Reports

Reports

With rapid industrialization and growth in technology, the way an industry operates has revolutionized tremendously. Use of automated equipment and upgraded technique of production has become the need of the hour to facilitate timely manufacture of quality goods. This has promoted use of mechanical handling equipment recognized as conveyor systems or conveying equipment which are largely utilized for transportation, shipments and other related manufacturing activities. The key areas of application for conveying equipment are durable goods industry, non durable goods industry and capital intensive industry. In addition, the market for conveying equipment can also be classified as conventional and automated conveyors both of which can be further segmented into bulk handling and unit handling. The parts and attachments required for maintenance of conveyors also comprise of conveying equipment.

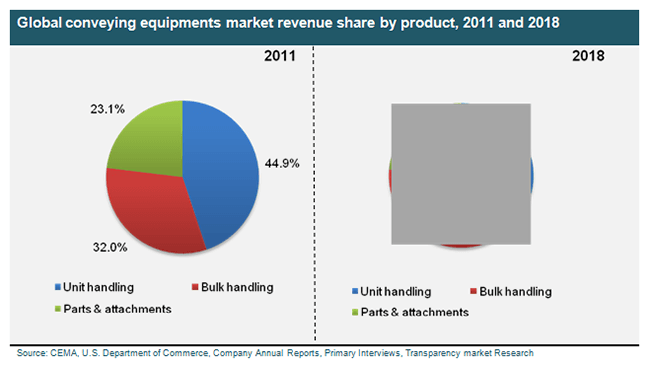

Unit handling equipment was the largest product segment and accounted for more than 44% in 2011, signifying the substantial need of such conveying equipment in different industries. The demand for bulk handling equipment varies from one industry to another; however due to its limited application, the global bulk handling market is expected to grow at a CAGR of 1.8% from 2012 and 2018. With increasing industrialization, the market for parts and attachments is slated to remain highly attractive and is expected to exceed USD 8,235 million by 2018.

Europe dominated the conveyor equipment market with nearly 35.5% of the global market in 2011. The demand for conveyor equipment grew until 2011 owing to the concentration of leading automobile manufacturer including Mercedes, Audi, Ducati and BMW in the region. Germany and France are some of the major markets owing to presence of some of the leading automobile manufacturers in the world. The accelerated demand for conveyor systems particularly in the automobile industry bolstered the conveyor equipment market. With the emerging economies of China and India, Asia Pacific is expected to acquire a market share of approximately 32% by 2018. The U.S. market is expected to reach above USD 7,498 million by 2018.

The U.S. is a hub for various manufacturing activities leading to high demand for conveying equipment. With stabilization of the U.S. economy after recession and industrialization returning to a steady pace, the U.S. conveying equipment market is expected to grow at a marginal rate over the forecast period. The U.S. unit handling conveying equipment market was valued at nearly USD 3,102 million in 2011. The unit handling equipment has been primarily used for handling small batches which are most widely applicable in industries such as food & beverage processing, shipments and manufacturing of automotive industries besides other durable goods industries. Bulk handling equipment market is expected to grow at a CAGR of 1.9% from 2012 to 2018, with slight fluctuations in demand due to limited product differentiation in this equipment market. Parts and attachment segment is expected to show a significant rise as compared to other product segments due to its widespread application as intermediate and final goods.

The conveying equipment market is highly fragmented as large number of manufacturers account for almost equal market share. Rexnord and Dematic together accounted for nearly 26% of the U.S. market in 2011. Some firms are specialized only in designing and installing, while few others in manufacturing of conveying equipment. In such a situation those firms which are able to achieve forward integration in the value chain get an advantage of low cost production with greater market share. Some of the key participants in the industry include Dematic, Fenner Dunlop, Intelligrated Inc., Nordstrong Equipment Ltd., Rexnord, Sandvik AB and Webster Industries among others.

1. Preface

1.1. Research Description

1.2. Market segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global conveying equipment market estimates and forecast, 2011-2018 (USD Million)

2.2. Global conveying equipment market: Snapshot

3. Conveying Equipment - Industry Analysis

3.1. Introduction

3.2. Value chain analysis

3.3. Market Drivers

3.3.1. Increased adoption of assembly line methodology and mass production in different industries

3.3.2. Growing need to customize conveying equipments

3.3.3. Growth of motor vehicle manufacturing

3.4. Market Restraints

3.4.1. Overdependence on the volatile durable goods market

3.4.2. Decrease in capital investments due to trade deficits

3.5. Market opportunities

3.5.1. Rising E-commerce

3.5.2. Growing food and beverage industry

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining power of suppliers

3.6.2. Bargaining power of buyers

3.6.3. Threat from new entrants

3.6.4. Degree of competition

3.7. Global conveying equipments market: Market attractiveness analysis

3.8. Company market share analysis

3.8.1. U.S. conveying equipments market: company market share analysis, 2011

4. Conveying Equipment Market - Product Segment Analysis

4.1. Global conveying equipment market: Product overview

4.1.1. Global conveying equipment market revenue share, by product segment, 2011 and 2018

4.2. Global conveying equipment market, by product

4.2.1. Unit handling

4.2.1.1. Global unit handling equipments market estimates and forecast, 2011-2018(USD Million)

4.2.2. Bulk Handling

4.2.2.1. Global bulk handling equipment market estimates and forecast, 2011-2018(USD Million)

4.2.3. Parts & attachments

4.2.3.1. Global parts and attachments market estimates and forecast, 2011-2018(USD Million)

5. Conveying Equipment Market - Regional Analysis

5.1. Conveying equipment market: Regional overview

5.1.1. Conveying equipment market revenue share by region, 2011 and 2018

5.2. North America

5.2.1. North America conveying equipment market estimates and forecast, 2011-2018 (USD Million)

5.2.2. United States

5.2.2.1. U.S. conveying equipment market estimates and forecast, 2011-2018, (USD Million)

5.2.2.2. U.S. conveying equipment market, by product

5.2.2.2.1. U.S. conveying equipment market share, by product, 2011 and 2018

5.2.2.3. Unit handling

5.2.2.3.1. U.S. conveying equipment market for unit handling equipment, 2011-2018(USD Million)

5.2.2.4. Bulk handling

5.2.2.4.1. U.S. conveying equipment market for bulk handling equipments, 2011-2018(USD Million)

5.2.2.5. Parts and attachments

5.2.2.5.1. U.S. conveying equipment market for parts and attachments, 2011-2018(USD Million)

5.2.2.6. U.S. conveying equipment market by application

5.2.2.6.1. U.S. conveying equipment market for durable goods manufacturing, 2011-2018 (USD Million)

5.2.2.6.2. U.S. conveying equipment market for non durable goods manufacturing, 2011-2018 (USD Million)

5.2.2.6.3. U.S. conveying equipment market for other manufacturing, 2011-2018 (USD Million)

5.3. Europe

5.3.1. Europe conveying equipment market estimates and forecast, 2011-2018 (USD Million)

5.4. Asia Pacific

5.4.1. Asia Pacific conveying equipment market estimates and forecast, 2011-2018 (USD Million)

5.5. Rest of the World

5.5.1. RoW conveying equipment market estimates and forecast, 2011-2018 (USD Million)

6. Company Profiles

6.1. Dematic

6.1.1. Company overview

6.1.2. Business strategy

6.1.3. SWOT analysis

6.1.4. Recent developments

6.2. Rexnord

6.2.1. Company overview

6.2.2. Financial Overview

6.2.3. Business strategies

6.2.4. SWOT analysis

6.2.5. Recent developments

6.3. Sandvik AB

6.3.1. Company overview

6.3.2. Financial Overview

6.3.3. Business strategy

6.3.4. SWOT analysis

6.3.5. Recent developments

6.4. Fenner Dunlop

6.4.1. Company overview

6.4.2. Financial Overview

6.4.3. Business strategy

6.4.4. SWOT analysis

6.4.5. Recent developments

6.5. Intelligrated Inc.

6.5.1. Company overview

6.5.2. Business strategy

6.5.3. SWOT analysis

6.5.4. Recent developments

6.6. Nordstrong Equipment Limited

6.6.1. Company overview

6.6.2. Business strategy

6.6.3. SWOT analysis

6.6.4. Recent developments

6.7. Webster industries Inc.

6.7.1. Company overview

6.7.2. Business strategy

6.7.3. SWOT analysis

6.7.4. Recent developments

6.8. Schneider Electric SA.

6.8.1. Company overview

6.8.2. Financial Overview

6.8.3. Business strategy

6.8.4. SWOT analysis

6.8.5. Recent Developments

List of Table

TABLE 1: Global conveying equipment market: Snapshot

TABLE 2: Drivers of the conveying equipment market : Impact analysis

TABLE 3: Restraints of the conveying equipment market : Impact analysis

List of Figures

FIG. 1: Global and U.S. conveying equipment: Market segmentation

FIG. 2: Global conveying equipment market estimates and forecast, 2011-2018 (USD Million)

FIG. 3: Conveying equipment: Value chain analysis

FIG. 4: World industrial production growth rate, 2000-2011 (%)

FIG. 5: U.S. industrial production growth rate, 1999-2011 (%)

FIG. 6: Total motor vehicle production, 2007-2011 (Million units)

FIG. 7: Global refrigerator shipments, 2006-2010 (Million Units)

FIG. 8: U.S. trade deficits 2007-2012 (USD billion)

FIG. 9: World food Industry: Food consumption trend

FIG. 10: World beverage consumption, 2006-2010 (billion litres)

FIG. 11: Conveying equipments market: Porter’s five forces analysis

FIG. 12: Global conveying equipment market: market attractiveness analysis

FIG. 13: U.S conveying equipment market: company market share analysis, 2011

FIG. 14: Global conveying equipment market revenue share by product, 2011 and 2018

FIG. 15: Global unit handling equipment market estimates and forecast , 2011-2018 (USD Million)

FIG. 16: Global bulk handling equipment market estimates and forecast , 2011-2018 (USD Million)

FIG. 17: Global parts & attachments market estimates and forecast , 2011-2018 (USD Million)

FIG. 18: Global conveying equipment revenue share, by region, 2011 and 2018

FIG. 19: North America conveying equipment market estimates and forecast, 2011-2018, (USD Million)

FIG. 20: U.S. conveying equipment market estimates and forecast, 2011-2018 (USD Million)

FIG. 21: U.S. conveying equipment market revenue share by product, 2011-2018

FIG. 22: U.S. conveying equipment market for unit handling equipment, 2011-2018 (USD Million)

FIG. 23: U.S. conveying equipment market for bulk handling equipments, 2011-2018 (USD Million)

FIG. 24: U.S. conveying equipment market for parts & attachments, 2011-2018 (USD Million)

FIG. 25: U.S. conveying equipment market share by application, 2011 and 2018

FIG. 26: U.S. conveying equipment market for durable goods manufacturing, 2011-2018 (USD Million)

FIG. 27: U.S. conveying equipment market for non durable goods manufacturing, 2011-2018, (USD Million)

FIG. 28: U.S. conveying equipment market for other industries, 2011-2018 (USD Million)

FIG. 29: Europe conveying equipment market estimates and forecast, 2011-2018 (USD Million)

FIG. 30: Asia Pacific conveying equipment market estimates and forecast, 2011-2018 (USD Million)

FIG. 31: RoW conveying equipment market estimates and forecast, 2011-2018 (USD Million)