Reports

Reports

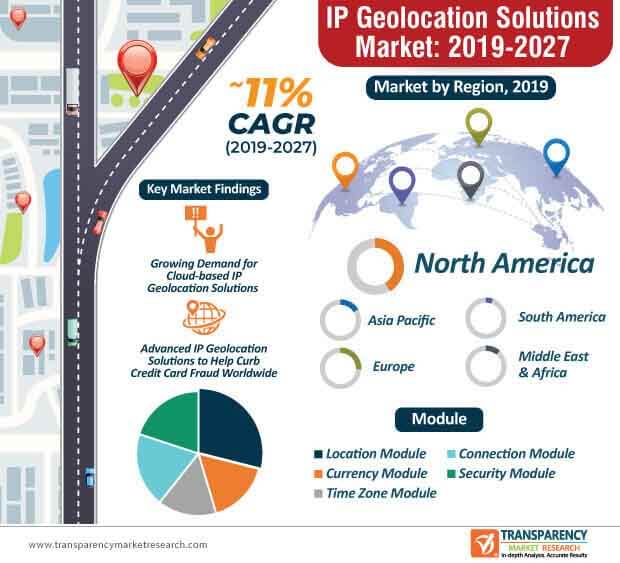

Geolocation-based applications have evolved at a rapid pace in the past decade. IP geolocation solutions have evolved from niche software-based solutions to user-specific applications to important software deployed in computing systems. In the past few years, the uptake for IP geolocation, especially from the business sector is scaling new heights. Businesses around the world are gradually recognizing the potential of IP geolocation and are formulating marketing strategies based on the geographic location of their clients. While the adoption of on-premise IP geolocation solutions is expected to gain momentum in the second half of the forecast period (2019-2027), preference for cloud-based solutions will remain higher during the stipulated timeframe of the study.

With the dawn of the digital era, the IP geolocation solutions market has witnessed considerable growth. Moreover, as demand for online solutions continues to grow at an unprecedented rate, software developers are in the process of rolling out innovative solutions to automate the redundant manual processes and streamline workflow models. As IP geolocation continues to head towards the mainstream, mobile applications are increasingly using these systems to collect geolocation data to pinpoint the geographical location of a device connected to the Internet. These factors are playing a crucial role in the development of the IP geolocation solutions market, which is on course to reach a value of ~US$ 2.1 Bn by the end of 2020.

Due to significant advancements made by IP geolocation solutions, geo advertising has garnered noteworthy popularity in recent times - a trend that is set to continue through the entirety of the forecast period. Brands are leveraging the advantages of location-based advertising such as pay per click campaigns, organic searches, and banner ads to tap into their target audience. Moreover, IP geolocation solutions have emerged as one of the most critical components, which marketers can rely on for their location-based marketing campaigns.

The adoption of IP geolocation solutions is on the rise, as geo ad targeting offers businesses significant cost benefits. Apart from being a cost-effective solution and enabling marketers to run ads in the specified location, geo advertising also plays an important role in enabling brands to reach their target audience effectively. This is expected to drive the IP geolocation solutions market during the forecast period. Moreover, demand for IP geolocation solutions for ad targeting is projected to grow at an impressive CAGR of ~12% during the forecast period, as more brands are leaning toward advanced automation platforms to reach their geolocation-based marketing objectives.

Despite significant advancements in digital technologies and cybersecurity systems, credit and debit frauds across the world continue to pose a major challenge. Detecting and preventing fraud is a major concern within the e-Commerce sector, as e-Commerce companies continue to focus on providing a seamless customer experience, particularly during the payment stage. In addition, according to the Identity Theft Resource Centre (ITRC), credit card fraud is one of the major causes of identity theft in the U.S. The advent of fraud monitoring techniques, including IP geolocation has made significant promise in addressing this problem. IP geolocation solutions assist analysts and fraud investigators to pinpoint the geographical location of the user by offering insights including latitude, longitude, postal code, city, country, time zone, etc. Within the IP geolocation solutions market, the security module segment is expected to have the second-highest market share by 2020.

Stakeholders in the IP geolocation solutions market are expected to forge new strategic alliances to develop innovative IP geolocation solutions for an array of applications. For instance, in November 2019, Sigfox entered into an agreement with Amadeus to streamline luggage tracking. Furthermore, the Sigfox also revealed that by using WiFi and GPS, the company has significantly improved its IP geolocation solution offerings.

Analysts’ Viewpoint

The IP geolocation solutions market is projected to grow at an impressive CAGR of ~11% during the forecast period. The growth of the IP geolocation solutions market can be primarily attributed to the growing demand for IP geolocation solutions for fraud detection, ad targeting, geo-targeting, and geo-fencing, among others. Location and security modules will remain high in demand during the forecast period, owing to the growing number of credit card frauds, targeted marketing requirements, and the likes. North America will remain the most prominent regional IP geolocation solutions market, owing to advancements in technology and a high concentration of software developers in the region.

IP Geolocation Solutions Market: Introduction

IP Geolocation Solutions Market: Definition

North America IP Geolocation Solutions Market: Snapshot

North America is a rapidly expanding market owing to increasing usage of location-based services in which the U.S. is expected to be a dominating country because of increasing utilization of enterprise spatial database enabling robust location data management. These factors are expected to fuel the demand for IP geolocation solutions considerably in the near future for the region.

Key Drivers of IP Geolocation Solutions Market

Key Restraints of IP Geolocation Solutions Market

IP Geolocation Solutions Market: Competition Landscape

IP Geolocation Solutions Market: Company Snapshot

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global IP Geolocation Solutions Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Mn), 2013, 2018, 2019, 2026, 2027

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. Ecosystem Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.4. Adoption Analysis of IP Geolocation Solutions, by Framework

4.4.1. .NET Component

4.4.2. Java Component

4.4.3. ActiveX/COM DLL

4.4.4. HTTP Module

4.5. Global IP Geolocation Solutions Market Analysis and Forecast, 2016 - 2027

4.5.1. Market Revenue Analysis (US$ Mn)

4.5.1.1. Historic Growth Trends, 2016-2018

4.5.1.2. Forecast Trends, 2019-2027

4.6. Market Attractiveness Analysis – (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.6.1. by Solution

4.6.2. by Enterprise Size

4.6.3. by Module

4.6.4. by Application

4.6.5. by Region/Country

4.7. Competitive Scenario and Trends

4.7.1. IP Geolocation Solutions Market Concentration Rate

4.7.1.1. List of Emerging, Prominent and Leading Players

4.7.1.2. Mergers & Acquisitions, Expansions

4.7.2. Pricing Analysis

4.8. Market Outlook

5. Global IP Geolocation Solutions Market Analysis and Forecast, by Solution

5.1. Overview & Definitions

5.2. Key Segment Analysis

5.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Solution, 2017 - 2027

5.3.1. Software/Tools

5.3.1.1. Cloud-based

5.3.1.2. On-premise

5.3.2. Services

5.3.2.1. Professional Services

5.3.2.2. Managed Services

6. Global IP Geolocation Solutions Market Analysis and Forecast, by Enterprise Size

6.1. Overview & Definitions

6.2. Key Segment Analysis

6.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

6.3.1. Small & Medium Enterprises

6.3.2. Large Enterprises

7. Global IP Geolocation Solutions Market Analysis and Forecast, by Module

7.1. Overview & Definitions

7.2. Key Segment Analysis

7.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Module, 2017 - 2027

7.3.1. Location Module

7.3.2. Currency Module

7.3.3. Time Zone Module

7.3.4. Connection Module

7.3.5. Security Module

8. Global IP Geolocation Solutions Market Analysis and Forecast, by Application

8.1. Overview & Definitions

8.2. Key Segment Analysis

8.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

8.3.1. Content Personalization

8.3.2. Fraud Detection

8.3.3. Ad Targeting

8.3.4. Traffic Analysis

8.3.5. Compliance

8.3.6. Geo-Targeting

8.3.7. Geo-Fencing

8.3.8. Digital Rights Management

9. Global IP Geolocation Solutions Market Analysis and Forecast, by Region

9.1. Key Segment Analysis

9.2. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America IP Geolocation Solutions Market Analysis and Forecast

10.1. Key Findings

10.2. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Solution, 2017 - 2027

10.2.1. Software/Tools

10.2.1.1. Cloud-based

10.2.1.2. On-premise

10.2.2. Services

10.2.2.1. Professional Services

10.2.2.2. Managed Services

10.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

10.3.1. Small & Medium Enterprises

10.3.2. Large Enterprises

10.4. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Module, 2017 - 2027

10.4.1. Location Module

10.4.2. Currency Module

10.4.3. Time Zone Module

10.4.4. Connection Module

10.4.5. Security Module

10.5. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

10.5.1. Content Personalization

10.5.2. Fraud Detection

10.5.3. Ad Targeting

10.5.4. Traffic Analysis

10.5.5. Compliance

10.5.6. Geo-Targeting

10.5.7. Geo-Fencing

10.5.8. Digital Rights Management

10.6. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Country, 2017 – 2027

10.6.1. U.S.

10.6.2. Canada

10.6.3. Mexico

11. Europe IP Geolocation Solutions Market Analysis and Forecast

11.1. Key Findings

11.2. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Solution, 2017 - 2027

11.2.1. Software/Tools

11.2.1.1. Cloud-based

11.2.1.2. On-premise

11.2.2. Services

11.2.2.1. Professional Services

11.2.2.2. Managed Services

11.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

11.3.1. Small & Medium Enterprises

11.3.2. Large Enterprises

11.4. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Module, 2017 - 2027

11.4.1. Location Module

11.4.2. Currency Module

11.4.3. Time Zone Module

11.4.4. Connection Module

11.4.5. Security Module

11.5. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

11.5.1. Content Personalization

11.5.2. Fraud Detection

11.5.3. Ad Targeting

11.5.4. Traffic Analysis

11.5.5. Compliance

11.5.6. Geo-Targeting

11.5.7. Geo-Fencing

11.5.8. Digital Rights Management

11.6. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Spain

11.6.5. Russia

11.6.6. Rest of Europe

12. Asia Pacific IP Geolocation Solutions Market Analysis and Forecast

12.1. Key Findings

12.2. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Solution, 2017 - 2027

12.2.1. Software/Tools

12.2.1.1. Cloud-based

12.2.1.2. On-premise

12.2.2. Services

12.2.2.1. Professional Services

12.2.2.2. Managed Services

12.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

12.3.1. Small & Medium Enterprises

12.3.2. Large Enterprises

12.4. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Module, 2017 - 2027

12.4.1. Location Module

12.4.2. Currency Module

12.4.3. Time Zone Module

12.4.4. Connection Module

12.4.5. Security Module

12.5. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

12.5.1. Content Personalization

12.5.2. Fraud Detection

12.5.3. Ad Targeting

12.5.4. Traffic Analysis

12.5.5. Compliance

12.5.6. Geo-Targeting

12.5.7. Geo-Fencing

12.5.8. Digital Rights Management

12.6. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. Australia

12.6.5. South Korea

12.6.6. Rest of Asia Pacific

13. Middle East & Africa (MEA) IP Geolocation Solutions Market Analysis and Forecast

13.1. Key Findings

13.2. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Solution, 2017 - 2027

13.2.1. Software/Tools

13.2.1.1. Cloud-based

13.2.1.2. On-premise

13.2.2. Services

13.2.2.1. Professional Services

13.2.2.2. Managed Services

13.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

13.3.1. Small & Medium Enterprises

13.3.2. Large Enterprises

13.4. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Module, 2017 - 2027

13.4.1. Location Module

13.4.2. Currency Module

13.4.3. Time Zone Module

13.4.4. Connection Module

13.4.5. Security Module

13.5. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

13.5.1. Content Personalization

13.5.2. Fraud Detection

13.5.3. Ad Targeting

13.5.4. Traffic Analysis

13.5.5. Compliance

13.5.6. Geo-Targeting

13.5.7. Geo-Fencing

13.5.8. Digital Rights Management

13.6. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

13.6.1. United Arab Emirates (U.A.E.)

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

14. South America IP Geolocation Solutions Market Analysis and Forecast

14.1. Key Findings

14.2. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Solution, 2017 - 2027

14.2.1. Software/Tools

14.2.1.1. Cloud-based

14.2.1.2. On-premise

14.2.2. Services

14.2.2.1. Professional Services

14.2.2.2. Managed Services

14.3. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

14.3.1. Small & Medium Enterprises

14.3.2. Large Enterprises

14.4. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Module, 2017 - 2027

14.4.1. Location Module

14.4.2. Currency Module

14.4.3. Time Zone Module

14.4.4. Connection Module

14.4.5. Security Module

14.5. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

14.5.1. Content Personalization

14.5.2. Fraud Detection

14.5.3. Ad Targeting

14.5.4. Traffic Analysis

14.5.5. Compliance

14.5.6. Geo-Targeting

14.5.7. Geo-Fencing

14.5.8. Digital Rights Management

14.6. IP Geolocation Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

14.6.1. Brazil

14.6.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Revenue Share Analysis (%), by Company (2018)

16. Company Profiles (Details – Business Overview, Key Competitors, Sales Area/Geographical Presence, Revenue and Strategy)

16.1. BigDataCloud Pty Ltd

16.1.1. Business Overview

16.1.2. Key Competitors

16.1.3. Sales Area/Geographical Presence

16.1.4. Revenue and Strategy

16.2. db-ip.com

16.2.1. Business Overview

16.2.2. Key Competitors

16.2.3. Sales Area/Geographical Presence

16.2.4. Revenue and Strategy

16.3. Digital Element, Inc.

16.3.1. Business Overview

16.3.2. Key Competitors

16.3.3. Sales Area/Geographical Presence

16.3.4. Revenue and Strategy

16.4. El Toro LLC

16.4.1. Business Overview

16.4.2. Key Competitors

16.4.3. Sales Area/Geographical Presence

16.4.4. Revenue and Strategy

16.5. Google LLC

16.5.1. Business Overview

16.5.2. Key Competitors

16.5.3. Sales Area/Geographical Presence

16.5.4. Revenue and Strategy

16.6. IDB LLC (ipinfo.io)

16.6.1. Business Overview

16.6.2. Key Competitors

16.6.3. Sales Area/Geographical Presence

16.6.4. Revenue and Strategy

16.7. IP2Location.com

16.7.1. Business Overview

16.7.2. Key Competitors

16.7.3. Sales Area/Geographical Presence

16.7.4. Revenue and Strategy

16.8. Ipapi

16.8.1. Business Overview

16.8.2. Key Competitors

16.8.3. Sales Area/Geographical Presence

16.8.4. Revenue and Strategy

16.9. Ipstack

16.9.1. Business Overview

16.9.2. Key Competitors

16.9.3. Sales Area/Geographical Presence

16.9.4. Revenue and Strategy

16.10. ipwhois.io

16.10.1. Business Overview

16.10.2. Key Competitors

16.10.3. Sales Area/Geographical Presence

16.10.4. Revenue and Strategy

16.11. MaxMind, Inc

16.11.1. Business Overview

16.11.2. Key Competitors

16.11.3. Sales Area/Geographical Presence

16.11.4. Revenue and Strategy

16.12. Neustar, Inc.

16.12.1. Business Overview

16.12.2. Key Competitors

16.12.3. Sales Area/Geographical Presence

16.12.4. Revenue and Strategy

16.13. Pitney Bowes Inc.

16.13.1. Business Overview

16.13.2. Key Competitors

16.13.3. Sales Area/Geographical Presence

16.13.4. Revenue and Strategy

17. Key Takeaways

List of Tables

Table 1: Acquisition/Partnership/Product Launch

Table 2: Global IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Solution, 2017 - 2027

Table 3: Global IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size 2017 - 2027

Table 4: Global IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Module 2017 - 2027

Table 5: Global IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Application 2017 - 2027

Table 6: Global IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Region, 2017 - 2027

Table 7: North America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Solution, 2017 - 2027

Table 8: North America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size 2017 - 2027

Table 9: North America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Module 2017 - 2027

Table 10: North America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Application 2017 - 2027

Table 11: North America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 12: Europe IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Solution, 2017 - 2027

Table 13: Europe IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size 2017 - 2027

Table 14: Europe IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Module 2017 - 2027

Table 15: Europe IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Application 2017 - 2027

Table 16: Europe IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 17: Asia Pacific IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Solution, 2017 - 2027

Table 18: Asia Pacific IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size 2017 - 2027

Table 19: Asia Pacific IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Module 2017 - 2027

Table 20: Asia Pacific IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Application 2017 - 2027

Table 21: Asia Pacific IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 22: Middle East & Africa IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Solution, 2017 - 2027

Table 23: Middle East & Africa IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size 2017 - 2027

Table 24: Middle East & Africa IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Module 2017 - 2027

Table 25: Middle East & Africa IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Application 2017 - 2027

Table 26: Middle East & Africa IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 27: South America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Solution, 2017 - 2027

Table 28: South America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size 2017 - 2027

Table 29: South America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Module 2017 - 2027

Table 30: South America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Application 2017 - 2027

Table 31: South America IP Geolocation Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

List of Figures

Figure 1: Global IP Geolocation Solutions Market Size (US$ Mn) Forecast, 2017 – 2027

Figure 2: Global IP Geolocation Solutions Market Value (US$ Mn) Opportunity Assessment, by Region, 2019E

Figure 3: Global IP Geolocation Solutions Market Value (US$ Mn) Opportunity Assessment, by Region, 2027F

Figure 4: Top Segment Analysis

Figure 5: Executive Summary (3/4)

Figure 6: Executive Summary (4/4)

Figure 7: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 8: Top Economies GDP Landscape, 2018

Figure 9: Global ICT Spending (1/3)

Figure 10: Global ICT Spending (%), by Region, 2019E

Figure 11: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 12: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 13: Global ICT Spending (%), by Type, 2019E

Figure 14: by Framework Adoption (%), 2018

Figure 15: Global IP Geolocation Solutions Market Historic Growth Trends (US$ Mn), 2016 – 2018

Figure 16: Global IP Geolocation Solutions Market Forecast Growth Trends (US$ Mn), 2019 – 2027

Figure 17: Global IP Geolocation Solutions Market Opportunity Analysis, by Solution (2019-2027)

Figure 18: Global IP Geolocation Solutions Market Opportunity Analysis, by Enterprise Size (2019-2027)

Figure 19: Global IP Geolocation Solutions Market Opportunity Analysis, by Module (2019-2027)

Figure 20: Global IP Geolocation Solutions Market Opportunity Analysis, by Application (2019-2027)

Figure 21: Global IP Geolocation Solutions Market Opportunity Analysis, by Region (2019-2027)

Figure 22: Five Firm Concentration Ratio Analysis (2018)

Figure 23: Global IP Geolocation Solutions Market, Solution, CAGR (%) (2019 – 2027)

Figure 24: Global IP Geolocation Solutions Market, Enterprise Size CAGR (%) (2019 – 2027)

Figure 25: Global IP Geolocation Solutions Market, Module CAGR (%) (2019 – 2027)

Figure 26: Global IP Geolocation Solutions Market, Application CAGR (%) (2019 – 2027)

Figure 27: Global IP Geolocation Solutions Market, Region CAGR (%) (2019 – 2027)

Figure 28: Global IP Geolocation Solutions Market Share Analysis, by Solution (2019)

Figure 29: Global IP Geolocation Solutions Market Share Analysis, by Solution (2027)

Figure 30: Global IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 31: Global IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 32: Global IP Geolocation Solutions Market Share Analysis, by Module (2019)

Figure 33: Global IP Geolocation Solutions Market Share Analysis, by Module (2027)

Figure 34: Global IP Geolocation Solutions Market Share Analysis, by Application (2019)

Figure 35: Global IP Geolocation Solutions Market Share Analysis, by Application (2027)

Figure 36: Global IP Geolocation Solutions Market Share Analysis, by Region (2019)

Figure 37: Global IP Geolocation Solutions Market Share Analysis, by Region (2027)

Figure 38: North America IP Geolocation Solutions Market Share Analysis, by Solution (2019)

Figure 39: North America IP Geolocation Solutions Market Share Analysis, by Solution (2027)

Figure 40: North America IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 41: North America IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 42: North America IP Geolocation Solutions Market Share Analysis, by Module (2019)

Figure 43: North America IP Geolocation Solutions Market Share Analysis, by Module (2027)

Figure 44: North America IP Geolocation Solutions Market Share Analysis, by Application (2019)

Figure 45: North America IP Geolocation Solutions Market Share Analysis, by Application (2027)

Figure 46: North America IP Geolocation Solutions Market Share Analysis, by Country (2019)

Figure 47: North America IP Geolocation Solutions Market Share Analysis, by Country (2027)

Figure 48: Europe IP Geolocation Solutions Market Share Analysis, by Solution (2019)

Figure 49: Europe IP Geolocation Solutions Market Share Analysis, by Solution (2027)

Figure 50: Europe IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 51: Europe IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 52: Europe IP Geolocation Solutions Market Share Analysis, by Module (2019)

Figure 53: Europe IP Geolocation Solutions Market Share Analysis, by Module (2027)

Figure 54: Europe IP Geolocation Solutions Market Share Analysis, by Application (2019)

Figure 55: Europe IP Geolocation Solutions Market Share Analysis, by Application (2027)

Figure 56: Europe IP Geolocation Solutions Market Share Analysis, by Country (2019)

Figure 57: Europe IP Geolocation Solutions Market Share Analysis, by Country (2027)

Figure 58: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Solution (2019)

Figure 59: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Solution (2027)

Figure 60: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 61: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 62: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Module (2019)

Figure 63: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Module (2027)

Figure 64: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Application (2019)

Figure 65: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Application (2027)

Figure 66: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Country (2019)

Figure 67: Asia Pacific IP Geolocation Solutions Market Share Analysis, by Country (2027)

Figure 68: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Solution (2019)

Figure 69: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Solution (2027)

Figure 70: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 71: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 72: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Module (2019)

Figure 73: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Module (2027)

Figure 74: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Application (2019)

Figure 75: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Application (2027)

Figure 76: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Country (2019)

Figure 77: Middle East & Africa IP Geolocation Solutions Market Share Analysis, by Country (2027)

Figure 78: South America IP Geolocation Solutions Market Share Analysis, by Solution (2019)

Figure 79: South America IP Geolocation Solutions Market Share Analysis, by Solution (2027)

Figure 80: South America IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 81: South America IP Geolocation Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 82: South America IP Geolocation Solutions Market Share Analysis, by Module (2019)

Figure 83: South America IP Geolocation Solutions Market Share Analysis, by Module (2027)

Figure 84: South America IP Geolocation Solutions Market Share Analysis, by Application (2019)

Figure 85: South America IP Geolocation Solutions Market Share Analysis, by Application (2027)

Figure 86: South America IP Geolocation Solutions Market Share Analysis, by Country (2019)

Figure 87: South America IP Geolocation Solutions Market Share Analysis, by Country (2027)

Figure 88: Global IP Geolocation Solutions Market Share Analysis by Company (2018)

Figure 89: Sales Area/Geographical Presence

Figure 90: Sales Area/Geographical Presence

Figure 91: Sales Area/Geographical Presence

Figure 92: Sales Area/Geographical Presence

Figure 93: Sales Area/Geographical Presence

Figure 94: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 95: Sales Area/Geographical Presence