Non-Life-Insurance Platforms: Introduction

- Damage caused by a specific financial event is likely to be charged to the insured, which is known as non-life insurance. Non-life-insurance is also known as property insurance, general insurance, and casualty insurance. It is a type of insurance that is not related to life insurance. Non-life-insurance policies cover people, legal liabilities, and property.

- Non-life-insurance refers to property and asset insurance. Insurance that is taken out of property other than human life is known as non-life insurance.

- An individual or organization suffers a significant financial loss as a result of destruction of its tangible belongings. Consequently, an individual or organization can protect property from various threats such as marine risk, etc.

- Non-life-insurance provides financial security for machines, buildings, furniture, equipment, vehicles, and goods against earthquakes, fire, theft, and accidents

- The non-life-insurance platforms market consists of offerings that support the idea of the digital corporate platform through the amalgamation of fundamental systems and significant technologies with a focus on partners, customers, data, or things

- These core platforms include elements such as data storage, core systems, reports and analysis, agent and application portal, customer and application portal, integration accelerator, provider, and application portal

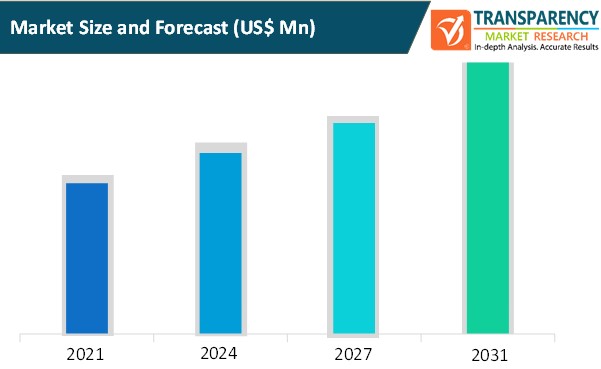

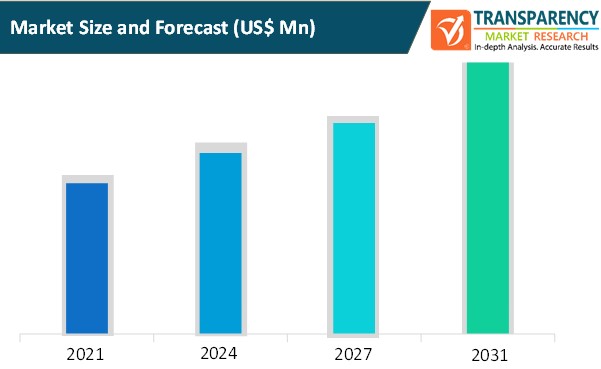

- The global non-life-insurance platforms market is projected to expand significantly during the forecast period. The market is estimated to expand at a steady pace in 2021 owing to the increasing adoption of business strategies by major players, the market is expected to protrude beyond the projected horizon.

Global Non-Life-Insurance Platforms Market: Dynamics

Global Non-Life-Insurance Platforms Market: Key Drivers

- Expansion of industries such as automotive and healthcare as well as the strengthening of the online sales channel is further boosting the non-life-insurance platforms market

- The non-life-insurance platforms market is anticipated to expand during the forecast period due to economic growth witnessed by countries across the globe, which in turn is likely to increase the adoption of such platforms

- Significant increase in demand for automobiles and auto insurance liability is expected to fuel the non-life-insurance platforms in the next few years

- Growing health awareness and increasing propensity for preventive healthcare are boost the health insurance segment, which in turn is expected to boost the global non-life-insurance platforms during the forecast period

- People prefer to purchase insurance plans through direct company distribution channels since the process is quick and simple. Consequently, the need for non-life-insurance platforms is expected to rise in the near future.

- However, limited incentives for brokers and agents as well as supply-side issues in associated industries are estimated to restrain the global non-life-insurance platforms during the forecast period

Impact of COVID-19 on the Global Non-Life-Insurance Platforms Market

- COVID-19 is having a massive impact on small, medium, and large businesses and various industries such as automotive, textiles, manufacturing, hospitality, travel and transportation due to country-level lockdowns around the world

- In 2020, non-life insurance companies dropped; however, the claims are increased for non-life insurance within the period due to the lockdown in every country. Hence, the impact of COVID-19 on non-life-insurance platforms is neutral.

North America to Hold Major Share of Global Non- Life-Insurance Platforms Market

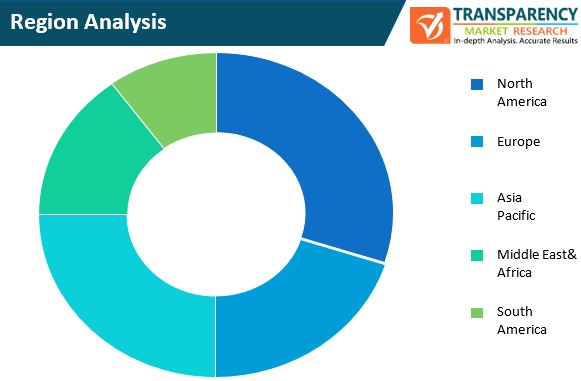

- The global non-life-insurance platforms market can be divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America

- North America is expected to hold a prominent share of the global non-life-insurance platforms market due to the presence of developing countries and advanced technologies used in various industrial sectors in the region

- Almost a third of the world's population lives in Asia Pacific, and is home to expanding economies, and several countries with a rapidly growing middle class, which in turn is expected to increase the demand for non-life-insurance platforms during the forecast period.

- Adoption of non-life-insurance platforms in Europe is increasing and cloud and intelligent decision support are becoming key differentiators. Hence, the non-life-insurance platform market in Europe is estimated to expand during the forecast period.

Global Non- Life-Insurance Platforms Market: Competition Landscape

- Various key players are active in the non-life-insurance platform's market such as Allianz SE, Swiss Reinsurance Company Ltd., Chubb Limited, etc.

- In July 2021, Allianz (China) declared that Allianz Insurance Asset Management Co., Ltd. has been approved by the China Insurance and Banking Regulatory Commission to become the country's first fully foreign property insurance asset management company, with a recorded capital of RMB 100 million and headquarters in Beijing.

- Swiss Re Group, a provider of insurance, reinsurance, and other forms of insurance-based risk transfer, works to make the world more resilient. The Swiss Re Group emphasizes on helping the society prosper and progress and to create solutions and new opportunities for its customers.

Key players operating in the global non-life-insurance platforms market include:

- Allianz SE

- Assicurazioni Generali S.p.A.

- China Life Insurance Company Limited

- Munich Re Group

- Zurich Insurance Group Ltd.

- Reliance Nippon Life Insurance Company

- Japan Post Holdings Co., Ltd.

- Berkshire Hathaway Inc.

- MetLife, Inc.

- Manulife Financial Corporation

- Chubb Limited

- Aviva Inc.

- The Allstate Corporation

- Swiss Reinsurance Company Ltd.

- Prudential Financial, Inc.

- AIA Group Limited

- Aflac Inc.

Global Non-Life-Insurance Platforms Market: Research Scope

Global Non-Life-Insurance Platforms Market, by Type

- Marine insurance

- Home insurance

- Travel insurance

- Health insurance

- Motor insurance

- Commercial insurance

Global Non-Life-Insurance Platforms Market, by Enterprise size

- Large Enterprises

- Small and Medium Enterprises

Global Non-Life-Insurance Platforms Market, by Deployment

Global Non-Life-Insurance Platforms Market, by Application

- Agency

- Brokers

- Bancassurance

- Digital & Direct Channels

Global Non-Life-Insurance Platforms Market, by End-user

- BFSI

- Retail

- IT & Telecommunication

- Transportation & Logistics

- Healthcare

- Manufacturing

- Others

Global Non-Life-Insurance Platforms Market, by Region

- North America

- U.S.

- Canada

- Rest of North America

- Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America