Reports

Reports

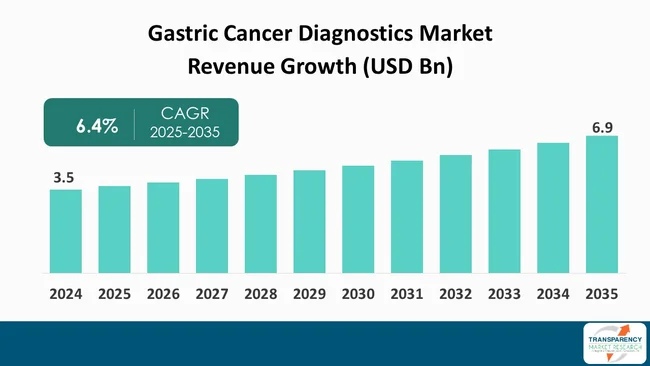

The global gastric cancer diagnostics market size was valued at US$ 3.5 billion in 2024 and is projected to reach US$ 6.9 billion by 2035, expanding at a CAGR of 6.4% from 2025 to 2035. The market growth is driven by the rising incidence of gastric cancer, increasing risk factors like H. pylori infections, obesity, and smoking, and advancements in diagnostic technology.

The increasing expenditure on healthcare and improved public healthcare policy support for early detection and screening are significant drivers bolstering the gastric cancer diagnostics market. Increased funding of public and private payers into preventive oncology has increased the accessibility of diagnostic tests.

National screening programs and campaigns have driven endoscopic and non-invasive screening tests to greater use, so that diagnostics are a central part of routine care pathways. Increased risk-sharing mechanisms and facilitative reimbursement models reduce out-of-pocket expenditure further, allowing for deeper market penetration in urban and semi-urban geographies and inducing sustained diagnostic consumption and commercialization.

A second salient driver is greater capital inflow and harmonized partnership throughout the healthcare value system, which propels market development more rapidly. Further venture capital investment, private equity investment, and public–private partnership provides commercial scale-up and distribution networks, especially in the underserved regions. In particular, payers and health systems are increasingly integrating diagnostics into value-based care models to enable earlier testing and improve long-term outcomes at lower cost.

The recent trends have shifted their focus toward minimally invasive, patient-centric diagnostic pathways, and simplification of service delivery. Practitioners have started to use more blood-based assays and multiplex biomarker panels for their investigation.

Additionally, decentralized testing and improved sample logistics have been implemented to shorten turnaround time. The commercial priorities circle around generating real-world evidence and conducting health-economic analyses to show the usefulness of the clinic and to help with reimbursement negotiations. Collaborative pilots between healthcare systems, together with the diagnostics developers and regulatory authorities, are promoting clinical integration and the acceptance among both clinicians and payers.

Gastric cancer refers to the abnormalities wherein cancer cells grow in stomach lining. The leading risk factors for gastric cancer are excessive body weight, consumption of a diet mainly consisting of processed foods, and genetic predispositions. There are multiple methods for diagnosis, which are used to verify and stage the condition. Typical testing methods involve endoscopy with biopsy to examine stomach tissue, imaging tests like CT Scans and PET Scans to determine whether the tumor has spread, and blood tests for tumor markers.

The gastric cancer diagnostics begins with clinical assessment and non-invasive tests. These tests involve blood sampling to establish certain tumor markers, stool examinations, and imaging tests to determine visualization of stomach abnormalities. These screening tests help identify suspicious lesions that further require investigation.

Usually, confirmation of disease is achieved through endoscopy and biopsy, where a sample of the stomach lining is collected and it undergoes histological examination to detect cancer cells. Besides, molecular and genetic tests may be used to ascertain gene mutations and biomarkers helpful in therapy, e.g., HER2 or PD-L1 expression.

The development of molecular diagnostics and precision oncology has significantly improved the early detection of gastric cancer. The adoption of liquid biopsies, genomic profiling, and AI-powered diagnostic tools has led to the customization of screening strategies that provide not only diagnostic accuracy but also patient management.

| Attribute | Detail |

|---|---|

| Gastric Cancer Diagnostics Market Drivers |

|

The increasing prevalence of gastric cancer is a significant driver fostering the gastric cancer diagnostics market. Increased prevalence rates generate increased demand for screening programs and diagnostic technologies for the detection of the disease at earlier stages, thus improving survival rates. Health systems are increasingly emphasizing on early intervention, thereby encouraging the utilization of a wide array of diagnostic modalities, including imaging, endoscopy, histopathology, and molecular testing, in an attempt to provide timely and accurate disease management.

With increased number of individuals affected, clinics, and hospitals are expanding their diagnostic capabilities to treat the growing patient pool. This has led to more investment in diagnostic equipment, like high-resolution endoscopes, and laboratory equipment. Increased capacity of diagnostics allows clinicians to treat more effectively and efficiently, reducing the diagnostic delay and facilitating population-level screening programs with consistent demand for diagnostic service.

The rising incidence of gastric cancer also prompts healthcare policy makers and insurers to include gastric cancer diagnostics as part of their preventive care programs. The reimbursement policies and national screening guidelines that are issued are progressively favoring regular testing, especially for the high-risk groups, thus giving more ground for the use of diagnostic tests. Early diagnosis lowers treatment costs in the long run, thereby motivating healthcare systems to allocate funds in the right and easily scalable diagnostic tools, which guarantee better patient outcomes.

Moreover, patient knowledge that comes as a result of the rising disease prevalence is also positively impacting the market. Various awareness campaigns and educational activities are encouraging individuals to get tested, thus, increasing the demand for diagnostic solutions. The clinical need, policy support, and patient-driven demand, are the main forces that are pushing forward the gastric cancer diagnostics market, thus, opening up opportunities for further innovation and growth.

The innovation in diagnostic technologies are another significant factor that greatly contributes to the gastric cancer diagnostics market growth. The imaging techniques that aid in the innovative diagnostic procedures such as high-resolution endoscopy, narrow-band imaging, and endoscopic ultrasound have indeed revolutionized the doctors’ ability to visualize tumors and the other abnormal growths in stomach lining. Besides, such instruments will not only eliminate errors in diagnosis but will also facilitate the discovery of early-stage diseases, which is very important in ensuring better patient outcomes.

The introduction of genetics and molecular diagnostics like PCR, NGS, and immunohistochemistry have essentially changed the way gastric cancer is diagnosed. These kinds of tests provide accurate information about tumor biology and are sensitive in identifying the presence of biomarkers like HER2, and PD-L1. As a result, the development of personalized treatment regimens and the employment of targeted therapy become feasible.

Integration of artificial intelligence (AI) and machine learning into diagnostic workflows is a major factor that is contributing to the market expansion. AI-enabled image processing, predictive modeling, and pattern recognition have empowered the medical professionals to find the very minute abnormalities that can easily escape a manual check. These solution providers not only boost the diagnostic effectiveness, but also help to shorten the overall time of turnaround, thus reducing the total number of errors, which in turn enhances the value of these diagnostic tools.

Moreover, point-of-care testing as well as minimally invasive diagnostic methods, are widening the reach of gastric cancer diagnostics. Mobile endoscopic devices, liquid biopsies, and rapid biomarker assays are enabling testing to be done in remote areas, rendering convenience and facilitating intervention at an earlier disease stage. Collectively, these technological advancements create a customer base that is strong, promote market penetration, and decisively accelerate the gastric cancer diagnostics market.

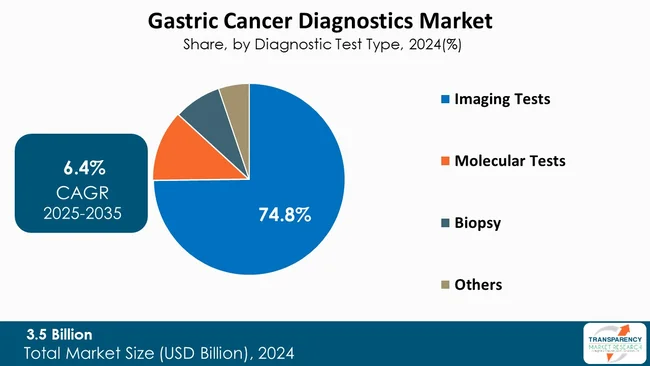

Imaging tests are leading the gastric cancer diagnostics market as they are an essential part of early detection, localization of tumor, and staging accuracy. Some of the techniques like computed tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET) allow a detailed visualization of gastric lesions, which makes it possible for doctors to measure the size, extension, and treatment response of the tumor.

Their features such as being non-invasive, having high diagnostic precision, and ability to guide the surgical or therapeutic planning add more to their clinical utility. The continuous innovations in imaging technologies, which comprise AI-based interpretation and enhanced resolution systems have raised diagnostic reliability and thus imaging tests have become the preferred choice across all healthcare facilities, worldwide.=

| Attribute | Detail |

|---|---|

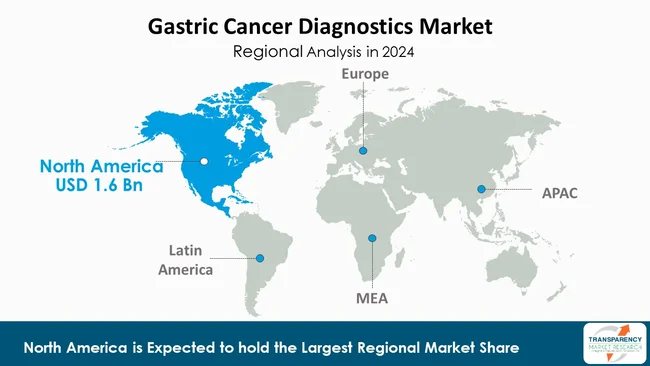

| Leading Region | North America |

As per the latest gastric cancer diagnostics market analysis, North America dominated in 2024, capturing a market share of 45.7%. This is attributed to the region’s well-implemented healthcare infrastructure and high healthcare expenditure. Routine diagnostic facilities, universal implementation of screening programs, and accessibility of cutting-edge technologies, like high-resolution endoscopy, molecular testing, and AI-assisted diagnostics, are some of the key elements that further contribute in the region’s dominance. Additionally, rigorous regulatory frameworks and appealing reimbursement policies facilitate the acceptance of innovative diagnostic solutions thus ensuring an extensive market penetration.

Moreover, the growing awareness among patients and doctors about early detection, coupled with the strategic moves of healthcare providers’ in incorporating complete diagnostic protocols, drives consistent demand. Partnerships between healthcare systems and diagnostic developers also reinforce the hold of North America on the gastric cancer diagnostics market.

Companies that operate in the gastric cancer diagnostics market focus on strategic initiatives like elaborating comprehensive testing portfolios, regional distribution networks expanding, forming partnerships with healthcare providers, implementing reimbursement support programs, investing in real-world evidence studies, and launching clinician education and patient awareness campaigns with the purpose of increasing market penetration.

Abbott, Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, MiRXES Pte Ltd., Endofotonics Pte Ltd., Hipro Biotechnology Co.,Ltd., Fulgent Genetics, NeoGenomics Laboratories, Samsung Medison Co., Ltd., Natera, Inc., Randox Laboratories Ltd., GE HealthCare, Koninklijke Philips N.V, CANON MEDICAL SYSTEMS CORPORATION, and Promega Corporation are some of the leading players operating in the global gastric cancer diagnostics market.

Each of these players has been profiled in the gastric cancer diagnostics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 3.5 Bn |

| Forecast Value in 2035 | US$ 6.9 Bn |

| CAGR | 6.4% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn |

| Gastric Cancer Diagnostics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Diagnostic Test Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global gastric cancer diagnostics market was valued at US$ 3.5 Bn in 2024

The global gastric cancer diagnostics industry is projected to reach more than US$ 6.9 Bn by the end of 2035.

The rising incidence of gastric cancer, increasing risk factors like H. pylori infections, obesity, and smoking, advances in diagnostic technology, and rising focus on early detection through screening programs are some of the factors driving the expansion of gastric cancer diagnostics market.

The CAGR is anticipated to be 6.4% from 2025 to 2035

Abbott, Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, MiRXES Pte Ltd., Endofotonics Pte Ltd., Hipro Biotechnology Co.,Ltd., Fulgent Genetics, NeoGenomics Laboratories, Samsung Medison Co., Ltd., Natera, Inc., Randox Laboratories Ltd., GE HealthCare, Koninklijke Philips N.V, CANON MEDICAL SYSTEMS CORPORATION, and Promega Corporation

Table 01: Global Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 02: Global Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 03: Global Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Molecular Tests, 2020 to 2035

Table 04: Global Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Disease Type, 2020 to 2035

Table 05: Global Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 08: North America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 09: North America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 10: North America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Molecular Tests, 2020 to 2035

Table 11: North America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Disease Type, 2020 to 2035

Table 12: North America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Europe Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 15: Europe Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 16: Europe Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Molecular Tests, 2020 to 2035

Table 17: Europe Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Disease Type, 2020 to 2035

Table 18: Europe Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 20: Asia Pacific Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 21: Asia Pacific Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 22: Asia Pacific Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Molecular Tests, 2020 to 2035

Table 23: Asia Pacific Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Disease Type, 2020 to 2035

Table 24: Asia Pacific Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 26: Latin America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 27: Latin America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 28: Latin America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Molecular Tests, 2020 to 2035

Table 29: Latin America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Disease Type, 2020 to 2035

Table 30: Latin America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 32: Middle East & Africa Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 33: Middle East & Africa Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging Tests, 2020 to 2035

Table 34: Middle East & Africa Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Molecular Tests, 2020 to 2035

Table 35: Middle East & Africa Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By Disease Type, 2020 to 2035

Table 36: Middle East & Africa Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Gastric Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 02: Global Gastric Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 03: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Imaging Tests, 2020 to 2035

Figure 04: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Molecular Tests, 2020 to 2035

Figure 05: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Biopsy, 2020 to 2035

Figure 06: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 07: Global Gastric Cancer Diagnostics Market Value Share Analysis, By Disease Type, 2024 and 2035

Figure 08: Global Gastric Cancer Diagnostics Market Attractiveness Analysis, By Disease Type, 2025 to 2035

Figure 09: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Adenocarcinoma, 2020 to 2035

Figure 10: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Gastrointestinal stromal tumors (GIST), 2020 to 2035

Figure 11: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Gastrointestinal Neuroendocrine (Carcinoid) Tumors, 2020 to 2035

Figure 12: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 13: Global Gastric Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 14: Global Gastric Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 15: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Hospital Laboratories, 2020 to 2035

Figure 16: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Diagnostic Centers, 2020 to 2035

Figure 17: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Academic and Research Institutes, 2020 to 2035

Figure 18: Global Gastric Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Gastric Cancer Diagnostics Market Value Share Analysis, By Region, 2024 and 2035

Figure 20: Global Gastric Cancer Diagnostics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 21: North America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 22: North America Gastric Cancer Diagnostics Market Value Share Analysis, by Country, 2024 and 2035

Figure 23: North America Gastric Cancer Diagnostics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 24: North America Gastric Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 25: North America Gastric Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 26: North America Gastric Cancer Diagnostics Market Value Share Analysis, By Disease Type, 2024 and 2035

Figure 27: North America Gastric Cancer Diagnostics Market Attractiveness Analysis, By Disease Type, 2025 to 2035

Figure 28: North America Gastric Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 29: North America Gastric Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 30: Europe Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 31: Europe Gastric Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 32: Europe Gastric Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 33: Europe Gastric Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 34: Europe Gastric Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 35: Europe Gastric Cancer Diagnostics Market Value Share Analysis, By Disease Type, 2024 and 2035

Figure 36: Europe Gastric Cancer Diagnostics Market Attractiveness Analysis, By Disease Type, 2025 to 2035

Figure 37: Europe Gastric Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 38: Europe Gastric Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 39: Asia Pacific Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Asia Pacific Gastric Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Asia Pacific Gastric Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 42: Asia Pacific Gastric Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 43: Asia Pacific Gastric Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 44: Asia Pacific Gastric Cancer Diagnostics Market Value Share Analysis, By Disease Type, 2024 and 2035

Figure 45: Asia Pacific Gastric Cancer Diagnostics Market Attractiveness Analysis, By Disease Type, 2025 to 2035

Figure 46: Asia Pacific Gastric Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 47: Asia Pacific Gastric Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 48: Latin America Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Latin America Gastric Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 50: Latin America Gastric Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 51: Latin America Gastric Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 52: Latin America Gastric Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 53: Latin America Gastric Cancer Diagnostics Market Value Share Analysis, By Disease Type, 2024 and 2035

Figure 54: Latin America Gastric Cancer Diagnostics Market Attractiveness Analysis, By Disease Type, 2025 to 2035

Figure 55: Latin America Gastric Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 56: Latin America Gastric Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 57: Middle East & Africa Gastric Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Middle East & Africa Gastric Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Middle East & Africa Gastric Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 60: Middle East & Africa Gastric Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 61: Middle East & Africa Gastric Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 62: Middle East & Africa Gastric Cancer Diagnostics Market Value Share Analysis, By Disease Type, 2024 and 2035

Figure 63: Middle East & Africa Gastric Cancer Diagnostics Market Attractiveness Analysis, By Disease Type, 2025 to 2035

Figure 64: Middle East & Africa Gastric Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Middle East & Africa Gastric Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035