Reports

Reports

Consumer care and personal care product providers continue to cash in on the growing opportunities due to the increasing consumption of consumer care products. Changing lifestyles have led to the adoption of new hygiene routines, such as the use of anti-aging products, driving the sales of beauty and personal care packaging, worldwide. The increasing trend for flexibility and affordability has led to the consumption of smaller pack sizes. While cosmetic demand propels, manufacturers are not only focused towards offering effective cosmetics, but are also emphasizing the need to offer convenient product usage and dispensing, driving design innovation.

Emphasis on driving consumer engagement is further likely to support innovation in cosmetic packaging. Moreover, consumer distaste for plastic on account of the environmental hazards followed by its use is shifting attention towards metal cosmetic packaging. Transparency Market Research (TMR) recently published an extensive study on the metal cosmetic packaging market, with a positive perspective of the industry, owing to the aforementioned factors. The study unveils the key elements driving the industry’s growth, while elaborating on the developments witnessed across the metal cosmetic packaging market.

Through ancient times, metal packaging has been in seen in the form of gold and silver boxes, along with strong alloys. 1200 A.C. marked the start of the production of tin sheets in Bohemia. Following this, the beginning of the 14th century experienced the commencement of the use of tin containers for food packaging. Over the course of time, metal packaging containers found their application in several end-use sectors, including cosmetic packaging. Around 1966, enactment of the Fair Packaging and Labeling Act (FPLA) gained ground, which required all consumer products in interstate commerce to be informatively and honestly labeled, with the FDA imposing regulations on food, drugs, cosmetics, and medical devices. The use of metal packaging for cosmetics has surged phenomenally over the recent past, as cosmetic product manufacturers recognized the need to reduce the use of plastic in packaging.

Changing consumption patterns and the requirements of cosmetic product manufacturers led to an evolutionary growth in the metal cosmetic packaging market. According to TMR’s study, the metal cosmetic packaging market is expected to witness sales revenue of ~ US$ 4.4 Bn, registering a CAGR of ~4% in 2019. The rising demand from commercial setups and the growing popularity of packaging as a key differentiating factor for cosmetics are expected to fuel the growth of the metal cosmetics market.

Brand owners are focusing more on improved visuals for metal cosmetic packaging to help clients gain a competitive edge. Many have embraced digital printing that offers opportunities for developing eye-catching colors, and bold and striking visuals. Technological developments in digital printing continue to foster these efforts, bringing key changes across the metal cosmetic packaging landscape.

Most metal cosmetic packaging manufacturers are focusing on providing sustainable and eco-friendly packaging for cosmetics, which has been one of the major factors affecting consumer purchase decisions regarding cosmetics. Recyclable packaging solutions such as metal packaging are therefore gaining immense popularity among cosmetic product manufacturers.

Lightweighting has been a fast-growing trend within the metal cosmetics packaging industry over the past decade. This trend enables packaging manufacturers and cosmetic brand owners to reduce their environmental footprint, thereby improving their sustainability credentials, while also reducing overall costs. By developing more lightweight metal cosmetic packaging, less material is utilized, whilst reducing the energy consumption for distribution and logistic purposes.

The aspect of product differentiation is gaining center stage for cosmetic product providers in an attempt to build a brand image, consequently creating the need for improved and differentiated packaging solutions. Players in the metal cosmetic packaging market are adopting various technologies such as 3D printing technology to develop appealing metal cosmetic packaging. 3D printing is the new trend that is being adopted by manufacturers to enhance product look and attract cosmetic consumers. This is expected to contribute to the rise in the sales of metal cosmetic packaging solutions.

Application of metal packaging in skin care and hair care products is expected to boost the business of market players. Rising skin care awareness coupled with falling cosmetic prices is offering promising opportunities for packaging providers. Owing to this, investments centered towards producing packaging for skin care products would prove profitable.

Although significant developments are cited towards improving products, certain aspects are expected to hinder the progress of the market. Volatile raw material prices and fluctuating demand and supply of raw materials are likely to restrain the overall global metal cosmetic packaging market.

In 2018, AptarGroup, Inc. announced the acquisition of Reboul, a renowned and innovative leader in prestige beauty packaging. With this strategic acquisition, Aptar improved its capabilities, including high speed metal stamping, deep metal drawing, and differentiated lipstick mechanism design and production. The transaction positioned Aptar to capitalize on the growth in the color cosmetics market, and strengthened its ability to serve customers in the fragrance and skin care markets.

In 2019, Crown Holdings Inc. launched a new metal packaging-a new round-to-square-shaped tin that would find its application in the packaging of luxury products, as well as biscuits, confectionery, tea, and cosmetics. Produced by using a 100% recyclable material, this product fits the consumer requirement for convenience.

With merely 10-15% of the global metal cosmetic packaging market held by leading market players, and the remaining 80-85% controlled by other companies in 2018, the market remains fragmented in nature. Leading players of metal cosmetic packaging are adopting key strategies to enhance the quality of the product. Companies are constantly showing innovations in the design and functionality of their products in the beauty segment. Expansion in the global market remains a go-to strategy to increase their consumer base, which is incorporated by means of collaborations and acquisitions.

Metal Cosmetic Packaging Industry: Analysts’ View

The metal cosmetics packaging market continues to expand significantly, on account of the changing preferences of consumers and the growing trend of individuality. TMR’s analysts have a positive outlook of the market on account of the growing use of metal cosmetic packaging to not only protect the packaged product but also improve its appeal. Although the skin care segment is expected to dominate the global cosmetic packaging market by value and volume, significant demand for metal cosmetic packaging is expected to be generated by the hair care segment. Estimated to be a fast-growing segment throughout the forecast period, investments in producing packaging for hair care product packaging could churn greater profits in the near-future. E-Commerce penetration into rural and semi-urban areas could be a vital avenue that new entrants could explore in a bid to expand distribution capacity across the global market. Manufacturers of cosmetic products are preferring to sell their offerings through e-Commerce platforms, as the online purchase of cosmetics continues to surge. Metal cosmetic packaging providers are, therefore, developing products that are ideal for online sales channels. Market entrants can channelize their new product development strategies towards this avenue.

The growing desire of people to look beautiful is driving the demand for cosmetics, and subsequently metal cosmetic packaging. An increasing number of related commercial setups such as salons and beauty parlors is driving the demand for metal cosmetics packaging. Factors such as changing lifestyles of people, services provided by beauty and wellness industries, and increasing middle-class population in the developing countries of the Asia Pacific region are expected to drive the growth of the global metal cosmetic packaging market during the forecast period.

The hair care segment is anticipated to expand at a high CAGR of ~ 5%, in the metal cosmetic packaging market, during the forecast period. The skin care application segment is expected to be prominent in the overall metal cosmetic packaging market throughout the forecast period, by value and volume. Recent trends in the global cosmetics market show that, prices are steadily falling due to the rising competition between market players. This has led to an increase in penetration and rise in per capita consumption of cosmetics, worldwide, especially in APAC and Latin America. Packaging helps in driving impulse buying and enhancing shelf appeal as well as consumer satisfaction.

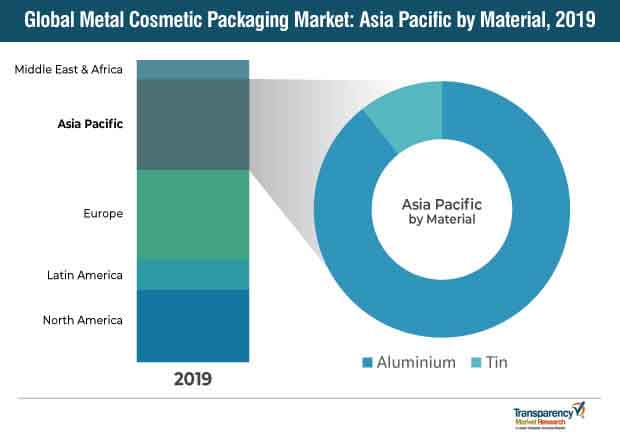

The global metal cosmetic packaging market has been segmented into five regions, i.e. North America, Latin America, Europe, Asia Pacific (APAC), and the Middle East & Africa (MEA). On the basis of product, the global metal cosmetic packaging market is segmented into tubes, bottles, pumps & dispensers, and others. On the basis of material, the global metal cosmetic packaging market is segmented into aluminum and tin. On the basis of application, the global metal cosmetic packaging market is segmented into skin care, hair care, makeup, and nail care. On the basis of capacity, the global metal cosmetic packaging market is segmented into lesser than 5 ml, 5 ml - 10 ml, 11 ml – 15 ml, and above 15 ml. Asia Pacific dominates the metal cosmetic packaging market in terms of value as well as volume. The APAC metal cosmetic packaging market share is prominently held by China and Japan. The Europe metal cosmetic packaging market is anticipated to expand by a CAGR of ~ 3% during the forecast period. The U.K. and Germany are major contributors to the Europe metal cosmetic packaging market.

Some of the key players in the global metal cosmetic packaging market that are included in the report are

Key manufacturers in the global metal cosmetic packaging market are focusing on expansion through acquisitions and partnerships. In recent years, it has also been observed that, key participants in the metal cosmetic packaging market are increasing their popularity around the globe by participating in exhibitions.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Viewpoint

3.1. Cosmetics Industry Outlook

3.2. Cosmetic Packaging Market Outlook

3.3. Cosmetic Pen & Pencil Packaging Market Outlook

3.4. Macro-economic Factors & Correlation Analysis

3.5. Forecast Factors: Relevance & Impact

3.6. Value Chain Analysis

3.6.1. Key Market Participants

3.6.1.1. Raw Material Suppliers

3.6.1.2. Metal Cosmetic Packaging Manufacturers

3.6.1.3. Distributors

3.6.2. Profitability Margin

3.7. Market Dynamics

3.7.1. Drivers

3.7.2. Restraints

3.7.3. Trends

3.7.4. Opportunities

4. Global Metal Cosmetic Packaging Market Analysis

4.1. Pricing Analysis

4.2. Market Value (US$ Mn) and Volume (Mn Units) Analysis & Forecast

4.3. Y-o-Y Growth Projections

4.4. Absolute $ Opportunity Analysis

5. Global Metal Cosmetic Packaging Market Analysis, by Product

5.1. Section Summary

5.2. Introduction

5.2.1. Market Value Share Analysis, by Product

5.2.2. Y-o-Y Growth Analysis, by Product

5.3. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Product

5.3.1. Tubes

5.3.2. Bottles

5.3.3. Pumps & Dispensers

5.3.4. Others

5.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Product

5.4.1. Tubes

5.4.2. Bottles

5.4.3. Pumps & Dispensers

5.4.4. Others

5.5. Market Attractiveness Analysis, by Product

6. Global Metal Cosmetic Packaging Market Analysis, by Material Type

6.1. Section Summary

6.2. Introduction

6.2.1. Market Value Share Analysis, by Material Type

6.2.2. Y-o-Y Growth Analysis, by Material Type

6.3. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Material Type

6.3.1. Aluminum

6.3.2. Tin

6.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Material Type

6.4.1. Aluminum

6.4.2. Tin

6.5. Market Attractiveness Analysis, by Material Type

7. Global Metal Cosmetic Packaging Market Analysis, by Application

7.1. Section Summary

7.2. Introduction

7.2.1. Market Value Share Analysis, by Application

7.2.2. Y-o-Y Growth Analysis, by Application

7.3. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Application

7.3.1. Skin Care

7.3.2. Hair Care

7.3.3. Makeup

7.3.4. Nail Care

7.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Application

7.4.1. Skin Care

7.4.2. Hair Care

7.4.3. Makeup

7.4.4. Nail Care

7.5. Market Attractiveness Analysis, by Application

8. Global Metal Cosmetic Packaging Market Analysis, by Capacity

8.1. Section Summary

8.2. Introduction

8.2.1. Market Value Share Analysis, by Capacity

8.2.2. Y-o-Y Growth Analysis, by Capacity

8.3. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Capacity

8.3.1. Lesser than 5 ml

8.3.2. 5 ml – 10 ml

8.3.3. 11 ml – 15 ml

8.3.4. Above 15 ml

8.4. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Capacity

8.4.1. Lesser than 5 ml

8.4.2. 5 ml – 10 ml

8.4.3. 11 ml – 15 ml

8.4.4. Above 15 ml

8.5. Market Attractiveness Analysis, by Capacity

9. Global Metal Cosmetic Packaging Market Analysis, by Region

9.1. Section Summary

9.2. Introduction

9.2.1. Market Value Share Analysis, by Region

9.2.2. Y-o-Y Growth Analysis, by Region

9.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Region

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific

9.3.5. Middle East & Africa (MEA)

9.4. Market Attractiveness Analysis, by Region

10. North America Metal Cosmetic Packaging Market Analysis

10.1. Introduction

10.2. Historical Market Value(US$ Mn) and Volume (Mn Units) Analysis, 2014-2018, by Country

10.2.1. U.S.

10.2.2. Canada

10.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Country

10.3.1. U.S.

10.3.2. Canada

10.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Product

10.4.1. Tubes

10.4.2. Bottles

10.4.3. Pumps & Dispensers

10.4.4. Others

10.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Product

10.5.1. Tubes

10.5.2. Bottles

10.5.3. Pumps & Dispensers

10.5.4. Others

10.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Material Type

10.6.1. Aluminum

10.6.2. Tin

10.7. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Material Type

10.7.1. Aluminum

10.7.2. Tin

10.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Application

10.8.1. Skin Care

10.8.2. Hair Care

10.8.3. Makeup

10.8.4. Nail Care

10.9. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Application

10.9.1. Skin Care

10.9.2. Hair Care

10.9.3. Makeup

10.9.4. Nail Care

10.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Capacity

10.10.1. Lesser than 5 ml

10.10.2. 5 ml – 10 ml

10.10.3. 11 ml – 15 ml

10.10.4. Above 15 ml

10.11. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Capacity

10.11.1. Lesser than 5 ml

10.11.2. 5 ml – 10 ml

10.11.3. 11 ml – 15 ml

10.11.4. Above 15 ml

11. Latin America Metal Cosmetic Packaging Market Analysis

11.1. Introduction

11.2. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Country

11.2.1. Brazil

11.2.2. Mexico

11.2.3. Argentina

11.2.4. Rest of Latin America

11.3. Market Value (US$ Mn) and Volume (Mn Units) Analysis, by Country, 2019-2027

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Product

11.4.1. Tubes

11.4.2. Bottles

11.4.3. Pumps & Dispensers

11.4.4. Others

11.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Product

11.5.1. Tubes

11.5.2. Bottles

11.5.3. Pumps & Dispensers

11.5.4. Others

11.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Material Type

11.6.1. Aluminum

11.6.2. Tin

11.7. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Material Type

11.7.1. Aluminum

11.7.2. Tin

11.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Application

11.8.1. Skin Care

11.8.2. Hair Care

11.8.3. Makeup

11.8.4. Nail Care

11.9. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Application

11.9.1. Skin Care

11.9.2. Hair Care

11.9.3. Makeup

11.9.4. Nail Care

11.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Capacity

11.10.1. Lesser than 5 ml

11.10.2. 5 ml – 10 ml

11.10.3. 11 ml – 15 ml

11.10.4. Above 15 ml

11.11. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Capacity

11.11.1. Lesser than 5 ml

11.11.2. 5 ml – 10 ml

11.11.3. 11 ml – 15 ml

11.11.4. Above 15 ml

12. Europe Metal Cosmetic Packaging Market Analysis

12.1. Introduction

12.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Country

12.2.1. Germany

12.2.2. Italy

12.2.3. France

12.2.4. U.K.

12.2.5. Spain

12.2.6. Benelux

12.2.7. Russia

12.2.8. Poland

12.2.9. Rest of Europe

12.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Country

12.3.1. Germany

12.3.2. Italy

12.3.3. France

12.3.4. U.K.

12.3.5. Spain

12.3.6. Benelux

12.3.7. Russia

12.3.8. Poland

12.3.9. Rest of Europe

12.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Product

12.4.1. Tubes

12.4.2. Bottles

12.4.3. Pumps & Dispensers

12.4.4. Others

12.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Product

12.5.1. Tubes

12.5.2. Bottles

12.5.3. Pumps & Dispensers

12.5.4. Others

12.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Material Type

12.6.1. Aluminum

12.6.2. Tin

12.7. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Material Type

12.7.1. Aluminum

12.7.2. Tin

12.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Application

12.8.1. Skin Care

12.8.2. Hair Care

12.8.3. Makeup

12.8.4. Nail Care

12.9. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Application

12.9.1. Skin Care

12.9.2. Hair Care

12.9.3. Makeup

12.9.4. Nail Care

12.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Capacity

12.10.1. Lesser than 5 ml

12.10.2. 5 ml – 10 ml

12.10.3. 11 ml – 15 ml

12.10.4. Above 15 ml

12.11. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Capacity

12.11.1. Lesser than 5 ml

12.11.2. 5 ml – 10 ml

12.11.3. 11 ml – 15 ml

12.11.4. Above 15 ml

13. Asia Pacific Metal Cosmetic Packaging Market Analysis

13.1. Introduction

13.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Country

13.2.1. China

13.2.2. India

13.2.3. ASEAN

13.2.4. Australia and New Zealand

13.2.5. Japan

13.2.6. Rest of Asia Pacific

13.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Country

13.3.1. China

13.3.2. India

13.3.3. ASEAN

13.3.4. Australia and New Zealand

13.3.5. Japan

13.3.6. Rest of Asia Pacific

13.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Product

13.4.1. Tubes

13.4.2. Bottles

13.4.3. Pumps & Dispensers

13.4.4. Others

13.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Product

13.5.1. Tubes

13.5.2. Bottles

13.5.3. Pumps & Dispensers

13.5.4. Others

13.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Material Type

13.6.1. Aluminum

13.6.2. Tin

13.7. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Material Type

13.7.1. Aluminum

13.7.2. Tin

13.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Application

13.8.1. Skin Care

13.8.2. Hair Care

13.8.3. Makeup

13.8.4. Nail Care

13.9. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Application

13.9.1. Skin Care

13.9.2. Hair Care

13.9.3. Makeup

13.9.4. Nail Care

13.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Capacity

13.10.1. Lesser than 5 ml

13.10.2. 5 ml – 10 ml

13.10.3. 11 ml – 15 ml

13.10.4. Above 15 ml

13.11. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Capacity

13.11.1. Lesser than 5 ml

13.11.2. 5 ml – 10 ml

13.11.3. 11 ml – 15 ml

13.11.4. Above 15 ml

14. Middle East & Africa Metal Cosmetic Packaging Market Analysis

14.1. Introduction

14.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Country

14.2.1. GCC Countries

14.2.2. Northern Africa

14.2.3. South Africa

14.2.4. Rest of MEA

14.3. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Country

14.3.1. GCC Countries

14.3.2. Northern Africa

14.3.3. South Africa

14.3.4. Rest of MEA

14.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Product

14.4.1. Tubes

14.4.2. Bottles

14.4.3. Pumps & Dispensers

14.4.4. Others

14.5. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Product

14.5.1. Tubes

14.5.2. Bottles

14.5.3. Pumps & Dispensers

14.5.4. Others

14.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Material Type

14.6.1. Aluminum

14.6.2. Tin

14.7. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Material Type

14.7.1. Aluminum

14.7.2. Tin

14.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Application

14.8.1. Skin Care

14.8.2. Hair Care

14.8.3. Makeup

14.8.4. Nail Care

14.9. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Application

14.9.1. Skin Care

14.9.2. Hair Care

14.9.3. Makeup

14.9.4. Nail Care

14.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, by Capacity

14.10.1. Lesser than 5 ml

14.10.2. 5 ml – 10 ml

14.10.3. 11 ml – 15 ml

14.10.4. Above 15 ml

14.11. Market Value (US$ Mn) and Volume (Mn Units) Forecast, 2019-2027, by Capacity

14.11.1. Lesser than 5 ml

14.11.2. 5 ml – 10 ml

14.11.3. 11 ml – 15 ml

14.11.4. Above 15 ml

15. Market Structure Analysis

15.1. Market Analysis by Tier of Companies

15.1.1. By Large, Medium, and Small

15.2. Market Concentration

15.2.1. By Top 5 and by Top 10

15.3. Production Capacity Share Analysis

15.3.1. By Large, Medium, and Small

15.3.2. By Top 5 and Top 10

15.4. Market Share Analysis of Top 10 Players

15.4.1. The Americas Market Share Analysis, by Top Players

15.4.2. MEA Market Share Analysis, by Top Players

15.4.3. Asia Pacific Market Share Analysis, by Top Players

15.5. Market Presence Analysis

15.5.1. By Regional footprint of Players

15.5.2. Product footprint, by Players

15.5.3. Channel footprint, by Players

16. Competition Analysis

16.1. Competition Dashboard

16.2. Profitability and Gross Margin Analysis

16.3. Competition Developments

16.4. Competition Deep Dive

16.4.1. Aptar Group Inc.

16.4.1.1. Overview

16.4.1.2. Product Portfolio

16.4.1.3. Profitability

16.4.1.4. Production Footprint

16.4.1.5. Sales Footprint

16.4.1.6. Channel Footprint

16.4.1.7. Competition Benchmarking

16.4.1.8. Strategy

16.4.1.8.1. Marketing Strategy

16.4.1.8.2. Product Strategy

16.4.1.8.3. Channel Strategy

16.4.2. RPC Group Plc.

16.4.2.1. Overview

16.4.2.2. Product Portfolio

16.4.2.3. Profitability

16.4.2.4. Production Footprint

16.4.2.5. Sales Footprint

16.4.2.6. Channel Footprint

16.4.2.7. Competition Benchmarking

16.4.2.8. Strategy

16.4.2.8.1. Marketing Strategy

16.4.2.8.2. Product Strategy

16.4.2.8.3. Channel Strategy

16.4.3. Libo Cosmetics Company, Ltd

16.4.3.1. Overview

16.4.3.2. Product Portfolio

16.4.3.3. Profitability

16.4.3.4. Production Footprint

16.4.3.5. Sales Footprint

16.4.3.6. Channel Footprint

16.4.3.7. Competition Benchmarking

16.4.3.8. Strategy

16.4.3.8.1. Marketing Strategy

16.4.3.8.2. Product Strategy

16.4.3.8.3. Channel Strategy

16.4.4. Quadpack Industries

16.4.4.1. Overview

16.4.4.2. Product Portfolio

16.4.4.3. Profitability

16.4.4.4. Production Footprint

16.4.4.5. Sales Footprint

16.4.4.6. Channel Footprint

16.4.4.7. Competition Benchmarking

16.4.4.8. Strategy

16.4.4.8.1. Marketing Strategy

16.4.4.8.2. Product Strategy

16.4.4.8.3. Channel Strategy

16.4.5. HCP Packaging

16.4.5.1. Overview

16.4.5.2. Product Portfolio

16.4.5.3. Profitability

16.4.5.4. Production Footprint

16.4.5.5. Sales Footprint

16.4.5.6. Channel Footprint

16.4.5.7. Competition Benchmarking

16.4.5.8. Strategy

16.4.5.8.1. Marketing Strategy

16.4.5.8.2. Product Strategy

16.4.5.8.3. Channel Strategy

16.4.6. Fusion Packaging

16.4.6.1. Overview

16.4.6.2. Product Portfolio

16.4.6.3. Profitability

16.4.6.4. Production Footprint

16.4.6.5. Sales Footprint

16.4.6.6. Channel Footprint

16.4.6.7. Competition Benchmarking

16.4.6.8. Strategy

16.4.6.8.1. Marketing Strategy

16.4.6.8.2. Product Strategy

16.4.6.8.3. Channel Strategy

16.4.7. Swallowfield Plc

16.4.7.1. Overview

16.4.7.2. Product Portfolio

16.4.7.3. Profitability

16.4.7.4. Production Footprint

16.4.7.5. Sales Footprint

16.4.7.6. Channel Footprint

16.4.7.7. Competition Benchmarking

16.4.7.8. Strategy

16.4.7.8.1. Marketing Strategy

16.4.7.8.2. Product Strategy

16.4.7.8.3. Channel Strategy

16.4.8. Crown Holdings, Inc.

16.4.8.1. Overview

16.4.8.2. Product Portfolio

16.4.8.3. Profitability

16.4.8.4. Production Footprint

16.4.8.5. Sales Footprint

16.4.8.6. Channel Footprint

16.4.8.7. Competition Benchmarking

16.4.8.8. Strategy

16.4.8.8.1. Marketing Strategy

16.4.8.8.2. Product Strategy

16.4.8.8.3. Channel Strategy

16.4.9. Albea S.A.

16.4.9.1. Overview

16.4.9.2. Product Portfolio

16.4.9.3. Profitability

16.4.9.4. Production Footprint

16.4.9.5. Sales Footprint

16.4.9.6. Channel Footprint

16.4.9.7. Competition Benchmarking

16.4.9.8. Strategy

16.4.9.8.1. Marketing Strategy

16.4.9.8.2. Product Strategy

16.4.9.8.3. Channel Strategy

16.4.10. Linhardt GmbH & Co. KG

16.4.10.1. Overview

16.4.10.2. Product Portfolio

16.4.10.3. Profitability

16.4.10.4. Production Footprint

16.4.10.5. Sales Footprint

16.4.10.6. Channel Footprint

16.4.10.7. Competition Benchmarking

16.4.10.8. Strategy

16.4.10.8.1. Marketing Strategy

16.4.10.8.2. Product Strategy

16.4.10.8.3. Channel Strategy

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Material Type, 2014H – 2027F

Table 02: Global Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2014H – 2027F

Table 03: Global Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Product, 2014H – 2027F

Table 04: Global Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Product, 2014H – 2027F

Table 05: Global Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Region, 2014H – 2027F

Table 06: North America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Country, 2014H – 2027F

Table 07: North America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Material Type, 2014H – 2027F

Table 08: North America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2014H – 2027F

Table 09: North America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Product, 2014H – 2027F

Table 10: North America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Capacity, 2014H – 2027F

Table 11: Latin America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume ('000 Units) Forecast, by Country, 2014H – 2027F

Table 12: Latin America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Material Type, 2014H – 2027F

Table 13: Latin America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2014H – 2027F

Table 14: Latin America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Product, 2014H – 2027F

Table 15: Latin America Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Capacity, 2014H – 2027F

Table 16: Europe Metal Cosmetics Packaging Market Value (US$ Mn) and Volume ('000 Units) Forecast, by Country, 2014H – 2027F

Table 17: Europe Metal Cosmetics Packaging Market Value (US$ Mn) and Volume ('000 Units) Forecast, by Country, 2014H – 2027F

Table 18: Europe Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Material Type, 2014H – 2027F

Table 19: Europe Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2014H – 2027F

Table 20: Europe Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Product, 2014H – 2027F

Table 21: Europe Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Capacity, 2014H – 2027F

Table 22: APAC Metal Cosmetics Packaging Market Value (US$ Mn) and Volume ('000 Units) Forecast, by Country, 2014H – 2027F

Table 23: APAC Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Material Type, 2014H – 2027F

Table 24: APAC Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2014H – 2027F

Table 25: APAC Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Product, 2014H – 2027F

Table 26: APAC Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Capacity, 2014H – 2027F

Table 27: MEA Metal Cosmetics Packaging Market Value (US$ Mn) and Volume ('000 Units) Forecast, by Country, 2014H – 2027F

Table 28: MEA Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Material Type, 2014H – 2027F

Table 29: MEA Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Application Type, 2014H – 2027F

Table 30: MEA Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by Product, 2014H – 2027F

Table 31: MEA Metal Cosmetics Packaging Market Value (US$ Mn) and Volume (Tons) Forecast, by CMEAity, 2014H – 2027F

List of Figures

Figure 01: Global Metal Cosmetics Packaging Market BPS Analysis, by Material Type, 2019(E) & 2027(F)

Figure 02: Global Metal Cosmetics Packaging Market Y-o-Y growth, by Material Type, 2019(E) – 2027(F)

Figure 03: Global Metal Cosmetics Packaging Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 04: Global Metal Cosmetics Packaging Market BPS Analysis, by Application Type, 2019(E) & 2027(F)

Figure 05: Global Metal Cosmetics Packaging Market Y-o-Y growth, by Application Type, 2019(E) – 2027(F)

Figure 06: Global Metal Cosmetics Packaging Market Attractiveness Index, by Application Type, 2019(E) – 2027(F)

Figure 07: Global Metal Cosmetics Packaging Market BPS Analysis, by Product, 2019(E) & 2027(F)

Figure 08: Global Metal Cosmetics Packaging Market Y-o-Y growth, by Product, 2019(E) – 2027(F)

Figure 09: Global Metal Cosmetics Packaging Market Attractiveness Index, by Product, 2019(E) – 2027(F)

Figure 10: Global Metal Cosmetics Packaging Market BPS Analysis, by Capacity , 2019(E) & 2027(F)

Figure 11: Global Metal Cosmetics Packaging Market Y-o-Y growth, by Capacity, 2019(E) – 2027(F)

Figure 12: Global Metal Cosmetics Packaging Market Attractiveness Index, by Capacity, 2019(E) – 2027(F)

Figure 13: Global Metal Cosmetics Packaging Market BPS Analysis, by Region, 2019(E) & 2027(F)

Figure 14: Global Metal Cosmetics Packaging Market Y-o-Y growth, by Region, 2019(E) – 2027(F)

Figure 15: Global Metal Cosmetics Packaging Market Attractiveness Index, by Region, 2019(E) – 2027(F)

Figure 16: North America Metal Cosmetics Packaging Market Value (US$ Mn), and volume (Mn Units) analysis, 2019-2027

Figure 17: North America Metal Cosmetics Packaging Market Absolute $ Opportunity, 2019-2027

Figure 18: North America Metal Cosmetics Packaging Market BPS Analysis, by Country, 2019(E) & 2027(F)

Figure 19: North America Metal Cosmetics Packaging Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 20: North America Metal Cosmetics Packaging Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 21: North America Metal Cosmetics Packaging Market BPS Analysis, by Material Type, 2019(E) & 2027(F)

Figure 22: North America Metal Cosmetics Packaging Market Y-o-Y growth, by Material Type, 2019(E) – 2027(F)

Figure 23: North America Metal Cosmetics Packaging Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 24: North America Metal Cosmetics Packaging Market BPS Analysis, by Application Type, 2019(E) & 2027(F)

Figure 25: North America Metal Cosmetics Packaging Market Y-o-Y growth, by Application Type, 2019(E) – 2027(F)

Figure 26: North America Metal Cosmetics Packaging Market Attractiveness Index, by Application Type, 2019(E) – 2027(F)

Figure 27: North America Metal Cosmetics Packaging Market BPS Analysis, by Product, 2019(E) & 2027(F)

Figure 28: North America Metal Cosmetics Packaging Market Y-o-Y growth, by Product, 2019(E) – 2027(F)

Figure 29: North America Metal Cosmetics Packaging Market Attractiveness Index, by Product, 2019(E) – 2027(F)

Figure 30: North America Metal Cosmetics Packaging Market BPS Analysis, by Capacity, 2019(E) & 2027(F)

Figure 31: North America Metal Cosmetics Packaging Market Y-o-Y growth, by Capacity, 2019(E) – 2027(F)

Figure 32: North America Metal Cosmetics Packaging Market Attractiveness Index, by Capacity, 2019(E) – 2027(F)

Figure 33: Latin America Metal Cosmetics Packaging Market Value (US$ Mn), and volume (‘000 Units) analysis, 2019-2027

Figure 34: Latin America Metal Cosmetics Packaging Market Absolute $ Opportunity, 2019-2027

Figure 35: Latin America Metal Cosmetics Packaging Market BPS Analysis, by Country, 2019(E) & 2027(F)

Figure 36: Latin America Metal Cosmetics Packaging Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 37: Latin America Metal Cosmetics Packaging Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 38: Latin America Metal Cosmetics Packaging Market BPS Analysis, by Material Type, 2019(E) & 2027(F)

Figure 39: Latin America Metal Cosmetics Packaging Market Y-o-Y growth, by Material Type, 2019(E) – 2027(F)

Figure 40: Latin America Metal Cosmetics Packaging Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 41: Latin America Metal Cosmetics Packaging Market BPS Analysis, by Application Type, 2019(E) & 2027(F)

Figure 42: Latin America Metal Cosmetics Packaging Market Y-o-Y growth, by Application Type, 2019(E) – 2027(F)

Figure 43: Latin America Metal Cosmetics Packaging Market Attractiveness Index, by Application Type, 2019(E) – 2027(F)

Figure 44: Latin America Metal Cosmetics Packaging Market BPS Analysis, by Product, 2019(E) & 2027(F)

Figure 45: Latin America Metal Cosmetics Packaging Market Y-o-Y growth, by Product, 2019(E) – 2027(F)

Figure 46: Latin America Metal Cosmetics Packaging Market Attractiveness Index, by Product, 2019(E) – 2027(F)

Figure 47: Latin America Metal Cosmetics Packaging Market BPS Analysis, by Capacity, 2019(E) & 2027(F)

Figure 48: Latin America Metal Cosmetics Packaging Market Y-o-Y growth, by Capacity, 2019(E) – 2027(F)

Figure 49: Latin America Metal Cosmetics Packaging Market Attractiveness Index, by Capacity, 2019(E) – 2027(F)

Figure 50: Europe Metal Cosmetics Packaging Market Value (US$ Mn), and volume (‘000 Units) analysis, 2019-2027

Figure 51: Europe Metal Cosmetics Packaging Market Absolute $ Opportunity, 2019-2027

Figure 52: Europe Metal Cosmetics Packaging Market BPS Analysis, by Country, 2019(E) & 2027(F)

Figure 53: Europe Metal Cosmetics Packaging Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 54: Europe Metal Cosmetics Packaging Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 55: Europe Metal Cosmetics Packaging Market BPS Analysis, by Material Type, 2019(E) & 2027(F)

Figure 56: Europe Metal Cosmetics Packaging Market Y-o-Y growth, by Material Type, 2019(E) – 2027(F)

Figure 57: Europe Metal Cosmetics Packaging Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 58: Europe Metal Cosmetics Packaging Market BPS Analysis, by Application Type, 2019(E) & 2027(F)

Figure 59: Europe Metal Cosmetics Packaging Market Y-o-Y growth, by Application Type, 2019(E) – 2027(F)

Figure 60: Europe Metal Cosmetics Packaging Market Attractiveness Index, by Application Type, 2019(E) – 2027(F)

Figure 61: Europe Metal Cosmetics Packaging Market BPS Analysis, by Product, 2019(E) & 2027(F)

Figure 62: Europe Metal Cosmetics Packaging Market Y-o-Y growth, by Product, 2019(E) – 2027(F)

Figure 63: Europe Metal Cosmetics Packaging Market Attractiveness Index, by Product, 2019(E) – 2027(F)

Figure 64: Europe Metal Cosmetics Packaging Market BPS Analysis, by Capacity, 2019(E) & 2027(F)

Figure 65: Europe Metal Cosmetics Packaging Market Y-o-Y growth, by Capacity, 2019(E) – 2027(F)

Figure 66: Europe Metal Cosmetics Packaging Market Attractiveness Index, by Capacity, 2019(E) – 2027(F)

Figure 67: APAC Metal Cosmetics Packaging Market Value (US$ Mn), and volume (‘000 Units) analysis, 2019-2027

Figure 68: APAC Metal Cosmetics Packaging Market Absolute $ Opportunity, 2019-2027

Figure 69: APAC Metal Cosmetics Packaging Market BPS Analysis, by Country, 2019(E) & 2027(F)

Figure 70: APAC Metal Cosmetics Packaging Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 71: APAC Metal Cosmetics Packaging Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 72: APAC Metal Cosmetics Packaging Market BPS Analysis, by Material Type, 2019(E) & 2027(F)

Figure 73: APAC Metal Cosmetics Packaging Market Y-o-Y growth, by Material Type, 2019(E) – 2027(F)

Figure 74: APAC Metal Cosmetics Packaging Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 75: APAC Metal Cosmetics Packaging Market BPS Analysis, by Application Type, 2019(E) & 2027(F)

Figure 76: APAC Metal Cosmetics Packaging Market Y-o-Y growth, by Application Type, 2019(E) – 2027(F)

Figure 77: APAC Metal Cosmetics Packaging Market Attractiveness Index, by Application Type, 2019(E) – 2027(F)

Figure 78: APAC Metal Cosmetics Packaging Market BPS Analysis, by Product, 2019(E) & 2027(F)

Figure 79: APAC Metal Cosmetics Packaging Market Y-o-Y growth, by Product, 2019(E) – 2027(F)

Figure 80: APAC Metal Cosmetics Packaging Market Attractiveness Index, by Product, 2019(E) – 2027(F)

Figure 81: APAC Metal Cosmetics Packaging Market BPS Analysis, by Capacity, 2019(E) & 2027(F)

Figure 82: APAC Metal Cosmetics Packaging Market Y-o-Y growth, by Capacity, 2019(E) – 2027(F)

Figure 83: APAC Metal Cosmetics Packaging Market Attractiveness Index, by Capacity, 2019(E) – 2027(F)

Figure 84: MEA Metal Cosmetics Packaging Market Value (US$ Mn), and volume (‘000 Units) analysis, 2019-2027

Figure 85: MEA Metal Cosmetics Packaging Market Absolute $ Opportunity, 2019-2027

Figure 86: MEA Metal Cosmetics Packaging Market BPS Analysis, by Country, 2019(E) & 2027(F)

Figure 87: MEA Metal Cosmetics Packaging Market Y-o-Y growth, by Country, 2019(E) – 2027(F)

Figure 88: MEA Metal Cosmetics Packaging Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 89: MEA Metal Cosmetics Packaging Market BPS Analysis, by Material Type, 2019(E) & 2027(F)

Figure 90: MEA Metal Cosmetics Packaging Market Y-o-Y growth, by Material Type, 2019(E) – 2027(F)

Figure 91 MEA Metal Cosmetics Packaging Market Attractiveness Index, by Material Type, 2019(E) – 2027(F)

Figure 92: MEA Metal Cosmetics Packaging Market BPS Analysis, by Application Type, 2019(E) & 2027(F)

Figure 93: MEA Metal Cosmetics Packaging Market Y-o-Y growth, by Application Type, 2019(E) – 2027(F)

Figure 94: MEA Metal Cosmetics Packaging Market Attractiveness Index, by Application Type, 2019(E) – 2027(F)

Figure 95: MEA Metal Cosmetics Packaging Market BPS Analysis, by Product, 2019(E) & 2027(F)

Figure 96: MEA Metal Cosmetics Packaging Market Y-o-Y growth, by Product, 2019(E) – 2027(F)

Figure 97: MEA Metal Cosmetics Packaging Market Attractiveness Index, by Product, 2019(E) – 2027(F)

Figure 98: MEA Metal Cosmetics Packaging Market BPS Analysis, by Capacity, 2019(E) & 2027(F)

Figure 99: MEA Metal Cosmetics Packaging Market Y-o-Y growth, by Capacity, 2019(E) – 2027(F)

Figure 100: MEA Metal Cosmetics Packaging Market Attractiveness Index, by Capacity, 2019(E) – 2027(F)