Reports

Reports

DevOps market is growing at a robust rate, driven by the increasing demand for quicker software release and enhanced cooperation among the operations and development teams. Companies are increasingly moving toward continuous integration and continuous deployment (CI/CD) to speed up release cycles and deliver better quality applications.

The digitalization of businesses has also compelled organizations to embrace DevOps culture in a bid to stay competitive. Additionally, high demand for the automation of software development, testing, and deployment is increasing productivity rates while decreasing the rate of human mistakes, thereby making DevOps a driving force for agile business operation.

The second of the key drivers in the DevOps marketplace is increasing customer-centric application development. Additionally, the trend of micro services and containerization is generating the need for effective DevOps pipelines to handle intricate software design. This trend is making DevOps obligatory for organizations that wish to reduce feedback loops and deliver novelty.

Recent trends in the DevOps market reflect the ongoing development of practices to solve contemporary IT problems. Infrastructure as Code (IaC) is increasing relevant as IaC enables teams to manage and provide infrastructure as code with consistency, and it allows for infrastructure growth. Another prevalent trend within the DevOps marketplace is observability and monitoring practices. This is important, as it enables complete end-to-end observability throughout being implemented.

Besides, there is a growing necessity to infuse security into DevOps, which is popularly known as DevSecOps, which is being used for vulnerability detection at an early stage in the development process. Low-code and no-code platforms are also starting to be embraced by organizations into DevOps cycles to enable non-technical teams' collaboration on application delivery.

The competitive environment in the DevOps market is marked by continuous expansion of the capabilities of the solutions and the companies’ ingenuity. Firms are pouring large sums to upgrade automation throughout the development pipeline and rolling out new features in monitoring, security, and testing.

Numerous companies are also launching managed services and training courses to be of assistance to enterprises in the implementation process. Furthermore, the creation of open-source software and community-driven projects has become a major aspect, as they provide the potential for innovation and offer adaptability to businesses of different sizes.

DevOps is an interactive framework that integrates IT operations (Ops) and software development (Dev) to automate application deployment, build, test, and maintenance. DevOps allows continuous integration, continuous delivery, and continuous monitoring in an attempt to improve the quality of software and minimize the release cycles. DevOps aims to improve deployment frequency and reduce time to market while enhancing overall product quality.

Automation probably plays an essential role among DevOps practices, facilitating all stages of software lifecycle, right from code integration up to deployment and monitoring. Automation reduces human interventions to a bare minimum, removes errors, and promotes uniformity, thus enabling teams to discharge their stable applications at a high turnover rate. DevOps automation tools make it easier to carry out various operations such as configuration management, infrastructure provisioning, and testing.

Continuous monitoring and feedback are the other key ingredient in DevOps. Owing to the deployment of monitoring products, teams have end-to-end visibility into the performance of the application and infrastructure health and user experience in real-time. Monitoring products enable teams to find bottlenecks or security exposures proactively before they become issues that need to be triaged.

DevOps is a sign of collaboration, beliefs, and responsibility within teams. Rather than work internally, operations, testers, and developers are accountable for the product and product lifecycle.

| Attribute | Detail |

|---|---|

| DevOps Market Drivers |

|

Cloud computing adoption is a major driving factor for the DevOps market due to its flexibility, scalability, and continuous development and deployment infrastructure. Cloud platforms let organizations establish and manage the development pipeline with ease without having to invest heavily in on-premises infrastructure. This frictionless access enables cross-functional teams to be dispersed, work together, and optimize software delivery operations more effectively, and hence cloud platforms become the natural underpinning for DevOps practices.

One of the biggest advantages DevOps gains from cloud computing is the on-demand resource provisioning. The usage of cloud DevOps also allows seamless integration with CI/CD pipelines, which means faster and cost-effective updates by developers. This feature allows businesses to keep their workloads flexible and be able to quickly expand their software applications without stoppages or downtime.

Besides, cloud services make automation more accessible in DevOps. The use of resources through the method of Infrastructure as Code (IaC) coupled with the automated testing and deployment makes it possible for cloud services to simplify the repetitive processes without losing accuracy.

Furthermore, such automation not only decreases the burden on manual operations but also the possibility of human error is lowered and higher consistency across environments is ensured, which is important in the case of software release at high speeds.

Additionally, cloud computing supports innovation by giving access to advanced analytics, monitoring, and collaboration tools, which are part of the DevOps ecosystem. The teams can see the real-time performance of the application and hence they can find the problem quicker and practice continuous improvement. The migration of enterprises to cloud has become a major trend over time, thus the adoption of DevOps is poised to follow the same pace. This is due to the fact that cloud-based DevOps is the driving force for the new delivery models that are agile, efficient, and scalable.

Machine learning and artificial intelligence have come together to transform DevOps processes by automating the software development lifecycle processes, increasing the efficiency, and enabling well-informed decision-making across the software development life cycle. Through most of the DevOps business, AI and ML are seen as tools that add value by speeding operations and increasing collaboration. Consequently, the predictive element enables institutions to operate without interruption while progressing software quality at the same time.

AI and ML also constitute a new brick in the automation part of the DevOps pipelines. One of the automation benefits is the implementation of intelligent bots and algorithms that are capable of performing routine tasks, such as code reviewing, testing, and monitoring, in a faster way and with higher accuracy. Also, the self-healing AI-powered systems can not only locate the problem but fix it automatically, thus, reducing the number of manual interventions.

The collaboration aspect has been further enhanced by the availability of AI-powered insights into easily understandable recommendations for stakeholders. Monitoring can be one of the activities that is poised to greatly benefit from automation and the use of advanced monitoring tools complemented with ML for the analysis of logs and metrics. The system's health and performance are visible to the team in real-time, thus paving the way for data-driven decisions and continuous learning, which are the core principles of DevOps. Thus, the incorporation of AI and ML makes the workflow of DevOps more intelligent, autonomous, and adaptable.

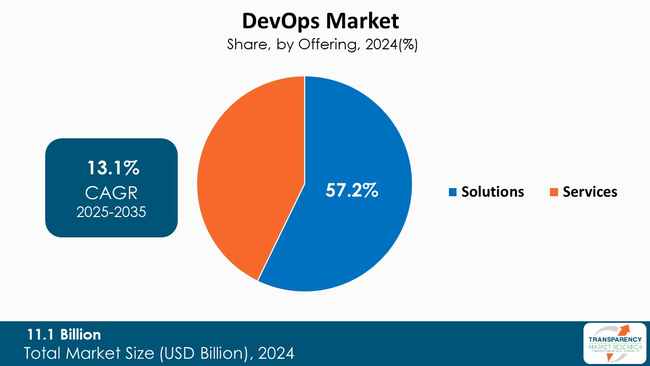

The solutions segment is leading the DevOps market as organizations are adopting all-in-one tools for the entire software development lifecycle to be more efficient. Automation, integration, and monitoring provided by DevOps solutions are the primary factors leading to faster and more stable application delivery. By allowing the use of CI/CD, infrastructure as code, and security integration, these products become the driving force behind efficiency, the reduction of organizational errors, and the setting of an innovation pace.

Moreover, the complicated nature of IT environments and the necessity for smooth exchange of ideas and collaboration between different teams have been the major factors toward the need for a robust DevOps platform. These solutions give the customer the possibility of scalability, flexibility, and even visibility from start to finish, hence they are the first option for enterprises looking for agility and operational excellence.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest DevOps market analysis, North America dominated in 2024. This is due to the region's well developed technological infrastructure and enterprises, which are known to be quick in adopting innovative practices. The region is home to industries that are going through digital transformation driving the need for faster and more reliable software delivery. The availability of skilled professionals and the general adoption of agile methodologies, have a positive effect on the implementation of DevOps.

Besides that, North America also has the advantage of being the first to use highly developed tools, automation frameworks, and modern IT architectures such as microservices and containers. The region is a leader in the use of DevOps for business agility and competitiveness due to strong investments in R&D and a very mature ecosystem for software development.

Market players dealing with DevOps concentrate their efforts on the improvement of automation capabilities, broadening of product portfolios through innovation, and the integration of security within pipelines. Besides, these firms are forging strategic collaborations, partnerships, and acquisitions to consolidate their position in the market while investing in managed services, open-source tools, and training programs to speed up the market uptake and enhance the relationship with clients.

Atlassian, GitLab Inc., GitHub, Inc., Docker Inc., Red Hat, IBM, Microsoft, Google LLC, Amazon Web Services, Inc., CloudBees, Inc., JFrog Ltd., Circle Internet Services, Inc., JetBrains s.r.o., Splunk LLC, and DYNATRACE LLC are some of the leading players operating in the global DevOps market.

Each of these players has been profiled in the DevOps market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

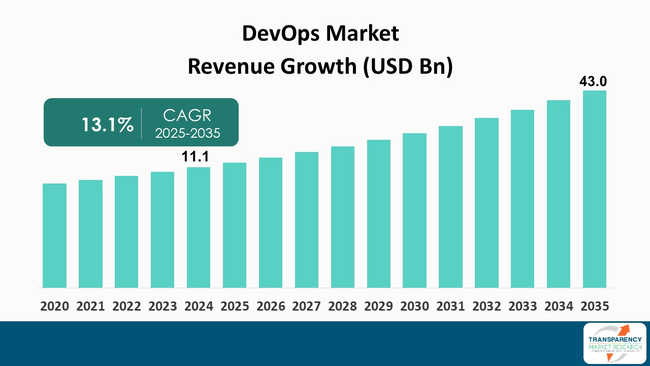

| Size in 2024 | US$ 11.1 Bn |

| Forecast Value in 2035 | US$ 43.0 Bn |

| CAGR | 13.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| DevOps Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Offering

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global DevOps market was valued at US$ 11.1 Bn in 2024

The global DevOps industry is projected to reach more than US$ 43.0 Bn by the end of 2035

The demand for faster software delivery, increased adoption of cloud computing, the emphasis on automation and continuous integration/delivery (CI/CD) to improve efficiency, the need for better collaboration between development and operations teams, and the rise of microservices and hybrid cloud architectures are some of the factors driving the expansion of DevOps market.

The CAGR is anticipated to be 13.1% from 2025 to 2035

Atlassian, GitLab Inc., GitHub, Inc., Docker Inc., Red Hat, IBM, Microsoft, Google LLC, Amazon Web Services, Inc., CloudBees, Inc., JFrog Ltd., Circle Internet Services, Inc., JetBrains s.r.o., Splunk LLC, and DYNATRACE LLC

Table 01: Global DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 02: Global DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 03: Global DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 04: Global DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 05: Global DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 06: Global DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 07: Global DevOps Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America DevOps Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 10: North America DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 11: North America DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 12: North America DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 13: North America DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 14: North America DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 15: U.S. DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 16: U.S. DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 17: U.S. DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 18: U.S. DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 19: U.S. DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 20: U.S. DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 21: Canada DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 22: Canada DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 23: Canada DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 24: Canada DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 25: Canada DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 26: Canada DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 27: Europe DevOps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 28: Europe DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 29: Europe DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 30: Europe DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 31: Europe DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 32: Europe DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 33: Europe DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 34: UK DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 35: UK DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 36: UK DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 37: UK DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 38: UK DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 39: UK DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 40: Germany DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 41: Germany DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 42: Germany DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 43: Germany DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 44: Germany DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 45: Germany DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 46: Italy DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 47: Italy DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 48: Italy DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 49: Italy DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 50: Italy DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 51: Italy DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 52: Spain DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 53: Spain DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 54: Spain DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 55: Spain DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 56: Spain DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 57: Spain DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 58: The Netherlands DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 59: The Netherlands DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 60: The Netherlands DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 61: The Netherlands DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 62: The Netherlands DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 63: The Netherlands DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 64: Rest of Europe DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 65: Rest of Europe DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 66: Rest of Europe DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 67: Rest of Europe DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 68: Rest of Europe DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 69: Rest of Europe DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 70: Asia Pacific DevOps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 71: Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 72: Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 73: Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 74: Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 75: Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 76: Asia Pacific DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 77: China DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 78: China DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 79: China DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 80: China DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 81: China DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 82: China DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 83: India DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 84: India DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 85: India DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 86: India DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 87: India DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 88: India DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 89: Japan DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 90: Japan DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 91: Japan DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 92: Japan DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 93: Japan DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 94: Japan DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 95: Australia DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 96: Australia DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 97: Australia DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 98: Australia DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 99: Australia DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 100: Australia DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 101: South Korea DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 102: South Korea DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 103: South Korea DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 104: South Korea DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 105: South Korea DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 106: South Korea DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 107: ASEAN DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 108: ASEAN DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 109: ASEAN DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 110: ASEAN DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 111: ASEAN DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 112: ASEAN DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 113: Rest of Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 114: Rest of Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 115: Rest of Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 116: Rest of Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 117: Rest of Asia Pacific DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 118: Rest of Asia Pacific DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 119: Latin America DevOps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 120: Latin America DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 121: Latin America DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 122: Latin America DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 123: Latin America DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 124: Latin America DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 125: Latin America DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 126: Brazil DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 127: Brazil DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 128: Brazil DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 129: Brazil DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 130: Brazil DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 131: Brazil DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 132: Argentina DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 133: Argentina DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 134: Argentina DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 135: Argentina DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 136: Argentina DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 137: Argentina DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 138: Mexico DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 139: Mexico DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 140: Mexico DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 141: Mexico DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 142: Mexico DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 143: Mexico DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 144: Rest of Latin America DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 145: Rest of Latin America DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 146: Rest of Latin America DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 147: Rest of Latin America DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 148: Rest of Latin America DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 149: Rest of Latin America DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 150: Middle East & Africa DevOps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 151: Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 152: Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 153: Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 154: Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 155: Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 156: Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 157: GCC Countries DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 158: GCC Countries DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 159: GCC Countries DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 160: GCC Countries DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 161: GCC Countries DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 162: GCC Countries DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 163: South Africa DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 164: South Africa DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 165: South Africa DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 166: South Africa DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 167: South Africa DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 168: South Africa DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 169: Rest of Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 170: Rest of Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Solutions, 2020 to 2035

Table 171: Rest of Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 172: Rest of Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 173: Rest of Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 174: Rest of Middle East & Africa DevOps Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Figure 01: Global DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 02: Global DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 03: Global DevOps Market Revenue (US$ Bn), by Solutions, 2020 to 2035

Figure 04: Global DevOps Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 05: Global DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 06: Global DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 07: Global DevOps Market Revenue (US$ Bn), by Public Cloud, 2020 to 2035

Figure 08: Global DevOps Market Revenue (US$ Bn), by Private Cloud, 2020 to 2035

Figure 09: Global DevOps Market Revenue (US$ Bn), by Hybrid, 2020 to 2035

Figure 10: Global DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 11: Global DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 12: Global DevOps Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 13: Global DevOps Market Revenue (US$ Bn), by Small and Medium Enterprises (SMEs), 2020 to 2035

Figure 14: Global DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 15: Global DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 16: Global DevOps Market Revenue (US$ Bn), by BFSI, 2020 to 2035

Figure 17: Global DevOps Market Revenue (US$ Bn), by Retail and Consumer Goods, 2020 to 2035

Figure 18: Global DevOps Market Revenue (US$ Bn), by Government and Public Sector, 2020 to 2035

Figure 19: Global DevOps Market Revenue (US$ Bn), by Manufacturing, 2020 to 2035

Figure 20: Global DevOps Market Revenue (US$ Bn), by IT & Telecommunication, 2020 to 2035

Figure 21: Global DevOps Market Revenue (US$ Bn), by Healthcare and Life Sciences, 2020 to 2035

Figure 22: Global DevOps Market Revenue (US$ Bn), by Energy and Utilities, 2020 to 2035

Figure 23: Global DevOps Market Revenue (US$ Bn), by Media and Entertainment, 2020 to 2035

Figure 24: Global DevOps Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global DevOps Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global DevOps Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America DevOps Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America DevOps Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 31: North America DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 32: North America DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 33: North America DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 34: North America DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 35: North America DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 36: North America DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 37: North America DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 38: U.S. - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: U.S. - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 40: U.S. - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 41: U.S. - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 42: U.S. - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 43: U.S. - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 44: U.S. - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 45: U.S. - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 46: U.S. - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 47: Canada - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Canada - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 49: Canada - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 50: Canada - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 51: Canada - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 52: Canada - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 53: Canada - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 54: Canada - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 55: Canada - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 56: Europe - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Europe - DevOps Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 58: Europe - DevOps Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 59: Europe - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 60: Europe - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 61: Europe - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 62: Europe - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 63: Europe - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 64: Europe - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 65: Europe - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 66: Europe - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 67: UK - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: UK - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 69: UK - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 70: UK - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 71: UK - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 72: UK - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 73: UK - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 74: UK - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 75: UK - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 76: Germany - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: Germany - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 78: Germany - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 79: Germany - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 80: Germany - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 81: Germany - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 82: Germany - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 83: Germany - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 84: Germany - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 85: France - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 86: France - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 87: France - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 88: France - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 89: France - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 90: France - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 91: France - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 92: France - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 93: France - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 94: Italy - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: Italy - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 96: Italy - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 97: Italy - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 98: Italy - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 99: Italy - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 100: Italy - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 101: Italy - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 102: Italy - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 103: Spain - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: Spain - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 105: Spain - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 106: Spain - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 107: Spain - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 108: Spain - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 109: Spain - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 110: Spain - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 111: Spain - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 112: The Netherlands - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 113: The Netherlands - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 114: The Netherlands - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 115: The Netherlands - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 116: The Netherlands - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 117: The Netherlands - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 118: The Netherlands - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 119: The Netherlands - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 120: The Netherlands - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 121: Rest of Europe - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 122: Rest of Europe - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 123: Rest of Europe - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 124: Rest of Europe - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 125: Rest of Europe - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 126: Rest of Europe - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 127: Rest of Europe - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 128: Rest of Europe - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 129: Rest of Europe - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 130: Asia Pacific - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 131: Asia Pacific - DevOps Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 132: Asia Pacific - DevOps Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 133: Asia Pacific - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 134: Asia Pacific - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 135: Asia Pacific - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 136: Asia Pacific - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 137: Asia Pacific - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 138: Asia Pacific - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 139: Asia Pacific - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 140: Asia Pacific - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 141: China - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 142: China - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 143: China - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 144: China - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 145: China - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 146: China - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 147: China - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 148: China - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 149: China - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 150: India - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 151: India - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 152: India - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 153: India - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 154: India - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 155: India - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 156: India - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 157: India - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 158: India - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 159: Japan - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 160: Japan - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 161: Japan - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 162: Japan - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 163: Japan - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 164: Japan - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 165: Japan - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 166: Japan - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 167: Japan - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 168: Australia - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 169: Australia - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 170: Australia - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 171: Australia - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 172: Australia - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 173: Australia - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 174: Australia - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 175: Australia - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 176: Australia - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 177: South Korea - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 178: South Korea - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 179: South Korea - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 180: South Korea - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 181: South Korea - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 182: South Korea - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 183: South Korea - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 184: South Korea - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 185: South Korea - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 186: ASEAN - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 187: ASEAN - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 188: ASEAN - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 189: ASEAN - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 190: ASEAN - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 191: ASEAN - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 192: ASEAN - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 193: ASEAN - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 194: ASEAN - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 195: Rest of Asia Pacific - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: Rest of Asia Pacific - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 197: Rest of Asia Pacific - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 198: Rest of Asia Pacific - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 199: Rest of Asia Pacific - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 200: Rest of Asia Pacific - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 201: Rest of Asia Pacific - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 202: Rest of Asia Pacific - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 203: Rest of Asia Pacific - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 204: Rest of Asia Pacific Enterprise Risk Management Market Value Share Analysis, By End-user, 2024 and 2035

Figure 205: Rest of Asia Pacific Enterprise Risk Management Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 206: Latin America - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 207: Latin America - DevOps Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 208: Latin America - DevOps Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 209: Latin America - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 210: Latin America - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 211: Latin America - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 212: Latin America - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 213: Latin America - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 214: Latin America - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 215: Latin America - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 216: Latin America - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 217: Brazil - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 218: Brazil - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 219: Brazil - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 220: Brazil - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 221: Brazil - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 222: Brazil - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 223: Brazil - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 224: Brazil - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 225: Brazil - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 226: Argentina - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 227: Argentina - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 228: Argentina - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 229: Argentina - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 230: Argentina - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 231: Argentina - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 232: Argentina - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 233: Argentina - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 234: Argentina - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 235: Mexico - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 236: Mexico - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 237: Mexico - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 238: Mexico - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 239: Mexico - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 240: Mexico - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 241: Mexico - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 242: Mexico - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 243: Mexico - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 244: Rest of Latin America - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 245: Rest of Latin America - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 246: Rest of Latin America - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 247: Rest of Latin America - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 248: Rest of Latin America - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 249: Rest of Latin America - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 250: Rest of Latin America - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 251: Rest of Latin America - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 252: Rest of Latin America - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 253: Middle East & Africa - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 254: Middle East & Africa - DevOps Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 255: Middle East & Africa - DevOps Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 256: Middle East & Africa - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 257: Middle East & Africa - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 258: Middle East & Africa - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 259: Middle East & Africa - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 260: Middle East & Africa - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 261: Middle East & Africa - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 262: Middle East & Africa - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 263: Middle East & Africa - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 264: GCC Countries - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 265: GCC Countries - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 266: GCC Countries - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 267: GCC Countries - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 268: GCC Countries - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 269: GCC Countries - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 270: GCC Countries - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 271: GCC Countries - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 272: GCC Countries - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 273: South Africa - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 274: South Africa - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 275: South Africa - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 276: South Africa - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 277: South Africa - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 278: South Africa - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 279: South Africa - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 280: South Africa - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 281: South Africa - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 282: Rest of Middle East & Africa - DevOps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 283: Rest of Middle East & Africa - DevOps Market Value Share Analysis, By Offering, 2024 and 2035

Figure 284: Rest of Middle East & Africa - DevOps Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 285: Rest of Middle East & Africa - DevOps Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 286: Rest of Middle East & Africa - DevOps Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 287: Rest of Middle East & Africa - DevOps Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 288: Rest of Middle East & Africa - DevOps Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 289: Rest of Middle East & Africa - DevOps Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 290: Rest of Middle East & Africa - DevOps Market Attractiveness Analysis, By End-use Industry, 2025 to 2035