Reports

Reports

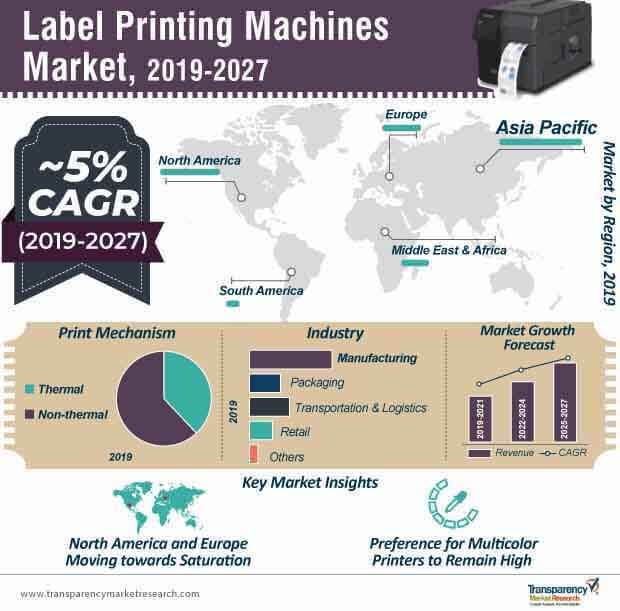

In recent times, packaging has become synonymous to communicating brand identity to consumers, and stakeholders in the industry are making a profitable deal out of this. The suit is also followed by manufacturers in the label printing machines industry, which is advancing at a steady pace, as found by the latest Transparency Market Research (TMR) study.

Packaging and transportation industries seek cost-reduction through product weight reduction, which has put pressure on manufacturers of label printing machines to accommodate longer rolls on the thinner base material, with better turnaround time. Manufacturers invest in automated and specialized colour performance technology to achieve shorter print runs, customization, and greater flexibility, thereby navigating the label printing machines market yet further. However, manufacturers need to offset the 'pain point' of the high cost that deters the adoption rate of label printing machines.

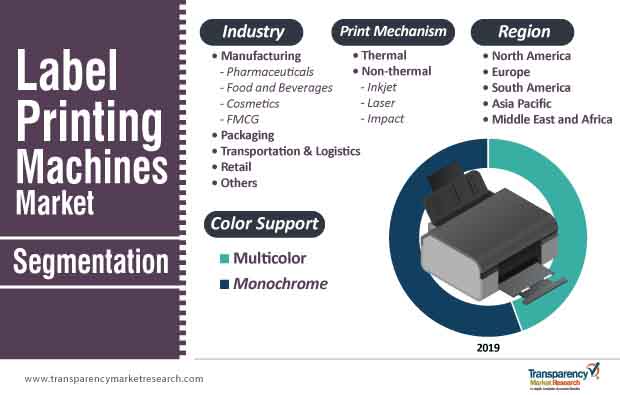

Since visual appeal can turn into a one-shot deal to close sales, end-use industries are prioritizing investments toward offering an 'expensive' appearance to their products. As color is directly associated with appeal, manufacturers are diligently focusing on the development of monochrome and multicolor printers, out of which, monochrome printers are deemed suitable to enhance the appeal of products. According to TMR’s estimate, the sales of monochrome label printing machines will arrive at a value tantamount to ~US$ 4.4 Bn by 2027, while the popularity of multicolor label printing machines is projected to record a CAGR of ~5% during 2019-2027.

Beside the premiumization of labels, market players address grave concerns regarding the rising instances of product counterfeits through the introduction of sophisticated security features directly onto product labels by leveraging QR codes and barcodes, which allows consumers to validate the authenticity of the purchased goods. In order to accommodate security features, end-use industries are gradually moving toward thermal printers that offset challenges such as smudging of ink and stained labels that are associated with non-thermal label printing machines. The trend also points toward the versatility and durability of thermal label printers that complete the quest for quality over the cost attributes of end-use industries.

A significant spurt in the demand for label printing machines is attributable to surging industrialization activities. The 'Grab n’ Go' food trend has compelled the food and beverage industry to roll out more packaged products. The curative over preventive healthcare approach has instigated the use of label printers in the pharmaceutical industry. Enhanced focus on skin and personal care is giving label printing machines the desired traction in the cosmetic industry. All these trends are allowing the manufacturing industry to make headway towards upholding the demand for label printing machines. This has presented improved market opportunities to market players in Asia Pacific, given the enormous potential of the manufacturing sector in the region. Japan is projected to remain home to market majors in the industry that seek measureable growth opportunities through market penetration and product innovation.

Analysts’ Viewpoint

Authors of the report infer that, the label printing machines market will grow at an average CAGR of ~5% during 2019-2027, and much of this has to do with the massive demand from the packaging and transportation sectors. With the fickle preference of end users for product labels, market players will need to navigate their business strategies on a frequent basis. Currently, the trend of 'weight reduction to achieve reduced size' demands label printing machines with greater flexibility. However, the high cost of development could turn out as a deal-breaker to the steady adoption of label printing machines. While some label printers can print on only flat or square surfaces, market players can justify the high cost by offering a suite of features that enable printers to print labels on curved, edged, tapered, and rounded surfaces. Besides product innovation, market players can look at employing an inorganic growth strategy by collaborating with overseas players to gain production and distribution benefits.

Label Printing Machines Market in Brief

Label Printing Machines Market - Definition

Asia Pacific Label Printing Machines Market – Snapshot

Key Growth Drivers of the Label Printing Machines Market

Restraint of the Label Printing Machines Market

Label Printing Machines Market – Competitive Landscape

Label Printing Machines Market - Company Profile Snapshot

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Label Printing Machines Market

4. Market Overview

4.1. Introduction

4.2. Global Market - Macro Economic Factors Overview

4.2.1. Global GDP Indicator - For Top Countries

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. ValueChain Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.4. Global Label Printing Machines Market Analysis and Forecast, 2017 - 2027

4.4.1. Market Size Analysis (US$ Mn & 000’ Units)

4.4.1.1. Historic Growth Trends, 2017-2018

4.4.1.2. Forecast Trends, 2019-2027

4.5. Market Opportunity Assessment

4.5.1. By Print Mechanism

4.5.2. By Color Support

4.5.3. By Industry

4.5.4. By Region

4.6. Competitive Scenario and Trends

4.6.1. Global Label Printing Machines Market Concentration Rate

4.6.1.1. List of Emerging, Prominent and Leading Players

4.7. Market Outlook

5. Global Label Printing Machines Market Analysis and Forecast, by Print Mechanism

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Global Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Print Mechanism, 2017 - 2027

5.3.1. Thermal

5.3.2. Non-thermal

5.3.2.1. Inkjet

5.3.2.2. Laser

5.3.2.3. Impact

6. Global Label Printing Machines Market Analysis and Forecast, by Color Support

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Global Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Color Support, 2017 - 2027

6.3.1. Multicolor

6.3.2. Monochrome

7. Global Label Printing Machines Market Analysis and Forecast, by Industry

7.1. Overview

7.2. Key Segment Analysis

7.3. Global Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Industry, 2017 - 2027

7.3.1. Manufacturing

7.3.1.1. Pharmaceuticals

7.3.1.2. Food & Beverages

7.3.1.3. Cosmetics

7.3.1.4. FMCG

7.3.2. Packaging

7.3.3. Transportation & Logistics

7.3.4. Retail

7.3.5. Others (Research, Postal Services, Construction)

8. Global Label Printing Machines Market Analysis and Forecast, by Region

8.1. Key Segment Analysis

8.2. Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Region, 2017 - 2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Label Printing Machines Market Analysis and Forecast

9.1. Key Findings

9.2. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Print Mechanism, 2017 - 2027

9.2.1. Thermal

9.2.2. Non-thermal

9.2.2.1. Inkjet

9.2.2.2. Laser

9.2.2.3. Impact

9.3. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Color Support, 2017 - 2027

9.3.1. Multicolor

9.3.2. Monochrome

9.4. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Industry, 2017 - 2027

9.4.1. Manufacturing

9.4.1.1. Pharmaceuticals

9.4.1.2. Food & Beverages

9.4.1.3. Cosmetics

9.4.1.4. FMCG

9.4.2. Packaging

9.4.3. Transportation & Logistics

9.4.4. Retail

9.4.5. Others (Research, Postal Services, Construction)

9.5. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Country & Sub-region, 2017 - 2027

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

10. Europe Label Printing Machines Market Analysis and Forecast

10.1. Key Findings

10.2. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Print Mechanism, 2017 - 2027

10.2.1. Thermal

10.2.2. Non-thermal

10.2.2.1. Inkjet

10.2.2.2. Laser

10.2.2.3. Impact

10.3. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Color Support, 2017 - 2027

10.3.1. Multicolor

10.3.2. Monochrome

10.4. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Industry, 2017 - 2027

10.4.1. Manufacturing

10.4.1.1. Pharmaceuticals

10.4.1.2. Food & Beverages

10.4.1.3. Cosmetics

10.4.1.4. FMCG

10.4.2. Packaging

10.4.3. Transportation & Logistics

10.4.4. Retail

10.4.5. Others (Research, Postal Services, Construction)

10.5. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Country & Sub-region, 2017 - 2027

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Rest of Europe

11. Asia Pacific Label Printing Machines Market Analysis and Forecast

11.1. Key Findings

11.2. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Print Mechanism, 2017 - 2027

11.2.1. Thermal

11.2.2. Non-thermal

11.2.2.1. Inkjet

11.2.2.2. Laser

11.2.2.3. Impact

11.3. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Color Support, 2017 - 2027

11.3.1. Multicolor

11.3.2. Monochrome

11.4. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Industry, 2017 - 2027

11.4.1. Manufacturing

11.4.1.1. Pharmaceuticals

11.4.1.2. Food & Beverages

11.4.1.3. Cosmetics

11.4.1.4. FMCG

11.4.2. Packaging

11.4.3. Transportation & Logistics

11.4.4. Retail

11.4.5. Others (Research, Postal Services, Construction)

11.5. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Country & Sub-region, 2017 - 2027

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Rest of Asia Pacific

12. Middle East & Africa Label Printing Machines Market Analysis and Forecast

12.1. Key Findings

12.2. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Print Mechanism, 2017 - 2027

12.2.1. Thermal

12.2.2. Non-thermal

12.2.2.1. Inkjet

12.2.2.2. Laser

12.2.2.3. Impact

12.3. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Color Support, 2017 - 2027

12.3.1. Multicolor

12.3.2. Monochrome

12.4. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Industry, 2017 - 2027

12.4.1. Manufacturing

12.4.1.1. Pharmaceuticals

12.4.1.2. Food & Beverages

12.4.1.3. Cosmetics

12.4.1.4. FMCG

12.4.2. Packaging

12.4.3. Transportation & Logistics

12.4.4. Retail

12.4.5. Others (Research, Postal Services, Construction)

12.5. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Country & Sub-region, 2017 - 2027

12.5.1. UAE

12.5.2. South Africa

12.5.3. Rest of Middle East &Africa

13. South America Label Printing Machines Market Analysis and Forecast

13.1. Key Findings

13.2. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Print Mechanism, 2017 - 2027

13.2.1. Thermal

13.2.2. Non-thermal

13.2.2.1. Inkjet

13.2.2.2. Laser

13.2.2.3. Impact

13.3. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Color Support, 2017 - 2027

13.3.1. Multicolor

13.3.2. Monochrome

13.4. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Industry, 2017 - 2027

13.4.1. Manufacturing

13.4.1.1. Pharmaceuticals

13.4.1.2. Food & Beverages

13.4.1.3. Cosmetics

13.4.1.4. FMCG

13.4.2. Packaging

13.4.3. Transportation & Logistics

13.4.4. Retail

13.4.5. Others (Research, Postal Services, Construction)

13.5. Label Printing Machines Market Size (US$ Mn & 000’ Units) Forecast, by Country & Sub-region, 2017 - 2027

13.5.1. Brazil

13.5.2. Rest of South America

14. Competition Landscape

14.1. Market Player - Competition Matrix

14.2. Market Revenue Share Analysis (%), by Company (2018)

15. Company Profiles

15.1. Brother Industries, Ltd.

15.1.1. Business Overview

15.1.2. Net Sales (US$ Bn), by Region, 2018

15.1.3. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

15.1.4. Strategic Overview

15.2. Seiko Epson Corporation

15.2.1. Business Overview

15.2.2. Net Sales (US$ Bn), by Region, 2018

15.2.3. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

15.2.4. Strategic Overview

15.3. SATO Holdings Corporation

15.3.1. Business Overview

15.3.2. Net Sales (US$ Bn), by Region, 2018

15.3.3. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

15.3.4. Strategic Overview

15.4. Zebra Technologies Corporation

15.4.1. Business Overview

15.4.2. Net Sales (US$ Bn), by Region, 2018

15.4.3. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

15.4.4. Strategic Overview

15.5. Honeywell International, Inc.

15.5.1. Business Overview

15.5.2. Net Sales (US$ Bn), by Region, 2018

15.5.3. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

15.5.4. Strategic Overview

15.6. Toshiba Tec Corporation

15.6.1. Business Overview

15.6.2. Net Sales (US$ Bn), by Region, 2018

15.6.3. Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2018

15.6.4. Strategic Overview

16. Key Takeaways

List of Tables

Table 1: Global Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Print Mechanism, 2017 - 2027

Table 2: Global Label Printing Machines Market Volume (000’ units) and Forecast, by Print Mechanism, 2017 - 2027

Table 3: Global Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Color Support, 2017 - 2027

Table 4: Global Label Printing Machines Market Volume (000’ units) and Forecast, by Color Support, 2017 - 2027

Table 5: Global Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Industry, 2017 - 2027

Table 6: Global Label Printing Machines Market Volume (000’ units) and Forecast, by Industry, 2017 - 2027

Table 7: Global Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Region, 2017 - 2027

Table 8: Global Label Printing Machines Market Volume (000’ units) and Forecast, by Region, 2017 - 2027

Table 9: North America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Print Mechanism, 2017 - 2027

Table 10: North America Label Printing Machines Market Volume (000’ units) and Forecast, by Print Mechanism, 2017 - 2027

Table 11: North America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Color Support, 2017 - 2027

Table 12: North America Label Printing Machines Market Volume (000’ units) and Forecast, by Color Support, 2017 - 2027

Table 13: North America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Industry, 2017 - 2027

Table 14: North America Label Printing Machines Market Volume (000’ units) and Forecast, by Industry, 2017 - 2027

Table 15: North America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Country, 2017 - 2027

Table 16: North America Label Printing Machines Market Volume (000’ units) and Forecast, by Country, 2017 - 2027

Table 17: Europe Printing Machines Market Revenue (US$ Mn) and Forecast, by Print Mechanism, 2017 - 2027

Table 18: Europe Printing Machines Market Volume (000’ units) and Forecast, by Print Mechanism, 2017 - 2027

Table 19: Europe Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Color Support, 2017 - 2027

Table 20: Europe Label Printing Machines Market Volume (000’ units) and Forecast, by Color Support, 2017 - 2027

Table 21: Europe Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Industry, 2017 - 2027

Table 22: Europe Label Printing Machines Market Volume (000’ units) and Forecast, by Industry, 2017 - 2027

Table 23: Europe Printing Machines Market Revenue (US$ Mn) and Forecast, by Country, 2017 - 2027

Table 24: Europe Printing Machines Market Volume (000’ units) and Forecast, by Country, 2017 - 2027

Table 25: South America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Print Mechanism, 2017 - 2027

Table 26: South America Label Printing Machines Market Volume (000’ units) and Forecast, by Print Mechanism, 2017 - 2027

Table 27: South America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Color Support, 2017 - 2027

Table 28: South America Label Printing Machines Market Volume (000’ units) and Forecast, by Color Support, 2017 - 2027

Table 29: South America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Industry, 2017 - 2027

Table 30: South America Label Printing Machines Market Volume (000’ units) and Forecast, by Industry, 2017 - 2027

Table 31: South America Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Country, 2017 - 2027

Table 32: South America Label Printing Machines Market Volume (000’ units) and Forecast, by Country, 2017 - 2027

Table 33: Asia Pacific Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Print Mechanism, 2017 - 2027

Table 34: Asia Pacific Label Printing Machines Market Volume (000’ units) and Forecast, by Print Mechanism, 2017 - 2027

Table 35: Asia Pacific Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Color Support, 2017 - 2027

Table 36: Asia Pacific Label Printing Machines Market Volume (000’ units) and Forecast, by Color Support, 2017 - 2027

Table 37: Asia Pacific Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Industry, 2017 - 2027

Table 38: Asia Pacific Label Printing Machines Market Volume (000’ units) and Forecast, by Industry, 2017 - 2027

Table 39: Asia Pacific Printing Machines Market Revenue (US$ Mn) and Forecast, by Country, 2017 - 2027

Table 40: Asia Pacific Printing Machines Market Volume (000’ units) and Forecast, by Country, 2017 - 2027

Table 41: Middle East & Africa Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Print Mechanism, 2017 - 2027

Table 42: Middle East & Africa Label Printing Machines Market Volume (000’ units) and Forecast, by Print Mechanism, 2017 - 2027

Table 43: Middle East & Africa Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Color Support, 2017 - 2027

Table 44: Middle East & Africa Label Printing Machines Market Volume (000’ units) and Forecast, by Color Support, 2017 - 2027

Table 45: Middle East & Africa Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Industry, 2017 - 2027

Table 46: Middle East & Africa Label Printing Machines Market Volume (000’ units) and Forecast, by Industry, 2017 - 2027

Table 47: Middle East & Africa Label Printing Machines Market Revenue (US$ Mn) and Forecast, by Country, 2017 - 2027

Table 48: Middle East & Africa Label Printing Machines Market Volume (000’ units) and Forecast, by Country, 2017 - 2027

List of Figures

Figure 1: Global Label Printing Machine Market Size (US$ Mn & 000’ Units) Forecast, 2017 – 2027

Figure 2: Global Label Printing Machine Market Growth (%) Forecast, 2017 – 2027

Figure 3: Global Label Printing Machine Market Value (US$ Mn) Opportunity Assessment, by Region, 2019E

Figure 4: Global Label Printing Machine Market Volume (thousand units) Opportunity Assessment, by Region, 2027F

Figure 5: Top Market Segment Analysis, Global, 2019E

Figure 6: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 7: Top Economies GDP Landscape, 2018

Figure 8: Global Label Printing Machines Market Opportunity Assessment, by Print Mechanism

Figure 9: Global Label Printing Machines Market Attractiveness Rating, by Print Mechanism

Figure 10: Global Label Printing Machines Market Opportunity Assessment, by Color Support

Figure 11: Global Label Printing Machines Market Attractiveness Rating, by Color Support

Figure 12: Global Label Printing Machines Market Opportunity Assessment, by Industry

Figure 13: Global Label Printing Machines Market Attractiveness Rating, by Industry

Figure 14: Global Label Printing Machines Market Opportunity Assessment, by Industry

Figure 15: Global Label Printing Machines Market Attractiveness Rating, by Industry

Figure 16: Figure 16: Four Firm Concentration Rate Analysis (CR4), 2018

Figure 17: Global Label Printing Machines Market CAGR (%), by Print Mechanism (2019 – 2027)

Figure 18: Global Label Printing Machines Market CAGR (%), by Color Support (2019 – 2027)

Figure 19: Global Label Printing Machines Market CAGR (%), by Industry (2019 – 2027)

Figure 20: Global Label Printing Machines Market Revenue Opportunity (%) Analysis, by Print Mechanism, 2019

Figure 21: Global Label Printing Machines Market Volume Share (%) Analysis, by Print Mechanism, 2019

Figure 22: Global Label Printing Machines Market Revenue Opportunity (%) Analysis, by Color Support, 2019

Figure 23: Global Label Printing Machines Market Volume Share (%) Analysis, by Color Support, 2019

Figure 24: Global Label Printing Machines Market Revenue Opportunity (%) Analysis, by Industry, 2019

Figure 25: Global Label Printing Machines Market Volume Share (%) Analysis, by Industry, 2019

Figure 26: Global Label Printing Machines Market Revenue Opportunity (%) Analysis, by Region, 2019

Figure 27: Global Label Printing Machines Market Volume Share (%) Analysis, by Region, 2019

Figure 28: North America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Print Mechanism, 2019

Figure 29: North America Label Printing Machines Market Volume Share (%) Analysis, by Print Mechanism, 2019

Figure 30: North America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Color Support, 2019

Figure 31: North America Label Printing Machines Market Volume Share (%) Analysis, by Color Support, 2019

Figure 32: North America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Industry, 2019

Figure 33: North America Label Printing Machines Market Volume Share (%) Analysis, by Industry, 2019

Figure 34: North America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Country, 2019

Figure 35: North America Label Printing Machines Market Volume Share (%) Analysis, by Country, 2019

Figure 36: Europe Label Printing Machines Market Revenue Opportunity (%) Analysis, by Print Mechanism, 2019

Figure 37: Europe Label Printing Machines Market Volume Share (%) Analysis, by Print Mechanism, 2019

Figure 38: Europe Label Printing Machines Market Revenue Opportunity (%) Analysis, by Color Support, 2019

Figure 39: Europe Label Printing Machines Market Volume Share (%) Analysis, by Color Support, 2019

Figure 40: Europe Label Printing Machines Market Revenue Opportunity (%) Analysis, by Industry, 2019

Figure 41: Europe Label Printing Machines Market Volume Share (%) Analysis, by Industry, 2019

Figure 42: Europe Label Printing Machines Market Revenue Opportunity (%) Analysis, by Country, 2019

Figure 43: Europe Label Printing Machines Market Volume Share (%) Analysis, by Country, 2019

Figure 44: South America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Print Mechanism, 2019

Figure 45: South America Label Printing Machines Market Volume Share (%) Analysis, by Print Mechanism, 2019

Figure 46: South America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Color Support, 2019

Figure 47: South America Label Printing Machines Market Volume Share (%) Analysis, by Color Support, 2019

Figure 48: South America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Industry, 2019

Figure 49: South America Label Printing Machines Market Volume Share (%) Analysis, by Industry, 2019

Figure 50: South America Label Printing Machines Market Revenue Opportunity (%) Analysis, by Country, 2019

Figure 51: South America Label Printing Machines Market Volume Share (%) Analysis, by Country, 2019

Figure 52: Asia Pacific Label Printing Machines Market Revenue Opportunity (%) Analysis, by Print Mechanism, 2019

Figure 53: Asia Pacific Label Printing Machines Market Volume Share (%) Analysis, by Print Mechanism, 2019

Figure 54: Asia Pacific Label Printing Machines Market Revenue Opportunity (%) Analysis, by Color Support, 2019

Figure 55: Asia Pacific Label Printing Machines Market Volume Share (%) Analysis, by Color Support, 2019

Figure 56: Asia Pacific Label Printing Machines Market Revenue Opportunity (%) Analysis, by Industry, 2019

Figure 57: Asia Pacific Label Printing Machines Market Volume Share (%) Analysis, by Industry, 2019

Figure 58: Asia Pacific Label Printing Machines Market Revenue Opportunity (%) Analysis, by Country, 2019

Figure 59: Asia Pacific Label Printing Machines Market Volume Share (%) Analysis, by Country, 2019

Figure 60: Middle East & Africa Label Printing Machines Market Revenue Opportunity (%) Analysis, by Print Mechanism, 2019

Figure 61: Middle East & Africa Label Printing Machines Market Volume Share (%) Analysis, by Print Mechanism, 2019

Figure 62: Middle East & Africa Label Printing Machines Market Revenue Opportunity (%) Analysis, by Color Support, 2019

Figure 63: Middle East & Africa Label Printing Machines Market Volume Share (%) Analysis, by Color Support, 2019

Figure 64: Middle East & Africa Label Printing Machines Market Revenue Opportunity (%) Analysis, by Industry, 2019

Figure 65: Middle East & Africa Label Printing Machines Market Volume Share (%) Analysis, by Industry, 2019

Figure 66: Middle East & Africa Label Printing Machines Market Revenue Opportunity (%) Analysis, by Country, 2019

Figure 67: Middle East & Africa Label Printing Machines Market Volume Share (%) Analysis, by Country, 2019