Reports

Reports

Relaxations in travel bans and reopening of various businesses in 2021 are creating incremental opportunities for companies in the passenger service system market. During the first quarter of 2020, airlines were seen gravitating toward PSS to manage their inventory and ancillary services. For instance, the Amadeus Passenger Service System was contracted and implemented by Mauritania Airlines and JSX Airlines, respectively, to manage loyalty services and revenue accounting.

Companies in the passenger service system market continue to expand their portfolio of customers to keep economies running. They are entering into multi-year agreements to establish stable revenue streams. Cloud-based solutions are being used to effectively manage event bookings and operations.

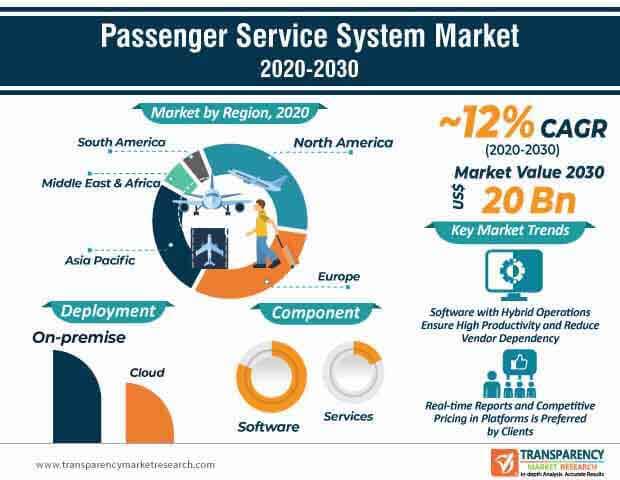

The passenger service system market is projected to advance at a robust CAGR of 12% during the forecast period. However, these systems are subject to data security concerns of passengers. Since several million travelers post pictures of their boarding passes and barcodes under hashtags such as boarding pass on social media, malicious hackers may potentially take advantage of the technological vulnerabilities of reservation systems. Hence, software developers are integrating bot protection mechanisms to limit the amount of requests that can be submitted during a certain period of time.

Companies in the passenger service system market are adopting bot protection mechanisms in software to prevent automated attacks in reservation systems.

The passenger service system market is estimated to reach the revenue mark of US$ 20 Bn by the end of 2030. This is evident since companies are setting their collaboration wheels in motion to innovate in cloud-based software solutions. For instance, Flightdocs has announced to join forces with the ATP family to deliver power cloud-based software solutions that enable aircraft maintenance, troubleshooting, and inventory management.

Software developers in the passenger service system market are increasing efforts to incorporate a library of technical publications and regulatory content in cloud-based solutions. Safe and reliable operation of aircraft has become a need of the hour in today’s unprecedented times. User-friendly maintenance tracking and inventory management software are being preferred by users.

iFly Res by IBS Software - a leading SaaS solutions provider to the travel industry globally is gaining recognition for its next-gen airline passenger services platform, which offers greater business flexibility and operational efficiency. Companies in the passenger service system market are fulfilling client needs for a dynamic platform with a customer centric design that can seamlessly adapt as per changing business models.

Stakeholders in the passenger service system market are creating platforms that cater to low cost as well as hybrid operations. Such platforms not only ensure high productivity but also reduce vendor dependency. Fares, ancillary fees, departure control, and customer service have become key focus points for software developers.

Companies in the passenger service system market are developing reliable and custom-built software platforms that offer sustainable solutions in aircraft management. This has become necessary since airlines are faced with increased competition and the pressure to reduce costs. Airline parking reservation systems and ticketing services are generating stable revenue streams for companies in the passenger service system market.

iFour Technolab is gaining popularity among India’s well-known aviation software companies, owing to its platform that offers credible insights about the fuel tracking system, airport workforce check-in/check-out, and cabin crew management. Time management and flight dispatch management are emerging as important applications of aviation PSS. Software companies are working with cyber security professionals to prevent the damage caused by hackers on a daily basis.

Analysts’ Viewpoint

Whilst reinforcing their financial situation, companies in the passenger service system market are actively involved with customers to support them during the unprecedented times of the coronavirus pandemic. Full distribution capabilities, real-time flexible reports, and highly competitive pricing in platforms are being preferred by clients. However, software companies are pressured with the burden of ever-increasing customer expectations and the need to incorporate IT innovations. Hence, companies should adopt digitization and automation technologies to overcome errors made in manual operation of platforms. Cloud-based platforms are being leveraged with dedicated hosting services and regulatory compliance such as the GDS Type A/B and ATPCO standards.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Passenger Service System Market

4. Market Overview

4.1. Market Definition

4.2. Key Market Indicator

4.3. Technology Roadmap

4.4. Market Factor Analysis

4.4.1. Forecast Factors

4.4.2. Ecosystem Analysis

4.4.3. Market Dynamics (Growth Influencers)

4.4.3.1. Drivers

4.4.3.2. Restraints

4.4.3.3. Opportunities

4.4.3.4. Impact Analysis of Drivers and Restraints

4.5. COVID-19 Impact Analysis

4.5.1. Impact Analysis of COVID-19 on the Passenger Service System Market

4.5.2. Impact of COVID-19 on the Passenger Service System Market, By Industry

4.5.3. Short Term and Long Term Impact on the Market

4.6. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.6.1. By Component

4.6.2. By Deployment

4.7. Mergers & Acquisitions, Expansions

5. Global Passenger Service System Market Analysis and Forecast

5.1.1. Market Revenue Analysis (US$ Mn), 2015-2030

5.1.1.1. Historic Growth Trends, 2015-2019

5.1.1.2. Forecast Trends, 2020-2030

6. Global Passenger Service System Market Analysis, by Component

6.1. Definition

6.2. Key Segment Analysis

6.3. Passenger Service System Market Size (US$ Mn) Forecast, by Component, 2018 - 2030

6.3.1. Software

6.3.1.1. Airline Reservation System

6.3.1.2. Airline Inventory System

6.3.1.3. Departure Control System

6.3.1.4. Internet Booking System

6.3.1.5. Loyalty System

6.3.1.6. Customer Care System

6.3.1.7. Airport Management Consulting

6.3.1.8. Ancillary Services

6.3.2. Services

6.3.2.1. Professional

6.3.2.2. Managed

7. Global Passenger Service System Market Analysis, by Deployment

7.1. Definition

7.2. Key Segment Analysis

7.3. Passenger Service System Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2030

7.3.1. On-premise

7.3.2. Cloud

8. Global Passenger Service System Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. Passenger Service System Market Size (US$ Mn) Forecast, by Region, 2018 - 2030

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Passenger Service System Market Analysis

9.1. Regional Outlook

9.2. Passenger Service System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

9.2.1. By Component

9.2.2. By Deployment

9.3. Passenger Service System Market Size (US$ Mn) Forecast, by Country, 2018 - 2030

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe Passenger Service System Market Analysis and Forecast

10.1. Regional Outlook

10.2. Passenger Service System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

10.2.1. By Component

10.2.2. By Deployment

10.3. Passenger Service System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Rest of Europe

11. APAC Passenger Service System Market Analysis and Forecast

11.1. Regional Outlook

11.2. Passenger Service System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

11.2.1. By Component

11.2.2. By Deployment

11.3. Passenger Service System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa (MEA) Passenger Service System Market Analysis and Forecast

12.1. Regional Outlook

12.2. Passenger Service System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

12.2.1. By Component

12.2.2. By Deployment

12.3. Passenger Service System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

12.3.1. The United Arab Emirates

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa (MEA)

13. South America Passenger Service System Market Analysis and Forecast

13.1. Regional Outlook

13.2. Passenger Service System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

13.2.1. By Component

13.2.2. By Deployment

13.3. Passenger Service System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2019)

15. Company Profiles

15.1. Amadeus IT Group SA

15.1.1. Business Overview

15.1.2. Product Portfolio

15.1.3. Geographical Footprint

15.1.4. Revenue and Strategy

15.2. AeroCRS (Enoya-one LTD)

15.2.1. Business Overview

15.2.2. Product Portfolio

15.2.3. Geographical Footprint

15.2.4. Revenue and Strategy

15.3. Bravo Passenger Solutions Pte Limited

15.3.1. Business Overview

15.3.2. Product Portfolio

15.3.3. Geographical Footprint

15.3.4. Revenue and Strategy

15.4. Hewlett Packard Enterprise

15.4.1. Business Overview

15.4.2. Product Portfolio

15.4.3. Geographical Footprint

15.4.4. Revenue and Strategy

15.5. Hexaware Technologies Ltd.

15.5.1. Business Overview

15.5.2. Product Portfolio

15.5.3. Geographical Footprint

15.5.4. Revenue and Strategy

15.6. Hitit Computer Services A.S.

15.6.1. Business Overview

15.6.2. Product Portfolio

15.6.3. Geographical Footprint

15.6.4. Revenue and Strategy

15.7. IBM Corporation

15.7.1. Business Overview

15.7.2. Product Portfolio

15.7.3. Geographical Footprint

15.7.4. Revenue and Strategy

15.8. IBS Software Services Pvt. Ltd.

15.8.1. Business Overview

15.8.2. Product Portfolio

15.8.3. Geographical Footprint

15.8.4. Revenue and Strategy

15.9. Information Systems Associates FZE

15.9.1. Business Overview

15.9.2. Product Portfolio

15.9.3. Geographical Footprint

15.9.4. Revenue and Strategy

15.10. Intelisys Aviation Systems Inc.

15.10.1. Business Overview

15.10.2. Product Portfolio

15.10.3. Geographical Footprint

15.10.4. Revenue and Strategy

15.11. KIU System Solutions

15.11.1. Business Overview

15.11.2. Product Portfolio

15.11.3. Geographical Footprint

15.11.4. Revenue and Strategy

15.12. Mercator Limited

15.12.1. Business Overview

15.12.2. Product Portfolio

15.12.3. Geographical Footprint

15.12.4. Revenue and Strategy

15.13. Radixx International, Inc.

15.13.1. Business Overview

15.13.2. Product Portfolio

15.13.3. Geographical Footprint

15.13.4. Revenue and Strategy

15.14. Sabre Corporation

15.14.1. Business Overview

15.14.2. Product Portfolio

15.14.3. Geographical Footprint

15.14.4. Revenue and Strategy

15.15. Sirena-Travel JSCS

15.15.1. Business Overview

15.15.2. Product Portfolio

15.15.3. Geographical Footprint

15.15.4. Revenue and Strategy

15.16. SITA NV

15.16.1. Business Overview

15.16.2. Product Portfolio

15.16.3. Geographical Footprint

15.16.4. Revenue and Strategy

15.17. Travel Technology Interactive

15.17.1. Business Overview

15.17.2. Product Portfolio

15.17.3. Geographical Footprint

15.17.4. Revenue and Strategy

15.18. Travelport Worldwide Ltd.

15.18.1. Business Overview

15.18.2. Product Portfolio

15.18.3. Geographical Footprint

15.18.4. Revenue and Strategy

15.19. Travelsky Technology Ltd.

15.19.1. Business Overview

15.19.2. Product Portfolio

15.19.3. Geographical Footprint

15.19.4. Revenue and Strategy

15.20. Unisys Corporation

15.20.1. Business Overview

15.20.2. Product Portfolio

15.20.3. Geographical Footprint

15.20.4. Revenue and Strategy

15.20.5. Key Takeaways

16. Key Takeaways

List of Tables

Table 1: Acronyms Used in Passenger Service System Market

Table 2: North America Passenger Service System Market Revenue Analysis, by Country, 2020 - 2030 (US$ Mn)

Table 3: Europe Passenger Service System Market Revenue Analysis, by Country, 2020 - 2030 (US$ Mn)

Table 4: Asia Pacific Passenger Service System Market Revenue Analysis, by Country, 2020 - 2030 (US$ Mn)

Table 5: Middle East & Africa Passenger Service System Market Revenue Analysis, by Country, 2020 and 2030 (US$ Mn)

Table 6: South America Passenger Service System Market Revenue Analysis, by Country, 2020 - 2030 (US$ Mn)

Table 7: Travel & Tourism Contribution To GDP, 2019

Table 8: Forecast Factors: Relevance and Impact (1/2)

Table 9: Forecast Factors: Relevance and Impact (2/2)

Table 10: Impact Analysis of Drivers & Restraints

Table 11: Mergers & Acquisitions, Expansions (1/2)

Table 12: Mergers & Acquisitions, Expansions (2/2)

Table 13: Global Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (1/3)

Table 14: Global Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (2/3)

Table 15: Global Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (3/3)

Table 16: Global Passenger Service System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 17: Global Passenger Service System Market Value (US$ Mn) Forecast, by Region, 2018 - 2030

Table 18: North America Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (1/3)

Table 19: North America Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (2/3)

Table 20: North America Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (3/3)

Table 21: North America Passenger Service System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 22: North America Passenger Service System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 23: The U.S. Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 24: Canada Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 25: Mexico Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 26: Europe Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (1/3)

Table 27: Europe Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (2/3)

Table 28: Europe Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (3/3)

Table 29: Europe Passenger Service System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 30: Europe Passenger Service System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 31: Germany Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 32: U.K. Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 33: France Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 34: Spain Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 35: Italy Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 36: Asia Pacific Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (1/3)

Table 37: Asia Pacific Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (2/3)

Table 38: Asia Pacific Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (3/3)

Table 39: Asia Pacific Passenger Service System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 40: Asia Pacific Passenger Service System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 41: China Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 42: India Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 43: Japan Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 44: ASEAN Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 45: Middle East & Africa Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (1/3)

Table 46: Middle East & Africa Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (2/3)

Table 47: Middle East & Africa Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (3/3)

Table 48: Middle East & Africa Passenger Service System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 49: Middle East & Africa Passenger Service System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 50: UAE Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 51: Saudi Arabia Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 52: South Africa Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 53: South America Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (1/3)

Table 54: South America Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (2/3)

Table 55: South America Passenger Service System Market Value (US$ Mn) Forecast, by Component, 2018 – 2030 (3/3)

Table 56: South America Passenger Service System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 57: South America Passenger Service System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 58: Brazil Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 59: Argentina Passenger Service System Revenue CAGR Breakdown (%), by Growth Term

Table 60: AeroCRS - Product Portfolio

Table 61: Amadeus IT Group, S.A. Product Portfolio

Table 62: Bravo Passenger Solutions Pte Limited - Product Portfolio

Table 63: Hewlett Packard Enterprise Development LP Product Portfolio

Table 64: Hexaware Technologies Ltd. Product Portfolio

Table 65: Hitit Computer Services A.S. - Product Portfolio

Table 66: IBM Corporation Product Portfolio

Table 67: IBS Software Services Pvt. Ltd. - Product Portfolio

Table 68: Information Systems Associates FZE - Product Portfolio

Table 69: Intelisys Aviation Systems Inc. - Product Portfolio

Table 70: KIU System Solutions - Product Portfolio

Table 71: Mercator Limited - Product Portfolio

Table 72: Radixx International, Inc. - Product Portfolio

Table 73: Sabre Corporation Product Portfolio

Table 74: Sirena-Travel CJSC - Product Portfolio

Table 75: SITA NV Product Portfolio

Table 76: Travel Technology Interactive Group Product Portfolio

Table 77: Travelport Worldwide Ltd. Product Portfolio

Table 78: TravelSky Technology Ltd. Product PortfolioTable 79: Unisys Corporation Product Portfolio

List of Figures

Figure 1: Global Passenger Service System Market Size (US$ Mn) Forecast, 2018–2030

Figure 2: Global Passenger Service System Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2020E

Figure 3: Global Passenger Service System Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2030F

Figure 4: Top Segment Analysis of Passenger Service System Market

Figure 5: Global GDP Growth, 2018-2019 (%)

Figure 6: Breakdown of Global Travel & Tourism Spending (2019)

Figure 7: International Tourist Arrivals, by Region (2016-2019)

Figure 8: Global Analysis of COVID-19 Impact on International Traffic

Figure 9: Global Analysis of COVID-19 Impact on Domestic Traffic

Figure 10: Global Passenger Service System Market Opportunity Assessment, by Component

Figure 11: Global Passenger Service System Market Opportunity Assessment, by Deployment

Figure 12: Global Passenger Service System Market Opportunity Assessment, by Region

Figure 13: Global Passenger Service System Market Revenue (US$ Mn) Historic Trends, 2015 - 2019

Figure 14: Global Passenger Service System Market Revenue Opportunity (US$ Mn) Historic Trends, 2015 - 2019

Figure 15: Global Passenger Service System Market Opportunity Share (%), by Services

Figure 16: Global Passenger Service System Market Opportunity Share (%), by Software

Figure 17: Global Passenger Service System Market Value Share Analysis, by Component, 2020

Figure 18: Global Passenger Service System Market Value Share Analysis, by Component, 2030

Figure 19: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Software, 2020 – 2030

Figure 20: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Services, 2020 – 2030

Figure 21: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Airline Reservation System, 2020 – 2030

Figure 22: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Airline Inventory System, 2020 – 2030

Figure 23: Asia Pacific Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Departure Control System, 2020 – 2030

Figure 24: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Internet Booking System, 2020 – 2030

Figure 25: Asia Pacific Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Loyalty System, 2020 – 2030

Figure 26: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Customer Care System, 2020 – 2030

Figure 27: Asia Pacific Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Airport Management Consulting, 2020 – 2030

Figure 28: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Ancillary Services, 2020 – 2030

Figure 29: Asia Pacific Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Professional, 2020 – 2030

Figure 30: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Managed, 2020 – 2030

Figure 31: Global Passenger Service System Market Opportunity Share (%), by Deployment, 2020–2030

Figure 32: Global Passenger Service System Market Value Share Analysis, by Deployment, 2020

Figure 33: Global Passenger Service System Market Value Share Analysis, by Deployment, 2030

Figure 34: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by On Premise, 2020 – 2030

Figure 35: Passenger Service System Market Absolute $ Opportunity (US$ Mn), by Cloud, 2020 – 2030

Figure 36: Global Passenger Service System Market Value Share Analysis, by Region, 2020

Figure 37: Global Passenger Service System Market Value Share Analysis, by Region, 2030

Figure 38: North America Passenger Service System Market Absolute $ Opportunity (US$ Mn), 2020 – 2030

Figure 39: Europe Passenger Service System Market Absolute $ Opportunity (US$ Mn), 2020 – 2030

Figure 40: Asia Pacific Passenger Service System Market Absolute $ Opportunity (US$ Mn), 2020 – 2030

Figure 41: Middle East & Africa Passenger Service System Market Absolute $ Opportunity (US$ Mn), 2020 – 2030

Figure 42: South America Passenger Service System Market Absolute $ Opportunity (US$ Mn), 2020 – 2030

Figure 43: North America Passenger Service System Market Revenue Opportunity (US$ Mn), 2020–2030

Figure 44: North America Passenger Service System Market Revenue Opportunity Share, by Deployment

Figure 45: North America Passenger Service System Market Revenue Opportunity Share, by Country

Figure 46: North America Passenger Service System Market Revenue Opportunity Share, by Software

Figure 47: North America Passenger Service System Market Value Share Analysis, by Component, 2020

Figure 48: North America Passenger Service System Market Value Share Analysis, by Component, 2030

Figure 49: North America Passenger Service System Market Value Share Analysis, by Deployment, 2020

Figure 50: North America Passenger Service System Market Value Share Analysis, by Deployment, 2030

Figure 51: North America Passenger Service System Market Value Share Analysis, by Country, 2020

Figure 52: North America Passenger Service System Market Value Share Analysis, by Country, 2030

Figure 53: North America Passenger Service System Market Opportunity Assessment, by Component

Figure 54: North America Passenger Service System Market Opportunity Assessment, by Deployment

Figure 55: North America Passenger Service System Market Opportunity Assessment, by Country

Figure 56: U.S. Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 57: Canada Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 58: Mexico Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 59: Europe Passenger Service System Market Revenue Opportunity (US$ Mn), 2020–2030

Figure 60: Europe Passenger Service System Market Revenue Opportunity Share, by Deployment

Figure 61: Europe Passenger Service System Market Revenue Opportunity Share, by Country

Figure 62: Europe Passenger Service System Market Revenue Opportunity Share, by Software

Figure 63: Europe Passenger Service System Market Value Share Analysis, by Component, 2020

Figure 64: Europe Passenger Service System Market Value Share Analysis, by Component, 2030

Figure 65: Europe Passenger Service System Market Value Share Analysis, by Deployment, 2020

Figure 66: Europe Passenger Service System Market Value Share Analysis, by Deployment, 2030

Figure 67: Europe Passenger Service System Market Value Share Analysis, by Country, 2020

Figure 68: Europe Passenger Service System Market Value Share Analysis, by Country, 2030

Figure 69: Europe Passenger Service System Market Opportunity Assessment, by Component

Figure 70: Europe Passenger Service System Market Opportunity Assessment, by Deployment

Figure 71: Europe Passenger Service System Market Opportunity Assessment, by Country

Figure 72: Germany Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 73: U.K. Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 74: France Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 75: Spain Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 76: Italy Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 77: Asia Pacific Passenger Service System Market Revenue Opportunity (US$ Mn), 2020–2030

Figure 78: Asia Pacific Passenger Service System Market Revenue Opportunity Share, by Deployment

Figure 79: Asia Pacific Passenger Service System Market Revenue Opportunity Share, by Country

Figure 80: Asia Pacific Passenger Service System Market Revenue Opportunity Share, by Software

Figure 81: Asia Pacific Passenger Service System Market Value Share Analysis, by Component, 2020

Figure 82: Asia Pacific Passenger Service System Market Value Share Analysis, by Component, 2030

Figure 83: Asia Pacific Passenger Service System Market Value Share Analysis, by Deployment, 2020

Figure 84: Asia Pacific Passenger Service System Market Value Share Analysis, by Deployment, 2030

Figure 85: Asia Pacific Passenger Service System Market Value Share Analysis, by Country, 2020

Figure 86: Asia Pacific Passenger Service System Market Value Share Analysis, by Country, 2030

Figure 87: Asia Pacific Passenger Service System Market Opportunity Assessment, by Component

Figure 88: Asia Pacific Passenger Service System Market Opportunity Assessment, by Deployment

Figure 89: Asia Pacific Passenger Service System Market Opportunity Assessment, by Country

Figure 90: China Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 91: India Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 92: Japan Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 93: ASEAN Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 94: Middle East & Africa Passenger Service System Market Revenue Opportunity (US$ Mn), 2020–2030

Figure 95: Middle East & Africa Passenger Service System Market Revenue Opportunity Share, by Deployment

Figure 96: Middle East & Africa Passenger Service System Market Revenue Opportunity Share, by Country

Figure 97: Middle East & Africa Passenger Service System Market Revenue Opportunity Share, by Software

Figure 98: Middle East & Africa Passenger Service System Market Value Share Analysis, by Component, 2020

Figure 99: Middle East & Africa Passenger Service System Market Value Share Analysis, by Component, 2030

Figure 100: Middle East & Africa Passenger Service System Market Value Share Analysis, by Deployment, 2020

Figure 101: Middle East & Africa Passenger Service System Market Value Share Analysis, by Deployment, 2030

Figure 102: Middle East & Africa Passenger Service System Market Value Share Analysis, by Country, 2020

Figure 103: Middle East & Africa Passenger Service System Market Value Share Analysis, by Country, 2030

Figure 104: Middle East & Africa Passenger Service System Market Opportunity Assessment, by Component

Figure 105: Middle East & Africa Passenger Service System Market Opportunity Assessment, by Deployment

Figure 106: Middle East & Africa Passenger Service System Market Opportunity Assessment, by Country

Figure 107: UAE Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 108: Saudi Arabia Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 109: South Africa Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 110: South America Passenger Service System Market Revenue Opportunity (US$ Mn), 2020–2030

Figure 111: South America Passenger Service System Market Revenue Opportunity Share, by Deployment

Figure 112: South America Passenger Service System Market Revenue Opportunity Share, by Country

Figure 113: South America Passenger Service System Market Revenue Opportunity Share, by Software

Figure 114: South America Passenger Service System Market Value Share Analysis, by Component, 2020

Figure 115: South America Passenger Service System Market Value Share Analysis, by Component, 2030

Figure 116: South America Passenger Service System Market Value Share Analysis, by Deployment, 2020

Figure 117: South America Passenger Service System Market Value Share Analysis, by Deployment, 2030

Figure 118: South America Passenger Service System Market Value Share Analysis, by Country, 2020

Figure 119: South America Passenger Service System Market Value Share Analysis, by Country, 2030

Figure 120: South America Passenger Service System Market Opportunity Assessment, by Component

Figure 121: South America Passenger Service System Market Opportunity Assessment, by Deployment

Figure 122: South America Passenger Service System Market Opportunity Assessment, by Country

Figure 123: Brazil Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030

Figure 124: Argentina Passenger Service System Market Opportunity Growth Analysis (US$ Mn) Forecast, 2020 – 2030