Reports

Reports

Special focus on ferroalloys continues to grow, due to their growing importance in the iron and steel industry. Any fluctuation in prices and instability in the steel industry have a direct effect on the growth of the noble ferroalloys market. Noble ferroalloys are used in the manufacturing of steel, stainless steel, and superalloys; the steel industry consumes ~ 80% of the produced noble ferroalloys around the world.

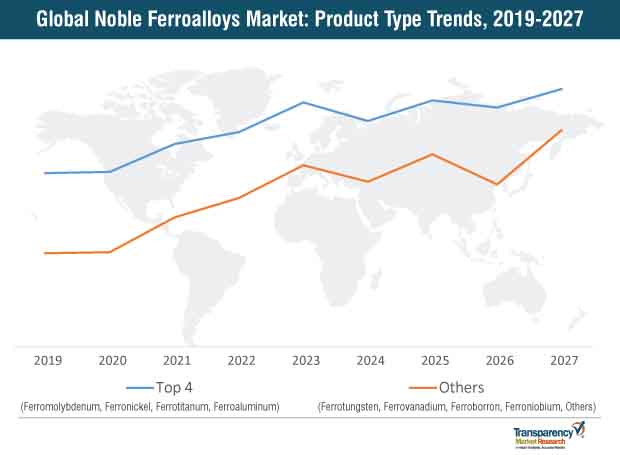

To develop a clear understanding of the growth of the global noble ferroalloys market, Transparency Market Research piloted a comprehensive study on this market space. Researchers have presented their analysis for the period of 2019 to 2027, to thoroughly understand the potential of the global noble ferroalloys market. With this information, players in the global noble ferroalloys market can take better and well-informed business decisions to further their business growth.

The growth and decline of the global ferroalloys market is directly linked with the ups and downs taking place in the global steel market. As China is a dominating global steel producer, holding ~ 51% share of the world’s crude steel production, it largely influences the growth of the global noble ferroalloys market. Things changed when recently, China and the U.S. became locked in an ugly trade war. In addition to this, uncertainties regarding the trade environment, rising interest rates, and complacent financial markets have also adversely impacted the growth of the steel market. Attributing to these global scenarios, the demand for steel dipped in 2016-2017. However, the global steel market regained its pace, but at a moderate growth rate in the following years.

With current instability in the steel industry, fluctuations are expected to come as impediments in the growth of the noble ferroalloys space. In 2018, the global noble ferroalloys market was valued at ~ US$ 32 billion, and the market is projected to reach ~ US$ 68 billion by the end of 2027.

China – Largest Steel Producer

China is the largest producer of steel, and in 2018, it produced ~ 928 million tons (MT) of steel, up from ~ 870 MT in 2017, an increase of 6.6 percent. In early 2018, the Chinese steel industry took a hit due to huge tariffs imposed by the U.S. on Chinese goods. The situation turned into a trade war between these two giant economies. This eventually affected the growth of the global noble ferroalloys market too. It also had a ripple effect on other countries closely connected to China’s supply chain for steel, such as India, Japan, Korea, and others. As a counter, the Chinese government also imposed certain import tariffs on U.S. goods. This is an ongoing situation and its outcome is likely to affect the noble ferroalloys market in one way or another. As per TMR analysis, the steel industry in China is expected to grow in the coming years, due to increasing infrastructural developments and the expanding construction industry in the Asia Pacific region.

Bright Future for the Ferroalloys Market in India

India has overtaken Japan as far as steel production is concerned, and now stands second, globally. In 2018, India’s crude steel production shot up by 4.9%, reaching 106 MT from 101 MT in 2017. Growth in steel production has significantly benefited the noble ferroalloys market. Noble ferroalloy producers are innovating and introducing new technologies in processing and plant equipment designs. With increasing infrastructural development in India, the noble ferroalloys market is expected to have a bright future in India in the near future. Although, there are chances that the market in India might be adversely affected due to cheaper imports from China.

Companies manufacturing noble ferroalloys in India are expected to witness high growth due to increasing infrastructural development and construction. According to international reports, India is expected to rise at an annual GDP growth rate of 7.5 percent in 2019. Despite the global slowdown for steel, Indian demand has shown resilience. Infrastructure development is the key growth driver, as the Indian infrastructure sector witnessed 91 mergers and acquisition deals worth US$ 5.4 billion in 2017. The development of smart cities and increasing urbanization has further attracted investments from companies across the globe. With ~ 50% of steel consumed for infrastructure development, this sector opens huge opportunities for the global noble ferroalloys market.

U.S. Stake in Steel Production

In 2017, U.S. steel demand grew substantially due to strong consumer spending and business investment, supported by tax and regulatory changes. But growth in the construction sector was moderate. The overall production of steel in the U.S. was ~ 95 million tons in 2018. Steel demand growth during 2019-2020 is expected to slow down, attributing to modest growth in auto manufacturing and construction activity in the country. However, the manufacturing sector is expected to perform well based on the growing strength of the machinery and equipment sector.

Prominent Players Leveraging Advanced Technologies to Enhance Production of Noble Ferroalloys

Noble ferroalloy manufacturers are focusing on using new technologies and innovations to design plant equipment, process technology, and product mix. Their main objective is to improve the overall efficiency and cost-effectiveness of ferroalloy production plants. For instance, SMS Siemag AG has developed a new technology for ferroalloy production, by using the vacuum technique and the converter technology, which is anticipated to reduce thermal loss, lessen operating costs, and reduce nitrogen and hydrogen content in steel alloy compositions.

Growing Use of Ferroniobium in the Automotive Sector

The use of ferroniobium has been increasing considerably in the automobile sector. Ferroniobium helps produce lighter structures without compromising on their strength. Ferroniobium can also be employed in the production of lighter cars that run on lower amounts of fuel. In North America, Canada is a prominent producer of ferroniobium. This is majorly used for the production of high-strength, low-alloy (HSLA) steel, which is used in automotive, construction, and pipeline industries. As per the technology used by AMG Advanced Metallurgical Group N.V., ferroniobium is produced by the aluminothermic reduction of niobium oxide. This procedure helps in improving the wear, heat, and corrosion resistance in superalloys.

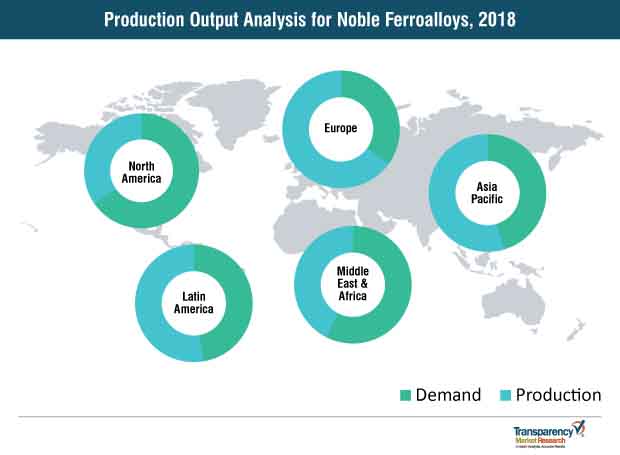

Countries such as India and China are production hubs for noble ferroalloys. Noble ferroalloys are crucial components that are required for the manufacturing of stainless steel, foundry, steel making, welding rods, wire products, and others. Among the various noble ferroalloys, the demand for ferronickel is the highest. In 2018, the export value of ferronickel crossed the US$ 5 billion mark, which is likely to increase in the coming years. China, India, Russia & CIS (Commonwealth of Independent States), and Kazakhstan are the major producers of noble ferroalloys. These countries have ~ 70% of the world’s noble ferroalloys production capacity. But strict EPA regulations in China, along with price fluctuations in the stainless steel market in the country, results in an unstable import-export trade scenario.

Noble Ferroalloys Market: Fragmented Landscape

The presence of a large number of producers of noble ferroalloys has created a highly fragmented market structure. A large number of leading players are concentrated in the Asia Pacific region. Companies engaged in the production of noble ferroalloys are specialized in single noble ferroalloys, among all the noble ferroalloys. Leading players in the global noble ferroalloys market are engaged in mergers and acquisitions, expansion, collaborations, and innovation. For instance, AMG Advanced Metallurgical Group N.V. recently started two new strategic operating divisions: AMG Technologies and AMG Critical Materials. Among the seven operating units, AMG Vanadium is the largest producer of ferrovanadium in North America; it has its own proprietary technology based on the pyrometallurgical process. Recently, the company announced that AMG Vanadium LLC entered into an agreement to supply 7 million pounds of vanadium to a U.S.-based steel producer for the next two years, starting from January 2019.

Other prominent players in the global noble ferroalloys market are also focusing on research and development activities to develop new and customized products. They are also engaged in delivering support services to their customers. Moreover, national and international ferroalloy conferences are also benefiting producers in expanding their presence and establishing relationships with other industry players.

Analysts’ Viewpoint

Analysts have a positive outlook for the global noble ferroalloys market, as steel is extensively used in construction and infrastructural development. Analysts believe that, the U.S.-China trade war will have an adverse effect on market growth, which, if addressed, would help the market grow faster. Players in Asia Pacific are enjoying a certain level of dominance in the noble ferroalloys market, due to the high availability of raw materials in the region. Prominent players in the market are willing to invest in research and development with the objective of providing better and enhanced products and services. New entrants need to connect with big industry players, mainly through national/international conferences, besides others means, as this will help them in creating a robust brand image and presence in the market. They also need to focus on developing new technologies, just as a few leading companies are already doing, as this will help them gain an edge in the production of noble ferroalloys.

Rise in Demand for Steel in Various End-Use Industries Driving the Noble Ferroalloys Market

Market Indicators for the Noble Ferroalloys Market

Ferronickel Accounted for a Prominent Share of the Noble Ferroalloy Market

Demand for Noble Ferroalloys to Increase in High Grade Steel and Superalloys

Asia Pacific Expected to be a Highly Lucrative Market

Noble Ferroalloys Market - Competitive Landscape:

A majority of companies are located in Asia Pacific. Key players that operate in the noble ferroalloys market include

List of Tables

Table 1: Global Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 2: Global Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 3: Global Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 4: Global Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 5: Global Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Region, 2018–2027

Table 6: Global Noble Ferroalloys Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 7: North America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 8: North America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 9: North America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 10: North America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 13: North America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Country, 2018–2027

Table 14: North America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 15: U.S. Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 16: U.S. Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 17: U.S. Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 18: U.S. Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 19: Canada Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 20: Canada Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 21: Canada Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 22: Canada Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 23: Europe Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 24: Europe Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 25: Europe Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 26: Europe Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 27: Europe Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 28: Europe Noble Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 29: Germany Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 30: Germany Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 31: Germany Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 32: Germany Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 33: France Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 34: France Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 35: France Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 36: France Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 37: U.K. Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 38: U.K. Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 39: U.K. Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 40: U.K. Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 41: Italy Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 42: Italy Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 43: Italy Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 44: Italy Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 45: Spain Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 48: Spain Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 49: Spain Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 50: Spain Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 51: Russia & CIS Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 52: Russia & CIS Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 53: Russia & CIS Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 54: Russia & CIS Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 55: Rest of Europe Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 58: Rest of Europe Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 59: Rest of Europe Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 60: Rest of Europe Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 61: Asia Pacific Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 63: Asia Pacific Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 64: Asia Pacific Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 65: Asia Pacific Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 66: Asia Pacific Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 67: Asia Pacific Noble Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 68: China Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 69: China Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 70: China Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 71: China Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 72: Japan Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 73: Japan Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 74: Japan Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 75: Japan Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 76: India Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 77: India Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 78: India Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 79: India Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 80: ASEAN Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 81: ASEAN Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 82: ASEAN Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 83: ASEAN Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 84: Rest of Asia Pacific Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 85: Rest of Asia Pacific Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 86: Rest of Asia Pacific Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 87: Rest of Asia Pacific Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 88: Latin America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 89: Latin America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 90: Latin America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 91: Latin America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 92: Latin America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 93: Latin America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 94: Brazil Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 95: Brazil Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 96: Brazil Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 97: Brazil Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 98: Mexico Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 99: Mexico Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 100: Mexico Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 101: Mexico Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 102: Rest of Latin America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 103: Rest of Latin America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 104: Rest of Latin America Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 105: Rest of Latin America Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 106: Middle East & Africa Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 107: Middle East & Africa Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 108: Middle East & Africa Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 109: Middle East & Africa Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 110: Middle East & Africa Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 111: Middle East & Africa Noble Ferroalloys Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 112: GCC Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 113: GCC Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 114: GCC Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 115: GCC Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 116: South Africa Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 117: South Africa Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 118: South Africa Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 119: South Africa Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 120: India Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Product, 2018–2027

Table 121: Rest of Middle East & Africa Noble Ferroalloys Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 122: Rest of Middle East & Africa Noble Ferroalloys Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 123: Rest of Middle East & Africa Noble Ferroalloys Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 1: Global Noble Ferroalloys Market Value Share Analysis, by Product, 2018 and 2027

Figure 2: Global Noble Ferroalloys Market Attractiveness Analysis, by Product, 2019-2027

Figure 3: Global Noble Ferroalloys Market Value Share Analysis, by Application, 2018 and 2027

Figure 4: Global Noble Ferroalloys Market Attractiveness Analysis, by Application, 2018

Figure 5: Global Noble Ferroalloys Market Value Share Analysis, by Region, 2018 and 2027

Figure 6: Global Noble Ferroalloys Market Attractiveness Analysis, by Region, 2019-2027

Figure 7: North America Noble Ferroalloys Market Value Share, by Product, 2018 and 2027

Figure 8: North America Noble Ferroalloys Market Value Share, by Application, 2018 and 2027

Figure 9: North America Noble Ferroalloys Market Value Share, by Country, 2018 and 2027

Figure 10: North America Noble Ferroalloys Market Attractiveness, by Country, 2018–2027

Figure 11: Europe Noble Ferroalloys Market Value Share Analysis, by Product, 2018 and 2027

Figure 12: Europe Noble Ferroalloys Market Value Share Analysis, by Application, 2018 and 2027

Figure 13: Europe Noble Ferroalloys Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 14: Europe Noble Ferroalloys Market attractiveness Analysis, by Product, 2018 and 2027

Figure 15: Europe Noble Ferroalloys Market attractiveness Analysis, by Application, 2018

Figure 16: Europe Noble Ferroalloys Market attractiveness Analysis, by Country and Sub-region, 2018 and 2027

Figure 17: Asia Pacific Noble Ferroalloys Market Value Share Analysis, by Product, 2018 and 2027

Figure 18: Asia Pacific Noble Ferroalloys Market Value Share Analysis, by Application, 2018 and 2027

Figure 19: Asia Pacific Noble Ferroalloys Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 20: Asia Pacific Noble Ferroalloys Market Attractiveness, by Product, 2018

Figure 21: Asia Pacific Noble Ferroalloys Market Attractiveness, by Application, 2018

Figure 22: Asia Pacific Noble Ferroalloys Market Attractiveness, by Country and Sub-region, 2018

Figure 23: Latin America Noble Ferroalloys Market Value Share, by Product, 2018 and 2027

Figure 24: Latin America Noble Ferroalloys Market Value Share, by Application, 2018 and 2027

Figure 25: Latin America Noble Ferroalloys Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 26: Latin America Noble Ferroalloys Market Attractiveness, by Product, 2018

Figure 27: Latin America Noble Ferroalloys Market Attractiveness, by Application, 2018

Figure 28: Latin America Noble Ferroalloys Market Attractiveness, by Country and Sub-region, 2018

Figure 29: Middle East & Africa Noble Ferroalloys Market Value Share Analysis, by Product, 2018 and 2027

Figure 30: Middle East & Africa Noble Ferroalloys Market Value Share Analysis, by Application, 2018 and 2027

Figure 31: Middle East & Africa Noble Ferroalloys Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 32: Middle East & Africa Noble Ferroalloys Market attractiveness Analysis, by Product, 2018 and 2027

Figure 33: Middle East & Africa Noble Ferroalloys Market attractiveness Analysis, by Application, 2018

Figure 34: Middle East & Africa Noble Ferroalloys Market attractiveness Analysis, by Country and Sub-region, 2018 and 2027