IoT in Banking and Financial Services Market: Introduction

- IoT in banking and financial services helps the customer to provide easy-to-access services. The IoT delivers services to the banks to control the customer’s use of ATM kiosks in several areas and increase or decrease the installation system of ATMs in those places, depending on the usage volumes.

- IoT in banking and financial services provides customers individualized experience and timely insights. The device connectivity enables a visitor to schedule an appointment on the smartphone. So the customer can have complete knowledge when it’s their turn to stand at the counter, instead of waiting in a long queue. The banks keep the entire record of services that the customer has opted for whenever they visit the banks in the database system

- Banks sectors are using IoT technology and other banking applications to solve the problem with mobile banking that is opted in traditional branch banking. The IoT helps to introduce the interactive digital experience where customers can opt for self-services and bank can also reduce the number of staff.

IoT in Banking and Financial Services Market: Dynamics

IoT in Banking and Financial Services Market: Key Drivers

- IoT in banking and financial services provides complete banking solutions to the customers in real-time. The IoT-enabled devices help the bank to satisfy the requirements of the customer with the support of the data collected from several smart devices to simplify the smart financial decision.

- The existing customer data helps banks to deliver value-added services, customized products, and financial assistance to individual customers. Moreover, this data helps to reduce the cost of operation due to the increased IT and user productivity and the reduced technology costs.

- IoT in banking and financial services faces connectivity issues between IoT products and devices is one of the major restraining factors for all businesses and their clients, as companies existing systems do not meet the global connectivity standards.

- Data migration in IoT in banking and financial services is the main component to use while adopting a new system, either via integration with new deployment or new systems. The main issue during data migration is the completion of the operation process within the specified target and the elimination of risk associated with it, as many data migration tasks undergo implementation delays.

Impact of COVID-19 on IoT in Banking and Financial Services Market

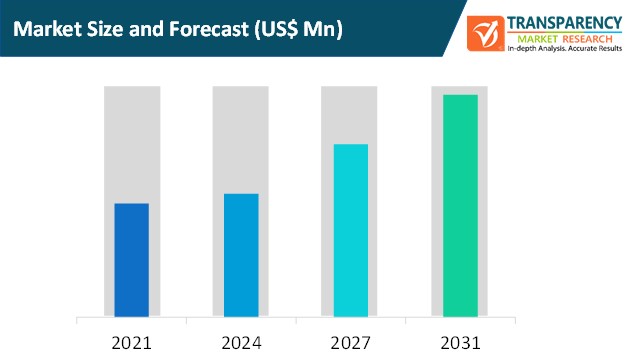

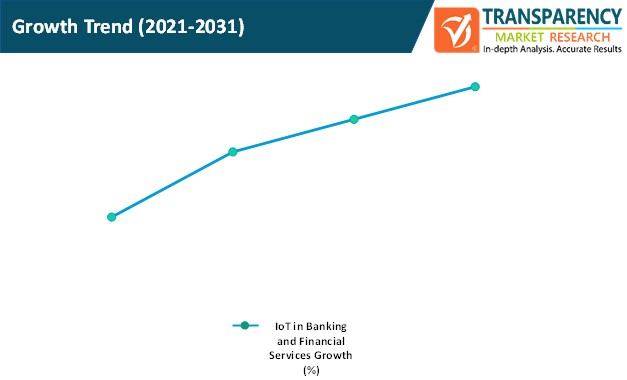

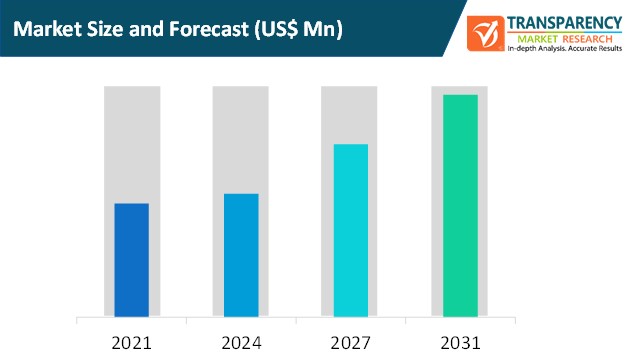

- An increase in cases of COVID-19 across the globe is resulting in an economic slowdown. Developed countries are strongly affected by the pandemic. COVID-19 has a negative impact on the IoT in banking and financial services Market, as banks and financial institutes are decreasing their investment in new technologies and services to sustain themselves in the competitive market. The market is expected to expand in the next few years, as financial services and banks start making a profit to recover from the economic downturn associated with COVID-19

APAC to Hold Major Share of IoT in Banking and Financial Services Market

- In terms of region, the global IoT in banking and financial services market can be divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America

- APAC dominated the global IoT in banking and financial services market and held a notable share during the forecast period. The increasing requirements for cashless payments, agile, connected, and the overall speed and responsiveness of connected financial solutions is expected to grow in the APAC region. The developing countries are focusing on the adoption of new technologies, and countries such as India, China, and Japan are planning to invest in IoT in banking and finance sector.

Key Players Operating in Global IoT in Banking and Financial Services Market

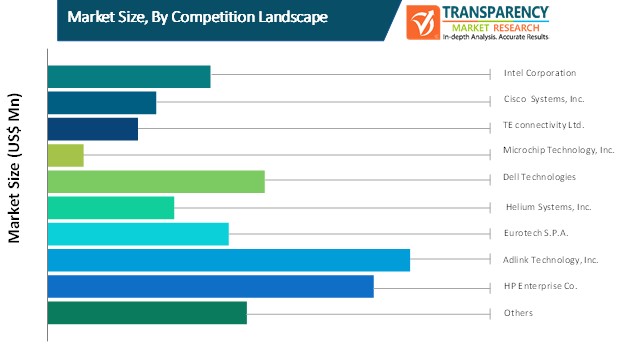

Intel Corporation designs and manufactures integrated processors, platforms, chipsets, circuits, and software solutions, such as Intel Security and embedded software. The company offers a wide range of products - desktops, tablets, SSDs, boards & kits, server products, Intel gateways, modems, and radiofrequency transceivers. It provides the solutions for embedded applications for healthcare, automotive, energy, and retail market segments.

Cisco Systems, Inc. is a provider of IT infrastructure, services, and solutions. The company offers Hybrid IT, Intelligent Edge, Financial Services, and Corporate Investments. The company works in professional, communication, and media solutions. It provides Internet-of-Things (IoT) & mobility solutions and networking & security solutions, including wired and wireless products.

Other key players operating in the IoT in banking and financial services market include Huawei Technologies Co., Ltd., Texas Instruments Incorporated, NXP Semiconductors, TE Connectivity Ltd, Hewlett Packard Enterprise Co., Microchip Technology Inc., Dell Technologies, Aaeon Technology Inc., Nexcom International Co., Ltd., Helium Systems, Inc., STMicroelectronics N.V., Adlink Technology Inc., and Eurotech S.P.A.

IoT in Banking and Financial Services Market: Research Scope

IoT in Banking and Financial Services Market, by Hardware

- Processors

- Connectivity Integrated Circuits (ICs)

- Sensors

- Memory Devices

- Logic Devices

IoT in Banking and Financial Services Market, by Component

- Solutions

- Security

- Customer Experience Management

- Monitoring

- Data Management

- BFSI

- Services

- Professional Services

- Integration and Deployment

- Support and Maintenance

- Business Consulting

- Managed Services

IoT in Banking and Financial Services Market, by End-user

IoT in Banking and Financial Services Market, by Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

IoT in Banking and Financial Services Market, by Region

- North America

- U.S.

- Canada

- Rest of North America

- Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America