Reports

Reports

The global market for payment security software has been witnessing a significant rise over the last few years, thanks to the increasing trend of digitization. The advancements in electronic and online payment is leading to a tremendous rise in the number of transactions made over the Internet. With the escalating penetration of smartphones, the number of mobile payments has also increased. This, as a result, has increased the concerns over the security of these payments across the world, which is reflecting greatly on the worldwide payment security software market.

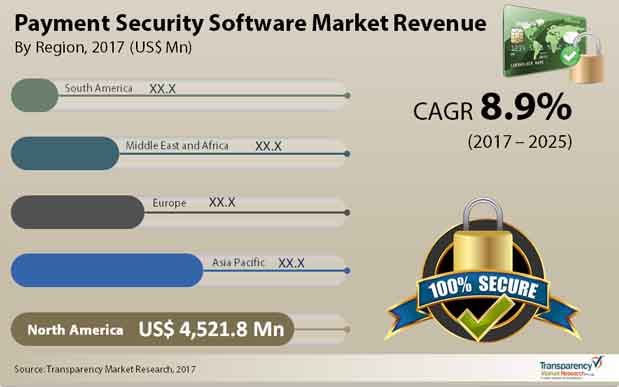

The ongoing shift towards cashless economy is also influencing the growth of this market substantially, as non-banking players are adopting various cashless transaction platforms, such as digital wallets, mobile money, and virtual currencies. Overall, the future of the global payment security software market looks bright. According to Transparency Market Research (TMR), the market is estimated to expand at a CAGR of 8.90% between 2017 and 2025 and reach a value of US$23.7 bn by the end of 2025.

In terms of the geography, the global market for payment security software reports its presence across Asia Pacific, South America, the Middle East and Africa, Europe, and North America. With nearly 40% shares, North America has emerged as the market leader. The high adoption rate of online medium of payments is the key factor behind the growth of this regional market. Apart from this, the presence of a large pool of payment security software providers in North America also supports this market considerably.

Over the forthcoming years, the investment in the online payment technology is likely to increase. Coupled with the rising partnership between software and hardware providers in this region, this factor is expected to boost the North America market for payment security software significantly in the near future. The introduction of innovative technologies in payment security, particularly in the U.S. is also projected to propel this regional market over the next few years.

Currently, Europe, which stood at the second position, is witnessing a slowdown in its payment security software market sue to stringent regulations and economic upheaval. Asia Pacific, on the other hand, is anticipated to provide the most promising opportunities for growth in the years to come, owing to the increasing awareness about technological advancements among people in this region. The markets in South America and the Middle East and Africa are still in the nascent stage and are predicted to gain momentum in the forthcoming years.

The worldwide payment security software market is broadly analyzed on three fronts: The solution, mode of payment, and the end user. Based on the solution, software and services are considered as the key segments of this market. Firewalls, security information and event management (SIEM), intrusion detection and prevention (IDS/IPS), anti-virus/anti malware, data encryption, multi-factor authentication, tokenization, and data loss prevention (DLP) are the main payment security software available across the world. Among these, the demand for security information and event management software is greater than other software and the trend is likely to remain so over the forthcoming years.

By the mode of payment, the market is classified into mobile payment security software, online payment security software, and point-of-sale (PoS) systems and security. Since mobile payments is widely utilized for transactions, this segment is expected to lead the market over the forecast period. The banking, financial services, and insurance (BFSI), healthcare, retail, and the government sectors have emerged as the prime end users of payment security software.

At the forefront of the global market for payment security software are Symantec Corp., Intel Corp., Cisco Systems Inc., Trend Micro, CA Inc., Gemalto, HCL Technologies, TNS Inc., Thales e-Security, and VASCO Data Security Int. Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Payment Security Software Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Key Trend Analysis

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Global Payment Security Software Market Analysis and Forecast, 2015 – 2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Global Payment Security Software Market Analysis and Forecast, By Solution

5.1. Key Findings

5.2. Payment Security Software Market Analysis and Forecast, By Solution, 2015 – 2025

5.2.1. Software

5.2.1.1. Firewalls

5.2.1.2. Anti-virus/anti malware

5.2.1.3. Intrusion detection and prevention (IDS/IPS)

5.2.1.4. Data encryption

5.2.1.5. Tokenization

5.2.1.6. Multi-factor authentication

5.2.1.7. Security Information and Event Management (SIEM)

5.2.1.8. Data Loss Prevention (DLP)

5.2.1.9. Others

5.2.2. Services

5.3. Market Revenue Share Analysis By Solution

5.4. Market Attractiveness By Solution

6. Global Payment Security Software Market Analysis and Forecast, By Mode of Payment

6.1. Key Findings

6.2. Payment Security Software Market Analysis and Forecast, By Mode of Payment, 2015 – 2025

6.2.1. Mobile payment security software

6.2.2. Point-of-Sale (PoS) systems and security

6.2.3. Online payment security software

6.3. Market Revenue Share Analysis By Mode of Payment

6.4. Market Attractiveness By Mode of Payment

7. Global Payment Security Software Market Analysis and Forecast, By End-use

7.1. Key Findings

7.2. Payment Security Software Market Analysis and Forecast, By End-use, 2015 – 2025

7.2.1. Banking, Financial Services and Insurance

7.2.2. Retail

7.2.3. Healthcare

7.2.4. Government

7.2.5. Others

7.3. Market Revenue Share Analysis By End-use

7.4. Market Attractiveness By End-use

8. Global Payment Security Software Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. Payment Security Software Market Analysis and Forecast, By Region, 2015 – 2025

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East and Africa

8.2.5. South America

8.3. Market Attractiveness By Region

9. North America Payment Security Software Market Analysis and Forecast

9.1. Key Findings

9.2. Payment Security Software Market Analysis and Forecast, By Solution, 2015 – 2025

9.2.1. Software

9.2.1.1. Firewalls

9.2.1.2. Anti-virus/anti malware

9.2.1.3. Intrusion detection and prevention (IDS/IPS)

9.2.1.4. Data encryption

9.2.1.5. Tokenization

9.2.1.6. Multi-factor authentication

9.2.1.7. Security Information and Event Management (SIEM)

9.2.1.8. Data Loss Prevention (DLP)

9.2.1.9. Others

9.2.2. Services

9.3. Payment Security Software Market Analysis and Forecast, By Mode of Payment, 2015 – 2025

9.3.1. Mobile payment security software

9.3.2. Point-of-Sale (PoS) systems and security

9.3.3. Online payment security software

9.4. Payment Security Software Market Analysis and Forecast, By End-use, 2015 – 2025

9.4.1. Banking, Financial Services and Insurance

9.4.2. Retail

9.4.3. Healthcare

9.4.4. Government

9.4.5. Others

9.5. Payment Security Software Market Analysis and Forecast, By Country, 2015 – 2025

9.5.1. The U.S.

9.5.1.1. By Solution

9.5.1.1.1. By Software

9.5.1.1.1.1. Firewalls

9.5.1.1.1.2. Anti-virus/anti malware

9.5.1.1.1.3. Intrusion detection and prevention (IDS/IPS)

9.5.1.1.1.4. Data encryption

9.5.1.1.1.5. Tokenization

9.5.1.1.1.6. Multi-factor authentication

9.5.1.1.1.7. Security Information and Event Management (SIEM)

9.5.1.1.1.8. Data Loss Prevention (DLP)

9.5.1.1.1.9. Others

9.5.1.1.2. Services

9.5.1.2. By Mode of Payment

9.5.1.2.1. Mobile payment security software

9.5.1.2.2. Point-of-Sale (PoS) systems and security

9.5.1.2.3. Online payment security software

9.5.1.3. By End-use

9.5.1.3.1. Banking, Financial Services and Insurance

9.5.1.3.2. Retail

9.5.1.3.3. Healthcare

9.5.1.3.4. Government

9.5.1.3.5. Others

9.5.2. Canada

9.5.2.1. By Solution

9.5.2.1.1. By Software

9.5.2.1.1.1. Firewalls

9.5.2.1.1.2. Anti-virus/anti malware

9.5.2.1.1.3. Intrusion detection and prevention (IDS/IPS)

9.5.2.1.1.4. Data encryption

9.5.2.1.1.5. Tokenization

9.5.2.1.1.6. Multi-factor authentication

9.5.2.1.1.7. Security Information and Event Management (SIEM)

9.5.2.1.1.8. Data Loss Prevention (DLP)

9.5.2.1.1.9. Others

9.5.2.1.2. Services

9.5.2.2. By Mode of Payment

9.5.2.2.1. Mobile payment security software

9.5.2.2.2. Point-of-Sale (PoS) systems and security

9.5.2.2.3. Online payment security software

9.5.2.3. By End-use

9.5.2.3.1. Banking, Financial Services and Insurance

9.5.2.3.2. Retail

9.5.2.3.3. Healthcare

9.5.2.3.4. Government

9.5.2.3.5. Others

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Solution

9.6.2. By Mode of Payment

9.6.3. By End-use

9.6.4. By Country

10. Europe Payment Security Software Market Analysis and Forecast

10.1. Key Findings

10.2. Payment Security Software Market Analysis and Forecast, By Solution, 2015 – 2025

10.2.1. Software

10.2.1.1. Firewalls

10.2.1.2. Anti-virus/anti malware

10.2.1.3. Intrusion detection and prevention (IDS/IPS)

10.2.1.4. Data encryption

10.2.1.5. Tokenization

10.2.1.6. Multi-factor authentication

10.2.1.7. Security Information and Event Management (SIEM)

10.2.1.8. Data Loss Prevention (DLP)

10.2.1.9. Others

10.2.2. Services

10.3. Payment Security Software Market Analysis and Forecast, By Mode of Payment, 2015 – 2025

10.3.1. Mobile payment security software

10.3.2. Point-of-Sale (PoS) systems and security

10.3.3. Online payment security software

10.4. Payment Security Software Market Analysis and Forecast, By End-use, 2015 – 2025

10.4.1. Banking, Financial Services and Insurance

10.4.2. Retail

10.4.3. Healthcare

10.4.4. Government

10.4.5. Others

10.5. Payment Security Software Market Analysis and Forecast, By Country, 2015 – 2025

10.5.1. Germany

10.5.1.1. By Solution

10.5.1.1.1. By Software

10.5.1.1.1.1. Firewalls

10.5.1.1.1.2. Anti-virus/anti malware

10.5.1.1.1.3. Intrusion detection and prevention (IDS/IPS)

10.5.1.1.1.4. Data encryption

10.5.1.1.1.5. Tokenization

10.5.1.1.1.6. Multi-factor authentication

10.5.1.1.1.7. Security Information and Event Management (SIEM)

10.5.1.1.1.8. Data Loss Prevention (DLP)

10.5.1.1.1.9. Others

10.5.1.1.2. Services

10.5.1.2. By Mode of Payment

10.5.1.2.1. Mobile payment security software

10.5.1.2.2. Point-of-Sale (PoS) systems and security

10.5.1.2.3. Online payment security software

10.5.1.3. By End-use

10.5.1.3.1. Banking, Financial Services and Insurance

10.5.1.3.2. Retail

10.5.1.3.3. Healthcare

10.5.1.3.4. Government

10.5.1.3.5. Others

10.5.2. Italy

10.5.2.1. By Solution

10.5.2.1.1. By Software

10.5.2.1.1.1. Firewalls

10.5.2.1.1.2. Anti-virus/anti malware

10.5.2.1.1.3. Intrusion detection and prevention (IDS/IPS)

10.5.2.1.1.4. Data encryption

10.5.2.1.1.5. Tokenization

10.5.2.1.1.6. Multi-factor authentication

10.5.2.1.1.7. Security Information and Event Management (SIEM)

10.5.2.1.1.8. Data Loss Prevention (DLP)

10.5.2.1.1.9. Others

10.5.2.1.2. Services

10.5.2.2. By Mode of Payment

10.5.2.2.1. Mobile payment security software

10.5.2.2.2. Point-of-Sale (PoS) systems and security

10.5.2.2.3. Online payment security software

10.5.2.3. By End-use

10.5.2.3.1. Banking, Financial Services and Insurance

10.5.2.3.2. Retail

10.5.2.3.3. Healthcare

10.5.2.3.4. Government

10.5.2.3.5. Others

10.5.3. France

10.5.3.1. By Solution

10.5.3.1.1. By Software

10.5.3.1.1.1. Firewalls

10.5.3.1.1.2. Anti-virus/anti malware

10.5.3.1.1.3. Intrusion detection and prevention (IDS/IPS)

10.5.3.1.1.4. Data encryption

10.5.3.1.1.5. Tokenization

10.5.3.1.1.6. Multi-factor authentication

10.5.3.1.1.7. Security Information and Event Management (SIEM)

10.5.3.1.1.8. Data Loss Prevention (DLP)

10.5.3.1.1.9. Others

10.5.3.1.2. Services

10.5.3.2. By Mode of Payment

10.5.3.2.1. Mobile payment security software

10.5.3.2.2. Point-of-Sale (PoS) systems and security

10.5.3.2.3. Online payment security software

10.5.3.3. By End-use

10.5.3.3.1. Banking, Financial Services and Insurance

10.5.3.3.2. Retail

10.5.3.3.3. Healthcare

10.5.3.3.4. Government

10.5.3.3.5. Others

10.5.4. The U.K.

10.5.4.1. By Solution

10.5.4.1.1. By Software

10.5.4.1.1.1. Firewalls

10.5.4.1.1.2. Anti-virus/anti malware

10.5.4.1.1.3. Intrusion detection and prevention (IDS/IPS)

10.5.4.1.1.4. Data encryption

10.5.4.1.1.5. Tokenization

10.5.4.1.1.6. Multi-factor authentication

10.5.4.1.1.7. Security Information and Event Management (SIEM)

10.5.4.1.1.8. Data Loss Prevention (DLP)

10.5.4.1.1.9. Others

10.5.4.1.2. Services

10.5.4.2. By Mode of Payment

10.5.4.2.1. Mobile payment security software

10.5.4.2.2. Point-of-Sale (PoS) systems and security

10.5.4.2.3. Online payment security software

10.5.4.3. By End-use

10.5.4.3.1. Banking, Financial Services and Insurance

10.5.4.3.2. Retail

10.5.4.3.3. Healthcare

10.5.4.3.4. Government

10.5.4.3.5. Others

10.5.5. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Solution

10.6.2. By Mode of Payment

10.6.3. By End-use

10.6.4. By Country

11. Asia Pacific Payment Security Software Market Analysis and Forecast

11.1. Key Findings

11.2. Payment Security Software Market Analysis and Forecast, By Solution, 2015 – 2025

11.2.1. Software

11.2.1.1. Firewalls

11.2.1.2. Anti-virus/anti malware

11.2.1.3. Intrusion detection and prevention (IDS/IPS)

11.2.1.4. Data encryption

11.2.1.5. Tokenization

11.2.1.6. Multi-factor authentication

11.2.1.7. Security Information and Event Management (SIEM)

11.2.1.8. Data Loss Prevention (DLP)

11.2.1.9. Others

11.2.2. Services

11.3. Payment Security Software Market Analysis and Forecast, By Mode of Payment, 2015 – 2025

11.3.1. Mobile payment security software

11.3.2. Point-of-Sale (PoS) systems and security

11.3.3. Online payment security software

11.4. Payment Security Software Market Analysis and Forecast, By End-use, 2015 – 2025

11.4.1. Banking, Financial Services and Insurance

11.4.2. Retail

11.4.3. Healthcare

11.4.4. Government

11.4.5. Others

11.5. Payment Security Software Market Analysis and Forecast, By Country, 2015 – 2025

11.5.1. Japan

11.5.1.1. By Solution

11.5.1.1.1. By Software

11.5.1.1.1.1. Firewalls

11.5.1.1.1.2. Anti-virus/anti malware

11.5.1.1.1.3. Intrusion detection and prevention (IDS/IPS)

11.5.1.1.1.4. Data encryption

11.5.1.1.1.5. Tokenization

11.5.1.1.1.6. Multi-factor authentication

11.5.1.1.1.7. Security Information and Event Management (SIEM)

11.5.1.1.1.8. Data Loss Prevention (DLP)

11.5.1.1.1.9. Others

11.5.1.1.2. Services

11.5.1.2. By Mode of Payment

11.5.1.2.1. Mobile payment security software

11.5.1.2.2. Point-of-Sale (PoS) systems and security

11.5.1.2.3. Online payment security software

11.5.1.3. By End-use

11.5.1.3.1. Banking, Financial Services and Insurance

11.5.1.3.2. Retail

11.5.1.3.3. Healthcare

11.5.1.3.4. Government

11.5.1.3.5. Others

11.5.2. China

11.5.2.1. By Solution

11.5.2.1.1. By Software

11.5.2.1.1.1. Firewalls

11.5.2.1.1.2. Anti-virus/anti malware

11.5.2.1.1.3. Intrusion detection and prevention (IDS/IPS)

11.5.2.1.1.4. Data encryption

11.5.2.1.1.5. Tokenization

11.5.2.1.1.6. Multi-factor authentication

11.5.2.1.1.7. Security Information and Event Management (SIEM)

11.5.2.1.1.8. Data Loss Prevention (DLP)

11.5.2.1.1.9. Others

11.5.2.1.2. Services

11.5.2.2. By Mode of Payment

11.5.2.2.1. Mobile payment security software

11.5.2.2.2. Point-of-Sale (PoS) systems and security

11.5.2.2.3. Online payment security software

11.5.2.3. By End-use

11.5.2.3.1. Banking, Financial Services and Insurance

11.5.2.3.2. Retail

11.5.2.3.3. Healthcare

11.5.2.3.4. Government

11.5.2.3.5. Others

11.5.3. India

11.5.3.1. By Solution

11.5.3.1.1. By Software

11.5.3.1.1.1. Firewalls

11.5.3.1.1.2. Anti-virus/anti malware

11.5.3.1.1.3. Intrusion detection and prevention (IDS/IPS)

11.5.3.1.1.4. Data encryption

11.5.3.1.1.5. Tokenization

11.5.3.1.1.6. Multi-factor authentication

11.5.3.1.1.7. Security Information and Event Management (SIEM)

11.5.3.1.1.8. Data Loss Prevention (DLP)

11.5.3.1.1.9. Others

11.5.3.1.2. Services

11.5.3.2. By Mode of Payment

11.5.3.2.1. Mobile payment security software

11.5.3.2.2. Point-of-Sale (PoS) systems and security

11.5.3.2.3. Online payment security software

11.5.3.3. By End-use

11.5.3.3.1. Banking, Financial Services and Insurance

11.5.3.3.2. Retail

11.5.3.3.3. Healthcare

11.5.3.3.4. Government

11.5.3.3.5. Others

11.5.4. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Solution

11.6.2. By Mode of Payment

11.6.3. By End-use

11.6.4. By Country

12. Middle East and Africa (MEA) Payment Security Software Market Analysis and Forecast

12.1. Key Findings

12.2. Payment Security Software Market Analysis and Forecast, By Solution, 2015 – 2025

12.2.1. Software

12.2.1.1. Firewalls

12.2.1.2. Anti-virus/anti malware

12.2.1.3. Intrusion detection and prevention (IDS/IPS)

12.2.1.4. Data encryption

12.2.1.5. Tokenization

12.2.1.6. Multi-factor authentication

12.2.1.7. Security Information and Event Management (SIEM)

12.2.1.8. Data Loss Prevention (DLP)

12.2.1.9. Others

12.2.2. Services

12.3. Payment Security Software Market Analysis and Forecast, By Mode of Payment, 2015 – 2025

12.3.1. Mobile payment security software

12.3.2. Point-of-Sale (PoS) systems and security

12.3.3. Online payment security software

12.4. Payment Security Software Market Analysis and Forecast, By End-use, 2015 – 2025

12.4.1. Banking, Financial Services and Insurance

12.4.2. Retail

2.4.3. Healthcare

12.4.4. Government

12.4.5. Others

12.5. Payment Security Software Market Analysis and Forecast, By Country, 2015 – 2025

12.5.1. Saudi Arabia

12.5.1.1. By Solution

12.5.1.1.1. By Software

12.5.1.1.1.1. Firewalls

12.5.1.1.1.2. Anti-virus/anti malware

12.5.1.1.1.3. Intrusion detection and prevention (IDS/IPS)

12.5.1.1.1.4. Data encryption

12.5.1.1.1.5. Tokenization

12.5.1.1.1.6. Multi-factor authentication

12.5.1.1.1.7. Security Information and Event Management (SIEM)

12.5.1.1.1.8. Data Loss Prevention (DLP)

12.5.1.1.1.9. Others

12.5.1.1.2. Services

12.5.1.2. By Mode of Payment

12.5.1.2.1. Mobile payment security software

12.5.1.2.2. Point-of-Sale (PoS) systems and security

12.5.1.2.3. Online payment security software

12.5.1.3. By End-use

12.5.1.3.1. Banking, Financial Services and Insurance

12.5.1.3.2. Retail

12.5.1.3.3. Healthcare

12.5.1.3.4. Government

12.5.1.3.5. Others

12.5.2. Africa

12.5.2.1. By Solution

12.5.2.1.1. By Software

12.5.2.1.1.1. Firewalls

12.5.2.1.1.2. Anti-virus/anti malware

12.5.2.1.1.3. Intrusion detection and prevention (IDS/IPS)

12.5.2.1.1.4. Data encryption

12.5.2.1.1.5. Tokenization

12.5.2.1.1.6. Multi-factor authentication

12.5.2.1.1.7. Security Information and Event Management (SIEM)

12.5.2.1.1.8. Data Loss Prevention (DLP)

12.5.2.1.1.9. Others

12.5.2.1.2. Services

12.5.2.2. By Mode of Payment

12.5.2.2.1. Mobile payment security software

12.5.2.2.2. Point-of-Sale (PoS) systems and security

12.5.2.2.3. Online payment security software

12.5.2.3. By End-use

12.5.2.3.1. Banking, Financial Services and Insurance

12.5.2.3.2. Retail

12.5.2.3.3. Healthcare

12.5.2.3.4. Government

12.5.2.3.5. Others

12.5.3. Rest of MEA

12.6. Market Attractiveness Analysis

12.6.1. By Solution

12.6.2. By Mode of Payment

12.6.3. By End-use

12.6.4. By Country

13. South America Payment Security Software Market Analysis and Forecast

13.1. Key Findings

13.2. Payment Security Software Market Analysis and Forecast, By Solution, 2015 – 2025

13.2.1. Software

13.2.1.1. Firewalls

13.2.1.2. Anti-virus/anti malware

13.2.1.3. Intrusion detection and prevention (IDS/IPS)

13.2.1.4. Data encryption

13.2.1.5. Tokenization

13.2.1.6. Multi-factor authentication

13.2.1.7. Security Information and Event Management (SIEM)

13.2.1.8. Data Loss Prevention (DLP)

13.2.1.9. Others

13.2.2. Services

13.3. Payment Security Software Market Analysis and Forecast, By Mode of Payment, 2015 – 2025

13.3.1. Mobile payment security software

13.3.2. Point-of-Sale (PoS) systems and security

13.3.3. Online payment security software

13.4. Payment Security Software Market Analysis and Forecast, By End-use, 2015 – 2025

13.4.1. Banking, Financial Services and Insurance

13.4.2. Retail

13.4.3. Healthcare

13.4.4. Government

13.4.5. Others

13.5. Payment Security Software Market Analysis and Forecast, By Country, 2015 – 2025

13.5.1. Brazil

13.5.1.1. By Solution

13.5.1.1.1. By Software

13.5.1.1.1.1. Firewalls

13.5.1.1.1.2. Anti-virus/anti malware

13.5.1.1.1.3. Intrusion detection and prevention (IDS/IPS)

13.5.1.1.1.4. Data encryption

13.5.1.1.1.5. Tokenization

13.5.1.1.1.6. Multi-factor authentication

13.5.1.1.1.7. Security Information and Event Management (SIEM)

13.5.1.1.1.8. Data Loss Prevention (DLP)

13.5.1.1.1.9. Others

13.5.1.1.2. Services

13.5.1.2. By Mode of Payment

13.5.1.2.1. Mobile payment security software

13.5.1.2.2. Point-of-Sale (PoS) systems and security

13.5.1.2.3. Online payment security software

13.5.1.3. By End-use

13.5.1.3.1. Banking, Financial Services and Insurance

13.5.1.3.2. Retail

13.5.1.3.3. Healthcare

13.5.1.3.4. Government

13.5.1.3.5. Others

13.5.2. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Solution

13.6.2. By Mode of Payment

13.6.3. By End-use

13.6.4. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2016)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. Symantec Corporation

14.3.1.1. Company details

14.3.1.2. Company description

14.3.1.3. Business Overview

14.3.1.4. SWOT analysis

14.3.1.5. Financials

14.3.1.6. Strategic overview

14.3.2. Intel Corporation

14.3.2.1. Company details

14.3.2.2. Company description

14.3.2.3. Business Overview

14.3.2.4. SWOT analysis

14.3.2.5. Financials

14.3.2.6. Strategic overview

14.3.3. Cisco Systems, Inc.

14.3.3.1. Company details

14.3.3.2. Company description

14.3.3.3. Business Overview

14.3.3.4. SWOT analysis

14.3.3.5. Financials

14.3.3.6. Strategic overview

14.3.4. CA, Inc.

14.3.4.1. Company details

14.3.4.2. Company description

14.3.4.3. Business Overview

14.3.4.4. SWOT analysis

14.3.4.5. Financials

14.3.4.6. Strategic overview

14.3.5. Trend Micro Incorporated

14.3.5.1. Company details

14.3.5.2. Company description

14.3.5.3. Business Overview

14.3.5.4. SWOT analysis

14.3.5.5. Financials

14.3.5.6. Strategic overview

14.3.6. Gemalto NV

14.3.6.1. Company details

14.3.6.2. Company description

14.3.6.3. Business Overview

14.3.6.4. SWOT analysis

14.3.6.5. Financials

14.3.6.6. Strategic overview

14.3.7. Transaction Network Services

14.3.7.1. Company details

14.3.7.2. Company description

14.3.7.3. Business Overview

14.3.7.4. SWOT analysis

14.3.7.5. Strategic overview

14.3.8. HCL Technologies Limited

14.3.8.1. Company details

14.3.8.2. Company description

14.3.8.3. Business Overview

14.3.8.4. SWOT analysis

14.3.8.5. Financials

14.3.8.6. Strategic overview

14.3.9. VASCO Data Security International, Inc.

14.3.9.1. Company details

14.3.9.2. Company description

14.3.9.3. Business Overview

14.3.9.4. SWOT analysis

14.3.9.5. Financials

14.3.9.6. Strategic overview

14.3.10. Thales e-Security

14.3.10.1. Company details

14.3.10.2. Company description

14.3.10.3. Business Overview

14.3.10.4. SWOT analysis

14.3.10.5. Financials

14.3.10.6. Strategic overview

15. Key Take Away

List of Tables

Table 1 Global Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 2 Global Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 3 Global Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 4 Global Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 5 Global Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 6 Global Payment Security Software Market Size (US$ Mn) and Forecast, By Region, 2015 – 2025

Table 7 North America Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 8 North America Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 9 North America Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 10 North America Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 11 North America Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 12 North America Payment Security Software Market Size (US$ Mn) and Forecast, By Region, 2015 – 2025

Table 13 The U.S. Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 14 The U.S. Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 15 The U.S. Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 16 The U.S. Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 17 The U.S. Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 18 Canada Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 19 Canada Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 20 Canada Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 21 Canada Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 22 Canada Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 23 Rest of North America Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 24 Rest of North America Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 25 Rest of North America Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 26 Rest of North America Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 27 Rest of North America Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 28 Europe Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 29 Europe Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 30 Europe Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 31 Europe Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 32 Europe Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 33 Europe Payment Security Software Market Size (US$ Mn) and Forecast, By Region, 2015 – 2025

Table 34 Germany Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 35 Germany Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 36 Germany Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 37 Germany Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 38 Germany Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 39 Italy Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 40 Italy Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 41 Italy Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 42 Italy Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 43 Italy Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 44 France Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 45 France Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 46 France Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 47 France Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 48 France Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 49 The U.K. Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 50 The U.K. Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 51 The U.K. Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 52 The U.K. Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 53 The U.K. Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 54 Rest of Europe Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 55 Rest of Europe Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 56 Rest of Europe Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 57 Rest of Europe Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 58 Rest of Europe Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 59 Asia Pacific Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 60 Asia Pacific Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 61 Asia Pacific Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 62 Asia Pacific Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 63 Asia Pacific Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 64 Asia Pacific Payment Security Software Market Size (US$ Mn) and Forecast, By Region, 2015 – 2025

Table 65 Japan Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 66 Japan Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 67 Japan Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 68 Japan Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 69 Japan Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 70 China Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 71 China Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 72 China Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 73 China Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 74 China Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 75 India Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 76 India Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 77 India Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 78 India Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 79 India Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 80 Rest of Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 81 Rest of Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 82 Rest of Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 83 Rest of Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 84 Rest of Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 85 Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 86 Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 87 Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 88 Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 89 Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 90 Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Region, 2015 – 2025

Table 91 Saudi Arabia Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 92 Saudi Arabia Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 93 Saudi Arabia Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 94 Saudi Arabia Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 95 Saudi Arabia Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 96 Africa Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 97 Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 98 Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 99 Africa Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 100 Africa Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 101 South America Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 102 South America Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 103 South America Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 104 South America Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 105 South America Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 106 South America Payment Security Software Market Size (US$ Mn) and Forecast, By Region, 2015 – 2025

Table 107 Brazil Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 108 Brazil Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 109 Brazil Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 110 Brazil Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 111 Brazil Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

Table 112 Rest of South America Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Table 113 Rest of South America Payment Security Software Market Size (US$ Mn) and Forecast, By Solution, 2015 – 2025

Table 114 Rest of South America Payment Security Software Market Size (US$ Mn) and Forecast, By Software, 2015 – 2025

Table 115 Rest of South America Payment Security Software Market Size (US$ Mn) and Forecast, By Mode of Payment, 2015 – 2025

Table 116 Rest of South America Payment Security Software Market Size (US$ Mn) and Forecast, By End-use, 2015 – 2025

List of Figures

Figure 1 Global Payment Security Software Market Revenue Projections, 2015 - 2025 (US$ Mn)

Figure 2 Global Payment Security Software Market, By Software (US$ Mn & %)

Figure 3 Global Payment Security Software Market, By Services (US$ Mn & %)

Figure 4 Global Firewall Market (US$ Mn & %)

Figure 5 Global Anti-virus/anti malware Market (US$ Mn & %)

Figure 6 Global Intrusion detection and prevention (IDS/IPS) Market (US$ Mn & %)

Figure 7 Global Data encryption Market (US$ Mn & %)

Figure 8 Global Tokenization Market (US$ Mn & %)

Figure 9 Global Multi-factor authentication Market (US$ Mn & %)

Figure 10 Global Security Information and Event Management (SIEM) Market (US$ Mn & %)

Figure 11 Global Data Loss Prevention (DLP) Market (US$ Mn & %)

Figure 12 Global Market of Other Software (US$ Mn & %)

Figure 13 Global Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 14 Global Payment Security Software Market Attractiveness Analysis, By Solution

Figure 15 Global Mobile Payment Security Software Market (US$ Mn & %)

Figure 16 Global Point-of-Sale (PoS) Systems and Security Market (US$ Mn & %)

Figure 17 Global Online Payment Security Software Market (US$ Mn & %)

Figure 18 Global Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 19 Global Payment Security Software Market Attractiveness Analysis, By Mode of Payment

Figure 20 Global Payment Security Software Market For BFSI (US$ Mn & %)

Figure 21 Global Payment Security Software Market For Retail (US$ Mn & %)

Figure 22 Global Payment Security Software Market For Healthcare (US$ Mn & %)

Figure 23 Global Payment Security Software Market For Government (US$ Mn & %)

Figure 24 Global Payment Security Software Market For Others (US$ Mn & %)

Figure 25 Global Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 26 Global Payment Security Software Market Attractiveness Analysis, By End-use

Figure 27 Global Payment Security Software Market CAGR (2016 – 2024) Analysis, By Country

Figure 28 Global Payment Security Software Market Attractiveness Analysis, By Region

Figure 29 North America Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 30 North America Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 30 North America Payment Security Software Market Attractiveness Analysis, By Solution

Figure 31 North America Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 32 North America Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 33 North America Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 34 North America Payment Security Software Market Revenue Share Analysis, By Country, 2016 and 2024

Figure 35 North America Payment Security Software Market Attractiveness Analysis, By Mode of Payment

Figure 36 North America Payment Security Software Market Attractiveness Analysis, By End-use

Figure 37 North America Payment Security Software Market Attractiveness Analysis, By Country

Figure 38 The U.S. Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 39 The U.S. Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 40 The U.S. Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 41 The U.S. Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 42 The U.S. Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 43 Canada Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 44 Canada Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 45 Canada Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 46 Canada Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 47 Canada Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 48 Europe Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 49 Europe Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 50 Europe Payment Security Software Market Attractiveness Analysis, By Solution

Figure 51 Europe Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 52 Europe Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 53 Europe Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 54 Europe Payment Security Software Market Revenue Share Analysis, By Country, 2016 and 2024

Figure 55 Europe Payment Security Software Market Attractiveness Analysis, By Mode of Payment

Figure 56 Europe Payment Security Software Market Attractiveness Analysis, By End-use

Figure 57 Europe Payment Security Software Market Attractiveness Analysis, By Country

Figure 58 Germany Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 59 Germany Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 60 Germany Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 61 Germany Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 62 Germany Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 63 Italy Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 64 Italy Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 65 Italy Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 66 Italy Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 67 Italy Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 68 France Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 69 France Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 70 France Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 71 France Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 72 France Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 73 The U.K. Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 74 The U.K. Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 75 The U.K. Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 76 The U.K. Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 77 The U.K. Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 78 Asia Pacific Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 79 Asia Pacific Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 80 Asia Pacific Payment Security Software Market Attractiveness Analysis, By Solution

Figure 81 Asia Pacific Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 82 Asia Pacific Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 83 Asia Pacific Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 84 Asia Pacific Payment Security Software Market Revenue Share Analysis, By Country, 2016 and 2024

Figure 85 Asia Pacific Payment Security Software Market Attractiveness Analysis, By Mode of Payment

Figure 86 Asia Pacific Payment Security Software Market Attractiveness Analysis, By End-use

Figure 87 Asia Pacific Payment Security Software Market Attractiveness Analysis, By Country

Figure 88 Japan Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 89 Japan Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 90 Japan Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 91 Japan Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 92 Japan Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 93 China Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 94 China Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 95 China Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 96 China Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 97 China Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 98 India Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 99 India Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 100 India Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 101 India Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 102 India Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 103 Middle East and Africa Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 104 Middle East and Africa Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 105 Middle East and Africa Payment Security Software Market Attractiveness Analysis, By Solution

Figure 106 Middle East and Africa Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 107 Middle East and Africa Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 108 Middle East and Africa Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 109 Middle East and Africa Payment Security Software Market Revenue Share Analysis, By Country, 2016 and 2024

Figure 110 Middle East and Africa Payment Security Software Market Attractiveness Analysis, By Mode of Payment

Figure 111 Middle East and Africa Payment Security Software Market Attractiveness Analysis, By End-use

Figure 112 Middle East and Africa Payment Security Software Market Attractiveness Analysis, By Country

Figure 113 Saudi Arabia Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 114 Saudi Arabia Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 115 Saudi Arabia Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 116 Saudi Arabia Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 117 Saudi Arabia Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 118 Africa Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 119 Africa Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 120 Africa Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 121 Africa Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 122 Africa Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 123 South America Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 124 South America Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 125 South America Payment Security Software Market Attractiveness Analysis, By Solution

Figure 126 South America Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 127 South America Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 128 South America Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025

Figure 129 South America Payment Security Software Market Revenue Share Analysis, By Country, 2016 and 2024

Figure 130 South America Payment Security Software Market Attractiveness Analysis, By Mode of Payment

Figure 131 South America Payment Security Software Market Attractiveness Analysis, By End-use

Figure 132 South America Payment Security Software Market Attractiveness Analysis, By Country

Figure 133 Brazil Payment Security Software Market Size (US$ Mn) and Forecast, 2015 – 2025

Figure 134 Brazil Payment Security Software Services Market Size (US$ Mn) and Forecast, 2015 – 2026

Figure 135 Brazil Payment Security Software Market Revenue Share Analysis, By Software, 2017 and 2025

Figure 136 Brazil Payment Security Software Market Revenue Share Analysis, By Mode of Payment, 2017 and 2025

Figure 137 Brazil Payment Security Software Market Revenue Share Analysis, By End-use, 2017 and 2025