Reports

Reports

Apart from agricultural farms, companies in the farm video surveillance system market are increasing efforts to meet the needs of end users in poultry farms. This has led to the emergence of Wi-Fi surveillance solutions that address the dispersed nature of chicken-rearing facilities. For instance, Hikvision— a leading provider of digital surveillance solutions, announced the launch of their innovative Hikvision Wi-Fi surveillance solution that caters to stakeholders handling multi-site chicken farms. These innovative monitoring solutions are contributing toward the growth of the farm video surveillance system market, which is estimated to reach a revenue of ~US$ 3.6 Bn by the end of 2027.

Companies in the farm video surveillance system market are focusing on thermal cameras that serve as effective security measures well suited in the rural setting. There is a growing demand for farm video surveillance systems in poultry sheds, since end users need to ensure operational efficiency and biosecurity adherence. This is evident since livestock & crop monitoring application of the farm video surveillance system market is predicted for exponential growth.

Companies in the farm video surveillance system market are introducing security cameras that eliminate the need for technicians during installation. This trend has contributed to the expansion of the hardware component segment of the farm video surveillance system market. Manufacturers are increasing their production capabilities to develop advanced single farm PTZ (Pan/Tilt/Zoom) security cameras that are rapidly replacing the need for multiple fixed ranch security cameras, thus saving on the end users’ budget. On the other hand, manufacturers are developing wireless farm security cameras that are capable of transmitting data over the air.

Smart agriculture monitoring solutions are witnessing high demand in the farm video surveillance system market to optimize farming productivity. This is evident, since employee monitoring and operations monitoring application segments of the farm video surveillance system market are expected to witness significant growth during the forecast period. Since agriculture is heavily dependent on machinery, there is a growing need for surveillance systems that offer equipment monitoring.

Proliferation of IoT in farm video surveillance systems is bringing about a change in the global market, which is estimated to progress at a CAGR of ~6% during the forecast period. The concept of smart agriculture systems is being fueled with the integration of IoT-based solutions. Growing population and ongoing developments in Industry 4.0 are expected to revolutionize IoT in farm video surveillance systems. Moreover, rising demand for organic produce is another key driver contributing toward market growth, which is aimed at fulfilling the demand for premium-quality grains.

Intelligent agriculture surveillance systems are being incorporated with smart sensing technology. For instance, Eastern Peak-an international IT company provides IoT and digital solutions through smart agriculture systems. Thus, smart agriculture systems are being highly publicized in the farm video surveillance system market, owing to their cost efficiency in eliminating wastewater and overhead expenses. Companies in the farm video surveillance system market are focusing on R&D spending to develop advanced monitoring systems that offer insights on poorly watered plants and overwatering in farm fields.

Automated tracking of animals is much easier in a controlled laboratory setting. Hence, there is a growing demand for large-scale phenotyping of animal behavior traits in the market for farm video surveillance systems in commercial farm conditions. The farm video surveillance system market is continuously evolving, since five leading players account to ~85% of the total market stake. However, commercial farm conditions are subject to several issues involving animal group sizing and changing stock density, which pose as a challenges for companies to offer efficient tracking to end users. Hence, vendors are increasing research in automatic recording of livestock and poultry behavior that fulfil the needs of end users.

The concept of precision livestock farming (PLF) is surfacing in the farm video surveillance system market. Technological advancements in PLF has offered end users with continuous real-time monitoring of health and reproduction of animals, along with insights about the environmental impact on animals. Moreover, IoT has enabled interconnection between computing devices via the Internet to provide end users with options for informed decision-making.

Analysts’ Viewpoint

The estimation of correct planting times and digital pest management are only a few of the several advantages provided by smart agriculture monitoring systems. Companies in the farm video surveillance system market are tapping opportunities in North America and Europe, the market in these regions is expected to experience exponential growth during the forecast period.

Smart farming is encouraging end users to adopt IoT and cloud-enabled remote sensing monitoring systems. However, the adoption of smart farming is hampered due to lack of models providing guidance to end users regarding the necessary components that constitute IoT-based monitoring systems. Hence, companies should gain expertise in efficient designing of IoT-enhanced technologies that promote user-friendliness.

Farm Video Surveillance System Market: Overview

Farm Video Surveillance System Market: Definition

North America Farm Video Surveillance System Market Snapshot

Key Drivers of Farm Video Surveillance System Market

Key Restraints of Farm Video Surveillance System Market

Farm Video Surveillance System Market: Competition Landscape

Farm Video Surveillance System Market: Company Profile Snapshot

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Farm Video Surveillance System Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. Global GDP Indicator – For Top Countries

4.2.2. Global ICT Spending (US$ Mn), 2018, 2021, 2024, and 2027

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. Value Chain Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.4. Overview of Farm Video Surveillance System, by Camera Type

4.4.1. Fixed Cameras

4.4.2. PTZ Cameras

4.4.3. Box Cameras

4.4.4. Thermal Imaging Cameras

4.4.5. Miniature or Covert Cameras

4.4.6. Night Vision Cameras

4.5. Analysis of Wireless Vs. Wired Camera Systems

4.6. Global Farm Video Surveillance System Market Analysis and Forecast, 2017 - 2027

4.6.1. Market Revenue Analysis (US$ Mn)

4.6.1.1. Historic Growth Trends, 2016-2018

4.6.1.2. Forecast Trends, 2019-2027

4.6.2. Market Volume Analysis (‘000 Units)

4.6.2.1. Historic Growth Trends, 2016-2018

4.6.2.2. Forecast Trends, 2019-2027

4.7. Market Opportunity Assessment

4.7.1. By Component

4.7.2. By Application

4.7.3. By Region

4.8. Competitive Scenario and Trends

4.8.1. Global Farm Video Surveillance System Market Concentration Rate

4.8.1.1. List of Emerging, Prominent and Leading Players

4.8.2. Strategic Initiatives, by Key Players

4.9. Market Outlook

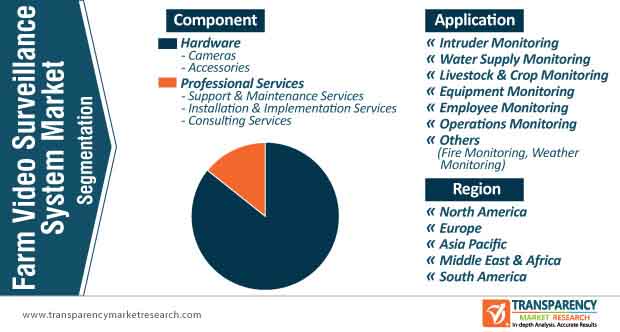

5. Global Farm Video Surveillance System Market Analysis and Forecast, by Component

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Global Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

5.3.1. Hardware (‘000 Units)

5.3.1.1. Cameras

5.3.1.2. Accessories

5.3.1.2.1. Antenna (Long Range & Indoor)

5.3.1.2.2. Storage Devices (HDD, SDD)

5.3.1.2.3. Monitors

5.3.1.2.4. Others (Power Adapter, Alarm Systems, Cables)

5.3.2. Professional Services

5.3.2.1. Support & Maintenance Services

5.3.2.2. Installation & Implementation Services

5.3.2.3. Consulting Services

6. Global Farm Video Surveillance System Market Analysis and Forecast, by Application

6.1. Overview

6.2. Key Segment Analysis

6.3. Global Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

6.3.1. Intruder Monitoring

6.3.2. Water Supply Monitoring

6.3.3. Livestock & Crop Monitoring

6.3.4. Equipment Monitoring

6.3.5. Employee Monitoring

6.3.6. Operations Monitoring

6.3.7. Others (Fire Monitoring, Weather Monitoring)

7. Farm Video Surveillance System Market Analysis and Forecast, by Region

7.1. Key Segment Analysis

7.2. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Farm Video Surveillance System Market Analysis and Forecast

8.1. Regional Outlook

8.2. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

8.2.1. Hardware (‘000 Units)

8.2.1.1. Cameras

8.2.1.2. Accessories

8.2.1.2.1. Antenna (Long Range & Indoor)

8.2.1.2.2. Storage Devices (HDD, SDD)

8.2.1.2.3. Monitors

8.2.1.2.4. Others (Power Adapter, Alarm Systems, Cables)

8.2.2. Professional Services

8.2.2.1. Support & Maintenance Services

8.2.2.2. Installation & Implementation Services

8.2.2.3. Consulting Services

8.3. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

8.3.1. Intruder Monitoring

8.3.2. Water Supply Monitoring

8.3.3. Livestock & Crop Monitoring

8.3.4. Equipment Monitoring

8.3.5. Employee Monitoring

8.3.6. Operations Monitoring

8.3.7. Others (Fire Monitoring, Weather Monitoring)

8.4. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

8.4.1. U.S.

8.4.2. Canada

8.4.3. Mexico

8.4.4. Rest of North America

9. Europe Farm Video Surveillance System Market Analysis and Forecast

9.1. Regional Outlook

9.2. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

9.2.1. Hardware (‘000 Units)

9.2.1.1. Cameras

9.2.1.2. Accessories

9.2.1.2.1. Antenna (Long Range & Indoor)

9.2.1.2.2. Storage Devices (HDD, SDD)

9.2.1.2.3. Monitors

9.2.1.2.4. Others (Power Adapter, Alarm Systems, Cables)

9.2.2. Professional Services

9.2.2.1. Support & Maintenance Services

9.2.2.2. Installation & Implementation Services

9.2.2.3. Consulting Services

9.3. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

9.3.1. Intruder Monitoring

9.3.2. Water Supply Monitoring

9.3.3. Livestock & Crop Monitoring

9.3.4. Equipment Monitoring

9.3.5. Employee Monitoring

9.3.6. Operations Monitoring

9.3.7. Others (Fire Monitoring, Weather Monitoring)

9.4. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

9.4.1. Germany

9.4.2. France

9.4.3. U.K.

9.4.4. Russia

9.4.5. Italy

9.4.6. Denmark

9.4.7. Rest of Europe

10. Asia Pacific Farm Video Surveillance System Market Analysis and Forecast

10.1. Regional Outlook

10.2. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

10.2.1. Hardware (‘000 Units)

10.2.1.1. Cameras

10.2.1.2. Accessories

10.2.1.2.1. Antenna (Long Range & Indoor)

10.2.1.2.2. Storage Devices (HDD, SDD)

10.2.1.2.3. Monitors

10.2.1.2.4. Others (Power Adapter, Alarm Systems, Cables)

10.2.2. Professional Services

10.2.2.1. Support & Maintenance Services

10.2.2.2. Installation & Implementation Services

10.2.2.3. Consulting Services

10.3. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

10.3.1. Intruder Monitoring

10.3.2. Water Supply Monitoring

10.3.3. Livestock & Crop Monitoring

10.3.4. Equipment Monitoring

10.3.5. Employee Monitoring

10.3.6. Operations Monitoring

10.3.7. Others (Fire Monitoring, Weather Monitoring)

10.4. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

10.4.1. China

10.4.2. India

10.4.3. Japan

10.4.4. Kazakhstan

10.4.5. Australia

10.4.6. New Zealand

10.4.7. Philippines

10.4.8. Rest of Asia Pacific

11. Middle East & Africa Farm Video Surveillance System Market Analysis and Forecast

11.1. Regional Outlook

11.2. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

11.2.1. Hardware (‘000 Units)

11.2.1.1. Cameras

11.2.1.2. Accessories

11.2.1.2.1. Antenna (Long Range & Indoor)

11.2.1.2.2. Storage Devices (HDD, SDD)

11.2.1.2.3. Monitors

11.2.1.2.4. Others (Power Adapter, Alarm Systems, Cables)

11.2.2. Professional Services

11.2.2.1. Support & Maintenance Services

11.2.2.2. Installation & Implementation Services

11.2.2.3. Consulting Services

11.3. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

11.3.1. Intruder Monitoring

11.3.2. Water Supply Monitoring

11.3.3. Livestock & Crop Monitoring

11.3.4. Equipment Monitoring

11.3.5. Employee Monitoring

11.3.6. Operations Monitoring

11.3.7. Others (Fire Monitoring, Weather Monitoring)

11.4. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

11.4.1. Turkey

11.4.2. Rest of Middle East & Africa

12. South America Farm Video Surveillance System Market Analysis and Forecast

12.1. Regional Outlook

12.1.1. Hardware (‘000 Units)

12.1.1.1. Cameras

12.1.1.2. Accessories

12.1.1.2.1. Antenna (Long Range & Indoor)

12.1.1.2.2. Storage Devices (HDD, SDD)

12.1.1.2.3. Monitors

12.1.1.2.4. Others (Power Adapter, Alarm Systems, Cables)

12.1.2. Professional Services

12.1.2.1. Support & Maintenance Services

12.1.2.2. Installation & Implementation Services

12.1.2.3. Consulting Services

12.2. Farm Video Surveillance System Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

12.2.1. Brazil

12.2.2. Argentina

12.2.3. Rest of South America

13. Competition Landscape

13.1. Market Player – Competition Matrix

13.2. Market Revenue Share Analysis (%), by Company (2018)

14. Company Profiles (Details – Business Overview, Sales Area/ Geographical Presence, Revenue and Strategy)

14.1. Axis Communications

14.1.1. Business Overview

14.1.2. Sales Area/Geographical Presence

14.1.3. Revenue and Strategy

14.2. Basler AG

14.2.1. Business Overview

14.2.2. Sales Area/Geographical Presence

14.2.3. Revenue and Strategy

14.3. Bosch Security Systems

14.3.1. Business Overview

14.3.2. Sales Area/Geographical Presence

14.3.3. Revenue and Strategy

14.4. Dakota Micro, Inc.

14.4.1. Business Overview

14.4.2. Sales Area/Geographical Presence

14.4.3. Revenue and Strategy

14.5. Flir System Inc.

14.5.1. Business Overview

14.5.2. Sales Area/Geographical Presence

14.5.3. Revenue and Strategy

14.6. Hangzhou Hikvision Digital Technology Co., Ltd.

14.6.1. Business Overview

14.6.2. Sales Area/Geographical Presence

14.6.3. Revenue and Strategy

14.7. Luda.Farm AB

14.7.1. Business Overview

14.7.2. Sales Area/Geographical Presence

14.7.3. Revenue and Strategy

14.8. Onsight247.com

14.8.1. Business Overview

14.8.2. Sales Area/Geographical Presence

14.8.3. Revenue and Strategy

14.9. ORLACO (Stoneridge, Inc.)

14.9.1. Business Overview

14.9.2. Sales Area/Geographical Presence

14.9.3. Revenue and Strategy

14.10. Supercircuits, Inc.

14.10.1. Business Overview

14.10.2. Sales Area/Geographical Presence

14.10.3. Revenue and Strategy

14.11. Tetracam Inc.

14.11.1. Business Overview

14.11.2. Sales Area/Geographical Presence

14.11.3. Revenue and Strategy

14.12. VideoSurveillance.com LLC

14.12.1. Business Overview

14.12.2. Sales Area/Geographical Presence

14.12.3. Revenue and Strategy

15. Key Takeaways

List of Tables

Table 1: Strategic Initiatives

Table 2: Global Farm Video Surveillance System Size (US$ Mn) Forecast, By Component, 2017 – 2027

Table 3: Global Farm Video Surveillance System Size (US$ Mn) Forecast, By Accessories, 2017 – 2027

Table 4: Global Farm Video Surveillance System Volume (‘000 Units) Forecast, By Hardware, 2017 – 2027

Table 5: Global Farm Video Surveillance System Size (US$ Mn) Forecast, by Application, 2017 – 2027

Table 6: Global Farm Video Surveillance System Market Size (US$ Mn) Forecast, By Region, 2017 – 2027

Table 7: North America Farm Video Surveillance System Size (US$ Mn) Forecast, By Component, 2017 – 2027

Table 8: Global Farm Video Surveillance System Size (US$ Mn) Forecast, By Accessories, 2017 – 2027

Table 9: North America Farm Video Surveillance System Volume (‘000 Units) Forecast, By Hardware, 2017 – 2027

Table 10: North America Farm Video Surveillance System Size (US$ Mn) Forecast, by Application, 2017 – 2027

Table 11: North America Farm Video Surveillance System Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

Table 12: Europe Farm Video Surveillance System Size (US$ Mn) Forecast, By Component, 2017 – 2027

Table 13: Europe Farm Video Surveillance System Size (US$ Mn) Forecast, By Accessories, 2017 – 2027

Table 14: Europe Farm Video Surveillance System Volume (‘000 Units) Forecast, By Hardware, 2017 – 2027

Table 15: Europe Farm Video Surveillance System Size (US$ Mn) Forecast, by Application, 2017 – 2027

Table 16: Europe Farm Video Surveillance System Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

Table 17: Asia Pacific Farm Video Surveillance System Size (US$ Mn) Forecast, By Component, 2017 – 2027

Table 18: Asia Pacific Farm Video Surveillance System Size (US$ Mn) Forecast, By Accessories, 2017 – 2027

Table 19: Asia Pacific Farm Video Surveillance System Volume (‘000 Units) Forecast, By Hardware, 2017 – 2027

Table 20: Asia Pacific Farm Video Surveillance System Size (US$ Mn) Forecast, by Application, 2017 – 2027

Table 21: Asia Pacific Farm Video Surveillance System Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

Table 22: Middle East & Africa Farm Video Surveillance System Size (US$ Mn) Forecast, By Component, 2017 – 2027

Table 23: Middle East & Africa Farm Video Surveillance System Size (US$ Mn) Forecast, By Accessories, 2017 – 2027

Table 24: Middle East & Africa Farm Video Surveillance System Volume (‘000 Units) Forecast, By Hardware, 2017 – 2027

Table 25: Middle East & Africa Farm Video Surveillance System Size (US$ Mn) Forecast, by Application, 2017 – 2027

Table 26: Middle East & Africa Farm Video Surveillance System Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

Table 27: South America Farm Video Surveillance System Size (US$ Mn) Forecast, By Component, 2017 – 2027

Table 28: South America Farm Video Surveillance System Size (US$ Mn) Forecast, By Accessories, 2017 – 2027

Table 29: South America Farm Video Surveillance System Volume (‘000 Units) Forecast, By Hardware, 2017 – 2027

Table 30: South America Farm Video Surveillance System Size (US$ Mn) Forecast, by Application, 2017 – 2027

Table 31: South America Farm Video Surveillance System Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

Table 32: Product Portfolio

Table 33: Product Portfolio

Table 34: Product Portfolio

Table 35: Product Portfolio

Table 36: Product Portfolio

Table 37: Product Portfolio

Table 38: Product Portfolio

Table 39: Product Portfolio

Table 40: Product Portfolio

Table 41: Product Portfolio

Table 42: Product Portfolio

Table 43: Product Portfolio

List of Figures

Figure 1: Global Farm Video Surveillance Systems Market Size (US$ Mn) Forecast, 2017 – 2027

Figure 2: Global Farm Video Surveillance Systems Market Volume (‘000 Units) Forecast, 2017 – 2027

Figure 3: Global Farm Video Surveillance Systems Market Value (US$ Mn) Opportunity Assessment, by Region, 2019E

Figure 4: Global Farm Video Surveillance Systems Market Value (US$ Mn) Opportunity Assessment, by Region, 2027F

Figure 5: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 6: Top Economies GDP Landscape, 2018

Figure 7: Global ICT Spending (%), By Region, 2019E

Figure 8: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 9: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 10: Global ICT Spending (%), By Type, 2019E

Figure 11: Value Chain Analysis: Farm Video Surveillance Systems Market

Figure 12: Global Farm Video Surveillance System Market Revenue (US$ Mn) and Y-o-Y Growth (Value %) Forecast, 2016 - 2018

Figure 13: Global Farm Video Surveillance System Market Revenue Opportunity (US$ Mn) Forecast, 2019 - 2027

Figure 14: Global Farm Video Surveillance System Market Volume (‘000 Units) and Y-o-Y Growth (Value %) Forecast, 2016 - 2018

Figure 15: Global Farm Video Surveillance System Market Volume (‘000 Units) and Y-o-Y Growth (Value %) Forecast, 2019 - 2027

Figure 16: Attractiveness Assessment- By Component

Figure 17: Opportunity Assessment- By Component

Figure 18: Attractiveness Assessment- By Application

Figure 19: Opportunity Assessment- By Application

Figure 20: Attractiveness Assessment- By Region

Figure 21: Opportunity Assessment- By Region

Figure 22: Five Firm Concentration Ratio Analysis (2018)

Figure 23: Global Farm Video Surveillance System Market, Component CAGR (%) (2019 – 2027)

Figure 24: Global Farm Video Surveillance System Market, Application CAGR (%) (2019 – 2027)

Figure 25: Global Farm Video Surveillance System Market, by Region CAGR (%) (2019 – 2027)

Figure 26: Global Farm Video Surveillance System Market Share Analysis, By Component (2019)

Figure 27: Global Farm Video Surveillance System Market Share Analysis, By Component (2027)

Figure 28: Global Farm Video Surveillance System Market Share Analysis, by Application (2019)

Figure 29: Global Farm Video Surveillance System Market Share Analysis, by Application (2027)

Figure 30: Global Farm Video Surveillance System Market Share Analysis, By Region (2019)

Figure 31: Global Farm Video Surveillance System Market Share Analysis, By Region (2027)

Figure 32: North America Farm Video Surveillance System Market Share Analysis, By Component (2019)

Figure 33: North America Farm Video Surveillance System Market Share Analysis, By Component (2027)

Figure 34: North America Farm Video Surveillance System Market Share Analysis, by Application (2019)

Figure 35: North America Farm Video Surveillance System Market Share Analysis, by Application (2027)

Figure 36: North America Farm Video Surveillance System Market Share Analysis, By Country (2019)

Figure 37: North America Farm Video Surveillance System Market Share Analysis, By Country (2027)

Figure 38: Europe Farm Video Surveillance System Market Share Analysis, By Component (2019)

Figure 39: Europe Farm Video Surveillance System Market Share Analysis, By Component (2027)

Figure 40: Europe Farm Video Surveillance System Market Share Analysis, by Application (2019)

Figure 41: Europe Farm Video Surveillance System Market Share Analysis, by Application (2027)

Figure 42: Europe Farm Video Surveillance System Market Share Analysis, By Country (2019)

Figure 43: Europe Farm Video Surveillance System Market Share Analysis, By Country (2027)

Figure 44: Asia Pacific Farm Video Surveillance System Market Share Analysis, By Component (2019)

Figure 45: Asia Pacific Farm Video Surveillance System Market Share Analysis, By Component (2027)

Figure 46: Asia Pacific Farm Video Surveillance System Market Share Analysis, by Application (2019)

Figure 47: Asia Pacific Farm Video Surveillance System Market Share Analysis, by Application (2027)

Figure 48: Asia Pacific Farm Video Surveillance System Market Share Analysis, By Country (2019)

Figure 49: Asia Pacific Farm Video Surveillance System Market Share Analysis, By Country (2027)

Figure 50: Middle East & Africa Farm Video Surveillance System Market Share Analysis, By Component (2019)

Figure 51: Middle East & Africa Farm Video Surveillance System Market Share Analysis, By Component (2027)

Figure 52: Middle East & Africa Farm Video Surveillance System Market Share Analysis, by Application (2019)

Figure 53: Middle East & Africa Farm Video Surveillance System Market Share Analysis, by Application (2027)

Figure 54: Middle East & Africa Farm Video Surveillance System Market Share Analysis, By Country (2019)

Figure 55: Middle East & Africa Farm Video Surveillance System Market Share Analysis, By Country (2027)

Figure 56: South America Farm Video Surveillance System Market Share Analysis, By Component (2019)

Figure 57: South America Farm Video Surveillance System Market Share Analysis, By Component (2027)

Figure 58: South America Farm Video Surveillance System Market Share Analysis, by Application (2019)

Figure 59: South America Farm Video Surveillance System Market Share Analysis, by Application (2027)

Figure 60: South America Farm Video Surveillance System Market Share Analysis, By Country (2019)

Figure 61: South America Farm Video Surveillance System Market Share Analysis, By Country (2027)

Figure 62: Global Farm Video Surveillance System Market Share Analysis by Company (2018)

Figure 63: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure 64: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure 65: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure 66: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017

Figure 67: Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2017