Reports

Reports

A digital check is sent electronically to the bank to be cashed the same way as the paper check, however faster. The banks use the digital check scanner, which employs magnetic ink character recognition (MICR) to read data on a check. The MICR works by reading the line on the check that includes data such as check number, bank number, and routing number. The process has become easier and remote as with the technology, the process takes place electronically and can save time and paper. The digital check scanner works by using light sensors to pick up the contrast that if found adequate, replicates the check's appearance.

Banks are upgrading their digital platforms and technology solutions to improve customer experience in online banking. Banks presently offer a united solution with a pre-installed check scanner in the particular bank's ATM. The user or accountholder can scan the check and begin the payment process without any delay. Increased digital platforms and improvements in out-of-the-bank services are offering immense growth opportunities to the digital check scanning solutions market. Furthermore, digital check scanners dwindle fraud by validating and verifying each check process. Many financial institutions are now turning checks into digital formats in their branches so that deposits can be received electronically. These factors are driving the digital check scanning solutions market.

Many individuals are stuck in their homes due to the risk of the COVID-19 virus. Moreover, several governments have imposed a strict lockdown that limits the travel for consumers and working hours for banks, making it hard for bank transactions and check cash withdrawals. Technology and digital services are helping people to do almost all of their tasks from near homes. The digital check scanning solutions are helping banks and customers to cash the digital checks without customers having to move to the bank. In addition, as the security provided in the digital check scanners is proving to be more secure, customers are preferring digital transactions over conventional ways. This factor is propelling the digital check scanning solutions market.

Moreover, business activities are being affected by usual business challenges such as interruptions in the supply of manufacturing materials and volatile demand. However, the digital check scanning solutions market and electronics manufacturing are far from experiencing the desolating effects of the COVID-19 outbreak compared to healthcare, airlines, and hospitality industries. Many companies are seen to have sufficient inventory stocks and are adopting innovative technologies to manage production activities. With risks in public places including banks, customers are likely to prefer visiting ATMs and other check scanning places, which will drive the digital check scanning solutions market.

Banks and major enterprises are mainly focusing on the adoption of new technologies in the digital check scanning process. Banking solutions include all-in-one capture solutions to upgrade the work performance of the system, enhance security, and improve productivity. Digital check scanning solutions are expected to prove efficient for better cash flow, eliminate branch visits, and simplify the customer and banking relationship. Furthermore, there has been a significant rise in investment in advanced technology solutions for asset management, and is likely to expand in the future, which is projected to propel the digital check scanning solutions market during the forecast period.

Most banks are highlighting the installation of advanced ATM solutions with in-built digital check scanning, which will help users to process accountholder’s checks digitally within a short time. This has improved the awareness about the benefits of digital check scanning solutions among customers and enterprises. With rise in awareness, government institutes are moving toward the adoption of digital banking solutions to sustain records of all financial documents, increasing the speed of check payment for different government departments. The rising use of technological devices in financial institutions and the government sector are expected to propel the digital check scanning solutions market during the forecast period.

According to Federal Reserve information, more than 84% of accountholders visit banks at least once a year. Due to this, solution providers are proposing electronic banking solutions for banks and credit unions. Banks that operate through multiple branches are installing digital check scanner devices. However, the devices require high maintenance for the system to work for a long time. Nevertheless, manufacturers are improving the production quality and using advanced technology to overcome the maintenance challenges that will prove important to raise the demand. Owing to these factors, the global digital check scanning solutions market is expected to reach US$ 3.3 Bn by 2031, expanding at a CAGR of ~11% during the forecast period.

Analysts’ Viewpoint

The growing adoption of digital check scanning solutions, owing to increasing customer awareness is providing cost-effective solutions for all enterprise sizes, maintaining security standards. Most enterprises prefer check payments in business transactions and advanced payment solutions are proving significant and convenient options. However, the initial cost of the system or device is high for new start-ups and small businesses, which is retraining the global market growth. Solution providers must focus on less expensive and low maintenance products to dominate the digital check scanning solutions market with rising demand. Small enterprises are driving the demand for single-feed check scanning solutions to process check payments through digital platforms as well as adopting freely available payment application solutions for limited use.

Digital Check Scanning Solutions Market: Key Developments

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary – Global Digital Check Scanning Solutions Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. Impact Analysis of COVID-19 on Digital Check Scanning Solutions Market

4.4.1. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.1.1. Increase in Spending

4.4.1.2. Decrease in Spending

4.4.2. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Type

4.5.2. By End-user

4.6. Competitive Scenario and Trends

4.6.1. Digital Check Scanning Solutions Market Concentration Rate

4.6.1.1. List of Emerging, Prominent, and Leading Players

4.6.2. Mergers & Acquisitions, Expansions

4.6.3. Product Mapping of Digital Check Scanning Solutions, by Leading Players

4.7. Market Outlook

5. Global Digital Check Scanning Solutions Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2020

5.1.2. Forecast Trends, 2021-2031

5.2. Market Volume Analysis (Thousand Units), 2016-2031

5.2.1. Historic Growth Trends, 2016-2020

5.2.2. Forecast Trends, 2021-2031

5.3. Pricing Model Analysis/ Price Trend Analysis

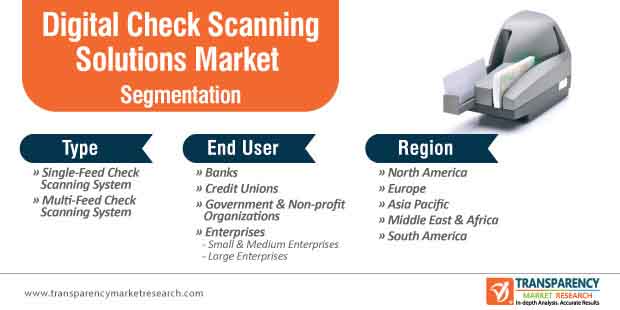

6. Global Digital Check Scanning Solutions Market Analysis, by Type

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Forecast, by Type, 2018 - 2031

6.3.1. Single-Feed Check Scanning System

6.3.2. Multi-Feed Check Scanning System

7. Global Digital Check Scanning Solutions Market Analysis, by End-user

7.1. Key Segment Analysis

7.2. Digital Check Scanning Solutions Market Size (US$ Mn) Forecast, by End-user, 2018 - 2031

7.2.1. Banks

7.2.2. Credit Unions

7.2.3. Government & Non-profit Organizations

7.2.4. Enterprises

7.2.4.1. Small & Medium Enterprises

7.2.4.2. Large Enterprises

8. Global Digital Check Scanning Solutions Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Forecast, by Region, 2018 - 2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Digital Check Scanning Solutions Market Analysis

9.1. Regional Outlook

9.2. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Analysis and Forecast (2018 - 2031)

9.2.1. By Type

9.2.2. By End-user

9.3. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Forecast, by Country & Sub-region, 2018 - 2031

9.3.1. U.S.

9.3.2. Canada

9.3.3. Rest of North America

10. Europe Digital Check Scanning Solutions Market Analysis and Forecast

10.1. Regional Outlook

10.2. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Analysis and Forecast (2018 - 2031)

10.2.1. By Type

10.2.2. By End-user

10.3. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Forecast, by Country & Sub-region, 2018 - 2031

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Spain

10.3.5. Italy

10.3.6. Rest of Europe

11. Asia Pacific Digital Check Scanning Solutions Market Analysis and Forecast

11.1. Regional Outlook

11.2. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Analysis and Forecast (2018 - 2031)

11.2.1. By Type

11.2.2. By End-user

11.3. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. China

11.3.2. Japan

11.3.3. India

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa Digital Check Scanning Solutions Market Analysis and Forecast

12.1. Regional Outlook

12.2. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Analysis and Forecast (2018 - 2031)

12.2.1. By Type

12.2.2. By End-user

12.3. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. United Arab Emirates (UAE)

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

13. South America Digital Check Scanning Solutions Market Analysis and Forecast

13.1. Regional Outlook

13.2. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Analysis and Forecast (2018 - 2031)

13.2.1. By Type

13.2.2. By End-user

13.3. Digital Check Scanning Solutions Market Size (US$ Mn & Thousand Unit) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2020)

15. Company Profiles

15.1. ALOGENT

15.1.1. Business Overview

15.1.2. Product Portfolio

15.1.3. Geographical Footprint

15.1.4. Revenue and Strategy

15.2. ARCA Tech Systems, LLC

15.2.1. Business Overview

15.2.2. Product Portfolio

15.2.3. Geographical Footprint

15.2.4. Revenue and Strategy

15.3. Canon U.S.A., Inc.

15.3.1. Business Overview

15.3.2. Product Portfolio

15.3.3. Geographical Footprint

15.3.4. Revenue and Strategy

15.4. Digital Check Corp

15.4.1. Business Overview

15.4.2. Product Portfolio

15.4.3. Geographical Footprint

15.4.4. Revenue and Strategy

15.5. Epson America, Inc.

15.5.1. Business Overview

15.5.2. Product Portfolio

15.5.3. Geographical Footprint

15.5.4. Revenue and Strategy

15.6. Fujitsu Limited

15.6.1. Business Overview

15.6.2. Product Portfolio

15.6.3. Geographical Footprint

15.6.4. Revenue and Strategy

15.7. MagTek Inc.

15.7.1. Business Overview

15.7.2. Product Portfolio

15.7.3. Geographical Footprint

15.7.4. Revenue and Strategy

15.8. Murni Solusindo Nusantara

15.8.1. Business Overview

15.8.2. Product Portfolio

15.8.3. Geographical Footprint

15.8.4. Revenue and Strategy

15.9. NCR Corporation

15.9.1. Business Overview

15.9.2. Product Portfolio

15.9.3. Geographical Footprint

15.9.4. Revenue and Strategy

15.10. NIMBLE

15.10.1. Business Overview

15.10.2. Product Portfolio

15.10.3. Geographical Footprint

15.10.4. Revenue and Strategy

15.11. Panini S.p.A.

15.11.1. Business Overview

15.11.2. Product Portfolio

15.11.3. Geographical Footprint

15.11.4. Revenue and Strategy

15.12. RDM, (A Deleux Company)

15.12.1. Business Overview

15.12.2. Product Portfolio

15.12.3. Geographical Footprint

15.12.4. Revenue and Strategy

15.13. Source Technologies

15.13.1. Business Overview

15.13.2. Product Portfolio

15.13.3. Geographical Footprint

15.13.4. Revenue and Strategy

15.14. The Eastman Kodak Company

15.14.1. Business Overview

15.14.2. Product Portfolio

15.14.3. Geographical Footprint

15.14.4. Revenue and Strategy

15.15. WitsEnds Software

15.15.1. Business Overview

15.15.2. Product Portfolio

15.15.3. Geographical Footprint

15.15.4. Revenue and Strategy

16. Key Takeaways

List of Tables

Table 1: Acronyms Used in Digital Check Scanning Solutions Market

Table 2: List of Primary and Secondary Resources

Table 3: Forecast Factors: Relevance and Impact

Table 4: Impact Analysis of Drivers & Restraint

Table 5: Mergers & Acquisitions, Expansions, Partnership

Table 6: Product Mapping of Digital Check Scanning Solutions, by Leading Players

Table 7: Global Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 8: Global Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 9: Global Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 10: Global Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Region, 2018 - 2031

Table 11: North America Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 12: North America Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 13: North America Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 14: North America Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 15: U.S. Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 16: U.S. Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 17: U.S. Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 18: Canada Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 19: Canada Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 20: Canada Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 21: Europe Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 22: Europe Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 23: Europe Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 24: Europe Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 25: Europe Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Country, 2018 - 2031

Table 26: Asia Pacific Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 27: Asia Pacific Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 28: Asia Pacific Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 29: Asia Pacific Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 30: Asia Pacific Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Country, 2018 - 2031

Table 31: Middle East & Africa Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 32: Middle East & Africa Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 33: Middle East & Africa Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 34: Middle East & Africa Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 35: Middle East & Africa Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Country, 2018 - 2031

Table 36: South America Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Type, 2018 – 2031

Table 37: South America Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Type, 2018 – 2031

Table 38: South America Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 39: South America Digital Check Scanning Solutions Market Value (US$ Mn) Forecast, by Country, 2018 – 2031

Table 40: South America Digital Check Scanning Solutions Market Volume (000’ Units) Forecast, by Country, 2018 - 2031

List of Figures

Figure 1: Global Digital Check Scanning Solutions Market Size (US$ Mn) Forecast, 2018–2031

Figure 2: North America Digital Check Scanning Solutions Market Size (000’ Units) Forecast, 2018–2031

Figure 3: North America Digital Check Scanning Solutions Y-o-Y Trend

Figure 4: Global Digital Check Scanning Solutions Market Attractiveness Assessment, by Type

Figure 5: Global Digital Check Scanning Solutions Market Attractiveness Assessment, by End-user

Figure 6: Global Digital Check Scanning Solutions Market Attractiveness Assessment, by Region

Figure 7: Global Digital Check Scanning Solutions Market, by Type, Revenue (%) (2021-2031)

Figure 8: Global Digital Check Scanning Solutions Market, by End-user, Revenue (%) (2021-2031)

Figure 9: Global Digital Check Scanning Solutions Market, by Country, Revenue (%)

Figure 10: Global Digital Check Scanning Solutions Market: Snapshot

Figure 11: Global Digital Check Scanning Solutions Market Historic Growth Trends (US$ Mn), 2016 – 2020

Figure 12: Global Digital Check Scanning Solutions Market Revenue Opportunity (US$ Mn) Historic Trends, 2016 - 2020

Figure 13: Global Digital Check Scanning Solutions Market: Snapshot

Figure 14: Global Digital Check Scanning Solutions Market Historic Growth Trends (000’ Units), 2016 – 2020

Figure 15: Global Digital Check Scanning Solutions Market Volume Opportunity (000’ Units) Historic Trends, 2016 - 2020

Figure 16: Global Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 17: Global Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 18: Global Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 19: Global Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 20: Global Digital Check Scanning Solutions Market Opportunity (US$ Mn), by Region

Figure 21: Global Digital Check Scanning Solutions Market Opportunity Share (%), by Region, 2021–2031

Figure 22: Global Digital Check Scanning Solutions Market Size (US$ Mn), by Region, 2021 & 2031

Figure 23: Global Digital Check Scanning Solutions Market Value Share Analysis, by Region, 2021

Figure 24: Global Digital Check Scanning Solutions Market Value Share Analysis, by Region, 2031

Figure 25: North America Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 26: North America Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 27: North America Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 28: North America Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 29: North America Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2021

Figure 30: North America Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2031

Figure 31: U.S. Digital Check Scanning Solutions Market: Snapshot

Figure 32: U.S. Digital Check Scanning Solutions Market: Snapshot

Figure 33: U.S. Digital Check Scanning Solutions Market Revenue Opportunity Share, by Type

Figure 34: U.S. Digital Check Scanning Solutions Market Revenue Opportunity Share, by End-user

Figure 35: U.S. Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 36: U.S. Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 37: U.S. Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 38: U.S. Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 39: Canada Digital Check Scanning Solutions Market: Snapshot

Figure 40: Canada Digital Check Scanning Solutions Market: Snapshot

Figure 41: Canada Digital Check Scanning Solutions Market Revenue Opportunity Share, by Type

Figure 42: Canada Digital Check Scanning Solutions Market Revenue Opportunity Share, by End-user

Figure 43: Canada Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 44: Canada Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 45: Canada Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 46: Canada Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 47: Europe Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 48: Europe Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 49: Europe Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 50: Europe Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 51: Europe Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2021

Figure 52: Europe Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2031

Figure 53: Germany Digital Check Scanning Solutions Market: Snapshot

Figure 54: Germany Digital Check Scanning Solutions Market: Snapshot

Figure 55: U.K. Digital Check Scanning Solutions Market: Snapshot

Figure 56: U.K. Digital Check Scanning Solutions Market: Snapshot

Figure 57: France Digital Check Scanning Solutions Market: Snapshot

Figure 58: France Digital Check Scanning Solutions Market: Snapshot

Figure 59: Spain Digital Check Scanning Solutions Market: Snapshot

Figure 60: Spain Digital Check Scanning Solutions Market: Snapshot

Figure 61: Italy Digital Check Scanning Solutions Market: Snapshot

Figure 62: Italy Digital Check Scanning Solutions Market: Snapshot

Figure 63: Rest of Europe Digital Check Scanning Solutions Market: Snapshot

Figure 64: Rest of Europe Digital Check Scanning Solutions Market: Snapshot

Figure 65: Asia Pacific Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 66: Asia Pacific Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 67: Asia Pacific Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 68: Asia Pacific Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 69: Asia Pacific Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2021

Figure 70: Asia Pacific Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2031

Figure 71: China Digital Check Scanning Solutions Market: Snapshot

Figure 72: China Digital Check Scanning Solutions Market: Snapshot

Figure 73: Japan Digital Check Scanning Solutions Market: Snapshot

Figure 74: Japan Digital Check Scanning Solutions Market: Snapshot

Figure 75: India Digital Check Scanning Solutions Market: Snapshot

Figure 76: India Digital Check Scanning Solutions Market: Snapshot

Figure 77: ASEAN Digital Check Scanning Solutions Market: Snapshot

Figure 78: ASEAN Digital Check Scanning Solutions Market: Snapshot

Figure 79: Rest of Asia Pacific Digital Check Scanning Solutions Market: Snapshot

Figure 80: Rest of Asia Pacific Digital Check Scanning Solutions Market: Snapshot

Figure 81: Middle East & Africa Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 82: Middle East & Africa Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 83: Middle East & Africa Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 84: Middle East & Africa Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 85: Middle East & Africa Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2021

Figure 86: Middle East & Africa Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2031

Figure 87: UAE Digital Check Scanning Solutions Market: Snapshot

Figure 88: UAE Digital Check Scanning Solutions Market: Snapshot

Figure 89: South Africa Digital Check Scanning Solutions Market: Snapshot

Figure 90: South Africa Digital Check Scanning Solutions Market: Snapshot

Figure 91: Rest of Middle East & Africa Digital Check Scanning Solutions Market: Snapshot

Figure 92: Rest of Middle East & Africa Digital Check Scanning Solutions Market: Snapshot

Figure 93: South America Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2021

Figure 94: South America Digital Check Scanning Solutions Market Value Share Analysis, by Type, 2031

Figure 95: South America Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2021

Figure 96: South America Digital Check Scanning Solutions Market Value Share Analysis, by End-user, 2031

Figure 97: South America Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2021

Figure 98: South America Digital Check Scanning Solutions Market Value Share Analysis, by Country, 2031

Figure 99: Brazil Digital Check Scanning Solutions Market: Snapshot

Figure 100: Brazil Digital Check Scanning Solutions Market: Snapshot

Figure 101: Argentina Digital Check Scanning Solutions Market: Snapshot

Figure 102: Argentina Digital Check Scanning Solutions Market: Snapshot

Figure 103: Rest of South America Digital Check Scanning Solutions Market: Snapshot

Figure 104: Rest of South America Digital Check Scanning Solutions Market: Snapshot