Chapter 1 Introduction

1.1 Report Description

1.2 Market Segmentation

1.3 Research Methodology

1.3.1 Sources

1.3.1.1 Secondary Research

1.3.1.2 Primary Research

1.3.2 Assumptions

Chapter 2 Executive Summary

2.1 Market Snapshot: Europe Ambulatory Surgical and Emergency Center Services Market (2013 & 2020)

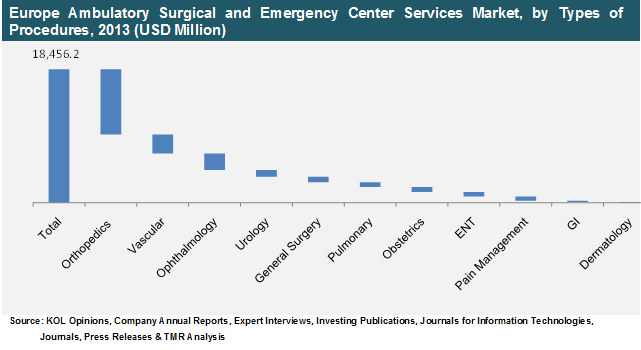

2.2 Europe Ambulatory Surgical and Emergency Center Services Market Revenue, by Types of Procedures, 2013 (USD Million)

2.3 Europe Ambulatory Surgical and Emergency Center Services Market (Volume %), by Types of Procedures, 2013

2.3.1 Comparative Analysis: Europe Ambulatory Surgical and Emergency Center Services Market, by Country, 2013 and 2020 (Value %)

2.3.2 Comparative Analysis: Europe Ambulatory Surgical and Emergency Center Services Market, by Country, 2013 and 2020 (Volume %)

Chapter 3 Market Overview

3.1 Overview

3.2 Market Drivers

3.2.1 Long waiting time results in migration of patients from inpatient to outpatient settings

3.2.1.1 Waiting time from specialist appointment to treatment for Cataract Surgery (2006-2012)

3.2.2 Reduced cost of procedures induces patients to shift to ambulatory surgical centers

3.2.3 Technological advancements support the performance of a surgery in a single day

3.2.4 Increase in geriatric population and rising life expectancy of Europeans raises demand for ambulatory centers

3.3 Market Restraints

3.3.1 Reluctance of people to accept outpatient surgery and lack of adequate facilities likely to slow down the growth of the market

3.4 Market Opportunities

3.4.1 Favorable government initiatives

3.5 Porter’s Five Forces Analysis: Europe Ambulatory Surgical & Emergency Center Services Market

3.5.1 Bargaining power of suppliers

3.5.2 Bargaining power of buyers

3.5.3 Threat of new entrants

3.5.4 Threat of substitutes

3.5.5 Competitive rivalry

3.6 Market Attractiveness Analysis: Europe Ambulatory Surgical & Emergency Center Services Market, by Geography

Chapter 4 Europe Ambulatory Surgical & Emergency Center Services Market, by Types of Procedure

4.1 Overview

4.1.1 Europe Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedures, 2012 – 2020 (USD Million)

4.2 Ophthalmology

4.2.1 Europe Ophthalmology Procedures Market Revenue , 2012 – 2020, (USD Million)

4.2.2 Europe Ophthalmology Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.3 Gastrointestinal

4.3.1 Europe Gastrointestinal Procedures Market Revenue , 2012 – 2020, (USD Million)

4.3.2 Europe Gastrointestinal Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.4 Pain Management

4.4.1 Europe Pain Management Procedures Market Revenue , 2012 – 2020, (USD Million)

4.4.2 Europe Pain Management Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.5 Orthopedics

4.5.1 Europe Orthopedics Procedures Market Revenue , 2012 – 2020, (USD Million)

4.5.2 Europe Orthopedics Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.6 Dermatology

4.6.1 Europe Dermatology Procedures Market Revenue , 2012 – 2020, (USD Million)

4.6.2 Europe Dermatology Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.7 Ear, Nose and Throat (ENT)

4.7.1 Europe ENT Procedures Market Revenue , 2012 – 2020, (USD Million)

4.7.2 Europe ENT Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.8 Urology

4.8.1 Europe Urology Procedures Market Revenue , 2012 – 2020, (USD Million)

4.8.2 Europe Urology Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.9 Obstetrics

4.9.1 Europe Obstetrics Procedures Market Revenue , 2012 – 2020, (USD Million)

4.9.2 Europe Obstetrics Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.10 Vascular

4.10.1 Europe Vascular Procedures Market Revenue , 2012 – 2020, (USD Million)

4.10.2 Europe Vascular Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.11 General Surgery

4.11.1 Europe General Surgery Procedures Market Revenue , 2012 – 2020, (USD Million)

4.11.2 Europe General Surgery Procedures Market Volume, 2012 – 2020, (No. of Procedures)

4.12 Pulmonary

4.12.1 Europe Pulmonary Procedures Market Revenue , 2012 – 2020, (USD Million)

4.12.2 Europe Pulmonary Procedures Market Volume, 2012 – 2020, (No. of Procedures)

Chapter 5 Europe Ambulatory Surgical & Emergency Center Services Market, by Country

5.1 Overview

5.1.1 Europe Ambulatory Surgery and Emergency Center Services Market Revenue, by Country, 2012 – 2020 (USD Million)

5.1.2 Europe Ambulatory Surgery and Emergency Center Services Market Volume, by Country, 2012 – 2020 (No. of Procedures)

5.2 U.K.

5.2.1 U.K. Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

5.2.2 U.K. Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

5.3 Germany

5.3.1 Germany Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

5.3.2 Germany Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

5.4 France

5.4.1 France Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

5.4.2 France Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

5.5 Italy

5.5.1 Italy Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

5.5.2 Italy Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

5.6 Spain

5.6.1 Spain Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedures, 2012 – 2020 (USD Million)

5.6.2 Spain Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedure)

5.7 Belgium

5.7.1 Belgium Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

5.7.2 Belgium Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedure)

5.8 Rest of Europe

5.8.1 RoE Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

5.8.2 RoE Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedure)

Chapter 6 Competitive Landscape

6.2 Heat Map Analysis of the Ambulatory Surgical & Emergency Center Services Market, by Key Market Players, 2013

6.2.1 Community Health Systems, Inc.

6.2.2 Healthway Medical Group

6.2.3 Medical Facilities Corporation

Chapter 7 Recommendations

7.1 Market Strategy for Success

7.1.1 To initiate favorable reimbursement policies for outpatient ambulatory service

Chapter 8 Company Profiles

8.1 AmSurg Corp.

8.1.1 Company Overview

8.1.2 Financial Overview

8.1.3 Service Portfolio

8.1.4 Business Strategies

8.1.5 Recent Developments

8.2 Community Health Systems, Inc.

8.2.1 Company Overview

8.2.2 Financial Overview

8.2.3 Product Portfolio

8.2.4 Business Strategies

8.2.5 Recent Developments

8.3 Eifelhöhen Klinik AG

8.3.1 Company Overview

8.3.2 Financial Overview

8.3.3 Product Portfolio

8.3.4 Business Strategies

8.3.5 Recent Developments

8.4 Healthway Medical Group

8.4.1 Company Overview

8.4.2 Financial Overview

8.4.3 Product Portfolio

8.4.4 Business Strategies

8.4.5 Recent Developments

8.5 IntegraMed America, Inc.

8.5.1 Company Overview

8.5.2 Financial Overview

8.5.3 Product Portfolio

8.5.4 Business Strategies

8.5.5 Recent Developments

8.6 LCA – Vision, Inc.

8.6.1 Company Overview

8.6.2 Financial Overview

8.6.3 Product Portfolio

8.6.4 Business Strategies

8.6.5 Recent Development

8.7 Medical Facilities Corporation

8.7.1 Company Overview

8.7.2 Product Portfolio

8.7.3 Financial Overview

8.7.4 Business Strategies

8.7.5 Recent Developments

8.8 Nueterra

8.8.1 Company Overview

8.8.2 Financial Overview

8.8.3 Product Portfolio

8.8.4 Business Strategies

8.8.5 Recent Developments

8.9 Surgery Partners

8.9.1 Company Overview

8.9.2 Financial Overview

8.9.3 Product Portfolio

8.9.4 Business Strategies

8.9.5 Recent Developments

8.10 Symbion, Inc.

8.10.1 Company Overview

8.10.2 Financial Overview

8.10.3 Product Portfolio

8.10.4 Business Strategies

8.10.5 Recent Developments

8.11 Terveystalo Healthcare Oyj

8.11.1 Company Overview

8.11.2 Financial Overview

8.11.3 Product Portfolio

8.11.4 Business Strategies

8.11.5 Recent Developments

List of Tables

TABLE 1 Market Snapshot: Europe Ambulatory Surgical and Emergency Center Services Market (2013 & 2020)

TABLE 2 Europe Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedures, 2012 – 2020 (USD Million)

TABLE 3 Europe Ambulatory Surgery and Emergency Center Services Market Revenue, by Country, 2012 – 2020 (USD Million)

TABLE 4 Europe Ambulatory Surgery and Emergency Center Services Market Volume, by Country, 2012 – 2020 (No. of Procedures)

TABLE 5 U.K. Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

TABLE 6 U.K. Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

TABLE 7 Germany Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

TABLE 8 Germany Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

TABLE 9 France Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

TABLE 10 France Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

TABLE 11 Italy Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

TABLE 12 Italy Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

TABLE 13 Spain Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedures, 2012 – 2020 (USD Million)

TABLE 14 Spain Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedure)

TABLE 15 Belgium Ambulatory Surgery and Emergency Center Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

TABLE 16 Belgium Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedures)

TABLE 17 RoE Ambulatory Surgery and Emergency Centers Services Market Revenue, by Types of Procedure, 2012 – 2020 (USD Million)

TABLE 18 RoE Ambulatory Surgery and Emergency Center Services Market Volume, by Types of Procedure, 2012 – 2020 (No. of Procedure)

List of Figures

FIG. 1 Europe Ambulatory Surgical Emergency Center Services Market: Market Segmentation

FIG. 2 Europe Ambulatory Surgical and Emergency Center Services Market Revenue, by Types of Procedures, 2013 (USD Million)

FIG. 3 Europe Ambulatory Surgical and Emergency Center Services Market (Volume %), by Types of Procedures, 2013

FIG. 4 Comparative Analysis: Europe Ambulatory Surgical and Emergency Center Services Market, by Country, 2013 and 2020 (Value %)

FIG. 5 Comparative Analysis: Europe Ambulatory Surgical and Emergency Center Services Market, by Country, 2013 and 2020 (Volume %)

FIG. 6 Waiting time from specialist appointment to treatment for Cataract Surgery (2006-2011)

FIG. 7 Porter’s Five Forces Analysis: Europe Ambulatory Surgical & Emergency Center Services Market

FIG. 8 Market Attractiveness Analysis: Europe Ambulatory Surgical & Emergency Center Services Market, by Geography

FIG. 9 Europe Ophthalmology Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 10 Europe Ophthalmology Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 11 Europe Gastrointestinal Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 12 Europe Gastrointestinal Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 13 Europe Pain Management Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 14 Europe Pain Management Procedures Market, 2012 - 2020 (No. of Procedures)

FIG. 15 Europe Orthopedics Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 16 Europe Orthopedics Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 17 Europe Dermatology Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 18 Europe Dermatology Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 19 Europe ENT Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 20 Europe ENT Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 21 Europe Urology Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 22 Europe Urology Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 23 Europe Obstetrics Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 24 Europe Obstetrics Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 25 Europe Vascular Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 26 Europe Vascular Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 27 Europe General Surgery Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 28 Europe General Surgery Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 29 Europe Pulmonary Procedures Market Revenue, 2012 - 2020 (USD Million)

FIG. 30 Europe Pulmonary Procedures Market Volume, 2012 - 2020 (No. of Procedures)

FIG. 31 Heat Map Analysis of Key Market Players of the Ambulatory Surgical & Emergency Center Services Market

FIG. 32 AmSurg Corp.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 33 Community Health Systems.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 34 Eifelhöhen Klinik AG: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 35 Healthway Medical Corporation Limited.: Annual Revenue, 2011 – 2013 (USD Thousand)

FIG. 36 Medical Facilities Corporation.: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 37 Symbion, Inc.: Annual Revenue, 2011 – 2013 (USD Million)