Reports

Reports

The COVID-19 pandemic has affected business activities in the cosmetic pipette market. This has brought focus on women leaders in the cosmetics industry to understand how they are tackling new challenges that arise with the ongoing work from home norms, sheltering in place, and homeschooling. Daya Fields - current President of Pipette and Purecane at Amyris Corporation is increasing efforts to understand changing consumer buying behavior, new products, and ingredient interests of consumers that are focused on wellness and clean formulas in personal care products.

Monitoring growing interest in the personal care industry is becoming challenging for companies in the cosmetic pipette market. Brands are anticipating market revival with coronavirus vaccine programs. As such, poor market sentiments are affecting product sales. Hence, brands are capitalizing on opportunities through eCommerce to increase product uptake. Lucrative offers and online marketing are generating revenue streams.

The cosmetic pipette market is projected to cross the production of ~440 million units by 2031. However, variable supply of natural rubber bulbs and issues such as non-compatibility with solvents or oils is concerning pipette manufacturers. Hence, manufacturers are increasing their focus in science and engineering to develop high performance natural rubber bulbs to meet end-use cases in cosmetics & personal care products.

Apart from natural rubber bulbs, manufacturers are increasing their production capabilities in thermoplastic elastomers and thermosets to innovate in cosmetic pipettes. Brands are introducing new bulb styles such as miniature, ring, straight, and skirt bulbs. There is a demand for bulbs that reduce leakage of oils, liquids, and even smell.

The growing demand for luxury cosmetics brands is translating into revenue opportunities for manufacturers in the cosmetic pipette market. Paptic Oy - a company focused on technology for sustainable development as well as the sales and marketing of wood-based renewable & recyclable products, is broadening its portfolio with Gloss Gold Smoothwall Cosmetic Pipette and Gloss Gold Smoothwall Treatment Pump.

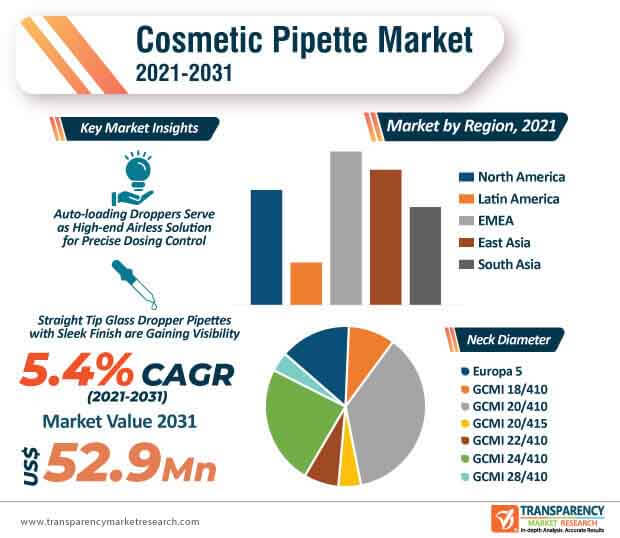

Manufacturers in the cosmetic pipette market are increasing the availability of pipettes and containers that grab the attention of customers from retail store shelves. They are innovating in straight tip glass dropper pipettes with attractive and sleek finish. Manufacturers are unlocking growth opportunities in high-end skincare and cosmeceutical brands that require packaging of oils and serums. On the other hand, manufacturers are introducing tamper-evident caps in cosmetic pipettes.

The cosmetic pipette market is projected to reach US$ 23 Mn by 2031. Yonwoo - a provider of complete packaging solutions for beauty, skin care, and personal care, is building its portfolio in airless droppers that are being used in skincare and cosmeceutical applications. Manufacturers are innovating in luxury glass bottles for cosmetics that are triggering the demand for cosmetic pipettes. Such trends are translating into revenue opportunities for manufacturers in the cosmetic pipette market.

Airless droppers are being preferred for precise dosing control. Since facial treatment formulations are becoming increasingly complex and multi-functional, there is a need for advanced delivery systems that involve cosmetic pipettes. Manufacturers are developing auto-loading droppers that serve as a high-end airless solution for precise dosing control. They are increasing their R&D in airless technologies that help to keep out external contaminants and enable less dependence on artificial preservatives.

Analysts’ Viewpoint

Since footfall at offline retail stores have reduced, cosmetics and personal care brands are bullish on eCommerce and social media marketing to boost product uptake during the ongoing COVID-19 outbreak. It has been found that ball tip pipettes are growing popular in Europe, owing to advantages of a uniform drop each time and consistent dosing. The cosmetic pipette market is expected to register a modest CAGR of 5.4% during the forecast period. This is evident since different bulbs in pipette dispensing system components such as those made with thermosets cannot be recycled and are potentially difficult to surface finish. Hence, manufacturers in the cosmetic pipette market should increase the availability of natural rubber, thermoplastic elastomers, and other materials in bulbs to suit specific applications in cosmetics and personal care products. They should increase R&D in pipette dispensing system components that can be easily recycled.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition

2.2. Market Taxonomy

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation

4. Key Success Factors

4.1. Product Adoption

4.2. Product USPs

4.3. Strategic Promotional Strategies

5. Global Cosmetic Pipette Market Demand Analysis 2015–2020 and Forecast, 2021–2031

5.1. Market Value (US$ Mn) and Volume (Mn Units) Analysis & Forecast

5.2. Y-o-Y Growth Projections

5.3. Absolute $ Opportunity Analysis

6. Pricing Analysis

6.1.1. Regional Pricing Analysis By Material Type

6.1.2. Price Projections By Material Type

7. Market Background

7.1. Macro-Economic Factors

7.1.1. Global Cosmetic and Beauty Market Growth

7.1.2. COVID-19 Pandemic

7.1.3. Global Rigid Packaging Market Growth

7.1.4. Glass & Plastic Production Growth

7.1.5. Global Retail Industry Growth

7.1.6. Global GDP Growth Outlook

7.2. Forecast Factors - Relevance & Impact

7.2.1. Global Cosmetic & Beauty Industry Growth

7.2.2. Global Cosmetic Packaging Industry Growth

7.2.3. Global Rigid Packaging Industry Growth

7.2.4. Global Retail Industry Growth

7.2.5. Segmental Revenue Growth

7.2.6. Production Growth by Region

7.2.7. Consumer Spending Growth By Region

7.2.8. Global E-Commerce Industry Growth

7.3. Cost Tear Down Analysis

7.4. Porter’s Analysis

7.5. Value Chain

7.5.1. Key Participants

7.5.1.1. Raw Packaging Suppliers

7.5.1.2. Droppers Manufacturers

7.5.1.3. End Users

7.5.2. Profitability Margin

7.6. Market Dynamics

7.6.1. Drivers

7.6.2. Restraints

7.6.3. Opportunity Analysis

7.7. Cosmetic Packaging Industry Overview

7.8. Comparative Analysis: Plastic vs Glass

7.9. Consumer Preference Analysis

8. Impact of COVID-19

8.1. Current Statistics and Probable Future Impact

8.2. Impact of COVID-19 on Cosmetic Pipette Market

9. Global Cosmetic Pipette Analysis and Forecast, By Material Type

9.1. Section Summary

9.2. Introduction

9.2.1. Market share and Basis Points (BPS) Analysis By Material Type

9.2.2. Y-o-Y Growth Projections By Material Type

9.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Material Type

9.3.1. Glass Pipette

9.3.2. Plastic Pipette

9.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Material Type

9.4.1. Glass Pipette

9.4.2. Plastic Pipette

9.5. Market Attractiveness Analysis By Material Type

10. Global Cosmetic Pipette Analysis and Forecast, By Neck Diameter

10.1. Section Summary

10.2. Introduction

10.2.1. Market share and Basis Points (BPS) Analysis By Neck Diameter

10.2.2. Y-o-Y Growth Projections By Neck Diameter

10.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Neck Diameter

10.3.1. Europa 5

10.3.2. GCMI 18/410

10.3.3. GCMI 20/410

10.3.4. GCMI 20/415

10.3.5. GCMI 22/410

10.3.6. GCMI 24/410

10.3.7. GCMI 28/410

10.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Neck Diameter

10.4.1. Europa 5

10.4.2. GCMI 18/410

10.4.3. GCMI 20/410

10.4.4. GCMI 20/415

10.4.5. GCMI 22/410

10.4.6. GCMI 24/410

10.4.7. GCMI 28/410

10.5. Market Attractiveness Analysis By Neck Diameter

11. Global Cosmetic Pipette Analysis and Forecast, By Technology

11.1. Section Summary

11.2. Introduction

11.2.1. Market share and Basis Points (BPS) Analysis By Technology

11.2.2. Y-o-Y Growth Projections By Technology

11.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Technology

11.3.1. Airless Dropper

11.3.2. Atmospheric Dropper

11.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Technology

11.4.1. Airless Dropper

11.4.2. Atmospheric Dropper

11.5. Market Attractiveness Analysis By Technology

12. Global Cosmetic Pipette Analysis and Forecast, By Overshell Screw

12.1. Section Summary

12.2. Introduction

12.2.1. Market share and Basis Points (BPS) Analysis By Overshell Screw

12.2.2. Y-o-Y Growth Projections By Overshell Screw

12.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Overshell Screw

12.3.1. Plastic Screw Cap

12.3.2. Metal Screw Cap

12.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Overshell Screw

12.4.1. Plastic Screw Cap

12.4.2. Metal Screw Cap

12.5. Market Attractiveness Analysis By Overshell Screw

13. Global Cosmetic Pipette Analysis and Forecast, By Button Type

13.1. Section Summary

13.2. Introduction

13.2.1. Market share and Basis Points (BPS) Analysis By Button Type

13.2.2. Y-o-Y Growth Projections By Button Type

13.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Button Type

13.3.1. Tetine Bulb

13.3.2. Push Button

13.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Button Type

13.4.1. Tetine Bulb

13.4.2. Push Button

13.5. Market Attractiveness Analysis By Button Type

14. Global Cosmetic Pipette Analysis and Forecast, By Applicator

14.1. Section Summary

14.2. Introduction

14.2.1. Market share and Basis Points (BPS) Analysis By Applicator

14.2.2. Y-o-Y Growth Projections By Applicator

14.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Applicator

14.3.1. With Applicator

14.3.2. Without Applicator

14.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Applicator

14.4.1. With Applicator

14.4.2. Without Applicator

14.5. Market Attractiveness Analysis By Applicator

15. Global Cosmetic Pipette Analysis and Forecast, By Dropper Type

15.1. Section Summary

15.2. Introduction

15.2.1. Market share and Basis Points (BPS) Analysis By Dropper Type

15.2.2. Y-o-Y Growth Projections By Dropper Type

15.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dropper Type

15.3.1. Standard Dropper

15.3.2. Customized Dropper

15.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dropper Type

15.4.1. Standard Dropper

15.4.2. Customized Dropper

15.5. Market Attractiveness Analysis By Dropper Type

16. Global Cosmetic Pipette Analysis and Forecast, By Dosage Capacity

16.1. Section Summary

16.2. Introduction

16.2.1. Market share and Basis Points (BPS) Analysis By Dosage Capacity

16.2.2. Y-o-Y Growth Projections By Dosage Capacity

16.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dosage Capacity

16.3.1. 0.15 Ml

16.3.2. 0.35 ml

16.3.3. 0.5 ml

16.3.4. 1 ml

16.3.5. Others

16.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dosage Capacity

16.4.1. 0.15 Ml

16.4.2. 0.35 ml

16.4.3. 0.5 ml

16.4.4. 1 ml

16.4.5. Others

16.5. Market Attractiveness Analysis By Dosage Capacity

17. Global Cosmetic Pipette Analysis and Forecast, By End Use

17.1. Section Summary

17.2. Introduction

17.2.1. Market share and Basis Points (BPS) Analysis By End Use

17.2.2. Y-o-Y Growth Projections By End Use

17.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By End Use

17.3.1. Hair Care

17.3.2. Make Up

17.3.2.1. Lip care

17.3.2.2. Eye care

17.3.2.3. Others

17.3.3. Skin Care

17.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By End Use

17.4.1. Hair Care

17.4.2. Make Up

17.4.2.1. Lip care

17.4.2.2. Eye care

17.4.2.3. Others

17.4.3. Skin Care

17.5. Market Attractiveness Analysis By End Use

18. Global Cosmetic Pipette Analysis and Forecast, By Product Category

18.1. Section Summary

18.2. Introduction

18.2.1. Market share and Basis Points (BPS) Analysis By Product Category

18.2.2. Y-o-Y Growth Projections By Product Category

18.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Product Category

18.3.1. Oil

18.3.2. Serums

18.3.3. Liquid Foundations

18.3.4. Others

18.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Product Category

18.4.1. Oil

18.4.2. Serums

18.4.3. Liquid Foundations

18.4.4. Others

18.5. Market Attractiveness Analysis By Product Category

19. Global Cosmetic Pipette Analysis and Forecast, By Pipette Length

19.1. Section Summary

19.2. Introduction

19.2.1. Market share and Basis Points (BPS) Analysis By Pipette Length

19.2.2. Y-o-Y Growth Projections By Pipette Length

19.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Pipette Length

19.3.1. Less than 3 cm

19.3.2. 3 cm to 5 cm

19.3.3. Above 5 cm

19.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Pipette Length

19.4.1. Less than 3 cm

19.4.2. 3 cm to 5 cm

19.4.3. Above 5 cm

19.5. Market Attractiveness Analysis By Pipette Length

20. Global Cosmetic Pipette Market Analysis and Forecast, By Region

20.1. Section Summary

20.2. Introduction

20.2.1. Market share and Basis Points (BPS) Analysis By Region

20.2.2. Y-o-Y Growth Projections By Region

20.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Region

20.3.1. North America

20.3.2. Latin America

20.3.3. EMEA

20.3.4. South Asia

20.3.5. East Asia

20.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031 By Region

20.4.1. North America

20.4.2. Latin America

20.4.3. EMEA

20.4.4. South Asia

20.4.5. East Asia

20.5. Market Attractiveness Analysis By Region

21. North America Cosmetic Pipette Market Analysis and Forecast

21.1. Section Summary

21.2. Introduction

21.2.1. Market share and Basis Points (BPS) Analysis By Country

21.2.2. Y-o-Y Growth Projections By Country

21.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Country

21.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031 By Country

21.4.1. U.S.

21.4.2. Canada

21.5. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Material Type

21.6. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Material Type

21.6.1. Glass Pipette

21.6.2. Plastic Pipette

21.7. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Neck Diameter

21.8. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Neck Diameter

21.8.1. Europa 5

21.8.2. GCMI 18/410

21.8.3. GCMI 20/410

21.8.4. GCMI 20/415

21.8.5. GCMI 22/410

21.8.6. GCMI 24/410

21.8.7. GCMI 28/410

21.9. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Technology

21.10. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Technology

21.10.1. Airless Dropper

21.10.2. Atmospheric Dropper

21.11. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Overshell Screw

21.12. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Overshell Screw

21.12.1. Plastic Screw Cap

21.12.2. Metal Screw Cap

21.13. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Button Type

21.14. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Button Type

21.14.1. Tetine Bulb

21.14.2. Push Button

21.15. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Applicator

21.16. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Applicator

21.16.1. With Applicator

21.16.2. Without Applicator

21.17. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dropper Type

21.18. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dropper Type

21.18.1. Standard Dropper

21.18.2. Customized Dropper

21.19. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dosage Capacity

21.20. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dosage Capacity

21.20.1. 0.15 Ml

21.20.2. 0.35 ml

21.20.3. 0.5 ml

21.20.4. 1 ml

21.20.5. Others

21.21. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By End Use

21.22. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By End Use

21.22.1. Hair Care

21.22.2. Make Up

21.22.2.1. Lip care

21.22.2.2. Eye care

21.22.2.3. Others

21.22.3. Skin Care

21.23. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Product Category

21.24. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Product Category

21.24.1. Oil

21.24.2. Serums

21.24.3. Liquid Foundations

21.24.4. Others

21.25. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Pipette Length

21.26. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Pipette Length

21.26.1. Less than 3 cm

21.26.2. 3 cm to 5 cm

21.26.3. Above 5 cm

22. Latin America Cosmetic Pipette Market Analysis and Forecast

22.1. Section Summary

22.2. Introduction

22.2.1. Market share and Basis Points (BPS) Analysis By Country

22.2.2. Y-o-Y Growth Projections By Country

22.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Country

22.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031 By Country

22.4.1. Brazil

22.4.2. Mexico

22.4.3. Argentina

22.4.4. Andean countries

22.5. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Material Type

22.6. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Material Type

22.6.1. Glass Pipette

22.6.2. Plastic Pipette

22.7. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Neck Diameter

22.8. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Neck Diameter

22.8.1. Europa 5

22.8.2. GCMI 18/410

22.8.3. GCMI 20/410

22.8.4. GCMI 20/415

22.8.5. GCMI 22/410

22.8.6. GCMI 24/410

22.8.7. GCMI 28/410

22.9. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Technology

22.10. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Technology

22.10.1. Airless Dropper

22.10.2. Atmospheric Dropper

22.11. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Overshell Screw

22.12. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Overshell Screw

22.12.1. Plastic Screw Cap

22.12.2. Metal Screw Cap

22.13. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Button Type

22.14. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Button Type

22.14.1. Tetine Bulb

22.14.2. Push Button

22.15. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Applicator

22.16. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Applicator

22.16.1. With Applicator

22.16.2. Without Applicator

22.17. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dropper Type

22.18. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dropper Type

22.18.1. Standard Dropper

22.18.2. Customized Dropper

22.19. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dosage Capacity

22.20. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dosage Capacity

22.20.1. 0.15 Ml

22.20.2. 0.35 ml

22.20.3. 0.5 ml

22.20.4. 1 ml

22.20.5. Others

22.21. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By End Use

22.22. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By End Use

22.22.1. Hair Care

22.22.2. Make Up

22.22.2.1. Lip care

22.22.2.2. Eye care

22.22.2.3. Others

22.22.3. Skin Care

22.23. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Product Category

22.24. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Product Category

22.24.1. Oil

22.24.2. Serums

22.24.3. Liquid Foundations

22.24.4. Others

22.25. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Pipette Length

22.26. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Pipette Length

22.26.1. Less than 3 cm

22.26.2. 3 cm to 5 cm

22.26.3. Above 5 cm

23. EMEA Cosmetic Pipette Market Analysis and Forecast

23.1. Section Summary

23.2. Introduction

23.2.1. Market share and Basis Points (BPS) Analysis By Region

23.2.2. Y-o-Y Growth Projections By Region

23.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Region

23.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031 By Region

23.4.1. Europe

23.4.2. MEA

23.5. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Material Type

23.6. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Material Type

23.6.1. Glass Pipette

23.6.2. Plastic Pipette

23.7. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Neck Diameter

23.8. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Neck Diameter

23.8.1. Europa 5

23.8.2. GCMI 18/410

23.8.3. GCMI 20/410

23.8.4. GCMI 20/415

23.8.5. GCMI 22/410

23.8.6. GCMI 24/410

23.8.7. GCMI 28/410

23.9. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Technology

23.10. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Technology

23.10.1. Airless Dropper

23.10.2. Atmospheric Dropper

23.11. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Overshell Screw

23.12. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Overshell Screw

23.12.1. Plastic Screw Cap

23.12.2. Metal Screw Cap

23.13. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Button Type

23.14. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Button Type

23.14.1. Tetine Bulb

23.14.2. Push Button

23.15. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Applicator

23.16. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Applicator

23.16.1. With Applicator

23.16.2. Without Applicator

23.17. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dropper Type

23.18. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dropper Type

23.18.1. Standard Dropper

23.18.2. Customized Dropper

23.19. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dosage Capacity

23.20. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dosage Capacity

23.20.1. 0.15 Ml

23.20.2. 0.35 ml

23.20.3. 0.5 ml

23.20.4. 1 ml

23.20.5. Others

23.21. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By End Use

23.22. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By End Use

23.22.1. Hair Care

23.22.2. Make Up

23.22.2.1. Lip care

23.22.2.2. Eye care

23.22.2.3. Others

23.22.3. Skin Care

23.23. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Product Category

23.24. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Product Category

23.24.1. Oil

23.24.2. Serums

23.24.3. Liquid Foundations

23.24.4. Others

23.25. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Pipette Length

23.26. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Pipette Length

23.26.1. Less than 3 cm

23.26.2. 3 cm to 5 cm

23.26.3. Above 5 cm

24. South Asia Cosmetic Pipette Market Analysis and Forecast

24.1. Section Summary

24.2. Introduction

24.2.1. Market share and Basis Points (BPS) Analysis By Country

24.2.2. Y-o-Y Growth Projections By Country

24.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Country

24.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031 By Country

24.4.1. India

24.4.2. Thailand

24.4.3. Indonesia

24.4.4. Others (Malaysia, Vietnam, etc.)

24.5. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Material Type

24.6. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Material Type

24.6.1. Glass Pipette

24.6.2. Plastic Pipette

24.7. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Neck Diameter

24.8. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Neck Diameter

24.8.1. Europa 5

24.8.2. GCMI 18/410

24.8.3. GCMI 20/410

24.8.4. GCMI 20/415

24.8.5. GCMI 22/410

24.8.6. GCMI 24/410

24.8.7. GCMI 28/410

24.9. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Technology

24.10. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Technology

24.10.1. Airless Dropper

24.10.2. Atmospheric Dropper

24.11. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Overshell Screw

24.12. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Overshell Screw

24.12.1. Plastic Screw Cap

24.12.2. Metal Screw Cap

24.13. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Button Type

24.14. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Button Type

24.14.1. Tetine Bulb

24.14.2. Push Button

24.15. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Applicator

24.16. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Applicator

24.16.1. With Applicator

24.16.2. Without Applicator

24.17. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dropper Type

24.18. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dropper Type

24.18.1. Standard Dropper

24.18.2. Customized Dropper

24.19. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dosage Capacity

24.20. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dosage Capacity

24.20.1. 0.15 Ml

24.20.2. 0.35 ml

24.20.3. 0.5 ml

24.20.4. 1 ml

24.20.5. Others

24.21. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By End Use

24.22. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By End Use

24.22.1. Hair Care

24.22.2. Make Up

24.22.2.1. Lip care

24.22.2.2. Eye care

24.22.2.3. Others

24.22.3. Skin Care

24.23. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Product Category

24.24. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Product Category

24.24.1. Oil

24.24.2. Serums

24.24.3. Liquid Foundations

24.24.4. Others

24.25. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Pipette Length

24.26. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Pipette Length

24.26.1. Less than 3 cm

24.26.2. 3 cm to 5 cm

24.26.3. Above 5 cm

25. East Asia Cosmetic Pipette Market Analysis and Forecast

25.1. Section Summary

25.2. Introduction

25.2.1. Market share and Basis Points (BPS) Analysis By Country

25.2.2. Y-o-Y Growth Projections By Country

25.3. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Country

25.4. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031 By Country

25.4.1. China

25.4.2. Japan

25.4.3. South Korea

25.5. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Material Type

25.6. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Material Type

25.6.1. Glass Pipette

25.6.2. Plastic Pipette

25.7. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Neck Diameter

25.8. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Neck Diameter

25.8.1. Europa 5

25.8.2. GCMI 18/410

25.8.3. GCMI 20/410

25.8.4. GCMI 20/415

25.8.5. GCMI 22/410

25.8.6. GCMI 24/410

25.8.7. GCMI 28/410

25.9. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Technology

25.10. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Technology

25.10.1. Airless Dropper

25.10.2. Atmospheric Dropper

25.11. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Overshell Screw

25.12. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Overshell Screw

25.12.1. Plastic Screw Cap

25.12.2. Metal Screw Cap

25.13. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Button Type

25.14. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Button Type

25.14.1. Tetine Bulb

25.14.2. Push Button

25.15. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Applicator

25.16. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Applicator

25.16.1. With Applicator

25.16.2. Without Applicator

25.17. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dropper Type

25.18. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dropper Type

25.18.1. Standard Dropper

25.18.2. Customized Dropper

25.19. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Dosage Capacity

25.20. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Dosage Capacity

25.20.1. 0.15 Ml

25.20.2. 0.35 ml

25.20.3. 0.5 ml

25.20.4. 1 ml

25.20.5. Others

25.21. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By End Use

25.22. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By End Use

25.22.1. Hair Care

25.22.2. Make Up

25.22.2.1. Lip care

25.22.2.2. Eye care

25.22.2.3. Others

25.22.3. Skin Care

25.23. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Product Category

25.24. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Product Category

25.24.1. Oil

25.24.2. Serums

25.24.3. Liquid Foundations

25.24.4. Others

25.25. Historical Market Size (US$ Mn) and Volume (Mn Units) Analysis 2015-2020 By Pipette Length

25.26. Market Size (US$ Mn) and Volume (Mn Units) Forecast 2021-2031, By Pipette Length

25.26.1. Less than 3 cm

25.26.2. 3 cm to 5 cm

25.26.3. Above 5 cm

26. Competitive Landscape

26.1. Market Structure

26.2. Competition Dashboard

26.3. Company Market Share Analysis

26.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

26.5. Competition Deep Dive

26.5.1. Cosmetic Pipette Manufacturers

26.5.1.1. Virospack SL

26.5.1.1.1. Overview

26.5.1.1.2. Product Portfolio

26.5.1.1.3. Profitability

26.5.1.1.4. Sales Footprint

26.5.1.1.5. Competition Benchmarking

26.5.1.1.6. Strategy

26.5.1.1.6.1. Marketing Strategy

26.5.1.1.6.2. Product Strategy

26.5.1.1.6.3. Channel Strategy

26.5.1.2. LUMSON S.p.A

26.5.1.2.1. Overview

26.5.1.2.2. Product Portfolio

26.5.1.2.3. Profitability

26.5.1.2.4. Sales Footprint

26.5.1.2.5. Competition Benchmarking

26.5.1.2.6. Strategy

26.5.1.2.6.1. Marketing Strategy

26.5.1.2.6.2. Product Strategy

26.5.1.2.6.3. Channel Strategy

26.5.1.3. Comar LLC

26.5.1.3.1. Overview

26.5.1.3.2. Product Portfolio

26.5.1.3.3. Profitability

26.5.1.3.4. Sales Footprint

26.5.1.3.5. Competition Benchmarking

26.5.1.3.6. Strategy

26.5.1.3.6.1. Marketing Strategy

26.5.1.3.6.2. Product Strategy

26.5.1.3.6.3. Channel Strategy

26.5.1.4. FusionPKG

26.5.1.4.1. Overview

26.5.1.4.2. Product Portfolio

26.5.1.4.3. Profitability

26.5.1.4.4. Sales Footprint

26.5.1.4.5. Competition Benchmarking

26.5.1.4.6. Strategy

26.5.1.4.6.1. Marketing Strategy

26.5.1.4.6.2. Product Strategy

26.5.1.4.6.3. Channel Strategy

26.5.1.5. Quadpack

26.5.1.5.1. Overview

26.5.1.5.2. Product Portfolio

26.5.1.5.3. Profitability

26.5.1.5.4. Sales Footprint

26.5.1.5.5. Competition Benchmarking

26.5.1.5.6. Strategy

26.5.1.5.6.1. Marketing Strategy

26.5.1.5.6.2. Product Strategy

26.5.1.5.6.3. Channel Strategy

26.5.1.6. HCP Packaging

26.5.1.6.1. Overview

26.5.1.6.2. Product Portfolio

26.5.1.6.3. Profitability

26.5.1.6.4. Sales Footprint

26.5.1.6.5. Competition Benchmarking

26.5.1.6.6. Strategy

26.5.1.6.6.1. Marketing Strategy

26.5.1.6.6.2. Product Strategy

26.5.1.6.6.3. Channel Strategy

26.5.1.7. DWK Life Sciences Ltd

26.5.1.7.1. Overview

26.5.1.7.2. Product Portfolio

26.5.1.7.3. Profitability

26.5.1.7.4. Sales Footprint

26.5.1.7.5. Competition Benchmarking

26.5.1.7.6. Strategy

26.5.1.7.6.1. Marketing Strategy

26.5.1.7.6.2. Product Strategy

26.5.1.7.6.3. Channel Strategy

26.5.1.8. Taiwan K. K. Corp

26.5.1.8.1. Overview

26.5.1.8.2. Product Portfolio

26.5.1.8.3. Profitability

26.5.1.8.4. Sales Footprint

26.5.1.8.5. Competition Benchmarking

26.5.1.8.6. Strategy

26.5.1.8.6.1. Marketing Strategy

26.5.1.8.6.2. Product Strategy

26.5.1.8.6.3. Channel Strategy

26.5.1.9. Carow Packaging, Inc

26.5.1.9.1. Overview

26.5.1.9.2. Product Portfolio

26.5.1.9.3. Profitability

26.5.1.9.4. Sales Footprint

26.5.1.9.5. Competition Benchmarking

26.5.1.9.6. Strategy

26.5.1.9.6.1. Marketing Strategy

26.5.1.9.6.2. Product Strategy

26.5.1.9.6.3. Channel Strategy

26.5.1.10. Paramark Corporation

26.5.1.10.1. Overview

26.5.1.10.2. Product Portfolio

26.5.1.10.3. Profitability

26.5.1.10.4. Sales Footprint

26.5.1.10.5. Competition Benchmarking

26.5.1.10.6. Strategy

26.5.1.10.6.1. Marketing Strategy

26.5.1.10.6.2. Product Strategy

26.5.1.10.6.3. Channel Strategy

26.5.1.11. RTN Applicator Company LLC

26.5.1.11.1. Overview

26.5.1.11.2. Product Portfolio

26.5.1.11.3. Profitability

26.5.1.11.4. Sales Footprint

26.5.1.11.5. Competition Benchmarking

26.5.1.11.6. Strategy

26.5.1.11.6.1. Marketing Strategy

26.5.1.11.6.2. Product Strategy

26.5.1.11.6.3. Channel Strategy

26.5.1.12. Adelphi Healthcare Packaging

26.5.1.12.1. Overview

26.5.1.12.2. Product Portfolio

26.5.1.12.3. Profitability

26.5.1.12.4. Sales Footprint

26.5.1.12.5. Competition Benchmarking

26.5.1.12.6. Strategy

26.5.1.12.6.1. Marketing Strategy

26.5.1.12.6.2. Product Strategy

26.5.1.12.6.3. Channel Strategy

26.5.1.13. SONE Products Ltd

26.5.1.13.1. Overview

26.5.1.13.2. Product Portfolio

26.5.1.13.3. Profitability

26.5.1.13.4. Sales Footprint

26.5.1.13.5. Competition Benchmarking

26.5.1.13.6. Strategy

26.5.1.13.6.1. Marketing Strategy

26.5.1.13.6.2. Product Strategy

26.5.1.13.6.3. Channel Strategy

26.5.1.14. FH Packaging

26.5.2. China/Korea Players

26.5.2.1. Hangzhou Lecos Packaging Co. Ltd

26.5.2.1.1. Overview

26.5.2.1.2. Product Portfolio

26.5.2.1.3. Profitability

26.5.2.1.4. Sales Footprint

26.5.2.1.5. Competition Benchmarking

26.5.2.1.6. Strategy

26.5.2.1.6.1. Marketing Strategy

26.5.2.1.6.2. Product Strategy

26.5.2.1.6.3. Channel Strategy

26.5.2.2. Guangzhou YELLO Packaging Co., Ltd

26.5.2.2.1. Overview

26.5.2.2.2. Product Portfolio

26.5.2.2.3. Profitability

26.5.2.2.4. Sales Footprint

26.5.2.2.5. Competition Benchmarking

26.5.2.2.6. Strategy

26.5.2.2.6.1. Marketing Strategy

26.5.2.2.6.2. Product Strategy

26.5.2.2.6.3. Channel Strategy

26.5.2.3. Xuzhou Erose Glass Products Co., Ltd

26.5.2.3.1. Overview

26.5.2.3.2. Product Portfolio

26.5.2.3.3. Profitability

26.5.2.3.4. Sales Footprint

26.5.2.3.5. Competition Benchmarking

26.5.2.3.6. Strategy

26.5.2.3.6.1. Marketing Strategy

26.5.2.3.6.2. Product Strategy

26.5.2.3.6.3. Channel Strategy

26.5.2.4. Hangzhou Rainbow Packaging Co. Ltd

26.5.2.4.1. Overview

26.5.2.4.2. Product Portfolio

26.5.2.4.3. Profitability

26.5.2.4.4. Sales Footprint

26.5.2.4.5. Competition Benchmarking

26.5.2.4.6. Strategy

26.5.2.4.6.1. Marketing Strategy

26.5.2.4.6.2. Product Strategy

26.5.2.4.6.3. Channel Strategy

26.5.2.5. Yonwoo Co. Ltd

26.5.2.5.1. Overview

26.5.2.5.2. Product Portfolio

26.5.2.5.3. Profitability

26.5.2.5.4. Sales Footprint

26.5.2.5.5. Competition Benchmarking

26.5.2.5.6. Strategy

26.5.2.5.6.1. Marketing Strategy

26.5.2.5.6.2. Product Strategy

26.5.2.5.6.3. Channel Strategy

26.5.2.6. Guangzhou Rich Packaging Co., Ltd

26.5.2.6.1. Overview

26.5.2.6.2. Product Portfolio

26.5.2.6.3. Profitability

26.5.2.6.4. Sales Footprint

26.5.2.6.5. Competition Benchmarking

26.5.2.6.6. Strategy

26.5.2.6.6.1. Marketing Strategy

26.5.2.6.6.2. Product Strategy

26.5.2.6.6.3. Channel Strategy

26.5.2.7. Hangzhou Rayuen Packaging Co., Limited

26.5.2.7.1. Overview

26.5.2.7.2. Product Portfolio

26.5.2.7.3. Profitability

26.5.2.7.4. Sales Footprint

26.5.2.7.5. Competition Benchmarking

26.5.2.7.6. Strategy

26.5.2.7.6.1. Marketing Strategy

26.5.2.7.6.2. Product Strategy

26.5.2.7.6.3. Channel Strategy

26.5.2.8. PUMTECH Korea Co. Ltd

26.5.2.8.1. Overview

26.5.2.8.2. Product Portfolio

26.5.2.8.3. Profitability

26.5.2.8.4. Sales Footprint

26.5.2.8.5. Competition Benchmarking

26.5.2.8.6. Strategy

26.5.2.8.6.1. Marketing Strategy

26.5.2.8.6.2. Product Strategy

26.5.2.8.6.3. Channel Strategy

26.5.2.9. FSKOREA Co., Ltd

26.5.2.9.1. Overview

26.5.2.9.2. Product Portfolio

26.5.2.9.3. Profitability

26.5.2.9.4. Sales Footprint

26.5.2.9.5. Competition Benchmarking

26.5.2.9.6. Strategy

26.5.2.9.6.1. Marketing Strategy

26.5.2.9.6.2. Product Strategy

26.5.2.9.6.3. Channel Strategy

26.5.2.10. China Suncity Plastic Vials Factory

26.5.2.10.1. Overview

26.5.2.10.2. Product Portfolio

26.5.2.10.3. Profitability

26.5.2.10.4. Sales Footprint

26.5.2.10.5. Competition Benchmarking

26.5.2.10.6. Strategy

26.5.2.10.6.1. Marketing Strategy

26.5.2.10.6.2. Product Strategy

26.5.2.10.6.3. Channel Strategy

26.5.2.11. Yuan Xinmeng Plastic Products Co., Ltd

26.5.2.11.1. Overview

26.5.2.11.2. Product Portfolio

26.5.2.11.3. Profitability

26.5.2.11.4. Sales Footprint

26.5.2.11.5. Competition Benchmarking

26.5.2.11.6. Strategy

26.5.2.11.6.1. Marketing Strategy

26.5.2.11.6.2. Product Strategy

26.5.2.11.6.3. Channel Strategy

26.5.2.12. JX Pack(Guangzhou Jiaxing Glass Products Co. Ltd.)

26.5.2.12.1. Overview

26.5.2.12.2. Product Portfolio

26.5.2.12.3. Profitability

26.5.2.12.4. Sales Footprint

26.5.2.12.5. Competition Benchmarking

26.5.2.12.6. Strategy

26.5.2.12.6.1. Marketing Strategy

26.5.2.12.6.2. Product Strategy

26.5.2.12.6.3. Channel Strategy

*The above list is indicative in nature and is subject to change during the course of research

27. Assumptions and Acronyms

28. Research Methodology

List of Tables

Table 01: Global Cosmetic Pipette Market Value (US$ Mn) by Material Type, 2015H-2031F

Table 02: Global Cosmetic Pipette Market Volume (Mn Units) by Material Type, 2015H-2031F

Table 03: Global Cosmetic Pipette Market Value (US$ Mn) by Neck Diameter, 2015H-2031F

Table 04: Global Cosmetic Pipette Market Volume (Mn Units) by Neck Diameter, 2015H-2031F

Table 05: Global Cosmetic Pipette Market Value (US$ Mn) by Technology, 2015H-2031F

Table 06: Global Cosmetic Pipette Market Volume (Mn Units) by Technology, 2015H-2031F

Table 07: Global Cosmetic Pipette Market Value (US$ Mn) by Overshell Screw, 2015H-2031F

Table 08: Global Cosmetic Pipette Market Volume (Mn Units) by Overshell Screw, 2015H-2031F

Table 09: Global Cosmetic Pipette Market Value (US$ Mn) by Button Type, 2015H-2031F

Table 10: Global Cosmetic Pipette Market Volume (Mn Units) by Button Type, 2015H-2031F

Table 11: Global Cosmetic Pipette Market Value (US$ Mn) by Applicator, 2015H-2031F

Table 12: Global Cosmetic Pipette Market Volume (Mn Units) by Applicator, 2015H-2031F

Table 13: Global Cosmetic Pipette Market Value (US$ Mn) by Dropper Type, 2015H-2031F

Table 14: Global Cosmetic Pipette Market Volume (Mn Units) by Dropper Type, 2015H-2031F

Table 15: Global Cosmetic Pipette Market Value (US$ Mn) by Dosage Capacity, 2015H-2031F

Table 16: Global Cosmetic Pipette Market Volume (Mn Units) by Dosage Capacity, 2015H-2031F

Table 17: Global Cosmetic Pipette Market Value (US$ Mn) by End Use, 2015H-2031F

Table 18: Global Cosmetic Pipette Market Volume (Mn Units) by End Use, 2015H-2031F

Table 19: Global Cosmetic Pipette Market Value (US$ Mn) by Product Category, 2015H-2031F

Table 20: Global Cosmetic Pipette Market Volume (Mn Units) by Product Category, 2015H-2031F

Table 21: Global Cosmetic Pipette Market Value (US$ Mn) by Pipette Length, 2015H-2031F

Table 22: Global Cosmetic Pipette Market Volume (Mn Units) by Pipette Length, 2015H-2031F

Table 23: Global Cosmetic Pipette Market Value (US$ Mn) by Region, 2015H-2031F

Table 24: Global Cosmetic Pipette Market Volume (Mn Units) by Region, 2015H-2031F

Table 25: North America Cosmetic Pipette Market Value (US$ Mn) by Material Type, 2015H-2031F

Table 26: North America Cosmetic Pipette Market Volume (Mn Units) by Material Type, 2015H-2031F

Table 27: North America Cosmetic Pipette Market Value (US$ Mn) by Neck Diameter, 2015H-2031F

Table 28: North America Cosmetic Pipette Market Volume (Mn Units) by Neck Diameter, 2015H-2031F

Table 29: North America Cosmetic Pipette Market Value (US$ Mn) by Technology, 2015H-2031F

Table 30: North America Cosmetic Pipette Market Volume (Mn Units) by Technology, 2015H-2031F

Table 31: North America Cosmetic Pipette Market Value (US$ Mn) by Overshell Screw, 2015H-2031F

Table 32: North America Cosmetic Pipette Market Volume (Mn Units) by Overshell Screw, 2015H-2031F

Table 33: North America Cosmetic Pipette Market Value (US$ Mn) by Button Type, 2015H-2031F

Table 34: North America Cosmetic Pipette Market Volume (Mn Units) by Button Type, 2015H-2031F

Table 35: North America Cosmetic Pipette Market Value (US$ Mn) by Applicator, 2015H-2031F

Table 36: North America Cosmetic Pipette Market Volume (Mn Units) by Applicator, 2015H-2031F

Table 37: North America Cosmetic Pipette Market Value (US$ Mn) by Dropper Type, 2015H-2031F

Table 38: North America Cosmetic Pipette Market Volume (Mn Units) by Dropper Type, 2015H-2031F

Table 39: North America Cosmetic Pipette Market Value (US$ Mn) by Dosage Capacity, 2015H-2031F

Table 40: North America Cosmetic Pipette Market Volume (Mn Units) by Dosage Capacity, 2015H-2031F

Table 41: North America Cosmetic Pipette Market Value (US$ Mn) by End Use, 2015H-2031F

Table 42: North America Cosmetic Pipette Market Volume (Mn Units) by End Use, 2015H-2031F

Table 43: North America Cosmetic Pipette Market Value (US$ Mn) by Product Category, 2015H-2031F

Table 44: North America Cosmetic Pipette Market Volume (Mn Units) by Product Category, 2015H-2031F

Table 45: North America Cosmetic Pipette Market Value (US$ Mn) by Pipette Length, 2015H-2031F

Table 46: North America Cosmetic Pipette Market Volume (Mn Units) by Pipette Length, 2015H-2031F

Table 47: North America Cosmetic Pipette Market Value (US$ Mn) by Country, 2015H-2031F

Table 48: North America Cosmetic Pipette Market Volume (Mn Units) by Country, 2015H-2031F

Table 49: Latin America Cosmetic Pipette Market Value (US$ Mn) by Material Type, 2015H-2031F

Table 50: Latin America Cosmetic Pipette Market Volume (Mn Units) by Material Type, 2015H-2031F

Table 51: Latin America Cosmetic Pipette Market Value (US$ Mn) by Neck Diameter, 2015H-2031F

Table 52: Latin America Cosmetic Pipette Market Volume (Mn Units) by Neck Diameter, 2015H-2031F

Table 53: Latin America Cosmetic Pipette Market Value (US$ Mn) by Technology, 2015H-2031F

Table 54: Latin America Cosmetic Pipette Market Volume (Mn Units) by Technology, 2015H-2031F

Table 55: Latin America Cosmetic Pipette Market Value (US$ Mn) by Overshell Screw, 2015H-2031F

Table 56: Latin America Cosmetic Pipette Market Volume (Mn Units) by Overshell Screw, 2015H-2031F

Table 57: Latin America Cosmetic Pipette Market Value (US$ Mn) by Button Type, 2015H-2031F

Table 58: Latin America Cosmetic Pipette Market Volume (Mn Units) by Button Type, 2015H-2031F

Table 59: Latin America Cosmetic Pipette Market Value (US$ Mn) by Applicator, 2015H-2031F

Table 60: Latin America Cosmetic Pipette Market Volume (Mn Units) by Applicator, 2015H-2031F

Table 61: Latin America Cosmetic Pipette Market Value (US$ Mn) by Dropper Type, 2015H-2031F

Table 62: Latin America Cosmetic Pipette Market Volume (Mn Units) by Dropper Type, 2015H-2031F

Table 63: Latin America Cosmetic Pipette Market Value (US$ Mn) by Dosage Capacity, 2015H-2031F

Table 64: Latin America Cosmetic Pipette Market Volume (Mn Units) by Dosage Capacity, 2015H-2031F

Table 65: Latin America Cosmetic Pipette Market Value (US$ Mn) by End Use, 2015H-2031F

Table 66: Latin America Cosmetic Pipette Market Volume (Mn Units) by End Use, 2015H-2031F

Table 67: Latin America Cosmetic Pipette Market Value (US$ Mn) by Product Category, 2015H-2031F

Table 68: Latin America Cosmetic Pipette Market Volume (Mn Units) by Product Category, 2015H-2031F

Table 69: Latin America Cosmetic Pipette Market Value (US$ Mn) by Pipette Length, 2015H-2031F

Table 70: Latin America Cosmetic Pipette Market Volume (Mn Units) by Pipette Length, 2015H-2031F

Table 71: Latin America Cosmetic Pipette Market Value (US$ Mn) by Country, 2015H-2031F

Table 72: Latin America Cosmetic Pipette Market Volume (Mn Units) by Country, 2015H-2031F

Table 73: EMEA Cosmetic Pipette Market Value (US$ Mn) by Material Type, 2015H-2031F

Table 74: EMEA Cosmetic Pipette Market Volume (Mn Units) by Material Type, 2015H-2031F

Table 75: EMEA Cosmetic Pipette Market Value (US$ Mn) by Neck Diameter, 2015H-2031F

Table 76: EMEA Cosmetic Pipette Market Volume (Mn Units) by Neck Diameter, 2015H-2031F

Table 77: EMEA Cosmetic Pipette Market Value (US$ Mn) by Technology, 2015H-2031F

Table 78: EMEA Cosmetic Pipette Market Volume (Mn Units) by Technology, 2015H-2031F

Table 79: EMEA Cosmetic Pipette Market Value (US$ Mn) by Overshell Screw, 2015H-2031F

Table 80: EMEA Cosmetic Pipette Market Volume (Mn Units) by Overshell Screw, 2015H-2031F

Table 81: EMEA Cosmetic Pipette Market Value (US$ Mn) by Button Type, 2015H-2031F

Table 82: EMEA Cosmetic Pipette Market Volume (Mn Units) by Button Type, 2015H-2031F

Table 83: EMEA Cosmetic Pipette Market Value (US$ Mn) by Applicator, 2015H-2031F

Table 84: EMEA Cosmetic Pipette Market Volume (Mn Units) by Applicator, 2015H-2031F

Table 85: EMEA Cosmetic Pipette Market Value (US$ Mn) by Dropper Type, 2015H-2031F

Table 86: EMEA Cosmetic Pipette Market Volume (Mn Units) by Dropper Type, 2015H-2031F

Table 87: Europe Cosmetic Pipette Market Value (US$ Mn) by Dosage Capacity, 2015H-2031F

Table 88: Europe Cosmetic Pipette Market Volume (Mn Units) by Dosage Capacity, 2015H-2031F

Table 89: EMEA Cosmetic Pipette Market Value (US$ Mn) by End Use, 2015H-2031F

Table 90: EMEA Cosmetic Pipette Market Volume (Mn Units) by End Use, 2015H-2031F

Table 91: EMEA Cosmetic Pipette Market Value (US$ Mn) by Product Category, 2015H-2031F

Table 92: EMEA Cosmetic Pipette Market Volume (Mn Units) by Product Category, 2015H-2031F

Table 93: EMEA Cosmetic Pipette Market Value (US$ Mn) by Pipette Length, 2015H-2031F

Table 94: EMEA Cosmetic Pipette Market Volume (Mn Units) by Pipette Length, 2015H-2031F

Table 95: EMEA Cosmetic Pipette Market Value (US$ Mn) by Region, 2015H-2031F

Table 96: EMEA Cosmetic Pipette Market Volume (Mn Units) by Region, 2015H-2031F

Table 97: South Asia Cosmetic Pipette Market Value (US$ Mn) by Material Type, 2015H-2031F

Table 98: South Asia Cosmetic Pipette Market Volume (Mn Units) by Material Type, 2015H-2031F

Table 99: South Asia Cosmetic Pipette Market Value (US$ Mn) by Neck Diameter, 2015H-2031F

Table 100: South Asia Cosmetic Pipette Market Volume (Mn Units) by Neck Diameter, 2015H-2031F

Table 101: South Asia Cosmetic Pipette Market Value (US$ Mn) by Technology, 2015H-2031F

Table 102: South Asia Cosmetic Pipette Market Volume (Mn Units) by Technology, 2015H-2031F

Table 103: South Asia Cosmetic Pipette Market Value (US$ Mn) by Overshell Screw, 2015H-2031F

Table 104: South Asia Cosmetic Pipette Market Volume (Mn Units) by Overshell Screw, 2015H-2031F

Table 105: South Asia Cosmetic Pipette Market Value (US$ Mn) by Button Type, 2015H-2031F

Table 106: South Asia Cosmetic Pipette Market Volume (Mn Units) by Button Type, 2015H-2031F

Table 107: South Asia Cosmetic Pipette Market Value (US$ Mn) by Applicator, 2015H-2031F

Table 108: South Asia Cosmetic Pipette Market Volume (Mn Units) by Applicator, 2015H-2031F

Table 109: South Asia Cosmetic Pipette Market Value (US$ Mn) by Dropper Type, 2015H-2031F

Table 110: South Asia Cosmetic Pipette Market Volume (Mn Units) by Dropper Type, 2015H-2031F

Table 111: South Asia Cosmetic Pipette Market Value (US$ Mn) by Dosage Capacity, 2015H-2031F

Table 112: South Asia Cosmetic Pipette Market Volume (Mn Units) by Dosage Capacity, 2015H-2031F

Table 113: South Asia Cosmetic Pipette Market Value (US$ Mn) by End Use, 2015H-2031F

Table 114: South Asia Cosmetic Pipette Market Volume (Mn Units) by End Use, 2015H-2031F

Table 115: South Asia Cosmetic Pipette Market Value (US$ Mn) by Product Category, 2015H-2031F

Table 116: South Asia Cosmetic Pipette Market Volume (Mn Units) by Product Category, 2015H-2031F

Table 117: South Asia Cosmetic Pipette Market Value (US$ Mn) by Pipette Length, 2015H-2031F

Table 118: South Asia Cosmetic Pipette Market Volume (Mn Units) by Pipette Length, 2015H-2031F

Table 119: South Asia Cosmetic Pipette Market Value (US$ Mn) by Country, 2015H-2031F

Table 120: South Asia Cosmetic Pipette Market Volume (Mn Units) by Country, 2015H-2031F

Table 121: East Asia Cosmetic Pipette Market Value (US$ Mn) by Material Type, 2015H-2031F

Table 122: East Asia Cosmetic Pipette Market Volume (Mn Units) by Material Type, 2015H-2031F

Table 123: East Asia Cosmetic Pipette Market Value (US$ Mn) by Neck Diameter, 2015H-2031F

Table 124: East Asia Cosmetic Pipette Market Volume (Mn Units) by Neck Diameter, 2015H-2031F

Table 125: East Asia Cosmetic Pipette Market Value (US$ Mn) by Technology, 2015H-2031F

Table 126: East Asia Cosmetic Pipette Market Volume (Mn Units) by Technology, 2015H-2031F

Table 127: East Asia Cosmetic Pipette Market Value (US$ Mn) by Overshell Screw, 2015H-2031F

Table 128: East Asia Cosmetic Pipette Market Volume (Mn Units) by Overshell Screw, 2015H-2031F

Table 129: East Asia Cosmetic Pipette Market Value (US$ Mn) by Button Type, 2015H-2031F

Table 130: East Asia Cosmetic Pipette Market Volume (Mn Units) by Button Type, 2015H-2031F

Table 131: East Asia Cosmetic Pipette Market Value (US$ Mn) by Applicator, 2015H-2031F

Table 132: East Asia Cosmetic Pipette Market Volume (Mn Units) by Applicator, 2015H-2031F

Table 133: East Asia Cosmetic Pipette Market Value (US$ Mn) by Dropper Type, 2015H-2031F

Table 134: East Asia Cosmetic Pipette Market Volume (Mn Units) by Dropper Type, 2015H-2031F

Table 135: East Asia Cosmetic Pipette Market Value (US$ Mn) by Dosage Capacity, 2015H-2031F

Table 136: East Asia Cosmetic Pipette Market Volume (Mn Units) by Dosage Capacity, 2015H-2031F

Table 137: East Asia Cosmetic Pipette Market Value (US$ Mn) by End Use, 2015H-2031F

Table 138: East Asia Cosmetic Pipette Market Volume (Mn Units) by End Use, 2015H-2031F

Table 139: East Asia Cosmetic Pipette Market Value (US$ Mn) by Product Category, 2015H-2031F

Table 140: East Asia Cosmetic Pipette Market Volume (Mn Units) by Product Category, 2015H-2031F

Table 141: East Asia Cosmetic Pipette Market Value (US$ Mn) by Pipette Length, 2015H-2031F

Table 142: East Asia Cosmetic Pipette Market Volume (Mn Units) by Pipette Length, 2015H-2031F

Table 143: East Asia Cosmetic Pipette Market Value (US$ Mn) by Country, 2015H-2031F

Table 144: East Asia Cosmetic Pipette Market Volume (Mn Units) by Country, 2015H-2031F

List of Figures

Figure 01: Global Cosmetic Pipette Market Share Analysis by Material Type, 2021E & 2031F

Figure 02: Global Cosmetic Pipette Market Y-o-Y Analysis by Material Type, 2019H-2031F

Figure 03: Global Cosmetic Pipette Market Attractiveness Analysis by Material Type, 2021E-2031F

Figure 04: Global Cosmetic Pipette Market Share Analysis by Neck Diameter, 2021E & 2031F

Figure 05: Global Cosmetic Pipette Market Y-o-Y Analysis by Neck Diameter, 2019H-2031F

Figure 06: Global Cosmetic Pipette Market Attractiveness Analysis by Neck Diameter, 2021E-2031F

Figure 07: Global Cosmetic Pipette Market Share Analysis by Technology, 2021E & 2031F

Figure 08: Global Cosmetic Pipette Market Y-o-Y Analysis by Technology, 2019H-2031F

Figure 09: Global Cosmetic Pipette Market Attractiveness Analysis by Technology, 2021E-2031F

Figure 10: Global Cosmetic Pipette Market Share Analysis by Overshell Screw, 2021E & 2031F

Figure 11: Global Cosmetic Pipette Market Y-o-Y Analysis by Overshell Screw, 2019H-2031F

Figure 12: Global Cosmetic Pipette Market Attractiveness Analysis by Overshell Screw, 2021E-2031F

Figure 13: Global Cosmetic Pipette Market Share Analysis by Button Type, 2021E & 2031F

Figure 14: Global Cosmetic Pipette Market Y-o-Y Analysis by Button Type, 2019H-2031F

Figure 15: Global Cosmetic Pipette Market Attractiveness Analysis by Button Type, 2021E-2031F

Figure 16: Global Cosmetic Pipette Market Share Analysis by Applicator, 2021E & 2031F

Figure 17: Global Cosmetic Pipette Market Y-o-Y Analysis by Applicator, 2019H-2031F

Figure 18: Global Cosmetic Pipette Market Attractiveness Analysis by Applicator, 2021E-2031F

Figure 19: Global Cosmetic Pipette Market Share Analysis by Dropper Type, 2021E & 2031F

Figure 20: Global Cosmetic Pipette Market Y-o-Y Analysis by Dropper Type, 2019H-2031F

Figure 21: Global Cosmetic Pipette Market Attractiveness Analysis by Dropper Type, 2021E-2031F

Figure 22: Global Cosmetic Pipette Market Share Analysis by Dosage Capacity, 2021E & 2031F

Figure 23: Global Cosmetic Pipette Market Y-o-Y Analysis by Dosage Capacity, 2019H-2031F

Figure 24: Global Cosmetic Pipette Market Attractiveness Analysis by Dosage Capacity, 2021E-2031F

Figure 25: Global Cosmetic Pipette Market Share Analysis by End Use, 2021E & 2031F

Figure 26: Global Cosmetic Pipette Market Y-o-Y Analysis by End Use, 2019H-2031F

Figure 27: Global Cosmetic Pipette Market Attractiveness Analysis by End Use, 2021E-2031F

Figure 28: Global Cosmetic Pipette Market Share Analysis by Product Category, 2021E & 2031F

Figure 29: Global Cosmetic Pipette Market Y-o-Y Analysis by Product Category, 2019H-2031F

Figure 30: Global Cosmetic Pipette Market Attractiveness Analysis by Product Category, 2021E-2031F

Figure 31: Global Cosmetic Pipette Market Share Analysis by Pipette Length, 2021E & 2031F

Figure 32: Global Cosmetic Pipette Market Y-o-Y Analysis by Pipette Length, 2019H-2031F

Figure 33: Global Cosmetic Pipette Market Attractiveness Analysis by Pipette Length, 2021E-2031F

Figure 34: Global Cosmetic Pipette Market Share Analysis by Region, 2021E & 2031F

Figure 35: Global Cosmetic Pipette Market Y-o-Y Analysis by Region, 2019H-2031F

Figure 36: Global Cosmetic Pipette Market Attractiveness Analysis by Region, 2021E-2031F

Figure 37: North America Cosmetic Pipette Market Attractiveness Analysis by Technology, 2021E-2031F

Figure 38: North America Cosmetic Pipette Market Y-o-Y Analysis by Material Type, 2019H-2031F

Figure 39: North America Cosmetic Pipette Market Share Analysis by Overshell Screw, 2021E & 2031F

Figure 40: North America Cosmetic Pipette Market Value Share Analysis by Neck Diameter, 2021(E)

Figure 41: MEA North America Cosmetic Pipette Market Value Share Analysis by Button Type, 2021(E)

Figure 42: North America Cosmetic Pipette Market Value Share Analysis by Dropper Type, 2021(E) & 2031(F)

Figure 43: North America Cosmetic Pipette Market Value Share Analysis by Applicator, 2021(E)

Figure 44: North America Cosmetic Pipette Market, Incremental Opportunity Analysis by Dosage Capacity (US$ Mn), 2021(E)-2031(F)

Figure 45: North America Cosmetic Pipette Market Attractiveness Analysis by End Use, 2021E-2031F

Figure 46: North America Cosmetic Pipette Market Value Share Analysis by Product Category, 2021(E)

Figure 47: North America Cosmetic Pipette Market Value Share Analysis, by Pipette Length, 2021E & 2031F

Figure 48: North America Cosmetic Pipette Market Share Analysis by Country, 2021E & 2031F

Figure 49: Latin America Cosmetic Pipette Market Attractiveness Analysis by Technology, 2021E-2031F

Figure 50: Latin America Cosmetic Pipette Market Y-o-Y Analysis by Material Type, 2019H-2031F

Figure 51: Latin America Cosmetic Pipette Market Share Analysis by Overshell Screw, 2021E & 2031F

Figure 52: Latin America Cosmetic Pipette Market Value Share Analysis by Neck Diameter, 2021(E)

Figure 53: MEA Latin America Cosmetic Pipette Market Value Share Analysis by Button Type, 2021(E)

Figure 54: Latin America Cosmetic Pipette Market Value Share Analysis by Dropper Type, 2021(E) & 2031(F)

Figure 55: Latin America Cosmetic Pipette Market Value Share Analysis by Applicator, 2021(E)

Figure 56: Latin America Cosmetic Pipette Market, Incremental Opportunity Analysis by Dosage Capacity (US$ Mn), 2021(E)-2031(F)

Figure 57: Latin America Cosmetic Pipette Market Attractiveness Analysis by End Use, 2021E-2031F

Figure 58: Latin America Cosmetic Pipette Market Value Share Analysis by Product Category, 2021(E)

Figure 59: Latin America Cosmetic Pipette Market Value Share Analysis, by Pipette Length, 2021E & 2031F

Figure 60: Latin America Cosmetic Pipette Market Share Analysis by Country, 2021E & 2031F

Figure 61: EMEA Cosmetic Pipette Market Attractiveness Analysis by Technology, 2021E-2031F

Figure 62: EMEA Cosmetic Pipette Market Y-o-Y Analysis by Material Type, 2019H-2031F

Figure 63: EMEA Cosmetic Pipette Market Share Analysis by Overshell Screw, 2021E & 2031F

Figure 64: EMEA Cosmetic Pipette Market Value Share Analysis by Neck Diameter, 2021(E)

Figure 65: MEA EMEA Cosmetic Pipette Market Value Share Analysis by Button Type, 2021(E)

Figure 66: EMEA Cosmetic Pipette Market Value Share Analysis by Dropper Type, 2021(E) & 2031(F)

Figure 67: EMEA Cosmetic Pipette Market Value Share Analysis by Applicator, 2021(E)

Figure 68: EMEA Cosmetic Pipette Market, Incremental Opportunity Analysis by Dosage Capacity (US$ Mn), 2021(E)-2031(F)

Figure 69: EMEA Cosmetic Pipette Market Attractiveness Analysis by End Use, 2021E-2031F

Figure 70: EMEA Cosmetic Pipette Market Value Share Analysis by Product Category, 2021(E)

Figure 71: EMEA Cosmetic Pipette Market Value Share Analysis, by Pipette Length, 2021E & 2031F

Figure 72: EMEA Cosmetic Pipette Market Share Analysis by Region, 2021E & 2031F

Figure 73: South Asia Cosmetic Pipette Market Attractiveness Analysis by Technology, 2021E-2031F

Figure 74: South Asia Cosmetic Pipette Market Y-o-Y Analysis by Material Type, 2019H-2031F

Figure 75: South Asia Cosmetic Pipette Market Share Analysis by Overshell Screw, 2021E & 2031F

Figure 76: South Asia Cosmetic Pipette Market Value Share Analysis by Neck Diameter, 2021(E)

Figure 77: MEA South Asia Cosmetic Pipette Market Value Share Analysis by Button Type, 2021(E)

Figure 78: South Asia Cosmetic Pipette Market Value Share Analysis by Dropper Type, 2021(E) & 2031(F)

Figure 79: South Asia Cosmetic Pipette Market Value Share Analysis by Applicator, 2021(E)

Figure 80: South Asia Cosmetic Pipette Market, Incremental Opportunity Analysis by Dosage Capacity (US$ Mn), 2021(E)-2031(F)

Figure 81: South Asia Cosmetic Pipette Market Attractiveness Analysis by End Use, 2021E-2031F

Figure 82: South Asia Cosmetic Pipette Market Value Share Analysis by Product Category, 2021(E)

Figure 83: South Asia Cosmetic Pipette Market Value Share Analysis, by Pipette Length, 2021E & 2031F

Figure 84: South Asia Cosmetic Pipette Market Share Analysis by Country, 2021E & 2031F

Figure 85: East Asia Cosmetic Pipette Market Attractiveness Analysis by Technology, 2021E-2031F

Figure 86: East Asia Cosmetic Pipette Market Y-o-Y Analysis by Material Type, 2019H-2031F

Figure 87: East Asia Cosmetic Pipette Market Share Analysis by Overshell Screw, 2021E & 2031F

Figure 88: East Asia Cosmetic Pipette Market Value Share Analysis by Neck Diameter, 2021(E)

Figure 89: MEA East Asia Cosmetic Pipette Market Value Share Analysis by Button Type, 2021(E)

Figure 90: East Asia Cosmetic Pipette Market Value Share Analysis by Dropper Type, 2021(E) & 2031(F)

Figure 91: East Asia Cosmetic Pipette Market Value Share Analysis by Applicator, 2021(E)

Figure 92: East Asia Cosmetic Pipette Market, Incremental Opportunity Analysis by Dosage Capacity (US$ Mn), 2021(E)-2031(F)

Figure 93: East Asia Cosmetic Pipette Market Attractiveness Analysis by End Use, 2021E-2031F

Figure 94: East Asia Cosmetic Pipette Market Value Share Analysis by Product Category, 2021(E)

Figure 95: East Asia Cosmetic Pipette Market Value Share Analysis, by Pipette Length, 2021E & 2031F

Figure 96: East Asia Cosmetic Pipette Market Share Analysis by Country, 2021E & 2031F