Reports

Reports

Global Oil and Gas Project Management Software Market: Overview

Projects undertaken by oil and gas companies having highly complex operations, resource management, capital management, and inventory management, among others are at the forefront of driving demand for global oil and gas project management software. These highly sophisticated and efficient software are leveraged by oil and gas companies to handle their capital projects.

Oil and gas project management software have many advantages. They enable companies to properly utilize resources and keep a tab on the progress of projects. They also aid companies to understand risks and bring about compliance. Further, they help with analytics and reporting as well.

Providing headwinds to the global oil and gas project management software market is the growing investments in alternate energy such as wind, solar, tidal, nuclear and water. Moreover, the yawning gap between demand and supply of oil and gas is also acting as a deterrent to the market.

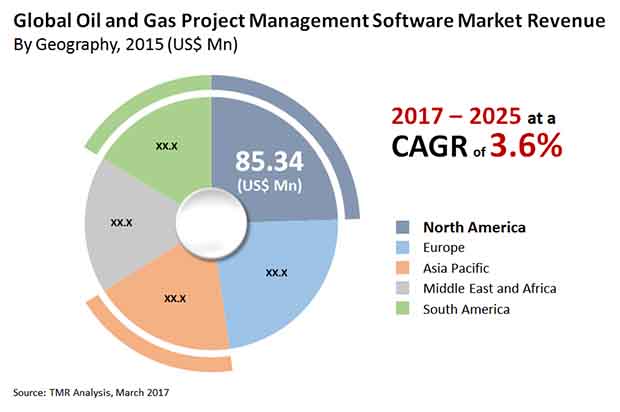

As per a report by Transparency Market Research, the global oil and gas project management software market will likely progress slowly at a CAGR of 3.6% from 2017 to 2025 to attain a value of US$ 489.5 mn by 2025-end.

Need for Operational Efficiency in Exploration and Production, Makes Upstream Applications Dominant Segment

Application-wise, the global oil and gas project management software market is can be bifurcated into upstream and mid and downstream. Of the two, the upstream application segment is predicted to contribute majorly to the market on account of rising investments in upstream application. As the global oil and gas industry looks to improve upon operational efficiency of exploration and production activities and tread a path of consolidation in the face of lessening revenues through mergers and acquisitions, the demand for oil and gas project management software is only slated to increase. The mid and downstream application segment is expected to hold a comparatively smaller share of the global oil and gas project management software market.

Large Reserves of Shale Catapults North America Market

From a geographical perspective, North America currently leads the market with maximum share. The U.S., which grosses maximum revenue in the region, is the main driver of expansion. North America is a leading region because of being home to a large number of industry players in the region and its massive shale oil reserves.

Europe trails North America vis-à-vis revenue in the global oil and gas project management software market. Europe is powered primarily by the U.K. and Scandinavia region. The massive reserves of oil and gas in the North Sea and Scandinavian regions are one of the reasons for strong demand in the market. The presence of complex geological structures and pipeline network, increasing investments and exploration and production activities are said to be catalyzing growth in the region.

Asia-Pacific region is another key market, which is being boosted by China and other South East Asian countries as the regional information technology industry, which supports the oil and gas industry gains strength. Swift pace of urbanization and burgeoning population is also helping to boost the market. In addition, the highly connected and advanced economies of South East Asian countries along with the presence of necessary infrastructures is expected to boost the regional market’s growth.

Some of the key comapnies in the global oil and gas project management software market are Deltek, Inc., InEight, Inc., EcoSys Management LLC, Oracle Corp., LiquidFrameworks, Inc., AVEVA Group PLC, SAP SE, Penta Technologies, Inc., Siemens AG, IBM Corp., IFS World Operations AB, Microsoft Corp., Stormgeo Holding AS, Aconex Ltd., Coreworx Inc., and Varec, Inc.

Increased Adoption of Advanced Tools in Oil and Gas Industry Fuels Demand Opportunities in Oil & Gas Project Management Software Market

The projects carried out in the oil and gas industry generally comprise extremely complex operations including capital management, inventory management, and resource management activities. As a result, the companies engaged in the industry are growing inclination toward the use of oil & gas project management software, which is specifically designed for performing abovementioned tasks in this industry.

Oil & gas project management software are gaining immense popularity in the oil and gas industry as they are extremely sophisticated and are efficient in handling all the capital projects of organizations. Apart from this, these software offer many advantages. One of the prominent advantages of oil & gas project management software is their ability to fully utilize available resources and keep the track of all the ongoing projects of the company.

The products from the global oil & gas project management software market are in high demand as they help organizations in understanding risks and bringing about compliances. Apart from this, companies are growing dependence on the oil & gas project management software owing to the ability of these software to assist in reporting and analytics. Thus, increased adoption from the oil and gas industry worldwide is likely to generate prominent sales opportunities for vendors working in the global oil & gas project management software market.

In recent few months, many countries across the globe had to impose lockdowns to contain the COVID-19 spread. As a result, there was sudden fall in transportation activities. Apart from this, many companies working in the oil and gas industry had to stop their ongoing projects. All these factors have impacted adversely on the global oil & gas project management software market. However, with companies engaged in this sector pouring efforts to regain their regular activities, the global market for oil & gas project management software is expected to recover from the losses due to COVID-19 and show moderate growth during the forthcoming years.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Oil & Gas Project Management Software Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Key Trends

4.4. Global Oil & Gas Project Management Software Market Analysis and Forecasts, 2015 – 2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Value Chain Analysis

4.6. Porter’s Five Forces Analysis

4.7. Market Outlook

5. Global Oil & Gas Project Management Software Market Analysis and Forecasts, By Application

5.1. Introduction & Definition

5.2. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

5.2.1. Upstream

5.2.1.1. On-Shore

5.2.1.2. Off-Shore

5.2.2. Mid and Down Stream

5.3. Market Value Share Analysis By Application

5.4. Application Comparison Matrix

5.5. Market Attractiveness By Application

6. Global Oil & Gas Project Management Software Market Analysis and Forecasts, By Deployment

6.1. Introduction & Definition

6.2. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

6.2.1. On-premise

6.2.2. Off-premise

6.3. Market Value Share Analysis By Deployment

6.4. Deployment Comparison Matrix

6.5. Market Attractiveness By Deployment

7. Global Oil & Gas Project Management Software Market Analysis and Forecasts, By Module

7.1. Introduction & Definition

7.2. Market Size (US$ Mn) Forecast By Module, 2015 – 2025

7.2.1. Contract Management

7.2.2. Scheduling

7.2.3. Asset Management

7.2.4. Inventory Management

7.2.5. Costing

7.2.6. Analytics

7.2.7. Maintenance

7.2.8. Others (Weather Forecast and Logistics)

7.3. Market Value Share Analysis By Module

7.4. Module Comparison Matrix

7.5. Market Attractiveness By Module

8. Global Oil & Gas Project Management Software Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Size (US$ Mn) Forecast By Region, 2015 – 2025

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East and Africa

8.2.5. South America

8.3. Market Value Share Analysis By Region

8.4. Region Comparison Matrix

8.5. Market Attractiveness By Region

9. North America Oil & Gas Project Management Software Market Analysis and Forecast

9.1. Key Findings

9.2. Market Overview

9.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

9.3.1. Upstream

9.3.1.1. On-shore

9.3.1.2. Off-shore

9.3.2. Mid and Down Stream

9.4. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

9.4.1. On-premise

9.4.2. Off-premise

9.5. Market Size (US$ Mn) Forecast By Module, 2015 – 2025

9.5.1. Contract Management

9.5.2. Scheduling

9.5.3. Asset Management

9.5.4. Inventory Management

9.5.5. Costing

9.5.6. Analytics

9.5.7. Maintenance

9.5.8. Others (Weather Forecast and Logistics)

9.6. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Application

9.7.2. By Deployment

9.7.3. By Module

9.7.4. By Country

10. Europe Oil & Gas Project Management Software Market Analysis and Forecast

10.1. Key Findings

10.2. Market Overview

10.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

10.3.1. Upstream

10.3.1.1. On-shore

10.3.1.2. Off-shore

10.3.2. Mid and Down Stream

10.4. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

10.4.1. On-premise

10.4.2. Off-premise

10.5. Market Size (US$ Mn) Forecast By Module, 2015 – 2025

10.5.1. Contract Management

10.5.2. Scheduling

10.5.3. Asset Management

10.5.4. Inventory Management

10.5.5. Costing

10.5.6. Analytics

10.5.7. Maintenance

10.5.8. Others (Weather Forecast and Logistics)

10.6. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

10.6.1. The U.K

10.6.2. Germany

10.6.3. Scandinavia

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Application

10.7.2. By Deployment

10.7.3. By Module

10.7.4. By Country

11. Asia Pacific Oil & Gas Project Management Software Market Analysis and Forecast

11.1. Key Findings

11.2. Market Overview

11.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

11.3.1. Upstream

11.3.1.1. On-shore

11.3.1.2. Off-shore

11.3.2. Mid and Down Stream

11.4. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

11.4.1. On-premise

11.4.2. Off-premise

11.5. Market Size (US$ Mn) Forecast By Module, 2015 – 2025

11.5.1. Contract Management

11.5.2. Scheduling

11.5.3. Asset Management

11.5.4. Inventory Management

11.5.5. Costing

11.5.6. Analytics

11.5.7. Maintenance

11.5.8. Others (Weather Forecast and Logistics)

11.6. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

11.6.1. China

11.6.2. India

11.6.3. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Application

11.7.2. By Deployment

11.7.3. By Module

11.7.4. By Country

12. Middle East and Africa Oil & Gas Project Management Software Market Analysis and Forecast

12.1. Key Findings

12.2. Market Overview

12.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

12.3.1. Upstream

12.3.1.1. On-shore

12.3.1.2. Off-shore

12.3.2. Mid and Down Stream

12.4. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

12.4.1. On-premise

12.4.2. Off-premise

12.5. Market Size (US$ Mn) Forecast By Module, 2015 – 2025

12.5.1. Contract Management

12.5.2. Scheduling

12.5.3. Asset Management

12.5.4. Inventory Management

12.5.5. Costing

12.5.6. Analytics

12.5.7. Maintenance

12.5.8. Others (Weather Forecast and Logistics)

12.6. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Application

12.7.2. By Deployment

12.7.3. By Module

12.7.4. By Country

13. South America Oil & Gas Project Management Software Market Analysis and Forecast

13.1. Key Findings

13.2. Market Overview

13.3. Market Size (US$ Mn) Forecast By Application, 2015 – 2025

13.3.1. Upstream

13.3.1.1. On-shore

13.3.1.2. Off-shore

13.3.2. Mid and Down Stream

13.4. Market Size (US$ Mn) Forecast By Deployment, 2015 – 2025

13.4.1. On-premise

13.4.2. Off-premise

13.5. Market Size (US$ Mn) Forecast By Module, 2015 – 2025

13.5.1. Contract Management

13.5.2. Scheduling

13.5.3. Asset Management

13.5.4. Inventory Management

13.5.5. Costing

13.5.6. Analytics

13.5.7. Maintenance

13.5.8. Others (Weather Forecast and Logistics)

13.6. Market Size (US$ Mn) Forecast By Country, 2015 – 2025

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Application

13.7.2. By Deployment

13.7.3. By Module

13.7.4. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2016)

14.3. Company Profiles (Details – Overview, Financials, Strategy, SWOT)

14.3.1. Deltek, Inc.

14.3.1.1. Detail Overview

14.3.1.2. Business Segments

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Business Strategies

14.3.2. InEight, Inc.

14.3.2.1. Detail Overview

14.3.2.2. Business Segments

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Business Strategies

14.3.3. EcoSys Management LLC

14.3.3.1. Detail Overview

14.3.3.2. Business Segments

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Business Strategies

14.3.4. Oracle Corp.

14.3.4.1. Detail Overview

14.3.4.2. Business Segments

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Business Strategies

14.3.5. LiquidFrameworks, Inc.

14.3.5.1. Detail Overview

14.3.5.2. Business Segments

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Business Strategies

14.3.6. AVEVA Group PLC

14.3.6.1. Detail Overview

14.3.6.2. Business Segments

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Business Strategies

14.3.7. SAP SE

14.3.7.1. Detail Overview

14.3.7.2. Business Segments

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Business Strategies

14.3.8. Penta Technologies, Inc

14.3.8.1. Detail Overview

14.3.8.2. Business Segments

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Business Strategies

14.3.9. Siemens AG

14.3.9.1. Detail Overview

14.3.9.2. Business Segments

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Business Strategies

14.3.10. IBM Corp.

14.3.10.1. Detail Overview

14.3.10.2. Business Segments

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Business Strategies

14.3.11. IFS World Operations AB

14.3.11.1. Detail Overview

14.3.11.2. Business Segments

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Business Strategies

14.3.12. Microsoft Corp.

14.3.12.1. Detail Overview

14.3.12.2. Business Segments

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Business Strategies

14.3.13. Stormgeo Holding AS

14.3.13.1. Detail Overview

14.3.13.2. Business Segments

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Business Strategies

14.3.14. Aconex Ltd.

14.3.14.1. Detail Overview

14.3.14.2. Business Segments

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.14.5. Business Strategies

14.3.15. Coreworx Inc.

14.3.15.1. Detail Overview

14.3.15.2. Business Segments

14.3.15.3. Financial Overview

14.3.15.4. SWOT Analysis

14.3.15.5. Business Strategies

14.3.16. Varec, Inc.

14.3.16.1. Detail Overview

14.3.16.2. Business Segments

14.3.16.3. Financial Overview

14.3.16.4. SWOT Analysis

14.3.16.5. Business Strategies

15. Key Takeaways

List of Tables

Table 1: Global Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application, 2015 – 2025

Table 2: Global Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application, 2015 – 2025

Table 3: Global Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Deployment, 2015 – 2025

Table 4: Global Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Module, 2015 – 2025

Table 5: Global Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Region, 2015 – 2025

Table 6: North America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application, 2015 – 2025

Table 7: North America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application (Upstream), 2015 – 2025

Table 8: North America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Deployment, 2015 – 2025

Table 9: North America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Module, 2015 – 2025

Table 10: North America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Country, 2015 – 2025

Table 11: Europe Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application, 2015 – 2025

Table 12: Europe Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application (Upstream), 2015 – 2025

Table 13: Europe Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Deployment, 2015 – 2025

Table 14: Europe Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Module, 2015 – 2025

Table 15: Europe Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Country, 2015 – 2025

Table 16: Asia Pacific Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application, 2015 – 2025

Table 17: Asia Pacific Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application (Upstream), 2015 – 2025

Table 18: Asia Pacific Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Deployment, 2015 – 2025

Table 19: Asia Pacific Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Module, 2015 – 2025

Table 20: Asia Pacific Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Country, 2015 – 2025

Table 21: Middle East and Africa Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application, 2015 – 2025

Table 22: Middle East and Africa Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application (Upstream), 2015 – 2025

Table 23: Middle East and Africa Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Deployment, 2015 – 2025

Table 24: Middle East and Africa Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Module, 2015 – 2025

Table 25: Middle East and Africa Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Country, 2015 – 2025

Table 26: South America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application, 2015 – 2025

Table 27: South America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Application (Upstream), 2015 – 2025

Table 28: South America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Deployment, 2015 – 2025

Table 29: South America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Module, 2015 – 2025

Table 30: South America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, by Country, 2015 – 2025

List of Figures

Figure 1: Executive Summary: Market Size, Indicative (US$ Mn) and Top Solution Segments

Figure 2: Global Oil & Gas Project Management Software Market Revenue Projection (US$ Mn), 2015 – 2025

Figure 3: Global Oil & Gas Project Management Software Market Y–o–Y Growth (%) Forecast, 2016 – 2025

Figure 4: Global Oil & Gas Project Management Software Market Revenue Share by Application (2016)

Figure 5: Global Oil & Gas Project Management Software Market Revenue Share by Deployment (2016)

Figure 6: Global Oil & Gas Project Management Software Market Revenue Share by Module (2016)

Figure 7: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Application– Upstream, 2015 – 2025, (US$ Mn and %)

Figure 8: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Application– Mid and Downstream, 2015 – 2025, (US$ Mn and %)

Figure 9: Global Oil & Gas Project Management Software Market Value Share Analysis, by Application, 2017 and 2025

Figure 10: Global Oil & Gas Project Management Software Market Comparison Matrix, by Application

Figure 11: Oil & Gas Project Management Software Market Attractiveness Analysis by Application (2016)

Figure 12: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Application (Upstream) – On–shore, 2015 – 2025, (US$ Mn and %)

Figure 13: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Application (Upstream) – Off–shore, 2015 – 2025, (US$ Mn and %)

Figure 14: Global Oil & Gas Project Management Software Market Value Share Analysis, by Application (Upstream), 2017 and 2025

Figure 15: Global Oil & Gas Project Management Software Market Comparison Matrix, by Application (Upstream)

Figure 16: Oil & Gas Project Management Software Market Attractiveness Analysis by Application (Upstream) (2016)

Figure 17: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Deployment– Off–Premise, 2015 – 2025, (US$ Mn and %)

Figure 18: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Deployment– On–Premise, 2015 – 2025, (US$ Mn and %)

Figure 19: Global Oil & Gas Project Management Software Market Value Share Analysis, by Deployment, 2017 and 2025

Figure 20: Global Oil & Gas Project Management Software Market Comparison Matrix, by Deployment

Figure 21: Oil & Gas Project Management Software Market Attractiveness Analysis by Deployment (2016)

Figure 22: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Contract Management, 2015 – 2025, (US$ Mn and %)

Figure 23: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Scheduling, 2015 – 2025, (US$ Mn and %)

Figure 24: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Asset Management, 2015 – 2025, (US$ Mn and %)

Figure 25: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Inventory Management, 2015 – 2025, (US$ Mn and %)

Figure 26: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Costing, 2015 – 2025, (US$ Mn and %)

Figure 27: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Analytics, 2015 – 2025, (US$ Mn and %)

Figure 28: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Maintenance, 2015 – 2025, (US$ Mn and %)

Figure 29: Global Oil & Gas Project Management Software Market Revenue and Y–o–Y Growth, by Module– Others, 2015 – 2025, (US$ Mn and %)

Figure 30: Global Oil & Gas Project Management Software Market Value Share Analysis, by Module, 2017 and 2025

Figure 31: Global Oil & Gas Project Management Software Market Comparison Matrix, by Module

Figure 32: Oil & Gas Project Management Software Market Attractiveness Analysis by Module (2016)

Figure 33: Global Oil & Gas Project Management Software Market Value Share Analysis, by Region, 2017 and 2025

Figure 34: Global Oil & Gas Project Management Software Market Comparison Matrix, by Region

Figure 35: Global Oil & Gas Project Management Software Market Attractiveness Analysis, by Region, 2016

Figure 36: North America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, 2015 – 2025

Figure 37: North America Oil & Gas Project Management Software Market Y–o–Y Growth (%), 2016 – 2025

Figure 38: North America Oil & Gas Project Management Software Market Share Analysis, by Application, 2017 and 2025

Figure 39: North America Oil & Gas Project Management Software Market Share Analysis, by Application (Upstream), 2017 and 2025

Figure 40: North America Oil & Gas Project Management Software Market Share Analysis, by Deployment, 2017 and 2025

Figure 41: North America Oil & Gas Project Management Software Market Share Analysis, by Module, 2017 and 2025

Figure 42: North America Oil & Gas Project Management Software Market Share Analysis, by Country, 2017 and 2025

Figure 43: North America Oil & Gas Project Management Software Market Attractiveness Analysis, By Application (2016)

Figure 44: North America Oil & Gas Project Management Software Market Attractiveness Analysis, By Deployment (2016)

Figure 45: North America Oil & Gas Project Management Software Market Attractiveness Analysis, By Country (2016)

Figure 46: North America Oil & Gas Project Management Software Market Attractiveness Analysis, By Module (2016)

Figure 47: Europe Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, 2015 – 2025

Figure 48: Europe Oil & Gas Project Management Software Market Y–o–Y Growth (%), 2016–2025

Figure 49: Europe Oil & Gas Project Management Software Market Share Analysis, by Application, 2017 and 2025

Figure 50: Europe Oil & Gas Project Management Software Market Share Analysis, by Application (Upstream), 2017 and 2025

Figure 51: Europe Oil & Gas Project Management Software Market Share Analysis, by Deployment, 2017 and 2025

Figure 52: Europe Oil & Gas Project Management Software Market Share Analysis, by Module, 2017 and 2025

Figure 53: Europe Oil & Gas Project Management Software Market Share Analysis, by Country, 2017 and 2025

Figure 54: Europe Oil & Gas Project Management Software Market Attractiveness Analysis, by Application (2016)

Figure 55: Europe Oil & Gas Project Management Software Market Attractiveness Analysis, by Deployment (2016)

Figure 56: Europe Oil & Gas Project Management Software Market Attractiveness Analysis, by Country (2016)

Figure 57: Europe Oil & Gas Project Management Software Market Attractiveness Analysis, by Module (2016)

Figure 58: Asia Pacific Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, 2015 – 2025

Figure 59: Asia Pacific Oil & Gas Project Management Software Market Y–o–Y Growth (%), 2016–2025

Figure 60: Asia Pacific Oil & Gas Project Management Software Market Share Analysis, by Application, 2017 and 2025

Figure 61: Asia Pacific Oil & Gas Project Management Software Market Share Analysis, by Application (Upstream), 2017 and 2025

Figure 62: Asia Pacific Oil & Gas Project Management Software Market Share Analysis, by Deployment, 2017 and 2025

Figure 63: Asia Pacific Oil & Gas Project Management Software Market Share Analysis, by Module, 2017 and 2025

Figure 64: Asia Pacific Oil & Gas Project Management Software Market Share Analysis, by Country, 2017 and 2025

Figure 65: Asia Pacific Oil & Gas Project Management Software Market Attractiveness Analysis, by Application (2016)

Figure 66: Asia Pacific Oil & Gas Project Management Software Market Attractiveness Analysis, by Deployment (2016)

Figure 67: Asia Pacific Oil & Gas Project Management Software Market Attractiveness Analysis, by Country (2016)

Figure 68: Asia Pacific Oil & Gas Project Management Software Market Attractiveness Analysis, by Module (2016)

Figure 69: Middle East and Africa Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, 2015 – 2025

Figure 70: Middle East and Africa Oil & Gas Project Management Software Market Y–o–Y Growth (%), 2016–2025

Figure 71: Middle East and Africa Oil & Gas Project Management Software Market Share Analysis, by Application, 2017 and 2025

Figure 72: Middle East and Africa Oil & Gas Project Management Software Market Share Analysis, by Application (Upstream), 2017 and 2025

Figure 73: Middle East and Africa Oil & Gas Project Management Software Market Share Analysis, by Deployment, 2017 and 2025

Figure 74: Middle East and Africa Oil & Gas Project Management Software Market Share Analysis, by Module, 2017 and 2025

Figure 75: Middle East and Africa Oil & Gas Project Management Software Market Share Analysis, by Country, 2017 and 2025

Figure 76: Middle East and Africa Oil & Gas Project Management Software Market Attractiveness Analysis, by Application (2016)

Figure 77: Middle East and Africa Oil & Gas Project Management Software Market Attractiveness Analysis, by Deployment (2016)

Figure 78: Middle East and Africa Oil & Gas Project Management Software Market Attractiveness Analysis, by Country (2016)

Figure 79: Middle East and Africa Oil & Gas Project Management Software Market Attractiveness Analysis, by Module (2016)

Figure 80: South America Oil & Gas Project Management Software Market Revenue (US$ Mn) Forecast, 2015 – 2025

Figure 81: South America Oil & Gas Project Management Software Market Y–o–Y Growth (%), 2016–2025

Figure 82: South America Oil & Gas Project Management Software Market Share Analysis, by Application, 2017 and 2025

Figure 83:South America Oil & Gas Project Management Software Market Share Analysis, by Application (Upstream), 2017 and 2025

Figure 84: South America Oil & Gas Project Management Software Market Share Analysis, by Deployment, 2017 and 2025

Figure 85: South America Oil & Gas Project Management Software Market Share Analysis, by Module, 2017 and 2025

Figure 86: South America Oil & Gas Project Management Software Market Share Analysis, by Country, 2017 and 2025

Figure 87: South America Oil & Gas Project Management Software Market Attractiveness Analysis, By Application (2016)

Figure 88: South America Oil & Gas Project Management Software Market Attractiveness Analysis, By Deployment (2016)

Figure 89: South America Oil & Gas Project Management Software Market Attractiveness Analysis, By Country (2016)

Figure 90: South America Oil & Gas Project Management Software Market Attractiveness Analysis, By Module (2016)