Reports

Reports

Petrochemical-derived products such as carbon black, solvents, resins, mineral oils, and intermediates are used as key raw materials in the production of flexographic inks. Flexographic printing is an important printing process used in flexible package printing. Its popularity can be attributed to its high versatility in terms of printing on a wide range of substrates. Flexographic inks exhibit high adherence to the substrate surface and offer excellent printing quality, irrespective of the material of the substrate.

Packaging is considered a highly important aspect of marketing, which influences the consumer’s purchasing decision. The packaging industry is a major consumer of printing inks. Growth of the food & beverages sector and increased demand for flexible packaging from the health care sector are expected to boost the demand for flexographic inks in the next few years.

The trend of e-commerce is growing at a significant rate across the globe. It is hampering the publication & commercial printing industry. Thus, a substantial decrease in paper-based communication is estimated to restrict the global flexographic inks market during the forecast period. The trend of e-commerce comprises e-books, event tickets, sporting goods, toys, and hotel and airline reservations. Especially, rising adoption of e-books is anticipated to hamper the global flexographic inks market during the forecast period.

Water-based Flexographic Inks the Most Commonly Used Inks

In terms of type, the flexographic inks market has been segmented into solvent-based inks, water-based inks, and UV-cured inks. In 2017, the water-based inks segment held the leading share of the global market. Water-based flexographic inks contain water as its major constituent along with glycol. These inks are more eco-friendly than solvent-based flexographic inks. Globally, the demand for water-based flexographic inks is rising due to stringent regulations related to the environment.

On the other hand, UV-cured inks do not contain any volatile compounds and, therefore, they are used in various printing applications such as gravure, inkjet, and flexography printing. They offer several advantages over the conventional printing inks. Demand for VOC-free printing inks is gaining momentum, due to increased number of regulations imposed on the usage of inks emitting VOCs. Furthermore, strict monitoring of usage of toxic chemicals, which possess high vapor pressure at room temperature, and government investments in the renewable energy sector are anticipated to drive the demand for UV-cured flexographic inks in the next few years.

In terms of application, the flexographic inks market has been classified into packaging and others. The others segment comprises newspapers, magazines, and journals. The packaging segment has been sub-segregated into flexible packaging, corrugated containers, folding cartons, tags & labels, and others. In 2017, the packaging segment held the leading share of the global market. The packaging industry is a major consumer of printing inks. Rise in the demand for flexible packaging in the food & beverages industry led by lower weight and better aesthetic packaging is anticipated to fuel the packaging segment of the global flexographic inks market during the forecast period. This, in turn, is estimated to propel the global market for flexographic inks in the near future.

In 2017, the flexible packaging sub-segment dominated the packaging segment of the global flexographic inks market, followed by the corrugated containers sub-segment. Flexographic inks are most commonly used in applications such as corrugated containers and flexible packaging, with the latter being largely employed in the food & beverages industry. Flexographic inks are also used in cartons, folds, labels, and newspapers.

Asia Pacific a Prominent Consumer of Flexographic Inks

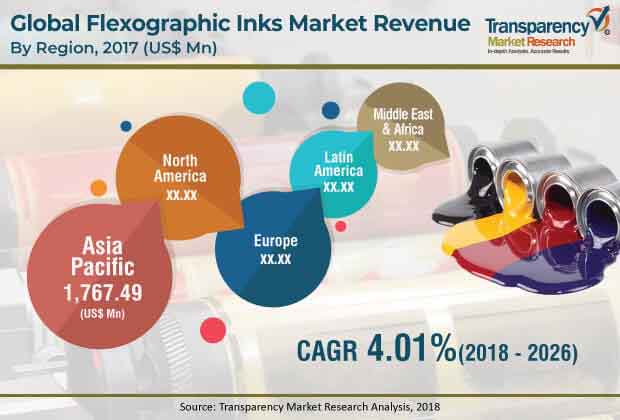

In terms of region, the global flexographic inks market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2017, Asia Pacific accounted for a major share of the global market. Rise in the demand for packaging in food & beverages and personal care industries to achieve better aesthetic packaging in Asia Pacific is expected to boost the packaging segment of the market in the region during the forecast period. China, India, and Japan collectively constitute a major share of the flexographic inks market in Asia Pacific. The market in the region is expected to expand at a more rapid rate than the market in other regions. Both North America and Europe are actively investing in the development and manufacture of VOC-free inks to comply with government regulations. Thus, the demand for UV-cured inks in these regions is expected to increase substantially in the next few years.

In terms of resin, the global flexographic inks market has been segregated into nitrocellulose, polyamide, polyurethane, acrylic, and others. Out of these, polyurethane is the most commonly used resin, as polyurethane-based flexographic inks can be used with plastic packaging such as flexible packaging, folding cartons, tags, and labels. As plastic packaging is widely used, so is polyurethane as a resin. This trend is expected to continue during the forecast period.

Flexographic Inks Market Moderately Consolidated in Nature

The global flexographic inks market is moderately consolidated, with a few multinational companies holding a key market share. Key manufacturers of flexographic inks include Altana AG, Zeller+Gmelin GmbH & Co. KG, Flint Group, Sun Chemical Corporation, and INX International Ink Co.

1. Preface

1.1. Report Scope

1.2. Market Segmentation

1.3. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Global Flexographic Inks Market Volume (Kilo Tons) and Value (US$ Mn), 2017–2026

3.2. Market Snapshot

4. Market Overview

4.1. Introduction

4.2. Market Indicators

4.3. Driver 1 – Growing Packaging Industry

4.4. Driver 2 – Rising Demand for UV-cured Printing Inks

4.5. Restraint

4.6. Opportunity Analysis

4.7. Opportunities

4.8. Porter's Five Forces Analysis

4.9. Regulatory Scenario

4.10. Value Chain Analysis

5. Global Flexographic Inks Market Analysis

5.1. Global Flexographic Inks Market Overview

5.2. Key Findings

6. Global Flexographic Inks Market Analysis, by Type

6.1. Definitions

6.2. Global Flexographic Inks Market Value Share Analysis, by Type

6.3. Global Flexographic Inks Market Analysis & Forecast, by Type, 2017–2026

6.3.1. Water-based

6.3.2. Solvent-based

6.3.3. UV-cured

6.4. Global Flexographic Inks Market Attractiveness Analysis, by Type

7. Global Flexographic Inks Market Analysis, by Application

7.1. Definitions

7.2. Global Flexographic Inks Market Value Share Analysis, by Application

7.3. Global Flexographic Inks Market Analysis & Forecast, by Application, 2017–2026

7.3.1. Packaging

7.3.1.1. Flexible Packaging

7.3.1.2. Corrugated Containers

7.3.1.3. Folding Cartons

7.3.1.4. Tags & Labels

7.3.1.5. Others

7.3.2. Others

7.4. Global Flexographic Inks Market Attractiveness Analysis, by Application

8. Global Flexographic Inks Market Analysis, by Resin

8.1. Definitions

8.2. Global Flexographic Inks Market Value Share Analysis, by Resin

8.3. Global Flexographic Inks Market Analysis & Forecast, by Resin, 2017–2026

8.3.1. Nitrocellulose

8.3.2. Polyamide

8.3.3. Polyurethane

8.3.4. Acrylic

8.3.5. Others

8.4. Global Flexographic Inks Market Attractiveness Analysis, by Resin

9. Global Flexographic Inks Market Analysis, by Region

9.1. Global Flexographic Inks Market Value Share Analysis, by Region

9.2. Global Flexographic Inks Market Analysis & Forecast, by Region, 2017–2026

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific

9.2.5. Middle East & Africa

9.3. Global Flexographic Inks Market Attractiveness Analysis, by Region

10. North America Flexographic Inks Market Analysis

10.1. North America Flexographic Inks Market Overview

10.2. North America Flexographic Inks Market Volume and Value Share Analysis, by Type, Application, Resin, and Country

10.3. North America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Type, 2017–2026

10.4. North America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Resin, 2017–2026

10.5. North America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Application, 2017–2026

10.6. North America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Country, 2017–2026

10.6.1. U.S.

10.6.2. Canada

10.7. U.S. Flexographic Inks Market Forecast, by Type

10.8. U.S. Flexographic Inks Market Forecast, by Resin

10.9. U.S. Flexographic Inks Market Forecast, by Application

10.10. Canada Flexographic Inks Market Forecast, by Type

10.11. Canada Flexographic Inks Market Forecast, by Resin

10.12. Canada Flexographic Inks Market Forecast, by Application

10.13. North America Flexographic Inks Market Attractiveness Analysis

11. Latin America Flexographic Inks Market Analysis

11.1. Latin America Flexographic Inks Market Overview

11.2. Latin America Flexographic Inks Market Volume and Value Share Analysis, by Type, Resin, Application, and Country and Sub-region

11.3. Latin America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Type, 2017–2026

11.4. Latin America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Resin, 2017–2026

11.5. Latin America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Application, 2017–2026

11.6. Latin America Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

11.6.1. Brazil

11.6.2. Mexico

11.6.3. Rest of Latin America

11.7. Brazil Flexographic Inks Market Forecast, by Type

11.8. Brazil Flexographic Inks Market Forecast, by Resin

11.9. Brazil Flexographic Inks Market Forecast, by Application

11.10. Mexico Flexographic Inks Market Forecast, by Type

11.11. Mexico Flexographic Inks Market Forecast, by Resin

11.12. Mexico Flexographic Inks Market Forecast, by Application

11.13. Rest of Latin America Flexographic Inks Market Forecast, by Type

11.14. Rest of Latin America Flexographic Inks Market Forecast, by Resin

11.15. Rest of Latin America Flexographic Inks Market Forecast, by Application

11.16. Latin America Flexographic Inks Market Attractiveness Analysis

12. Europe Flexographic Inks Market Analysis

12.1. Europe Flexographic Inks Market Overview

12.2. Europe Flexographic Inks Market Volume and Value Share Analysis, by Type, Resin, Application, and Country and Sub-region

12.3. Europe Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Type, 2017–2026

12.4. Europe Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Resin, 2017–2026

12.5. Europe Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Application, 2017–2026

12.6. Europe Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

12.6.1. Germany

12.6.2. France

12.6.3. U.K.

12.6.4. Italy

12.6.5. Spain

12.6.6. Russia & CIS

12.6.7. Rest of Europe

12.7. Germany Flexographic Inks Market Forecast, by Type

12.8. Germany Flexographic Inks Market Forecast, by Resin

12.9. Germany Flexographic Inks Market Forecast, by Application

12.10. France Flexographic Inks Market Forecast, by Type

12.11. France Flexographic Inks Market Forecast, by Resin

12.12. France Flexographic Inks Market Forecast, by Application

12.13. U.K. Flexographic Inks Market Forecast, by Type

12.14. U.K. Flexographic Inks Market Forecast, by Resin

12.15. U.K. Flexographic Inks Market Forecast, by Application

12.16. Italy Flexographic Inks Market Forecast, by Type

12.17. Italy Flexographic Inks Market Forecast, by Resin

12.18. Italy Flexographic Inks Market Forecast, by Application

12.19. Spain Flexographic Inks Market Forecast, by Type

12.20. Spain Flexographic Inks Market Forecast, by Resin

12.21. Spain Flexographic Inks Market Forecast, by Application

12.22. Russia & CIS Flexographic Inks Market Forecast, by Type

12.23. Russia & CIS Flexographic Inks Market Forecast, by Resin

12.24. Russia & CIS Flexographic Inks Market Forecast, by Application

12.25. Rest of Europe Flexographic Inks Market Forecast, by Type

12.26. Rest of Europe Flexographic Inks Market Forecast, by Resin

12.27. Rest of Europe Flexographic Inks Market Forecast, by Application

12.28. Europe Flexographic Inks Market Attractiveness Analysis

13. Asia Pacific Flexographic Inks Market Analysis

13.1. Asia Pacific Flexographic Inks Market Overview

13.2. Asia Pacific Flexographic Inks Market Volume and Value Share Analysis, by Type, Resin, Application, and Country and Sub-region

13.3. Asia Pacific Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Type, 2017–2026

13.4. Asia Pacific Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Resin, 2017–2026

13.5. Asia Pacific Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Application, 2017–2026

13.6. Asia Pacific Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. Australia

13.6.5. ASEAN

13.6.6. Rest of Asia Pacific

13.7. China Flexographic Inks Market Forecast, by Type

13.8. China Flexographic Inks Market Forecast, by Resin

13.9. China Flexographic Inks Market Forecast, by Application

13.10. India Flexographic Inks Market Forecast, by Type

13.11. India Flexographic Inks Market Forecast, by Resin

13.12. India Flexographic Inks Market Forecast, by Application

13.13. Japan Flexographic Inks Market Forecast, by Type

13.14. Japan Flexographic Inks Market Forecast, by Resin

13.15. Japan Flexographic Inks Market Forecast, by Application

13.16. Australia Flexographic Inks Market Forecast, by Type

13.17. Australia Flexographic Inks Market Forecast, by Resin

13.18. Australia Flexographic Inks Market Forecast, by Application

13.19. ASEAN Flexographic Inks Market Forecast, by Type

13.20. ASEAN Flexographic Inks Market Forecast, by Resin

13.21. ASEAN Flexographic Inks Market Forecast, by Application

13.22. Rest of Asia Pacific Flexographic Inks Market Forecast, by Type

13.23. Rest of Asia Pacific Flexographic Inks Market Forecast, by Resin

13.24. Rest of Asia Pacific Flexographic Inks Market Forecast, by Application

13.25. Asia Pacific Flexographic Inks Market Attractiveness Analysis

14. Middle East & Africa Flexographic Inks Market Analysis

14.1. Middle East & Africa Flexographic Inks Market Overview

14.2. Middle East & Africa Flexographic Inks Market Volume and Value Share Analysis, by Type, Resin, Application, Country and Sub-region

14.3. Middle East & Africa Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Type, 2017–2026

14.4. Middle East & Africa Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Resin, 2017–2026

14.5. Middle East & Africa Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Application, 2017–2026

14.6. Middle East & Africa Flexographic Inks Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

14.6.1. South Africa

14.6.2. GCC

14.6.3. Rest of Middle East & Africa

14.7. South Africa Flexographic Inks Market Forecast, by Type

14.8. South Africa Flexographic Inks Market Forecast, by Resin

14.9. South Africa Flexographic Inks Market Forecast, by Application

14.10. GCC Flexographic Inks Market Forecast, by Type

14.11. GCC Flexographic Inks Market Forecast, by Resin

14.12. GCC Flexographic Inks Market Forecast, by Application

14.13. Rest of Middle East & Africa Flexographic Inks Market Forecast, by Type

14.14. Rest of Middle East & Africa Flexographic Inks Market Forecast, by Resin

14.15. Rest of Middle East & Africa Flexographic Inks Market Forecast, by Application

14.16. Middle East & Africa Flexographic Inks Market Attractiveness Analysis

15. Competition Landscape

15.1. Competition Matrix

15.2. Global Flexographic Inks Market Share Analysis, by Company (2017)

15.3. Sun Chemical Corporation

15.3.1. Company Details

15.3.2. Company Description

15.3.3. Business Overview

15.3.4. Financial Details

15.3.5. Strategic Overview

15.4. Flint Group

15.4.1. Company Details

15.4.2. Company Description

15.4.3. Business Overview

15.4.4. Recent Developments

15.4.5. Strategic Overview

15.5. Wikoff Color Corporation

15.5.1. Company Details

15.5.2. Company Description

15.5.3. Business Overview

15.6. Siegwerk Druckfarben AG & Co. KGaA

15.6.1. Company Details

15.6.2. Company Description

15.6.3. Business Overview

15.6.4. Financial Details

15.6.5. Strategic Overview

15.7. Toyo Inc. SC Holdings Co. Ltd.

15.7.1. Company Details

15.7.2. Company Description

15.7.3. Business Overview

15.7.4. Financial Details

15.7.5. Strategic Overview

15.8. INX International Inc. Co.

15.8.1. Company Details

15.8.2. Company Description

15.8.3. Business Overview

15.9. Huber Group

15.9.1. Company Details

15.9.2. Company Description

15.9.3. Business Overview

15.9.4. Recent Developments

15.9.5. Strategic Overview

15.10. Altana AG

15.10.1. Company Details

15.10.2. Company Description

15.10.3. Business Overview

15.10.4. Financial Details

15.10.5. Strategic Overview

15.11. T&K Toka Co., Ltd.

15.11.1. Company Details

15.11.2. Company Description

15.11.3. Business Overview

15.11.4. Financial Details

15.11.5. Strategic Overview

15.12. Zeller+Gmelin GmbH & Co. KG

15.12.1. Company Details

15.12.2. Company Description

15.12.3. Business Overview

15.12.4. Recent Developments

15.12.5. Strategic Overview

16. Key Findings

17. Primary Insights

List of Tables

Table 01: Global Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 02: Global Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 03: Global Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 04: Global Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 05: Global Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 06: Global Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 07: Global Flexographic Inks Market Volume (Kilo Tons) Forecast, by Region, 2017–2026

Table 08: Global Flexographic Inks Market Value (US$ Mn) Forecast, by Region, 2017–2026

Table 09: North America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 10: North America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 11: North America Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 12: North America Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 13: North America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 14: North America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 15: North America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Country, 2017–2026

Table 16: North America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Country, 2017–2026

Table 17: U.S. Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 18: U.S. Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 19: U.S. Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 20: U.S. Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 21: U.S. Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 22: U.S. Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 23: Canada Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 24: Canada Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 25: Canada Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 26: Canada Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 27: Canada Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 28: Canada Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 29: Latin America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 30: Latin America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 31: Latin America Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 32: Latin America Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 33: Latin America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 34: Latin America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 35: Latin America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017–2026

Table 36: Latin America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 37: Brazil Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 38: Brazil Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 39: Brazil Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 40: Brazil Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 41: Brazil Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 42: Brazil Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 43: Mexico Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 44: Mexico Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 45: Mexico Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 46: Mexico Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 47: Mexico Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 48: Mexico Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 49: Rest of Latin America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 50: Rest of Latin America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 51: Rest of Latin America Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 52: Rest of Latin America Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 53: Rest of Latin America Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 54: Rest of Latin America Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 55: Europe Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 56: Europe Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 57: Europe Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 58: Europe Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 59: Europe Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 60: Europe Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 61: Europe Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017–2026

Table 62: Europe Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 63: Germany Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 64: Germany Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 65: Germany Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 66: Germany Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 67: Germany Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 68: Germany Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 69: U.K. Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 70: U.K. Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 71: U.K. Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 72: U.K. Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 73: U.K. Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 74: U.K. Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 75: France Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 76: France Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 77: France Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 78: France Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 79: France Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 80: France Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 81: Italy Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 82: Italy Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 83: Italy Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 84: Italy Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 85: Italy Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 86: Italy Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 87: Spain Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 88: Spain Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 89: Spain Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 90: Spain Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 91: Spain Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 92: Spain Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 93: Russia & CIS Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 94: Russia & CIS Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 95: Russia & CIS Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 96: Russia & CIS Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 97: Russia & CIS Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 98: Russia & CIS Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 99: Rest of Europe Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 100: Rest of Europe Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 101: Rest of Europe Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 102: Rest of Europe Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 103: Rest of Europe Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 104: Rest of Europe Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 105: Asia Pacific Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 106: Asia Pacific Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 107: Asia Pacific Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 108: Asia Pacific Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 109: Asia Pacific Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 110: Asia Pacific Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 111: Asia Pacific Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017–2026

Table 112: Asia Pacific Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 113: China Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 114: China Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 115: China Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 116: China Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 117: China Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 118: China Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 119: India Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 120: India Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 121: India Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 122: India Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 123: India Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 124: India Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 125: Japan Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 126: Japan Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 127: Japan Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 128: Japan Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 129: Japan Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 130: Japan Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 131: ASEAN Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 132: ASEAN Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 133: ASEAN Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 134: ASEAN Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 135: ASEAN Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 136: ASEAN Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 137: Rest of Asia Pacific Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 138: Rest of Asia Pacific Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 139: Rest of Asia Pacific Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 140: Rest of Asia Pacific Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 141: Rest of Asia Pacific Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 142: Rest of Asia Pacific Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 143: Middle East & Africa Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 144: Middle East & Africa Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 145: Middle East & Africa Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 146: Middle East & Africa Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 147: Middle East & Africa Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 148: Middle East & Africa Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 149: Middle East & Africa Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2017–2026

Table 150: Middle East & Africa Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2026

Table 151: GCC Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 152: GCC Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 153: GCC Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 154: GCC Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 155: GCC Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 156: GCC Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 157: South Africa Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 158: South Africa Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 159: South Africa Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 160: South Africa Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 161: South Africa Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 162: South Africa Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

Table 163: Rest of Middle East & Africa Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Type, 2017–2026

Table 164: Rest of Middle East & Africa Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Type, 2017–2026

Table 165: Rest of Middle East & Africa Flexographic Inks Market Volume (Kilo Tons) Forecast, by Application, 2017–2026

Table 166: Rest of Middle East & Africa Flexographic Inks Market Value (US$ Mn) Forecast, by Application, 2017–2026

Table 167: Rest of Middle East & Africa Flexographic Printing Inks Market Volume (Kilo Tons) Forecast, by Resin, 2017–2026

Table 168: Rest of Middle East & Africa Flexographic Printing Inks Market Value (US$ Mn) Forecast, by Resin, 2017–2026

List of Figures

Figure 01: Global Flexographic Inks Market

Figure 02: Global Flexographic Inks Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2017–2026

Figure 03: Global Flexographic Printing Inks Market Value Share Analysis, by Type, 2017 and 2026

Figure 04: Global Flexographic Printing Inks Market Attractiveness Analysis, by Type, 2017

Figure 05: Global Flexographic Printing Inks Market Value Share Analysis, by Resin, 2017 and 2026

Figure 06: Global Flexographic Printing Inks Market Attractiveness Analysis, by Resin, 2017

Figure 07: Global Flexographic Inks Market Value Share Analysis, by Application, 2017 and 2026

Figure 08: Global Flexographic Inks Market Attractiveness Analysis, by Application, 2017

Figure 09: Global Flexographic Inks Market Value Share Analysis, by Region, 2017 and 2026

Figure 10: Global Flexographic Inks Market Attractiveness Analysis, by Region

Figure 11: North America Flexographic Inks Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 12: North America Flexographic Inks Market Value (US$ Mn) Forecast, 2017–2026

Figure 13: North America Flexographic Inks Market Value Share Analysis, by Type, 2017 and 2026

Figure 14: North America Flexographic Inks Market Value Share Analysis, by Application, 2017 and 2026

Figure 15: North America Flexographic Inks Market Value Share Analysis, by Resin, 2017 and 2026

Figure 16: North America Flexographic Inks Market Value Share Analysis, by Country, 2017 and 2026

Figure 17: North America Flexographic Inks Market Attractiveness Analysis, by Type, 2017

Figure 18: North America Flexographic Inks Market Attractiveness Analysis, by Application, 2017

Figure 19: North America Flexographic Inks Market Attractiveness Analysis, by Resin, 2017

Figure 20: North America Flexographic Inks Market Attractiveness Analysis, by Country, 2017

Figure 21: Latin America Flexographic Inks Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 22: Latin America Flexographic Inks Market Value (US$ Mn) Forecast, 2017–2026

Figure 23: Latin America Flexographic Inks Market Value Share Analysis, by Type, 2017 and 2026

Figure 24: Latin America Flexographic Inks Market Value Share Analysis, by Application, 2017 and 2026

Figure 25: Latin America Flexographic Inks Market Value Share Analysis, by Resin, 2017 and 2026

Figure 26: Latin America Flexographic Inks Market Value Share Analysis, by Country and Sub-region, 2017 and 2026

Figure 27: Latin America Flexographic Inks Market Attractiveness Analysis, by Type, 2017

Figure 28: Latin America Flexographic Inks Market Attractiveness Analysis, by Application, 2017

Figure 29: Latin America Flexographic Inks Market Attractiveness Analysis, by Resin, 2017

Figure 30: Latin America Flexographic Inks Market Attractiveness Analysis, by Country and Sub-region, 2017

Figure 31: Europe Flexographic Inks Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 32: Europe Flexographic Inks Market Value (US$ Mn) Forecast, 2017–2026

Figure 33: Europe Flexographic Inks Market Value Share Analysis, by Type, 2017 and 2026

Figure 34: Europe Flexographic Inks Market Value Share Analysis, by Application, 2017 and 2026

Figure 35: Europe Flexographic Inks Market Value Share Analysis, by Resin, 2017 and 2026

Figure 36: Europe Flexographic Inks Market Value Share Analysis, by Country and Sub-region, 2017 and 2026

Figure 37: Europe Flexographic Inks Market Attractiveness Analysis, by Type, 2017

Figure 38: Europe Flexographic Inks Market Attractiveness Analysis, by Application, 2017

Figure 39: Europe Flexographic Inks Market Attractiveness Analysis, by Resin, 2017

Figure 40: Europe Flexographic Inks Market Attractiveness Analysis, by Country and Sub-region, 2017

Figure 41: Asia Pacific Flexographic Inks Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 42: Asia Pacific Flexographic Inks Market Value (US$ Mn) Forecast, 2017–2026

Figure 43: Asia Pacific Flexographic Inks Market Value Share Analysis, by Type, 2017 and 2026

Figure 44: Asia Pacific Flexographic Inks Market Value Share Analysis, by Application, 2017 and 2026

Figure 45: Asia Pacific Flexographic Inks Market Value Share Analysis, by Resin, 2017 and 2026

Figure 46: Asia Pacific Flexographic Inks Market Value Share Analysis, by Country and Sub-region, 2017 and 2026

Figure 47: Asia Pacific Flexographic Inks Market Attractiveness Analysis, by Type, 2017

Figure 48: Asia Pacific Flexographic Inks Market Attractiveness Analysis, by Application, 2017

Figure 49: Asia Pacific Flexographic Inks Market Attractiveness Analysis, by Resin, 2017

Figure 50: Asia Pacific Flexographic Inks Market Attractiveness Analysis, by Country and Sub-region, 2017

Figure 51: Middle East & Africa Flexographic Inks Market Volume (Kilo Tons) Forecast, 2017–2026

Figure 52: Middle East & Africa Flexographic Inks Market Value (US$ Mn) Forecast, 2017–2026

Figure 53: Middle East & Africa Flexographic Inks Market Value Share Analysis, by Type, 2017 and 2026

Figure 54: Middle East & Africa Flexographic Inks Market Value Share Analysis, by Application, 2017 and 2026

Figure 55: Middle East & Africa Flexographic Inks Market Value Share Analysis, by Resin, 2017 and 2026

Figure 56: Middle East & Africa Flexographic Inks Market Value Share Analysis, by Country and Sub-region, 2017 and 2026

Figure 57: Middle East & Africa Flexographic Inks Market Attractiveness Analysis, by Type, 2017

Figure 58: Middle East & Africa Flexographic Inks Market Attractiveness Analysis, by Application, 2017

Figure 59: Middle East & Africa Flexographic Inks Market Attractiveness Analysis, by Resin, 2017

Figure 60: Middle East & Africa Flexographic Inks Market Attractiveness Analysis, by Country and Sub-region, 2017

Figure 61: Global Flexographic Inks Market Share Analysis, by Company (2017)