Money Transfer Platforms Market - Introduction

- Money transfer platforms are electronic means of transferring money. Both the payer and the payee use digital modes to send and receive money in digital payments. Customers can self-serve and pay invoices from anywhere at any time using digital payments.

- Rising integration of digital payment platforms in the SMEs and standalone business is a key factor that is estimated to drive the demand for money transfer platforms in the near future. For instance, according to a Credit Suisse survey, India's digital payments market is currently valued at US$ 300 billion, and it is estimated to reach US$ 5 trillion by 2025. Digital payment companies such Google Pay and PayPal are continuously enhancing features of their money transfer platforms, which is boosting customer satisfaction.

Key Drivers of Money Transfer Platforms Market

- Rise in payment automation is a major factor that is projected to fuel the demand for money transfer platforms in the near future. Several techno-friendly customers across the globe have shifted to digital money platforms. This, in turn, is estimated to increase the demand for money transfer platforms in the next few years. Moreover, digital money platforms save time and money of customers. Residents of numerous rural and semi-rural areas are being drawn to urban areas owing to rapid urbanization and industrialization. Many people are relocating in search of work or education.

- Increase in adoption of smartphones in developed economies offers opportunity to the money transfer platforms market. Major benefit of mobile transfer money is that it secures the money from theft. Furthermore, the market is expected to benefit from an increase in the use of NFC and RFID technology in mobile payments, as well as a rise in the demand for fast and painless transaction services. For instance, according to GSMA, global smartphone adoption reached 60% in 2018, and it is expected to reach 85% by 2025.

- However, lack of awareness in developing economies is expected to hamper the money transfer platforms market

Impact of COVID-19 on the Global Money Transfer Platforms Market

The COVID-19 pandemic adversely affected all industries, except online shopping and e-commerce. During the pandemic, customers all over the world moved from offline shopping to online shopping. Customers are also turning to digital wallets, as they are highly effective, fast, and convenient ways to send money abroad since the lockdown began. All financial institutions and banks have shifted to digital platforms during the pandemic, as they enable banks to maintain social distance, which results in minimizing the spreading of the corona virus.

North America Accounts for Dominant Share of Global Money Transfer Platforms Market

- North America accounted for a prominent share of the global money transfer platforms market. Rising expansion of the industrial sector is a key factor that drives the demand for money transfer platforms. Furthermore, the U.S. is a prominent contributor to digital advertising, as it the base for companies such as TransferWise Ltd., Wirecard, PayPal Holdings, Inc, and Financial Software & Systems Pvt. Ltd. For instance, in December 2020, PayPal holdings, Inc. introduced 24×7 RTGS money transfer platform. This platform supports high value transactions, which enables businesses to transfer vast sums of money to their vendors, employees, and business partners. The major benefits of this service is that it saves time and money of SME and large businesses. Furthermore, enterprises are adopting money transfer platforms, as they also offer security-related benefits. Money transfer platforms solutions also help businesses to improve their security, which results in boosting customer satisfaction.

- The money transfer platforms market in Asia Pacific is estimated to expand at a notable CAGR during the forecast period. Rise in number standalone businesses is a major factor that is anticipated to propel the demand for money transfer platforms in the near future. Additionally, increase in government campaigns for digital platforms is another factor that is projected to drive the demand for money transfer platforms.

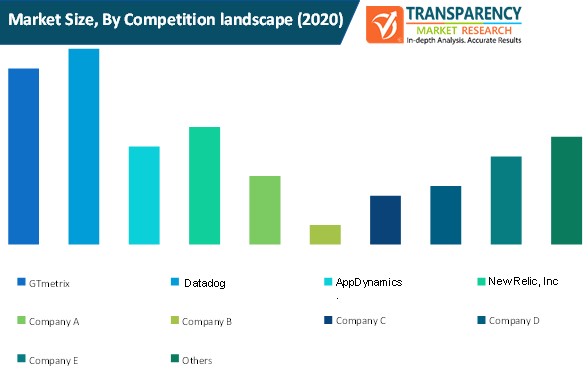

Key Players Operating in Global Money Transfer Platforms Market

Companies active in providing money transfer platforms are increasingly spending on research and development, which in turn is expected to increase the demand for money transfer platforms in the next few years. The market is diversified with the presence of numerous manufacturers across the globe. Key players operating in the global money transfer platforms market include:

- Azimo Limited

- Global Payments Inc.

- TransferWise Ltd.

- ACI Worldwide, Inc.

- Financial Software & Systems Pvt. Ltd.

- Digital Wallet Corporation

- Western Union Holdings, Inc.

- PayPal Holdings, Inc.

- Remit One Ltd

- Wirecard

Global Money Transfer Platforms Market: Research Scope

Global Money Transfer Platforms Market, by Component

Global Money Transfer Platforms Market, by Deployment Mode

Global Money Transfer Platforms Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

Global Money Transfer Platforms Market, by Industry Vertical

- Healthcare

- IT & Telecom

- Retail & E-commerce

- BFSI

- Transportation

- Media & Entertainment

- Others

Global Money Transfer Platforms Market Segmentation, by Region

- North America

- Europe

- Germany

- U.K.

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- Malaysia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America

Alternative Keywords

- Service Software Management

- Software Management