Reports

Reports

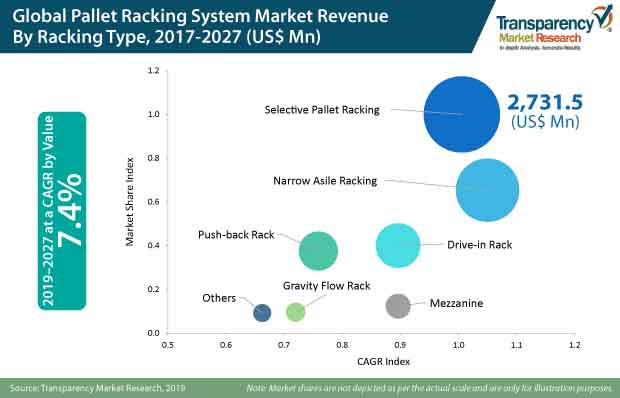

According to Transparency Market Research’s recent report titled “Pallet Racking Systems Market Global Industry Analysis, Size, Share, Growth, Trends, and Forecast Analysis 2019–2027,” the growth of awareness for organized warehouse space is expected to boost the demand for pallet racking systems during the forecast period. The global market for pallet racking systems was valued at US$7.8 Bn in 2018 and is projected to expand at a CAGR of 7.4%, during the forecast period (2019-2027).

The global market for pallet racking systems is segmented by frame load carrying capacity, system type, racking type, application, and end use. In terms of end use, the pallet racking systems market is segmented into packaging, food & beverages, electrical & electronics, healthcare, metal processing & manufacturing, building & construction, chemicals, logistics & warehousing, mining, and others.

The logistics sector is expected to grow at around 10-15% in the forthcoming years, largely due to growth in retail, E-commerce, and manufacturing sectors. This indicates that logistics demand will continue to grow and will create demand for large-scale warehouse spaces. Hence, robust growth in automation in warehouse space, coupled with rise in e-Commerce growth are cited to emerge as the key reasons for concrete growth in the global pallet racking systems market.

According to an independent analysis, the total global market logistics in terms of value in 2017 reached about USS$ 7.2 trillion, which represent approx. 9% of the global GDP.

In any economy, the logistics industry deals with the flow of products flow from place of manufacturing/origin to their consumption/end use. Logistics thus involves the amalgamation of warehousing, material handling, packaging and transportation, procurement, inventory & supply chain management, etc. These developments in the recent past have created a positive landscape for the pallet racking systems market.

Increase in labor costs along with rising warehousing rents consistently over the last decade, have forced companies to utilize their warehousing /storage space more resourcefully. End users need to keep a sharp eye on these cost factors, which is giving impetus to pallet racking system manufacturers. Many products with space efficient storage systems, such as pallet racking systems, have been developed recently to address this need. In order to reduce labor costs further, automation is expected to continue to rise. Various end-use industries using warehouse automation revealed that more companies are willing to enhance or upgrade their existing warehouse management systems rather than implement new ones.

Additionally, the demand for stand-alone subsystems and integrated ones is growing fast. Lastly, one of the key trends in the industrial market remains the movement of manufacturing operations to cheaper locations such as India, China, Mexico, Brazil, and Central & Eastern Europe (CEE).

Logistics and warehousing play an indispensable role in the transportation of goods across the globe. A warehouse is a fundamental part of any business infrastructure and is one of the key enablers in the global supply chain. Subsequently, it is the fulcrum for procurement, manufacturing, and distribution services that collectively build robust economies. The growing need for organized logistics to improve time, cost, and quality efficiencies in emerging countries of Asian Subcontinent are propelling opportunities for the growth of the pallet racking systems market.

Emerging customer segments such as E-commerce, present several unique opportunities for 3PLPs, owing to the rising demand for complete logistics management through the aggregation of vendors and services. Manufacturing companies of pallet racking systems must leverage this demand for new and differentiated services by suitably building capabilities.

The global pallet racking systems market critically analyzed key players during the course of the study. These include Stora Enso Oyj, Georgia-Pacific LLC, Canfor Corporation, International Paper Company, Clearwater Paper Corporation, UPM-Kymmene Oyj, P.H. Glatfelter Co., Domtar Corporation, Mitsubishi Paper Mills Limited, Verso Corporation, BillerudKorsnäs AB, Burgo Group SPA, Twin Rivers Paper Company Inc., American Eagle Paper Mills, Delta Paper Corp., Catalyst Paper Corporation, Asia Pacific Resources International Holdings Ltd., Rolland Enterprises Inc., Alberta Newsprint Company Ltd., and Finch Paper LLC.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

1.4. Opportunity Assessment

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Background

3.1. Global Warehousing Industry Outlook

3.2. Global Manufacturing Sector Outlook

3.3. Porter’s Analysis

3.4. Macro-Economic Factors

3.5. Forecast Factors – Relevance & Impact

3.6. Value Chain & Profitability Margin Analysis

3.6.1. Raw Material Suppliers

3.6.2. Pallet Racking System Manufacturers

3.6.3. End Users

3.7. Cost Tear-down Analysis

3.8. Pricing Analysis & Forecast

3.9. Market Dynamics

3.9.1. Drivers

3.9.1.1. Supply Side

3.9.1.2. Demand Side

3.9.2. Restraints

3.9.3. Opportunity Analysis

3.9.4. Trends

3.9.4.1. Product Level

3.9.4.2. Company Level

4. Market Forecast

4.1. Market Volume Projections

4.2. Pricing Analysis

4.3. Market Size Projections

4.3.1. Y-o-Y Projections

4.3.2. Absolute $ Opportunity Analysis

5. Global Pallet Racking System Market Analysis by System

5.1. Introduction

5.1.1. Market Value Share Analysis by System

5.1.2. Y-o-Y Growth Analysis by System

5.2. Market Size (US$ Mn) and Volume (Units) Forecast by System 2017–2027

5.2.1. Conventional

5.2.2. Mobile Racking

5.2.2.1. Horizontally Rotating

5.2.2.2. Vertically Rotating

5.2.3. Shuttle Racking

5.2.4. Hybrid and Customized

5.3. Market Attractiveness Analysis by System

6. Global Pallet Racking System Market Analysis by Racking System

6.1. Introduction

6.1.1. Market Value Share Analysis by Racking System

6.1.2. Y-o-Y Growth Analysis by Racking System

6.2. Market Size (US$ Mn) and Volume (Units) Forecast by Racking System 2017–2027

6.2.1. Selective Pallet Rack

6.2.2. Narrow Aisle Rack

6.2.3. Drive-in Rack

6.2.4. Push-back Rack

6.2.5. Gravity Flow Rack

6.2.6. Mezzanine

6.2.7. Others

6.3. Market Attractiveness Analysis by Racking System

7. Global Pallet Racking System Market Analysis by Frame Load Capacity

7.1. Introduction

7.1.1. Market Value Share Analysis by Frame Load Capacity

7.1.2. Y-o-Y Growth Analysis by Frame Load Capacity

7.2. Market Size (US$ Mn) and Volume (Units) Forecast by Frame Load Capacity 2017–2027

7.2.1. Up to 5 Ton

7.2.2. 5 to 10 Ton

7.2.3. 10 to 15 Ton

7.2.4. Above 15 Ton

7.3. Market Attractiveness Analysis by Frame Load Capacity

8. Global Pallet Racking System Market Analysis by Application

8.1. Introduction

8.1.1. Market Value Share Analysis by Application

8.1.2. Y-o-Y Growth Analysis by Application

8.2. Market Size (US$ Mn) and Volume (Units) Forecast by Application 2017–2027

8.2.1. Cases & Boxes

8.2.2. Pipes & Panels

8.2.3. Tires

8.2.4. Drums & Pails

8.2.5. Rigid Sheets

8.2.6. Timber & Rolls

8.2.7. Trays & Crates

8.2.8. Others

8.3. Market Attractiveness Analysis by Application

9. Global Pallet Racking System Market Analysis by End-user Industry

9.1. Introduction

9.1.1. Market Value Share Analysis by End-user Industry

9.1.2. Y-o-Y Growth Analysis by End-user Industry

9.2. Market Size (US$ Mn) and Volume (Units) Forecast by End-user Industry 2017–2027

9.2.1. Packaging

9.2.2. Food & Beverages

9.2.3. Electrical & Electronics

9.2.4. Healthcare

9.2.5. Metal Processing & Manufacturing

9.2.6. Building & Construction

9.2.7. Chemicals

9.2.8. Logistics & Warehousing

9.2.9. Mining

9.2.10. Others

9.3. Market Attractiveness Analysis by End-user Industry

10. Global Pallet Racking System Market Analysis by Region

10.1. Introduction

10.1.1. Market Value Share Analysis by Region

10.1.2. Y-o-Y Growth Analysis by Region

10.2. Market Size (US$ Mn) and Volume (Units) Forecast by Region 2017–2027

10.2.1. Europe

10.2.2. North America

10.2.3. Latin America

10.2.4. Asia Pacific

10.2.5. MEA

10.3. Market Attractiveness Analysis by Region

11. North America Pallet Racking System Market Analysis

11.1. Introduction

11.2. Regional Pricing Analysis

11.3. Key Trends

11.4. Market Value (US$ Mn) and Volume (Units) Historical Analysis 2014-2018 and Forecast 2019-2027

11.4.1. By Country

11.4.1.1. USA

11.4.1.2. Canada

11.4.2. By System

11.4.3. By Racking System

11.4.4. By Frame Load Capacity

11.4.5. By Application

11.4.6. By End-user Industry

11.5. Market Attractiveness Analysis

12. Latin America Pallet Racking System Market Analysis

12.1. Introduction

12.2. Regional Pricing Analysis

12.3. Key Trends

12.4. Market Value (US$ Mn) and Volume (Units) Historical Analysis 2014-2018 and Forecast 2019-2027

12.4.1. By Country

12.4.1.1. Brazil

12.4.1.2. Mexico

12.4.1.3. Rest of Latin America

12.4.2. By System

12.4.3. By Racking System

12.4.4. By Frame Load Capacity

12.4.5. By Application

12.4.6. By End-user Industry

12.5. Market Attractiveness Analysis

13. Europe Pallet Racking System Market Analysis

13.1. Introduction

13.2. Regional Pricing Analysis

13.3. Key Trends

13.4. Market Value (US$ Mn) and Volume (Units) Historical Analysis 2014-2018 and Forecast 2019-2027

13.4.1. By Country

13.4.1.1. Germany

13.4.1.2. Italy

13.4.1.3. France

13.4.1.4. U.K.

13.4.1.5. Spain

13.4.1.6. Russia

13.4.1.7. Poland

13.4.1.8. Rest of Europe

13.4.2. By System

13.4.3. By Racking System

13.4.4. By Frame Load Capacity

13.4.5. By Application

13.4.6. By End-user Industry

13.5. Market Attractiveness Analysis

14. APAC Pallet Racking System Market Analysis

14.1. Introduction

14.2. Regional Pricing Analysis

14.3. Key Trends

14.4. Market Value (US$ Mn) and Volume (Units) Historical Analysis 2014-2018 and Forecast 2019-2027

14.4.1. By Country

14.4.1.1. China

14.4.1.2. India

14.4.1.3. ASEAN

14.4.1.4. Australia and New Zealand

14.4.1.5. Japan

14.4.1.6. Rest of APAC

14.4.2. By System

14.4.3. By Racking System

14.4.4. By Frame Load Capacity

14.4.5. By Application

14.4.6. By End-user Industry

14.5. Market Attractiveness Analysis

15. MEA Pallet Racking System Market Analysis

15.1. Introduction

15.2. Regional Pricing Analysis

15.3. Key Trends

15.4. Market Value (US$ Mn) and Volume (Units) Historical Analysis 2014-2018 and Forecast 2019-2027

15.4.1. By Country

15.4.1.1. GCC Countries

15.4.1.2. North Africa

15.4.1.3. South Africa

15.4.1.4. Turkey

15.4.1.5. Rest of MEA

15.4.2. By System

15.4.3. By Racking System

15.4.4. By Frame Load Capacity

15.4.5. By Application

15.4.6. By End-user Industry

15.5. Market Attractiveness Analysis

16. Market Structure Analysis

16.1. Market Analysis by Tier of Companies

16.1.1. By Large, Medium and Small

16.2. Market Concentration

16.2.1. By Top 5 and by Top 10

16.3. Market Presence Analysis

16.3.1. By Regional Footprint of Players

16.3.2. Product Footprint by Players

16.3.3. Channel Footprint by Players

17. Competition Analysis

17.1. Competition Dashboard

17.2. Competition Benchmarking

17.3. Profitability and Gross Margin Analysis by Competition

17.4. Competition Developments

17.5. Competition Deep Dive

17.5.1. Daifuku Co., Ltd

17.5.1.1. Overview

17.5.1.2. Product Portfolio

17.5.1.3. Profitability

17.5.1.4. Production Footprint

17.5.1.5. Sales Footprint

17.5.1.6. Channel Footprint

17.5.1.7. Competition Benchmarking

17.5.1.8. Strategy

17.5.1.8.1. Marketing Strategy

17.5.1.8.2. Product Strategy

17.5.1.8.3. Channel Strategy

17.5.2. KARDEX AG

17.5.3. Interroll Dyanmic Storage

17.5.4. Jungheinrich AG

17.5.5. SSI Schaefer

17.5.6. AVERYS Group

17.5.7. Mecalux SA

17.5.8. NEDCON B.V.

17.5.9. Estral Innovation and Applied Logistics

17.5.10. Dexion Gmbh

17.5.11. Montel Inc.

17.5.12. Hannibal Industries, Inc.

17.5.13. Elite Storage Solutions Inc.

17.5.14. Ridg-U-Rak Inc.

17.5.15. ATOX SISTEMAS DE ALMACENAJE, S.A.

17.5.16. Vertice Diseño S.A.

17.5.17. Poveda & CIA.

17.5.18. Frazier Industrial Company

17.5.19. DR Storage Systems

17.5.20. Storage Equipment Systems, Inc.

17.5.21. Gonvarri Material Handling

17.5.22. Stöcklin Logistics de México

17.5.23. AR Racking.

17.5.24. PROMAN s.r.o.

17.5.25. AK Material Handling Systems

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 01: Global Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tons) 2017-2027, by System Type

Table 02: Global Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tons) 2017-2027, by Racking Type

Table 03: Global Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tons) 2017-2027, by Frame Load Capacity

Table 04: Global Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tons) 2017-2027, by Application

Table 05: Global Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tons) 2017-2027, by End Use

Table 06: Global Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tons) 2017-2027, by Region

Table 07: North America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Country

Table 08: North America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Frame Load Capacity

Table 09: North America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Racking Type

Table 10: North America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by System Type

Table 11: North America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Application

Table 12: North America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by End-Use

Table 13: Latin America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Country

Table 14: Latin America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Frame Load Capacity

Table 15: Latin America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Racking Type

Table 16: Latin America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes)2017-2027, by System Type

Table 17: Latin America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Application

Table 18: Latin America Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by End-Use

Table 19: Europe Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Country

Table 20: Europe Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Frame Load Capacity

Table 21: Europe Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Racking Type

Table 22: Europe Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by System Type

Table 23: Europe Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Application

Table 24: Europe Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by End-Use

Table 25: Asia Pacific Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Country

Table 26: Asia Pacific Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Frame Load Capacity

Table 27: Asia Pacific Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Racking Type

Table 28: Asia Pacific Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by System Type

Table 29: Asia Pacific Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Application

Table 30: Asia Pacific Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by End-Use

Table 31: Middle-East & Africa Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Country

Table 32: Middle-East & Africa Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Frame Load Capacity

Table 33: Middle-East & Africa Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Racking Type

Table 34: Middle-East & Africa Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes)2017-2027, by System Type

Table 35: Middle-East & Africa Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by Application

Table 36: Middle-East & Africa Pallet Racking System Market Value (US$ Mn) & Volume ('000 Tonnes) 2017-2027, by End Use

List of Figures

Figure 01: Global Pallet Racking System Market BPS Analysis by System Type, 2019(E) & 2027(F)

Figure 02: Global Pallet Racking System Market Y-o-Y Growth by System Type 2019(E) – 2027(F)

Figure 03: Global Pallet Racking System Market Attractiveness Index by System Type, 2019(E) – 2027(F)

Figure 04: Global Pallet Racking System Market BPS Analysis by Racking Type, 2019(E) & 2027(F)

Figure 05: Global Pallet Racking System Market Y-o-Y Growth by Racking Type, 2019(E) – 2027(F)

Figure 06: Global Pallet Racking System Market Attractiveness Index by Racking Type, 2019(E) – 2027(F)

Figure 07: Global Pallet Racking System Market BPS Analysis by Frame Load Capacity, 2019(E) & 2027(F)

Figure 08: Global Pallet Racking System Market Y-o-Y Growth by Frame Load Capacity, 2019(E) – 2027(F)

Figure 09: Global Pallet Racking System Market Attractiveness Index by Frame Load Capacity, 2019(E) – 2027(F)

Figure 10: Global Pallet Racking System Market BPS Analysis by Application, 2019(E) & 2027(F)

Figure 11: Global Pallet Racking System Market Y-o-Y Growth by Application 2019(E) – 2027(F)

Figure 12: Global Pallet Racking System Market Attractiveness Index by Application, 2019(E) – 2027(F)

Figure 13: Global Pallet Racking System Market BPS Analysis by End-Use, 2019(E) & 2027(F)

Figure 14: Global Pallet Racking System Market Y-o-Y Growth by End-Use 2019(E) – 2027(F)

Figure 15: Global Pallet Racking System Market Attractiveness Index by End-Use, 2019(E) – 2027(F)

Figure 16: Global Pallet Racking System Market BPS Analysis by Region, 2019(E) & 2027(F)

Figure 17: Global Pallet Racking System Market Y-o-Y Growth by Region, 2019(E) – 2027(F)

Figure 18: Global Pallet Racking System Market Attractiveness Index by Region, 2019(E) – 2027(F)

Figure 19: North America Pallet Racking System Market Attractiveness Index by Country, 2019 –2027

Figure 20: North America Pallet Racking System Market Attractiveness Index by Frame Load Carrying Capacity, 2019 –2027

Figure 21: North America Pallet Racking System Market Attractiveness Index by Racking Type, 2019 – 2027

Figure 22: North America Pallet Racking System Market Attractiveness Index by System Type, 2019 –2027

Figure 23: North America Pallet Racking System Market Attractiveness Index by Application, 2019 –2027

Figure 24: North America Pallet Racking System Market Attractiveness Index by End Use, 2019 – 2027

Figure 25: Latin America Pallet Racking System Market Attractiveness Index by Country, 2019 –2027

Figure 26: Latin America Pallet Racking System Market Attractiveness Index by Frame Load Carrying Capacity, 2019 –2027

Figure 27: Latin America Pallet Racking System Market Attractiveness Index by Racking Type, 2019 – 2027

Figure 28: Latin America Pallet Racking System Market Attractiveness Index by System Type, 2019 –2027

Figure 29: Latin America Pallet Racking System Market Attractiveness Index by Application, 2019 –2027

Figure 30: Latin America Pallet Racking System Market Attractiveness Index by End Use, 2019 – 2027

Figure 31: Europe Pallet Racking System Market Attractiveness Index by Country, 2019 –2027

Figure 32: Europe Pallet Racking System Market Attractiveness Index by Frame Load Carrying Capacity, 2019 –2027

Figure 33: Europe Pallet Racking System Market Attractiveness Index by Racking Type, 2019 – 2027

Figure 34: Europe Pallet Racking System Market Attractiveness Index by System Type, 2019 –2027

Figure 35: Europe Pallet Racking System Market Attractiveness Index by Application, 2019 –2027

Figure 36: Europe Pallet Racking System Market Attractiveness Index by End Use, 2019 – 2027

Figure 37: Asia Pacific Pallet Racking System Market Attractiveness Index by Country, 2019 –2027

Figure 38: Asia Pacific Pallet Racking System Market Attractiveness Index by Frame Load Carrying Capacity, 2019 –2027

Figure 39: Asia Pacific Pallet Racking System Market Attractiveness Index by Racking Type, 2019 – 2027

Figure 40: Asia Pacific Pallet Racking System Market Attractiveness Index by System Type, 2019 –2027

Figure 41: Asia Pacific Pallet Racking System Market Attractiveness Index by Application, 2019 –2027

Figure 42: Asia Pacific Pallet Racking System Market Attractiveness Index by End Use, 2019 – 2027

Figure 43: Middle-East & Africa Pallet Racking System Market Attractiveness Index by Country, 2019 –2027

Figure 44: Middle-East & Africa Pallet Racking System Market Attractiveness Index by Frame Load Carrying Capacity, 2019 –2027

Figure 45: Middle-East & Africa Pallet Racking System Market Attractiveness Index by Racking Type, 2019 – 2027

Figure 46: Middle-East & Africa Pallet Racking System Market Attractiveness Index by System Type, 2019 –2027

Figure 47: Middle-East & Africa Pallet Racking System Market Attractiveness Index by Application, 2019 –2027

Figure 48: Middle-East & Africa Pallet Racking System Market Attractiveness Index by End Use, 2019 – 2027