiveness, by Country and Sub-region

Figure 18 Europe Polymer Dispersion Market Value Share, by Resin, 2018 and 2027

Figure 19 Europe Polymer Dispersion Market Value Share, by Application, 2018 and 2027

Figure 20 Europe Polymer Dispersion Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 21 Europe Polymer Dispersion Market Attractiveness, by Resin

Figure 22 Europe Polymer Dispersion Market Attractiveness, by Application

Figure 23 Asia Pacific Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 24 Asia Pacific Polymer Dispersion Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Polymer Dispersion Market Value Share, by Resin, 2018 and 2027

Figure 26 Asia Pacific Polymer Dispersion Market Value Share, by Application, 2018 and 2027

Figure 27 Asia Pacific Polymer Dispersion Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 28 Asia Pacific Polymer Dispersion Market Attractiveness, by Resin

Figure 29 Asia Pacific Polymer Dispersion Market Attractiveness, by Application

Figure 30 Latin America Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 31 Latin America Polymer Dispersion Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Polymer Dispersion Market Value Share, by Resin, 2018 and 2027

Figure 33 Latin America Polymer Dispersion Market Value Share, by Application, 2018 and 2027

Figure 34 Latin America Polymer Dispersion Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 35 Latin America Polymer Dispersion Market Attractiveness, by Resin

Figure 36 Latin America Polymer Dispersion Market Attractiveness, by Application

Figure 37 Middle East & Africa Polymer Dispersion Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 38 Middle East & Africa Polymer Dispersion Market Attractiveness, by Country and Sub-region

Figure 39 Middle East & Africa Polymer Dispersion Market Value Share, by Resin, 2018 and 2027

Figure 40 Middle East & Africa Polymer Dispersion Market Value Share, by Application, 2018 and 2027

Figure 41 Middle East & Africa Polymer Dispersion Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 42 Middle East & Africa Polymer Dispersion Market Attractiveness, by Resin

Figure 43 Middle East & Africa Polymer Dispersion Market Attractiveness, by Application

Figure 44 Global Polymer Dispersion Market Share Analysis, by Company, 2018