Reports

Reports

High-purity Alumina (HPA) for Lithium-ion Batteries Market Description

High-purity aluminum oxide is often termed as High-purity alumina. It is a white, granular, chemical produced commercially either by treating aluminum with specific chemicals or by the use of other aluminous feed stock. Some of the commonly used processes for high-purity alumina production include alkoxide process, thermal decomposition process, choline hydrolysis process, and modified Bayer process. 4N, 5N, and 6N grades of high-purity alumina are extensively used for lithium-ion batteries.

High-purity alumina is used as a coating on lithium-ion battery separators. Lithium-ion batteries with high-purity alumina coated separator are extensively used in mobile electronic devices such as smartphones, laptops, smart wearable devices, media players, and smart speakers. Lithium-ion batteries are a preferred source of power for mobile devices due to their compact size and high stability. Increasing requirement for these batteries in developing economies is anticipated to drive demand for high-purity alumina for lithium-ion batteries in the near future.

Rising Demand for High-purity Alumina in Lithium-ion Batteries Separator Coatings to Fuel Market

Leading Players Focusing on Geographical Expansion

4N Segment to Dominate High-purity Alumina Market for Lithium-ion Batteries

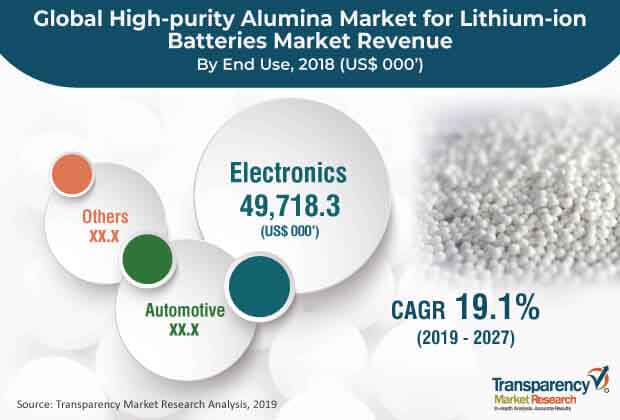

Demand for High-purity Alumina for Lithium-ion Batteries to Increase in Automotive End-use

Emerging Economies Dominate High-purity Alumina Market for Lithium-ion Batteries

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Research Highlights

1.4. Key Research Objectives

2. Assumptions and Research Methodology

3. Executive Summary: Global High-purity Alumina Market for Lithium-ion Batteries

4. Market Overview

4.1. Introduction

4.2. Product Definition

4.3. Key Developments

4.4. Market Indicators

4.5. Market Dynamics

4.5.1. Drivers

4.5.2. Restraints

4.5.3. Opportunities

4.6. Regulatory Scenario

4.7. Porter’s Five Forces Analysis

4.8. Value Chain Analysis

4.9. List of Potential Customers

5. Global High-purity Alumina Market for Lithium-ion Batteries, Production Output Analysis, 2018

6. Global High-purity Alumina Market for Lithium-ion Batteries Price Trend Analysis, 2018

7. Global High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast, by Grade

7.1. Introduction & Definition

7.2. Key Findings

7.3. Global High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

7.3.1. 4N

7.3.2. 5N

7.3.3. 6N

7.4. Global High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Grade

8. Global High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast, by End-use

8.1. Introduction & Definitions

8.2. Key Findings

8.3. Global High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

8.3.1. Electronics

8.3.1.1. Laptops/Tablets

8.3.1.2. Mobile Phones

8.3.1.3. UPS

8.3.1.4. Others

8.3.2. Automotive

8.3.2.1. Electric Vehicle

8.3.2.2. Plug-in Hybrid Electric Vehicles

8.3.3. Others

8.4. Global High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by End-use

9. Global High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast, by Region, 2018–2027

9.1. Global High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn) Forecast, by Region, 2018–2027

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Latin America

9.1.5. Middle East & Africa

10. North America High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast

10.1. Key Findings

10.2. North America High-purity Alumina Market for Lithium-ion Batteries Overview

10.3. North America High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by Grade

10.4. North America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

10.4.1. 4N

10.4.2. 5N

10.4.3. 6N

10.5. North America High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Grade

10.6. North America High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by End-use

10.7. North America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

10.7.1. Electronics

10.7.1.1. Laptops/Tablets

10.7.1.2. Mobile Phones

10.7.1.3. UPS

10.7.1.4. Others

10.7.2. Automotive

10.7.2.1. Electric Vehicle

10.7.2.2. Plug-in Hybrid Electric Vehicles

10.7.3. Others

10.8. North America High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by End-use

10.9. North America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Country, 2018–2027

10.9.1. U.S.

10.9.2. Canada

10.10. U.S. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

10.10.1. 4N

10.10.2. 5N

10.10.3. 6N

10.11. U.S. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

10.11.1. Electronics

10.11.1.1. Laptops/Tablets

10.11.1.2. Mobile Phones

10.11.1.3. UPS

10.11.1.4. Others

10.11.2. Automotive

10.11.2.1. Electric Vehicle

10.11.2.2. Plug-in Hybrid Electric Vehicles

10.11.3. Others

10.12. Canada High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

10.12.1. 4N

10.12.2. 5N

10.12.3. 6N

10.13. Canada High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

10.13.1. Electronics

10.13.1.1. Laptops/Tablets

10.13.1.2. Mobile Phones

10.13.1.3. UPS

10.13.1.4. Others

10.13.2. Automotive

10.13.2.1. Electric Vehicle

10.13.2.2. Plug-in Hybrid Electric Vehicles

10.13.3. Others

11. Europe High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast

11.1. Key Findings

11.2. Europe High-purity Alumina Market for Lithium-ion Batteries Overview

11.3. Europe High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by Grade

11.4. Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

11.4.1. 4N

11.4.2. 5N

11.4.3. 6N

11.5. Europe High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Grade

11.6. Europe High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by End-use

11.7. Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

11.7.1. Electronics

11.7.1.1. Laptops/Tablets

11.7.1.2. Mobile Phones

11.7.1.3. UPS

11.7.1.4. Others

11.7.2. Automotive

11.7.2.1. Electric Vehicle

11.7.2.2. Plug-in Hybrid Electric Vehicles

11.7.3. Others

11.8. Europe High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by End-uses

11.9. Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Country and Sub-region, 2018–2027

11.9.1. Germany

11.9.2. U.K.

11.9.3. France

11.9.4. Italy

11.9.5. Spain

11.9.6. Poland

11.9.7. Rest of Europe

11.10. Germany High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

11.10.1. 4N

11.10.2. 5N

11.10.3. 6N

11.11. Germany High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

11.11.1. Electronics

11.11.1.1. Laptops/Tablets

11.11.1.2. Mobile Phones

11.11.1.3. UPS

11.11.1.4. Others

11.11.2. Automotive

11.11.2.1. Electric Vehicle

11.11.2.2. Plug-in Hybrid Electric Vehicles

11.11.3. Others

11.12. U.K. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

11.12.1. 4N

11.12.2. 5N

11.12.3. 6N

11.13. U.K. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

11.13.1. Electronics

11.13.1.1. Laptops/Tablets

11.13.1.2. Mobile Phones

11.13.1.3. UPS

11.13.1.4. Others

11.13.2. Automotive

11.13.2.1. Electric Vehicle

11.13.2.2. Plug-in Hybrid Electric Vehicles

11.13.3. Others

11.14. France High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

11.14.1. 4N

11.14.2. 5N

11.14.3. 6N

11.15. France High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

11.15.1. Electronics

11.15.1.1. Laptops/Tablets

11.15.1.2. Mobile Phones

11.15.1.3. UPS

11.15.1.4. Others

11.15.2. Automotive

11.15.2.1. Electric Vehicle

11.15.2.2. Plug-in Hybrid Electric Vehicles

11.15.3. Others

11.16. Russia & CIS High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

11.16.1. 4N

11.16.2. 5N

11.16.3. 6N

11.17. Russia & CIS High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

11.17.1. Electronics

11.17.1.1. Laptops/Tablets

11.17.1.2. Mobile Phones

11.17.1.3. UPS

11.17.1.4. Others

11.17.2. Automotive

11.17.2.1. Electric Vehicle

11.17.2.2. Plug-in Hybrid Electric Vehicles

11.17.3. Others

11.18. Rest of Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

11.18.1. 4N

11.18.2. 5N

11.18.3. 6N

11.19. Rest of Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

11.19.1. Electronics

11.19.1.1. Laptops/Tablets

11.19.1.2. Mobile Phones

11.19.1.3. UPS

11.19.1.4. Others

11.19.2. Automotive

11.19.2.1. Electric Vehicle

11.19.2.2. Plug-in Hybrid Electric Vehicles

11.19.3. Others

12. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast

12.1. Key Findings

12.2. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Overview

12.3. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by Grade

12.4. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

12.4.1. 4N

12.4.2. 5N

12.4.3. 6N

12.5. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Grade

12.6. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by End-use

12.7. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

12.7.1. Electronics

12.7.1.1. Laptops/Tablets

12.7.1.2. Mobile Phones

12.7.1.3. UPS

12.7.1.4. Others

12.7.2. Automotive

12.7.2.1. Electric Vehicle

12.7.2.2. Plug-in Hybrid Electric Vehicles

12.7.3. Others

12.8. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by End-use

12.9. Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Country and Sub-region, 2018–2027

12.9.1. China

12.9.2. Japan

12.9.3. India

12.9.4. ASEAN

12.9.5. Rest of Asia Pacific

12.10. China High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

12.10.1. 4N

12.10.2. 5N

12.10.3. 6N

12.11. China High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

12.11.1. Electronics

12.11.1.1. Laptops/Tablets

12.11.1.2. Mobile Phones

12.11.1.3. UPS

12.11.1.4. Others

12.11.2. Automotive

12.11.2.1. Electric Vehicle

12.11.2.2. Plug-in Hybrid Electric Vehicles

12.11.3. Others

12.12. Japan High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

12.12.1. 4N

12.12.2. 5N

12.12.3. 6N

12.13. Japan High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

12.13.1. Electronics

12.13.1.1. Laptops/Tablets

12.13.1.2. Mobile Phones

12.13.1.3. UPS

12.13.1.4. Others

12.13.2. Automotive

12.13.2.1. Electric Vehicle

12.13.2.2. Plug-in Hybrid Electric Vehicles

12.13.3. Others

12.14. India High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

12.14.1. 4N

12.14.2. 5N

12.14.3. 6N

12.15. India High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

12.15.1. Electronics

12.15.1.1. Laptops/Tablets

12.15.1.2. Mobile Phones

12.15.1.3. UPS

12.15.1.4. Others

12.15.2. Automotive

12.15.2.1. Electric Vehicle

12.15.2.2. Plug-in Hybrid Electric Vehicles

12.15.3. Others

12.16. ASEAN High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

12.16.1. 4N

12.16.2. 5N

12.16.3. 6N

12.17. ASEAN High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

12.17.1. Electronics

12.17.1.1. Laptops/Tablets

12.17.1.2. Mobile Phones

12.17.1.3. UPS

12.17.1.4. Others

12.17.2. Automotive

12.17.2.1. Electric Vehicle

12.17.2.2. Plug-in Hybrid Electric Vehicles

12.17.3. Others

12.18. South Korea High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

12.18.1. 4N

12.18.2. 5N

12.18.3. 6N

12.19. South Korea High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

12.19.1. Electronics

12.19.1.1. Laptops/Tablets

12.19.1.2. Mobile Phones

12.19.1.3. UPS

12.19.1.4. Others

12.19.2. Automotive

12.19.2.1. Electric Vehicle

12.19.2.2. Plug-in Hybrid Electric Vehicles

12.19.3. Others

12.20. Rest of Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

12.20.1. 4N

12.20.2. 5N

12.20.3. 6N

12.21. Rest of Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

12.21.1. Electronics

12.21.1.1. Laptops/Tablets

12.21.1.2. Mobile Phones

12.21.1.3. UPS

12.21.1.4. Others

12.21.2. Automotive

12.21.2.1. Electric Vehicle

12.21.2.2. Plug-in Hybrid Electric Vehicles

12.21.3. Others

13. Latin America High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast

13.1. Key Findings

13.2. Latin America High-purity Alumina Market for Lithium-ion Batteries Overview

13.3. Latin America High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by Grade

13.4. Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

13.4.1. 4N

13.4.2. 5N

13.4.3. 6N

13.5. Latin America High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Grade

13.6. Latin America High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by End-use

13.7. Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

13.7.1. Electronics

13.7.1.1. Laptops/Tablets

13.7.1.2. Mobile Phones

13.7.1.3. UPS

13.7.1.4. Others

13.7.2. Automotive

13.7.2.1. Electric Vehicle

13.7.2.2. Plug-in Hybrid Electric Vehicles

13.7.3. Others

13.8. Latin America High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by End-use

13.9. Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Country and Sub-region, 2018–2027

13.9.1. Brazil

13.9.2. Mexico

13.9.3. Rest of Latin America

13.10. Brazil High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

13.10.1. 4N

13.10.2. 5N

13.10.3. 6N

13.11. Brazil High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

13.11.1. Electronics

13.11.1.1. Laptops/Tablets

13.11.1.2. Mobile Phones

13.11.1.3. UPS

13.11.1.4. Others

13.11.2. Automotive

13.11.2.1. Electric Vehicle

13.11.2.2. Plug-in Hybrid Electric Vehicles

13.11.3. Others

13.12. Mexico High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

13.12.1. 4N

13.12.2. 5N

13.12.3. 6N

13.13. Mexico High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

13.13.1. Electronics

13.13.1.1. Laptops/Tablets

13.13.1.2. Mobile Phones

13.13.1.3. UPS

13.13.1.4. Others

13.13.2. Automotive

13.13.2.1. Electric Vehicle

13.13.2.2. Plug-in Hybrid Electric Vehicles

13.13.3. Others

13.14. Rest of Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

13.14.1. 4N

13.14.2. 5N

13.14.3. 6N

13.15. Rest of Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

13.15.1. Electronics

13.15.1.1. Laptops/Tablets

13.15.1.2. Mobile Phones

13.15.1.3. UPS

13.15.1.4. Others

13.15.2. Automotive

13.15.2.1. Electric Vehicle

13.15.2.2. Plug-in Hybrid Electric Vehicles

13.15.3. Others

14. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Analysis and Forecast

14.1. Key Findings

14.2. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Overview

14.3. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by Grade

14.4. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

14.4.1. 4N

14.4.2. 5N

14.4.3. 6N

14.5. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Grade

14.6. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Value Share Analysis and Forecast, by End-use

14.7. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

14.7.1. Electronics

14.7.1.1. Laptops/Tablets

14.7.1.2. Mobile Phones

14.7.1.3. UPS

14.7.1.4. Others

14.7.2. Automotive

14.7.2.1. Electric Vehicle

14.7.2.2. Plug-in Hybrid Electric Vehicles

14.7.3. Others

14.8. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by End-use

14.9. Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Country and Sub-region, 2018–2027

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. GCC High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

14.10.1. 4N

14.10.2. 5N

14.10.3. 6N

14.11. GCC High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

14.11.1. Electronics

14.11.1.1. Laptops/Tablets

14.11.1.2. Mobile Phones

14.11.1.3. UPS

14.11.1.4. Others

14.11.2. Automotive

14.11.2.1. Electric Vehicle

14.11.2.2. Plug-in Hybrid Electric Vehicles

14.11.3. Others

14.12. South Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

14.12.1. 4N

14.12.2. 5N

14.12.3. 6N

14.13. South Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

14.13.1. Electronics

14.13.1.1. Laptops/Tablets

14.13.1.2. Mobile Phones

14.13.1.3. UPS

14.13.1.4. Others

14.13.2. Automotive

14.13.2.1. Electric Vehicle

14.13.2.2. Plug-in Hybrid Electric Vehicles

14.13.3. Others

14.14. Rest of Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by Grade, 2018–2027

14.14.1. 4N

14.14.2. 5N

14.14.3. 6N

14.15. Rest of Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Mn), by End-use, 2018–2027

14.15.1. Electronics

14.15.1.1. Laptops/Tablets

14.15.1.2. Mobile Phones

14.15.1.3. UPS

14.15.1.4. Others

14.15.2. Automotive

14.15.2.1. Electric Vehicle

14.15.2.2. Plug-in Hybrid Electric Vehicles

14.15.3. Others

15. Competition Landscape

15.1. Competition Matrix

15.2. Company Profiles

15.2.1. Sumitomo Chemical Co., Ltd.

15.2.1.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.1.2. Product Segments

15.2.1.3. Products

15.2.1.4. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

15.2.1.5. Strategic Overview

15.2.2. Sasol Ltd.

15.2.2.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.2.2. Business Segments

15.2.2.3. Product Segment

15.2.2.4. End-uses

15.2.3. Nippon Light Metal Co. Ltd.

15.2.3.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.3.2. Business Segments

15.2.3.3. Product Segment

15.2.3.4. End-uses

15.2.3.5. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

15.2.3.6. Strategic Overview

15.2.4. Baikowski SAS

15.2.4.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.4.2. Product Line

15.2.4.3. Application

15.2.5. Altech Chemicals Ltd.

15.2.5.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.5.2. Business Segments

15.2.5.3. Products

15.2.6. Polar Sapphire Ltd.

15.2.6.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.6.2. Business Segments

15.2.6.3. Products

15.2.7. Orbite Technologies Inc.

15.2.7.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.7.2. Business Segments

15.2.7.3. Products

15.2.8. Hebei Heng Bo new material Polytron Technologies Inc.

15.2.8.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.8.2. Business Segments

15.2.8.3. Products

15.2.9. Xuan Cheng Jing Rui New Material Co., Ltd.

15.2.9.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.9.2. Business Segment

15.2.9.3. Products

15.2.10. Zibo Honghe Chemical Co. Ltd.

15.2.10.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.10.2. Business Segment

15.2.10.3. Products

15.2.11. HMR Co. Ltd.

15.2.11.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.11.2. Business Segment

15.2.11.3. Products

15.2.12. Oxide India Pvt Ltd.

15.2.12.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

15.2.12.2. Business Segment

15.2.12.3. Products

16. Primary Insights

List of Tables

Table 01: List of Potential Customers for High-purity Alumina

Table 02: List of Potential Customers for High-purity Alumina

Table 03: Production of High-purity Alumina at Regional Level (Kilograms), 2018

Table 04: Average Price Range of High-purity Alumina, by Grade, US$/Kg, 2018–2027

Table 05: Average Price Range of High-purity Alumina, by End-use, US$/Kg, 2018–2027

Table 06: Average Price Comparison of High-purity Alumina, by Grade and Region, US$/Kg, 2018

Table 07: Global High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2029

Table 08: Global High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 09: Global High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 10: Global High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Region, 2018–2027

Table 11: North America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2027

Table 12: North America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 13: North America High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 14: North America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Country, 2018–2027

Table 15: U.S. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2027

Table 16: U.S. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 17: U.S. High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 18: Canada High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2027

Table 19: Canada High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 20: Canada High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 21: Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 22: Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 23: Europe High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 24: Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by Country and Sub-region, 2018–2027

Table 25: Europe High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 26: Germany High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 27: Germany High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 28: Germany High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 29: France High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 30: France High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 31: France High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 32: U.K. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 33: U.K. High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 34: U.K. High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 35: Russia & CIS High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 36: Russia & CIS High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 37: Russia & CIS High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 38: Rest of Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 39: Rest of Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 40: Rest of Europe High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 41: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 42: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 43: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 44: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by Country and Sub-region, 2018–2027

Table 45: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 46: China High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 47: China High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 48: China High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 49: Japan High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 50: Japan High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 51: Japan High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 52: India High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 53: India High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 54: India High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 55: ASEAN High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 56: ASEAN High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 57: ASEAN High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 58: South Korea High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 59: South Korea High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 60: South Korea High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 61: Rest of Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 62: Rest of Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 63: Rest of Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 64: Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 65: Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 66: Latin America High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 67: Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 68: Brazil High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 69: Brazil High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 70: Brazil High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 71: Mexico High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 72: Mexico High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 73: Mexico High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 74: Rest of Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, by Grade, 2018–2027

Table 75: Rest of Latin America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 76: Rest of Latin America High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousand) Forecast, by End-use, 2018–2027

Table 77: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2027

Table 78: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 79: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 80: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Country and Sub-region, 2018–2027

Table 81: GCC High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2027

Table 82: GCC High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 83: GCC High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 84: South Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2027

Table 85: South Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 86: South Africa High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 87: Rest of Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, by Grade, 2018–2027

Table 88: Rest of Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) Forecast, by End-use, 2018–2027

Table 89: Rest of Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) Forecast, by End-use, 2018–2027

Table 90: Production of High-purity Alumina (Kilograms), by Company, 2016–2017

List of Figures

Figure 01: Global High-purity Alumina Market Volume (Kilograms) and Value (US$ Thousands) Analysis, 2018–2027

Figure 02: Global High-purity Alumina Market Size and Volume,

Figure 03: Production of High-purity Alumina at Regional Level (Kilograms), 2018

Figure 04: Average Price Comparison of High-purity Alumina, by Grade by Region, US$/Kg, 2018

Figure 05: Global High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Grade, 2018 and 2027

Figure 06: Global High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) and Volume (Kilograms) Analysis for 4N, 2018–2029

Figure 07: Global High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) and Volume (Kilograms) Analysis for 5N, 2018–2029

Figure 08: Global High-purity Alumina Market for Lithium-ion Batteries Revenue (US$ Thousand) and Volume (Kilograms) Analysis for 6N, 2018–2029

Figure 09: Global High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Grade

Figure 10: Global High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by End-use, 2018 and 2027

Figure 11: Global High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) and Volume (Kilograms) Analysis, by Electronics, 2018–2027

Figure 12: Global High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) and Volume (Kilograms) Analysis, by Automotive, 2018–2027

Figure 13: Global High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) and Volume (Kilograms) Analysis, by Others, 2018–2027

Figure 14: Global High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by End-use

Figure 15: Global High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Region, 2018 and 2027

Figure 16: Global High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Region

Figure 17: North America High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousands) Forecast, 2018–2027

Figure 18: North America High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Country

Figure 19: North America High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Grade, 2018 and 2027

Figure 20: North America High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by End-use, 2018 and 2027

Figure 21: North America High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Country, 2018 and 2027

Figure 22: North America High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by Grade, 2018

Figure 23: North America High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by End-use, 2018

Figure 24: Europe High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, 2018–2027

Figure 25: Europe High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by Country and Sub-region

Figure 26: Europe High-purity Alumina Market for Lithium-ion Batteries Volume Share, by Grade, 2018 and 2027

Figure 27: Europe High-purity Alumina Market for Lithium-ion Batteries Volume Share, by End-use, 2018 and 2027

Figure 28: Europe High-purity Alumina Market for Lithium-ion Batteries Volume Share, by Country and Sub-region, 2018 and 2027

Figure 29: Europe High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by Grade, 2018

Figure 30: Europe High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by End-use, 2018

Figure 31: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) and Forecast, 2018–2027

Figure 32: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Country and Sub-region

Figure 33: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Grade, 2018 and 2027

Figure 34: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by End-use, 2018 and 2027

Figure 35: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 36: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by Grade, 2018

Figure 37: Asia Pacific High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by End-use, 2018

Figure 38: Latin America High-purity Alumina Market for Lithium-ion Batteries Value (US$ Thousands) and Volume (Kilograms) Forecast, 2018–2027

Figure 39: Latin America High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Country and Sub-region 2018

Figure 40: Latin America High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Grade, 2018 and 2027

Figure 41: Latin America High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by End-use, 2018 and 2027

Figure 42: Latin America High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 43: Rest of Latin America High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by Grade, 2018

Figure 44: Rest of Latin America High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by End-use, 2018

Figure 45: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume (Kilograms) and Value (US$ Thousand) Forecast, 2018–2027

Figure 46: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Attractiveness Analysis, by Country and Sub-region 2018

Figure 47: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Grade, 2018 and 2027

Figure 48: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by End-use, 2018 and 2027

Figure 49: Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Volume Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 50: Rest of Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by Grade, 2018

Figure 51: Rest of Middle East & Africa High-purity Alumina Market for Lithium-ion Batteries Attractiveness, by End-use, 2018

Figure 52: High-purity Alumina Market for Lithium-ion Batteries Share Analysis, by Company, 2018