Reports

Reports

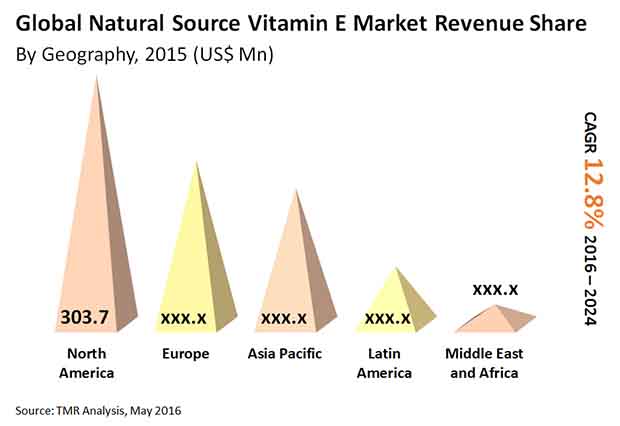

The global natural source vitamin E market is driven by an increased awareness among consumers about health and intake of necessary vitamins and minerals. The growing disposable income is increasing the affordability of products and this is also propelling the demand for natural source vitamin E. Amidst the market’s struggle due to declining supplies of deodorized distillates, a key raw material used for manufacturing natural Vitamin E, the market will expand at a12.8% CAGR from 2016 to 2024, states Transparency Market Research (TMR). With sustainable demand from the wealthy or well-to-do customer base, the market is estimated to be worth US$2,251.7 mn by 2024.

There are two variants of natural source vitamin E available in the market: tocopherol and tocotrienol. Of these, tocopherol is expected to lead in terms of demand as well as in terms of being the highest revenue contributor. The tocopherol segment accounted for 65% of the market back in 2015. High use in dietary supplements is a key reason for the growing demand for tocopherol. As tocotrienols are difficult to absorb during digestion and are also poorly distributed to blood cells, their demand will is low. Moreover, they are rapidly metabolized and eliminated from the body. Thus, its application is limited to cosmetics, where it is used for anti-aging creams. Therefore, tocotrienols occupies a significantly lower share as compared to tocopherol in the natural source vitamin E market.

The applications for natural source vitamin E include dietary supplements, cosmetics, food and beverage, and animal feed. Of these, the dietary supplements segment not only led in the past but will also witness growth in the coming years on account of the promise supplements hold in preventing chronic diseases or of the promise of longevity. The expansion of distribution chains will also aid the demand for vitamin E-based dietary supplements such as energy drinks, tablets, and capsules.

The market for natural source vitamin E is flourishing in Europe and North America. The market for natural source vitamin E market in North America was accounted for over 40% in 2015 and 26% in Europe. The growing awareness about having a healthy lifestyle and the increasing realization of the importance of nutrients by making use of supplements are both driving the natural source vitamin E market in these two regions. The presence of excellent distribution channels will also ensure the growth of the market in Europe and North America. The increasing affordability of natural source vitamin E on account of increasing disposable income in developing nations of Asia Pacific is helping the market in APAC to grow. It is estimated that during the forecast period of 2016 to 2024, the Asia Pacific natural source vitamin E market will expand at a 13.3% CAGR. China will be a lucrative market in Asia Pacific region for natural source vitamin E.

Demands in Natural Source Vitamin E Market Thrive on Growing Focus of People on Disease Prevention

Vitamin E intake has earned massive attention due to their distinct antioxidant activities, which make the sources highly desirable to prevent diseases due to oxidation. Cancer, aging, cataracts, and arthritis are some of the target diseases. Vitamin E comprises a group of fat-soluble compounds or is a lipid-soluble component. The group is collectively termed tocochromanols, and can be divided into tocopherols and tocotrienols. Eight naturally occurring forms of the vitamin are present. Dietary supplement manufacturers, food and beverages companies, and cosmetics companies have been showing substantial R&D interest in natural source vitamin E. The popularity has stemmed from the numerous health benefits of the vitamin, and is a key factor propelling industry investments in the natural source vitamin E market. Most notably, the need has stemmed for managing cardiovascular risks. Growing awareness about the dietary sources of vitamin E has also increased in general population, and the trend has played a crucial role in the expansion of the natural source vitamin E market. A better understanding of recommended dietary allowances (RDAs) for vitamin E will certainly benefit supplement manufacturers to better target the cohort likely to suffer from deficiencies.

The COVID-19 pandemic has brought a rapid resurgence of interest in supplements and nutraceuticals for populations of all ages. The post-pandemic world has seen many supplement trends falling apart and new contours gathering traction among end-use industries. With the changing trends, new vistas of growth have notably emerged in the recent months. The medical industry has also been at the vanguard and are supporting some of these trends. Further, new regulations are supporting the steady approval of new ingredients in the cosmetics industries in some parts of the developing world. A growing body of studies from time to time over the past two decades have reiterated the health benefits of natural source vitamin E market. The role of the vitamin E supplements in lowering the risk of mortality from thromboembolism in healthy women is a case in point.

Chapter 1 Preface

1.1 Report description

1.2 Research scope

1.3 Key Take away

1.4 Research methodology

Chapter 2 Executive Summary

Chapter 3 Natural Source Vitamin E MarketOverview

3.1 Introduction

3.2 Key Trend Analysis

3.3 Market dynamics

3.3.1 Market Drivers

3.3.2 Market Restraints

3.3.3 Market Opportunities

3.4 Value Chain Analysis

3.5 Natural Source Vitamin E Market: Competitive Landscape

3.5.1 Market Share of Key Players, 2015 (%)

3.5.2 Competitive Strategies Adopted by Major Players

3.6 Market Attractiveness Analysis: Description

3.6.1 Market Attractiveness Analysis, By Application, 2015

Chapter 4 Global Natural Source Vitamin E Market: By Product Type:

4.1 Overview

4.1.1 Global Natural Source Vitamin E Market Revenue Share, By Product Type, 2015 and 2024

4.2 Global Tocopherols Market, 2015 – 2024 (USD Million)

4.3 Global Tocotrienols Market, 2015 – 2024 (USD Million)

Chapter 5 Global Natural Source Vitamin E Market: By Application Type:

5.1 Overview

5.1.1 Global Natural Source Vitamin E Market Revenue Share, By Application Type, 2015 and 2024

5.2 Global Global Dietary Supplements Market, 2015 – 2024 (USD Million)

5.3 Global Food and Beverages Market, 2015 – 2024 (USD Million)

5.4 Global Cosmetics Market, 2015 – 2024 (USD Million)

5.5 Global Other Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

Chapter 6 North AmericaNatural Source Vitamin E Market: By Region:

6.1 North America Natural Source Vitamin E Market, Revenue Forecast, 2015 - 2024, (USD Million)

6.1.1 North America Natural Source Vitamin E Market, Revenue Forecast, By Product Type, 2015 - 2024, (USD Million)

6.1.2 North America Natural Source Vitamin E Market, Revenue Forecast, By Application Type, 2015 - 2024, (USD Million)

6.1.3 U.S.Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

6.1.4 Rest of North America Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

Chapter 7 EuropeNatural Source Vitamin E Market: By Region:

7.1 Europe Natural Source Vitamin E Market, Revenue Forecast, 2015 - 2024, (USD Million)

7.1.1 Europe Natural Source Vitamin E Market, Revenue Forecast, By Product Type, 2015 - 2024, (USD Million)

7.1.2 Europe Natural Source Vitamin E Market, Revenue Forecast, By Application Type, 2015 - 2024, (USD Million)

7.1.3 U.K. Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

7.1.4 Germany Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

7.1.5 France Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

7.1.6 Italy Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

7.1.7 Rest of Europe Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

Chapter 8 Asia PacificNatural Source Vitamin E Market: By Region:

8.1 Asia Pacific Natural Source Vitamin E Market, Revenue Forecast, 2015 - 2024, (USD Million)

8.1.1 Asia Pacific Natural Source Vitamin E Market, Revenue Forecast, By Product Type, 2015 - 2024, (USD Million)

8.1.2 Asia Pacific Natural Source Vitamin E Market, Revenue Forecast, By Application Type, 2015 - 2024, (USD Million)

8.1.3 China Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

8.1.4 Japan Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

8.1.5 India Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

8.1.6 Rest of Asia Pacific Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

Chapter 9 Middle East and AfricaNatural Source Vitamin E Market: By Region:

9.1 Middle East and Africa Natural Source Vitamin E Market, Revenue Forecast, 2015 - 2024, (USD Million)

9.1.1 Middle East and Africa Natural Source Vitamin E Market, Revenue Forecast, By Product Type, 2015 - 2024, (USD Million)

9.1.2 Middle East and Africa Natural Source Vitamin E Market, Revenue Forecast, By Application Type, 2015 - 2024, (USD Million)

9.1.3 UAE Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

9.1.4 Saudi Arabia Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

9.1.5 South Africa Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

9.1.6 Kenya Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

9.1.7 Rest of Middle East and Africa Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

Chapter 10 Latin America Natural Source Vitamin E Market: By Region:

10.1 Latin America Natural Source Vitamin E Market, Revenue Forecast, 2015 - 2024, (USD Million)

10.1.1 Latin America Natural Source Vitamin E Market, Revenue Forecast, By Product Type, 2015 - 2024, (USD Million)

10.1.2 Latin America Natural Source Vitamin E Market, Revenue Forecast, By Application Type, 2015 - 2024, (USD Million)

10.1.3 Brazil Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

10.1.4 Rest of Latin America Natural Source Vitamin E Market Revenue Forecast, 2015 – 2024 (USD Million)

Chapter 11 Company Profiles

11.1 DSM N.V.

11.1.1 Company Details (HQ, Foundation Year, Employee Strength)

11.1.2 Market Presence, By Segment and Geography

11.1.3 Key Developments

11.1.4 Strategy and Historical Roadmap

11.1.5 Revenue and Operating Profits

11.2 BASF S.E.

11.2.1 Company Details (HQ, Foundation Year, Employee Strength)

11.2.2 Market Presence, By Segment and Geography

11.2.3 Key Developments

11.2.4 Strategy and Historical Roadmap

11.2.5 Revenue and Operating Profits

11.3 Archer Daniels Midlands Company

11.3.1 Company Details (HQ, Foundation Year, Employee Strength)

11.3.2 Market Presence, By Segment and Geography

11.3.3 Key Developments

11.3.4 Strategy and Historical Roadmap

11.3.5 Revenue and Operating Profits

11.4 Davos Life Science Pte Ltd.

11.4.1 Company Details (HQ, Foundation Year, Employee Strength)

11.4.2 Market Presence, By Segment and Geography

11.4.3 Key Developments

11.4.4 Strategy and Historical Roadmap

11.4.5 Revenue and Operating Profits

11.5 Eisai Food & Chemical Co. Ltd.

11.5.1 Company Details (HQ, Foundation Year, Employee Strength)

11.5.2 Market Presence, By Segment and Geography

11.5.3 Key Developments

11.5.4 Strategy and Historical Roadmap

11.5.5 Revenue and Operating Profits

11.6 Beijing Gingko Group Co. Ltd.

11.6.1 Company Details (HQ, Foundation Year, Employee Strength)

11.6.2 Market Presence, By Segment and Geography

11.6.3 Key Developments

11.6.4 Strategy and Historical Roadmap

11.6.5 Revenue and Operating Profits

11.7 Fenchem Biotek Ltd.

11.7.1 Company Details (HQ, Foundation Year, Employee Strength)

11.7.2 Market Presence, By Segment and Geography

11.7.3 Key Developments

11.7.4 Strategy and Historical Roadmap

11.7.5 Revenue and Operating Profits

11.8 Wilmar Spring Fruit Nutrition Products Co. Ltd.

11.8.1 Company Details (HQ, Foundation Year, Employee Strength)

11.8.2 Market Presence, By Segment and Geography

11.8.3 Key Developments

11.8.4 Strategy and Historical Roadmap

11.8.5 Revenue and Operating Profits

11.9 Riken Vitamin Co. Ltd.

11.9.1 Company Details (HQ, Foundation Year, Employee Strength)

11.9.2 Market Presence, By Segment and Geography

11.9.3 Key Developments

11.9.4 Strategy and Historical Roadmap

11.9.5 Revenue and Operating Profits

11.10 Zhejiang Worldbestve Biotechnology Co. Ltd.

11.10.1 Company Details (HQ, Foundation Year, Employee Strength)

11.10.2 Market Presence, By Segment and Geography

11.10.3 Key Developments

11.10.4 Strategy and Historical Roadmap

11.10.5 Revenue and Operating Profits

List of Tables

TABLE 1 Snapshot: Global Natural Source Vitamin E Market

TABLE 2 North America Natural Source Vitamin E Market, 2015 - 2024, By Product Type (USD Million)

TABLE 3 North America Natural Source Vitamin E Market, 2015 - 2024, By Application Type (USD Million)

TABLE 4 Europe Natural Source Vitamin E Market, 2015 - 2024, By Product Type (USD Million)

TABLE 5 Europe Natural Source Vitamin E Market, 2015 - 2024, By Application Type (USD Million)

TABLE 6 Asia Pacific Natural Source Vitamin E Market, 2015 - 2024, By Product Type (USD Million)

TABLE 7 Asia Pacific Natural Source Vitamin E Market, 2015 - 2024, By Application Type (USD Million)

TABLE 8 Middle East and Africa Natural Source Vitamin E Market, 2015 - 2024, By Product Type (USD Million)

TABLE 9 Middle East and Africa Natural Source Vitamin E Market, 2015 - 2024, By Application Type (USD Million)

TABLE 10 Latin America Natural Source Vitamin E Market, 2015 - 2024, By Product Type (USD Million)

TABLE 11 Latin America Natural Source Vitamin E Market, 2015 - 2024, By Application Type (USD Million)

List of Figures

FIG. 1 Market Segmentation Natural Source Vitamin E Market

FIG. 2 Value Chain Analysis of Natural Source Vitamin E Market

FIG. 3 Market Share of Key Players, 2015 (%)

FIG. 4 Market Attractiveness Analysis, By Application, 2015

FIG. 5 Global Natural Source Vitamin E Market Revenue Share, By Product Type, 2015 and 2024

FIG. 6 GlobalTocopherols Market, 2015 – 2024 (USD Million)

FIG. 7 Global Tocotrienols Market, 2015 – 2024 (USD Million)

FIG. 8 Global Natural Source Vitamin E Market, By Application, 2015 and 2024

FIG. 9 Global Dietary Supplements Market, 2015 – 2024 (USD Million)

FIG. 10 Global Food and Beverages Market, 2015 - 2024 (USD Million)

FIG. 11 Global Cosmetics Market, 2015 – 2024 (USD Million)

FIG. 12 Global Other Natural Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 13 North America Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 14 U.S. Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 15 Rest of North America Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 16 EuropeNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 17 U.K.Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 18 GermanyNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 19 France Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 20 Italy Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 21 Rest of Europe Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 22 Asia Pacific Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 23 China Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 24 JapanNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 25 IndiaNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 26 Rest of Asia PacificNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 27 Middle East and Africa Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 28 UAE Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 29 Saudi Arabia Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 30 South Africa Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 31 Kenya Natural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 32 Rest of Middle East and AfricaNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 33 Latin AmericaNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 34 BrazilNatural Source Vitamin E Market, 2015 – 2024 (USD Million)

FIG. 35 Rest of Latin AmericaNatural Source Vitamin E Market, 2015 – 2024 (USD Million)