Reports

Reports

Insurance rating software is defined as an integrated software to handle the needs of insurers of all sizes. It is used to calculate the premium associated with a policy or other transactions. It stores the rating rules and algorithms, the base rates and associated factors, and the rules necessary to combine the rates and algorithms to calculate a premium.

Quality is the key to a company’s success. Insurance rating software allows organizations to keep up with and meet current quality levels and meet the requirements of consumers. It enables single point of change system capability and modifications to data. This means a single point of change incorporates rating, rules, forms, pages, and data into one product definition, enabling updates to be completed once and reflected across the enterprise.

Insurance companies are familiar with handling risk and have many compliance requirements to meet. SME’s do not have an adequate understanding of standardization and certification of the tools. For instance, an insurance company needs to gain many certifications for regulatory as well as compliance purposes. These include ISO 27001 for Insurance Companies, and ISO 9001 for Insurance Companies. The strong need for the compliance management increases the cost of the software as specialized professionals advice needs to be taken before developing the software.

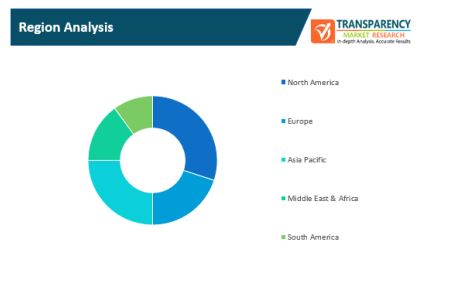

In terms of region, the global insurance rating software market can be divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa. North America is expected to dominate the insurance rating software market during the forecast period due to its large ratio of insured population and resources.

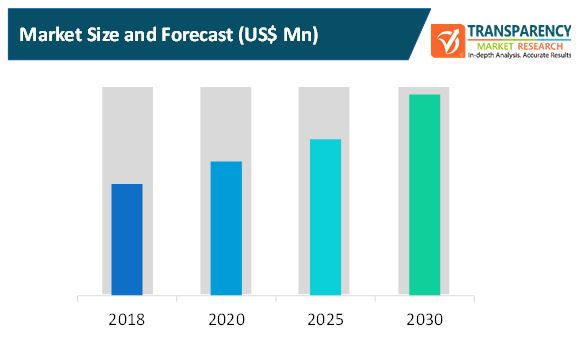

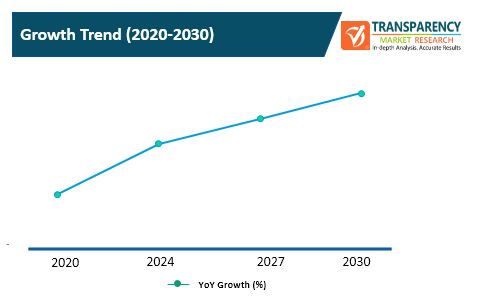

The COVID-19 pandemic is expected to moderately impact the global insurance rating software market for a short-term period. The lockdown and shutdown has resulted in closure of organizations and low investment by individuals and enterprises. However, demand from end- users has not been negative within the overall insurance industry.

Accenture

Incorporated in 1989, Accenture is a global management consulting, technology services, and outsourcing company, with approximately 336,000 people serving clients in more than 120 countries. Accenture Duck Creek delivers functionality-rich P&C insurance software on-premise or via Duck Creek On-Demand, a Software as a Service model

The global insurance rating software market can be segmented based on:

Based on enterprise size, the global insurance rating software market can be divided into:

In terms of deployment, the global insurance rating software market can be segregated into:

N/A