Reports

Reports

Machine Learning (ML) and Artificial Intelligence (AI) are known for predictive analysis. Hence, companies in the oil & gas analytics market should develop platforms using ML and AI to ease uncertainty pertaining to oil & gas mergers and acquisitions amidst the ongoing coronavirus (COVID-19) era. The pandemic has caused uncertainty for planned mergers & acquisitions (M&A) in the oil & gas sector, as the virus has caused disruptions in the supply and demand across critical industries.

The oil & gas industry has been plagued with oversupply and declining prices due to the ongoing price war between Saudi Arabia and Russia, thus causing a dilemma for planned M&A agreements. Several hundred M&A deals are at stake due to the COVID-19 pandemic. Hence, companies in the oil & gas analytics market should capitalize on this opportunity to develop software that enable stabilization of supply and demand ratio in the oil & gas industry.

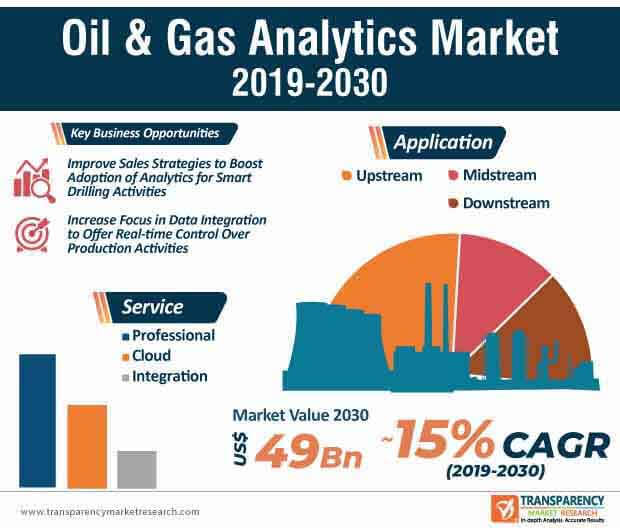

The oil & gas analytics market is anticipated to surpass US$ 49 Bn by the end of 2030. Despite having vast data sources, end-users lack the right tools and expertise to track various data points of oil & gas analytics. Hence, companies are upgrading IT (Information Technology) platforms so that end users can seamlessly track the data points of oil & gas analytics.

Bizmetric-a technologically driven company exhibiting data transformation is helping its oil & gas clients deploy IoT (Internet of Things)-driven applications in today’s digitized era. The involvement of connected devices is one of the key factors for the deployment of IoT in oil & gas analytics. Sensor-enabled devices deliver accurate information in data prediction.

Artificial intelligence is revolutionizing the oil & gas analytics market. However, capitalizing on the data can be potentially challenging for stakeholders in the oil & gas industry. Hence, companies are introducing AI-based solutions to automate end-to-end processes of the upstream sector. Oil & gas analytics is being highly publicized to accelerate the pace of production and ensures site development. Favorable market drivers contribute toward a striking CAGR of ~15% for the oil & gas analytics market during the assessment period.

Production analytics for the energy industry has helped to optimize operational efficiency, where oil & gas companies can gain a competitive edge over other market players. Since multiple operations run parallel in the energy industry, oil & gas analytics have become crucial for stakeholders to predict any occurrences or failures that might hamper production activities.

Digital technologies in the oil & gas industry have interconnected devices that benefit stakeholders in the value chain. Likewise, oil & gas analytics has established predictive maintenance and smart drilling activities that result in cost and time efficiency. Smart oilfields are driving profitability for oil & gas organizations. However, the pace of oil & gas analytics adoption is relatively slow, which poses as a hurdle for market growth. Hence, companies in the oil & gas analytics market are bringing significant changes in their marketing, sale, and service strategies to increase the pace of analytics adoption.

Analytics startups in the oil & gas analytics market are increasing their focus in oil exploration for clients. Careful analysis of geological data to choose the best drilling locations has become increasingly important for oil & gas organizations. Oil & gas analytics are now capable of providing intelligent and real-time management of gas hydrates.

Digital tools such as robotics, predictive maintenance, and connected work technologies are becoming increasingly mainstream in the oil & gas industry. These trends are fueling the adoption of cloud-based analytics tools in order to achieve cost savings. Hence, companies in the oil & gas analytics market are increasing their R&D activities to innovate in cloud-enabled platforms to meet end-user demands. As such, the success of cloud-based tools relies on the usage of specialized sensors that capture real-time information from physical assets, thus leaving enough scope for innovation.

With the help of cloud-based tools, oil & gas operators can analyze all types of data on the fly to accelerate decision-making and deploy transparency in operations. Companies in the oil & gas analytics market are innovating in platforms that enhance field productivity and empower users with real-time feedback on equipment performance.

Predictive analytics in the oil & gas industry is found to reduce risk and facilitate fast decision-making. Teradata Corporation-a provider of database and analytics-related software is increasing its portfolio in oil & gas analytics to offer users a holistic view of their data points regarding drilling and completions, production, and refining. Companies in the oil & gas analytics market are increasing their focus in drill bit failure analysis and enterprise analytics applications to eliminate the complexity of enterprise application integration.

Attaining real-time visibility and control over maintenance costs has helped to create incremental opportunities for oil & gas analytics providers. As such, data integration has become increasingly important for end-users, as platforms help to in-sync data from all sources such as rigs, field assets, sensors, and plants.

Analysts’ Viewpoint

Advanced analytics-driven programs help oil & gas operators to gain insights pertaining to investment decisions amidst the ongoing coronavirus era. Refinery optimization with the help of oil & gas analytics is found to increase return-on-investment. Increasing number of oil & gas operators are formulating their innovation strategies using oil & gas analytics platforms in order to deploy cost savings.

However, structuring new data sources, whilst storing existing data can be potentially challenging for end users. Hence, companies in the oil & gas analytics market should increase the availability of platforms that require simple loading of information to meet convenience needs of users.

Oil & Gas Analytics Market: Overview

Rise in Unconventional Oil & Gas Production to Drive Oil & Gas Analytics Market

Poor Quality of Data and Resistance toward Data Integration to Hamper Oil & Gas Analytics Market

Rise in Demand for Analytics in Oil & Gas Industry to Offer Lucrative Opportunities for Global Oil & Gas Analytics Market

Recent Developments, Expansions, Acquisitions, and New Contracts in Oil & Gas Analytics Market

North America Dominates Global Oil & Gas Analytics Market

Highly Competitive Global Oil & Gas Analytics Market

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

1.4. TMR’s Growth Opportunity Wheel Preface

2. Market Overview

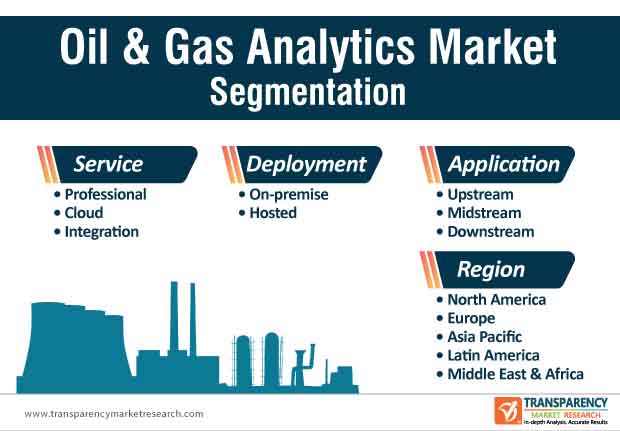

2.1. Market Segmentation

2.2. Market Indicators

3. COVID-19 Impact Analysis

4. Market Overview

4.1. Introduction

4.2. Market Indicators

4.3. Drivers and Restraints Snapshot Analysis

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Porter's Five Forces Analysis

4.4.1. Threat of Substitutes

4.4.2. Bargaining Power of Buyers

4.4.3. Bargaining Power of Suppliers

4.4.4. Threat of New Entrants

4.4.5. Degree of Competition

4.5. Regulatory Scenario

5. Global Oil & Gas Analytics Market Value (US$ Mn) Analysis, by Service

5.1. Key Findings and Introduction

5.2. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

5.2.1. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Professional, 2019–2030

5.2.2. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Cloud, 2019–2030

5.2.3. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Integration, 2019–2030

5.3. Oil & Gas Analytics Market Attractiveness Analysis, by Service

6. Global Oil & Gas Analytics Market Analysis, by Deployment

6.1. Key Findings and Introduction

6.2. Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Deployment, 2019–2030

6.2.1. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by On-premise, 2019–2030

6.2.2. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by On-premise, 2019–2030

6.3. Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

7. Global Oil & Gas Analytics Market Analysis, by Application

7.1. Key Findings and Introduction

7.2. Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Application, 2019–2030

7.2.1. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019–2030

7.2.2. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019–2030

7.2.3. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019–2030

7.3. Oil & Gas Analytics Market Attractiveness Analysis, by Application

8. Global Oil & Gas Analytics Market Analysis, by Region, 2019–2030

8.1. Key Findings

8.2. Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Region, 2019–2030

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Oil & Gas Analytics Market Attractiveness Analysis, by Region

9. North America Oil & Gas Analytics Market Analysis, 2019–2030

9.1. Key Findings

9.2. North America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Service, 2019–2030

9.3. North America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Deployment, 2019–2030

9.4. North America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Application, 2019–2030

9.5. North America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Country, 2019–2030

9.5.1. U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

9.5.2. U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

9.5.3. U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

9.5.4. Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

9.5.5. Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

9.5.6. Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

9.6. North America Oil & Gas Analytics Market Attractiveness Analysis, by Service

9.7. North America Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

9.8. North America Oil & Gas Analytics Market Attractiveness Analysis, by Application

9.9. North America Oil & Gas Analytics Market Attractiveness Analysis, by Country

10. Europe Oil & Gas Analytics Market Analysis, 2019–2030

10.1. Key Findings

10.2. Europe Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Service, 2019–2030

10.3. Europe Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Deployment, 2019–2030

10.4. Europe Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Application, 2019–2030

10.5. Europe Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2019–2030

10.5.1. Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

10.5.2. Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

10.5.3. Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

10.5.4. U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

10.5.5. U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

10.5.6. U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

10.5.7. Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

10.5.8. Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

10.5.9. Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

10.5.10. Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

10.5.11. Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

10.5.12. Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

10.5.13. Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

10.5.14. Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

10.5.15. Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

10.5.16. Rest of Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

10.5.17. Rest of Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

10.5.18. Rest of Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

10.6. Europe Oil & Gas Analytics Market Attractiveness Analysis, by Service

10.7. Europe Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

10.8. Europe Oil & Gas Analytics Market Attractiveness Analysis, by Application

10.9. Europe Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

11. Asia Pacific Oil & Gas Analytics Market Analysis, 2019–2030

11.1. Key Findings

11.2. Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Service, 2019–2030

11.3. Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Deployment, 2019–2030

11.4. Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Application, 2019–2030

11.5. Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2019–2030

11.5.1. China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

11.5.2. China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

11.5.3. China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

11.5.4. India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

11.5.5. India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

11.5.6. India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

11.5.7. ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

11.5.8. ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

11.5.9. ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

11.5.10. Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

11.5.11. Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

11.5.12. Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

11.6. Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Service

11.7. Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

11.8. Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Application

11.9. Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

12. Latin America Oil & Gas Analytics Market Analysis, 2019–2030

12.1. Key Findings

12.2. Latin America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Service, 2019–2030

12.3. Latin America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Deployment, 2019–2030

12.4. Latin America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Application, 2019–2030

12.5. Latin America Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Country and Sub-region2019–2030

12.5.1. Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

12.5.2. Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

12.5.3. Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

12.5.4. Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

12.5.5. Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

12.5.6. Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

12.5.7. Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

12.5.8. Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

12.5.9. Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

12.5.10. Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

12.5.11. Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

12.6. Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Service

12.7. Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

12.8. Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Application

12.9. Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

13. Middle East & Africa Oil & Gas Analytics Market Analysis, 2019–2030

13.1. Key Findings

13.2. Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Service, 2019–2030

13.3. Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Deployment, 2019–2030

13.4. Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Application, 2019–2030

13.5. Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Analysis & Forecast, by Country and Sub-region2019–2030

13.5.1. Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

13.5.2. Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

13.5.3. Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

13.5.4. Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

13.5.5. Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

13.5.6. Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

13.5.7. UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

13.5.8. UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

13.5.9. UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

13.5.10. Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

13.5.11. Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

13.5.12. Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

13.5.13. Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

13.5.14. Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

13.5.15. Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

13.5.16. Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019–2030

13.5.17. Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019–2030

13.5.18. Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019–2030

13.6. Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Service

13.7. Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

13.8. Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Application

13.9. Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

14. Competition Landscape

14.1. Oil & Gas Analytics Market Share Analysis, by Company (2018)

14.2. Company Profiles

14.2.1. Hitachi, Ltd.

14.2.1.1. Company Details

14.2.1.2. Company Description

14.2.1.3. Business Overview

14.2.1.4. Financial Overview

14.2.1.5. Strategic Overview

14.2.2. Capgemini

14.2.2.1. Company Details

14.2.2.2. Company Description

14.2.2.3. Business Overview

14.2.2.4. Financial Overview

14.2.2.5. Strategic Overview

14.2.3. Accenture

14.2.3.1. Company Details

14.2.3.2. Company Description

14.2.3.3. Business Overview

14.2.3.4. Financial Overview

14.2.3.5. Strategic Overview

14.2.4. Hewlett Packard Enterprise Development LP

14.2.4.1. Company Details

14.2.4.2. Company Description

14.2.4.3. Business Overview

14.2.4.4. Financial Overview

14.2.4.5. Strategic Overview

14.2.5. IBM

14.2.5.1. Company Details

14.2.5.2. Company Description

14.2.5.3. Business Overview

14.2.5.4. Financial Overview

14.2.5.5. Strategic Overview

14.2.6. Northwest Analytics, Inc.

14.2.6.1. Company Details

14.2.6.2. Company Description

14.2.6.3. Business Overview

14.2.7. Oracle

14.2.7.1. Company Details

14.2.7.2. Company Description

14.2.7.3. Business Overview

14.2.7.4. Financial Overview

14.2.7.5. Strategic Overview

14.2.8. SAP

14.2.8.1. Company Details

14.2.8.2. Company Description

14.2.8.3. Business Overview

14.2.8.4. Financial Overview

14.2.8.5. Strategic Overview

14.2.9. SAS Institute Inc.

14.2.9.1. Company Details

14.2.9.2. Company Description

14.2.9.3. Business Overview

14.2.9.4. Financial Overview

14.2.9.5. Strategic Overview

14.2.10. TABLEAU SOFTWARE, LLC

14.2.10.1. Company Details

14.2.10.2. Company Description

14.2.10.3. Business Overview

14.2.11. Teradata

14.2.11.1. Company Details

14.2.11.2. Company Description

14.2.11.3. Business Overview

14.2.11.4. Financial Overview

14.2.11.5. Strategic Overview

14.2.12. TIBCO Software Inc.

14.2.12.1. Company Details

14.2.12.2. Company Description

14.2.12.3. Business Overview

14.2.13. Cognizant

14.2.13.1. Company Details

14.2.13.2. Company Description

14.2.13.3. Business Overview

14.2.13.4. Financial Overview

14.2.13.5. Strategic Overview

15. Primary Research – Key Insights

16. Appendix

16.1. Research Methodology and Assumptions

List of Tables

Table 1: Global Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 2: Global Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 3: Global Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 4: Global Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 5: Global Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 6: Global Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 7: North America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Country, 2019?2030

Table 8: North America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 9: North America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 10: North America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 11: North America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 12: North America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 13: North America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 14: U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 15: U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 16: U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 17: U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 18: U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 19: U.S. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 20: Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 21: Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 22: Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 23: Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 24: Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 25: Canada Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 26: Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Country and Sub region, 2019?2030

Table 27: Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 28: Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 29: Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 30: Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 31: Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 32: Europe Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 33: Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 34: Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 35: Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 36: Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 37: Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 38: Germany Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 39: U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 40: U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 41: U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 42: U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 43: U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 44: U.K. Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 45: Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 46: Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 47: Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 48: Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 49: Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 50: Italy Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 51: Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 52: Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 53: Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 54: Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 55: Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 56: Norway Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 57: Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 58: Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 59: Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 60: Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 61: Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 62: Russia & CIS Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 63: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Country and Sub region, 2019?2030

Table 64: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 65: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 66: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 67: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 68: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 69: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 70: China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 71: China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 72: China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 73: China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 74: China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 75: China Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 76: India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 77: India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 78: India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 79: India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 80: India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 81: India Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 82: ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 83: ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 84: ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 85: ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 86: ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 87: ASEAN Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 88: Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 89: Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 90: Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 91: Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 92: Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 93: Rest of Asia Pacific Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 94: Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019?2030

Table 95: Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 96: Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 97: Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 98: Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 99: Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 100: Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 101: Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 102: Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 103: Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 104: Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 105: Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 106: Brazil Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 107: Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 108: Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 109: Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 110: Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 111: Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 112: Mexico Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 113: Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 114: Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 115: Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 116: Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 117: Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 118: Venezuela Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 119: Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 120: Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 121: Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 122: Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 123: Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 124: Rest of Latin America Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 125: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019?2030

Table 126: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 127: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 128: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 129: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 130: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 131: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 132: Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 133: Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 134: Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 135: Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 136: Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 137: Saudi Arabia Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 138: Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 139: Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 140: Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 141: Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 142: Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 143: Iran Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 144: UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 145: UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 146: UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 147: UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 148: UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 149: UAE Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 150: Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 151: Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 152: Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 153: Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 154: Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 155: Kuwait Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 156: Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 157: Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 158: Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 159: Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 160: Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 161: Nigeria Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

Table 162: Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Service, 2019?2030

Table 163: Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Deployment, 2019?2030

Table 164: Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Application, 2019?2030

Table 165: Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Upstream, 2019?2030

Table 166: Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Midstream, 2019?2030

Table 167: Rest of Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn) Forecast, by Downstream, 2019?2030

List of Figures

Figure 01: Global Oil & Gas Analytics Market Value Share Analysis, by Service

Figure 02: Global Oil & Gas Analytics Market Attractiveness Analysis, by Service

Figure 03: Global Oil & Gas Analytics Market Value Share Analysis, by Deployment

Figure 04: Global Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

Figure 04: Global Oil & Gas Analytics Market Value Share Analysis, by Application

Figure 06: Global Oil & Gas Analytics Market Attractiveness, by Application

Figure 07: Global Oil & Gas Analytics Market Value Share, by Region

Figure 08: Global Oil & Gas Analytics Market Attractiveness, by Region

Figure 09: North America Oil & Gas Analytics Market Value (US$ Mn), 2019–2030

Figure 10: North America Oil & Gas Analytics Market Value Share Analysis, by Country, 2019, 2025, and 2030

Figure 11: North America Oil & Gas Analytics Attractiveness Analysis, by Country

Figure 12: North America Oil & Gas Analytics Market Value Share Analysis, by Service

Figure 13: North America Oil & Gas Analytics Market Value Share Analysis, by Deployment

Figure 14: North America Oil & Gas Analytics Market Value Share Analysis, by Application

Figure 15: North America Oil & Gas Analytics Market Attractiveness Analysis, by Service

Figure 16: North America Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

Figure 17: North America Oil & Gas Analytics Market Attractiveness Analysis, by Application

Figure 18: Europe Oil & Gas Analytics Market Value (US$ Mn), 2019–2030

Figure 19: Europe Oil & Gas Analytics Market Value Share Analysis, by Country and Sub-region 2019, 2025, and 2030

Figure 20: Europe Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Europe Oil & Gas Analytics Market Value Share Analysis, by Service

Figure 22: Europe Oil & Gas Analytics Market Value Share Analysis, by Deployment

Figure 23: Europe Oil & Gas Analytics Market Value Share Analysis, by Application

Figure 24: Europe Oil & Gas Analytics Market Attractiveness Analysis, by Service

Figure 25: Europe Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

Figure 26: Europe Oil & Gas Analytics Market Attractiveness Analysis, by Application

Figure 27: Asia Pacific Oil & Gas Analytics Market Value (US$ Mn), 2019–2030

Figure 28: Asia Pacific Oil & Gas Analytics Market Value Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 29: Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

Figure 30: Asia Pacific Oil & Gas Analytics Market Value Share Analysis, by Service

Figure 31: Asia Pacific Oil & Gas Analytics Market Value Share Analysis, by Deployment

Figure 32: Asia Pacific Oil & Gas Analytics Market Value Share Analysis, by Application

Figure 33: Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Service

Figure 34: Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

Figure 35: Asia Pacific Oil & Gas Analytics Market Attractiveness Analysis, by Application

Figure 36: Latin America Oil & Gas Analytics Market Value (US$ Mn), 2019–2030

Figure 37: Latin America Oil & Gas Analytics Market Value Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 38: Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

Figure 39: Latin America Oil & Gas Analytics Market Value Share Analysis, by Service

Figure 40: Latin America Oil & Gas Analytics Market Value Share Analysis, by Deployment

Figure 41: Latin America Oil & Gas Analytics Market Value Share Analysis, by Application

Figure 42: Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Service

Figure 43: Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

Figure 44: Latin America Oil & Gas Analytics Market Attractiveness Analysis, by Application

Figure 45: Middle East & Africa Oil & Gas Analytics Market Value (US$ Mn), 2019–2030

Figure 46: Middle East & Africa Oil & Gas Analytics Market Value Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 47: Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Country and Sub-region

Figure 48: Middle East & Africa Oil & Gas Analytics Market Value Share Analysis, by Service

Figure 49: Middle East & Africa Oil & Gas Analytics Market Value Share Analysis, by Deployment

Figure 50: Middle East & Africa Oil & Gas Analytics Market Value Share Analysis, by Application

Figure 51: Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Service

Figure 52: Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Deployment

Figure 53: Middle East & Africa Oil & Gas Analytics Market Attractiveness Analysis, by Application