Reports

Reports

Mexico Industrial Bulk Packaging Market: Snapshot

The Mexico market for industrial bulk packaging has been expanding steadily for the last few years. The rise in industrialization and the increased shipment of goods in this country have driven a significant demand for industrial bulk packaging here. Boosted by this, this market was expected to reach US$232.0 mn by 2016.

Going forwards, the improving performance of the manufacturing sector and the rising industrial output are likely to reflect positively on the performance of the industrial bulk packaging market in Mexico over the forthcoming years. With a stable economic condition in the country, the market is anticipated to gain substantially from the rebounded performance of the chemicals sector, which is one of the prominent consumers of bulk industrial containers. Projected to rise at a CAGR of 5.50% between 2016 and 2024, the market is likely to reach a value of US$357 mn by the end of 2024.

The manufacturers of industrial bulk packaging materials are leveraging their in-house research and development capabilities to innovate products that suit specific requirements. Along with this, the players are also emphasizing on the technological advancements of their current offerings to meet the exact requirements of customers. However, this is a difficult marketplace, where customer-specific needs are rarely communicated to product developers, which, to an extent, hampers the market’s growth. Apart from this, the supply chain complexities are also creating manufacturing issues for producers, which is likely to hinder this market in the long run.

Drums, intermediate bulk containers (IBCs), pails, and jerry cans are some of the key products available in the Mexico industrial bulk packaging market. Among these, the demand for drums has been significantly higher than other products and is expected to remain so, rising at a CAGR of 4.90% from 2016 to 2024. Plastic, steel, and fiber/paperboard are the main components of the drum segment. With players shifting towards the sustainable packaging solutions over plastic and steel materials, the fiber/paperboard sub-segment is likely to witness considerable rise over the next few years.

Among others, IBCs are also projected to exhibit a significant rise in their demand in the near future, thanks to the remarkable progress in the chemical industry in Mexico. On the other hand, the demand for pails is expected to grow at a moderate pace over the forthcoming years, driven by their usage in a broad range of mid-sized applications, such as paints and coatings. Similarly, Jerry cans are also anticipated to witness stable growth rate in the years to come.

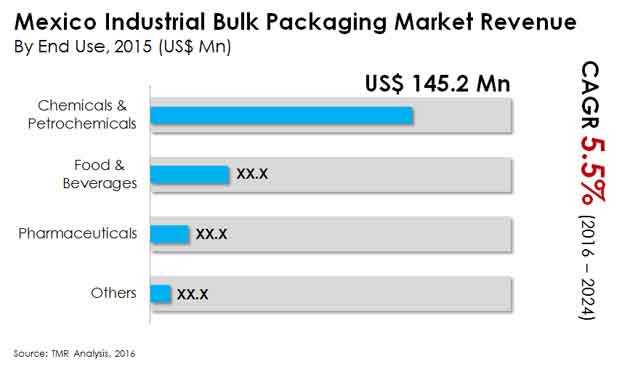

The chemicals and petrochemicals, food and beverages, and the pharmaceuticals sectors are the prime application areas of industrial bulk packaging across the world. The chemicals and petrochemicals sector have been registering a strong demand for industrial bulk packaging in Mexico, acquiring the top position among the end users. Analysts predict the scenario to remain so over the forthcoming years, increasing at a CAGR of 5.20% from 2016 to 2024.

Containers, such as rigid IBCs and drums, are mostly preferred for the packaging of chemicals and petrochemicals products and are expected continue like this in the near future due to high concentration of these products. The demand for industrial bulk packaging is also anticipated to increase considerably in the pharmaceuticals industry over the next few years.

Some of the leading vendors of industrial bulk packaging in Mexico are Hoover Container Solutions Inc., Mauser Group B.V., International Paper Co., Greif Inc., Menasha Corp., Cleveland Steel Container Corp., and Composite Containers LLC.

Industrial Bulk Packaging Market will Witness Growth Owing to Increasing Demand from Food & Beverage Sector

The increasing need for improved performance of manufacturing industries is expected to aid in expansion of the global industrial bulk packaging market in the coming years. The mechanical mass bundling market is relied upon to observe significant development as interest for hardware, and rising development of online business keeps on introducing new chances. The improving presentation of the assembling area keeps on driving development of the mass bundling market soon. Additionally, the rising interest for made synthetic compounds is required to stay the most prevailing fragment, as interest for drug and innovative work drives interest for synthetic substances. In addition, the steady development in Mexico's economy is probably going to stay a point of convergence for development over the estimate time frame.

Rising interest for food items, and expanding worldwide intermingling in exchange among Asia and North America will drive development for the modern mass bundling market. China keeps on arising as a significant scene for horticultural items. Then again, huge scope popularized horticulture in the US keeps on clearing a path for rewarding chances for development of the modern mass bundling market. Also, the developing interest for petrochemicals in a wide-scope of final results in assembling, will guarantee new chances for development for major parts in the mechanical mass bundling market.

The makers of mechanical mass bundling materials are utilizing their in-house innovative work capacities to develop items that suit explicit prerequisites. Alongside this, the players are additionally stressing on the innovative progressions of their present contributions to meet the specific prerequisites of clients. Nonetheless, this is a troublesome commercial center, where client explicit necessities are once in a while imparted to item engineers, which, to a degree, hampers the market's development. Aside from this, the store network complexities are additionally making fabricating issues for makers, which are probably going to obstruct this market over the long haul.

1.Executive Summary

2.Research Methodology

3.Assumptions and Acronyms Used

4.Market Introduction

4.1.Taxonomy

4.2. Value Chain

5.Market Dynamics

5.1. Drivers

5.2. Restraints

6.Mexico Industrial Bulk Packaging Market Overview

6.1. Value (US$ Mn) and Volume (‘000’ Units)

6.2. Absolute $ Opportunity

7.Mexico Industrial Bulk Packaging Market Analysis, by Product type

7.1.Introduction

7.1.1.Market share and Basis Points (BPS) Analysis By Product Type

7.1.2.Y-o-Y Growth Projections By Product Type

7.2.Market Size (US$ Mn) and Volume (‘000’ Units) Forecast, By Product Type

7.2.1.Drums

7.2.2.IBC

7.2.3.Pails

7.2.4.Jerry Cans

7.3. Market Attractiveness Analysis, By Product Type

8.Mexico Industrial Bulk Packaging Market Analysis, by Application

8.1.Introduction

8.1.1.Market share and Basis Points (BPS) Analysis By Application

8.1.2.Y-o-Y Growth Projections By Application

8.2.Market Size (US$ Mn) and Volume (‘000’ Units) Forecast, By Application

8.2.1.Chemicals & Petrochemicals

8.2.2.Food & Beverages

8.2.3.Pharmaceuticals

8.2.4.Others

8.3. Market Attractiveness Analysis, By Application

9.Competitive Landscape

9.1.Competition Dashboard

9.2.Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

9.2.1.Mauser Group B.V.

•Overview

•Financials

•Strategy

•Recent Developments

•SWOT analysis

9.2.2.Greif, Inc.

•Overview

•Financials

•Strategy

•Recent Developments

•SWOT analysis

9.2.3.International Paper Company

•Overview

•Financials

•Strategy

•Recent Developments

•SWOT analysis

9.2.4.Hoover Container Solutions, Inc.

•Overview

•Financials

•Strategy

•Recent Developments

•SWOT analysis

9.2.5.Menasha Corporation

•Overview

•Financials

•Strategy

•Recent Developments

•SWOT analysis

9.2.6.Cleveland Steel Container Corporation

•Overview

•Financials

•Strategy

•Recent Developments

•SWOT analysis

9.2.7.Composite Containers LLC

•Overview

•Financials

•Strategy

•Recent Developments

•SWOT analysis

List of Tables

Table 01: Mexico Industrial Bulk Packaging Market Size (US$ Mn) and Volume ('000 Units), by Product type, 2015–2024

Table 02: Mexico Industrial Bulk Packaging Market Size (US$ Mn) and Volume ('000 Units), by Application, 2015–2024

List of Figures

Figure 01: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), 2015–2024

Figure 02: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 03: Mexico Industrial Bulk Packaging Value Share (%) and BPS Analysis by Product Type 2016 & 2024

Figure 04: Mexico Industrial Bulk Packaging Market Y-o-Y Growth, by Product Type, 2015–2024

Figure 05: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by Drum Segment 2015–2024

Figure 06: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by Drum Segment 2016?2024

Figure 07: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by IBC Segment 2015–2024

Figure 08: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by IBC Segment 2016?2024

Figure 09: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by Pails Segment 2015–2024

Figure 10: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by Pails Segment 2016?2024

Figure 11: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by Jerry Cans Segment 2015–2024

Figure 12: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by Jerry Cans Segment 2016?2024

Figure 13: Mexico Industrial Bulk Market Attractiveness, by Product Type, 2016–2024

Figure 14: Mexico Industrial Bulk Packaging Value Share (%) and BPS Analysis by Application 2016 & 2024

Figure 15: Mexico Industrial Bulk Packaging Market Y-o-Y Growth, by Application, 2015–2024

Figure 16: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by Chemicals & petrochemicals segment 2015–2024

Figure 17: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by Chemicals & petrochemicals segment 2016?2024

Figure 18: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by Food & Beverage Segment 2015–2024

Figure 19: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by Food & Beverage Segment 2016?2024

Figure 20: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by Pharmaceuticals Segment 2015–2024

Figure 21: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by Pharmaceuticals Segment 2016?2024

Figure 22: Mexico Industrial Bulk Packaging Market Value (US$ Mn) and Volume ('000 Units), by Others Segment 2015–2024

Figure 23: Mexico Industrial Bulk Packaging Market Absolute $ Opportunity (US$ Mn), by Others Segment 2016?2024

Figure 24: Mexico Industrial Bulk Market Attractiveness, by Application, 2016–2024