Reports

Reports

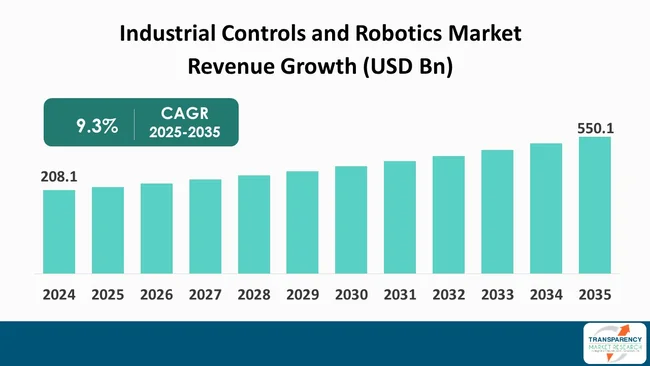

The global industrial controls & robotics market size was valued at USD 208.1 billion in 2024 and is projected to reach USD 550.1 billion by 2035, expanding at a CAGR of 9.3% from 2025 to 2035. The market growth is driven by the growth of end-user industries, and rising government initiatives & industry investments.

Industrial controls & robotics market has become a fundamental element of global industrial transformation, fueled by the high rate of automation uptake in a wide range of applications including automotive, electronics, food and beverages, pharmaceuticals, and logistics. Implementation of innovative technologies such as AI, IoT, cloud computing, and digital twins is allowing manufacturers to attain greater efficiency, flexibility, accuracy, and reduce human intervention.

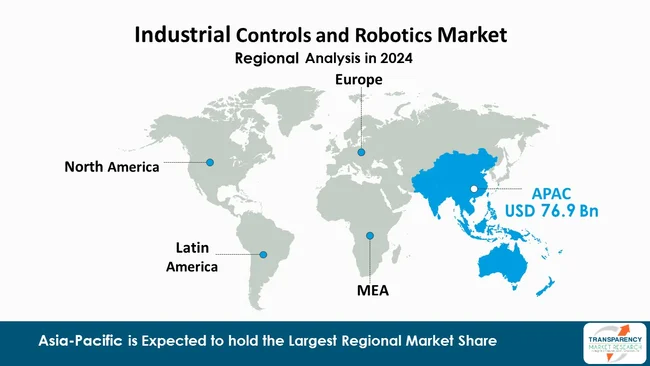

The Asia Pacific remains at the forefront of the global market due to the strong manufacturing foundation, massive industrialization, and government policies. Existence of dominant players including FANUC, Yaskawa, and Mitsubishi Electric further enhances the status of the region as an innovation hub. The market is highly dynamic and competitive with new technologies like continuous R&D, collaborative robots (cobots), and AI-powered automation serving as key drivers of growth.

Industrial controls & robotics market involves a broad selection of technologies, equipment, and systems that automate, control, and optimize industrial business processes. Industrial control is the central intelligence of production, a collection of devices including Programmable Logic Controllers (PLC), Distributed Control Systems (DCS), and Supervisory Control and Data Acquisition (SCADA) systems that manage, control and monitor machines, processes and workflow.

Industrial robots can be seen as the operational executor of the manufacturing process that includes the welding, assembling, spray painting, packaging, and transportation of materials, all done in an orderly and consistent process. They allow for advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), cloud computing, and digital twins to be connected into technologies, creating smart factories that can self-monitor, optimize, and practically run autonomously brand new products with minimal human input using real-time data/decisions.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

As End-user industries such as automotive, electronics, food & beverages, pharmaceuticals and logistics become more complex at larger scales, the demand for robotics and control systems increases. All these industries face continual pressure to produce faster, maintain quality, and reduce costs. For instance, robotics in the automotive industry is found throughout assembly, welding and painting processes, thereby ensuring precision and repeatability. In the electronics industry, automation lets companies automate individual components with the micro-level accuracy required when dealing with ever smaller parts. According to the International Federation of Robotics (IFR), the total number of industrial robots in operation worldwide reached 4,664,000 units in 2024, representing an approximate 9% increase from the previous year. This illustrates how robotics and control systems have become increasingly important for various End-user industries requiring higher efficiency and increased competitiveness. In addition to increased efficiencies, the flexibility of robotics and control systems also enables industries to adapt to shifting market needs.

From inventory and supply chain management to the fulfillment process, automated systems are transforming how companies develop their logistics operations. By empowering industries to achieve higher scales and levels of flexibility and innovation, robotics and control systems are playing a main function in driving these moving industries into exciting growth and transformations.

Government policies and initiatives are turning out to be significant drivers of growth in industrial robotics and control systems across the globe. According to International Federation of Robotics (IFR), China’s “14th Five-Year Plan” for the robotics industry running until 2025 aims to make China a global leader in robotics innovation. The updated “Key Special Program on Intelligent Robots,” introduced in July 2024 with a budget of about USD 45.2 million, supports research in frontier technologies, including generative AI model training. Such programs typically offer subsidies, tax breaks, and the other financing resources, which reduce the costs of doing business by companies and speeds up the adoption of robotics in manufacturing.

The investments by the private sector are complementing the efforts made by the governments in strengthening the market. Companies are progressively investing in AI-based robotics, IoT-based automation, and collaborative robots (cobots). This growing ecosystem is being strengthened by venture capital inflows, strategic partnerships, and infrastructure upgrades to create a steady stream of advanced solutions. Coupled with the governments’ support and industry-supported innovation, automation is becoming more available in all fields that affect efficiency and competitiveness in the global manufacturing industry.

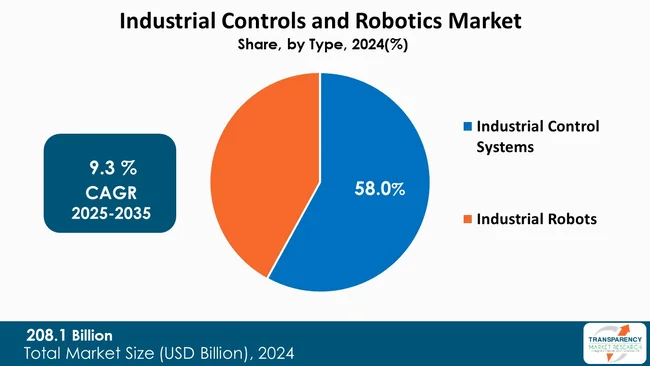

Industrial control systems dominate the market with a 58.0% market share. The rise of industrial control systems (ICS) in the market is attributed to the fact that they form the basis of automation in many industries such as manufacturing, oil and gas, energy, pharmaceuticals, and vehicles.

The process of streamlining the functions, safety, and efficiency includes systems like Programmable Logic Controllers (PLC), Supervisory Control and Data Acquisition (SCADA), and Distributed Control Systems (DCS) systems. They also play a crucial role in any industrial facility because of its functionality and ability to be integrated with outdated equipment and with new digital applications.

In addition, the increasing implementation of Industry 4.0, IoT-driven automation, and smart manufacturing have additionally intensified the need to use ICS. In contrast to robotics that are application-based, ICS offer universal functionality in the management, measurement, and optimization of industrial processes in any industry. They have a greater base of adoption as they are more scalable, more reliable, and act as the foundation of data-driven decision-making which means that they will control the entire market of industrial controls and robotics over all.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific dominates the market with a 37.0% market share. According to International Federation of Robotics (IFR) Asia accounted for 74% of new deployments in 2024, this illustrates the region’s dominance in the market. With its high manufacturing base and fast rate of industrialization, Asia Pacific leads the market for industrial controls and robotics. China, Japan, South Korea and India lead in the production of automotive, electronics, and consumer goods, and are dependent on automation and control systems to enhance efficiency and competitiveness. Government programs such as Made in China 2025, Make in India, and the Japanese emphasis on smart manufacturing is hastening the growth of robotization and industrial controls in all industries.

Moreover, the region benefits from high demand, reduced cost of production, and technological development. In contrast to North America and Europe, where growth is more consistent, the high pace of industrialization and widespread investments in smart factories are what make APAC the most rapidly growing center in industrial controls and robotics.

The region has remained the fastest-moving and most significant market in the world in automation with Asia Pacific rapidly becoming the most dominant and stronghold in the industrial controls and robotics industry.

Industrial controls & robotics business model of prominent manufacturers includes investments in R&D, product expansions, and mergers and acquisitions. Industrial controls & robotics Market competitor analysis suggests that product development is a major part of industrial controls & robotics marketing strategy for top players. The market is highly stagnant and competitive, with the presence of various global and regional players.

ABB Ltd., Comau S.p.A., DENSO Robotics, Elite Robot Co., Ltd, Emerson Electric Co., FANUC Corporation, Kawasaki Heavy Industries, Ltd., KUKA AG, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Siemens, and Yaskawa Electric Corporation along with several other prominent regional and global manufacturers are the key players.

Each of these players has been profiled in the industrial controls & robotics industry research report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 208.1 Bn |

| Forecast Value in 2035 | US$ 550.1 Bn |

| CAGR | 9.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Industrial controls & robotics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global industrial controls & robotics market was valued at US$ 208.1 Bn in 2024

The global industrial controls & robotics industry is projected to reach at US$ 550.1 Bn by the end of 2035

Growth of end-user industries, and rising government initiatives & industry investments are some of the factors driving the expansion of industrial controls & robotics market.

The CAGR is anticipated to be 9.3% from 2025 to 2035

ABB Ltd., Comau S.p.A., DENSO Robotics, Elite Robot Co., Ltd, Emerson Electric Co., FANUC Corporation, Kawasaki Heavy Industries, Ltd., KUKA AG, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Siemens, and Yaskawa Electric Corporation along with several other prominent regional and global manufacturers are the key players.

Table 01: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 02: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 03: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 04: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 05: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 06: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 07: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 08: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 09: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 10: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 11: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 12: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 13: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 14: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 15: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 16: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 17: U.S. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 18: U.S. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 19: U.S. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 20: U.S. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 21: U.S. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 22: U.S. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 23: Canada Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 24: Canada Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 25: Canada Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 26: Canada Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 27: Canada Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 28: Canada Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 29: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 30: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 31: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 32: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 33: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 34: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 35: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 36: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 37: U.K. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 38: U.K. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 39: U.K. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 40: U.K. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 41: U.K. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 42: U.K. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 43: Germany Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 44: Germany Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 45: Germany Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 46: Germany Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 47: Germany Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 48: Germany Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 49: France Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 50: France Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 51: France Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 52: France Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 53: France Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 54: France Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 55: Italy Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 56: Italy Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 57: Italy Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 58: Italy Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 59: Italy Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 60: Italy Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 61: Spain Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 62: Spain Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 63: Spain Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 64: Spain Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 65: Spain Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 66: Spain Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 67: The Netherlands Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 68: The Netherlands Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 69: The Netherlands Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 70: The Netherlands Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 71: The Netherlands Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 72: The Netherlands Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 73: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 74: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 75: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 76: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 77: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 78: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 79: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 80: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 81: China Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 82: China Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 83: China Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 84: China Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 85: China Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 86: China Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 87: India Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 88: India Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 89: India Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 90: India Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 91: India Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 92: India Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 93: Japan Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 94: Japan Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 95: Japan Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 96: Japan Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 97: Japan Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 98: Japan Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 99: Australia Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 100: Australia Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 101: Australia Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 102: Australia Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 103: Australia Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 104: Australia Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 105: South Korea Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 106: South Korea Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 107: South Korea Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 108: South Korea Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 109: South Korea Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 110: South Korea Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 111: ASEAN Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 112: ASEAN Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 113: ASEAN Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 114: ASEAN Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 115: ASEAN Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 116: ASEAN Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 117: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 118: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 119: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 120: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 121: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 122: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 123: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 124: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 125: GCC Countries Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 126: GCC Countries Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 127: GCC Countries Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 128: GCC Countries Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 129: GCC Countries Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 130: GCC Countries Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 131: South Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 132: South Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 133: South Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 134: South Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 135: South Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 136: South Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 137: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 138: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 139: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 140: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 141: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 142: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 143: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 144: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 145: Brazil Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 146: Brazil Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 147: Brazil Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 148: Brazil Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 149: Brazil Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 150: Brazil Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 151: Mexico Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 152: Mexico Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 153: Mexico Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 154: Mexico Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 155: Mexico Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 156: Mexico Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 157: Argentina Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 158: Argentina Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 159: Argentina Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Table 160: Argentina Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Table 161: Argentina Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 162: Argentina Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 01: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 02: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 03: Global Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 04: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 05: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 06: Global Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 07: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 08: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 09: Global Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 10: Global Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 11: Global Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 12: Global Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 13: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 14: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 15: North America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 16: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 17: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 18: North America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 19: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 20: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 21: North America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 22: North America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 23: North America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 24: North America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 25: U.S. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 26: U.S. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 27: U.S. Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 28: U.S. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 29: U.S. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 30: U.S. Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 31: U.S. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 32: U.S. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 33: U.S. Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 34: Canada Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 35: Canada Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 36: Canada Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 37: Canada Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 38: Canada Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 39: Canada Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 40: Canada Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 41: Canada Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 42: Canada Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 43: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 44: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 45: Europe Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 46: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 47: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 48: Europe Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 49: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 50: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 51: Europe Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 52: Europe Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 53: Europe Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 54: Europe Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 55: U.K. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 56: U.K. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 57: U.K. Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 58: U.K. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 59: U.K. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 60: U.K. Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 61: U.K. Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 62: U.K. Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 63: U.K. Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 64: Germany Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 65: Germany Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 66: Germany Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 67: Germany Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 68: Germany Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 69: Germany Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 70: Germany Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 71: Germany Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 72: Germany Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 73: France Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 74: France Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 75: France Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 76: France Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 77: France Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 78: France Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 79: France Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 80: France Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 81: France Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 82: Italy Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 83: Italy Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 84: Italy Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 85: Italy Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 86: Italy Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 87: Italy Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 88: Italy Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 89: Italy Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 90: Italy Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 91: Spain Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 92: Spain Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 93: Spain Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 94: Spain Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 95: Spain Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 96: Spain Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 97: Spain Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 98: Spain Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 99: Spain Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 100: The Netherlands Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 101: The Netherlands Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 102: The Netherlands Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 103: The Netherlands Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 104: The Netherlands Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 105: The Netherlands Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 106: The Netherlands Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 107: The Netherlands Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 108: The Netherlands Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 109: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 110: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 111: Asia Pacific Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 112: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 113: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 114: Asia Pacific Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 115: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 116: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 117: Asia Pacific Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 118: Asia Pacific Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 119: Asia Pacific Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 120: Asia Pacific Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 121: China Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 122: China Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 123: China Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 124: China Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 125: China Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 126: China Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 127: China Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 128: China Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 129: China Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 130: India Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 131: India Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 132: India Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 133: India Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 134: India Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 135: India Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 136: India Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 137: India Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 138: India Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 139: Japan Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 140: Japan Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 141: Japan Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 142: Japan Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 143: Japan Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 144: Japan Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 145: Japan Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 146: Japan Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 147: Japan Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 148: Australia Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 149: Australia Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 150: Australia Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 151: Australia Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 152: Australia Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 153: Australia Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 154: Australia Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 155: Australia Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 156: Australia Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 157: South Korea Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 158: South Korea Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 159: South Korea Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 160: South Korea Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 161: South Korea Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 162: South Korea Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 163: South Korea Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 164: South Korea Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 165: South Korea Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 166: ASEAN Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 167: ASEAN Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 168: ASEAN Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 169: ASEAN Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 170: ASEAN Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 171: ASEAN Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 172: ASEAN Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 173: ASEAN Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 174: ASEAN Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 175: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 176: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 177: Middle East & Africa Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 178: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 179: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 180: Middle East & Africa Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 181: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 182: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 183: Middle East & Africa Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 184: Middle East & Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 185: Middle East & Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 186: Middle East & Africa Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 187: GCC Countries Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 188: GCC Countries Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 189: GCC Countries Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 190: GCC Countries Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 191: GCC Countries Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 192: GCC Countries Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 193: GCC Countries Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 194: GCC Countries Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 195: GCC Countries Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 196: South Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 197: South Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 198: South Africa Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 199: South Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 200: South Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 201: South Africa Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 202: South Africa Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 203: South Africa Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 204: South Africa Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 205: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 206: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 207: Latin America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 208: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 209: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 210: Latin America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 211: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 212: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 213: Latin America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 214: Latin America Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 215: Latin America Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 216: Latin America Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 217: Brazil Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 218: Brazil Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 219: Brazil Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 220: Brazil Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 221: Brazil Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 222: Brazil Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 223: Brazil Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 224: Brazil Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 225: Brazil Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 226: Mexico Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 227: Mexico Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 228: Mexico Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 229: Mexico Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 230: Mexico Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 231: Mexico Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 232: Mexico Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 233: Mexico Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 234: Mexico Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 235: Argentina Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 236: Argentina Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 237: Argentina Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 238: Argentina Industrial Controls and Robotics Market Value (US$ Bn) Projection, By Deployment 2020 to 2035

Figure 239: Argentina Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By Deployment 2020 to 2035

Figure 240: Argentina Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By Deployment 2025 to 2035

Figure 241: Argentina Industrial Controls and Robotics Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 242: Argentina Industrial Controls and Robotics Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 243: Argentina Industrial Controls and Robotics Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035