Reports

Reports

Analysts’ Viewpoint on Plastic Tubs and Lids Bottles Market Scenario

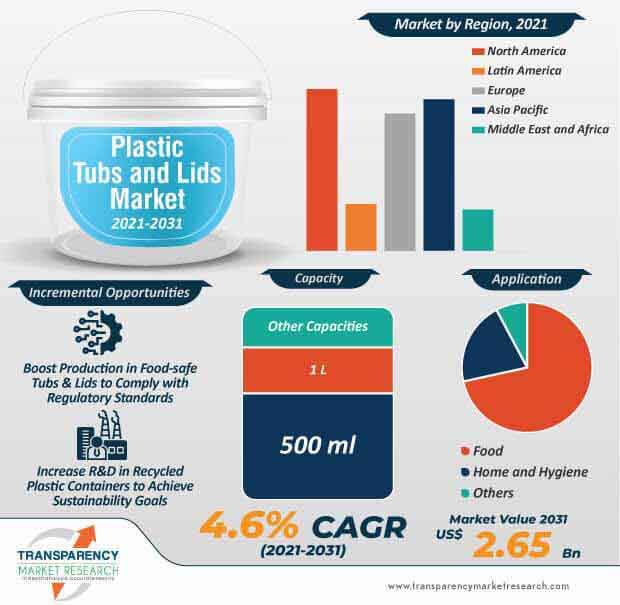

“Contingency planning and data-driven decisions are becoming important in the plastic tubs and lids market due to COVID-19 epidemic and potential disruption by its Omicron variant. Glass and stainless steel containers are emerging as an alternative to polycarbonate plastic since this plastic can break overtime due to overuse and effects of temperature. Hence, manufacturers should focus on R&D in new variants of plastic such as rPET that meet packaging, storage, and sustainability requirements. Manufacturers can also focus on increasing the availability of strong, leak-proof, and long-lasting plastic tubs and lids to bolster sales. Moreover, innovative cardboard-plastic tubs have an effective seal system that prevents moisture from entering the containers.”

The COVID-19 epidemic has interrupted production activities in the global packaging industry. This has caused ripple effects in the plastic tubs and lids market. Nevertheless, relaxation in coronavirus restrictions and opening up of all industries are anticipated to increase revenue generation in the global economy.

eCommerce is emerging as an effective strategy to expand revenue streams, since a significant number of people practice self-isolation and work from home (WFH) methods.

Since packaging is one of the essential industries, the COVID-19 outbreak seems to have a relatively low impact on the plastic tubs and lids market. Food & beverage (F&B) packaging has suffered less revenue losses as compared to consumer non-durables.

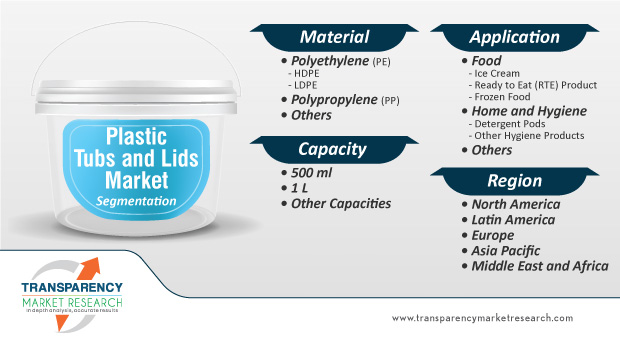

Thermoplastics used to manufacture containers and lids are linked with easy deformation when heated or when food is stored in them. Moreover, bisphenol A in some plastic dishes and tubs can be potentially dangerous for human health. Hence, companies are realizing the importance of investment in R&D to provide better plastics to consumers, which can be reused and recycled easily.

On the other hand, plastic waste generation is becoming a problem worldwide. Hence, manufacturers are increasing the production of rPET (recycled polyethylene terephthalate) tubs that are being adopted by big food brands to meet better packaging and sustainability factors.

New variants of plastics are fueling the growth of the global plastic tubs and lids market. The food industry is creating stable revenue streams for stakeholders in the value chain.

Consumers are becoming increasingly aware about food safe containers. A tiny triangle with a number, also known as the resin identification code ranging from 1 to 7, is being publicized to ensure an informed use of plastic food storage containers.

Even as BPA has been banned in baby bottles, sippy cups, and other packaging of infant formulas, BPA is under scrutiny for F&B containers by the U.S. Food and Drug Administration (FDA).

Asia Pacific is anticipated to be the frontrunner, in terms of value and volume, in the plastic tubs and lids market. Recycled plastic ice cream tubs are gaining popularity not only in Asia but also worldwide. Strategic collaborations are an effective strategy to innovate in sustainable plastic tubs and lids. Manufacturers in Europe are actively pursuing the trend of manufacturing recycled plastic ice cream tubs that are food grade and able to withstand freezing temperatures.

Companies in the Europe plastic tubs and lids market are making use of low quality mixed plastic waste to develop food grade recycled plastic ice cream tubs. These recycled solutions also have to meet the same technical and safety standards that are applicable for traditional food packaging.

Hybrid materials such as cardboard-plastic tubs are revolutionizing the global market. Companies in the plastic tubs and lids market are using 50% post-consumer recycled (PCR) polypropylene (PP) for the exterior coating sourced from end-consumer households to manufacture cardboard-plastic tubs. The tub’s interior is made of white virgin material.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 883.3 Mn |

|

Market Forecast Value in 2031 |

US$ 1.5 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & (Mn Units) for Volume |

|

Market Analysis |

This report represents market dynamics of plastic tubs and lids, qualitative & quantitative analysis along with lucrative hotspots of the market. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Plastic Tubs and Lids Market Overview

3.1. Introduction

3.2. Packaging Market Overview

3.3. Impact of E-commerce on Packaging Market

3.4. Import/Export Trade Analysis

3.5. Macro-economic Factors – Correlation Analysis

3.6. Forecast Factors – Relevance & Impact

3.7. Value Chain Analysis

3.7.1. Exhaustive List of Active Participants

3.7.1.1. Raw Material Suppliers

3.7.1.2. Manufacturers

3.7.1.3. Distributors/Retailers

3.7.2. Profitability Margins

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Target Market

5. Plastic Tubs and Lids Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Plastic Tubs and Lids Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Plastic Tubs and Lids Market Analysis and Forecast, By Material

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Material

7.1.2. Y-o-Y Growth Projections, By Material

7.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Material

7.2.1. Polyethylene (PE)

7.2.1.1. High Density Polyethylene (HDPE)

7.2.1.2. Low Density Polyethylene (LDPE)

7.2.2. Polypropylene (PP)

7.2.3. Others

7.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Material

7.3.1. Polyethylene (PE)

7.3.1.1. High Density Polyethylene (HDPE)

7.3.1.2. Low Density Polyethylene (LDPE)

7.3.2. Polypropylene (PP)

7.3.3. Others

7.4. Market Attractiveness Analysis, By Material

7.5. Prominent Trends

8. Global Plastic Tubs and Lids Market Analysis and Forecast, By Capacity

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Capacity

8.1.2. Y-o-Y Growth Projections, By Capacity

8.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Capacity

8.2.1. 500 ml

8.2.2. 1 litre

8.2.3. Other Capacities

8.3. Market Size (US$ Mn) and Volume (Tonne) Forecast Analysis 2021-2031, By Capacity

8.3.1. 500ml

8.3.2. 1 litre

8.3.3. Other Capacities

8.4. Market Attractiveness Analysis, By Capacity

8.5. Prominent Trends

9. Global Plastic Tubs and Lids Market Analysis and Forecast, By Application

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By Application

9.1.2. Y-o-Y Growth Projections, By Application

9.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Application

9.2.1. Food

9.2.1.1. Ice Cream

9.2.1.2. Ready-to-Eat (RTE) Product

9.2.1.3. Frozen Food

9.2.2. Home and Hygiene

9.2.2.1. Detergent Pods

9.2.2.2. Other Hygiene Products

9.2.3. Others

9.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Application

9.3.1. Food

9.3.1.1. Ice Cream

9.3.1.2. Ready-to-Eat (RTE) Product

9.3.1.3. Frozen Food

9.3.2. Home and Hygiene

9.3.2.1. Detergent Pods

9.3.2.2. Other Hygiene Products

9.3.3. Others

9.4. Market Attractiveness Analysis, By Application

9.5. Prominent Trends

10. Global Plastic Tubs and Lids Market Analysis and Forecast, By Region (Consumption Data)

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East and Africa (MEA)

10.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031 By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East and Africa (MEA)

10.4. Market Attractiveness Analysis By Region

10.5. Prominent Trends

11. Global Plastic Tubs and Lids Market (Estimates), By Region (Production Data)

11.1. Introduction

11.2. Market Size (US$ Mn) and Volume (Mn Units) Estimates in 2021, By Region

11.2.1. North America

11.2.2. Latin America

11.2.3. Europe

11.2.4. Asia Pacific

11.2.5. Middle East and Africa (MEA)

11.3. Prominent Trends

12. North America Plastic Tubs and Lids Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Country

12.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Country

12.3.1. U.S.

12.3.2. Canada

12.4. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Material

12.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Material

12.5.1. Polyethylene (PE)

12.5.1.1. High Density Polyethylene (HDPE)

12.5.1.2. Low Density Polyethylene (LDPE)

12.5.2. Polypropylene (PP)

12.5.3. Others

12.6. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Capacity

12.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Capacity

12.7.1. 500ml

12.7.2. 1 litre

12.7.3. Other Capacities

12.8. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Application

12.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Application

12.9.1. Food

12.9.1.1. Ice Cream

12.9.1.2. Ready-to-Eat (RTE) Product

12.9.1.3. Frozen Food

12.9.2. Home and Hygiene

12.9.2.1. Detergent Pods

12.9.2.2. Other Hygiene Products

12.9.3. Others

12.10. Market Attractiveness Analysis

12.10.1. By Material

12.10.2. By Capacity

12.10.3. By Application

12.11. Prominent Trends

12.12. Drivers and Restraints: Impact Analysis

13. Latin America Plastic Tubs and Lids Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Country

13.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031 By Country

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Argentina

13.3.4. Rest of Latin America

13.4. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Material

13.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Material

13.5.1. Polyethylene (PE)

13.5.1.1. High Density Polyethylene (HDPE)

13.5.1.2. Low Density Polyethylene (LDPE)

13.5.2. Polypropylene (PP)

13.5.3. Others

13.6. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Capacity

13.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Capacity

13.7.1. 500ml

13.7.2. 1 litre

13.7.3. Other Capacities

13.8. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Application

13.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Application

13.9.1. Food

13.9.1.1. Ice Cream

13.9.1.2. Ready-to-Eat (RTE) Product

13.9.1.3. Frozen Food

13.9.2. Home and Hygiene

13.9.2.1. Detergent Pods

13.9.2.2. Other Hygiene Products

13.9.3. Others

13.10. Market Attractiveness Analysis

13.10.1. By Material

13.10.2. By Capacity

13.10.3. By Application

13.11. Prominent Trends

13.12. Drivers and Restraints: Impact Analysis

14. Europe Plastic Tubs and Lids Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Country

14.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031 By Country

14.3.1. Germany

14.3.2. Spain

14.3.3. Italy

14.3.4. France

14.3.5. U.K.

14.3.6. BENELUX

14.3.7. Hungary

14.3.8. Turkey

14.3.9. Nordic

14.3.10. Russia

14.3.11. Poland

14.3.12. Rest of Europe

14.4. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Material

14.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Material

14.5.1. Polyethylene (PE)

14.5.1.1. High Density Polyethylene (HDPE)

14.5.1.2. Low Density Polyethylene (LDPE)

14.5.2. Polypropylene (PP)

14.5.3. Others

14.6. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Capacity

14.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Capacity

14.7.1. 500ml

14.7.2. 1 litre

14.7.3. Other Capacities

14.8. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Application

14.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Application

14.9.1. Food

14.9.1.1. Ice Cream

14.9.1.2. Ready-to-Eat (RTE) Product

14.9.1.3. Frozen Food

14.9.2. Home and Hygiene

14.9.2.1. Detergent Pods

14.9.2.2. Other Hygiene Products

14.9.3. Others

14.10. Market Attractiveness Analysis

14.10.1. By Material

14.10.2. By Capacity

14.10.3. By Application

14.11. Prominent Trends

14.12. Drivers and Restraints: Impact Analysis

15. Asia Pacific Plastic Tubs and Lids Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Country

15.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031 By Country

15.3.1. China

15.3.2. India

15.3.3. Japan

15.3.4. ASEAN Countries

15.3.5. Australia and New Zealand

15.3.6. Rest of APAC

15.4. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Material

15.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Material

15.5.1. Polyethylene (PE)

15.5.1.1. High Density Polyethylene (HDPE)

15.5.1.2. Low Density Polyethylene (LDPE)

15.5.2. Polypropylene (PP)

15.5.3. Others

15.6. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Capacity

15.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Capacity

15.7.1. 500ml

15.7.2. 1 litre

15.7.3. Other Capacities

15.8. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Application

15.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Application

15.9.1. Food

15.9.1.1. Ice Cream

15.9.1.2. Ready-to-Eat (RTE) Product

15.9.1.3. Frozen Food

15.9.2. Home and Hygiene

15.9.2.1. Detergent Pods

15.9.2.2. Other Hygiene Products

15.9.3. Others

15.10. Market Attractiveness Analysis

15.10.1. By Material

15.10.2. By Capacity

15.10.3. By Application

15.11. Prominent Trends

15.12. Drivers and Restraints: Impact Analysis

16. Middle East and Africa Plastic Tubs and Lids Market Analysis and Forecast

16.1. Introduction

16.1.1. Market share and Basis Points (BPS) Analysis, By Country

16.1.2. Y-o-Y Growth Projections, By Country

16.2. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Country

16.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Country

16.3.1. North Africa

16.3.2. GCC countries

16.3.3. South Africa

16.3.4. Israel

16.3.5. Rest of MEA

16.4. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Material

16.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Material

16.5.1. Polyethylene (PE)

16.5.1.1. High Density Polyethylene (HDPE)

16.5.1.2. Low Density Polyethylene (LDPE)

16.5.2. Polypropylene (PP)

16.5.3. Others

16.6. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Capacity

16.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Capacity

16.7.1. 500ml

16.7.2. 1 litre

16.7.3. Other Capacities

16.8. Historical Market Value (US$ Mn) and Volume (Mn Units), 2015-2020, By Application

16.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2031, By Application

16.9.1. Food

16.9.1.1. Ice Cream

16.9.1.2. Ready-to-Eat (RTE) Product

16.9.1.3. Frozen Food

16.9.2. Home and Hygiene

16.9.2.1. Detergent Pods

16.9.2.2. Other Hygiene Products

16.9.3. Others

16.10. Market Attractiveness Analysis

16.10.1. By Material

16.10.2. By Capacity

16.10.3. By Application

16.11. Prominent Trends

16.12. Drivers and Restraints: Impact Analysis

17. Country-wise Plastic Tubs and Lids Market Analysis

17.1. U.S. Plastic Tubs and Lids Market Analysis 2021 & 2031

17.1.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.1.1.1. By Capacity

17.1.1.2. By Material

17.1.1.3. By Application

17.2. Canada Plastic Tubs and Lids Market Analysis 2021 & 2031

17.2.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.2.1.1. By Capacity

17.2.1.2. By Material

17.2.1.3. By Application

17.3. Mexico Plastic Tubs and Lids Market Analysis 2021 & 2031

17.3.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.3.1.1. By Capacity

17.3.1.2. By Material

17.3.1.3. By Application

17.4. Germany Plastic Tubs and Lids Market Analysis 2021 & 2031

17.4.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.4.1.1. By Capacity

17.4.1.2. By Material

17.4.1.3. By Application

17.5. Brazil Plastic Tubs and Lids Market Analysis 2021 & 2031

17.5.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.5.1.1. By Capacity

17.5.1.2. By Material

17.5.1.3. By Application

17.6. UK Plastic Tubs and Lids Market Analysis 2021 & 2031

17.6.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.6.1.1. By Capacity

17.6.1.2. By Material

17.6.1.3. By Application

17.7. France Plastic Tubs and Lids Market Analysis 2021 & 2031

17.7.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.7.1.1. By Capacity

17.7.1.2. By Material

17.7.1.3. By Application

17.8. China Plastic Tubs and Lids Market Analysis 2021 & 2031

17.8.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.8.1.1. By Capacity

17.8.1.2. By Material

17.8.1.3. By Application

17.9. Australia Plastic Tubs and Lids Market Analysis 2021 & 2031

17.9.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.9.1.1. By Capacity

17.9.1.2. By Material

17.9.1.3. By Application

17.10. Philippines Plastic Tubs and Lids Market Analysis 2021 & 2031

17.10.1. Market Volume and Value (US$ Mn) Analysis and Forecast by Market Taxonomy

17.10.1.1. By Capacity

17.10.1.2. By Material

17.10.1.3. By Application

18. Competitive Landscape

18.1. Market Structure

18.2. Competition Dashboard

18.3. Company Market Share Analysis

18.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

18.5. Competition Deep Dive

18.5.1. Amcor plc

18.5.1.1. Overview

18.5.1.2. Financials

18.5.1.3. Strategy

18.5.1.4. Recent Developments

18.5.1.5. SWOT Analysis

18.5.2. Bergen Plastics AS

18.5.2.1. Overview

18.5.2.2. Financials

18.5.2.3. Strategy

18.5.2.4. Recent Developments

18.5.2.5. SWOT Analysis

18.5.3. Pact Group.

18.5.3.1. Overview

18.5.3.2. Financials

18.5.3.3. Strategy

18.5.3.4. Recent Developments

18.5.3.5. SWOT Analysis

18.5.4. Berry Global Company

18.5.4.1. Overview

18.5.4.2. Financials

18.5.4.3. Strategy

18.5.4.4. Recent Developments

18.5.4.5. SWOT Analysis

18.5.5. Sonoco Products Company

18.5.5.1. Overview

18.5.5.2. Financials

18.5.5.3. Strategy

18.5.5.4. Recent Developments

18.5.5.5. SWOT Analysis

18.5.6. Shalam Packaging

18.5.6.1. Overview

18.5.6.2. Financials

18.5.6.3. Strategy

18.5.6.4. Recent Developments

18.5.6.5. SWOT Analysis

18.5.7. Greiner Packaging

18.5.7.1. Overview

18.5.7.2. Financials

18.5.7.3. Strategy

18.5.7.4. Recent Developments

18.5.7.5. SWOT Analysis

18.5.8. Parkers Packaging

18.5.8.1. Overview

18.5.8.2. Financials

18.5.8.3. Strategy

18.5.8.4. Recent Developments

18.5.8.5. SWOT Analysis

18.5.9. Magnum UK

18.5.9.1. Overview

18.5.9.2. Financials

18.5.9.3. Strategy

18.5.9.4. Recent Developments

18.5.9.5. SWOT Analysis

18.5.10. Interpack Ltd.

18.5.10.1. Overview

18.5.10.2. Financials

18.5.10.3. Strategy

18.5.10.4. Recent Developments

18.5.10.5. SWOT Analysis

19. Assumptions and Acronyms Used

20. Research Methodology

LIST OF TABLES

Table 01: Global Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 02: Global Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 03: Global Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 04: Global Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 05: Global Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 06: Global Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 07: Global Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Region, 2015(H)-2031(F)

Table 08: Global Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Region, 2015(H)-2031(F)

Table 09: North America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 10: North America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 11: North America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 12: North America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 13: North America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 14: North America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 15: North America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 16: North America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 17: Latin America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 18: Latin America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 19: Latin America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 20: Latin America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 21: Latin America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 22: Latin America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 23: Latin America Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 24: Latin America Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 25: Europe Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 26: Europe Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 27: Europe Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 28: Europe Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 29: Europe Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 30: Europe Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 31: Europe Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 32: Europe Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 33: APAC Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 34: APAC Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 35: APAC Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 36: APAC Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 37: APAC Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 38: APAC Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 39: APAC Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 40: APAC Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 41: MEA Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 42: MEA Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Capacity, 2015(H)-2031(F)

Table 43: MEA Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 44: MEA Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Material, 2015(H)-2031(F)

Table 45: MEA Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 46: MEA Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Application, 2015(H)-2031(F)

Table 47: MEA Plastic Tubs and Lids Market Volume (Mn Units) Analysis and Forecast, By Country, 2015(H)-2031(F)

Table 48: MEA Plastic Tubs and Lids Market Value (US$ Mn) Analysis and Forecast, By Country, 2015(H)-2031(F)

LIST OF FIGURES

Figure 01: Global Plastic Tubs and Lids Market Attractiveness Analysis, By Capacity, 2021(E) - 2031(F)

Figure 02: Global Plastic Tubs and Lids Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 03: Global Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Capacity, 2019(H) - 2031(F)

Figure 04: Global Plastic Tubs and Lids Market Attractiveness Analysis, By Material, 2021(E) - 2031(F)

Figure 05: Global Plastic Tubs and Lids Market Value Share Analysis, By Material, 2021(E) & 2031(F)

Figure 06: Global Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Material, 2019(H) - 2031(F)

Figure 07: Global Plastic Tubs and Lids Market Attractiveness Analysis, By Application, 2021(E) - 2031(F)

Figure 08: Global Plastic Tubs and Lids Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 09: Global Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Application, 2019(H) - 2031(F)

Figure 10: Global Plastic Tubs and Lids Market Attractiveness Analysis, By Region, 2021(E) - 2031(F)

Figure 11: Global Plastic Tubs and Lids Market Value Share Analysis, By Region, 2021(E) & 2031(F)

Figure 12: Global Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Region, 2019(H) - 2031(F)

Figure 13: North America Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Capacity, 2021(E) - 2031(F)

Figure 14: North America Plastic Tubs and Lids Market Value Share Analysis, By Material, 2021 (E)

Figure 15: North America Plastic Tubs and Lids Market Value Share, By Application, 2021(E) & 2031(F)

Figure 16: North America Plastic Tubs and Lids Market Attractiveness Analysis, By Country, 2021(E) - 2031(F)

Figure 17: Latin America Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Capacity, 2021(E) - 2031(F)

Figure 18: Latin America Plastic Tubs and Lids Market Value Share Analysis, By Material, 2021 (E)

Figure 19: Latin America Plastic Tubs and Lids Market Value Share, By Application, 2021(E) & 2031(F)

Figure 20: Latin America Plastic Tubs and Lids Market Attractiveness Analysis, By Country, 2021(E) - 2031(F)

Figure 21: Europe Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Capacity, 2021(E) - 2031(F)

Figure 22: Europe Plastic Tubs and Lids Market Value Share Analysis, By Material, 2021 (E)

Figure 23: Europe Plastic Tubs and Lids Market Value Share, By Application, 2021(E) & 2031(F)

Figure 24: Europe Plastic Tubs and Lids Market Attractiveness Analysis, By Country, 2021(E) - 2031(F)

Figure 25: APAC Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Capacity, 2021(E) - 2031(F)

Figure 26: APAC Plastic Tubs and Lids Market Value Share Analysis, By Material, 2021 (E)

Figure 27: APAC Plastic Tubs and Lids Market Value Share, By Application, 2021(E) & 2031(F)

Figure 28: APAC Plastic Tubs and Lids Market Attractiveness Analysis, By Country, 2021(E) - 2031(F)

Figure 29: MEA Plastic Tubs and Lids Market Y-o-Y Growth Analysis, By Capacity, 2021(E) - 2031(F)

Figure 30: MEA Plastic Tubs and Lids Market Value Share Analysis, By Material, 2021 (E)

Figure 31: MEA Plastic Tubs and Lids Market Value Share, By Application, 2021(E) & 2031(F)

Figure 32: MEA Plastic Tubs and Lids Market Attractiveness Analysis, By Country, 2021(E) - 2031(F)

Figure 33: U.S. Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 34: U.S. Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 35: U.S. Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 36: Canada Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 37: Canada Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 38: Canada Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 39: Mexico Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 40: Mexico Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 41: Mexico Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 42: Brazil Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 43: Brazil Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 44: Brazil Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 45: Germany Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 46: Germany Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 47: Germany Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 48: UK Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 49: UK Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 50: UK Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 51: France Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 52: France Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 53: France Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 54: China Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 55: China Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 56: China Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 57: Australia Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 58: Australia Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 59: Australia Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)

Figure 60: Philippines Plastic Tubs Market Value Share Analysis, By Capacity, 2021(E) & 2031(F)

Figure 61: Philippines Plastic Tubs Market Value Share Analysis, By Material, 2031(F)

Figure 62: Philippines Plastic Tubs Market Value Share Analysis, By Application, 2021(E) & 2031(F)