Chapter 1 Preface

1.1 Report Description

1.2 Research Methodology

Chapter 2 Executive Summary

Chapter 3 Market Overview

3.1 Introduction

3.1.1 Synthesis of lysine

3.2 Value chain analysis

3.3 Market Drivers

3.3.1 Growth in global meat consumption

3.3.2 Advantages of lysine over soybean

3.3.3 Ban on blood meal and bone meal

3.4 Restraints

3.4.1 Tight raw material supply

3.5 Opportunities

3.5.1 Growing meat demand in Asia Pacific

3.5.2 Shift towards other raw materials

3.6 Raw material analysis

3.6.1 Maize/dextrose

3.6.1.1 Dextrose prices in the U.S. 2008-2012 (USD per ton)

3.6.2 Sugar

3.6.2.1 World raw sugar prices, 2008 - 2012 (USD per ton)

3.6.3 Cassava

3.6.3.1 Global cassava prices, 2008 - 2012 (USD per ton)

3.7 Porter’s five forces analysis

3.7.1 Bargaining power of supplier

3.7.2 Bargaining power of buyers

3.7.3 Threat from new entrants

3.7.4 Threat from substitutes

3.7.5 Degree of competition

3.8 Company market share analysis, 2011

3.9 Lysine Vs other amino acids

3.9.1 Comparative analysis of amino acids

3.9.2 Methionine

3.9.2.1 Methionine market volumes share by geography, 2011

3.9.2.2 Global methionine market estimates and forecast, 2011 - 2018 (Kilo tons) (USD Million)

3.9.3 Threonine

3.9.3.1 Threonine market volume share by geography, 2011

3.9.3.2 Global threonine market estimates and forecast, 2011 - 2018 (Kilo tons) (USD Million)

3.9.4 Tryptophan

3.9.4.1 Global tryptophan market volumes share by geography, 2011

3.9.4.2 Global tryptophan market estimates and forecast, 2011 - 2018 (Kilo tons) (USD Million)

Chapter 4 Global Lysine Market, by Application

4.1 Global lysine market: application overview

4.1.1 Global lysine market volumes share by application, 2011 & 2018

4.2 Global lysine market, by application

4.2.1 Animal feed

4.2.1.1 Global consumption of lysine for animal feed 2011 – 2018 (Kilo Tons) (USD Million)

4.2.2 Food & Dietary Supplements

4.2.2.1 Global demand of lysine for food and dietary supplements, 2011 – 2018 (Kilo Tons) (USD Million)

4.2.3 Pharmaceuticals

4.2.3.1 Global consumption of lysine for pharmaceuticals, 2011 – 2018 (Kilo Tons) (USD Million)

Chapter 5 Global Lysine Market, by livestock

5.1 Global lysine market: Livestock overview

5.1.1 Global lysine market volumes share by livestock, 2011 & 2018

5.2 Global lysine market, by livestock

5.2.1 Swine

5.2.1.1 Global demand for lysine for swine, 2011 – 2018 (Kilo Tons) (USD Million)

5.2.2 Poultry

5.2.2.1 Global demand for lysine for poultry, 2011 – 2018 (Kilo Tons) (USD Million)

5.2.3 Others(including aquaculture)

5.2.3.1 Global demand for lysine for other(including aquaculture), 2011 – 2018 (Kilo Tons) (USD Million)

Chapter 6 Geographic Analysis

6.1 Global lysine market: geographic overview

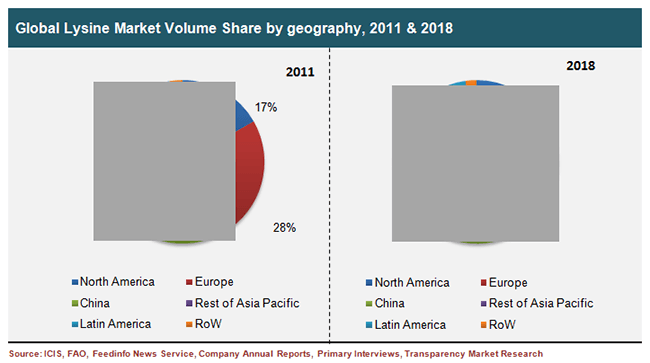

6.1.1 Global lysine market volumes share by geography, 2011 & 2018

6.2 Global lysine market, by geography

6.2.1 North America

6.2.1.1 North American lysine market estimates and forecast, 2011 - 2018 (Kilo tons), (USD Million)

6.2.1.2 North America lysine market by application, 2011 – 2018 (Kilo tons)

6.2.1.3 North America lysine market by application,2011 -2018(USD Million)

6.2.1.4 North America lysine market by livestock, 2011 – 2018(Kilo tons)

6.2.1.5 North America lysine market by livestock, 2011 – 2018(USD million)

6.2.1.6 United States market for lysine, 2011-2018 (Kilo tons), (USD Million)

6.2.2 Europe

6.2.2.1 European demand for lysine, 2011 - 2018 (Kilo tons), (USD Million)

6.2.2.2 Europe lysine market by application, 2011 – 2018(Kilo tons)

6.2.2.3 Europe lysine market by application, 2011 – 2018 (USD Million)

6.2.2.4 Europe lysine market by livestock, 2011- 2018(Kilo Tons)

6.2.2.5 Europe lysine market by livestock, 2011 – 2018(USD million)

6.2.2.6 Germany market for lysine, 2011-2018 (Kilo tons), (USD Million)

6.2.2.7 United Kingdom market for lysine, 2011-2018 (Kilo tons), (USD Million)

6.2.3 China

6.2.3.1 China demand for lysine, 2011 - 2018 (Kilo tons), (USD Million)

6.2.3.2 China lysine market by application, 2011-2018(Kilo tons)

6.2.3.3 China lysine market by application, 2011 – 2018 (USD Million)

6.2.3.4 China lysine market by livestock, 2011-2018(Kilo tons)

6.2.3.5 China lysine market by livestock, 2011 – 2018(USD Million)

6.2.4 Rest of Asia Pacific

6.2.4.1 Rest of Asia Pacific demand for lysine, 2011 - 2018 (Kilo tons), (USD Million)

6.2.4.2 Rest of Asia Pacific lysine market by application, 2011-2018 (Kilo tons)

6.2.4.3 Rest of Asia Pacific lysine market by application, 2011- 2018 (USD Million)

6.2.4.4 Rest of Asia Pacific lysine market by livestock, 2011-2018 (kilo tons)

6.2.4.5 Rest of Asia Pacific lysine market by livestock, 2011 – 2018(USD Million)

6.2.4.6 India market for lysine, 2011-2018 (Kilo tons), (USD Million)

6.2.4.7 Japan market for lysine, 2011-2018 (Kilo tons), (USD Million)

6.2.5 Latin America

6.2.5.1 Latin America demand for lysine, 2011 - 2018 (Kilo tons), (USD Million)

6.2.5.2 Latin America lysine market by application, 2011-2018(Kilo tons)

6.2.5.3 Latin America lysine market by application, 2011-2018 (USD Million)

6.2.5.4 Latin America lysine market by livestock, 2011- 2018 (Kilo tons)

6.2.5.5 Brazil market for lysine, 2011-2018 (Kilo tons), (USD Million)

6.2.5.6 Argentina market for lysine, 2011-2018 (Kilo tons), (USD Million)

6.2.6 Rest of the World(RoW)

6.2.6.1 Rest of the World(RoW) demand for lysine, 2011 - 2018 (Kilo tons), (USD Million)

6.2.6.2 Rest of World lysine market by application, 2011-2018 (Kilo tons)

6.2.6.3 Rest of World (RoW) lysine market by application, 2011- 2018(USD Million)

6.2.6.4 Rest of World (RoW) lysine market by livestock, 2011- 2018 (Kilo tons)

6.2.6.5 Rest of world (RoW) lysine market by livestock, 2011-2018(USD Million)

Chapter 7 Company Profiles

7.1 Archer Daniel Midland (ADM)

7.1.1 Company overview

7.1.2 Financial overview

7.1.3 Business strategies

7.1.4 SWOT analysis

7.1.5 Recent developments

7.2 COFCO Biochemical (Anhui) Co. Ltd.

7.2.1 Company overview

7.2.2 Financial overview

7.2.3 Business strategies

7.2.4 SWOT Analysis

7.3 Evonik Industries

7.3.1 Company overview

7.3.2 Financial overview

7.3.3 Business strategies

7.3.4 SWOT analysis

7.3.5 Recent developments

7.4 Vedan International(Holdings) Limited

7.4.1 Company overview

7.4.2 Financial overview

7.4.3 Business strategies

7.4.4 SWOT analysis

7.4.5 Recent developments

7.5 Ajinomoto Co.

7.5.1 Company overview

7.5.2 Financial Overview

7.5.3 Business strategies

7.5.4 SWOT analysis

7.5.5 Recent developments

7.6 Cheil Jedang Corporation

7.6.1 Company overview

7.6.2 Financial overview

7.6.3 Business strategies

7.6.4 SWOT analysis

7.6.5 Recent developments

7.7 Global Bio-chem Technology Group Company Limited

7.7.1 Company overview

7.7.2 Financial Overview

7.7.3 Business strategies

7.7.4 SWOT analysis

7.7.5 Recent developments

7.8 Changchun Dacheng Group

7.8.1 Company overview

7.8.2 Business strategies

7.8.3 SWOT analysis

7.8.4 Recent developments

7.9 Shandong Shaouguang Juneng Golden Corn co. Ltd.

7.9.1 Company overview

7.9.2 Business strategies

7.9.3 SWOT analysis

7.9.4 Recent developments

List of Tables

TABLE 1 Global Lysine Market- Snapshot

TABLE 2 Drivers for the lysine market: Impact Analysis

TABLE 3 Restraints for the Lysine market: Impact Analysis

TABLE 4 North America lysine market by application, 2011 – 2018 (Kilo tons)

TABLE 5 North America lysine market by application, 2011 – 2018 (USD Million)

TABLE 6 North America lysine market by livestock, 2011 – 2018 (Kilo tons)

TABLE 7 North America lysine market by livestock, 2011-2018(USD Million)

TABLE 8 Europe lysine market by application, 2011-2018 (Kilo tons)

TABLE 9 Europe lysine market by application, 2011-2018 (USD Million)

TABLE 10 Europe lysine market by livestock, 2011-2018 (Kilo Tons)

TABLE 11 Europe lysine market by livestock, 2011-2018 (USD Million)

TABLE 12 China lysine market by application, 2011-2018 (Kilo tons)

TABLE 13 China lysine market by application, 2011-2018 (USD Million)

TABLE 14 China lysine market by livestock, 2011-2018 (Kilo tons)

TABLE 15 China lysine market by livestock, 2011-2018 (USD Million)

TABLE 16 Rest of Asia Pacific lysine market by application, 2011-2018 (Kilo tons)

TABLE 17 Rest of Asia Pacific lysine market by application, 2011-2018 (USD Million)

TABLE 18 Rest of Asia Pacific lysine market by livestock, 2011-2018 (Kilo tons)

TABLE 19 Rest of Asia Pacific lysine market by livestock, 2011-2018 (USD Million)

TABLE 20 Latin America lysine market by application, 2011-2018 (Kilo tons)

TABLE 21 Latin America lysine market by application, 2011-2018 (USD Million)

TABLE 22 Latin America lysine market by livestock, 2011-2018 (Kilo tons)

TABLE 23 Latin America lysine market by livestock, 2011-2018 (USD Million)

TABLE 24 Rest of World (RoW) lysine market by application, 2011-2018 (Kilo tons)

TABLE 25 Rest of World (RoW) lysine market by application, 2011-2018 (USD Million)

TABLE 26 Rest of World (RoW) lysine market by livestock, 2011-2018 (Kilo tons)

TABLE 27 Rest of World (RoW) lysine market by livestock, 2011-2018 (USD Million)

List of Figures

FIG. 1 Global lysine market estimates and forecast, 2011 - 2018 (Kilo Tons), (USD Million)

FIG. 1 Lysine Industrial Production

FIG. 2 Lysine: Value Chain Analysis

FIG. 3 Global meat demand growth, 2011-2018 (million tons)

FIG. 4 Meat consumption in China, 2010 - 2018 (Million tons)

FIG. 5 Dextrose prices in the U.S. 2008-2012 (USD per ton)

FIG. 6 Global raw sugar prices, 2008 - 2012 (USD per ton)

FIG. 7 Global cassava prices, 2008 - 2012 (USD per ton)

FIG. 8 Porter’s five forces analysis for lysine market

FIG. 9 Global lysine market: company market share, 2011

FIG. 10 Comparative analysis of amino acids

FIG. 11 Methionine market volumes share by geography, 2011

FIG. 12 Global methionine market estimates and forecast, 2011 - 2018 (Kilo tons) (USD Million)

FIG. 13 Threonine market volume share by geography, 2011

FIG. 14 Global threonine market estimates and forecast, 2011 - 2018 (Kilo tons) (USD Million)

FIG. 15 Global tryptophan market volumes share by geography, 2011

FIG. 16 Global tryptophan market estimates and forecast, 2011 - 2018 (Kilo tons) (USD Million)

FIG. 17 Global lysine market volumes share by application, 2011 & 2018

FIG. 18 Global demand of lysine for animal feed, 2011 – 2018 (Kilo Tons) (USD Million)

FIG. 19 Global demand of lysine for food and dietary supplements, 2011 – 2018 (Kilo Tons) (USD Million)

FIG. 20 Global demand of lysine for pharmaceuticals, 2011 – 2018 (Kilo Tons) (USD Million)

FIG. 21 Global lysine demand for animal feed market volumes share by application, 2011 & 2018

FIG. 22 Global demand for lysine for swine, 2011 – 2018 (Kilo Tons) (USD Million)

FIG. 23 Global demand for lysine for poultry, 2011 – 2018 (Kilo Tons) (USD Million)

FIG. 24 Global demand for lysine for others(including aquaculture) , 2011 – 2018 (Kilo Tons) (USD Million)

FIG. 25 Global lysine market volumes share by geography, 2011 & 2018

FIG. 26 North American demand for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 27 United States market for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 28 European demand for lysine, 2011 - 2018 (Kilo tons), (USD Million)

FIG. 29 Germany market for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 30 United Kingdom market for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 31 China demand for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 32 Rest of Asia Pacific demand for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 33 India market for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 34 Japan market for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 35 Latin Americas demand for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 36 Brazil market for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 37 Argentina market for lysine, 2011-2018 (Kilo tons), (USD Million)

FIG. 38 Rest of the World(RoW) demand for lysine, 2011-2018 (Kilo tons), (USD Million)