Reports

Reports

Ethanolamines Market: Snapshot

Demand for ethanolamines is increasing exponentially with rising industrialization and growing demand from end-use industries. The compound is used as feedstock for manufacturing pharmaceuticals, detergents, and polishes.

Further, widening application of ethanolamines in corrosion inhibitors for metal protection and construction chemicals, is anticipated to provide tremendous growth opportunities to ethanolamines market in coming years.

Moreover, demand for ethanolamines is rising from personal care industries too. Ethanolamines are used for manufacturing bath foams, shampoos, and soaps. In addition, the compound is extensively used as weak base in various industries and is an essential head group for phospholipids.

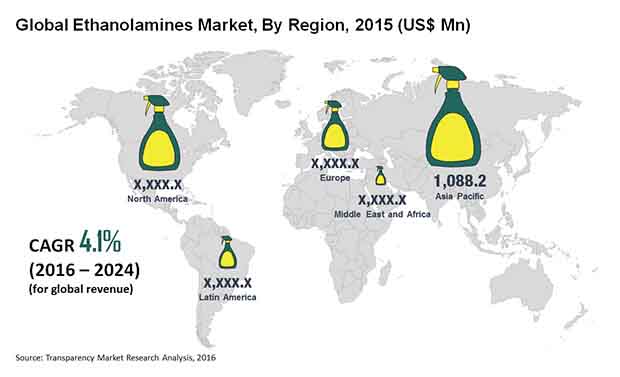

Wide applications of ethanolamines in various industries and new application avenues are likely to boost the global ethanolamines market in coming years. Meanwhile, strong economic growth in various regions are likely to propel growth of the market in the forecast period (2016-2024). As per a report published by Transparency Market Research, the global ethanolamines market is anticipated to expand at a moderate CAGR of 4.1% during forecast period. In 2015, the market stood at the value of US$2.8 bn. The market value is estimated to cross US$4 bn by the end of forecast period.

New Application Avenues Provide Expansion Opportunities to Ethanolamines Market

Development of new applications of ethanolamines in agrochemical production and wood preservation will provide fresh growth avenues to ethanolamines market. As a result, the market is likely to expand in the tenure of forecast period. Growth in agrochemicals production in Asia Pacific is projected to supplement global market growth in coming years.

Further, increasing demand from end-use industries for gas treatment and metal cleaning is a key driving factor. Gas treatment application is likely to grow at a significant rate. This, in turn, is likely to boost the market over the forecast period.

Frequently fluctuating prices of raw materials are likely to hamper growth of the global ethanolamines market. It is a major challenge being faced by the players operating in the market. It may restrain growth of the market.

North America and Asia Pacific Market Dominate Global Ethanolamines Market

In 2015, North America and Asia Pacific, conjointly, accounted for 70% share in the global ethanolamines market. The contribution is accredited to extensive applications of ethanolamines in herbicides and surfactants.

Moving forward, Asia Pacific is anticipated to witness significant growth rate in coming years. The growth rate is accredited to increasing domestic demand from end-use industries in emerging economies such as India and China. Low product cost, particularly in India, is anticipated to one of the key factors for growth of the regional ethanolamines market over the forecast period. Rising disposable income along with growth in industrial sector is likely to drive demand in the region.

On the other hand, North America is anticipated to exhibit substantial growth over the forecast period owing to high demand from end-use industries. Industries such as herbicides, personal care, and detergent are major consumers of ethanolamines. The U.S. is one of the leading consumers of ethanolamines. Further, growing development and innovation in applications are likely to uplift the regional ethanolamines market in coming years.

With presence of several players in the global ethanolamines market, the market is highly fragmented in nature. As a result of intense competition, the profit margin is also very low. However, due to the presence large number of suppliers and educated buyers, ethanolamine market is providing lucrative opportunities for growth of the market in coming years.

Some of the key players operating in the global ethanolamines market are INEOS Oxide Ltd., Dow Chemical Corporation, Huntsman Corporation, Thai Ethanolamines Co., Daicel Chemical Industries, CNPC, Fushun Beifang Chemical Co. Ltd., BASF, Celanese Corporation, Alkyl Amines Chemicals Ltd., CNPC, Akzo Nobel, and Celanese Corporation.

Wide Range of Industrial Applications Spur Growth Prospects of Ethanolamines Market

Ethanolamines are known for antihistaminic property. Also known variously by 2-aminoethanol, or monoethanolamine, or ETA, along with their derivatives, they have been utilized in a wide range of industrial applications. It has a role as a human metabolite, mouse metabolite, and Escherichia coli (E.coli) metabolite, and is viewed as a popular component of phospholipid phosphatidylethanolamine. Interestingly, S. enterica can respire the compound anaerobically. This is a key trend bolstering the expansion of avenues in the ethanolamines market. Over the years, understanding about enzymes and enzyme mechanisms is expanding the prospects for industrial use of ethanolamines. In particular, researchers have made strides in unravelling ethanolamine ammonia-lyase (EAL) activity, especially for several enteric bacteria. Need for advancing sample preparation techniques has boosted the prospects in the market. The ethanolamines market has also seen a growing body of research on carbon dioxide use, given its role in furthering the objectives of global sustainability. Over the past few years, market players have been able to explore new avenues on the back of their expanding understanding about the biochemistry mechanism of the derivatives of ethanolamines. Efforts are ongoing to incorporate this into LSC cocktails, and players are working actively working on alternatives since there are numerous challenges.

The currently emerging COVID-19 pandemic and the numerous outbreaks in several countries have led to vast repercussions on populations’ health and the general wellness. The fallouts led to several snags and posed challenges to businesses across industries. The economic downturn have adversely affected the firm production and supply, including in the chemical sector. Companies in the ethanolamines market have been quick to acknowledge the relevance of new business models to retain their agility in the post-pandemic world. Also, digital consumer connect strategies have been attracting pioneers and disruptors and businesses who want to retain their receding bottomline. All these have shaped the recent evolution trajectories in the market and are expected to change the course of research and product developments.

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Scope

1.4. Research Methodology

1.5. Assumptions

2. Executive Summary

2.1. Global Ethanolamines Market, Volume and Revenue, (Kilo Tons) (US$ Mn), 2015-2024

2.2. Market Snapshot

3. Industry Analysis

3.1. Introduction

3.2. Value Chain Analysis

3.3. Market Dynamics

3.3.1. Driver 1- Increase in Production of Glyphosate

3.3.2. Driver 2- Promising Growth in Surfactants Market

3.3.3. Restraint 1-Volatility in Raw Material Price

3.3.4. Opportunity 1-Growing Demand for Gas Sweetening Agent

3.4. Porter’s Five Forces Analysis

3.5. Market Attractiveness Analysis, by Application

3.6. Market Attractiveness Analysis, by Country

3.7. Company Market Share - Global Ethanolamines Market (% Share) (2015)

4. Raw Material & Price Trend Analysis

4.1. Raw Material Analysis – Manufacturing/Extraction Process

4.2. Ethanolamines Price Trends, 2015-2024 (US$/Ton)

5. Market Segmentation – Product Segment Analysis

5.1. Global Ethanolamines Market – Product Segment Analysis

5.1.1. Monoethanolamines Market, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

5.1.2. Diethanolamines Market, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

5.1.3. Triethanolamines Market, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

6. Market Segmentation – Application Analysis

6.1. Global Ethanolamines Market – Application Analysis

6.1.1. Global Ethanolamines Market for Surfactants, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

6.1.2. Global Ethanolamines Market for Chemical Intermediates, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

6.1.3. Global Ethanolamines Market for Herbicides, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

6.1.4. Global Ethanolamines Market for Gas Treatment, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

6.1.5. Global Ethanolamines Market for Cement, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

6.1.6. Global Ethanolamines Market for Other Applications, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7. Ethanolamines Market – Regional Analysis

7.1. Global Ethanolamines Market Snapshot

7.2. North America Ethanolamines Market Snapshot

7.2.1. North America Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.2.2. North America Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.2.3. U.S. Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.2.4. U.S. Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.2.5. Rest of North America Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.2.6. Rest of North America Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3. Europe Ethanolamines Market Snapshot

7.3.1. Europe Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.2. Europe Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.3. Germany Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.4. Germany Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.5. France Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.6. France Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.7. U.K. Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.8. U.K. Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.9. Italy Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.10. Italy Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.11. Spain Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.12. Spain Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.13. Rest of Europe Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.3.14. Rest of Europe Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4. Asia Pacific Ethanolamines Market Snapshot

7.4.1. Asia Pacific Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.2. Asia Pacific Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.3. China Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.4. China Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.5. Japan Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.6. Japan Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.7. ASEAN Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.8. ASEAN Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.9. Rest of Asia Pacific Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.4.10. Rest of Asia Pacific Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.5. Latin America Ethanolamines Market Snapshot

7.5.1. Latin America Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.5.2. Latin America Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.5.3. Brazil Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.5.4. Brazil Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.5.5. Rest of Latin America Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015- 2024

7.5.6. Rest of Latin America Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6. Middle East & Africa Ethanolamines Market Snapshot

7.6.1. Middle East & Africa Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6.2. Middle East & Africa Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6.3. GCC Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6.4. GCC Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6.5. South Africa Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6.6. South Africa Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6.7. Rest of Middle East & Africa Ethanolamines Market – Product Segment Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

7.6.8. Rest of Middle East & Africa Ethanolamines Market – Application Analysis, Volume & Revenue (Kilo Tons) (US$ Mn), 2015-2024

8. Company Profiles

8.1. Akzo Nobel N.V.

8.1.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.1.2. Business Overview

8.1.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.1.4. Business Strategy

8.1.5. Recent Developments

8.1.6. Financial Details by Segment & Region

8.2. BASF-YPC Company Limited

8.2.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.2.2. Business Overview

8.2.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.2.4. Business Strategy

8.3. China Petroleum & Chemical Corporation

8.3.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.3.2. Business Overview

8.3.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.3.4. Business Strategy

8.3.5. Recent Developments

8.3.6. Financial Details by Segment

8.4. Huntsman Corporation

8.4.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.4.2. Business Overview

8.4.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.4.4. Business Strategy

8.4.5. Recent Developments

8.4.6. Financial Details by Segment & Region

8.5. INEOS Group Ltd.

8.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.5.2. Business Overview

8.5.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.5.4. Business Strategy

8.5.5. Recent Developments

8.5.6. Financial Details by Segment & Region

8.6. Jiaxing Jinyan Chemical Co. Ltd.

8.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.6.2. Business Overview

8.6.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.6.4. Business Strategy

8.7. LyondellBasell Industries N.V.

8.7.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.7.2. Business Overview

8.7.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.7.4. Business Strategy

8.7.5. Financial Details by Segment & Region

8.8. SABIC

8.8.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.8.2. Business Overview

8.8.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.8.4. Business Strategy

8.8.5. Financial Details by Segment & Region

8.9. Sintez OKA LLC

8.9.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.9.2. Business Overview

8.9.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.9.4. Business Strategy

8.10. The Dow Chemical Company

8.10.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.10.2. Business Overview

8.10.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.10.4. Business Strategy

8.10.5. Financial Details by Segment & Region

8.11. Thai Ethanolamines Co. Ltd.

8.11.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

8.11.2. Business Overview

8.11.3. Product/ Services, Key Brands, Key Competitors, Key End-user Industries

8.11.4. Business Strategy

9. Primary Research - Key Findings

10. List of Key Customers

List of Tables

Table 1. Market Snapshot

Table 2. North America Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 3. North America Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 4. North America Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 5. North America Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 6. U.S. Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 7. U.S. Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 8. U.S. Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 9. U.S. Ethanolamines Market, Application Analysis by Revenue (US$ Mn), 2015-2024

Table 10. Rest of North America Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 11. Rest of North America Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 12. Rest of North America Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 13. Rest of North America Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 14. Europe Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 15. Europe Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 16. Europe Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 17. Europe Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 18. Germany Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 19. Germany Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 20. Germany Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 21. Germany Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 22. France Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 23. France Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 24. France Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 25. France Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 26. U.K. Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 27. U.K. Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 28. U.K. Ethanolamines Market, Application Analysis, by Volume, (Kilo Tons), 2015-2024

Table 29. U.K. Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 30. Italy Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 31. Italy Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 32. Italy Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 17. Europe Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 18. Germany Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 19. Germany Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 20. Germany Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 21. Germany Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 22. France Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 23. France Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 24. France Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 25. France Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 26. U.K. Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 27. U.K. Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 28. U.K. Ethanolamines Market, Application Analysis, by Volume, (Kilo Tons), 2015-2024

Table 29. U.K. Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 30. Italy Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 31. Italy Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 32. Italy Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 33. Italy Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 34. Spain Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 35. Spain Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 36. Spain Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 37. Spain Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 38. Rest of Europe Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 39. Rest of Europe Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 40. Rest of Europe Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 41. Rest of Europe Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 42. Asia Pacific Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 43. Asia Pacific Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 44. Asia Pacific Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 45. Asia Pacific Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 46. China Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 47. China Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 48. China Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 49. China Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 50. Japan Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 51. Japan Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 52. Japan Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 53. Japan Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 54. ASEAN Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 55. ASEAN Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 56. ASEAN Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 57. ASEAN Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 58. Rest of Asia Pacific Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 59. Rest of Asia Pacific Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 60. Rest of Asia Pacific Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 61. Rest of Asia Pacific Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 62. Latin America Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 63. Latin America Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 64. Latin America Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 65. Latin America Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 66. Brazil Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 67. Brazil Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 68. Brazil Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 69. Brazil Ethanolamines Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 70. Rest of Latin America Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 71. Rest of Latin America Ethanolamines Market, Product Segment Analysis, by Revenue (US$ Mn), 2015-2024

Table 72. Rest of Latin America Ethanolamines Market, Application Analysis, by Volume (Kilo Tons), 2015-2024

Table 73. Rest of Latin America Market, Application Analysis, by Revenue (US$ Mn), 2015-2024

Table 74. Middle East & Africa Ethanolamines Market, Product Segment Analysis, by Volume (Kilo Tons), 2015-2024

Table 75. Middle East & Africa Ethanolamines Market, Product Segment Analysis by Revenue (US$ Mn), 2015-2024

Table 76. Middle East & Africa Ethanolamines Market, Application Analysis by Volume (Kilo Tons), 2015-2024

Table 77. Middle East & Africa Market, Application Analysis by Revenue (US$ Mn), 2015-2024

Table 78. GCC Ethanolamines Market, Product Segment Analysis by Volume (Kilo Tons), 2015-2024

Table 79. GCC Ethanolamines Market, Product Segment Analysis by Revenue (US$ Mn), 2015-2024

Table 80. GCC Ethanolamines Market, Application Analysis by Volume (Kilo Tons), 2015-2024

Table 81. GCC Ethanolamines Market, Application Analysis by Revenue (US$ Mn), 2015-2024

Table 82. South Africa Ethanolamines Market, Product Segment Analysis by Volume (Kilo Tons), 2015-2024

Table 83. South Africa Ethanolamines Market, Product Segment Analysis by Revenue (US$ Mn), 2015-2024

Table 84. South Africa Ethanolamines Market, Application Analysis by Volume (Kilo Tons), 2015-2024

Table 85. South Africa Ethanolamines Market, Application Analysis by Revenue (US$ Mn), 2015-2024

Table 86. Rest of Middle East & Africa Ethanolamines Market, Product Segment Analysis by Volume (Kilo Tons), 2015-2024

Table 87. Rest of Middle East & Africa Ethanolamines Market, Product Segment Analysis by Revenue (US$ Mn), 2015-2024

Table 88. Rest of Middle East & Africa Market, Application Analysis by Volume (Kilo Tons), 2015-2024

Table 89. Rest of Middle East & Africa Market, Application Analysis by Revenue (US$ Mn), 2015-2024

Table 90. List of Potential Customers

List of Figures

Fig 1. Market Segmentation

Fig 2. Global Ethanolamines Market, by Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 3. Value Chain Analysis

Fig 4. Glyphosate Production Volume (Kilo Tons), 2010-2020

Fig 5. Global Surfactants Market Volume (Kilo Tons), 2015-2024

Fig 6. Global Price of Ethylene Oxide (US$/Ton)

Fig 7. Porter’s Five Forces Analysis

Fig 8. Market Attractiveness Analysis, by Application (2015)

Fig 9. Market Attractiveness Analysis, by Country & Region (2015)

Fig 10. Market Share of Players, Ethanolamines (%) (2015)

Fig 11. Raw Material Analysis – Manufacturing/Extraction Process

Fig 12. Price Trend Analysis, Ethylene Oxide & Ammonia, US$/Ton

Fig 13. Price Trend Analysis, Ethanolamines, US$/Kg

Fig 14. Global Ethanolamines Market – Product Segment Analysis

Fig 15. Global Monoethanolamines Market, Volume and Revenue, (Kilo Tons) (US$ Mn), 2015-2024

Fig 16. Global Diethanolamines Market, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 17. Global Triethanolamines, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 18. Global Ethanolamines Market – Application Analysis

Fig 19. Global Ethanolamines Market for Surfactants, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 20. Global Ethanolamines Market for Chemical Intermediates, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 21. Global Ethanolamines Market for Herbicides, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 22. Global Ethanolamines Market for Gas Treatment, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 23. Global Ethanolamines Market for Cement, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 24. Global Ethanolamines Market for Other Applications, Volume and Revenue (Kilo Tons) (US$ Mn), 2015-2024

Fig 25. Global Ethanolamines Market Snapshot

Fig 26. North America Ethanolamines Market Snapshot

Fig 27. Europe Ethanolamines Market Snapshot

Fig 28. Asia Pacific Ethanolamines Market Snapshot

Fig 29. Latin America Ethanolamines Market Snapshot

Fig 30. Middle East & Africa Ethanolamines Market Snapshot