Reports

Reports

HVAC and Refrigeration (HVACR) Systems Market: Snapshot

With the increasing count of new hotels, restaurants, cafes across the world, thanks to the swift expansion of the worldwide tourism industry, the global market for HVAC and Refrigeration (HVACR) systems is likely to witness a sturdy rise in its valuation over the forthcoming years. Apart from this, the increasing implementation of norms and rules for the regulation of food safety and quality is also expecting to boost the adoptions of HVACR systems in the near future.

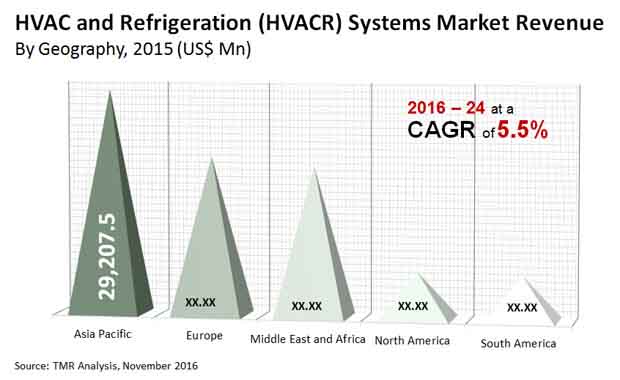

The opportunity in the global HVACR systems market is likely to increase at a CAGR of 5.50% during the period from 2016 to 2020, rising from US$81.1 bn in 2015 to a value of US$130.7 bn by the end of the forecast period. In terms of volume, the market is estimated to expand at a CAGR of 8.0% during the same forecast period, supported by the increasing demand for refrigeration equipment in cold storage and food processing end users, owing to the rising consumption of processed food and beverages.

Evaporators to Remain Leading Product Segment Thanks to Continued Demand

Condensing units, package systems, unit coolers, control devices, evaporators, chillers, cabinet counters, fan coils, display cases, compressor racks, walk-in cooling units, and HVAC air handling units are the main type of products available in the global market for HVACR systems. Among these, the evaporators segment has surfaced as the most valued product. In 2015, the segment accounted for a share of nearly 26% in the overall revenue generated in the global market.

Researchers predict the demand for evaporators to continue to rise, ensuring the dominance of this segment during the forecast period. However, the segment of display cases is likely to exhibit the most prominent growth rate in the coming years, thanks to the technological advancements in display cases, the cost benefits they offer, and their escalating demand in supermarkets across the world.

Asia Pacific to Continue as Leading Regional Market for HVACR Systems

On the basis of geography, the global market for HVACR systems stretches across North America, South America, the Middle East and Africa, Europe, and Asia Pacific. Asia Pacific, of these, has emerged as the key contributor to the demand for HVACR systems on account of the robust tourism industry. The regional market is also projected to continue its leading steak over the forecast period. India, China, Japan, South Korea, and Australia are anticipated lead the market for HVACR systems in Asia Pacific in the years to come.

The global HVACR systems market demonstrates a highly fragmented landscape with only a few companies being able to establish themselves as market leaders. At the forefront of this market are Lennox International Inc., Zero Zone Inc., Epta S.p.A., Hussmann International Inc., Dover Corp., Beverage-Air Corp., GEA Group, Larsen & Toubro, Foster GE, Airtex Compressors, Frank technologies, The Midea Group, Carrier Corp., Haier Electronics Group Co. Ltd., Mitsubishi Corp., and Daikin Industries Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : HVAC and Refrigeration (HVACR) Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

5. Global Outlook: HVAC and Refrigeration (HVACR) Systems Market, By Product Type

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2014 – 2024

5.4.1. Condensing units

5.4.2. Unit coolers

5.4.3. Package systems

5.4.4. Control/monitor Devices

5.4.5. HVAC RTU/AHU

5.4.6. Chillers/Heat Pump

5.4.7. Evaporator

5.4.8. Display Cases

5.4.9. Fan Coil

5.4.10. Compressor Racks

5.4.11. Cabinet/Counter

5.4.12. Walk-in and Cabinet Cooling Unit

6. Global Outlook: HVAC and Refrigeration (HVACR) Systems Market, Refrigerant Market, By Refrigerant Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size (US$ Mn) Forecast, Refrigerant Market By Refrigerant Type, 2014 – 2024

6.4.1. Fluorocarbons

6.4.2. Inorganic

6.4.3. Hydrocarbons/Natural

7. Global Outlook: HVAC and Refrigeration (HVACR) Systems Market, By End-use

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Size and Volume (US$ Mn and Million Units) Forecast By End-use, 2014 – 2024

7.4.1. Food Service

7.4.1.1. Condensing units

7.4.1.1.1. Fractional condensing units (up to 1 hp)

7.4.1.1.2. Unitary hermetic condensing units (Above 1 hp)

7.4.1.1.3. Semi-hermetic condensing units

7.4.1.1.4. Others

7.4.1.2. Unit coolers

7.4.1.3. Control/monitor Devices

7.4.1.4. Evaporator

7.4.1.5. Display Cases

7.4.1.6. Cabinet/Counter

7.4.1.7. Walk-in and Cabinet Cooling Unit

7.4.2. Food Processing

7.4.2.1. Condensing units

7.4.2.2. Unit coolers

7.4.2.3. Package systems

7.4.2.4. Control/monitor Devices

7.4.2.5. HVAC RTU/AHU

7.4.2.6. Chillers/Heat Pump

7.4.2.7. Evaporator

7.4.2.8. Fan Coil

7.4.2.9. Compressor Racks

7.4.3. Supermarket

7.4.3.1. Condensing units

7.4.3.2. Unit coolers

7.4.3.3. Package systems

7.4.3.4. Control/monitor Devices

7.4.3.5. HVAC RTU/AHU

7.4.3.6. Chillers/Heat Pump

7.4.3.7. Evaporator

7.4.3.8. Display Cases

7.4.3.9. Fan Coil

7.4.3.10. Compressor Racks

7.4.4. Cold Storage

7.4.4.1. Condensing units

7.4.4.2. Unit coolers

7.4.4.3. Package systems

7.4.4.4. Control/monitor Devices

7.4.4.5. HVAC RTU/AHU

7.4.4.6. Chillers/Heat Pump

7.4.4.7. Evaporator

7.4.4.8. Fan Coil

7.4.4.9. Compressor Racks

7.4.4.10. Walk-in and Cabinet Cooling Unit

7.4.5. Others

7.4.5.1. Condensing units

7.4.5.2. Unit coolers

7.4.5.3. Package systems

7.4.5.4. Control/monitor Devices

7.4.5.5. HVAC RTU/AHU

7.4.5.6. Chillers/Heat Pump

7.4.5.7. Evaporator

7.4.5.8. Display Cases

7.4.5.9. Fan Coil

7.4.5.10. Compressor Racks

8. North America Outlook: HVAC and Refrigeration (HVACR) Systems Market

8.1. Key Findings

8.2. Key Trends

8.3. Executive Summary

8.4. Metric

8.4.1. GDP

8.4.2. Personal Consumption Expenditure

8.4.3. Disposable Personal Income

8.5. North America Market Outlook: HVAC and Refrigeration (HVACR) Systems Market, By Industry

8.5.1. Industrial Refrigeration

8.5.2. Commercial Refrigeration

8.5.3. Food Processing

8.5.4. Retail

8.5.5. Cold Storage

8.6. Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2014 – 2024

8.6.1. Condensing units

8.6.2. Unit coolers

8.6.3. Package systems

8.6.4. Control/monitor Devices

8.6.5. HVAC RTU/AHU

8.6.6. Chillers/Heat Pump

8.6.7. Evaporator

8.6.8. Display Cases

8.6.9. Fan Coil

8.6.10. Compressor Racks

8.6.11. Cabinet/Counter

8.6.12. Walk-in and Cabinet Cooling Unit

8.7. Market Size (US$ Mn) Forecast, Refrigerant Market By Refrigerant Type, 2014 – 2024

8.7.1. Fluorocarbons

8.7.2. Inorganic

8.7.3. Hydrocarbons/Natural

8.8. Market Size and Volume (US$ Mn and Million Units) Forecast By End-use, 2014 – 2024

8.8.1. Food Service

8.8.1.1. Condensing units

8.8.1.1.1. Fractional condensing units (up to 1 hp)

8.8.1.1.2. Unitary hermetic condensing units (Above 1 hp)

8.8.1.1.3. Semi-hermetic condensing units

8.8.1.1.4. Others

8.8.1.2. Unit coolers

8.8.1.3. Control/monitor Devices

8.8.1.4. Evaporator

8.8.1.5. Display Cases

8.8.1.6. Cabinet/Counter

8.8.1.7. Walk-in and Cabinet Cooling Unit

8.8.2. Food Processing

8.8.2.1. Condensing units

8.8.2.2. Unit coolers

8.8.2.3. Package systems

8.8.2.4. Control/monitor Devices

8.8.2.5. HVAC RTU/AHU

8.8.2.6. Chillers/Heat Pump

8.8.2.7. Evaporator

8.8.2.8. Fan Coil

8.8.2.9. Compressor Racks

8.8.3. Supermarket

8.8.3.1. Condensing units

8.8.3.2. Unit coolers

8.8.3.3. Package systems

8.8.3.4. Control/monitor Devices

8.8.3.5. HVAC RTU/AHU

8.8.3.6. Chillers/Heat Pump

8.8.3.7. Evaporator

8.8.3.8. Fan Coil

8.8.3.9. Compressor Racks

8.8.4. Cold Storage

8.8.4.1. Condensing units

8.8.4.2. Unit coolers

8.8.4.3. Package systems

8.8.4.4. Control/monitor Devices

8.8.4.5. HVAC RTU/AHU

8.8.4.6. Chillers/Heat Pump

8.8.4.7. Evaporator

8.8.4.8. Fan Coil

8.8.4.9. Compressor Racks

8.8.4.10. Walk-in and Cabinet Cooling Unit

8.8.5. Others

8.8.5.1. Condensing units

8.8.5.2. Unit coolers

8.8.5.3. Package systems

8.8.5.4. Control/monitor Devices

8.8.5.5. HVAC RTU/AHU

8.8.5.6. Chillers/Heat Pump

8.8.5.7. Evaporator

8.8.5.8. Display Cases

8.8.5.9. Fan Coil

8.8.5.10. Compressor Racks

8.9. Market Size and Volume (US$ Mn and Million Units) Forecast By Country, 2014 – 2024

8.9.1. The U.S.

8.9.2. Canada

8.9.3. Rest of North America

9. Europe Outlook: HVAC and Refrigeration (HVACR) Systems Market

9.1. Key Findings

9.2. Key Trends

9.3. Executive Summary

9.4. Metric

9.4.1. GDP

9.4.2. Personal Consumption Expenditure

9.4.3. Disposable Personal Income

9.5. Europe Market Outlook: HVAC and Refrigeration (HVACR) Systems Market, By Industry

9.5.1. Industrial Refrigeration

9.5.2. Commercial Refrigeration

9.5.3. Food Processing

9.5.4. Retail

9.5.5. Cold Storage

9.6. Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2014 – 2024

9.6.1. Condensing units

9.6.2. Unit coolers

9.6.3. Package systems

9.6.4. Control/monitor Devices

9.6.5. HVAC RTU/AHU

9.6.6. Chillers/Heat Pump

9.6.7. Evaporator

9.6.8. Display Cases

9.6.9. Fan Coil

9.6.10. Compressor Racks

9.6.11. Cabinet/Counter

9.6.12. Walk-in and Cabinet Cooling Unit

9.7. Market Size (US$ Mn) Forecast, Refrigerant Market By Refrigerant Type, 2014 – 2024

9.7.1. Fluorocarbons

9.7.2. Inorganic

9.7.3. Hydrocarbons/Natural

9.8. Market Size and Volume (US$ Mn and Million Units) Forecast By End-use, 2014 – 2024

9.8.1. Food Service

9.8.1.1. Condensing units

9.8.1.1.1. Fractional condensing units (up to 1 hp)

9.8.1.1.2. Unitary hermetic condensing units (Above 1 hp)

9.8.1.1.3. Semi-hermetic condensing units

9.8.1.1.4. Others

9.8.1.2. Unit coolers

9.8.1.3. Control/monitor Devices

9.8.1.4. Evaporator

9.8.1.5. Display Cases

9.8.1.6. Cabinet/Counter

9.8.1.7. Walk-in and Cabinet Cooling Unit

9.8.2. Food Processing

9.8.2.1. Condensing units

9.8.2.2. Unit coolers

9.8.2.3. Package systems

9.8.2.4. Control/monitor Devices

9.8.2.5. HVAC RTU/AHU

9.8.2.6. Chillers/Heat Pump

9.8.2.7. Evaporator

9.8.2.8. Fan Coil

9.8.2.9. Compressor Racks

9.8.3. Supermarket

9.8.3.1. Condensing units

9.8.3.2. Unit coolers

9.8.3.3. Package systems

9.8.3.4. Control/monitor Devices

9.8.3.5. HVAC RTU/AHU

9.8.3.6. Chillers/Heat Pump

9.8.3.7. Evaporator

9.8.3.8. Fan Coil

9.8.3.9. Compressor Racks

9.8.4. Cold Storage

9.8.4.1. Condensing units

9.8.4.2. Unit coolers

9.8.4.3. Package systems

9.8.4.4. Control/monitor Devices

9.8.4.5. HVAC RTU/AHU

9.8.4.6. Chillers/Heat Pump

9.8.4.7. Evaporator

9.8.4.8. Fan Coil

9.8.4.9. Compressor Racks

9.8.4.10. Walk-in and Cabinet Cooling Unit

9.8.5. Others

9.8.5.1. Condensing units

9.8.5.2. Unit coolers

9.8.5.3. Package systems

9.8.5.4. Control/monitor Devices

9.8.5.5. HVAC RTU/AHU

9.8.5.6. Chillers/Heat Pump

9.8.5.7. Evaporator

9.8.5.8. Display Cases

9.8.5.9. Fan Coil

9.8.5.10. Compressor Racks

9.9. Market Size and Volume (US$ Mn and Million Units) Forecast By Region, 2014 – 2024

9.9.1. France

9.9.2. Spain

9.9.3. Portugal

9.9.4. Italy

9.9.5. Benelux

9.9.6. Germany

9.9.7. U.K.

9.9.8. Nordic countries

9.9.9. Central Europe (excl. Poland)

9.9.10. Poland

9.9.11. Russia

9.9.12. Rest of Europe

10. Asia Pacific Outlook: HVAC and Refrigeration (HVACR) Systems Market

10.1. Key Findings

10.2. Key Trends

10.3. Executive Summary

10.4. Metric

10.4.1. GDP

10.4.2. Personal Consumption Expenditure

10.4.3. Disposable Personal Income

10.5. Asia Pacific Market Outlook: HVAC and Refrigeration (HVACR) Systems Market, By Industry

10.5.1. Industrial Refrigeration

10.5.2. Commercial Refrigeration

10.5.3. Food Processing

10.5.4. Retail

10.5.5. Cold Storage

10.6. Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2014 – 2024

10.6.1. Condensing units

10.6.2. Unit coolers

10.6.3. Package systems

10.6.4. Control/monitor Devices

10.6.5. HVAC RTU/AHU

10.6.6. Chillers/Heat Pump

10.6.7. Evaporator

10.6.8. Display Cases

10.6.9. Fan Coil

10.6.10. Compressor Racks

10.6.11. Cabinet/Counter

10.6.12. Walk-in and Cabinet Cooling Unit

10.7. Market Size (US$ Mn) Forecast, Refrigerant Market By Refrigerant Type, 2014 – 2024

10.7.1. Fluorocarbons

10.7.2. Inorganic

10.7.3. Hydrocarbons/Natural

10.8. Market Size and Volume (US$ Mn and Million Units) Forecast By End-use, 2014 – 2024

10.8.1. Food Service

10.8.1.1. Condensing units

10.8.1.1.1. Fractional condensing units (up to 1 hp)

10.8.1.1.2. Unitary hermetic condensing units (Above 1 hp)

10.8.1.1.3. Semi-hermetic condensing units

10.8.1.1.4. Others

10.8.1.2. Unit coolers

10.8.1.3. Control/monitor Devices

10.8.1.4. Evaporator

10.8.1.5. Display Cases

10.8.1.6. Cabinet/Counter

10.8.1.7. Walk-in and Cabinet Cooling Unit

10.8.2. Food Processing

10.8.2.1. Condensing units

10.8.2.2. Unit coolers

10.8.2.3. Package systems

10.8.2.4. Control/monitor Devices

10.8.2.5. HVAC RTU/AHU

10.8.2.6. Chillers/Heat Pump

10.8.2.7. Evaporator

10.8.2.8. Fan Coil

10.8.2.9. Compressor Racks

10.8.3. Supermarket

10.8.3.1. Condensing units

10.8.3.2. Unit coolers

10.8.3.3. Package systems

10.8.3.4. Control/monitor Devices

10.8.3.5. HVAC RTU/AHU

10.8.3.6. Chillers/Heat Pump

10.8.3.7. Evaporator

10.8.3.8. Display Cases

10.8.3.9. Fan Coil

10.8.3.10. Compressor Racks

10.8.4. Cold Storage

10.8.4.1. Condensing units

10.8.4.2. Unit coolers

10.8.4.3. Package systems

10.8.4.4. Control/monitor Devices

10.8.4.5. HVAC RTU/AHU

10.8.4.6. Chillers/Heat Pump

10.8.4.7. Evaporator

10.8.4.8. Fan Coil

10.8.4.9. Compressor Racks

10.8.4.10. Walk-in and Cabinet Cooling Unit

10.8.5. Others

10.8.5.1. Condensing units

10.8.5.2. Unit coolers

10.8.5.3. Package systems

10.8.5.4. Control/monitor Devices

10.8.5.5. HVAC RTU/AHU

10.8.5.6. Chillers/Heat Pump

10.8.5.7. Evaporator

10.8.5.8. Display Cases

10.8.5.9. Fan Coil

10.8.5.10. Compressor Racks

10.9. Market Size and Volume (US$ Mn and Million Units) Forecast By Region, 2014 – 2024

10.9.1. China

10.9.2. Singapore

10.9.3. Thailand

10.9.4. Hong Kong

10.9.5. Vietnam

10.9.6. Malaysia

10.9.7. Australia

10.9.8. Rest of Asia Pacific

11. Middle East and Africa (MEA) Outlook: HVAC and Refrigeration (HVACR) Systems Market

11.1. Key Findings

11.2. Key Trends

11.3. Executive Summary

11.4. Metric

11.4.1. GDP

11.4.2. Personal Consumption Expenditure

11.4.3. Disposable Personal Income

11.5. Middle East and Africa Market Outlook: HVAC and Refrigeration (HVACR) Systems Market, By Industry

11.5.1. Industrial Refrigeration

11.5.2. Commercial Refrigeration

11.5.3. Food Processing

11.5.4. Retail

11.5.5. Cold Storage

11.6. Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2014 – 2024

11.6.1. Condensing units

11.6.2. Unit coolers

11.6.3. Package systems

11.6.4. Control/monitor Devices

11.6.5. HVAC RTU/AHU

11.6.6. Chillers/Heat Pump

11.6.7. Evaporator

11.6.8. Display Cases

11.6.9. Fan Coil

11.6.10. Compressor Racks

11.6.11. Cabinet/Counter

11.6.12. Walk-in and Cabinet Cooling Unit

11.7. Market Size (US$ Mn) Forecast, Refrigerant Market By Refrigerant Type, 2014 – 2024

11.7.1. Fluorocarbons

11.7.2. Inorganic

11.7.3. Hydrocarbons/Natural

11.8. Market Size and Volume (US$ Mn and Million Units) Forecast By End-use, 2014 – 2024

11.8.1. Food Service

11.8.1.1. Condensing units

11.8.1.1.1. Fractional condensing units (up to 1 hp)

11.8.1.1.2. Unitary hermetic condensing units (Above 1 hp)

11.8.1.1.3. Semi-hermetic condensing units

11.8.1.1.4. Others

11.8.1.2. Unit coolers

11.8.1.3. Control/monitor Devices

11.8.1.4. Evaporator

11.8.1.5. Display Cases

11.8.1.6. Cabinet/Counter

11.8.1.7. Walk-in and Cabinet Cooling Unit

11.8.2. Food Processing

11.8.2.1. Condensing units

11.8.2.2. Unit coolers

11.8.2.3. Package systems

11.8.2.4. Control/monitor Devices

11.8.2.5. HVAC RTU/AHU

11.8.2.6. Chillers/Heat Pump

11.8.2.7. Evaporator

11.8.2.8. Fan Coil

11.8.2.9. Compressor Racks

11.8.3. Supermarket

11.8.3.1. Condensing units

11.8.3.2. Unit coolers

11.8.3.3. Package systems

11.8.3.4. Control/monitor Devices

11.8.3.5. HVAC RTU/AHU

11.8.3.6. Chillers/Heat Pump

11.8.3.7. Evaporator

11.8.3.8. Display Cases

11.8.3.9. Fan Coil

11.8.3.10. Compressor Racks

11.8.4. Cold Storage

11.8.4.1. Condensing units

11.8.4.2. Unit coolers

11.8.4.3. Package systems

11.8.4.4. Control/monitor Devices

11.8.4.5. HVAC RTU/AHU

11.8.4.6. Chillers/Heat Pump

11.8.4.7. Evaporator

11.8.4.8. Fan Coil

11.8.4.9. Compressor Racks

11.8.4.10. Walk-in and Cabinet Cooling Unit

11.8.5. Others

11.8.5.1. Condensing units

11.8.5.2. Unit coolers

11.8.5.3. Package systems

11.8.5.4. Control/monitor Devices

11.8.5.5. HVAC RTU/AHU

11.8.5.6. Chillers/Heat Pump

11.8.5.7. Evaporator

11.8.5.8. Display Cases

11.8.5.9. Fan Coil

11.8.5.10. Compressor Racks

11.9. Market Size and Volume (US$ Mn and Million Units) Forecast By Region, 2014 – 2024

11.9.1. UAE

11.9.2. Saudi Arabia

11.9.3. South Africa

11.9.4. Rest of MEA

12. South America Outlook: HVAC and Refrigeration (HVACR) Systems Market

12.1. Key Findings

12.2. Key Trends

12.3. Executive Summary

12.4. Metric

12.4.1. GDP

12.4.2. Personal Consumption Expenditure

12.4.3. Disposable Personal Income

12.5. South America Market Outlook: HVAC and Refrigeration (HVACR) Systems Market, By Industry

12.5.1. Industrial Refrigeration

12.5.2. Commercial Refrigeration

12.5.3. Food Processing

12.5.4. Retail

12.5.5. Cold Storage

12.6. Market Size and Volume (US$ Mn and Million Units) Forecast By Product Type, 2014 – 2024

12.6.1. Condensing units

12.6.2. Unit coolers

12.6.3. Package systems

12.6.4. Control/monitor Devices

12.6.5. HVAC RTU/AHU

12.6.6. Chillers/Heat Pump

12.6.7. Evaporator

12.6.8. Display Cases

12.6.9. Fan Coil

12.6.10. Compressor Racks

12.6.11. Cabinet/Counter

12.6.12. Walk-in and Cabinet Cooling Unit

12.7. Market Size (US$ Mn) Forecast, Refrigerant Market By Refrigerant Type, 2014 – 2024

12.7.1. Fluorocarbons

12.7.2. Inorganic

12.7.3. Hydrocarbons/Natural

12.8. Market Size and Volume (US$ Mn and Million Units) Forecast By End-use, 2014 – 2024

12.8.1. Food Service

12.8.1.1. Condensing units

12.8.1.1.1. Fractional condensing units (up to 1 hp)

12.8.1.1.2. Unitary hermetic condensing units (Above 1 hp)

12.8.1.1.3. Semi-hermetic condensing units

12.8.1.1.4. Others

12.8.1.2. Unit coolers

12.8.1.3. Control/monitor Devices

12.8.1.4. Evaporator

12.8.1.5. Display Cases

12.8.1.6. Cabinet/Counter

12.8.1.7. Walk-in and Cabinet Cooling Unit

12.8.2. Food Processing

12.8.2.1. Condensing units

12.8.2.2. Unit coolers

12.8.2.3. Package systems

12.8.2.4. Control/monitor Devices

12.8.2.5. HVAC RTU/AHU

12.8.2.6. Chillers/Heat Pump

12.8.2.7. Evaporator

12.8.2.8. Fan Coil

12.8.2.9. Compressor Racks

12.8.3. Supermarket

12.8.3.1. Condensing units

12.8.3.2. Unit coolers

12.8.3.3. Package systems

12.8.3.4. Control/monitor Devices

12.8.3.5. HVAC RTU/AHU

12.8.3.6. Chillers/Heat Pump

12.8.3.7. Evaporator

12.8.3.8. Display Cases

12.8.3.9. Fan Coil

12.8.3.10. Compressor Racks

12.8.4. Cold Storage

12.8.4.1. Condensing units

12.8.4.2. Unit coolers

12.8.4.3. Package systems

12.8.4.4. Control/monitor Devices

12.8.4.5. HVAC RTU/AHU

12.8.4.6. Chillers/Heat Pump

12.8.4.7. Evaporator

12.8.4.8. Fan Coil

12.8.4.9. Compressor Racks

12.8.4.10. Walk-in and Cabinet Cooling Unit

12.8.5. Others

12.8.5.1. Condensing units

12.8.5.2. Unit coolers

12.8.5.3. Package systems

12.8.5.4. Control/monitor Devices

12.8.5.5. HVAC RTU/AHU

12.8.5.6. Chillers/Heat Pump

12.8.5.7. Evaporator

12.8.5.8. Display Cases

12.8.5.9. Fan Coil

12.8.5.10. Compressor Racks

12.9. Market Size and Volume (US$ Mn and Million Units) Forecast By Region, 2014 – 2024

12.9.1. Brazil

12.9.2. Columbia

12.9.3. Argentina

12.9.4. Chile

12.9.5. Venezuela

12.9.6. Peru

12.9.7. Rest of South America

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

13.2.1. Daikin Industries Ltd.

13.2.1.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.1.2. Market Presence, By Segment and Geography

13.2.1.3. Revenue and Operating Profits

13.2.1.4. Strategy and Historical Roadmap

13.2.1.5. SWOT Analysis

13.2.2. Mitsubishi Corporation

13.2.2.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.2.2. Market Presence, By Segment and Geography

13.2.2.3. Revenue and Operating Profits

13.2.2.4. Strategy and Historical Roadmap

13.2.2.5. SWOT Analysis

13.2.3. Haier Electronics Group Co., Ltd.

13.2.3.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.3.2. Market Presence, By Segment and Geography

13.2.3.3. Revenue and Operating Profits

13.2.3.4. Strategy and Historical Roadmap

13.2.3.5. SWOT Analysis

13.2.4. Carrier Corporation

13.2.4.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.4.2. Market Presence, By Segment and Geography

13.2.4.3. Revenue and Operating Profits

13.2.4.4. Strategy and Historical Roadmap

13.2.4.5. SWOT Analysis

13.2.5. The Midea Group

13.2.5.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.5.2. Market Presence, By Segment and Geography

13.2.5.3. Revenue and Operating Profits

13.2.5.4. Strategy and Historical Roadmap

13.2.5.5. SWOT Analysis

13.2.6. Frank technologies

13.2.6.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.6.2. Market Presence, By Segment and Geography

13.2.6.3. Revenue and Operating Profits

13.2.6.4. Strategy and Historical Roadmap

13.2.6.5. SWOT Analysis

13.2.7. Airtex Compressors

13.2.7.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.7.2. Market Presence, By Segment and Geography

13.2.7.3. Revenue and Operating Profits

13.2.7.4. Strategy and Historical Roadmap

13.2.7.5. SWOT Analysis

13.2.8. Foster GE

13.2.8.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.8.2. Market Presence, By Segment and Geography

13.2.8.3. Revenue and Operating Profits

13.2.8.4. Strategy and Historical Roadmap

13.2.8.5. SWOT Analysis

13.2.9. Larsen & Toubro

13.2.9.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.9.2. Market Presence, By Segment and Geography

13.2.9.3. Revenue and Operating Profits

13.2.9.4. Strategy and Historical Roadmap

13.2.9.5. SWOT Analysis

13.2.10. GEA Group

13.2.10.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.10.2. Market Presence, By Segment and Geography

13.2.10.3. Revenue and Operating Profits

13.2.10.4. Strategy and Historical Roadmap

13.2.10.5. SWOT Analysis

13.2.11. Beverage-Air Corporation

13.2.11.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.11.2. Market Presence, By Segment and Geography

13.2.11.3. Revenue and Operating Profits

13.2.11.4. Strategy and Historical Roadmap

13.2.11.5. SWOT Analysis

13.2.12. Dover Corporation

13.2.12.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.12.2. Market Presence, By Segment and Geography

13.2.12.3. Revenue and Operating Profits

13.2.12.4. Strategy and Historical Roadmap

13.2.12.5. SWOT Analysis

13.2.13. Hussmann International, Inc.

13.2.13.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.13.2. Market Presence, By Segment and Geography

13.2.13.3. Revenue and Operating Profits

13.2.13.4. Strategy and Historical Roadmap

13.2.13.5. SWOT Analysis

13.2.14. Epta S.p.A.

13.2.14.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.14.2. Market Presence, By Segment and Geography

13.2.14.3. Revenue and Operating Profits

13.2.14.4. Strategy and Historical Roadmap

13.2.14.5. SWOT Analysis

13.2.15. Zero Zone Inc.

13.2.15.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.15.2. Market Presence, By Segment and Geography

13.2.15.3. Revenue and Operating Profits

13.2.15.4. Strategy and Historical Roadmap

13.2.15.5. SWOT Analysis

13.2.16. Lennox International, Inc.

13.2.16.1. Company Details (HQ, Foundation Year, Employee Strength)

13.2.16.2. Market P

List of Tables

Table 01: Global Market Size (US$ Mn) Forecast by Product Type , 2014 - 2024

Table 02: Global Market Volume (Thousand Units) Forecast by Product Type , 2014 - 2024

Table 03: Global Market Size (US$ Mn) Forecast by Refrigerant Type, 2014 - 2024

Table 04: Global Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 05: Global Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 06: Global Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 07: Global Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 08: Global Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 09: Global Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 10: Global Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 11: Global Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 12: Global Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 13: Global Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 14: Global GDP Outlook: HVAC and Refrigeration (HVACR) Systems Market (US$ Bn)

Table 15: Global Consumer Spending Outlook: HVAC and Refrigeration (HVACR) Systems Market

Table 16: Global Disposable Personal Income Outlook: HVAC and Refrigeration (HVACR) Systems Market

Table 17: Global Consumer Price Index Outlook: HVAC and Refrigeration (HVACR) Systems Market

Table 18: Global Producer Price Index Outlook: HVAC and Refrigeration (HVACR) Systems Market

Table 19: North America Market Size (US$ Mn) Forecast by Product Type , 2014 - 2024

Table 20: North America Market Volume (Thousand Units) Forecast by Product Type , 2014 - 2024

Table 21: North America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 22: North America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 23: North America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 24: North America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 25: North America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 26: North America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 27: North America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 28: North America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 29: North America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 30: North America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 31: North America Market Size (US$ Mn) Forecast by Refrigerant Type, 2014 - 2024

Table 32: North America Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 33: North America Market Volume (Thousand Units) Forecast by Country, 2014 - 2024

Table 34: Europe Market Size (US$ Mn) Forecast by Product Type , 2014 - 2024

Table 35: Europe Market Volume (Thousand Units) Forecast by Product Type , 2014 - 2024

Table 36: Europe Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 37: Europe Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 38: Europe Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 39: Europe Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 40: Europe Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 41: Europe Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 42: Europe Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 43: Europe Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 44: Europe Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 45: Europe Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 46: Europe Market Size (US$ Mn) Forecast by Refrigerant Type, 2014 - 2024

Table 47: Europe Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 48: Europe Market Volume (Thousand Units) Forecast by Country, 2014 - 2024

Table 49: Asia Pacific Market Size (US$ Mn) Forecast by Product Type , 2014 - 2024

Table 50: Asia Pacific Market Volume (Thousand Units) Forecast by Product Type , 2014 - 2024

Table 51: Asia Pacific Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 52: Asia Pacific Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 53: Asia Pacific Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 54: Asia Pacific Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 55: Asia Pacific Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 56: Asia Pacific Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 57: Asia Pacific Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 58: Asia Pacific Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 59: Asia Pacific Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 60: Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 61: Asia Pacific Market Size (US$ Mn) Forecast by Refrigerant Type, 2014 - 2024

Table 62: Asia Pacific Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 63: Asia Pacific Market Volume (Thousand Units) Forecast by Country, 2014 - 2024

Table 64: MEA Market Size (US$ Mn) Forecast by Product Type , 2014 - 2024

Table 65: MEA Market Volume (Thousand Units) Forecast by Product Type , 2014 - 2024

Table 66: MEA Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 67: MEA Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 68: MEA Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 69: MEA Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 70: MEA Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 71: MEA Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 72: MEA Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 73: MEA Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 74: MEA Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 75: MEA Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 76: MEA Market Size (US$ Mn) Forecast by Refrigerant Type, 2014 - 2024

Table 77: MEA Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 78: MEA Market Volume (Thousand Units) Forecast by Country, 2014 - 2024

Table 79: South America Market Size (US$ Mn) Forecast by Product Type , 2014 - 2024

Table 80: South America Market Volume (Thousand Units) Forecast by Product Type , 2014 - 2024

Table 81: South America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 82: South America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 83: South America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 84: South America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 85: South America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 86: South America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 87: South America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 88: South America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 89: South America Market Size (US$ Mn) Forecast by End-use, 2014 - 2024

Table 90: South America Market Volume (Thousand Units) Forecast by End-use, 2014 - 2024

Table 91: South America Market Size (US$ Mn) Forecast by Refrigerant Type, 2014 - 2024

Table 92: South America Market Size (US$ Mn) Forecast by Country, 2014 - 2024

Table 93: South America Market Volume (Thousand Units) Forecast by Country, 2014 – 2024

List of Figures

Figure 01: Global Condensing Unit Graph

Figure 02: Global Unit Coolers Graph

Figure 03: Global Package systems Graph

Figure 04: Global Control Devices Graph

Figure 05: Global HVAC AHU Graph

Figure 06: Global Chillers Graph

Figure 06: Global Evaporator Graph

Figure 07: Global Display Cases Graph

Figure 08: Global Fan Coil Graph

Figure 09: Global Compressor Racks Graph

Figure 10: Global Cabinet/Counter Graph

Figure 11: Global Walk-in Cooling Unit Graph

Figure 12: Global Market Share (%) by Refrigerant Type, 2015 and 2024

Figure 13: Global Fluorocarbons Graph

Figure 14: Global Inorganic Graph

Figure 15: Global Hydrocarbons Graph

Figure 16: Global Market Share (%) by End-use, 2015 and 2024

Figure 17: Global Food Service Graph

Figure 18: Global Food Processing Graph

Figure 19: Global Supermarket Graph

Figure 20: Global Cold Storage Graph

Figure 21: Global Others Graph

Figure 22: North America Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 23: North America Market Volume (Thousand Units) Forecast, 2014 – 2024

Figure 24: North America Condensing Unit Graph

Figure 25: North America Unit Coolers Graph

Figure 26: North America Package systems Graph

Figure 27: North America Control Devices Graph

Figure 28: North America HVAC AHU Graph

Figure 29: North America Chillers Graph

Figure 30: North America Evaporator Graph

Figure 31: North America Display Cases Graph

Figure 32: North America Fan Coil Graph

Figure 33: North America Compressor Racks Graph

Figure 34: North America Cabinet/Counter Graph

Figure 35: North America Walk-in Cooling Unit Graph

Figure 36: North America Market Share (%) by End-use, 2015 and 2024

Figure 37: North America Food Service Graph

Figure 38: North America Food Processing Graph

Figure 39: North America Supermarket Graph

Figure 40: North America Cold Storage Graph

Figure 41: North America Others Graph

Figure 42: North America Market Share (%) by Refrigerant Type, 2015 and 2024

Figure 43: North America Fluorocarbons Graph

Figure 44: North America Inorganic Graph

Figure 45: North America Hydrocarbons Graph

Figure 46: Europe Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 47: Europe Market Volume (Thousand Units) Forecast, 2014 – 2024

Figure 48: Europe Condensing Unit Graph

Figure 49: Europe Unit Coolers Graph

Figure 50: Europe Package systems Graph

Figure 51: Europe Control Devices Graph

Figure 52: Europe HVAC AHU Graph

Figure 53: Europe Chillers Graph

Figure 54: Europe Evaporator Graph

Figure 55: Europe Display Cases Graph

Figure 56: Europe Fan Coil Graph

Figure 57: Europe Compressor Racks Graph

Figure 58: Europe Cabinet/Counter Graph

Figure 59: Europe Walk-in Cooling Unit Graph

Figure 60: Europe Market Share (%) by End-use, 2015 and 2024

Figure 61: Europe Food Service Graph

Figure 62: Europe Food Processing Graph

Figure 63: Europe Supermarket Graph

Figure 64: Europe Cold Storage Graph

Figure 65: Europe Others Graph

Figure 66: Europe Market Share (%) by Refrigerant Type, 2014 and 2024

Figure 67: Europe Fluorocarbons Graph

Figure 68: Europe Inorganic Graph

Figure 69: Europe Hydrocarbons Graph

Figure 70: Asia Pacific Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 71: Asia Pacific Market Volume (Thousand Units) Forecast, 2014 – 2024

Figure 72: Asia Pacific Condensing Unit Graph

Figure 73: Asia Pacific Unit Coolers Graph

Figure 74: Asia Pacific Package systems Graph

Figure 75: Asia Pacific Control Devices Graph

Figure 76: Asia Pacific HVAC AHU Graph

Figure 77: Asia Pacific Chillers Graph

Figure 78: Asia Pacific Evaporator Graph

Figure 79: Asia Pacific Display Cases Graph

Figure 80: Asia Pacific Fan Coil Graph

Figure 81: Asia Pacific Compressor Racks Graph

Figure 82: Asia Pacific Cabinet/Counter Graph

Figure 83: Asia Pacific Walk-in Cooling Unit Graph

Figure 84: Asia Pacific Market Share (%) by End-use, 2015 and 2024

Figure 85: Asia Pacific Food Service Graph

Figure 86: Asia Pacific Food Processing Graph

Figure 87: Asia Pacific Supermarket Graph

Figure 88: Asia Pacific Cold Storage Graph

Figure 89: Asia Pacific Others Graph

Figure 90: Asia Pacific Market Share (%) by Refrigerant Type, 2015 and 2024

Figure 91: Asia Pacific Fluorocarbons Graph

Figure 92: Asia Pacific Inorganic Graph

Figure 93: Asia Pacific Hydrocarbons Graph

Figure 94: Middle East and Africa (MEA) Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 95: Middle East and Africa (MEA) Market Volume (Thousand Units) Forecast, 2014 – 2024

Figure 96: Middle East and Africa (MEA) Condensing Unit Graph

Figure 97: Middle East and Africa (MEA) Unit Coolers Graph

Figure 98: Middle East and Africa (MEA) Package systems Graph

Figure 99: Middle East and Africa (MEA) Control Devices Graph

Figure 100: Middle East and Africa (MEA ) HVAC AHU Graph

Figure 101: Middle East and Africa (MEA) Chillers Graph

Figure 102: Middle East and Africa (MEA) Evaporator Graph

Figure 103: Middle East and Africa (MEA) Display Cases Graph

Figure 104: Middle East and Africa (MEA) Fan Coil Graph

Figure 105: Middle East and Africa (MEA) Compressor Racks Graph

Figure 106: Middle East and Africa (MEA) Cabinet/Counter Graph

Figure 107: Middle East and Africa (MEA) Walk-in Cooling Unit Graph

Figure 108: Middle East and Africa (MEA) Market Share (%) by End-use, 2015 and 2024

Figure 109: Middle East and Africa (MEA) Food Service Graph

Figure 110: Middle East and Africa (MEA) Food Processing Graph

Figure 111: Middle East and Africa (MEA) Supermarket Graph

Figure 112: Middle East and Africa (MEA) Cold Storage Graph

Figure 113: Middle East and Africa (MEA) Others Graph

Figure 114: Middle East and Africa (MEA) Market Share (%) by Refrigerant Type, 2015 and 2024

Figure 115: Middle East and Africa (MEA) Fluorocarbons Graph

Figure 116: Middle East and Africa (MEA) Inorganic Graph

Figure 117: Middle East and Africa (MEA) Hydrocarbons Graph

Figure 118: South America Market Size (US$ Mn) Forecast, 2014 – 2024

Figure 119: South America Market Volume (Thousand Units) Forecast, 2014 – 2024

Figure 120: South America Condensing Unit Graph

Figure 121: South America Unit Coolers Graph

Figure 122: South America Package systems Graph

Figure 123: South America Control Devices Graph

Figure 124: South America HVAC AHU Graph

Figure 125: South America Chillers Graph

Figure 126: South America Evaporator Graph

Figure 127: South America Display Cases Graph

Figure 128: South America Fan Coil Graph

Figure 129: South America Compressor Racks Graph

Figure 130: South America Cabinet/Counter Graph

Figure 131: South America Walk-in Cooling Unit Graph

Figure 132: South America Market Share (%) by End-use, 2015 and 2024

Figure 133: South America Food Service Graph

Figure 134: South America Food Processing Graph

Figure 135: South America Supermarket Graph

Figure 136: South America Cold Storage Graph

Figure 137: South America Others Graph

Figure 138: South America Market Share (%) by Refrigerant Type, 2015 and 2024

Figure 139: South America Fluorocarbons Graph

Figure 140: South America Inorganic Graph

Figure 141: South America Hydrocarbons Graph