Global InsureTech Services Market – Introduction

- InsureTech services empower insurance companies to utilize technologies to squeeze out operation efficiency and savings from the existing insurance industry model. The acceptance of InsureTech services has enabled insurance companies to assess various risks related to the operations, market, liquidity, and counterparty credit.

- InsureTech services utilizes artificial intelligence (AI) or machine learning and Internet of Things to manage the tasks of insurance companies and discover the accurate mix of policies to complete an entity’s coverage. InsureTech services are categorized in two ways includes professional services and managed services.

Increasing digitalization in the insurance sector driving the global InsureTech services market

- The insurance sector is seeing increased digitalization and industry players are rapidly shifting toward InsureTech to utilize the innovative technological developments, including Internet of Things (IoT), advanced analytics, mobile technology, and artificial intelligence. Almost all of the North American and European insurers have launched initiatives to digitize individual services, address current pain points, enhance analytics capabilities, and set up customer portals. For instance, they utilize “lighthouse projects” to gain approval for digitization within the organization, and initiate the required cultural change, and attract digital talent.

- Additionally, various digital insurance platforms/software help these companies to digitalize all the processes within the organization. These platforms comprise various disparate systems & modules in the digital insurance ecosystem. These disparate systems & modules include claim management, policy implementation, billing & premium accounting, regulatory filing, and reinsurance management.

- Many companies providing digital insurance platforms majorly emphasize on providing custom-made digital insurance solutions coupled with third-party InsureTech services, and integration of business operations. Moreover, vendors are also providing Digital Insurance as a Service (DIaaS), which includes business process services, infrastructure, and major insurance applications to provide efficient and effective insurance solutions to clients. Hence, increasing digitalization in the insurance sector driving the global InsureTech services market worldwide.

Lack of awareness regarding technological advancement in the insurance sector expected to significantly hamper the InsureTech services market

- Many emerging economies are far behind in terms of novel technologies like adoption of digitalization, internet of things, machine learning etc in various industries includes automotive industries, banking & financial sector, healthcare etc. This is because of lack of proper infrastructure and low cost budgeting systems. Therefore, lack of awareness regarding technological advancements in the insurance sector is having a negative impact on the growth of the InsureTech services market.

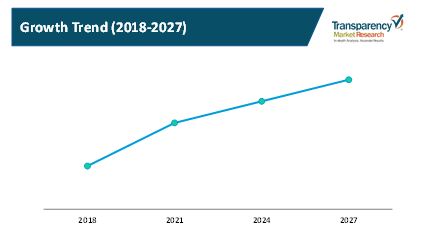

North America to hold major share of the global InsureTech services market

- In terms of region, the global InsureTech services market can be segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa

- North America is anticipated to account for major share of the global InsureTech services market during the forecast period due to the presence of a large number of insurance technology providers specifically in the U.S. and Canada. Europe is estimated to be the second largest market for InsureTech services from 2019 to 2027, owing to rapid adoption of Big Data in the insurance sector, which is likely to help the growth of the InsureTech services market in the region.

- Asia Pacific is projected to be a rapidly expanding region of the global InsureTech services market during the forecast period owing to increasing investment in digitization to enhance operation efficiency in insurance organizations specifically in China, India, Singapore, etc., which is expected to increase the adoption of InsureTech services in the region.

Global InsureTech Services Market – Competitive Landscape

- In January 2019, Tokio Marine & Nichido Fire Insurance Co. Partnered with 3i Infotech to enhance its operations with the help of PREMIA 9. 3i Infotech’s PREMIA 9 is an end-to-end innovative solution that enhances insurance operations from claims processing & underwriting to financial accounting. The initiative would help the company to enhance its market presence and attract more customers in the InsureTech services market worldwide.

Key Players Operating in the Global Market

- 3i Infotech

- DXC Technology Company

- Accenture

- Duck Creek Technologies

- ClaimVantage

- Cognizant

Global InsureTech Services Market: Research Scope

Global InsureTech Services Market, by Services

- Professional Services

- Consulting Services

- Integration & Implementation Services

- Support Services

- Training & Education Services

- Managed Services

Global InsureTech Services Market, by End-user

- Insurer/ Insurance Carrier

- Reinsurer

Global InsureTech Services Market, by Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- U.K.

- France

- Russia

- Italy

- Spain

- Nordics

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- Malaysia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America