Reports

Reports

The global micro data center market is expected to grow due to a strong demand for self–contained containers with integrated hardware to sustain the capacities of important IT parts with monitoring and control software devices. When compared to typical larger data centers, a micro data center refers to a unified physical infrastructure option that dramatically minimizes project timeline. This allows participants in the global micro data center market to cut down deployment time. Depending on available electrical capacity, space and, bandwidth, they can quickly expand their ability by building more micro data centers in a separate or the same site.

Increasing use of edge computing technologies due to demand from compute-intensive uses such as Artificial Intelligence and Internet of Things (IoT) is expected to boost market revenue. The demand for high-performance and reliable data centers has increased as a result of increased digital service usage, which has resulted in a significant increase in data. By moving data centers nearer to the application, bandwidth expenses and latency difficulties are reduced. In August 2020, EdgeMicro successfully opened mini data centers around the US to provide improved edge solutions in underserved markets and create stronger and better connectivity options.

The rising energy consumption of data centers has prompted various government administrations to place a greater emphasis on lowering consumption of energy and improving Power Usage Effectiveness (PUE). To maintain the optimal operation of data centers, market participants are focused on offering high–quality cooling solutions.

IoT, AI, and edge computing apps are driving up demand for higher chip and rack power densities in the industry. Data center owners are concentrating on ways to increase density sans sacrificing infrastructural compactness. In AI-based applications, the heat profile of GPU-based servers is twice that of traditional data centers, increasing the necessity for effective micro data center cooling solutions. Overheating is a primary cause of data center outages, which results in significant financial losses. With the increased demand for effective cooling solutions for optimal data center operations, micro data centers are estimated to gain popularity. These factors are likely to bolster growth of the global micro data center market in the years to come.

Global Micro Data Center Market: Snapshot

The global micro data center market is gaining from the changing data center needs of enterprises. A large number of enterprises are increasingly adopting micro data centers to store critical data either on premise or in remote locations. Micro data centers exhibit virtues of simplified workload that traditional data centers lack. As a result, enterprises are switching from local facilities to automated micro data centers for information storage.

Some other features of micro data centers include scalability, customizability, cost effectiveness, and are self-contained. In addition, micro data centers are portable and occupy very less space as compared to traditional data centers. Nevertheless, micro data centers are equipped with components of traditional data centers such as in-built cooling systems, security systems, fire suppression systems, monitoring systems, telecommunication and storage system, and uninterruptible power supply (UPS).

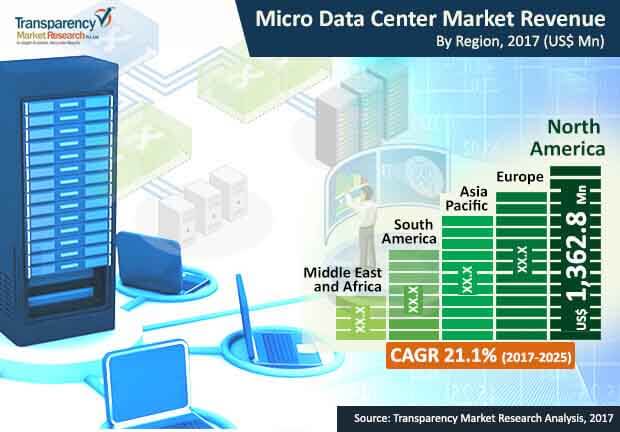

A report by Transparency Market Research (TMR) estimates the global micro data center market to rise at an impressive 21.1% CAGR over the forecast period between 2017 and 2025. At this pace, the market will be valued at US$14,813.2 mn by the end of 2025 from US$3,208.9 mn in 2016.

Less than 25 U Segment to Emerge Significant

The global micro data center market is broadly categorized on the basis of rack size, end use industry, and geography. On the basis of rack size, the market has been bifurcated into less than 25 U, 25 U – 40 U, and more than 40 U. Among them, the more than 40 U segment holds the leading market share; the segment accounted for 54.0% revenue contribution to the overall market in 2016. However, less than 25 U segment is anticipated to display the leading CAGR over the forecast period.

Based on end-use industry, the global micro data center market is segmented into IT and telecom, retail, education, BFSI, healthcare, energy, and others. Of them, in 2016, IT and telecom held the leading revenue share in the overall market. However, the retail segment is predicted to display the leading CAGR over the forecast period. The growth of the retail segment is mainly because of expansion of ecommerce and rising adoption of micro data centers for point of sale systems for improved efficiency and productivity.

Emergence of Several Regional Service Providers Makes Europe a Key Market

On the basis of region, the segments into which the global micro data center market is divided are North America, Asia Pacific, Europe, the Middle East and Africa, and South America. North America, among all, is currently the leading regional market for micro data center. In 2016, North America held 43.2% revenue of the overall micro data center market. Going forward, North America is estimated to display an impressive 18.6% CAGR over the forecast period. The growth in the region is mainly because of significant demand for micro data centers from IT and Telecom verticals in the U.S. and Canada. The retail sector also accounts for significant revenue contribution to North America micro data center market.

Europe is currently the second leading market for micro data centers. The growth in the region is mainly because of increasing demand for IT convergence and integration among enterprises from a host of industry verticals. Due to the rising demand, a number of regional players have emerged in the region to provide cost effective micro data center solutions to end users. In Europe, the U.K. is anticipated to emerge as the leading domestic market in 2017.

Leading players in the global micro data center market include Eaton Corporation plc, Hitachi Ltd., Panduit Corp., Zellabox Dataracks, Hewlett Packard Enterprise Development LP, Instant Data Centers, Huawei Technologies Co. Ltd., Rittal GmbH & Co. KG, and Schneider Electric SE.

1. Preface

1.1. Report Scope and Segmentation

1.2. Key Research Objectives and Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Micro Data Center Market

4. Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Functional Model

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Key Trends

4.4. Global Micro Data Center Market Analysis and Forecasts, 2015 – 2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

4.6. Value Chain Analysis

4.7. Market Outlook

5. Global Micro Data Center Market Analysis and Forecast by Rack Size

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

5.3.1. Less than 25 RU

5.3.2. 25 RU – 50 RU

5.3.3. More than 50 RU

5.4. Rack Size Comparison Matrix

5.5. Market Attractiveness by Rack Size

6. Global Micro Data Center Market Analysis and Forecast by End-Use Industry

6.1. Introduction

6.2. Key Findings / Developments

6.3. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

6.3.1. IT and telecom

6.3.2. Retail

6.3.3. BFSI

6.3.4. Healthcare

6.3.5. Energy

6.3.6. Others

6.4. End-Use Industry Comparison Matrix

6.5. Market Attractiveness by End-Use Industry

7. Global Micro Data Center Market Analysis and Forecasts, by Region

7.1. Key Findings

7.2. Micro Data Center Market Size (US$ Mn) Forecast by Region, 2015 – 2025

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East and Africa

7.2.5. South America

7.3. Market Attractiveness by Region

8. North America Micro Data Center Market Size and Forecast

8.1. Key Findings

8.2. Key Trends

8.3. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

8.3.1. Less than 25 RU

8.3.2. 25 RU – 50 RU

8.3.3. More than 50 RU

8.4. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

8.4.1. IT and telecom

8.4.2. Retail

8.4.3. BFSI

8.4.4. Healthcare

8.4.5. Energy

8.4.6. Others

8.5. Micro Data Center Market Size (US$ Mn) and Forecast by Country, 2015 – 2025

8.5.1. The U.S.

8.5.1.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

8.5.1.1.1. Less than 25 RU

8.5.1.1.2. 25 RU – 50 RU

8.5.1.1.3. More than 50 RU

8.5.1.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

8.5.1.2.1. IT and telecom

8.5.1.2.2. Retail

8.5.1.2.3. BFSI

8.5.1.2.4. Healthcare

8.5.1.2.5. Energy

8.5.1.2.6. Others

8.5.2. Canada

8.5.2.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

8.5.2.1.1. Less than 25 RU

8.5.2.1.2. 25 RU – 50 RU

8.5.2.1.3. More than 50 RU

8.5.2.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

8.5.2.2.1. IT and telecom

8.5.2.2.2. Retail

8.5.2.2.3. BFSI

8.5.2.2.4. Healthcare

8.5.2.2.5. Energy

8.5.2.2.6. Others

8.5.3. Rest of North America

8.6. Micro Data Center Market Attractiveness Analysis

8.6.1. By Rack Size

8.6.2. By End-Use Industry

8.6.3. By Country

9. Europe Micro Data Center Market Size and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Micro Data Center Market Size (US$ Mn ) and Forecast by Rack Size, 2015 – 2025

9.3.1. Less than 25 RU

9.3.2. 25 RU – 50 RU

9.3.3. More than 50 RU

9.4. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

9.4.1. IT and telecom

9.4.2. Retail

9.4.3. BFSI

9.4.4. Healthcare

9.4.5. Energy

9.4.6. Others

9.5. Micro Data Center Market Size (US$ Mn ) and Forecast by Country, 2015 – 2025

9.5.1. The U.K.

9.5.1.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

9.5.1.1.1. Less than 25 RU

9.5.1.1.2. 25 RU – 50 RU

9.5.1.1.3. More than 50 RU

9.5.1.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

9.5.1.2.1. IT and telecom

9.5.1.2.2. Retail

9.5.1.2.3. BFSI

9.5.1.2.4. Healthcare

9.5.1.2.5. Energy

9.5.1.2.6. Others

9.5.2. Germany

9.5.2.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

9.5.2.1.1. Less than 25 RU

9.5.2.1.2. 25 RU – 50 RU

9.5.2.1.3. More than 50 RU

9.5.2.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

9.5.2.2.1. IT and telecom

9.5.2.2.2. Retail

9.5.2.2.3. BFSI

9.5.2.2.4. Healthcare

9.5.2.2.5. Energy

9.5.2.2.6. Others

9.5.3. France

9.5.3.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

9.5.3.1.1. Less than 25 RU

9.5.3.1.2. 25 RU – 50 RU

9.5.3.1.3. More than 50 RU

9.5.3.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

9.5.3.2.1. IT and telecom

9.5.3.2.2. Retail

9.5.3.2.3. BFSI

9.5.3.2.4. Healthcare

9.5.3.2.5. Energy

9.5.3.2.6. Others

9.5.4. Rest of Europe

9.6. Micro Data Center Market Attractiveness Analysis

9.6.1. By Rack Size

9.6.2. By End-Use Industry

9.6.3. By Country

10. Asia Pacific Micro Data Center Market Size and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Micro Data Center Market Size (US$ Mn ) and Forecast by Rack Size, 2015 – 2025

10.3.1. Less than 25 RU

10.3.2. 25 RU – 50 RU

10.3.3. More than 50 RU

10.4. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

10.4.1. IT and telecom

10.4.2. Retail

10.4.3. BFSI

10.4.4. Healthcare

10.4.5. Energy

10.4.6. Others

10.5. Micro Data Center Market Size (US$ Mn ) and Forecast by Country, 2015 – 2025

10.5.1. India

10.5.1.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

10.5.1.1.1. Less than 25 RU

10.5.1.1.2. 25 RU – 50 RU

10.5.1.1.3. More than 50 RU

10.5.1.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

10.5.1.2.1. IT and telecom

10.5.1.2.2. Retail

10.5.1.2.3. BFSI

10.5.1.2.4. Healthcare

10.5.1.2.5. Energy

10.5.1.2.6. Others

10.5.2. China

10.5.2.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

10.5.2.1.1. Less than 25 RU

10.5.2.1.2. 25 RU – 50 RU

10.5.2.1.3. More than 50 RU

10.5.2.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry,2015 – 2025

10.5.2.2.1. IT and telecom

10.5.2.2.2. Retail

10.5.2.2.3. BFSI

10.5.2.2.4. Healthcare

10.5.2.2.5. Energy

10.5.2.2.6. Others

10.5.3. Japan

10.5.3.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

10.5.3.1.1. Less than 25 RU

10.5.3.1.2. 25 RU – 50 RU

10.5.3.1.3. More than 50 RU

10.5.3.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry,2015 – 2025

10.5.3.2.1. IT and telecom

10.5.3.2.2. Retail

10.5.3.2.3. BFSI

10.5.3.2.4. Healthcare

10.5.3.2.5. Energy

10.5.3.2.6. Others

10.5.4. Rest of Asia Pacific

10.6. Micro Data Center Market Attractiveness Analysis

10.6.1. By Rack Size

10.6.2. By End-Use Industry

10.6.3. By Country

11. Middle East and Africa (MEA) Micro Data Center Market Size and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Micro Data Center Market Size (US$ Mn ) and Forecast by Rack Size, 2015 – 2025

11.3.1. Less than 25 RU

11.3.2. 25 RU – 50 RU

11.3.3. More than 50 RU

11.4. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

11.4.1. IT and telecom

11.4.2. Retail

11.4.3. BFSI

11.4.4. Healthcare

11.4.5. Energy

11.4.6. Others

11.5. Micro Data Center Market Size (US$ Mn ) and Forecast by Country, 2015 – 2025

11.5.1. GCC Countries

11.5.1.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

11.5.1.1.1. Less than 25 RU

11.5.1.1.2. 25 RU – 50 RU

11.5.1.1.3. More than 50 RU

11.5.1.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

11.5.1.2.1. IT and telecom

11.5.1.2.2. Retail

11.5.1.2.3. BFSI

11.5.1.2.4. Healthcare

11.5.1.2.5. Energy

11.5.1.2.6. Others

11.5.2. South Africa

11.5.2.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

11.5.2.1.1. Less than 25 RU

11.5.2.1.2. 25 RU – 50 RU

11.5.2.1.3. More than 50 RU

11.5.2.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry,2015 – 2025

11.5.2.2.1. IT and telecom

11.5.2.2.2. Retail

11.5.2.2.3. BFSI

11.5.2.2.4. Healthcare

11.5.2.2.5. Energy

11.5.2.2.6. Others

11.5.3. Rest of Middle East & Africa

11.6. Micro Data Center Market Attractiveness Analysis

11.6.1. By Rack Size

11.6.2. By End-Use Industry

11.6.3. By Country

12. South America Micro Data Center Market Size and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Micro Data Center Market Size (US$ Mn ) and Forecast by Rack Size, 2015 – 2025

12.3.1. Less than 25 RU

12.3.2. 25 RU – 50 RU

12.3.3. More than 50 RU

12.4. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry, 2015 – 2025

12.4.1. IT and telecom

12.4.2. Retail

12.4.3. BFSI

12.4.4. Healthcare

12.4.5. Energy

12.4.6. Others

12.5. Micro Data Center Market Size (US$ Mn ) and Forecast by Country, 2015 – 2025

12.5.1. Brazil

12.5.1.1. Micro Data Center Market Size (US$ Mn) and Forecast by Rack Size, 2015 – 2025

12.5.1.1.1. Less than 25 RU

12.5.1.1.2. 25 RU – 50 RU

12.5.1.1.3. More than 50 RU

12.5.1.2. Micro Data Center Market Size (US$ Mn) and Forecast by End-Use Industry,2015 – 2025

12.5.1.2.1. IT and telecom

12.5.1.2.2. Retail

12.5.1.2.3. BFSI

12.5.1.2.4. Healthcare

12.5.1.2.5. Energy

12.5.1.2.6. Others

12.5.2. Rest of South America

12.6. Micro Data Center Market Attractiveness Analysis

12.6.1. By Rack Size

12.6.2. By End-Use Industry

12.6.3. By Country

13. Competition Landscape

13.1. Market Player – Competition Matrix

13.2. Company Profiles (Details – Overview, Financials, Strategy, SWOT analysis)

13.2.1. Rittal GmbH

13.2.1.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.1.2. Market Presence, By Segment.

13.2.1.3. Strategy

13.2.1.4. SWOT Analysis

13.2.2. Schneider Electric

13.2.2.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.2.2. Market Presence, By Segment.

13.2.2.3. Strategy

13.2.2.4. Revenue and Operating Profits

13.2.2.5. SWOT Analysis

13.2.3. Huawei Technologies Co

13.2.3.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.3.2. Market Presence, By Segment.

13.2.3.3. Strategy

13.2.3.4. Revenue and Operating Profits

13.2.3.5. SWOT Analysis

13.2.4. Panduit Corp.

13.2.4.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.4.2. Market Presence, By Segment.

13.2.4.3. Strategy

13.2.4.4. SWOT Analysis

13.2.5. Eaton Corporation

13.2.5.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.5.2. Market Presence, By Segment.

13.2.5.3. Strategy

13.2.5.4. Revenue and Operating Profits

13.2.5.5. SWOT Analysis

13.2.6. Zellabox

13.2.6.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.6.2. Market Presence, By Segment.

13.2.6.3. Strategy

13.2.6.4. SWOT Analysis

13.2.7. Dataracks

13.2.7.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.7.2. Market Presence, By Segment.

13.2.7.3. Strategy

13.2.7.4. SWOT Analysis

13.2.8. Instant Data Centers

13.2.8.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.8.2. Market Presence, By Segment.

13.2.8.3. Strategy

13.2.8.4. SWOT Analysis

13.2.9. Hitachi, Ltd.

13.2.9.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.9.2. Market Presence, By Segment.

13.2.9.3. Strategy

13.2.9.4. Revenue and Operating Profits

13.2.9.5. SWOT Analysis

13.2.10. Hewlett Packard Enterprise Development LP

13.2.10.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.10.2. Market Presence, By Segment.

13.2.10.3. Strategy

13.2.10.4. Revenue and Operating Profits

13.2.10.5. SWOT Analysis

14. Key Takeaways

List of Figures

Figure 1: Share Analysis

Figure 2: Global Micro Data Center Market, Revenue 2015 – 2025 (US$)

Figure 3: Market Value Share By Deployment Type (2017)

Figure 4: Market Value Share By End-use Industry (2017)

Figure 5: Market Revenue Share By Region (2017)

Figure 6: Global Micro Data Center Market Value Share Analysis, By Rack Size, 2017 and 2025

Figure 7: Comparison Matrix

Figure 8: Global Micro Data Center Market, Attractiveness Analysis, By Rack Size (2017)

Figure 9: Global Micro Data Center market Value Share Analysis, By End-Use Industry, 2017 and 2025

Figure 10: Comparison Matrix

Figure 11: Global Micro Data Center Market, Attractiveness Analysis, By End – Use Industry

Figure 12: Global Micro Data Center Market, Attractiveness Analysis, By Region

Figure 13: North America Micro Data Center Market Revenue Share Analysis, by Rack Size, 2017 and 2025

Figure 14: North America Micro Data Center Market Revenue Share Analysis, by End-Use Industry, 2017 and 2025

Figure 15: North America Micro Data Center Revenue Share Analysis, By Country, 2017 and 2025

Figure 16: U.S. Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 17: U.S. Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 18: Canada Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 19: Canada Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 20: Rest of North America Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 21: Rest of North America Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 22: Micro Data Center Market, Attractiveness Analysis, By Deployment

Figure 23: Micro Data Center Market, Attractiveness Analysis, By End-Use Industry

Figure 24: Micro Data Center Market, Attractiveness Analysis, By Country

Figure 25: Europe Micro Data Center Market Revenue Share Analysis, by Rack Size, 2017 and 2025

Figure 26: North America Micro Data Center Market Revenue Share Analysis, by End-Use Industry, 2017 and 2025

Figure 27: North America Micro Data Center Revenue Share Analysis, By Country, 2017 and 2025

Figure 28: UK Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 29: UK Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 30: Germany Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 31: Germany Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 32: France Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 33: France Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 34: Rest of Europe Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 35: Rest of Europe Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 36: Micro Data Center Market, Attractiveness Analysis, By Deployment

Figure 37: Micro Data Center Market, Attractiveness Analysis, By End-Use Industry

Figure 38: Micro Data Center Market, Attractiveness Analysis, By Country

Figure 39: Asia Pacific Micro Data Center Market Revenue Share Analysis, by Rack Size, 2017 and 2025

Figure 40: Asia Pacific Micro Data Center Market Revenue Share Analysis, by End-Use Industry, 2017 and 2025

Figure 41: Asia Pacific Micro Data Center Revenue Share Analysis, By Country, 2017 and 2025

Figure 42: India Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 43: India Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 44: China Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 45: China Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 46: Japan Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 47: Japan Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 48: Rest of Asia Pacific Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 49: Rest of Asia Pacific Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 50: Micro Data Center Market, Attractiveness Analysis, By Deployment

Figure 51: Micro Data Center Market, Attractiveness Analysis, By End-Use Industry

Figure 52: Micro Data Center Market, Attractiveness Analysis, By Country

Figure 53: Middle East & Africa (MEA) Micro Data Center Market Revenue Share Analysis, by Rack Size, 2017 and 2025

Figure 54: Middle East & Africa (MEA) Micro Data Center Market Revenue Share Analysis, by End-Use Industry, 2017 and 2025

Figure 55: Middle East & Africa (MEA) Micro Data Center Market Revenue Share Analysis, By Country, 2017 and 2025

Figure 56: GCC Countries Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 57: GCC Countries Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 58: South Africa Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 59: South Africa Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 60: Rest of MEA Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 61: Rest of MEA Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 62: Micro Data Center Market, Attractiveness Analysis, By Deployment

Figure 63: Micro Data Center Market, Attractiveness Analysis, By End-Use Industry

Figure 64: Micro Data Center Market, Attractiveness Analysis, By Country

Figure 65: South America Micro Data Center Market Revenue Share Analysis, by Rack Size, 2017 and 2025

Figure 66: South America Micro Data Center Market Revenue Share Analysis, by End-Use Industry, 2017 and 2025

Figure 67: South America Micro Data Center Revenue Share Analysis, By Country, 2017 and 2025

Figure 68: Brazil Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 69: Brazil Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 70: Rest of South America Micro Data Center Market Revenue Share Analysis, By Rack Size, 2017 and 2025

Figure 71: Rest of South America Micro Data Center Market Revenue Share Analysis, By End-Use Industry, 2017 and 2025

Figure 72: Micro Data Center Market, Attractiveness Analysis, By Deployment

Figure 73: Micro Data Center Market, Attractiveness Analysis, By End-Use Industry

Figure 74: Micro Data Center Market, Attractiveness Analysis, By Country