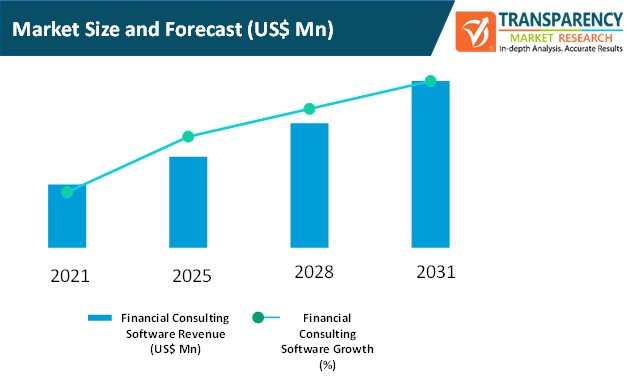

Financial Consulting Software Market: Introduction

- Financial consulting software is a type of financial advisory. A financial advisor is expected to conduct an inspection of the current financial condition and help his client plan to reach his future financial goals.

- Financial consulting software are used to meet current and future financial goals through a sound financial plan. Financial consulting software can be classified as wealth growing software and protection tool software.

- Financial consulting software provides a whole picture of a client's financial life, including assets, debts, income, and expenses. The software can also be used to manage a client's investments. If the client is interested in investing but does not want to manage his own portfolio, a robo advisory can help the client to achieve his financial goal.

- Financial consulting software supports the clients in financial matters in the field of property and real-estate management. The software provides information about real-estate valuations, advisory, and optimizes real-estate asset portfolio.

- The rate of adoption of financial consulting software is expected to increase as it provides suggestions about the best strategies to implement in order to improve the client's finances

Financial Consulting Software Market: Dynamics

Financial Consulting Software Market: Key Drivers

- High rate of adoption by financial consulting software among HNIs (High net worth individuals) and widespread digitalization are major factors driving the financial consulting software market

- The software helps a client compound and grow the value of the money over time. It also helps to meet financial goals that require big cash outlays, such as buying a new house or preparing for retirement. The software provides options to invest the client’s or user’s capital in stocks, bonds, or mutual funds.

- Financial consulting software is also utilized by risk management consultants; the software helps analyze risk (confirming a process and governance is in place to mitigate risk), internal audit (taxations aimed at portraying risk profiles and compliance), risk control (setting up the right warning systems that detect risks), and IT risks

- Lack or limited awareness and high initial cost to implement and integrate financial consulting software are expected to hamper the market

Impact of COVID-19 on the Financial Consulting Software Market

- Most companies are adopting the work-from-home module during the pandemic. Companies are decreasing their investment in new technologies and services to manage revenues. Most small businesses closed their business processes due to lack of funds to sustain in the market. Some companies have withheld all investments in advanced business solutions and tools due to the low return on investment. Thus, demand for financial consulting software decreased during the COVID-19 lockdown situation.

North America to Hold Major Share of the Financial Consulting Software Market

- In terms of region, the global financial consulting software market can be divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America

- North America dominated the global financial consulting software market in 2020. The U.S. is a key market in the adoption of new technologies. Strong financial position enables the country to invest heavily in the adoption of leading tools and technologies to ensure efficient business operations.

- The financial consulting software market in Asia Pacific is projected to expand at a rapid pace during the forecast period owing to an increase in investment by major players in the region to expand their business operations and industrial consumer base in rapidly expanding economies such as India and China. This, in turn, is likely to increase the demand for financial consulting software during the forecast period.

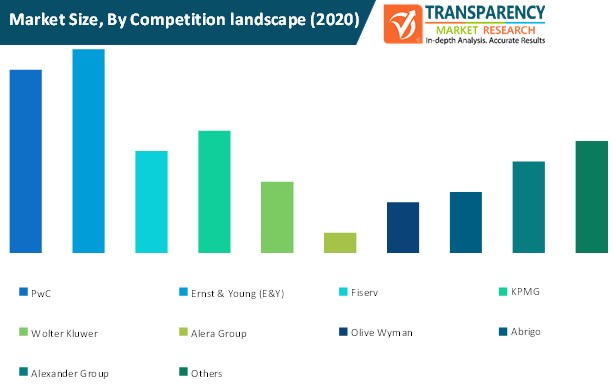

Key Players Operating in the Global Financial Consulting Software Market

PricewaterhouseCoopers, or PwC, was incorporated in 1998 and is headquartered in London, England. The company is a global provider of accounting, auditing, taxation, and corporate advisory services. The company caters to the banking, energy, aerospace, transportation, health care, insurance, engineering, wealth management, construction, and telecommunication industries worldwide.

Ernst & Young was incorporated in 1989 and is headquartered in London, England. The company provides auditing, assurance, enterprise risk management, technology and security risk, actuarial, merger and acquisition and real-estate advisory services. The company also offers entrepreneurial services, taxation, and employee benefits plan. EY caters to consumer products, insurance, energy, automotive, retail, and utilities sectors.

Other key players operating in the global financial consulting software market include Fiserv, Wolter Kluwer, KPMG, Mckinsey, AlixPartners, FTI Consulting, OnDeck, Bain & Company, Fisher Investments, Alera Group, Olive Wyman, Abrigo, Concentrix, and Alexander Group.

Financial Consulting Software Market: Research Scope

Financial Consulting Software Market, by Component

- Software

- Services

- Professional Services

- Consulting

- Support & Maintenance

- Managed Services

Financial Consulting Software Market, by Deployment

Financial Consulting Software Market, by Enterprise

Financial Consulting Software Market, by End-user

- Banks

- Financial Institutes

- Personal Purpose

- Others

Financial Consulting Software Market, by Region

- North America

- U.S.

- Canada

- Rest of North America

- Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America