Reports

Reports

Independent software vendors (ISVs) are pushing their boundaries of innovations to create value through products for customer. With the advent of digital disruption, companies are increasing their focus on process innovation to deploy an enriched end-user experience. Companies in the independent software vendors (ISVs) market are investing in product architectures that are scalable, fail-proof, and cost-effective. For instance, MSys Technologies— a company that enables digital transformation initiatives for ISVs, is gaining efficacy if fail-proof products that are capable of driving customer loyalty.

Companies in the independent software vendors (ISVs) market are focusing on the inclusion of right mix of digital technologies that help stakeholders gain a competitive edge over other players. As such, the market is largely fragmented with emerging players dictating ~55%-60% of the market revenue share. Independent software vendors are investing in right skills of software developers and building their credibility by complying with government rules and regulations.

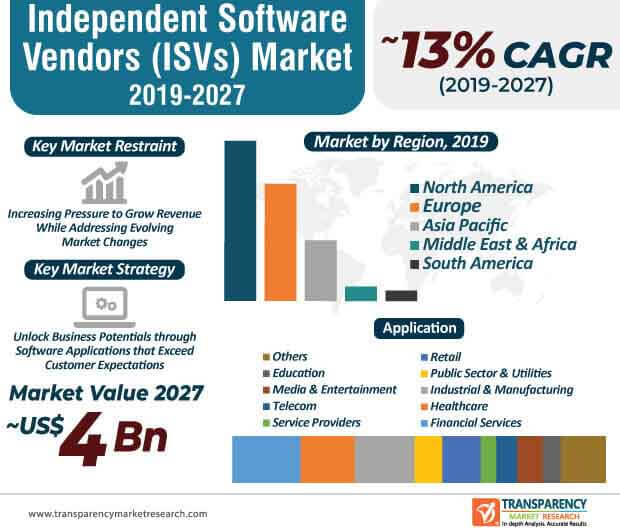

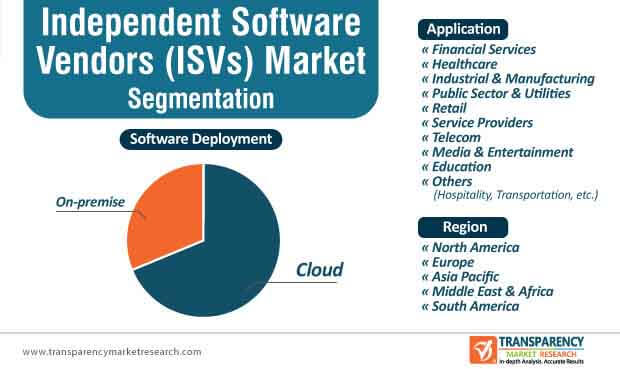

The global IT spending is anticipated to turn into a trillion dollar industry due to the increasing volume of independent software vendor products and services sold for and through cloud platforms. Hence, major companies are setting their collaboration wheels in motions to initiate strategic tie-ups with financial entities to capitalize on exponential cloud deployment. For instance, IBM— a leading U.S.-based IT company launched their one-of-its-kind financial services-ready public cloud by joining forces with the Bank of America. This explains why the revenue of financial services applications are projected for aggressive growth in the independent software vendors (ISVs) market, where the market is estimated to reach a value of ~US$ 4,077.72 Bn by the end of 2027.

Independent software vendors are benefitting through strategic collaborations, since ISVs can focus more on their core offerings to financial institutions through innovative cloud platforms. The establishment of a trusted technology ecosystem has become an important prerequisite raised by stakeholders of financial institutions in the independent software vendors market.

The growth of the independent software vendors market is anticipated to climb at a promising CAGR of ~13% during the forecast period. This is evident since the revenue of industrial & manufacturing application segment is predicted for exponential growth in the independent software vendors (ISVs) market. However, stakeholders in the industrial & manufacturing sector are straddling between software and services to progress in the market landscape. For instance, several vendors are offering services to replace software, especially in the supply chain network services domain. On the other hand, stakeholders in the industrial & manufacturing sector are outsourcing 3D printing services. However, lack of quality control in outsourced work is encouraging stakeholders to invest in software.

Independent software vendors are increasing efforts to analyze business needs of stakeholders in the industrial & manufacturing sector in order to offer the right software that improves efficiency levels in their organizations. Since software offering are not very straightforward in the industrial & manufacturing landscape, independent software vendors are educating stakeholders on the pros and cons about the software.

The acceleration of innovations and increased adoption of applications in the healthcare landscape are some of the major key drivers contributing toward the growth of the independent software vendors (ISVs) market. For instance, GE Healthcare— a U.S. multinational conglomerate revealed that the company is partnering with independent software vendors and developers in order to leverage their Edison platform. Strategic collaborations are creating value-grab opportunities for independent software vendors who are helping stakeholders in the healthcare industry to experience commercial growth through their healthcare applications.

The independent software vendors (ISVs) market is witnessing a transformation as developers gain the opportunity to innovate through intelligent software platforms of renowned healthcare companies. One of the most important end goals of stakeholders in the healthcare landscape is to increase the availability of efficient healthcare services that improve clinical outcomes. ISVs are aiming to ensure faster adoption of applications among end users through cloud.

Analysts’ Viewpoint

Companies are launching ISV partner programs to help customers with greater access to software solutions. Such innovative partner programs are being highly publicized to boost productivity and achieve cost savings in various end markets. Cloud innovations is one of the important takeaways in the independent software vendors (ISVs) market that has helped stakeholders in various end markets lower their operating costs.

Switching to cloud is offering stakeholders with increased amount of flexibility, allowing users to quickly scale up and down as per the demand. However, safeguarding valuable customer data in cloud environments is one of the restraints that may inhibit market growth. Hence, companies should increase their focus in fail-safe products to overcome limitations of data theft.

Key Growth Drivers of Independent Software Vendors (ISVs) Market

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Independent Software Vendors (ISVs) Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Bn), 2012, 2018 and 2027

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Ecosystem Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Regulations and Policies

4.6. ISV Market: Case Studies

4.7. End-users/Application Hardware Adoption Analysis (%), 2018

4.7.1. Adoption Analysis by Enterprise Function

4.7.1.1. Research and Development

4.7.1.2. Production and Designing

4.7.1.3. Sales and Marketing

4.7.1.4. Human Resource Management

4.7.1.5. Finance

4.7.2. Adoption Analysis by Devices

4.7.2.1. PCs

4.7.2.2. Workstations

4.7.2.3. Mixed Devices

4.7.3. Adoption Analysis by Operating System

4.7.3.1. Windows

4.7.3.2. Mac

4.7.3.3. Others

4.7.4. Adoption Analysis by Processor

4.7.4.1. Intel Xeon

4.7.4.2. Intel Core

4.7.5. Adoption Analysis of Cloud Services

4.7.6. Requirement Analysis of Hardware Specifications by Application/Enterprise Function

4.8. Global Independent Software Vendors (ISVs) Market Analysis and Forecast, 2015 - 2027

4.8.1. Market Revenue Analysis (US$ Bn)

4.8.1.1. Historic Growth Trends, 2015-2018

4.8.1.2. Forecast Trends, 2019-2027

4.9. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.9.1. By Software Deployment

4.9.2. By Application

4.9.3. By Region

4.10. Competitive Scenario and Trends

4.10.1. Independent Software Vendors (ISVs) Market Concentration Rate

4.10.1.1. List of Emerging, Prominent and Leading Players

4.10.2. Mergers & Acquisitions, Expansions

4.11. Market Outlook

5. Global Independent Software Vendors (ISVs) Market Analysis and Forecast, by Software Deployment

5.1. Overview & Definition

5.2. Key Segment Analysis

5.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

5.3.1. Cloud

5.3.2. On-premise

6. Global Independent Software Vendors (ISVs) Market Analysis and Forecast, by Application

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

6.3.1. Financial Services

6.3.2. Healthcare

6.3.3. Industrial & Manufacturing

6.3.4. Public Sector & Utilities

6.3.5. Retail

6.3.6. Service Providers

6.3.7. Telecom

6.3.8. Media & Entertainment

6.3.9. Education

6.3.10. Others (Hospitality, Transportation, etc.)

7. Global Independent Software Vendors (ISVs) Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Region, 2016 -2026

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Independent Software Vendors (ISVs) Market Analysis and Forecast

8.1. Key Findings

8.2. Impact Analysis of Drivers and Restraints

8.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

8.3.1. Cloud

8.3.2. On-premise

8.4. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

8.4.1. Financial Services

8.4.2. Healthcare

8.4.3. Industrial & Manufacturing

8.4.4. Public Sector & Utilities

8.4.5. Retail

8.4.6. Service Providers

8.4.7. Telecom

8.4.8. Media & Entertainment

8.4.9. Education

8.4.10. Others (Hospitality, Transportation, etc.)

8.5. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Country and Sub-region, 2017 - 2027

8.5.1. U.S.

8.5.2. Canada

8.5.3. Mexico

8.5.4. Rest of North America

9. U.S. Independent Software Vendors (ISVs) Market Analysis and Forecast

9.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

9.1.1. Cloud

9.1.2. On-premise

9.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

9.2.1. Financial Services

9.2.2. Healthcare

9.2.3. Industrial & Manufacturing

9.2.4. Public Sector & Utilities

9.2.5. Retail

9.2.6. Service Providers

9.2.7. Telecom

9.2.8. Media & Entertainment

9.2.9. Education

9.2.10. Others (Hospitality, Transportation, etc.)

10. Canada Independent Software Vendors (ISVs) Market Analysis and Forecast

10.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

10.1.1. Cloud

10.1.2. On-premise

10.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

10.2.1. Financial Services

10.2.2. Healthcare

10.2.3. Industrial & Manufacturing

10.2.4. Public Sector & Utilities

10.2.5. Retail

10.2.6. Service Providers

10.2.7. Telecom

10.2.8. Media & Entertainment

10.2.9. Education

10.2.10. Others (Hospitality, Transportation, etc.)

11. Mexico Independent Software Vendors (ISVs) Market Analysis and Forecast

11.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

11.1.1. Cloud

11.1.2. On-premise

11.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

11.2.1. Financial Services

11.2.2. Healthcare

11.2.3. Industrial & Manufacturing

11.2.4. Public Sector & Utilities

11.2.5. Retail

11.2.6. Service Providers

11.2.7. Telecom

11.2.8. Media & Entertainment

11.2.9. Education

11.2.10. Others (Hospitality, Transportation, etc.)

12. Europe Independent Software Vendors (ISVs) Market Analysis and Forecast

12.1. Key Findings

12.2. Impact Analysis of Drivers and Restraints

12.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

12.3.1. Cloud

12.3.2. On-premise

12.4. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

12.4.1. Financial Services

12.4.2. Healthcare

12.4.3. Industrial & Manufacturing

12.4.4. Public Sector & Utilities

12.4.5. Retail

12.4.6. Service Providers

12.4.7. Telecom

12.4.8. Media & Entertainment

12.4.9. Education

12.4.10. Others (Hospitality, Transportation, etc.)

12.5. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Country and Sub-region, 2017 - 2027

12.5.1. Germany

12.5.2. U.K.

12.5.3. France

12.5.4. Spain

12.5.5. Italy

12.5.6. Russia

12.5.7. Rest of Europe

13. Germany Independent Software Vendors (ISVs) Market Analysis and Forecast

13.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

13.1.1. Cloud

13.1.2. On-premise

13.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

13.2.1. Financial Services

13.2.2. Healthcare

13.2.3. Industrial & Manufacturing

13.2.4. Public Sector & Utilities

13.2.5. Retail

13.2.6. Service Providers

13.2.7. Telecom

13.2.8. Media & Entertainment

13.2.9. Education

13.2.10. Others (Hospitality, Transportation, etc.)

14. UK Independent Software Vendors (ISVs) Market Analysis and Forecast

14.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

14.1.1. Cloud

14.1.2. On-premise

14.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

14.2.1. Financial Services

14.2.2. Healthcare

14.2.3. Industrial & Manufacturing

14.2.4. Public Sector & Utilities

14.2.5. Retail

14.2.6. Service Providers

14.2.7. Telecom

14.2.8. Media & Entertainment

14.2.9. Education

14.2.10. Others (Hospitality, Transportation, etc.)

15. France Independent Software Vendors (ISVs) Market Analysis and Forecast

15.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

15.1.1. Cloud

15.1.2. On-premise

15.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

15.2.1. Financial Services

15.2.2. Healthcare

15.2.3. Industrial & Manufacturing

15.2.4. Public Sector & Utilities

15.2.5. Retail

15.2.6. Service Providers

15.2.7. Telecom

15.2.8. Media & Entertainment

15.2.9. Education

15.2.10. Others (Hospitality, Transportation, etc.)

16. Spain Independent Software Vendors (ISVs) Market Analysis and Forecast

16.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

16.1.1. Cloud

16.1.2. On-premise

16.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

16.2.1. Financial Services

16.2.2. Healthcare

16.2.3. Industrial & Manufacturing

16.2.4. Public Sector & Utilities

16.2.5. Retail

16.2.6. Service Providers

16.2.7. Telecom

16.2.8. Media & Entertainment

16.2.9. Education

16.2.10. Others (Hospitality, Transportation, etc.)

17. Italy Independent Software Vendors (ISVs) Market Analysis and Forecast

17.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

17.1.1. Cloud

17.1.2. On-premise

17.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

17.2.1. Financial Services

17.2.2. Healthcare

17.2.3. Industrial & Manufacturing

17.2.4. Public Sector & Utilities

17.2.5. Retail

17.2.6. Service Providers

17.2.7. Telecom

17.2.8. Media & Entertainment

17.2.9. Education

17.2.10. Others (Hospitality, Transportation, etc.)

18. Russia Independent Software Vendors (ISVs) Market Analysis and Forecast

18.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

18.1.1. Cloud

18.1.2. On-premise

18.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

18.2.1. Financial Services

18.2.2. Healthcare

18.2.3. Industrial & Manufacturing

18.2.4. Public Sector & Utilities

18.2.5. Retail

18.2.6. Service Providers

18.2.7. Telecom

18.2.8. Media & Entertainment

18.2.9. Education

18.2.10. Others (Hospitality, Transportation, etc.)

19. Asia Pacific Independent Software Vendors (ISVs) Market Analysis and Forecast

19.1. Key Findings

19.2. Impact Analysis of Drivers and Restraints

19.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

19.3.1. Cloud

19.3.2. On-premise

19.4. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

19.4.1. Financial Services

19.4.2. Healthcare

19.4.3. Industrial & Manufacturing

19.4.4. Public Sector & Utilities

19.4.5. Retail

19.4.6. Service Providers

19.4.7. Telecom

19.4.8. Media & Entertainment

19.4.9. Education

19.4.10. Others (Hospitality, Transportation, etc.)

19.5. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Country and Sub-region, 2017 - 2027

19.5.1. China

19.5.2. Japan

19.5.3. India

19.5.4. Australia & New Zealand

19.5.5. South Korea

19.5.6. ASEAN

19.5.7. Rest of Asia Pacific

20. China Independent Software Vendors (ISVs) Market Analysis and Forecast

20.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

20.1.1. Cloud

20.1.2. On-premise

20.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

20.2.1. Financial Services

20.2.2. Healthcare

20.2.3. Industrial & Manufacturing

20.2.4. Public Sector & Utilities

20.2.5. Retail

20.2.6. Service Providers

20.2.7. Telecom

20.2.8. Media & Entertainment

20.2.9. Education

20.2.10. Others (Hospitality, Transportation, etc.)

21. Japan Independent Software Vendors (ISVs) Market Analysis and Forecast

21.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

21.1.1. Cloud

21.1.2. On-premise

21.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

21.2.1. Financial Services

21.2.2. Healthcare

21.2.3. Industrial & Manufacturing

21.2.4. Public Sector & Utilities

21.2.5. Retail

21.2.6. Service Providers

21.2.7. Telecom

21.2.8. Media & Entertainment

21.2.9. Education

21.2.10. Others (Hospitality, Transportation, etc.)

22. India Independent Software Vendors (ISVs) Market Analysis and Forecast

22.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

22.1.1. Cloud

22.1.2. On-premise

22.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

22.2.1. Financial Services

22.2.2. Healthcare

22.2.3. Industrial & Manufacturing

22.2.4. Public Sector & Utilities

22.2.5. Retail

22.2.6. Service Providers

22.2.7. Telecom

22.2.8. Media & Entertainment

22.2.9. Education

22.2.10. Others (Hospitality, Transportation, etc.)

23. Australia & New Zealand Independent Software Vendors (ISVs) Market Analysis and Forecast

23.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

23.1.1. Cloud

23.1.2. On-premise

23.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

23.2.1. F Financial Services

23.2.2. Healthcare

23.2.3. Industrial & Manufacturing

23.2.4. Public Sector & Utilities

23.2.5. Retail

23.2.6. Service Providers

23.2.7. Telecom

23.2.8. Media & Entertainment

23.2.9. Education

23.2.10. Others (Hospitality, Transportation, etc.)

24. South Korea Independent Software Vendors (ISVs) Market Analysis and Forecast

24.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

24.1.1. Cloud

24.1.2. On-premise

24.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

24.2.1. Financial Services

24.2.2. Healthcare

24.2.3. Industrial & Manufacturing

24.2.4. Public Sector & Utilities

24.2.5. Retail

24.2.6. Service Providers

24.2.7. Telecom

24.2.8. Media & Entertainment

24.2.9. Education

24.2.10. Others (Hospitality, Transportation, etc.)

25. ASEAN Independent Software Vendors (ISVs) Market Analysis and Forecast

25.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

25.1.1. Cloud

25.1.2. On-premise

25.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

25.2.1. Financial Services

25.2.2. Healthcare

25.2.3. Industrial & Manufacturing

25.2.4. Public Sector & Utilities

25.2.5. Retail

25.2.6. Service Providers

25.2.7. Telecom

25.2.8. Media & Entertainment

25.2.9. Education

25.2.10. Others (Hospitality, Transportation, etc.)

25.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Country, 2017 - 2027

25.3.1. Singapore

25.3.2. Malaysia

25.3.3. Thailand

25.3.4. Philippines

25.3.5. Indonesia

25.3.6. Vietnam

25.3.7. Rest of ASEAN

26. Middle East & Africa (MEA) Independent Software Vendors (ISVs) Market Analysis and Forecast

26.1. Key Findings

26.2. Impact Analysis of Drivers and Restraints

26.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

26.3.1. Cloud

26.3.2. On-premise

26.4. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

26.4.1. Financial Services

26.4.2. Healthcare

26.4.3. Industrial & Manufacturing

26.4.4. Public Sector & Utilities

26.4.5. Retail

26.4.6. Service Providers

26.4.7. Telecom

26.4.8. Media & Entertainment

26.4.9. Education

26.4.10. Others (Hospitality, Transportation, etc.)

26.5. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Country and Sub-region, 2017 - 2027

26.5.1. GCC

26.5.2. South Africa

26.5.3. Rest of MEA

27. GCC Independent Software Vendors (ISVs) Market Analysis and Forecast

27.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

27.1.1. Cloud

27.1.2. On-premise

27.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

27.2.1. Financial Services

27.2.2. Healthcare

27.2.3. Industrial & Manufacturing

27.2.4. Public Sector & Utilities

27.2.5. Retail

27.2.6. Service Providers

27.2.7. Telecom

27.2.8. Media & Entertainment

27.2.9. Education

27.2.10. Others (Hospitality, Transportation, etc.)

28. South Africa Independent Software Vendors (ISVs) Market Analysis and Forecast

28.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

28.1.1. Cloud

28.1.2. On-premise

28.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

28.2.1. Financial Services

28.2.2. Healthcare

28.2.3. Industrial & Manufacturing

28.2.4. Public Sector & Utilities

28.2.5. Retail

28.2.6. Service Providers

28.2.7. Telecom

28.2.8. Media & Entertainment

28.2.9. Education

28.2.10. Others (Hospitality, Transportation, etc.)

29. South America Independent Software Vendors (ISVs) Market Analysis and Forecast

29.1. Key Findings

29.2. Impact Analysis of Drivers and Restraints

29.3. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

29.3.1. Cloud

29.3.2. On-premise

29.4. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

29.4.1. Financial Services

29.4.2. Healthcare

29.4.3. Industrial & Manufacturing

29.4.4. Public Sector & Utilities

29.4.5. Retail

29.4.6. Service Providers

29.4.7. Telecom

29.4.8. Media & Entertainment

29.4.9. Education

29.4.10. Others (Hospitality, Transportation, etc.)

29.5. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Country and Sub-region, 2017 - 2027

29.5.1. Brazil

29.5.2. Rest of South America

30. Brazil Independent Software Vendors (ISVs) Market Analysis and Forecast

30.1. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Software Deployment, 2017 - 2027

30.1.1. Cloud

30.1.2. On-premise

30.2. Independent Software Vendors (ISVs) Market Size (US$ Bn) Forecast, by Application, 2017 - 2027

30.2.1. Financial Services

30.2.2. Healthcare

30.2.3. Industrial & Manufacturing

30.2.4. Public Sector & Utilities

30.2.5. Retail

30.2.6. Service Providers

30.2.7. Telecom

30.2.8. Media & Entertainment

30.2.9. Education

30.2.10. Others (Hospitality, Transportation, etc.)

31. Competition Landscape

31.1. Market Player – Competition Matrix

31.2. Market Revenue Share Analysis (%), by Company (2018)

31.3. Product/ Service Mapping of ISVs, by Top Vendors

32. Company Profiles (Details – Business Overview, Sales Area/Geographical Presence, Revenue and Strategy)

32.1. Microsoft Corporation

32.1.1. Business Overview

32.1.2. Company Revenue

32.1.3. Geographic/Segment Revenue

32.1.4. Strategic Overview

32.2. Oracle Corporation.

32.2.1. Business Overview

32.2.2. Company Revenue

32.2.3. Geographic/Segment Revenue

32.2.4. Strategic Overview

32.3. IBM Corporation

32.3.1. Business Overview

32.3.2. Company Revenue

32.3.3. Geographic/Segment Revenue

32.3.4. Strategic Overview

32.4. Cisco Systems, Inc.

32.4.1. Business Overview

32.4.2. Company Revenue

32.4.3. Geographic/Segment Revenue

32.4.4. Strategic Overview

32.5. Hewlett Packard Company

32.5.1. Business Overview

32.5.2. Company Revenue

32.5.3. Geographic/Segment Revenue

32.5.4. Strategic Overview

32.6. Salesforce.com, Inc.

32.6.1. Business Overview

32.6.2. Company Revenue

32.6.3. Geographic/Segment Revenue

32.6.4. Strategic Overview

32.7. Google, LLC

32.7.1. Business Overview

32.7.2. Company Revenue

32.7.3. Geographic/Segment Revenue

32.7.4. Strategic Overview

32.8. Allscripts Healthcare Solutions Inc.

32.8.1. Business Overview

32.8.2. Company Revenue

32.8.3. Geographic/Segment Revenue

32.8.4. Strategic Overview

32.9. Apple Inc.

32.9.1. Business Overview

32.9.2. Company Revenue

32.9.3. Geographic/Segment Revenue

32.9.4. Strategic Overview

32.10. American Software, Inc.

32.10.1. Business Overview

32.10.2. Company Revenue

32.10.3. Geographic/Segment Revenue

32.10.4. Strategic Overview

32.11. Red Hat, Inc.

32.11.1. Business Overview

32.11.2. Company Revenue

32.11.3. Geographic/Segment Revenue

32.11.4. Strategic Overview

32.12. ServiceNow, Inc.

32.12.1. Business Overview

32.12.2. Company Revenue

32.12.3. Geographic/Segment Revenue

32.12.4. Strategic Overview

32.13. Virtusa Corporation

32.13.1. Business Overview

32.13.2. Company Revenue

32.13.3. Geographic/Segment Revenue

32.13.4. Strategic Overview

32.14. ASG Technologies Group, Inc.

32.14.1. Business Overview

32.14.2. Company Revenue

32.14.3. Geographic/Segment Revenue

32.14.4. Strategic Overview

32.15. Barnard Software, Inc.

32.15.1. Business Overview

32.15.2. Company Revenue

32.15.3. Geographic/Segment Revenue

32.15.4. Strategic Overview

32.16. Other Profiles

32.16.1. Arney Computer Systems

32.16.2. Astro Tech

32.16.3. Avgi Solutions

32.16.4. VMware, Inc.

32.16.5. Autodesk, Inc.

32.16.6. Fundamental Software, Inc.

32.16.7. GSF Software

32.16.8. GT Software

32.16.9. H & W Computer Systems, Inc.

32.16.10. HostBridge Technology

32.16.11. Interskill Interactive, Inc.

32.16.12. KELLTON TECH

32.16.13. Lee Technologies, Inc.

32.16.14. Levi, Ray and Shoup, Inc

32.16.15. Magic Software Enterprises Ltd

32.16.16. Numerical Algorithms Group Ltd

32.16.17. Pacific Systems Group

32.16.18. Phoenix Software International

32.16.19. Universal Software, Inc.

32.16.20. XPS Software GmbH

33. Key Takeaways

List of Tables

Table 1: Global Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 2: Global Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 3: Global Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Region, 2017 – 2027

Table 4: North America Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 5: North America Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 6: North America Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Country, 2017 – 2027

Table 7: U.S. Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 8: U.S. Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 9: Canada Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 10: Canada Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 11: Mexico Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 12: Mexico Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 13: Europe Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 14: Europe Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 15: Europe Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 16: Germany Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 17: Germany Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 18: U.K. Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 19: U.K. Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 20: France Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 21: France Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 22: Spain Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 23: Spain Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 24: Italy Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 25: Italy Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 26: Russia Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 27: Russia Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 28: Asia Pacific Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 29: Asia Pacific Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 30: Asia Pacific Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 31: China Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 32: China Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 33: India Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 34: India Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 35: Japan Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 36: Japan Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 37: Australia & New Zealand Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 38: Australia & New Zealand Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 39: South Korea Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 40: South Korea Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 41: ASEAN Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 42: ASEAN Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 43: ASEAN Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 44: Middle East & Africa Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 45: Middle East & Africa Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 46: Middle East & Africa Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 47: GCC Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 48: GCC Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 49: South Africa Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 50: South Africa Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 51: South America Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 52: South America Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 53: South America Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

Table 54: Brazil Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Software Deployment, 2017 – 2027

Table 55: Brazil Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Forecast, by Application, 2017 – 2027

List of Figures

Figure 1: Global Independent Software Vendors Market Size (US$ Bn) Forecast, 2017 – 2027

Figure 2: Global Independent Software Vendors Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2019E

Figure 3: Top Segment Analysis

Figure 4: Global Independent Software Vendors Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2027F

Figure 5: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 6: Top Economies GDP Landscape, 2018

Figure 7: Global ICT Spending (%), by Region, 2019E

Figure 8: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 9: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 10: Global ICT Spending (%), by Type, 2019E

Figure 11: Adoption (%), by Enterprise Function

Figure 12: Adoption (%), by Devices

Figure 13: Adoption (%), by Operating System

Figure 14: Adoption (%), by Processor

Figure 15: Global Independent Software Vendors (ISVs) Market Revenue (US$ Bn) Historic Trends, 2015 - 2018

Figure 16: Global Independent Software Vendors (ISVs) Market Revenue Opportunity (US$ Bn) Historic Trends, 2015 - 2018

Figure 17: Global Independent Software Vendors (ISVs) Market Revenue (US$ Bn) and Y-o-Y Growth (Revenue %) Forecast, 2019 - 2027

Figure 18: Global Independent Software Vendors (ISVs) Market Revenue Opportunity (US$ Bn) Forecast, 2019 - 2027

Figure 19: Global Independent Software Vendors (ISVs) Market Opportunity Assessment, by Software Deployment, 2019-2027

Figure 20: Global Independent Software Vendors (ISVs) Market Opportunity Assessment, by Application, 2019-2027

Figure 21: Global Independent Software Vendors (ISVs) Market Opportunity Assessment, by Region , 2019-2027

Figure 22: Global Independent Software Vendors (ISVs) Market, by Software Deployment, CAGR (%) (2019 – 2027)

Figure 23: Global Independent Software Vendors (ISVs) Market, by Region, CAGR (%) (2019 – 2027)

Figure 24: Global Independent Software Vendors (ISVs) Market, by Application, CAGR (%) (2019 – 2027)

Figure 25: Global Independent Software Vendors Market Share Analysis, by Software Deployment (2019 & 2027)

Figure 26: Global Independent Software Vendors Market Share Analysis, by Application (2019 & 2027)

Figure 27: Global Independent Software Vendors (ISVs) Market Outlook (Volume %), by Region, 2019

Figure 28: Global Independent Software Vendors (ISVs) Market Outlook (Volume %), by Region, 2027

Figure 29: North America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 30: North America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 31: North America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 32: North America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 33: North America Independent Software Vendors (ISVs) Market Outlook (Volume %), by Country, 2019

Figure 34: North America Independent Software Vendors (ISVs) Market Outlook (Volume %), by Country, 2027

Figure 35: U.S. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 36: U.S. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 37: U.S. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 38: U.S. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 39: Canada Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 40: Canada Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 41: Canada Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 42: Canada Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 43: Mexico Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 44: Mexico Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 45: Mexico Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 46: Mexico Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 47: Europe Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 48: Europe Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 49: Europe Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 50: Europe Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 51: Europe Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2019

Figure 52: Europe Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2027

Figure 53: Germany Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 54: Germany Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 55: Germany Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 56: Germany Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 57: U.K. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 58: U.K. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 59: U.K. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 60: U.K. Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 61: France Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 62: France Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 63: France Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 64: France Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 65: Spain Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 66: Spain Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 67: Spain Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 68: Spain Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 69: Italy Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 70: Italy Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 71: Italy Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 72: Italy Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 73: Russia Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 74: Russia Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 75: Russia Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 76: Russia Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 77: Asia Pacific Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 78: Asia Pacific Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 79: Asia Pacific Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 80: Asia Pacific Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 81: Asia Pacific Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2019

Figure 82: Asia Pacific Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2027

Figure 83: China Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 84: China Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 85: China Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 86: China Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 87: India Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 88: India Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 89: India Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 90: India Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 91: Japan Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 92: Japan Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 93: Japan Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 94: Japan Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 95: Australia & New Zealand Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 96: Australia & New Zealand Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 97: Australia & New Zealand Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 98: Australia & New Zealand Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 99: South Korea Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 100: South Korea Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 101: South Korea Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 102: South Korea Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 103: ASEAN Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 104: ASEAN Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 105: ASEAN Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 106: ASEAN Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 107: ASEAN Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2019

Figure 108: ASEAN Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2027

Figure 109: Middle East & Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 110: Middle East & Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 111: Middle East & Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 112: Middle East & Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 113: Middle East & Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2019

Figure 114: Middle East & Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2027

Figure 115: GCC Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 116: GCC Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 117: GCC Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 118: GCC Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 119: South Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 120: South Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 121: South Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 122: South Africa Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 123: South America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 124: South America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 125: South America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 126: South America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027

Figure 127: South America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2019

Figure 128: South America Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Country, 2027

Figure 129: Brazil Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2019

Figure 130: Brazil Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Software Deployment, 2027

Figure 131: Brazil Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2019

Figure 132: Brazil Independent Software Vendors (ISVs) Market Outlook (Revenue %), by Application, 2027