Reports

Reports

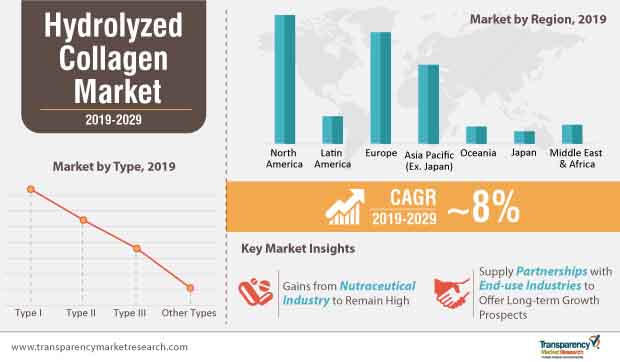

The hydrolyzed collagen market, valued at ~US$ 825 million in 2018, advances towards becoming a billion-dollar market by 2021, and will continue its stride at a CAGR of ~8% during 2019-2029, finds a new report published by Transparency Market Research (TMR).

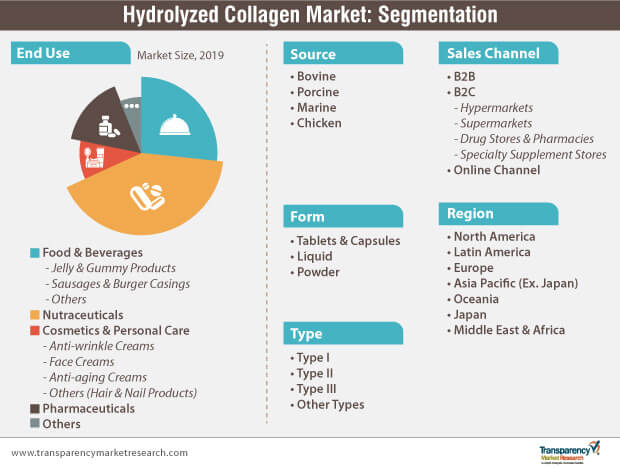

The hydrolyzed collagen market holds adjacent market opportunities, besides food and beverages, and much of this has to do with the newly-added thrust of preventive, rather than curative measures in the healthcare sector. Though the healthcare industry is not a direct contributor to the landscape, the blurring lines between food and nutraceutical industries, and the convergence of 'food-pharma' industries are projected to exert a sizeable influence on the popularity of hydrolyzed collagen to cater to nutritional inadequacies among consumers.

The significant shift in the strategy towards curative practices has, in turn, caught the attention of the cosmetics and personal care industry, and manufacturers are catalyzing the spurt in the growth of the hydrolyzed collagen market with the introduction of skincare- and hair care-based product portfolios. However, while tapping adjacent market opportunities, manufacturers need to be prepared for the discipline of regulatory compliance - norms regarding food claims and information presented to consumers to drive them into the sales funnel.

The hydrolyzed collagen market continues to undergo an epochal scale of transmutation, as manufacturers tap new sources to extract value-added collagens. Historically, hydrolyzed collagen, extracted from cattle, maintained a clear lead in terms of value share. However, as literature claiming benefits of marine-sourced collagens - better water solubility, skincare properties, and lesser carbon footprints - began coming to light, a spike in their adoption rate became apparent. In 2019, hydrolyzed collagen sourced from bovine accounted for ~US$ 350 million, while that sourced from marine is estimated to register a CAGR of ~11% during 2019-2029.

However, the evolutionary nature of the landscape is the very feature that could pose a challenge. Animal-sourced hydrolyzed collagens cater to the protein inadequacy of the non-vegetarian populace, while the growing interest towards the adoption of the vegan trend could be a weighted market deterrent.

As per searches made, Google Trends marked a whopping 90% increase in vegan trends in 2016, with leading searches from Australia, followed by North America. Increasing searches for 'vegan' and 'vegetarian' keywords, as a whole, surmise the growing proclivity of consumers for plant-based dietary choices. The quest for plant-based supplements has led to the introduction of vegan collagen, produced by genetically modifying yeast and bacteria. What further helps vegan collagen manufacturers distinguish their offerings is their cost-efficiency and high safety profile, which could dim the potential of the animal-based hydrolyzed collagen market.

In 2018, the sales of powdered hydrolyzed collagen accounted for a value of ~US$ 265 million, while that of liquid hydrolyzed collagen grew to a value of ~US$ 135 million. Despite the availability of various intake options, consumers tend to prefer nutritional supplements in the powdered form over the tablet and liquid forms, on account of their longer shelf life and high bioavailability. On top of that, powdered hydrolyzed collagen is deemed pure, as it is less susceptible to mixing with other ingredients. As compared to the other forms, cost-effectiveness and high flexibility with dosing remain the key attractive proposition of the powdered form, catalyzing its sales.

However, the report points towards the exponentially growing adoption rate of liquid hydrolyzed collagen, given its high absorbability, which makes it more effective than the powdered and tablet forms. The sales of liquid hydrolyzed collagen will move at a compound annual growth rate of ~10% during the forecast period.

Beside other success factors, distribution channels, in turn, play a pivotal role in influencing the purchasing behavior of consumers. For instance, the transit of powdered hydrolyzed collagen is much safer than that of the liquid form, which is thereby fortifying the sales of the former via online channels, and that of liquid through B2B and B2C channels such as hypermarkets/supermarkets, drug stores & pharmacies, and specialty supplement stores.

Despite an upsurge in sales through online and B2C channels, B2B channels will account for a sizeable share, given the direct and indirect supply-distribution partnerships with end-use industries such as food and beverages, nutraceuticals, pharmaceuticals, and cosmetic industries, among others.

Proper labeling of hydrolyzed collagens will be a focus area for market players, given the growing appetite of central and food regulators regarding safety. The FDA, operating in the U.S., issued new guidance on food labeling, to drive greater standardization in the way health and nutrition information is presented to the consumer. Food labeling changes in Europe are more stringent that those present in North America. New requirements include improved legibility of information and specific details regarding the source of the product.

Another key aspect of such regulations is the high number of product recalls in case of failure to meet legislated protocols, which needs the complete attention of manufacturers while marketing for their products to safeguard their business from product recall instances.

In a fragmented landscape, which lacks strong dominance, market players can make it big in the hydrolyzed collagen market by taking a cue from global players. The key to a high market share is intense focus on global reach and broadening of a consumer-centric product portfolio, an example of which can be taken from Rousselot, a leading player offering gelatin and collagen peptides. The company, along with Phamatech, collaborated for the launch of SiMoGel, a fortified confectionery, in the EMEA market.

With the presence of stringent regulatory norms scrutinizing hydrolyzed collagens as well as products made out of them, manufacturers will need to take a more granular and conscientious approach towards the development of clean-label products. Consumers’ fickle food choices mean that market players will have to closely understand the undercurrents and trends while conducting their R&D activities in order to develop a consumer-centric product. Since pure hydrolyzed collagen is flavorless and odorless, market players can increase the exclusiveness of their portfolio by introducing new flavors. All-in-all, market players can look at a market value of ~US$ 1.8 Bn by the end of 2029.

Hydrolyzed Collagen Market Witnessing Growth Due to Radical Shift towards Sustainability and Longevity

Increasing Demand for Cosmetics and Personal Care Products Boosting Hydrolyzed Collagen Market

Growing Commercialization of Hydrolyzed Collagen-based Drug Delivery Systems

Growing Popularity and Demand for Natural Ingredients

Economic Development in BRICS Countries

Challenges Pertaining to FDA Approval for Hydrolyzed Collagen

Global Hydrolyzed Collagen Market: Competition Landscape

Key players operating in the hydrolyzed collagen market, as profiled in the study, include

1. Executive Summary

1.1. Summary of Key Findings

1.2. Summary of Key Statistics

1.3. Supply and Demand Side Trends

1.4. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Market Background

4.1. Rising Cost of Healthcare and Role of Supplements

4.2. Per Capita Spending on Supplement (Country wise Benchmark)

4.3. Global Supplements Market Analysis

4.3.1. Supplement Sales Value and Forecast

4.3.2. Share of Collagen Hydrolysates Supplement (in Global Supplement Sales)

4.4. Global Supplements Market Overview

4.4.1. Supplements Spending Analysis, by Category

4.4.1.1. Heart Health

4.4.1.2. Bone Health

4.4.1.3. Brain Health

4.4.1.4. Vision Support

4.4.1.5. Others

4.4.2. Supplements Spending Analysis, by Consumer Type

4.4.2.1. Male

4.4.2.2. Female

4.4.3. Supplements Spending Analysis, by Age Group

4.4.3.1. 0-15 years

4.4.3.2. 15-30 years

4.4.3.3. 30-60 years

4.4.3.4. 60 years and Above

4.4.4. Supplements Spending Analysis, by Consumption Type

4.4.4.1. Prescription based

4.4.4.2. Over the Counter (OTC)

4.5. Regulations for Hydrolyzed Collagen Supplements across the Globe

4.6. Hydrolyzed Collagen Supplement Product Hotspot - Pipeline Analysis

4.7. Global Brain Health Supplements Spending Overview

4.7.1. Brain Health Supplements Spending based on Disorder Type

4.7.1.1. Alzheimer's Disease

4.7.1.2. Dementias

4.7.1.3. Epilepsy and Other Seizure Disorders

4.7.1.4. Mental Disorders

4.7.1.5. Parkinson's and Other Movement Disorders

4.7.1.6. Stroke and Transient Ischemic Attack (TIA)

4.7.1.7. Sleeping Disorders

4.7.1.8. Others

4.8. Rising Preventive Healthcare

4.8.1. Role of Education in the Global Preventive Healthcare Awareness

4.8.2. Role of Internet in the Global Preventive Healthcare Awareness

4.8.3. Role of Government Initiatives in the Global Preventive Healthcare Awareness

4.9. Macro-Economic Factors

4.9.1. Global GDP Growth Outlook

4.9.2. Global Per Capita Health Spending Outlook

4.9.3. Global Pharmaceutical Industry Outlook

4.9.4. Global Population Growth Outlook

4.9.4.1. Birth Rates

4.9.4.2. Death Rates

4.9.5. Per Capita Disposable Income

4.9.6. Health Sector GVA

4.10. Forecast Factors - Relevance & Impact

4.10.1. Top Companies Historical Growth

4.10.2. Incidences of Alzheimer Disorder

4.10.3. Incidences of Dementia

4.10.4. Incidences of Mental Disorder

4.11. Value Chain Analysis

4.11.1. Profitability Margin Analysis

4.11.2. Value Added at Each Node in the Supply Chain

4.11.3. List of Hydrolyzed Collagen Brand Owners

4.11.4. List of Hydrolyzed Collagen Manufacturers

4.11.5. List of Hydrolyzed Collagen Raw Material Suppliers

4.12. Market Dynamics

4.12.1. Drivers

4.12.2. Restraints

4.12.3. Opportunity Analysis

5. Global Hydrolyzed Collagen Market Demand Analysis 2014-2018 and Forecast, 2019-2029

5.1. Historical Market Volume (Tons) Analysis, 2014-2018

5.2. Current and Future Market Volume (Tons) Projections, 2019-2029

5.3. Y-o-Y Growth Trend Analysis

6. Global Hydrolyzed Collagen Market - Pricing Analysis

6.1. Regional Pricing Analysis By Size

6.2. Pricing Break-up

6.2.1. Manufacturer Level Pricing

6.2.2. Distributor Level Pricing

6.3. Global Average Pricing Analysis Benchmark

7. Global Hydrolyzed Collagen Market Demand (in Value or Size in US$ Mn) Analysis 2014-2018 and Forecast, 2019-2029

7.1. Historical Market Value (US$ Mn) Analysis, 2014-2018

7.2. Current and Future Market Value (US$ Mn) Projections, 2019-2029

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Global Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029, by Source

8.1. Introduction / Key Findings

8.2. Historical Market Size (US$ Mn) and Volume (Tons) Analysis By Source, 2014 - 2018

8.3. Current and Future Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast By Source, 2019 - 2029

8.3.1. Bovine

8.3.2. Porcine

8.3.3. Marine

8.3.4. Chicken

8.4. Market Attractiveness Analysis By Source

9. Global Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029, by Form

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume (Tons) Analysis By Form, 2014 - 2018

9.3. Current and Future Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast By Form, 2019 - 2029

9.3.1. Tablets & Capsules

9.3.2. Liquid

9.3.3. Powder

9.4. Market Attractiveness Analysis By Form

10. Global Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029, by Collagen Type

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume (Tons) Analysis By Collagen Type, 2014 - 2018

10.3. Current and Future Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast By Collagen Type, 2019 - 2029

10.3.1. Type I

10.3.2. Type II

10.3.3. Type III

10.3.4. Other Types

10.4. Market Attractiveness Analysis By Collagen Type

11. Global Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029, by End Use

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume (Tons) Analysis By End Use, 2014 - 2018

11.3. Current and Future Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast By End Use, 2019 - 2029

11.3.1. Food & Beverage Industry

11.3.1.1. Jelly & Gummy Products

11.3.1.2. Sausages & Burger Casings

11.3.1.3. Others

11.3.2. Nutraceuticals

11.3.3. Cosmetics & Personal Care Industry

11.3.3.1. Anti-Wrinkle Creams

11.3.3.2. Face Creams

11.3.3.3. Antiaging Creams

11.3.3.4. Others ( Hair & Nail Products)

11.3.4. Pharmaceuticals

11.3.5. Others

11.4. Market Attractiveness Analysis By End Use

12. Global Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029, by Sales Channel

12.1. Introduction / Key Findings

12.2. Historical Market Size (US$ Mn) and Volume (Tons) Analysis By Sales Channel, 2014 - 2018

12.3. Current and Future Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast By Sales Channel, 2019 - 2029

12.3.1. B2B

12.3.2. B2C

12.3.2.1. Hyper market

12.3.2.2. Super Market

12.3.2.3. Drug Store & Pharmacies

12.3.2.4. Specialty Supplement Store

12.3.3. Online Channel

12.4. Market Attractiveness Analysis By Sales Channel

13. Global Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029, by Region

13.1. Introduction

13.2. Historical Market Size (US$ Mn) and Volume (Tons) Analysis By Region, 2014 - 2018

13.3. Current Market Size (US$ Mn) and Volume (Tons) Analysis and Forecast By Region, 2019 - 2029

13.3.1. North America

13.3.2. Latin America

13.3.3. Europe

13.3.4. Asia Pacific Excluding Japan (APEJ)

13.3.5. Oceania

13.3.6. Middle East and Africa (MEA)

13.3.7. Japan

13.4. Market Attractiveness Analysis By Region

14. North America Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Mn) and Volume (Tons) Trend Analysis By Market Taxonomy, 2014 - 2018

14.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Market Taxonomy, 2019 - 2029

14.4.1. By Country

14.4.1.1. U.S.

14.4.1.2. Canada

14.4.2. By Source

14.4.3. By Form

14.4.4. By Collagen Type

14.4.5. By End Use

14.4.6. By Sales Channel

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Source

14.5.3. By Form

14.5.4. By Collagen Type

14.5.5. By End Use

14.5.6. By Sales Channel

14.6. Market Trends

14.7. Key Market Participants - Intensity Mapping

14.8. Drivers and Restraints - Impact Analysis

15. Latin America Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume (Tons) Trend Analysis By Market Taxonomy, 2014 - 2018

15.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Market Taxonomy, 2019 - 2029

15.4.1. By Country

15.4.1.1. Brazil

15.4.1.2. Mexico

15.4.1.3. Argentina

15.4.1.4. Rest of Latin America

15.4.2. By Source

15.4.3. By Form

15.4.4. By Collagen Type

15.4.5. By End Use

15.4.6. By Sales Channel

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Source

15.5.3. By Form

15.5.4. By Collagen Type

15.5.5. By End Use

15.5.6. By Sales Channel

15.6. Market Trends

15.7. Key Market Participants - Intensity Mapping

15.8. Drivers and Restraints - Impact Analysis

16. Europe Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume (Tons) Trend Analysis By Market Taxonomy, 2014 - 2018

16.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Market Taxonomy, 2019 - 2029

16.4.1. By Country

16.4.1.1. EU-5

16.4.1.2. Nordic Countries

16.4.1.3. BENELUX

16.4.1.4. Russia

16.4.1.5. Rest of Europe

16.4.2. By Source

16.4.3. By Form

16.4.4. By Collagen Type

16.4.5. By End Use

16.4.6. By Sales Channel

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Source

16.5.3. By Form

16.5.4. By Collagen Type

16.5.5. By End Use

16.5.6. By Sales Channel

16.6. Market Trends

16.7. Key Market Participants - Intensity Mapping

16.8. Drivers and Restraints - Impact Analysis

17. Asia Pacific Excluding Japan (APEJ) Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume (Tons) Trend Analysis By Market Taxonomy, 2014 - 2018

17.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Market Taxonomy, 2019 - 2029

17.4.1. By Country

17.4.1.1. China

17.4.1.2. India

17.4.1.3. South Korea

17.4.1.4. ASSEAN

17.4.2. By Source

17.4.3. By Form

17.4.4. By Collagen Type

17.4.5. By End Use

17.4.6. By Sales Channel

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Source

17.5.3. By Form

17.5.4. By Collagen Type

17.5.5. By End Use

17.5.6. By Sales Channel

17.6. Market Trends

17.7. Key Market Participants - Intensity Mapping

17.8. Drivers and Restraints - Impact Analysis

18. Oceania Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Mn) and Volume (Tons) Trend Analysis By Market Taxonomy, 2014 - 2018

18.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Market Taxonomy, 2019 - 2029

18.4.1. By Country

18.4.1.1. Australia

18.4.1.2. New Zealand

18.4.2. By Source

18.4.3. By Form

18.4.4. By Collagen Type

18.4.5. By End Use

18.4.6. By Sales Channel

18.5. Market Attractiveness Analysis

18.5.1. By Country

18.5.2. By Source

18.5.3. By Form

18.5.4. By Collagen Type

18.5.5. By End Use

18.5.6. By Sales Channel

18.6. Market Trends

18.7. Key Market Participants - Intensity Mapping

18.8. Drivers and Restraints - Impact Analysis

19. Middle East and Africa Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029

19.1. Introduction

19.2. Pricing Analysis

19.3. Historical Market Size (US$ Mn) and Volume (Tons) Trend Analysis By Market Taxonomy, 2014 - 2018

19.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Market Taxonomy, 2019 - 2029

19.4.1. By Country

19.4.1.1. GCC Countries

19.4.1.2. Turkey

19.4.1.3. Israel

19.4.1.4. South Africa

19.4.1.5. Rest of Middle East and Africa

19.4.2. By Product Type

19.4.3. By Source

19.4.4. By Form

19.4.5. By Collagen Type

19.4.6. By End Use

19.4.7. By Sales Channel

19.5. Market Attractiveness Analysis

19.5.1. By Country

19.5.2. By Source

19.5.3. By Form

19.5.4. By Collagen Type

19.5.5. By End Use

19.5.6. By Sales Channel

19.6. Market Trends

19.7. Key Market Participants - Intensity Mapping

19.8. Drivers and Restraints - Impact Analysis

20. Japan Hydrolyzed Collagen Market Analysis 2014-2018 and Forecast 2019-2029

20.1. Introduction

20.2. Pricing Analysis

20.3. Historical Market Size (US$ Mn) and Volume (Tons) Trend Analysis By Market Taxonomy, 2014 - 2018

20.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Market Taxonomy, 2019 - 2029

20.4.1. By Product Type

20.4.2. By Source

20.4.3. By Form

20.4.4. By Collagen Type

20.4.5. By End Use

20.4.6. By Sales Channel

20.5. Market Attractiveness Analysis

20.5.1. By Source

20.5.2. By Form

20.5.3. By Collagen Type

20.5.4. By End Use

20.5.5. By Sales Channel

20.6. Market Trends

20.7. Key Market Participants - Intensity Mapping

20.8. Drivers and Restraints - Impact Analysis

21. Market Structure Analysis

21.1. Market Analysis by Tier of Companies (Hydrolyzed Collagen)

21.2. Market Concentration

21.3. Market Share Analysis of Top Players

21.4. Market Presence Analysis

22. Competition Analysis

22.1. Competition Dashboard

22.2. Pricing Analysis by Competition

22.3. Competition Benchmarking

22.4. Competition Deep Dive

22.4.1. Gelita AG

22.4.1.1. Overview

22.4.1.2. Product Portfolio

22.4.1.3. Profitability by Market Segments (Product/Channel/Region)

22.4.1.4. Sales Footprint

22.4.1.5. Strategy Overview

22.4.1.5.1. Marketing Strategy

22.4.1.5.2. Product Strategy

22.4.1.5.3. Channel Strategy

22.4.2. Rousselot

22.4.2.1.1. Marketing Strategy

22.4.2.1.2. Product Strategy

22.4.2.1.3. Channel Strategy

22.4.3. Nitta Gelatin, Inc.

22.4.3.1.1. Marketing Strategy

22.4.3.1.2. Product Strategy

22.4.3.1.3. Channel Strategy

22.4.4. Hainan Huayan Collagen Biotech Co, Ltd.

22.4.4.1.1. Marketing Strategy

22.4.4.1.2. Product Strategy

22.4.4.1.3. Channel Strategy

22.4.5. Nippi Collagen

22.4.5.1.1. Marketing Strategy

22.4.5.1.2. Product Strategy

22.4.5.1.3. Channel Strategy

22.4.6. NeoCell Corporation

22.4.6.1.1. Marketing Strategy

22.4.6.1.2. Product Strategy

22.4.6.1.3. Channel Strategy

22.4.7. Giant Sports International Inc.

22.4.7.1.1. Marketing Strategy

22.4.7.1.2. Product Strategy

22.4.7.1.3. Channel Strategy

22.4.8. Beijing Semnl Biotechnology Co, Ltd

22.4.8.1.1. Marketing Strategy

22.4.8.1.2. Product Strategy

22.4.8.1.3. Channel Strategy

22.4.9. Codeage

22.4.9.1.1. Marketing Strategy

22.4.9.1.2. Product Strategy

22.4.9.1.3. Channel Strategy

22.4.10. Amicogen, Inc.

22.4.10.1.1. Marketing Strategy

22.4.10.1.2. Product Strategy

22.4.10.1.3. Channel Strategy

22.4.11. BioCell Technology LLC

22.4.11.1.1. Marketing Strategy

22.4.11.1.2. Product Strategy

22.4.11.1.3. Channel Strategy

22.4.12. Weishardt

22.4.12.1.1. Marketing Strategy

22.4.12.1.2. Product Strategy

22.4.12.1.3. Channel Strategy

22.4.13. Antler Farms

22.4.13.1.1. Marketing Strategy

22.4.13.1.2. Product Strategy

22.4.13.1.3. Channel Strategy

22.4.14. Connoils LLC

22.4.14.1.1. Marketing Strategy

22.4.14.1.2. Product Strategy

22.4.14.1.3. Channel Strategy

22.4.15. Perfect Supplements

22.4.15.1.1. Marketing Strategy

22.4.15.1.2. Product Strategy

22.4.15.1.3. Channel Strategy

22.4.16. Other Prominent Players (on Additional Request)

22.4.16.1.1. Marketing Strategy

22.4.16.1.2. Product Strategy

22.4.16.1.3. Channel Strategy

23. Assumptions and Acronyms Used

24. Research Methodology

List of Table

Table 01: Global Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Region, 2019–2029

Table 02: Global Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Region, 2019–2029

Table 03: Global Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 04: Global Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 05: Global Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 06: Global Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 07: Global Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collaen Type, 2019–2029

Table 08: Global Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collaen Type, 2019–2029

Table 09: Global Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 010: Global Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 011: Global Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 012: Global Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel, 2019–2029

Table 13: North America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 14: North America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 15: North America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 16: North America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 17: North America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 18: North America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 19: North America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collagen Type, 2019–2029

Table 20: North America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collagen Type, 2019–2029

Table 21: North America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 22: North America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use,

2019–2029

Table 23: North America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 24: North America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel, 2019–2029

Table 25: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 26: Latin America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 27: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 28: Latin America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 29: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 30: Latin America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 31: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collagen Type, 2019–2029

Table 32: Latin America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collagen Type, 2019–2029

Table 33: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 34: Latin America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use,

2019–2029

Table 35: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 36: Latin America Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel, 2019–2029

Table 37: Europe Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 38: Europe Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 39: Europe Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 40: Europe Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 41: Europe Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 42: Europe Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 43: Europe Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collagen Type, 2019–2029

Table 44: Europe Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collagen Type, 2019–2029

Table 45: Europe Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 46: Europe Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 47: Europe Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 48: Europe Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel, 2019–2029

Table 49: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 50: APEJ Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 51: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 52: APEJ Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 53: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 54: APEJ Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 55: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collagen Type, 2019–2029

Table 56: APEJ Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collagen Type, 2019–2029

Table 57: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 58: APEJ Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 59: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 60: APEJ Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel, 2019–2029

Table 61: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 62: Oceania Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 63: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 64: Oceania Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 65: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 66: Oceania Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 67: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collagen Type, 2019–2029

Table 68: Oceania Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collagen Type, 2019–2029

Table 69: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 70: Oceania Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 71: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 72: Oceania Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel, 2019–2029

Table 73: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 74: Middle East & Africa Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 75: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 76: Middle East & Africa Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 77: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 78: Middle East & Africa Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 79: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collagen Type, 2019–2029

Table 80: Middle East & Africa Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collagen Type,

2019–2029

Table 81: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use,

2019–2029

Table 82: Middle East & Africa Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use,

2019–2029

Table 83: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 84: Middle East & Africa Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel,

2019–2029

Table 85: Japan Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Country, 2019–2029

Table 86: Japan Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Country, 2019–2029

Table 87: Japan Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Source, 2019–2029

Table 88: Japan Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Source, 2019–2029

Table 89: Japan Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Form, 2019–2029

Table 90: Japan Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Form, 2019–2029

Table 91: Japan Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Collagen Type, 2019–2029

Table 92: Japan Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Collagen Type, 2019–2029

Table 93: Japan Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by End Use, 2019–2029

Table 94: Japan Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by End Use, 2019–2029

Table 95: Japan Hydrolyzed Collagen Market Value (US$ Mn) and Forecast by Sales Channel, 2019–2029

Table 96: Japan Hydrolyzed Collagen Market Volume (Metric Tons) and Forecast by Sales Channel, 2019–2029

List of Figure

Figure 01: Global Hydrolyzed Collagen Market Value (US$ Mn) and Volume (MT) Forecast, 2019–2029

Figure 02: Global Hydrolyzed Collagen Market Absolute $ Opportunity (US$ Mn), 2019?2029

Figure 03: Global Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Region, 2019 & 2029

Figure 04: Global Hydrolyzed Collagen Market Y-o-Y Growth Rate by Region, 2019 - 2029

Figure 05: Global Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 06: Global Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 07: Global Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 08: Global Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 09: Global Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type, 2019 & 2029

Figure 10: Global Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 11: Global Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 12: Global Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 13: Global Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 14: Global Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 15: Global Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 16: Global Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 17: Global Hydrolyzed Collagen Market Attractiveness Analysis by Form , 2019 - 2029

Figure 18: Global Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 19: Global Hydrolyzed Collagen Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 20: Global Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029

Figure 21: North America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 22: North America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 23: North America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 24: North America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 25: North America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 26: North America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 27: North America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type, 2019 & 2029

Figure 28: North America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 29: North America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use,

2019 & 2029

Figure 30: North America Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 31: North America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 32: North America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 33: North America Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 34: North America Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 35: North America Hydrolyzed Collagen Market Attractiveness Analysis by Form, 2019 - 2029

Figure 36: North America Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 37: North America Hydrolyzed Collagen Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 38: North America Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029

Figure 39: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 40: Latin America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 41: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 42: Latin America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 43: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 44: Latin America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 45: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type, 2019 & 2029

Figure 46: Latin America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 47: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 48: Latin America Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 49: Latin America Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 50: Latin America Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 51: Latin America Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 52: Latin America Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 53: Latin America Hydrolyzed Collagen Market Attractiveness Analysis by Form, 2019 - 2029

Figure 54: Latin America Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 55: Latin America Hydrolyzed Collagen Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 56: Latin America Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029

Figure 57: Europe Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 58: Europe Hydrolyzed Collagen Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 59: Europe Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 60: Europe Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 61: Europe Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 62: Europe Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 63: Europe Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type, 2019 & 2029

Figure 64: Europe Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 65: Europe Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 66: Europe Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 67: Europe Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 68: Europe Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 69: Europe Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 70: Europe Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 71: Europe Hydrolyzed Collagen Market Attractiveness Analysis by Form, 2019 - 2029

Figure 72: Europe Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 73: Europe Hydrolyzed Collagen Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 74: Europe Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029

Figure 75: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 76: APEJ Hydrolyzed Collagen Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 77: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 78: APEJ Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 79: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 80: APEJ Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 81: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type, 2019 & 2029

Figure 82: APEJ Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 83: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 84: APEJ Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 85: APEJ Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 86: APEJ Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 87: APEJ Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 88: APEJ Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 89: APEJ Hydrolyzed Collagen Market Attractiveness Analysis by Form, 2019 - 2029

Figure 90: APEJ Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 91: APEJ Hydrolyzed Collagen Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 92: APEJ Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029

Figure 93: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 94: Oceania Hydrolyzed Collagen Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 95: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 96: Oceania Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 97: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 98: Oceania Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 99: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type, 2019 & 2029

Figure 100: Oceania Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 101: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 102: Oceania Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 103: Oceania Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 104: Oceania Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 105: Oceania Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 106: Oceania Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 107: Oceania Hydrolyzed Collagen Market Attractiveness Analysis by Form, 2019 - 2029

Figure 108: Oceania Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 109: Oceania Hydrolyzed Collagen Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 110: Oceania Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029

Figure 111: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 112: Middle East & Africa Hydrolyzed Collagen Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 113: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 114: Middle East & Africa Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 115: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 116: Middle East & Africa Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 117: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type,

2019 & 2029

Figure 118: Middle East & Africa Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 119: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use,

2019 & 2029

Figure 120: Middle East & Africa Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 121: Middle East & Africa Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel,

2019 & 2029

Figure 122: Middle East & Africa Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 123: Middle East & Africa Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 124: Middle East & Africa Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 125: Middle East & Africa Hydrolyzed Collagen Market Attractiveness Analysis by Form, 2019 - 2029

Figure 126: Middle East & Africa Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 127: Middle East & Africa Hydrolyzed Collagen Market Attractiveness Analysis by End Use,

2019 - 2029

Figure 128: Middle East & Africa Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029

Figure 129: Japan Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 130: Japan Hydrolyzed Collagen Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 131: Japan Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Source, 2019 & 2029

Figure 132: Japan Hydrolyzed Collagen Market Y-o-Y Growth Rate by Source, 2019 - 2029

Figure 133: Japan Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Form, 2019 & 2029

Figure 134: Japan Hydrolyzed Collagen Market Y-o-Y Growth Rate by Form, 2019 - 2029

Figure 135: Japan Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Collagen Type, 2019 & 2029

Figure 136: Japan Hydrolyzed Collagen Market Y-o-Y Growth Rate by Collagen Type, 2019 - 2029

Figure 137: Japan Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by End Use, 2019 & 2029

Figure 138: Japan Hydrolyzed Collagen Market Y-o-Y Growth Rate by End Use, 2019 - 2029

Figure 139: Japan Hydrolyzed Collagen Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 140: Japan Hydrolyzed Collagen Market Y-o-Y Growth Rate by Sales Channel, 2019 - 2029

Figure 141: Japan Hydrolyzed Collagen Market Attractiveness Analysis by Region, 2019 - 2029

Figure 142: Japan Hydrolyzed Collagen Market Attractiveness Analysis by Source, 2019 - 2029

Figure 143: Japan Hydrolyzed Collagen Market Attractiveness Analysis by Form, 2019 - 2029

Figure 144: Japan Hydrolyzed Collagen Market Attractiveness Analysis by Collagen Type, 2019 - 2029

Figure 145: Japan Hydrolyzed Collagen Market Attractiveness Analysis by End Use, 2019 - 2029

Figure 146: Japan Hydrolyzed Collagen Market Attractiveness Analysis by Sales Channel, 2019 - 2029