Reports

Reports

Oil field equipments include drilling equipment, field production machinery, pumps and valves. These equipments are mainly used in oil extraction fields across the globe, both offshore and onshore. Drilling equipments are used to drill mechanically through soil or rock to reach the crude oil reservoir. These equipments include complete drilling rigs, and rig components. Rig components are drill bits and oil country tubular goods (OCTG). OCTG includes tubing and pipes such as drill pipes, casing pipes and tubing pipes.

The global demand for oilfield equipment was USD 84.25 billion in 2009 which increased to USD 87.60 billion in 2010. The demand for oilfield equipments is expected to be driven by the rising oil extraction and refining activities coupled with increasing regional consumption and its growing demand across the globe. Continuous efforts to discover new oilfields across various untapped regions across the globe are prompting the use of different oilfield equipments. Shift towards unconventional oil fields such as shale gas has been driving the demand for oilfield equipments in both developed economies such as the U.S. and Europe and in emerging markets such as Asia Pacific and Latin America and this trend is expected to drive the demand over the forecast period. Shift in focus towards increasing hydrocarbon production using techniques such as EOR (enhanced oil recovery) and IOR (improved oil recovery) has also been acting as one of the major factors driving the growth demand.

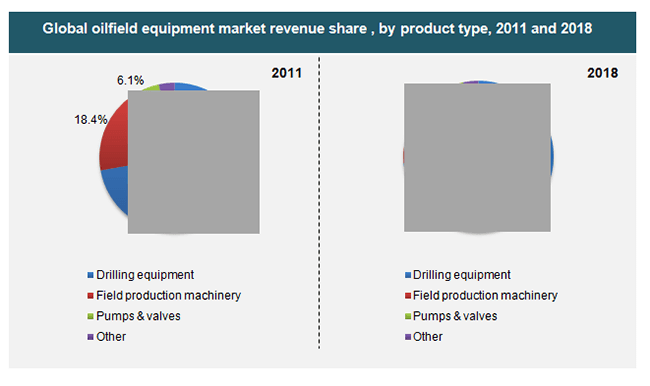

Drilling equipment emerged as the leading type oilfield equipment and accounted for over 72% of global oilfield equipment market and over 76% of the U.S. oilfield equipment market in 2011. Drilling equipments are used in piercing and boring through the earth in order to access crude oil (or natural gas) deposits below the surface. Along with being the biggest type, drilling equipments are also the fastest growing type of oilfield equipment growing at CAGR of 4.1% and 4.2% from 2012 to 2018 for global and U.S. market respectively. Drilling equipment was followed by field production machinery, which accounted for 18.4% of the overall market in 2011.

North America emerged as the leading market for oilfield equipment and accounted for over 30% of the global market in 2011. The growing drilling activities for natural oil and gas coupled with rapid development of unconventional resources such as shale gas, tight gas and coal bed methane (CBM) in U.S. and Canada is expected to drive the market for oilfield equipment in the region over the forecast period. U.S. is largest consumer of crude oil and in order to meet its growing demand, major producers has been exploring and developing new and untapped reservoirs across the regions which in turns promotes the use of oilfield equipment. Asia Pacific is fastest growing market for oilfield equipment growing at CAGR of 4.3% from 2012 to 2018. The growing energy consumption mainly in emerging economies of China and India is one of the major factors which are expected to drive the market in the region over the forecast period. Both China and India are ranked in the list of top five oil consumers in the world according to CIA World Factbook.

The global market for oilfield equipment is highly fragmented with top four companies accounting for just of 30% of the total market. Some of the major players operating in the global market include Aker Solutions, Baker Hughes, Cameroon International, Halliburton, National Oilwell Varco (NOV), Schlumberger and Weatherford International among some other companies.

1. Preface

1.1. Report Description

1.2. Research methodology

2. Executive Summary

3. Oilfield Equipment - Industry Analysis

3.1. Introduction

3.2. Value chain analysis

3.3. Market drivers

3.3.1. Growing production of oil and gas

3.3.2. Shift towards new, small unconventional fields

3.3.3. Implementation of advanced techniques such as EOR and IOR for enhanced recovery

3.4. Market restraints

3.4.1. Regulatory policies

3.4.2. Geopolitical issues

3.4.3. Growing demand for renewable sources of energy

3.5. Opportunities

3.5.1. Increasing demand for alternative energy resources

3.5.2. Increasing desire of self-dependency by nations

3.6. Porter’s five forces analysis

3.6.1. Bargaining power of suppliers

3.6.2. Bargaining power of buyers

3.6.3. Threat from new entrants

3.6.4. Threat from substitutes

3.6.5. Degree of competition

3.7. Oilfield equipment: Market attractiveness analysis

3.8. Company market share analysis, 2011

4. Oilfield Equipment - Product Segment Analysis

4.1. Global oilfield equipment market: Product overview

4.1.1. Global oilfield equipment market revenue share by product, 2011 and 2018

4.2. Global oilfield equipment market, by product

4.2.1. Drilling equipments

4.2.1.1. Global drilling equipments market estimates and forecast, 2010-2018 (USD million)

4.2.2. Field production machinery

4.2.2.1. Global field production machinery market estimates and forecast, 2010-2018 (USD million)

4.2.3. Pumps and valves

4.2.3.1. Global pumps and valves market estimates and forecast, 2010-2018 (USD million)

4.2.4. Other

4.2.4.1. Global other type of equipments’ market estimates and forecast, 2010-2018 (USD million)

5. Oilfield Equipment - Regional Analysis

5.1. Global oilfield equipment market: Geographic overview

5.1.1. Global oilfield equipment market revenue share by geography, 2011 and 2018

5.1.2. North America

5.1.2.1. North American oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

5.1.2.2. United States

5.1.2.2.1. U.S. oilfield equipment market estimates and forecast , 2010-2018 (USD Million)

5.1.2.3. U.S. oilfield equipment market, by product

5.1.2.3.1. U.S. oilfield equipment market revenue share, 2011 and 2018

5.1.2.4. Drilling equipment

5.1.2.4.1. U.S. drilling equipment market estimates and forecast, 2010-2018 (USD Million)

5.1.2.5. Field production machinery

5.1.2.5.1. U.S. field production machinery market estimates and forecast, 2010-2018 (USD Million)

5.1.2.6. Pumps and valves

5.1.2.6.1. U.S. pumps and valves market estimates and forecast, 2010-2018 (USD Million)

5.1.2.7. Other

5.1.2.7.1. U.S. other equipments market estimates and forecast, 2010-2018 (USD Million)

5.1.3. Europe

5.1.3.1. Europe oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

5.1.4. Asia Pacific

5.1.4.1. Asia Pacific oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

5.1.5. Middle East and Africa

5.1.5.1. Middle East and Africa oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

5.1.6. Latin America

5.1.6.1. Latin America oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

6. Company Profiles

6.1. National Oilwell Varco Incorporated

6.1.1. Company overview

6.1.2. Financial overview

6.1.3. Business strategies

6.1.4. SWOT analysis

6.1.5. Recent developments

6.2. Schlumberger

6.2.1. Company overview

6.2.2. Financial overview

6.2.3. Business strategies

6.2.4. SWOT analysis

6.2.5. Recent developments

6.3. Weatherford International

6.3.1. Company overview

6.3.2. Financial overview

6.3.3. Business strategies

6.3.4. SWOT analysis

6.3.5. Recent developments

6.4. Halliburton

6.4.1. Company overview

6.4.2. Financial overview

6.4.3. Business strategies

6.4.4. SWOT analysis

6.4.5. Recent developments

6.5. Baker Hughes

6.5.1. Company overview

6.5.2. Financial overview

6.5.3. Business strategies

6.5.4. SWOT analysis

6.5.5. Recent developments

6.6. Cameron International

6.6.1. Company overview

6.6.2. Financial overview

6.6.3. Business strategies

6.6.4. SWOT analysis

6.6.5. Recent developments

6.7. Aker Solutions

6.7.1. Company overview

6.7.2. Financial overview

6.7.3. Business strategy

6.7.4. SWOT analysis

6.7.5. Recent developments

6.8. FMC Technologies

6.8.1. Company overview

6.8.2. Financial overview

6.8.3. Business strategies

6.8.4. SWOT analysis

6.8.5. Recent developments

6.9. Eni

6.9.1. Company overview

6.9.2. Financial overview

6.9.3. Business strategies

6.9.4. SWOT analysis

6.9.5. Recent developments

List of Tables

TABLE 1: Global oilfield equipment market: Snapshot

TABLE 2: Drivers of the oilfield equipment market: Impact analysis

TABLE 3: Restraints for the oilfield equipment market: Impact analysis

List of Figures

FIG. 1: Global oilfield equipment market estimates and forecast, 2010-2018, (USD Billion)

FIG. 2: Global oilfield equipment market revenue, by product 2011 (USD million)

FIG. 3: Oilfield equipment: value chain analysis

FIG. 4: Global oil and gas production 2007-2011 (Million Tons)

FIG. 5: Global oil and gas reserves 2007-2011 (oil units- thousand million barrels, gas units- trillion cubic meters )

FIG. 6: Porter’s five forces analysis for oilfield equipment market

FIG. 7: Oilfield equipment: Market attractiveness analysis

FIG. 8: Global oilfield equipment market: company market share, 2011

FIG. 9: Global oilfield equipment market revenue share by product, 2011 and 2018

FIG. 10: Global drilling equipments market estimates and forecast, 2010-2018 (USD million)

FIG. 11: Global field production machinery market estimates and forecast, 2010-2018 (USD million)

FIG. 12: Global pumps and valves market estimates and forecast, 2010-2018 (USD million)

FIG. 13: Global other type of equipments’ market estimates and forecast, 2010-2018 (USD million)

FIG. 14: Global oilfield equipment market revenue share by geography, 2011 and 2018

FIG. 15: North American oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

FIG. 16: U.S. oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

FIG. 17: U.S. oilfield equipment market revenue share by product, 2011 and 2018

FIG. 18: U.S. drilling equipment market estimates and forecast, 2010-2018 (USD Million)

FIG. 19: U.S. field production machinery market estimates and forecast, 2010-2018 (USD Million)

FIG. 20: U.S. pumps and valves market estimates and forecast , 2010-2018 (USD Million)

FIG. 21: U.S. other equipments market estimates and forecast, 2010-2018 (USD Million)

FIG. 22: Europe oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

FIG. 23: Asia Pacific oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

FIG. 24: Middle East and Africa oilfield equipment market estimates and forecast, 2010-2018 (USD Million)

FIG. 25: Latin America oilfield equipment market estimates and forecast, 2010-2018 (USD Million)