Finance Cloud: Introduction

- Finance cloud is an integrated platform designed to manage an organization's financial planning on the cloud. The finance cloud platform deals with a wealth management system of company by allowing companies customers to connect with them economically and drive stronger customer relationships.

- Finance cloud solutions are used by several financial industries. The technology helps to automate manual business procedures and increase information accuracy. It supports finance teams and businesses with an ecosystem of integrated techniques to manage accounts, process payments, handle payroll, create financial reports, and manage budgets.

- Banking services, insurance, and financial companies are extensively adopting cloud computing services & solutions to quickly address the problems and concerns of clients by looking at long-term benefits and competitive advantage.

Global Finance Cloud Market: Dynamics

Global Finance Cloud Market: Key Drivers

- Increasing business agility along with the rising demand for customer relationship management (CRM) is estimated to boost the finance cloud market during the forecast period.

- Increased need for customer management is further projected to boost the market during the forecast period.

- Finance cloud solutions offer operational efficiency; this is another key factor driving the growth of the market.

- Increasing trend of deploying many applications via the cloud is anticipated to create opportunities for the finance cloud market.

- However, safety of intellectual property rights, concern about restrictive compliances, and growing cloud-based cyber threats are anticipated to hamper the market during the forecast period.

- The threat of cybercrimes, third-party services, and intense rivalry among players is expected to create challenges for the market during the forecast period.

Impact of COVID-19 on the Global Finance Cloud Market

- Increasing cases of COVID-19 across the globe is resulting in economic slowdown and many organizations are shut down due to partial or full lockdown. However, banking, financial services, and insurance are working during the time of the pandemic. Financial firms require advanced technologies to quickly address problems and concerns of clients. Thus, the adoption of finance cloud has increased during the pandemic. Hence, COVID-19 has a positive impact on the finance cloud market.

North America to Hold Major Share of the Global Finance Cloud Market

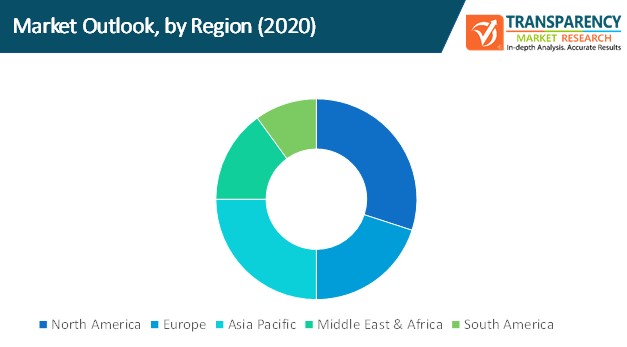

- In terms of region, the global finance cloud market can be divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America

- North America dominated the global finance cloud market with the largest share. A strong economy and a bigger internet penetration rate have shifted isolated infrastructure to cloud in the North American region. Furthermore, low IT management complexity, enhanced agility and security, and reduced CapEx spending are some of the major factors contributing to the growth of the finance cloud market in the North American region.

- The finance cloud market in Asia Pacific is projected to expand at a rapid pace during the forecast period. This can be attributed to digital transformation, growing adoption of cloud technologies, development of the BFSI sector, and continuous investment in technological advancements.

Global Finance Cloud Market: Competition Landscape

Several local, regional, and global players are active in the finance cloud market with a strong presence. Rapid technological advancements have created significant opportunities in the market. Players in the market are continuously focusing on developing technologically advanced solutions for their customers.

Key Players Operating in the Global Finance Cloud Market Include:

- Acumatica Inc by EQT

- Advent International

- Amazon Web Services

- AtemisCloud

- Capgemini SE

- Cerillion Technologies Limited

- Cisco Systems, Inc.

- CloudSigma Holding AG

- Cox Communications

- DigitalOcean,LLC

- DXC Technology

- Google LLC

- Huawei Technologies Co., Ltd

- IBM Corporation

- Microsoft Corporation

- NEC Corporation

- Oracle Corporation

- RamBase

- Sage Intacct Inc.

- Salesforce.Com, Inc.

- SAP SE

- SE2

- VMware

- Wipro Limited

- Workday, Inc.

Global Finance Cloud Market: Research Scope

Global Finance Cloud Market, by Type

- Solution

- Financial Reporting and Analysis

- Financial Forecasting

- Governance, Risk and Compliance

- Security

- Others

- Services

- Professional Services

- Managed Services

Global Finance Cloud Market, by Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

Global Finance Cloud Market, by Organization Size

Global Finance Cloud Market, by Application

- Wealth Management System

- Revenue Management

- Account Management

- Customer Management

- Others

Global Finance Cloud Market, by Region

- North America

- U.S.

- Canada

- Rest of North America

- Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America