Reports

Reports

India essential oils market is gearing up for continued growth. This could be credited to more number of consumers transition to natural, plant-based wellness and personal care products. Essential oils are made either by steaming or cold pressing aromatic plants including lemongrass, eucalyptus, and sandalwood. They are used in a wide range of applications including aromatherapy, cosmetics, food & beverages, and pharmaceuticals.

The growth of Ayurveda is bound to continue due to consumer awareness and government support through programs like the National AYUSH Mission that supports both - the cultivation and use of AYUSH products (which include essential oils). Another reason for this growth is the increase in consumers accessing essential oils from spas, wellness centers, and through e-Commerce in urban populated places.

Key players in the market have begun to change the environment and address consumers’ concerns regarding purity and adulteration by investing in sustainable sourcing, new distillation technology, and quality certification. Local players like Synthite and regional manufacturers also continue to create pathways for exporting high-value oils, thereby making India a supplier of these products.

India essential oils market encompasses the production and marketing of concentrated plant extracts from aromatic crops such as eucalyptus, lemongrass, sandalwood, and peppermint through steam distillation, solvent extraction, or cold pressing. These oils maintain the original smell of natural plant material as well as a range of active ingredients.

Essential oils are becoming increasingly popular within India for use in aromatherapy, personal care, cosmetics, wellness products, flavoring, and cleaning products marketed for household use. These oils are typically derived from plant materials that are firmly entrenched in Ayurveda and conventional medicine. Consumers ascribe therapeutic uses to essential oils and deploy them for stress relief, skin care, and other adjunct therapies that are aligned with the natural or naturalistic health movement.

| Attribute | Detail |

|---|---|

| Drivers |

|

With the increasing popularity of yoga, meditation, and spa culture, the use of aromatherapy and relaxation applications has grown, while personal care and cosmetics marketers work to reformulate product lines to include essential oil usage to address clean-label expectations. The transformation has been most evident in urban centers where increased exposure to global wellness trends and rise in e-Commerce platforms have widened consumer access to premium essential oils.

Another important driver to India essential oils market is the proactive involvement of domestic producers as well as multinationals in creating supply chains, exercising quality control, and expanding exports. Poor quality control, adulteration, and lack of standards are typical of the essential oil market.

Companies are engaging with farmers by offering training in high-yield cultivation techniques, contract farming models, and promoting aromatic crop cultivation under schemes such as the National AYUSH Mission.

The backward integration mentioned above secures raw material supply while empowering rural communities with better incomes. On the export front, India is leveraging its abundant low-cost cultivation base and biodiversity to strengthen its position as a supplier to Europe, North America, and Asia-Pacific.

With increasing demand for lemongrass, sandalwood, and peppermint oils globally, Indian players are upscaling production capacities and expanding the distribution networks. Strategic partnerships, brand collaborations, and joint ventures are also helping essential oils to penetrate premium global markets.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 203.5 Mn |

| Market Forecast Value in 2035 | US$ 455.5 Mn |

| Growth Rate (CAGR) | 7.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, India Essential Oils market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Country Covered |

|

| Zones Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

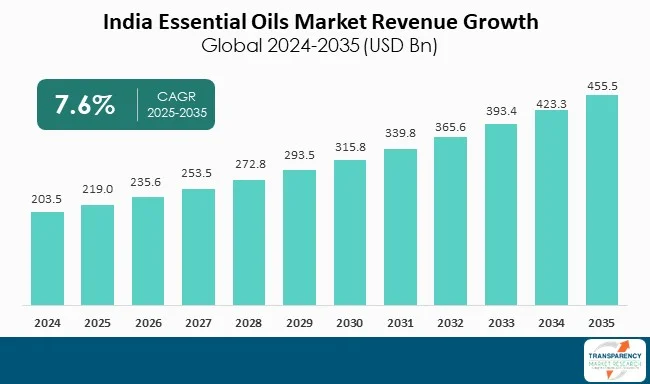

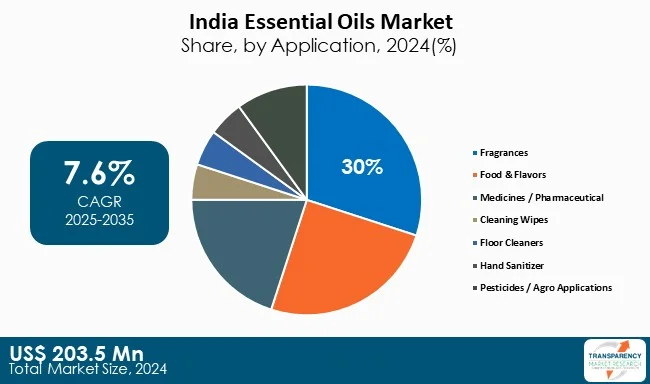

The India essential oils market was valued at US$ 203.5 Mn in 2024

The India essential oils industry is expected to grow at a CAGR of 7.6% from 2025 to 2035

Increasing consumer shift toward natural and holistic wellness solutions, strategic investments by industry players, and export expansion

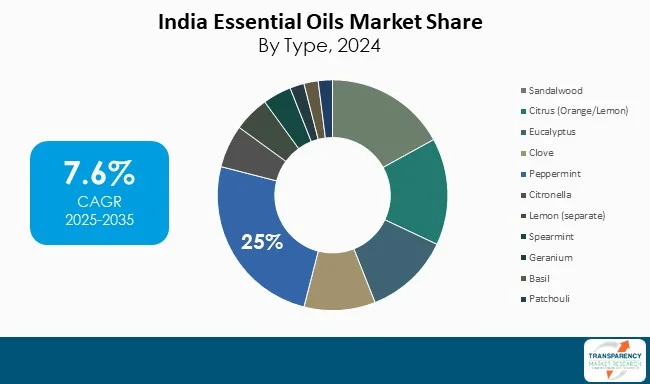

Peppermint Essential Oil type held the largest shares respectively within the type segment and was anticipated to grow at an estimated CAGR of 7.3% during the forecast period

North India was the most lucrative region in 2024

Bo International, Kanta Enterprises Private Limited, Indian Aroma Exports, India Essential Oils, AG Industries, BMV Fragrances Pvt. Ltd. and Moksha Lifestyle Products are the major players in India Essential Oils market

Table 1 India Essential Oils Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 India Essential Oils Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 3 India Essential Oils Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 4 India Essential Oils Market Value (US$ Mn) Forecast, by Grade, 2020 to 2035

Table 5 India Essential Oils Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 6 India Essential Oils Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 7 India Essential Oils Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 India Essential Oils Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 9 India Essential Oils Market Volume (Tons) Forecast, by Region, 2020 to 2035

Figure 1 India Essential Oils Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 India Essential Oils Market Attractiveness, by Type

Figure 3 India Essential Oils Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 4 India Essential Oils Market Attractiveness, by Grade

Figure 5 India Essential Oils Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 India Essential Oils Market Attractiveness, by Application

Figure 7 India Essential Oils Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 India Essential Oils Market Attractiveness, by End-use

Figure 9 India Essential Oils Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 India Essential Oils Market Attractiveness, by Region