Reports

Reports

Global Data Center IT Asset Disposition Market: Snapshot

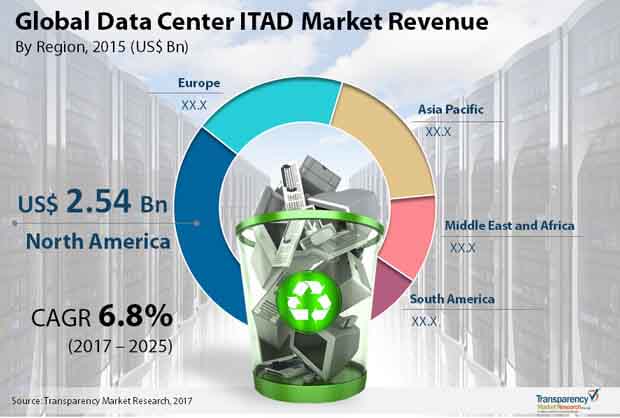

The demand in the global data center IT asset disposition market is projected to increment at a healthy CAGR of 6.8% during the forecast period of 2017 to 2025, gaining traction from a number of factors such as growing emphasis on the development of new electronic products, categorical innovations in the IT industry across the world, regulatory policies for the maintenance of environment safety, data security from old assets, and increasing adoption of new technology across various enterprises. On the other hand, lack of awareness, high service cost, and lenient IT asset disposition polices in various countries are a few factors hindering the proper prosperity of the market.

The global data center IT asset disposition market will be worth US$13.87 bn by the end of 2025, substantially up from its evaluated worth of US$7.74 bn in 2016. In terms of volume, the data center IT asset disposition market will be catering to 91 mn units by 2025. Increasing adoption of cloud services across the world is incrementing the efficient and secure elimination of discarded devices. This factor will continue to open new opportunities for the stockholders of the global data center IT asset disposition market.

Servers Serve Maximum Demand, Asset-type Segment

Based on asset-type, the global data center IT asset disposition market is segmented into server, HDD, memory modules, CPU, GBIC, line cards, laptops, desktops, and SSD. Among these, SSD, memory module and server segment are the major asset types supplementing the growth of data center IT asset disposition market in forthcoming years. By service, global data center IT asset disposition market is categorized into data sanitation/ destruction, remarketing/resale and recycling. Among these services, data sanitation/ destruction and remarketing/resale are the key segments supplementing the growth of data center IT asset disposition market. Market players are implementing aggressive remarketing strategies to attract enterprise level customers and increase their output in terms of remarketed products sold.

U.S. Highly Lucrative Country-wide Data Center IT Asset Disposition Market

Stringent government regulations and sustained demand for data protection has kept North America as the most profitable region among all, constituting for 34% of the market in 2015. The North America data center IT asset disposition market is projected to be worth US$4.40 bn by the end of the forecast period, which is 2025, gaining maximum demand from the developed country of the U.S. IT assets are frequently being changed due to constant technology upgrades within cloud data centers in the region, creating the need for secure disposition. Europe is another profitable region for the vendors operating in the data center IT asset disposition market, driven by growing recycling and reuse of discarded IT assets. The European region observes strict environmental policies, which thereby helps the awareness levels regarding e-waste. Various enterprises in Europe have employed eco-friendly infrastructure, investing in accordance to the norms and gaining popularity. Asia Pacific is expected to turn into a highly lucrative regional market towards the end of the forecast period, incrementing demand at most prominent CAGR among all regions.

Some of the key companies currently operating in the global data center IT asset disposition market are: Hewlett Packard Enterprise Company (HPE), Dell Inc., Arrow Electronics, Inc., CloudBlue Technologies, Inc., Apto Solutions, Inc., LifeSpan International, Inc., ITRenew Inc., Iron Mountain Incorporated., and Sims Recycling Ltd. In the near future, as the government policies get stricter, vast opportunities will arise, which will lure new players and intensify the competitive landscape of the global data center IT asset disposition market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Data Center IT Asset Disposition (ITAD) Market

4. Market Overview

4.1. Introduction

4.2. Global Data Center IT Asset Disposition (ITAD) Market Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Key Trends

4.5. Refurbished Assets Supply Demand Analysis

4.6. Average life cycle of re-cycled products

4.7. Global Data Center IT Asset Disposition (ITAD) Market Analysis and Forecasts, 2012 – 2025

4.7.1. Market Revenue Projections (US$ Bn)

4.7.2. Market Volume Projections (Mn Units)

4.8. Data Center IT Asset Disposition (ITAD) Market Analysis (Mn Units), 2012-2016

4.8.1. Resold (%)

4.8.2. Destroyed (%)

4.8.3. Recycled (%)

4.9. Porter's Five Forces Analysis

4.10. Value Chain Analysis

4.11. Market Outlook

5. Global Data Center IT Asset Disposition (ITAD) Market Analysis and Forecasts, By Asset Type

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Size (US$ Bn) and Volume (Mn Unit) Forecast By Asset Type, 2012-2025

5.3.1. Servers

5.3.2. Memory modules

5.3.3. HDD

5.3.4. CPU

5.3.5. GBIC

5.3.6. Line cards

5.3.7. Desktops

5.3.8. Laptops

5.3.9. SSD

5.4. Asset Type Comparison Matrix

5.5. Market Attractiveness By Asset Type

6. Global Data Center IT Asset Disposition (ITAD) Market Analysis and Forecasts, By Service

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Size (US$ Bn) and Forecast, By Service, 2012 - 2025

6.3.1. Data Sanitation/ Destruction

6.3.2. Remarketing/Resale

6.3.3. Recycling

6.4. Service Comparison Matrix

6.5. Market Attractiveness By Service

7. Global Data Center IT Asset Disposition (ITAD) Market Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Policies and Regulations

7.3. Market Size (US$ Bn) and Forecast By Region, 2012 - 2025

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East and Africa

7.3.5. South America

7.4. Market Attractiveness By Region

8. North America Data Center IT Asset Disposition (ITAD) Market Analysis and Forecast

8.1. Key Findings

8.2. Market Size (US$ Bn) and Volume (Mn Unit) Forecast By Asset Type, 2012-2025

8.2.1. Servers

8.2.2. Memory modules

8.2.3. HDD

8.2.4. CPU

8.2.5. GBIC

8.2.6. Line cards

8.2.7. Desktops

8.2.8. Laptops

8.2.9. SSD

8.3. Market Size (US$ Bn) and Forecast, By Service, 2012 - 2025

8.3.1. Data Sanitation/ Destruction

8.3.2. Remarketing/Resale

8.3.3. Recycling

8.4. Market Size (US$ Bn) and Forecast By Country, 2012 - 2025

8.4.1. The U.S

8.4.2. Canada

8.4.3. Rest of North America

8.5. Market Attractiveness Analysis

8.5.1. By Country

8.5.2. By Asset Type

8.5.3. By Service

9. Europe Data Center IT Asset Disposition (ITAD) Market Analysis and Forecast

9.1. Key Findings

9.2. Market Size (US$ Bn) and Volume (Mn Unit) Forecast By Asset Type, 2012-2025

9.2.1. Servers

9.2.2. Memory modules

9.2.3. HDD

9.2.4. CPU

9.2.5. GBIC

9.2.6. Line cards

9.2.7. Desktops

9.2.8. Laptops

9.2.9. SSD

9.3. Market Size (US$ Bn) and Forecast, By Service, 2012 - 2025

9.3.1. Data Sanitation/ Destruction

9.3.2. Remarketing/Resale

9.3.3. Recycling

9.4. Market Size (US$ Bn) and Volume Forecast By Country, 2012 - 2025

9.4.1. The U.K

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Country

9.5.2. By Asset Type

9.5.3. By Service

10. Asia Pacific Data Center IT Asset Disposition (ITAD) Market Analysis and Forecast

10.1. Key Findings

10.2. Market Size (US$ Bn) and Volume (Mn Unit) Forecast By Asset Type, 2012-2025

10.2.1. Servers

10.2.2. Memory modules

10.2.3. HDD

10.2.4. CPU

10.2.5. GBIC

10.2.6. Line cards

10.2.7. Desktops

10.2.8. Laptops

10.2.9. SSD

10.3. Market Size (US$ Bn) and Forecast, By Service, 2012 - 2025

10.3.1. Data Sanitation/ Destruction

10.3.2. Remarketing/Resale

10.3.3. Recycling

10.4. Market Size (US$ Bn) and Forecast By Country, 2012 - 2025

10.4.1. China

10.4.2. India

10.4.3. South Asia

10.4.4. Rest of Asia Pacific

10.5. Market Attractiveness Analysis

10.5.1. By Country

10.5.2. By Asset Type

10.5.3. By Service

11. Middle East and Africa Data Center IT Asset Disposition (ITAD) Market Analysis and Forecast

11.1. Key Findings

11.2. Market Size (US$ Bn) and Volume (Mn Unit) Forecast By Asset Type, 2012-2025

11.2.1. Servers

11.2.2. Memory modules

11.2.3. HDD

11.2.4. CPU

11.2.5. GBIC

11.2.6. Line cards

11.2.7. Desktops

11.2.8. Laptops

11.2.9. SSD

11.3. Market Size (US$ Bn) and Forecast, By Service, 2012 - 2025

11.3.1. Data Sanitation/ Destruction

11.3.2. Remarketing/Resale

11.3.3. Recycling

11.4. Market Size (US$ Bn) and Volume (Mn Unit) Forecast By Country, 2012 - 2025

11.4.1. GCC Countries

11.4.2. South Africa

11.4.3. Rest of Middle East and Africa

11.5. Market Attractiveness Analysis

11.5.1. By Country

11.5.2. By Asset Type

11.5.3. By Service

12. South America Data Center IT Asset Disposition (ITAD) Market Analysis and Forecast

12.1. Key Findings

12.2. Market Size (US$ Bn) and Volume (Mn Unit) Forecast By Asset Type, 2012-2025

12.2.1. Servers

12.2.2. Memory modules

12.2.3. HDD

12.2.4. CPU

12.2.5. GBIC

12.2.6. Line cards

12.2.7. Desktops

12.2.8. Laptops

12.2.9. SSD

12.3. Market Size (US$ Bn) and Forecast, By Service, 2012 - 2025

12.3.1. Data Sanitation/ Destruction

12.3.2. Remarketing/Resale

12.3.3. Recycling

12.4. Market Size (US$ Bn) and Forecast By Country, 2012 - 2025

12.4.1. Brazil

12.4.2. Rest of South America

12.5. Market Attractiveness Analysis

12.5.1. By Country

12.5.2. By Asset Type

12.5.3. By Service

13. Competitive Intelligence Analysis

13.1. ITAD Partner Selection Criteria

13.1.1. Price

13.1.2. Reliability

13.1.3. Security

13.1.4. Geographical Footprint

13.2. Cloud Computing Data center (Amazon, Facebook, Google, Apple, Microsoft) IT Asset Disposition (ITAD) Market Analysis (Thousand Units & Percentage Share (%)),2016

13.2.1. Resold

13.2.2. Destroyed

13.2.3. Recycled

*Note: Here we have considered all asset types (including HDD/SDD) which are getting replaced from data center servers only

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2016)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Differential Business Strategies)

14.3.1. Apto Solutions, Inc.

14.3.1.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.1.2. Company Description

14.3.1.3. SWOT Analysis

14.3.1.4. Annual Revenue

14.3.1.5. Strategic Overview

14.3.2. Arrow Electronics, Inc.

14.3.2.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.2.2. Company Description

14.3.2.3. SWOT Analysis

14.3.2.4. Annual Revenue

14.3.2.5. Strategic Overview

14.3.3. CloudBlue Technologies, Inc.

14.3.3.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.3.2. Company Description

14.3.3.3. SWOT Analysis

14.3.3.4. Annual Revenue

14.3.3.5. Strategic Overview

14.3.4. Dataserv Group

14.3.4.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.4.2. Company Description

14.3.4.3. SWOT Analysis

14.3.4.4. Annual Revenue

14.3.4.5. Strategic Overview

14.3.5. Dell Inc.

14.3.5.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.5.2. Company Description

14.3.5.3. SWOT Analysis

14.3.5.4. Annual Revenue

14.3.5.5. Strategic Overview

14.3.6. HP Ltd.

14.3.6.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.6.2. Company Description

14.3.6.3. SWOT Analysis

14.3.6.4. Annual Revenue

14.3.6.5. Strategic Overview

14.3.7. Iron Mountain Incorporated.

14.3.7.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.7.2. Company Description

14.3.7.3. SWOT Analysis

14.3.7.4. Annual Revenue

14.3.7.5. Strategic Overview

14.3.8. ITRenew Inc.

14.3.8.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.8.2. Company Description

14.3.8.3. SWOT Analysis

14.3.8.4. Annual Revenue

14.3.8.5. Strategic Overview

14.3.9. LifeSpan International, Inc.

14.3.9.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.9.2. Company Description

14.3.9.3. SWOT Analysis

14.3.9.4. Annual Revenue

14.3.9.5. Strategic Overview

14.3.10. Sims Recycling Ltd.

14.3.10.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.10.2. Company Description

14.3.10.3. SWOT Analysis

14.3.10.4. Annual Revenue

14.3.10.5. Strategic Overview

14.3.11. TES-AMM Pte Ltd.

14.3.11.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

14.3.11.2. Company Description

14.3.11.3. SWOT Analysis

14.3.11.4. Annual Revenue

14.3.11.5. Strategic Overview

14.4. End-Market Players Analysis

14.4.1. Esiso

14.4.2. Goharddrive.com

14.4.3. Abacus

14.4.4. Calhoun

14.4.5. Curvature

14.4.6. Joy Systems

14.4.7. US Digitek

14.4.8. Affinity Computer Technology

14.4.9. NW Remarketing

15. Key Takeaways

List of Tables

Table 1: Acronyms Used

Table 2: Research Scope

Table 3: Global Data Center IT Asset Disposition Market Size and Forecast, By Asset Type, 2012–2025 (US$ Bn)

Table 4: Global Data Center IT Asset Disposition Market Volume and Forecast, By Asset Type, 2012–2025 (Mn Units)

Table 5: Global Data Center IT Asset Disposition Market Size and Forecast, By Service, 2012–2025 (US$ Bn)

Table 6: Global Data Center IT Asset Disposition Market Size and Forecast, By Region, 2012–2025 (US$ Bn)

Table 7: North America Data Center IT Asset Disposition Market Size and Forecast, By Asset Type, 2012–2025 (US$ Bn)

Table 8: North America Data Center IT Asset Disposition Market Volume and Forecast, By Asset Type, 2012 – 2025 (Mn Units)

Table 9: North America Data Center IT Asset Disposition Market Size and Forecast, By Service, 2012– 2025 (US$ Bn)

Table 10: North America Data Center IT Asset Disposition Market Size and Forecast, By Country, 2012–2025 (US$ Bn)

Table 11: Europe Data Center IT Asset Disposition Market Size and Forecast, By Asset Type, 2012–2025 (US$ Bn)

Table 12: Europe Data Center IT Asset Disposition Market Volume and Forecast, By Asset Type, 2012–2025 (Mn Units)

Table 13: Europe Data Center IT Asset Disposition Market Size and Forecast, By Service, 2012–2025 (US$ Bn)

Table 14: Europe Data Center IT Asset Disposition Market Size and Forecast, By Country, 2012–2025 (US$ Bn)

Table 15: Asia Pacific Data Center IT Asset Disposition Market Size and Forecast, By Asset Type, 2012–2025 (US$ Bn)

Table 16: Asia Pacific Data Center IT Asset Disposition Market Volume and Forecast, By Asset Type, 2012–2025 (Mn Units)

Table 17: Asia Pacific Data Center IT Asset Disposition Market Size and Forecast, By Service, 2012–2025 (US$ Bn)

Table 18: Asia Pacific Data Center IT Asset Disposition Market Size and Forecast, By Country, 2012–2025 (US$ Bn)

Table 19: MEA Data Center IT Asset Disposition Market Size and Forecast, By Asset Type, 2012–2025 (US$ Bn)

Table 20: MEA Data Center IT Asset Disposition Market Volume and Forecast, By Asset Type, 2012–2025 (Mn Units)

Table 21: MEA Data Center IT Asset Disposition Market Size and Forecast, By Service, 2012–2025 (US$ Bn)

Table 22: MEA Data Center IT Asset Disposition Market Size and Forecast, By Country, 2012–2025 (US$ Bn)

Table 23: South America Data Center IT Asset Disposition Market Size and Forecast, By Asset Type, 2012–2025 (US$ Bn)

Table 24: South America Data Center IT Asset Disposition Market Volume and Forecast, By Asset Type, 2012–2025 (Mn Units)

Table 25: South America Data Center IT Asset Disposition Market Size and Forecast, By Service, 2012–2025 (US$ Bn)

Table 26: South America Data Center IT Asset Disposition Market Size and Forecast, By Country, 2012–2025 (US$ Bn)

Table 27: Cloud Computing Data center IT Asset Disposition (ITAD) Market, Analysis (Thousand Units & Percentage Share), 2016

Table 28: Data center IT Asset Disposition (ITAD) Share Analysis by Company (2016)

List of Figures

Figure 1: Research Methodology

Figure 2: Research Methodology Calculation of the Global Data Center IT Asset Disposition Market

Figure 3: Share Analysis

Figure 4: Executive Summary

Figure 5: Refurbished Assets Supply Demand Analysis

Figure 6: Global Data Center IT Asset Disposition Market Size (US$ Bn) and Volume (Mn Units) Forecast, 2012–2025

Figure 7: Global Data Center IT Asset Disposition Market Y-o-Y Growth (Value %) Forecast, 2012 – 2025

Figure 8: Data Center IT Asset Disposition (ITAD) Market Analysis (Mn Units), 2012

Figure 9: Data Center IT Asset Disposition (ITAD) Market Analysis (Mn Units), 2016

Figure 10: Value Chain Analysis

Figure 12: Market Value Share, By Service (2017)

Figure 11: Market Value Share, by Asset Type (%), 2017

Figure 13: Market Value Share, By Geography (2017)

Figure 14: Key Findings

Figure 15: Global Data Center IT Asset Disposition Market Value Share Analysis, By Asset Type, 2017 and 2025

Figure 16: Data Center IT Asset Disposition Market Value and Volume Share Analysis, By Servers

Figure 17: Data Center IT Asset Disposition Market Value Share Analysis, By Memory modules

Figure 18: Data Center IT Asset Disposition Market Value and Volume Share Analysis, By HDD

Figure 19: Data Center IT Asset Disposition Market Value Share Analysis, By CPU

Figure 20: Data Center IT Asset Disposition Market Value and Volume Share Analysis, By GBIC

Figure 21: Data Center IT Asset Disposition Market Value Share Analysis, By Line cards

Figure 22: Data Center IT Asset Disposition Market Value and Volume Share Analysis, By Desktops

Figure 23: Data Center IT Asset Disposition Market Value Share Analysis, By Laptops

Figure 24: Data Center IT Asset Disposition Market Value and Volume Share Analysis, By SSD

Figure 26: Segment Revenue Contribution, 2017 - 25 (%)

Figure 27: Segment Compounded Growth Matrix (CAGR %)

Figure 28: Global Data Center IT Asset Disposition Market Attractiveness Analysis, By Type

Figure 29: Key Findings

Figure 30: Global Data Center IT Asset Disposition Market Value Share Analysis, By Service, 2017 and 2025

Figure 31: Global Data Center IT Asset Disposition Market Value Share Analysis, By Service, Data Sanitation/ Destruction

Figure 32: Global Data Center IT Asset Disposition Market Value Share Analysis, By Service, Remarketing/Resale

Figure 33: Global Data Center IT Asset Disposition Market Value Share Analysis, By Service, Recycling

Figure 35: Segment Revenue Contribution, 2017 - 25 (%)

Figure 36: Segment Compounded Growth Matrix (CAGR %)

Figure 37: Data Center IT Asset Disposition Market Attractiveness Analysis, By Service

Figure 38: Key Findings

Figure 39: Global Data Center IT Asset Disposition Market Value Share Analysis, by Region, 2017 and 2025

Figure 40: Data Center IT Asset Disposition Market Attractiveness Analysis, By Region

Figure 41: Key Findings

Figure 42: North America Data Center IT Asset Disposition Market Value Share Analysis, By Asset Type, 2017 and 2025

Figure 43: North America Data Center IT Asset Disposition Market Value Share Analysis, By Service, 2017 and 2025

Figure 44: North America Data Center IT Asset Disposition Market Value Share Analysis, by Country, 2017 and 2025

Figure 45: North America Data Center IT Asset Disposition Market Attractiveness Analysis, By Country

Figure 46: North America Data Center IT Asset Disposition Market Attractiveness Analysis, By Asset Type

Figure 47: North America Data Center IT Asset Disposition Market Attractiveness Analysis, By Service

Figure 48: Key Findings

Figure 49: Europe Data Center IT Asset Disposition Market Value Share Analysis, By Asset Type, 2017 and 2025

Figure 50: Europe Data Center IT Asset Disposition Market Value Share Analysis, By Service, 2017 and 2025

Figure 51: Europe Data Center IT Asset Disposition Market Value Share Analysis, by Country, 2017 and 2025

Figure 52: Europe Data Center IT Asset Disposition Market Attractiveness Analysis, By Country

Figure 53: Europe Data Center IT Asset Disposition Market Attractiveness Analysis, By Asset Type

Figure 54: Europe Data Center IT Asset Disposition Market Attractiveness Analysis, By Service

Figure 55: Key Findings

Figure 56: Asia Pacific Data Center IT Asset Disposition Market Value Share Analysis, By Asset Type, 2017 and 2025

Figure 57: Asia Pacific Data Center IT Asset Disposition Market Value Share Analysis, By Service, 2017 and 2025

Figure 58: Asia Pacific Data Center IT Asset Disposition Market Value Share Analysis, by Country, 2017 and 2025

Figure 59: Asia Pacific Data Center IT Asset Disposition Market Attractiveness Analysis, By Country

Figure 60: Asia Pacific Data Center IT Asset Disposition Market Attractiveness Analysis, By Asset Type

Figure 61: Asia Pacific Data Center IT Asset Disposition Market Attractiveness Analysis, By Service

Figure 62: Key Findings

Figure 63: MEA Data Center IT Asset Disposition Market Value Share Analysis, By Asset Type, 2017 and 2025

Figure 64: MEA Data Center IT Asset Disposition Market Value Share Analysis, By Service, 2017 and 2025

Figure 65: MEA Data Center IT Asset Disposition Market Value Share Analysis, by Country, 2017 and 2025

Figure 66: MEA Data Center IT Asset Disposition Market Attractiveness Analysis, By Country

Figure 67: MEA Data Center IT Asset Disposition Market Attractiveness Analysis, By Asset Type

Figure 68: MEA Data Center IT Asset Disposition Market Attractiveness Analysis, By Service

Figure 69: Key Findings

Figure 70: South America Data Center IT Asset Disposition Market Value Share Analysis, By Asset Type, 2017 and 2025

Figure 71: South America Data Center IT Asset Disposition Market Value Share Analysis, By Service, 2017 and 2025

Figure 72: South America Data Center IT Asset Disposition Market Value Share Analysis, by Country, 2017 and 2025

Figure 73: South America Data Center IT Asset Disposition Market Attractiveness Analysis, By Country

Figure 74: South America Data Center IT Asset Disposition Market Attractiveness Analysis, By Asset Type

Figure 75: South America Data Center IT Asset Disposition Market Attractiveness Analysis, By Service

Figure 76: ITAD Partner Selection Criteria: Reliability

Figure 77: ITAD Partner Selection Criteria: Security

Figure 78: ITAD Partner Selection Criteria: Geographical Footprint

Figure 79: ITAD Partner Selection Criteria: Price