Reports

Reports

Heavy industry components, such as lines, pipes, silos, turbines, and cranes and automotive components, such as bunkers, are prone to abrasion and corrosion. The interruption caused by the breakdown of a single component leads to major expenditures to plant owners. In order to prevent such incidents in the workplace, the installation of wear protection systems for heavy duty machinery is vital. The global heavy duty wear protection systems market is expected to expand at a CAGR of 4.3% from 2015 to 2023 owing to expenditures incurred by plant owners for replacement, efficiency improvements, and environmental legislations.

With rapid industrialization and urbanization around the globe, a notable rise in the growth of heavy industries such as oil and gas, iron and steel, and construction and mining has been witnessed over the past few years. Due to rising industrialization, wide-scale deployment of machinery and automotive parts is recorded, which in turn has created a beneficial prospect for the growth of the heavy duty wear protection systems market. The early-life failure of wear components, causing loss of production time, has further pushed end-users to install the latest wear protection systems for machinery. Increasing end-use market applications of the wear protection systems and further innovation in terms of design are also opportunities to supplement the growth rate. However, the growing market for wear-proof components and fluctuating heavy industry project costs are hampering the growth of the heavy duty wear protection systems market.

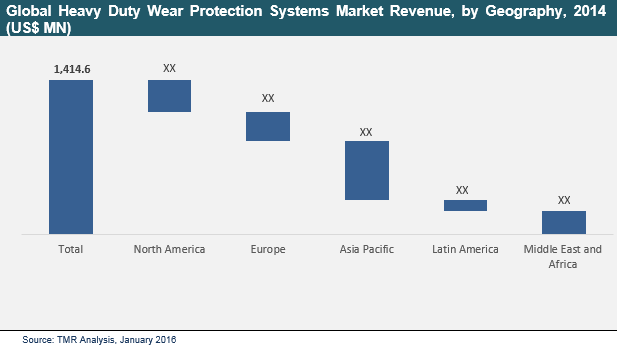

The heavy duty wear protection systems market is segmented on the basis of material type, end-use industry, and geography. Segments on the basis of material type are ceramic, rubber, steel, and plastic. Rubber wear protection systems can be further segmented on the basis of product type into lining systems and coating systems, of which the coating systems segment is expected to grow the fastest. Reported end-use industries deploying wear protection systems encompass transportation and automotive, oil and gas, iron and steel, mining, power plants, wood, pulp and paper, construction, and others such as planer mills, agriculture and farming, F&B and marine. The oil and gas industry, along with the construction and mining industries, are expected to grow the fastest in terms of their deployment of wear protection systems. The heavy duty wear protection systems market has been studied for five geographies: North America, Europe, Asia Pacific, Latin America and, Middle East and Africa.

The Asia Pacific region recorded the highest implementation of heavy duty wear protection systems over the past few decades and is expected to dominate the wear protection systems market with the highest CAGR over the forecast period. This growth rate is anticipated due to the large-scale installations of heavy industries across major economies such as China, Japan, India, Indonesia, and Australia.

The heavy duty wear protection systems market is fragmented in nature, with many global and local companies present. The key strategies undertaken by most internationally acclaimed players were mergers and acquisitions in order to dominate the global wear protection systems market. Furthermore, several SMEs operating exclusively in the wear protection domain have adopted joint venture strategies and long-term service agreements in order to strengthen their market position.

Key players in the heavy duty wear protection systems market include Sandvik Construction (Sandvik Group), Metso Corporation, CeramTec GmbH, FLSmidth & Co. A/S, Kalenborn International GmbH & Co. KG, Bradken Limited, ThyssenKrupp Industrial Solutions AG, Sulzer ltd, and Thejo Engineering Limited.

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global Heavy Duty Wear Protection Systems Market Snapshot

2.2. Market Dynamics

2.3. Global Heavy Duty Wear Protection Systems Market Revenue Analysis, 2013 – 2023 (US$ Mn) and Year-on-Year Growth (%)

3. Global Heavy Duty Wear Protection Systems Market Analysis, 2013 – 2023 (US$ Mn)

3.1. Overview

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. Key Trends Analysis

3.4. Global Heavy Duty Wear Protection Systems Market Analysis, By Material type, 2013 – 2023 (US$ Mn)

3.4.1. Overview

3.4.2. Ceramic

3.4.3. Rubber

3.4.3.1. Lining System

3.4.3.2. Coating System

3.4.4. Steel

3.4.5. Plastic

3.5. Global Heavy Duty Wear Protection Systems Market Analysis, By End-use Industry, 2013 – 2023 (US$ Mn)

3.5.1. Overview

3.5.2. Transportation & Automotive

3.5.3. Oil and Gas

3.5.4. Iron and steel

3.5.5. Mining

3.5.6. Power Plants

3.5.7. Wood, Pulp and Paper

3.5.8. Construction

3.5.9. Others (Planer mills, Agriculture & farming, F&B, Marine)

3.6. Competitive Landscape

3.6.1. Market Positioning of Key Players, 2014

3.6.2. Competitive Strategies Adopted by Leading Players

4. North America Heavy Duty Wear Protection Systems Market Analysis, 2013 – 2023 (US$ Mn)

4.1. Overview

4.2. North America Heavy Duty Wear Protection Systems Market Analysis, By Material type, 2013 – 2023 (US$ Mn)

4.2.1. Overview

4.2.2. Ceramic

4.2.3. Rubber

4.2.3.1. Lining System

4.2.3.2. Coating System

4.2.4. Steel

4.2.5. Plastic

4.3. North America Heavy Duty Wear Protection Systems Market Analysis, By End-users, 2013 – 2023 (US$ Mn)

4.3.1. Overview

4.3.2. Transportation & Automotive

4.3.3. Oil and Gas

4.3.4. Iron and steel

4.3.5. Mining

4.3.6. Power Plants

4.3.7. Wood, Pulp and Paper

4.3.8. Construction

4.3.9. Others (Planer mills, Agriculture & farming, F&B, Marine)

4.4. North America Heavy Duty Wear Protection Systems Market Analysis, By Country, 2013 – 2023 (US$ Mn)

4.4.1. Overview

4.4.2. U.S.

4.4.3. Rest of North America

5. Europe Heavy Duty Wear Protection Systems Market Analysis, 2013 – 2023 (US$ Mn)

5.1. Overview

5.2. Europe Heavy Duty Wear Protection Systems Market Analysis, By Material type, 2013 – 2023 (US$ Mn)

5.2.1. Overview

5.2.2. Ceramic

5.2.3. Rubber

5.2.3.1. Lining System

5.2.3.2. Coating System

5.2.4. Steel

5.2.5. Plastic

5.3. Europe Heavy Duty Wear Protection Systems Market Analysis, By End-users, 2013 – 2023 (US$ Mn)

5.3.1. Overview

5.3.2. Transportation & Automotive

5.3.3. Oil and Gas

5.3.4. Iron and steel

5.3.5. Mining

5.3.6. Power Plants

5.3.7. Wood, Pulp and Paper

5.3.8. Construction

5.3.9. Others (Planer mills, Agriculture & farming, F&B, Marine)

5.4. Europe Heavy Duty Wear Protection Systems Market Analysis, By Country, 2013 – 2023 (US$ Mn)

5.4.1. Overview

5.4.2. EU7 (UK, Italy, Spain, France, Germany, Belgium, and Netherlands)

5.4.3. CIS

5.4.4. Rest of Europe

6. Asia Pacific Heavy Duty Wear Protection Systems Market Analysis, 2013 – 2023 (US$ Mn)

6.1. Overview

6.2. Asia Pacific Heavy Duty Wear Protection Systems Market Analysis, By Material type, 2013 – 2023 (US$ Mn)

6.2.1. Overview

6.2.2. Ceramic

6.2.3. Rubber

6.2.3.1. Lining System

6.2.3.2. Coating System

6.2.4. Steel

6.2.5. Plastic

6.3. Asia Pacific Heavy Duty Wear Protection Systems Market Analysis, By End-users, 2013 – 2023 (US$ Mn)

6.3.1. Overview

6.3.2. Transportation & Automotive

6.3.3. Oil and Gas

6.3.4. Iron and steel

6.3.5. Mining

6.3.6. Power Plants

6.3.7. Wood, Pulp and Paper

6.3.8. Construction

6.3.9. Others (Planer mills, Agriculture & farming, F&B, Marine)

6.4. Asia Pacific Heavy Duty Wear Protection Systems Market Analysis, By Country, 2013 – 2023 (US$ Mn)

6.4.1. Overview

6.4.2. Japan

6.4.3. China

6.4.4. South East Asia

6.4.5. Rest of APAC

7. Middle-East & Africa (MEA) Heavy Duty Wear Protection Systems Market Analysis, 2013 – 2023 (US$ Mn)

7.1. Overview

7.2. MEA Heavy Duty Wear Protection Systems Market Analysis, By Material type, 2013 – 2023 (US$ Mn)

7.2.1. Overview

7.2.2. Ceramic

7.2.3. Rubber

7.2.3.1. Lining System

7.2.3.2. Coating System

7.2.4. Steel

7.2.5. Plastic

7.3. MEA Heavy Duty Wear Protection Systems Market Analysis, By End-users, 2013 – 2023 (US$ Mn)

7.3.1. Overview

7.3.2. Transportation & Automotive

7.3.3. Oil and Gas

7.3.4. Iron and steel

7.3.5. Mining

7.3.6. Power Plants

7.3.7. Wood, Pulp and Paper

7.3.8. Construction

7.3.9. Others (Planer mills, Agriculture & farming, F&B, Marine)

7.4. MEA Heavy Duty Wear Protection Systems Market Analysis, By Country, 2013 – 2023 (US$ Mn)

7.4.1. Overview

7.4.2. GCC Countries

7.4.3. North Africa

7.4.4. Southern Africa

7.4.5. Rest of MEA

8. Latin America Heavy Duty Wear Protection Systems Market Analysis, 2013 – 2023 (US$ Mn)

8.1. Overview

8.2. Latin America Heavy Duty Wear Protection Systems Market Analysis, By Material type, 2013 – 2023 (US$ Mn)

8.2.1. Overview

8.2.2. Ceramic

8.2.3. Rubber

8.2.3.1. Lining System

8.2.3.2. Coating System

8.2.4. Steel

8.2.5. Plastic

8.3. Latin America Heavy Duty Wear Protection Systems Market Analysis, By End-users, 2013 – 2023 (US$ Mn)

8.3.1. Overview

8.3.2. Transportation & Automotive

8.3.3. Oil and Gas

8.3.4. Iron and steel

8.3.5. Mining

8.3.6. Power Plants

8.3.7. Wood, Pulp and Paper

8.3.8. Construction

8.3.9. Others (Planer mills, Agriculture & farming, F&B, Marine)

8.4. Latin America Heavy Duty Wear Protection Systems Market Analysis, By Country, 2013 – 2023 (US$ Mn)

8.4.1. Overview

8.4.2. Brazil

8.4.3. Rest of Latin America

9. Company Profiles

9.1. Sandvik Construction

9.2. Blair Rubber Company

9.3. Polycorp Ltd.

9.4. West American Rubber Company, LLC

9.5. Metso Oyj

9.6. The Trelleborg Group

9.7. ContiTech AG

9.8. FLSmidth & Co. A/S

9.9. The Weir Group PLC

9.10. CERATIZIT S.A

9.11. REMA TIP TOP AG

9.12. Raptor Mining Products Inc.

9.13. Densit (ITW Engineered Polymers)

9.14. germanBelt GmbH

9.15. Kingfisher Industrial

9.16. Kalenborn International GmbH & Co. KG

9.17. WPE Wear Protection Engineering GmbH

9.18. TEGA Industries LTD

9.19. Bradken Limited

9.20. Fuller Industrial

9.21. Industrial Lining Inc

9.22. Xervon GmbH

9.23. Outotec Oyj

9.24. ThyssenKrupp Industrial Solutions AG

9.25. Fluor Corporation

9.26. SNC-Lavalin Group

9.27. Nilos GmbH & Co. KG

9.28. Plant Maintenance Service Corporation

9.29. Quant AB

9.30. Sulzer Ltd.

9.31. Bilfinger SE

9.32. Thejo Engineering Limited

9.33. CeramTec GmbH