Reports

Reports

The demand within the global market for mixed tocopherol has been rising on account of the health benefits served by the compound. The past decade has witnessed increasing popularity of foods that are rich in protein, vitamins, and minerals. For this reason, the cumulative revenues in the global market for mixed tocopherol are expected to increase in the years to come. Moreover, the presence of several research entities that have accredited mixed tocopherol with a mark of healthiness has also propelled market demand. Mixed tocopherol consists of compounds that are rich in vitamins, especially vitamin-E. This factor is a key consideration in gauging the growth dynamics of the global market for mixed tocopherol. The compounds and minerals present in egg yolk, leafy vegetables, and wheatgerm oil are found in mixed tocopherol.

Mixed tocopherol can also act as an effective anti-oxidant which has further given an impetus to the growth of the global market. There is a recurring demand for mixed tocopherol in multiple industries including food and beverages, medicine, pharmaceuticals, and nutraceuticals. There is also heavy demand for healthy food supplements which has in turn propelled market demand for mixed tocopherol in recent times. The manufacture of several food products involves the use of varying classes of tocopherols.

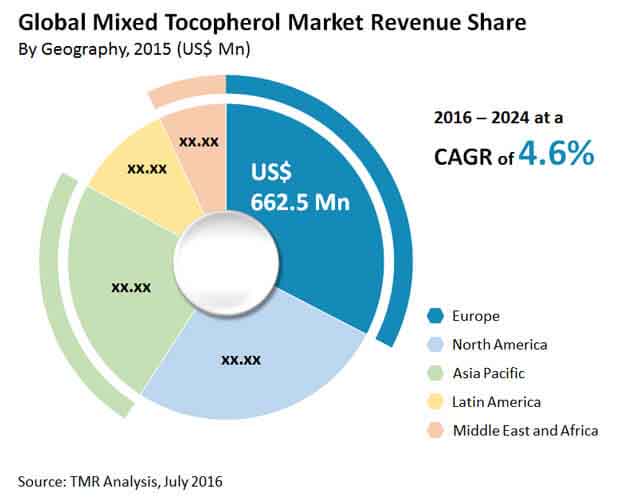

Transparency Market Research (TMR) finds that the global market for mixed tocopherol would expand at a stellar CAGR of 4.6% over the period ranging from 2016 to 2024. Furthermore, the total valuation of the global mixed tocopherol market is expected to reach a total value of US$3.04 bn by 2024. The market for US$3.04 bn by 2024 had a total worth of US$2.03 bn in 2015. Transparency Market Research (TMR) gives a wide purview of the global mixed tocopherol market in a research report.

Alpha Tocopherols to Experience Increased Demand

The global market for mixed tocopherol is segmented on the basis of product, application, and region. On the basis of product, the global market for mixed tocopherol is segmented into beta tocopherol, delta tocopherol, gamma tocopherol, and alpha tocopherol. Amongst these, the demand for alpha tocopherol is in great demand due to its direct usage in the manufacture of multiple food products. Based on application, the market for mixed tocopherol has been segmented into animal feed, dietary supplement, and pharmaceuticals. Amongst these, the market for dietary supplements has been expanding at a stellar rate in recent times. This owe to the rising propensity of the masses towards leading healthier lifestyles. Furthermore, increase adoption of pets has led to an increase in demand for mixed tocopherol for animal feeds.

North America to Emerge as Leading Regional Segment

The global market for mixed tocopherol has been segmented into North America, Latin America, the Middle East and Africa, Asia Pacific, and Europe. Amongst these, the market for mixed tocopherol in North America has been growing at a boisterous pace. This owes to the fact that animal feeds are bought by several people in the US and Canada for their pets. In the US, every third family has a pet animal which is a key consideration from the perspective of market growth. The market for mixed tocopherol in Asia Pacific has been rising on account of an expansive pharmaceutical industry in India.

Some of the key players in the global market for mixed tocopherol are DSM N.V., B&D Nutritional Ingredients, Inc., COFCO Tech Bio Engineering, and Advance Organic Material S.A.

Increased Awareness about Health and Wellness to Bolster Mixed Tocopherol Market

The global mixed tocopherol market is foreseen to be driven by rising demand for vitamin E as dietary supplements due to rising health issues. The ability of vitamin E to decrease joint pain, chest pain, and the risk of heart disease is likely to drive the demand for mixed tocopherols in the near future. Demand for vitamin E in pharmaceuticals for the treatment of breast, colorectal, dental, and pancreatic cancer, Huntington's Chorea, restless leg syndrome, polyps, epilepsy, sleep cramps, and gastric is anticipated to fuel expansion of the global mixed tocopherol market in the years to come.

Tocopherol demand in North America is anticipated to rise due to growing demand for nutritional items such as energy drinks and fortified food items. Because of the country's growing health-related challenges, the US is predicted to rise at a modest pace. In the near future, anti-dumping policies and strict government restrictions in the US are expected to increase demand for natural-based goods.

High Demand for Vitamin E in Dietary Supplements to Support Development of the Market

Over the next few years, the market is expected to be driven by rising demand for dietary supplements to improve muscle strength and physical endurance. Vitamin E also helps to mitigate the side effects of medical therapies including dialysis and radiation, as well as doxorubicin and amiodarone. In dietary supplements, alpha tocopherols are the most common source of vitamin E. It is anticipated that regulatory clearance as antioxidants and as nutrient preparation additive in infant formula formulation is likely to accelerate demand for mixed tocopherol in the foreseeable future.

To satisfy the global demand for vitamin E-rich items, several feed manufacturers and food & beverage producers are making use of mixed tocopherols. Dietary supplement and pharmaceutical manufacturers often make use of mixed tocopherols as a source of vitamin E. The vacuum extraction process is used to extract them from a variety of sources, including sunflower oil, corn oil, rapeseed oil, and soybean oil. Health and wellness developments such as vitamin fortification in food & beverages and feed are likely to augur well for the market. Besides, regulations for the manufacturing of refining, packaging, and labeling of food & beverages are expected to drive demand for mixed tocopherols in the years to come.

Chapter 1 Preface

1.1 Report Description

1.2 Market Segmentation

1.3 Research Scope

1.4 Research Methodology

Chapter 2 Executive Summary

2.1 Global Mixed Tocopherols Market Revenue, 2014-2023 (US$ Mn)

2.2 Market Snapshot

Chapter 3 Market Overview

3.1 Introduction

3.2 Key Trend Analysis

3.3 Market Dynamics

3.3.1 Market Drivers

3.3.2 Market Restraints

3.3.3 Market Opportunities

3.4 Global Mixed Tocopherols Market, by Product Type, Revenue (2012-2024)

3.4.1 Alpha Tocopherols

3.4.2 Beta Tocopherols

3.4.3 Gamma Tocopherols

3.4.4 Delta Tocopherols

3.4.5 Others

3.5 Global Mixed Tocopherols Market, by Application Type, Revenue (2012-2024)

3.5.1 Pharmaceuticals

3.5.2 Dietary Suppliments

3.5.3 Animal Feed

3.5.4 Others

3.6 Company Market Share, 2015 (%)

3.7 Value Chain Analysis

Chapter 4 North America Mixed Tocopherols Market (2012-2024) (USD Millions

4.1 North America Mixed Tocopherols Market, by Product Type, 2012-2024

4.2 North America Mixed Tocopherols Market, by Applications, 2012-2024

4.3 U.S. Mixed Tocopherols Market, 2012-2024

4.4 Rest of North America Mixed Tocopherols Market 2012-2024s

Chapter 5 Europe Mixed Tocopherols Market, (2012-2024) (USD Millions)

5.1 Europe Mixed Tocopherols Market, by Product Type, 2012-2024

5.2 Europe Mixed Tocopherols Market, by Applications, 2012-2024

5.3 Germany Mixed Tocopherols Market, 2012-2024

5.4 U.K. Mixed Tocopherols Market, 2012-2024

5.5 France Mixed Tocopherols Market, 2012-2024

5.6 Italy Mixed Tocopherols Market, 2012-2024

5.7 Rest of Europe Mixed Tocopherols Market, 2012-2024

Chapter 6 Asia Pacific Mixed Tocopherols Market, (2012-2024) (USD Millions)

6.1 Asia Pacific Mixed Tocopherols Market, by Product Type, 2012-2024

6.2 Asia Pacific Mixed Tocopherols Market, by Applications, 2012-2024

6.3 India Mixed Tocopherols Market, 2012-2024

6.4 Japan Mixed Tocopherols Market, 2012-2024

6.5 China Mixed Tocopherols Market, 2012-2024

6.6 Rest of Asia Pacific Mixed Tocopherols Market, 2012-2024

Chapter 7 Middle East and Africa Mixed Tocopherols Market (2012-2024) (USD Millions)

7.1 Middle East and Africa Mixed Tocopherols Market, by Product Type, 2012-2024

7.2 Middle East and Africa Mixed Tocopherols Market, by Applications, 2012-2024

7.3 UAE Mixed Tocopherols Market, 2012-2024

7.4 Saudi Arabia America Mixed Tocopherols Market 2012-2024

7.5 South Africa Mixed Tocopherols Market, 2012-2024

7.6 Kenya Mixed Tocopherols Market 2012-2024

7.7 Rest of Middle East and Africa Mixed Tocopherols Market, 2012-2024

7.8 Libelium

7.9 ARM Holdings plc

7.10 Digi International Inc

Chapter 8 Latin America Mixed Tocopherols Market (2012-2024) (USD Millions)

8.1 Latin America Mixed Tocopherols Market, by Product Type

8.2 Latin America Mixed Tocopherols Market, by Applications

8.3 Brazil Mixed Tocopherols Market, 2012-2024

8.4 Rest of Latin America Mixed Tocopherols Market, 2012-2024

Chapter 9 Company Profiles

9.1 DSM N.V.

9.1.1. Company Details (HQ, Foundation Year, Employee Strength)

9.1.2. Market Presence, By Segment and Geography

9.1.3. Key Developments

9.1.4. Strategy and Historical Roadmap

9.1.5. Revenue and Operating Profits

9.2 BASF SE

Company Details (HQ, Foundation Year, Employee Strength)

9.2.2. Market Presence, By Segment and Geography

9.2.3. Key Developments

9.2.4. Strategy and Historical Roadmap

9.2.5. Revenue and Operating Profits

9.3 B & D Nutritional Ingredients, Inc.

Company Details (HQ, Foundation Year, Employee Strength)

9.3.2. Market Presence, By Segment and Geography

9.3.3. Key Developments

9.3.4. Strategy and Historical Roadmap

9.3.5. Revenue and Operating Profits

9.4 Archer Daniels Midlands Company

Company Details (HQ, Foundation Year, Employee Strength)

9.4.2. Market Presence, By Segment and Geography

9.4.3. Key Developments

9.4.4. Strategy and Historical Roadmap

9.4.5. Revenue and Operating Profits

9.5 COFCO Tech Bio Engineering

9.5.1 Company Details (HQ, Foundation Year, Employee Strength)

9.5.2. Market Presence, By Segment and Geography

9.5.3. Key Developments

9.5.4. Strategy and Historical Roadmap

9.5.5. Revenue and Operating Profits

9.6 Davos Life Science Pte Ltd.

9.6.1 Company Details (HQ, Foundation Year, Employee Strength)

9.6.2. Market Presence, By Segment and Geography

9.6.3. Key Developments

9.6.4. Strategy and Historical Roadmap

9.6.5. Revenue and Operating Profits

9.7 Eisai Food and Chemical Co. Ltd

9.7.1 Company Details (HQ, Foundation Year, Employee Strength)

9.7.2. Market Presence, By Segment and Geography

9.7.3. Key Developments

9.7.4. Strategy and Historical Roadmap

9.7.5. Revenue and Operating Profits

9.8 Advance Organic Material S.A.

9.8.1 Company Details (HQ, Foundation Year, Employee Strength)

9.8.2. Market Presence, By Segment and Geography

9.8.3. Key Developments

9.8.4. Strategy and Historical Roadmap

9.8.5. Revenue and Operating Profits

9.9 Advance Organic Material S.A.

9.9.1 Company Details (HQ, Foundation Year, Employee Strength)

9.9.2. Market Presence, By Segment and Geography

9.9.3. Key Developments

9.9.4. Strategy and Historical Roadmap

9.9.5. Revenue and Operating Profits

List of Tables

TABLE 1 Snapshot: Global Mixed Tocopherol Market

TABLE 2 North America Mixed Tocopherol Market Analysis, Revenue Forecast, by Product Type, 2012 – 2024, (USD Million)

TABLE 3 North America Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

TABLE 4 Europe Mixed Tocopherol Market Analysis, Revenue Forecast, by Product Type, 2012 – 2024, (USD Million)

TABLE 5 Europe Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

TABLE 6 Asia Pacific Mixed Tocopherol Market Analysis, Revenue Forecast, by Product Type, 2012 – 2024, (USD Million)

TABLE 7 Asia Pacific Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

TABLE 8 Middle East & Africa Mixed Tocopherol Market Analysis, Revenue Forecast, by Product Type, 2012 – 2024, (USD Million

TABLE 9 Middle East & Africa Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

TABLE 10 Latin America Mixed Tocopherol Market Analysis, Revenue Forecast, by Product Type, 2012 – 2024, (USD Million)

TABLE 11 Latin America Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

List of Figures

FIG. 1 Increasing Health Consciousness Among Consumers

FIG. 2 Increasing Health Consciousness Among Consumers

FIG. 2 Increasing Demand for Vitamin E Fortified Food and Cosmetics

FIG. 3 Increasing Demand for Health Supplements and Rise in Aging Population

FIG. 4 Increasing Demand for Health Supplements and Rise in Aging Population

FIG. 5 Imbalance in Demand and Supply of Mixed Tocopherol

FIG. 6 Imbalance in Demand and Supply of Mixed Tocopherol

FIG. 7 Imbalance in Demand and Supply of Mixed TocopherolGlobal Industrial Gloves

FIG. 8 Alpha Tocopherol Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 9 Beta Tocopherol Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 10 Gamma Tocopherol Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 11 Delta Tocopherol Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 12 Others Tocopherol Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 13 Pharmaceutical Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 14 Dietary Supplements Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 15 Animal Feed Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 16 Others Market Analysis, Revenue Forecast, 2015 – 2024, (USD Million)

FIG. 17 Company Market Share, (2015), (%)

FIG. 18 U.S Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 19 Rest of North America Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 20 Germany Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 21 U.K Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG 22 France Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 23 Italy Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 24 Rest of Europe Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 25 India Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 26 Japan Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 27 China Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 28 Rest of Asia Pacific Mixed Tocopherol Market Analysis, Revenue Forecast, by Application, 2012 – 2024, (USD Million)

FIG. 29 U.A.E. Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 30 Saudi Arabia Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 31 South Africa Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 32 Kenya Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 33 Rest of Middle East & Africa Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 34 Brazil Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)

FIG. 35 Rest of Latin America Mixed Tocopherol Market Analysis, Revenue Forecast, 2012 – 2024, (USD Million)