Reports

Reports

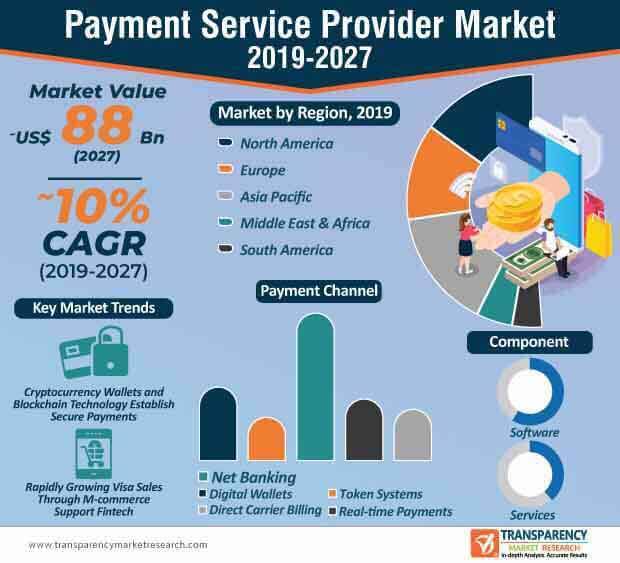

Worldwide digital transactions are surging due to innovation in Fintech. Likewise, digital wallets are sweeping the payment service provider market at the lightening speed, from a revenue share of ~19% in 2019 to ~25% by 2027. Hence, companies are capitalizing on various trends in the digital wallets, such as cryptocurrency wallets and blockchain technology that have established a network of secure payments. Cryptocurrency is no more reserved for multi-million dollar brands or exclusive investors. Thus, greater transparency in transactions with the help of the blockchain technology is creating waves of innovations in the payment service provider market.

Easy accessibility of cryptocurrency wallets for startups and small-scale businesses have led to increased adoption of digital wallets. Such trends are contributing toward the growth of the payment service provider market. Innovations in digital wallets have also led to the emergence of several cryptocurrency wallet app solutions in the market for payment service providers. Thus, the blockchain technology is eliminating the need for a third-party transaction, which allows secure transactions and also lowers costs.

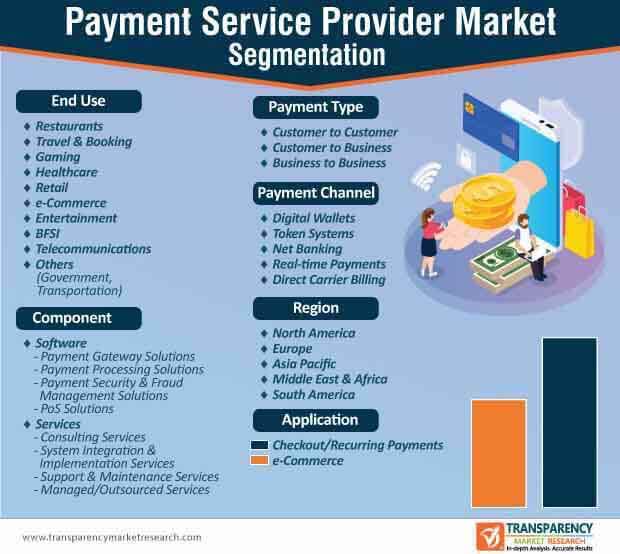

Once known as a prominent social networking site, Facebook has now turned into a dynamic business platform, which is enabling budding entrepreneurs and startups to take their business to the next level. Likewise, Facebook is now embracing digital payment methods that encourages customers to stay within the ecosystem. Since Facebook has upgraded its e-Commerce capabilities with the introduction of Facebook Pay, other market players in the market for payment service providers are following suit. This is evident, since the e-Commerce application segment is expected to account for ~51% share of the payment service provider market by 2027.

Innovations in the e-Commerce sector are facilitating increased retail transactions in the payment service provider market. e-Commerce payment service providers are enabling the option of online fundraising to bolster their credibility credentials in the global landscape. As such, e-Commerce transactions help service providers gain important insights about their users, and allow them to efficiently target market strategies and other advertising efforts.

The payment service provider market is anticipated to expand at a CAGR of ~10% during the forecast period. However, certain limitations in digital payments are hampering market growth. For instance, Asia Pacific is anticipated to lead the payment service providers market during the forecast period. India being one of the primary economies of Asia Pacific is challenged by the slow growth of Aadhaar-enabled payments in the past couple of months. Since some agents were splitting single transactions into multiple small transactions to gain more commission, several public sector banks applied limitations on the number of Aadhaar-enabled transactions that can be conducted by users. Hence, manufacturers are leveraging opportunities in Near Field Communication (NFC) -based wallet solutions in the U.K., since such transactions have increased considerably in the past few years.

The payment service provider market in Europe is expected to generate significant revenue. Thus, companies in the payment service provider market are tapping opportunities for the development of NFC apps, since contactless payments are gaining strong grounds in the U.K.

Apart from digital wallet and NFC apps, companies in the payment service provider market are tapping opportunities in international remittance. On the other hand, IoT payments are anticipated to become commonplace in the near future. Moreover, the integration of virtual voice assistants such as Alexa and Google Assistant has led to the trend of AI-powered payments using voice command. Thus, voice-activated payments are acquiring popularity worldwide. Moreover, there is a growing interest in payments involved with a connected car or a smart fridge, owing to the advantages of IoT and industry 4.0. Biometric payments are gaining traction in the market for payment service providers, as biometric features of smartphones are increasingly being used in mobile payments.

Analysts’ Viewpoint

The payment service provider market is estimated to reach a value of ~US$ 88 Bn by the end of 2027. AI-based wallet solutions are bringing about a change in the market landscape, since novel solutions help to automate routine transactions. The AI and NFC technologies are being highly publicized as a game changer in the global market.

Companies are aiming to provide a frictionless experience through increased cost savings. However, critical challenges of cybersecurity issues faced by players in the digital payment ecosystem pose as a restraint for companies. Hence, companies should focus on improving standards involved with stronger authentication and data confidentiality to avoid risks of cybersecurity.

Payment Service Provider Market: Overview

Payment Service Provider Market: Definition

Asia Pacific Payment Service Provider Market: Snapshot

Key Challenges Faced by Payment Service Provider Market Players

Payment Service Provider Market Developments

Payment Service Provider Market: Company Profile Snapshot

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Payment Service Provider Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Mn), 2013, 2019, 2023 and 2027

4.3. Technology/ Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. Ecosystem Analysis/ Value Chain Analysis

4.4.2.1. Key End-user/Customers Analysis

4.4.3. PESTEL Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers and Restraints

4.5. Key Market Indicators

4.5.1. Global Cyber Security Industry

4.5.2. Global Cyber Security Spending Share

4.5.3. Economic Impact of Global Cyber Attacks

4.6. Global Payment Service Provider Market, by Mode of Transaction (2017)

4.6.1. POS Terminal

4.6.1.1. Wireless/ Mobile POS Terminal

4.6.1.2. Fixed POS Terminal

4.6.2. Cards/Web/Wallet

4.6.3. Wearable Devices

4.7. Penetration of Different Payment Systems (%)

4.7.1. Cash

4.7.2. Digital/ Cashless

4.7.2.1. Proximity

4.7.2.2. Remote

4.8. Pricing Model Analysis

4.8.1. Subscription

4.8.2. Recurring

4.9. Overview of Various E-payment Methods

4.9.1. Debit/ Credit Cards

4.9.2. Bank Transfers

4.9.3. E-Wallets

4.9.4. Prepaid Cards

4.10. Global Payment Service Provider Market Analysis and Forecast, 2013 - 2027

4.10.1. Market Revenue Analysis (US$ Mn)

4.10.1.1. Historic Growth Trends, 2013-2018

4.10.1.2. Forecast Trends, 2019-2027

4.11. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.11.1. By Country

4.11.2. By Component

4.11.3. By Payment Type

4.11.4. By Payment Channel

4.11.5. By Application

4.11.6. By End-use

4.12. Competitive Scenario and Trends

4.12.1. Payment Service Provider Market Concentration Rate

4.12.1.1. List of Emerging, Prominent and Leading Players

4.12.2. Mergers & Acquisitions, Expansions

4.13. Market Outlook

5. Global Payment Service Provider Market Analysis and Forecast, by Component

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

5.3.1. Software

5.3.1.1. Payment Gateway Solutions

5.3.1.2. Payment Processing Solutions

5.3.1.3. Payment Security & Fraud Management Solutions

5.3.1.4. PoS Solutions

5.3.2. Service

5.3.2.1. Consulting Services

5.3.2.2. System Integration & Implementation Services

5.3.2.3. Support & Maintenance Services

5.3.2.4. Managed/ Outsourced Services

6. Global Payment Service Provider Market Analysis and Forecast, by Payment Type

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Type, 2017 - 2027

6.3.1. Customer to Customer

6.3.2. Customer to Business

6.3.3. Business to Business

7. Global Payment Service Provider Market Analysis and Forecast, by Payment Channel

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Channel, 2017 - 2027

7.3.1. Digital wallets

7.3.2. Token System

7.3.3. Net Banking

7.3.4. Real-Time Payments

7.3.5. Direct Carrier Billing

7.3.6. Customer to Customer

8. Global Payment Service Provider Market Analysis and Forecast, by Application

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

8.3.1. Checkout/ Recurring Payments

8.3.2. E-commerce

9. Global Payment Service Provider Market Analysis and Forecast, by End-use

9.1. Overview and Definitions

9.2. Key Segment Analysis

9.3. Payment Service Provider Market Size (US$ Mn) Forecast, by End-use, 2017 - 2027

9.3.1. Restaurants

9.3.2. Travel & Booking

9.3.3. Gaming

9.3.4. Healthcare

9.3.5. Retail

9.3.6. E-commerce

9.3.7. Entertainment

9.3.8. BFSI

9.3.9. Telecommunications

9.3.10. Others (Government, Transportation)

10. Global Payment Service Provider Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Emerging Markets/Countries

10.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

10.3.1. North America

10.3.2. Europe

10.3.3. Asia Pacific

10.3.4. Middle East & Africa

10.3.5. South America

11. North America Payment Service Provider Market Analysis and Forecast

11.1. Regional Outlook

11.2. Key Findings

11.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

11.3.1. Software

11.3.1.1. Payment Gateway Solutions

11.3.1.2. Payment Processing Solutions

11.3.1.3. Payment Security & Fraud Management Solutions

11.3.1.4. PoS Solutions

11.3.2. Service

11.3.2.1. Consulting Services

11.3.2.2. System Integration & Implementation Services

11.3.2.3. Support & Maintenance Services

11.3.2.4. Managed/ Outsourced Services

11.4. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Type, 2017 - 2027

11.4.1. Customer to Customer

11.4.2. Customer to Business

11.4.3. Business to Business

11.5. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Channel, 2017 - 2027

11.5.1. Digital wallets

11.5.2. Token System

11.5.3. Net Banking

11.5.4. Real-Time Payments

11.5.5. Direct Carrier Billing

11.5.6. Customer to Customer

11.6. Payment Service Provider Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

11.6.1. Checkout/ Recurring Payments

11.6.2. E-commerce

11.7. Payment Service Provider Market Size (US$ Mn) Forecast, by End-use, 2017 - 2027

11.7.1. Restaurants

11.7.2. Travel & Booking

11.7.3. Gaming

11.7.4. Healthcare

11.7.5. Retail

11.7.6. Ecommerce

11.7.7. Entertainment

11.7.8. BFSI

11.7.9. Telecommunications

11.7.10. Others (Government, Transportation)

11.8. Payment Service Provider Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

11.8.1. U.S.

11.8.2. Canada

11.8.3. Mexico

12. Europe Payment Service Provider Market Analysis and Forecast

12.1. Regional Outlook

12.2. Key Findings

12.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

12.3.1. Software

12.3.1.1. Payment Gateway Solutions

12.3.1.2. Payment Processing Solutions

12.3.1.3. Payment Security & Fraud Management Solutions

12.3.1.4. PoS Solutions

12.3.2. Service

12.3.2.1. Consulting Services

12.3.2.2. System Integration & Implementation Services

12.3.2.3. Support & Maintenance Services

12.3.2.4. Managed/ Outsourced Services

12.4. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Type, 2017 - 2027

12.4.1. Customer to Customer

12.4.2. Customer to Business

12.4.3. Business to Business

12.5. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Channel, 2017 - 2027

12.5.1. Digital wallets

12.5.2. Token System

12.5.3. Net Banking

12.5.4. Real-Time Payments

12.5.5. Direct Carrier Billing

12.5.6. Customer to Customer

12.6. Payment Service Provider Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

12.6.1. Checkout/ Recurring Payments

12.6.2. E-commerce

12.7. Payment Service Provider Market Size (US$ Mn) Forecast, by End-use, 2017 - 2027

12.7.1. Restaurants

12.7.2. Travel & Booking

12.7.3. Gaming

12.7.4. Healthcare

12.7.5. Retail

12.7.6. E-commerce

12.7.7. Entertainment

12.7.8. BFSI

12.7.9. Telecommunications

12.7.10. Others (Government, Transportation)

12.8. Payment Service Provider Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

12.8.1. Germany

12.8.2. U.K.

12.8.3. France

12.8.4. Spain

12.8.5. Russia

12.8.6. Rest of Europe

13. Asia Pacific Payment Service Provider Market Analysis and Forecast

13.1. Regional Outlook

13.2. Key Findings

13.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

13.3.1. Software

13.3.1.1. Payment Gateway Solutions

13.3.1.2. Payment Processing Solutions

13.3.1.3. Payment Security & Fraud Management Solutions

13.3.1.4. PoS Solutions

13.3.2. Service

13.3.2.1. Consulting Services

13.3.2.2. System Integration & Implementation Services

13.3.2.3. Support & Maintenance Services

13.3.2.4. Managed/ Outsourced Services

13.4. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Type, 2017 - 2027

13.4.1. Customer to Customer

13.4.2. Customer to Business

13.4.3. Business to Business

13.5. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Channel, 2017 - 2027

13.5.1. Digital wallets

13.5.2. Token System

13.5.3. Net Banking

13.5.4. Real-Time Payments

13.5.5. Direct Carrier Billing

13.5.6. Customer to Customer

13.6. Payment Service Provider Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

13.6.1. Checkout/ Recurring Payments

13.6.2. E-commerce

13.7. Payment Service Provider Market Size (US$ Mn) Forecast, by End-use, 2017 - 2027

13.7.1. Restaurants

13.7.2. Travel & Booking

13.7.3. Gaming

13.7.4. Healthcare

13.7.5. Retail

13.7.6. Ecommerce

13.7.7. Entertainment

13.7.8. BFSI

13.7.9. Telecommunications

13.7.10. Others (Government, Transportation)

13.8. Payment Service Provider Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. Australia and New Zealand

13.8.5. South Korea

13.8.6. ASEAN

13.8.7. Rest of Asia Pacific

14. Middle East & Africa (MEA) Payment Service Provider Market Analysis and Forecast

14.1. Regional Outlook

14.2. Key Findings

14.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

14.3.1. Software

14.3.1.1. Payment Gateway Solutions

14.3.1.2. Payment Processing Solutions

14.3.1.3. Payment Security & Fraud Management Solutions

14.3.1.4. PoS Solutions

14.3.2. Service

14.3.2.1. Consulting Services

14.3.2.2. System Integration & Implementation Services

14.3.2.3. Support & Maintenance Services

14.3.2.4. Managed/ Outsourced Services

14.4. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Type, 2017 - 2027

14.4.1. Customer to Customer

14.4.2. Customer to Business

14.4.3. Business to Business

14.5. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Channel, 2017 - 2027

14.5.1. Digital wallets

14.5.2. Token System

14.5.3. Net Banking

14.5.4. Real-Time Payments

14.5.5. Direct Carrier Billing

14.5.6. Customer to Customer

14.6. Payment Service Provider Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

14.6.1. Checkout/ Recurring Payments

14.6.2. E-commerce

14.7. Payment Service Provider Market Size (US$ Mn) Forecast, by End-use, 2017 - 2027

14.7.1. Restaurants

14.7.2. Travel & Booking

14.7.3. Gaming

14.7.4. Healthcare

14.7.5. Retail

14.7.6. E-commerce

14.7.7. Entertainment

14.7.8. BFSI

14.7.9. Telecommunications

14.7.10. Others (Government, Transportation)

14.8. Payment Service Provider Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

14.8.1. United Arab Emirates (U.A.E.)

14.8.2. Saudi Arabia

14.8.3. South Africa

14.8.4. Rest of MEA

15. South America Payment Service Provider Market Analysis and Forecast

15.1. Regional Outlook

15.2. Key Findings

15.3. Payment Service Provider Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

15.3.1. Software

15.3.1.1. Payment Gateway Solutions

15.3.1.2. Payment Processing Solutions

15.3.1.3. Payment Security & Fraud Management Solutions

15.3.1.4. PoS Solutions

15.3.2. Service

15.3.2.1. Consulting Services

15.3.2.2. System Integration & Implementation Services

15.3.2.3. Support & Maintenance Services

15.3.2.4. Managed/ Outsourced Services

15.4. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Type, 2017 - 2027

15.4.1. Customer to Customer

15.4.2. Customer to Business

15.4.3. Business to Business

15.5. Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Channel, 2017 - 2027

15.5.1. Digital wallets

15.5.2. Token System

15.5.3. Net Banking

15.5.4. Real-Time Payments

15.5.5. Direct Carrier Billing

15.5.6. Customer to Customer

15.6. Payment Service Provider Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

15.6.1. Checkout/ Recurring Payments

15.6.2. E-commerce

15.7. Payment Service Provider Market Size (US$ Mn) Forecast, by End-use, 2017 - 2027

15.7.1. Restaurants

15.7.2. Travel & Booking

15.7.3. Gaming

15.7.4. Healthcare

15.7.5. Retail

15.7.6. E-commerce

15.7.7. Entertainment

15.7.8. BFSI

15.7.9. Telecommunications

15.7.10. Others (Government, Transportation)

15.8. Payment Service Provider Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

15.8.1. Brazil

15.8.2. Rest of South America

16. Competition Landscape

16.1. Market Competition Matrix, by Leading Players

16.2. Market Revenue Share Analysis (%), by Leading Players (2018)

17. Company Profiles (Details – Business Overview, Geographical Presence, Key Competitors, Revenue and Strategy)

17.1. ACI Worldwide, Inc

17.1.1. Business Overview

17.1.2. Geographical Presence

17.1.3. Key Competitors

17.1.4. Revenue and Strategy

17.2. Adyen, N.V

17.2.1. Business Overview

17.2.2. Geographical Presence

17.2.3. Key Competitors

17.2.4. Revenue and Strategy

17.3. Amazon Web Services (Amazon pay)

17.3.1. Business Overview

17.3.2. Geographical Presence

17.3.3. Key Competitors

17.3.4. Revenue and Strategy

17.4. American Express Banking Corp.

17.4.1. Business Overview

17.4.2. Geographical Presence

17.4.3. Key Competitors

17.4.4. Revenue and Strategy

17.5. ASEAN Payments Direct, Inc.

17.5.1. Business Overview

17.5.2. Geographical Presence

17.5.3. Key Competitors

17.5.4. Revenue and Strategy

17.6. CCBill, LLC

17.6.1. Business Overview

17.6.2. Geographical Presence

17.6.3. Key Competitors

17.6.4. Revenue and Strategy

17.7. Diners Club International Ltd

17.7.1. Business Overview

17.7.2. Geographical Presence

17.7.3. Key Competitors

17.7.4. Revenue and Strategy

17.8. First Data Corporation (Fiserv)

17.8.1. Business Overview

17.8.2. Geographical Presence

17.8.3. Key Competitors

17.8.4. Revenue and Strategy

17.9. Ingenico Group

17.9.1. Business Overview

17.9.2. Geographical Presence

17.9.3. Key Competitors

17.9.4. Revenue and Strategy

17.10. MasterCard, Inc

17.10.1. Business Overview

17.10.2. Geographical Presence

17.10.3. Key Competitors

17.10.4. Revenue and Strategy

17.11. PayPal Holdings, Inc.

17.11.1. Business Overview

17.11.2. Geographical Presence

17.11.3. Key Competitors

17.11.4. Revenue and Strategy

17.12. PayU Group

17.12.1. Business Overview

17.12.2. Geographical Presence

17.12.3. Key Competitors

17.12.4. Revenue and Strategy

17.13. Stripe, Inc.

17.13.1. Business Overview

17.13.2. Geographical Presence

17.13.3. Key Competitors

17.13.4. Revenue and Strategy

17.14. Total System Services, Inc. (TSYS)

17.14.1. Business Overview

17.14.2. Geographical Presence

17.14.3. Key Competitors

17.14.4. Revenue and Strategy

17.15. Visa Inc.

17.15.1. Business Overview

17.15.2. Geographical Presence

17.15.3. Key Competitors

17.15.4. Revenue and Strategy

18. Key Takeaways

List of Tables

Table No.1 Penetration of Different Payment Systems

Table No.2 Global Payment Service Provider Market Size (US$ Mn), by Component, 2017–2027

Table No.3 Global Payment Service Provider Market Size (US$ Mn), by Component, by Software, 2017–2027

Table No.4 Global Payment Service Provider Market Size (US$ Mn), by Component, by Services, 2017–2027

Table No.5 Global Payment Service Provider Market Size (US$ Mn), by Payment Type, 2017–2027

Table No.6 Global Payment Service Provider Market Size (US$ Mn), by Application, 2017–2027

Table No.7 Global Payment Service Provider Market Size (US$ Mn), by Payment Channel, 2017–2027

Table No.8 Global Payment Service Provider Market Size (US$ Mn), by End-use, 2017–2027

Table No.9 Global Payment Service Provider Market Size (US$ Mn), by Country, 2017–2027

Table No.10 North America Payment Service Provider Market Size (US$ Mn), by Component, 2017–2027

Table No.11 North America Payment Service Provider Market Size (US$ Mn), by Component, by Software, 2017–2027

Table No.12 North America Payment Service Provider Market Size (US$ Mn), by Component, by Services, 2017–2027

Table No.13 North America Payment Service Provider Market Size (US$ Mn), by Payment Type, 2017–2027

Table No.14 North America Payment Service Provider Market Size (US$ Mn), by Application, 2017–2027

Table No.15 North America Payment Service Provider Market Size (US$ Mn), by Payment Channel, 2017–2027

Table No.16 North America Payment Service Provider Market Size (US$ Mn), by End-use, 2017–2027

Table No.17 North America Payment Service Provider Market Size (US$ Mn), by Country, 2017–2027

Table No.18 Europe Payment Service Provider Market Size (US$ Mn), by Component, 2017–2027

Table No.19 Europe Payment Service Provider Market Size (US$ Mn), by Component, by Software, 2017–2027

Table No.20 Europe Payment Service Provider Market Size (US$ Mn), by Component, by Services, 2017–2027

Table No.21 Europe Payment Service Provider Market Size (US$ Mn), by Payment Type, 2017–2027

Table No.22 Europe Payment Service Provider Market Size (US$ Mn), by Application, 2017–2027

Table No.23 Europe Payment Service Provider Market Size (US$ Mn), by Payment Channel, 2017–2027

Table No.24 Europe Payment Service Provider Market Size (US$ Mn), by End-use, 2017–2027

Table No.25 Europe Payment Service Provider Market Size (US$ Mn), by Country, 2017–2027

Table No.26 Asia Pacific Payment Service Provider Market Size (US$ Mn), by Component, 2017–2027

Table No.27 Asia Pacific Payment Service Provider Market Size (US$ Mn), by Component, by Software, 2017–2027

Table No.28 Asia Pacific Payment Service Provider Market Size (US$ Mn), by Component, by Services, 2017–2027

Table No.29 Asia Pacific Payment Service Provider Market Size (US$ Mn), by Payment Type, 2017–2027

Table No.30 Asia Pacific Payment Service Provider Market Size (US$ Mn), by Application, 2017–2027

Table No.31 Asia Pacific Payment Service Provider Market Size (US$ Mn), by Payment Channel, 2017–2027

Table No.32 Asia Pacific Payment Service Provider Market Size (US$ Mn), by End-use, 2017–2027

Table No.33 Asia Pacific Payment Service Provider Market Size (US$ Mn), by Country, 2017–2027

Table No.34 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by Component, 2017–2027

Table No.35 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by Component, by Software, 2017–2027

Table No.36 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by Component, by Services, 2017–2027

Table No.37 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by Payment Type, 2017–2027

Table No.38 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by Application, 2017–2027

Table No.39 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by Payment Channel , 2017–2027

Table No.40 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by End-use , 2017–2027

Table No.41 Middle East & Africa Payment Service Provider Market Size (US$ Mn), by Payment Channel , 2017–2027

Table No.42 South America Payment Service Provider Market Size (US$ Mn), by Component, 2017–2027

Table No.43 South America Payment Service Provider Market Size (US$ Mn), by Component, by Software, 2017–2027

Table No.44 South America Payment Service Provider Market Size (US$ Mn), by Component, by Services, 2017–2027

Table No.45 South America Payment Service Provider Market Size (US$ Mn), by Payment Type, 2017–2027

Table No.46 South America Payment Service Provider Market Size (US$ Mn), by Application, 2017–2027

Table No.47 South America Payment Service Provider Market Size (US$ Mn), by Payment Channel , 2017–2027

Table No.48 South America Payment Service Provider Market Size (US$ Mn), by End-use , 2017–2027

Table No.49 South America Payment Service Provider Market Size (US$ Mn), by Payment Channel , 2017–2027

List of Figures

Figure No.1 Global Payment Service Provider Market Size (US$ Mn) Forecast, 2017–2027

Figure No.2 Global Payment Service Provider Market Size (US$ Mn) Forecast, by Component, 2017–2027

Figure No.3 Global Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Type, 2017–2027

Figure No.4 Global Payment Service Provider Market Size (US$ Mn) Forecast, by Application, 2017–2027

Figure No.5 Global Payment Service Provider Market Size (US$ Mn) Forecast, by Payment Channel, 2017–2027

Figure No.6 Global Payment Service Provider Market Size (US$ Mn) Forecast, by End-use, 2017–2027

Figure No.7 Global Payment Service Provider Market Size (US$ Mn) Forecast, by Country, 2017–2027

Figure No.8 GDP (US$ Bn), Top Countries (2014 – 2019)

Figure No.9 Top Economies GDP Landscape, 2018

Figure No.11 Global ICT Spending (US$ Bn), Regional Contribution, 2019

Figure No.10 Global ICT Spending (%), by Region, 2019

Figure No.12 Global ICT Spending (US$ Bn), Spending Type Contribution, 2019

Figure No.13 Global ICT Spending (%), by Type, 2019

Figure No.14 Global Payment Service Provider Market Size (US$ Mn), 2013 - 2018

Figure No.15 Global Payment Service Provider Market Y-o-Y Growth (Value %), 2013 - 2018

Figure No.16 Global Payment Service Provider Market Size (US$ Mn), 2019 - 2027

Figure No.17 Global Payment Service Provider Market Y-o-Y Growth (Value %), 2019 - 2027

Figure No.18 Global Payment Service Provider Market Opportunity Assessment, by Component (2019)

Figure No.19 Global Payment Service Provider Market Opportunity Assessment, by Payment Type (2019)

Figure No.20 Global Payment Service Provider Market Opportunity Assessment, by Application (2019)

Figure No.21 Global Payment Service Provider Market Opportunity Assessment, by Payment Channel (2019)

Figure No.22 Global Payment Service Provider Market Opportunity Assessment, by End-use (2019)

Figure No.23 Global Payment Service Provider Market Opportunity Assessment, by Region (2019)

Figure No.25 Global Payment Service Provider Market, by Payment Type, CAGR (%) (2019 – 2027)

Figure No.27 Global Payment Service Provider Market, by Payment Channel, CAGR (%) (2019 – 2027)

Figure No.24 Global Payment Service Provider Market, by Component, CAGR (%) (2019 – 2027)

Figure No.26 Global Payment Service Provider Market, by Application, CAGR (%) (2019 – 2027)

Figure No.28 Global Payment Service Provider Market, by End-use, CAGR (%) (2019 – 2027)

Figure No.29 Global Payment Service Provider Market, by Country, CAGR (%) (2019 – 2027)

Figure No.30 Global Payment Service Provider Market Share Analysis, by Component (2019)

Figure No.31 Global Payment Service Provider Market Share Analysis, by Component (2027)

Figure No.32 Global Payment Service Provider Market Share Analysis, by Payment Type (2019)

Figure No.33 Global Payment Service Provider Market Share Analysis, by Payment Type (2027)

Figure No.34 Global Payment Service Provider Market Share Analysis, by Application (2019)

Figure No.35 Global Payment Service Provider Market Share Analysis, by Application (2027)

Figure No.36 Global Payment Service Provider Market Share Analysis, by Payment Channel (2019)

Figure No.37 Global Payment Service Provider Market Share Analysis, by Payment Channel (2027)

Figure No.38 Global Payment Service Provider Market Share Analysis, by End-use (2019)

Figure No.39 Global Payment Service Provider Market Share Analysis, by End-use (2027)

Figure No.40 Global Payment Service Provider Market Share Analysis, by Region (2019)

Figure No.41 Global Payment Service Provider Market Share Analysis, by Region (2027)

Figure No.42 North America Payment Service Provider Market Share Analysis, by Component (2019)

Figure No.43 North America Payment Service Provider Market Share Analysis, by Component (2027)

Figure No.44 North America Payment Service Provider Market Share Analysis, by Payment Type (2019)

Figure No.45 North America Payment Service Provider Market Share Analysis, by Payment Type (2027)

Figure No.46 North America Payment Service Provider Market Share Analysis, by Application (2019)

Figure No.47 North America Payment Service Provider Market Share Analysis, by Application (2027)

Figure No.48 North America Payment Service Provider Market Share Analysis, by Payment Channel (2019)

Figure No.49 North America Payment Service Provider Market Share Analysis, by Payment Channel (2027)

Figure No.50 North America Payment Service Provider Market Share Analysis, by End-use (2019)

Figure No.51 North America Payment Service Provider Market Share Analysis, by End-use (2027)

Figure No.52 North America Payment Service Provider Market Share Analysis, by Country (2019)

Figure No.53 North America Payment Service Provider Market Share Analysis, by Country (2027)

Figure No.54 Europe Payment Service Provider Market Share Analysis, by Component (2019)

Figure No.55 Europe Payment Service Provider Market Share Analysis, by Component (2027)

Figure No.56 Europe Payment Service Provider Market Share Analysis, by Payment Type (2019)

Figure No.57 Europe Payment Service Provider Market Share Analysis, by Payment Type (2027)

Figure No.58 Europe Payment Service Provider Market Share Analysis, by Application (2019)

Figure No.59 Europe Payment Service Provider Market Share Analysis, by Application (2027)

Figure No.60 Europe Payment Service Provider Market Share Analysis, by Payment Channel (2019)

Figure No.61 Europe Payment Service Provider Market Share Analysis, by Payment Channel (2027)

Figure No.62 Europe Payment Service Provider Market Share Analysis, by End-use (2019)

Figure No.63 Europe Payment Service Provider Market Share Analysis, by End-use (2027)

Figure No.64 Europe Payment Service Provider Market Share Analysis, by Country (2019)

Figure No.65 Europe Payment Service Provider Market Share Analysis, by Country (2027)

Figure No.66 Asia Pacific Payment Service Provider Market Share Analysis, by Component (2019)

Figure No.67 Asia Pacific Payment Service Provider Market Share Analysis, by Component (2027)

Figure No.68 Asia Pacific Payment Service Provider Market Share Analysis, by Payment Type (2019)

Figure No.69 Asia Pacific Payment Service Provider Market Share Analysis, by Payment Type (2027)

Figure No.70 Asia Pacific Payment Service Provider Market Share Analysis, by Singapore (2019)

Figure No.71 Asia Pacific Payment Service Provider Market Share Analysis, by Application (2027)

Figure No.72 Asia Pacific Payment Service Provider Market Share Analysis, by Payment Channel (2019)

Figure No.73 Asia Pacific Payment Service Provider Market Share Analysis, by Payment Channel (2027)

Figure No.74 Asia Pacific Payment Service Provider Market Share Analysis, by End-use (2019)

Figure No.75 Asia Pacific Payment Service Provider Market Share Analysis, by End-use (2027)

Figure No.76 Asia Pacific Payment Service Provider Market Share Analysis, by Country (2019)

Figure No.77 Asia Pacific Payment Service Provider Market Share Analysis, by Country (2027)

Figure No.78 Middle East & Africa Payment Service Provider Market Share Analysis, by Component (2019)

Figure No.79 Middle East & Africa Payment Service Provider Market Share Analysis, by Component (2027)

Figure No.80 Middle East & Africa Payment Service Provider Market Share Analysis, by Payment Type (2019)

Figure No.81 Middle East & Africa Payment Service Provider Market Share Analysis, by Payment Type (2027)

Figure No.82 Middle East & Africa Payment Service Provider Market Share Analysis, by Singapore (2019)

Figure No.83 Middle East & Africa Payment Service Provider Market Share Analysis, by Application (2027)

Figure No.84 Middle East & Africa Payment Service Provider Market Share Analysis, by Payment Channel (2019)

Figure No.85 Middle East & Africa Payment Service Provider Market Share Analysis, by Payment Channel (2027)

Figure No.86 Middle East & Africa Payment Service Provider Market Share Analysis, by End-use (2019)

Figure No.87 Middle East & Africa Payment Service Provider Market Share Analysis, by End-use (2027)

Figure No.88 Middle East & Africa Payment Service Provider Market Share Analysis, by Country (2019)

Figure No.89 Middle East & Africa Payment Service Provider Market Share Analysis, by Country (2027)

Figure No.90 South America Payment Service Provider Market Share Analysis, by Component (2019)

Figure No.91 South America Payment Service Provider Market Share Analysis, by Component (2027)

Figure No.92 South America Payment Service Provider Market Share Analysis, by Payment Type (2019)

Figure No.93 South America Payment Service Provider Market Share Analysis, by Payment Type (2027)

Figure No.94 South America Payment Service Provider Market Share Analysis, by Singapore (2019)

Figure No.95 South America Payment Service Provider Market Share Analysis, by Application (2027)

Figure No.96 South America Payment Service Provider Market Share Analysis, by Payment Channel (2019)

Figure No.97 South America Payment Service Provider Market Share Analysis, by Payment Channel (2027)

Figure No.98 South America Payment Service Provider Market Share Analysis, by End-use (2019)

Figure No.99 South America Payment Service Provider Market Share Analysis, by End-use (2027)

Figure No.100 South America Payment Service Provider Market Share Analysis, by Country (2019)

Figure No.101 South America Payment Service Provider Market Share Analysis, by Country (2027)